The strong October employment report makes it look likely that the era of zero interest rates will soon come to an end, at least for the United States.

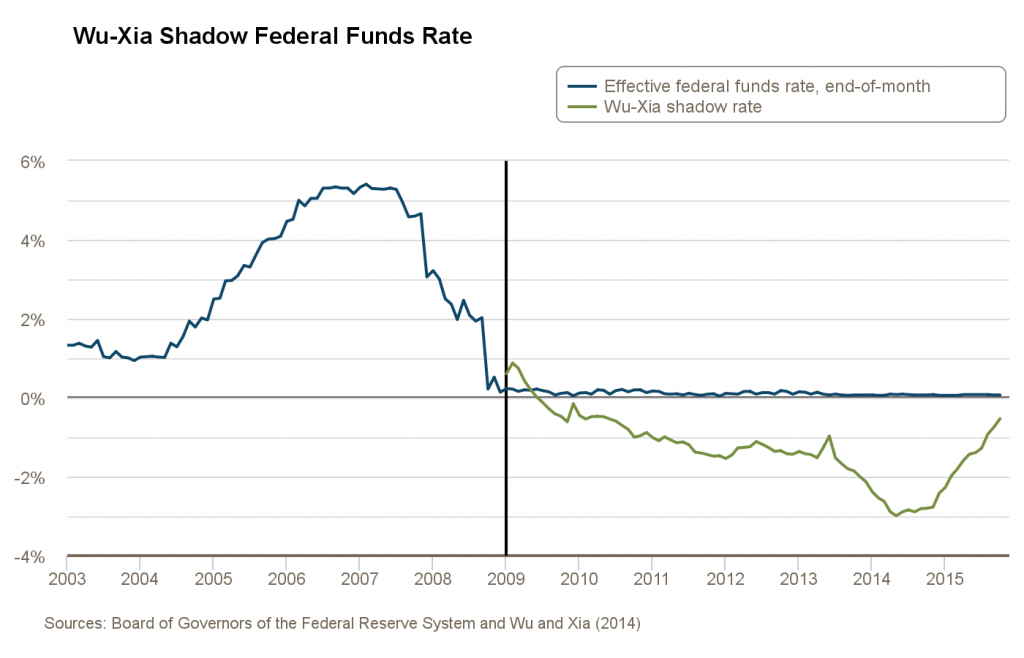

This raises an interesting question for economic researchers of how we bridge statistical models through the episode when the fed funds rate was not a useful summary of monetary policy. I continue to recommend the idea of a shadow fed funds rate that may be negative. Research by University of Chicago Professor Cynthia Wu and Merrill Lynch researcher Dora Xia that will shortly appear in the Journal of Money, Credit, and Banking developed convenient closed-form expressions for magnitudes such as forward rates and risk premia for this model. Here’s the latest value for their series, which had risen to -53 basis points prior to last week’s news.

Wu-Xia shadow rate based on data through October 2015. Source: Federal Reserve Bank of Atlanta.

I was at a conference on interest rates at the Federal Reserve Bank of San Francisco last week where a couple of other interesting approaches to modeling interest rates across the zero lower bound were also presented. Fulvio Pegoraro of the Bank of France presented a very nice paper with co-authors Alain Monfort, Jean-Paul Renne, and Guillaume Roussellet that found ways to make the intriguing autoregressive gamma-zero specification quite tractable for many of the questions analysts want to ask of these data. Bruno Feunou, Jean-Sebastien Fontaine, and Anh Le described an alternative tractable approach.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2oPM

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2thC

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2t7w

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2rYf

A recession-like contraction in the acceleration of money velocity. Widening corporate risk spreads. A bear market underway for the broad equity index and junk bonds. CPI at 0% and implied periodic deflation from wages and PPI.

Raising rates at this particular juncture in the business/financial/market cycle is a mistake, with the historical timing WRT the Long Wave aligning with the late 1930s, the early 1890s. and the late 1830s.

That isn’t the velocity of money however. Nor is that corporate bond spreads. Try again.

Seeing is not always believing. Sometimes it takes time and outcomes to believe.

JDH,

I haven’t read the Wu-Xia paper (yet!), but I’m surpised that their shadow rate starts out so high relative to the effective FF rate.

PS

I’m looking at buying a condo. (First RE purchase ever.) Went over the financials (condo doc disclosure). They are looking at 5.4 MM of 2012 capex over the next 30 years. Based on what I saw, it was a little shy, so I estimate 6MM (plus it makes the math easier). So, 30 years of 200M per year. They have a reserves fund of 650M. This is considered large (more than their annual budget).

The bizarre thing, is that the more I looked into it, they are compiling a war chest, but not actually doing the capex. So…they had this big study in 2012 that showed how they would be in deficits over the next 30 years. They subsequently drastically increased monthly assessments. But guess what? They’re not doing any of the capex! Just regular expenses. and salting away ~190M per year into reserves. And it sits in bank accounts. And draws less interest than the rate of inflation! Meanwhile, the building actually deteriorates (X of paint can save 10X of wood, similar with downspouts and flashing versus masonry repointing or replacement.) Plus we don’t have the benefits of the prettier exterior!

Don’t sit on cash! Put it into assets.

Nony, it is de facto in an asset: the condo complex.

But like a growing percent of businesses with top line revenues growing at most 2-3% and the S&P 500 revenues contracting YoY, they’re sitting on the cash because assets are overvalued vs. fundamentals (profits, incomes, and gov’t receipts from profits and incomes), and the liquidity will become more dear with little or no revenue growth and price inflation and periodic deflation hereafter.

It’s the liquidity trap of secular stagnation and ZIRP/NIRP of the Long Wave Trough, which will likely be with us for years to come.

Some other shadow rate estimates have it up close to 2%.

Professor

Could you comment on the mechanism of the Fed to raise interest rate?. If I have it right, because of the huge excess reserves, the traditional method of control of short term interest rates by the overnight rate is no longer effective. Instead, the mechanism of the Fed will be to raise the interest rate paid on these excess reserves.

On the face of it, it would seem that banks and other through banks will be more inclined to place funds into reserves, receiving a greater return the day after Fed action than day before. How is it, that this will put more action into the economy?

Ed

ED look at this

Rewriting Monetary Policy 101: What’s

the Fed’s Preferred Post-Crisis Approach

to Raising Interest Rates?

http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.29.4.177

The TBTE banks determine reserves and the rate, not the Fed. The Fed follows “the market”, i.e., the TBTE banks’ requirements and actions. The TBTE banks own the Fed. The Fed’s first job is to respond to TBTE banks’ requirements for liquidity and, in the process, run political cover for the TBTE bank’s license to steal via fractional reserve banking.

Understand this clearly and internalize it, and there is no mystery what the Fed will do, when, and why.

The Fed’s incessant proclamations of the intention to raise the reserve rate is merely part of the forward guidance (“forward giddiness”) script as a desperate attempt to avoid a deflationary mindset from taking hold among firms, households, and financial markets.

Myriad metrics virtually no one on Wall St., academic eCONomists, and the financial media influentials publicly acknowledge imply unambiguously that the Fed cannot raise rates in Dec or for years to come; rather, the Fed is as likely to resume QEternity and eventually resort to NIRP in 2016.

But if we internalized this probabilistic outcome, we would be consciously or tacitly conceding the Japan-like, post-1998 outcome hereafter into the early to mid-2020s, which would suggest that the Fed will be no more “successful” than has the BOJ been since the early 2000s.

Ed,

Did you see Ed Rombach’s email saying interest rates are going to continue down? The market is going to be flabbergasted when there is virtually no change when the FED raises interest rates. Bad theory has everyone convinced that it is going to make the bottom fall out.

I think the Fed is stuck playing in some theoretical lab with its media driven passion to achieve “liftoff” as if its some NASA like event for the US and global economy and of course financial markets – and perhaps most importantly, the media… After Fed meetings these days, individual Fed members host media talks given their individual views, which are often the exact opposite of official policy statements thus adding to uncertainty and certainly not achieving their intended aim of more transparency. When Greenspan was Fed Governor, the only Fed noise occurred around official meeting dates – or when an unexpected policy took place and that period was a period where the Fed had a lot more credibility…

With the continued overhang of deflation risks prevailing in the market, the Fed would better fulfill its dual mandate of full employment and “price stability” by simply letting core inflation run a little hot or range between 2.0 – 2.5 percent for 2- to 3-quarters before it starts to panic about a return to the 1970s era…

The OECD put out an interesting statement Monday November 9th saying that global trade looks recessionary and the outlook for global growth is again to be revised downward and is a concern. However, “the US is okay to go ahead and raise interest rates…” Sounds like a very contradictory set of statements. Sure, jack up short-term lending rates and the yield curve, pump up the US$, kill the Yuan and other currencies, watch portfolio flows migrate right back into the US$, watch the US banks layoff thousands of mortgage brokers, watch market volatility surge, watch risk aversion heighten once again, watch emerging markets and their growth tank and growth outlooks get lowered once again… and then watch how the forces of deflation take hold and crush the global economy and the Fed is right back to a new form of quantitative easing. Just recently, the Bank of China and the ECB did the Fed’s job of raising US rates indirectly by lowering rates in China and signaling more stimulus at the December meeting at the ECB. The macro effect was the same as far as its impact on relative exchange rates and their influence on portfolio flows and relative asset markets. The US$ appreciated while the other currencies fell – just like a domestic rate increase so by achieving “liftoff” the Fed will be whacking global currency and asset markets with a double whammy…

There is nothing to gain by panicking and jacking up rates too soon and a lot to be gained by waiting for core inflation to become more of a sustained concern. With the state of the global macros at present, and how they are anticipated to develop over the following 24-month period, the 1970s is nowhere in sight and those thinking so should simply throw out their old models and get in snyc with the current data, state of policy making around the globe, fiscal and monetary, and learn how investors and consumers react to the most important variable or determinant of capital flows, or lending rates….

Ricardo

I can not predict interest rates, beyond that the Fed will be successful in the very short term to raise the rate. But I do not understand its reasoning. It seems they have changed policy of the use of interest rates to the goal of interest rates.

Using the economist technique of all other things remaining the same, raising the return of excess reserves would simply mean more resources entering the reserves at the expense of the general economy.

Ed

Was the oil rally (early OCT 2015) real?

http://www.cnbc.com/2015/10/09/is-the-oil-rally-real-commentary.html

“Oil prices have rallied off of their August lows, popping above $50 a barrel on Thursday. Is this merely another blip on a harrowing roller coaster of oil prices moves, or does it signal some return to sanity and normalcy?”

“We expect continued downward supply revisions, and therefore balances may prove more favorable to price increases than currently envisioned.”

“For long suffering oil investors, the worst may well be behind us.”

——————————

Answer. NO! No normalcy. Continued ‘insanity’!

WTI has dropped below $42 (prompt month, DEC delivery, as of 12NOV 1200 EDT). And the whole strip is down also. Doesn’t get above $50 until FEB2017.

Since I am pro consumer, I love the low prices.

This from Satyajit Das, Market Watch, Nov 13th. His view of the unintended consequences.

Central bankers dismiss criticism that the policies are at best ineffective and at worst damaging.

Low rates have created problems for savers and retirees around the world. Pension funds are in trouble with rising levels of unfunded liabilities. Debt levels continue to rise from unsustainable to even more unsustainable. Low rates have distorted financial markets and created asset price bubbles in shares, property, and other investments.

In Japan, for example, interest rates have been around zero for almost a decade. The Bank of Japan has undertaken nine rounds of QE. The central bank’s balance sheet is approaching 70% of GDP. It owns a significant proportion of the outstanding stock of government bonds and equities. But the policies have not restored growth.

The effect of further rate cuts is also diminished by continuing trade and currency wars. Each individual cut is increasingly offset by competing reductions elsewhere in the world. Despite denials by policy makers, countries are using monetary policy to devalue currencies to gain competitiveness and capture a greater share of global demand. Individual nation’s actions are now redundant in a nugatory race to the bottom in interest rates and currency values.

Maintaining interest rates at low “emergency” levels for an extended period also makes it increasingly difficult to increase them to more normal levels. Increase in debt levels, made possible by lower rates, means the financial impact of higher rates is attenuated.

This is evident in the concern that a potential 0.25% increase in U.S. rates has created.

Here’s my observation on what Das says. The Fed is well-aware of these consequences. Why do they and mainstream economists studiously avoid any mention of these huge societal costs? Nary a paper in the literature on this.

THE US IS NOT JAPAN FOR MANY REASONS. EXTRAPOLATING JAPAN’S QEATHER EXPERIENCE DIRT TRY ONTO THE US IS A WEAK ATTEMPT TO JUSTIFY A FAILED ATTEMPT TO RAISE RATES. CONSUMER SPENDING FELL BY TWO THIRDS IN JAPAN WHEN THE NIKKEi BURST IN THE LATE 80S. Japan became a hoarder and saver. Not due to qeather but due to fear and heightened risk aversion. Go travel to Japan and see for yourself if the Japanese consumer is identically equivalent to the us consumer.

The fed is wrong to want to raise rates no matter how big the glee club gets as the downside far out weighs the 0 benefit from raising rates. Recall, the Fed made disastrous monetary policy in the great depression and I could see a repeat given the recent comments out of fed officials as they do not seem to enjoy in touch with the data but are fixed to data sets from the 70s….

The argument about asset price distortions makes no sense either and last I checked the federal did make one target policy targeting asset prices….

Accordingly, the argument for a rate hike is flawed and especially if Japan is the comparison economy or asset prices are the concern….

The US is also a “hoarder”, with the top 1-10% hoarding 85% of financial wealth in the form of highly overvalued assets as a share of GDP at no acceleration of velocity to private GDP.

Look at the post-2000 and -2007 trend rates of real GDP per capita, and we’re tracking Japan very closely, including the peak demographic cycle progression.

One major difference is that the US has spent cumulatively trillions of dollars on imperial wars that Japan did/could not do since the 1990s-2000s.

Moreover, so-called “health” care spending is again accelerating to more than twice the rate of final sales, which occurred at the onset of the previous two recessions in 2008 and 2001.

Real final sales per capita less “health” care (including Medicare and Medicaid), war, and the fiscal deficit are at the levels of 2000, 2005, and 2008, and decelerating below 2%.

Incremental spending on war and illness as a share of final sales, and running deficits to achieve the growth, is not a positive that distinguishes the US from Japan.

“Raising rates at this particular juncture in the business/financial/market cycle is a mistake”

-said every econ talking head at every single point in the business cycle ever

It will never be the “right time” and we WILL follow JAPAN right into the gutter.

Interesting article on oil by an analyst living in Qatar.

http://seekingalpha.com/article/3684396-how-much-spare-capacity-do-saudis-have-a-conversation-with-robin-mills

His comments in summer 2014 about how more attention should be paid to Iran, Iraq, and general OPEC capability to increase production were prescient and against the general slant on this blog.

http://www.thenational.ae/business/energy/peak-oil-proponents-still-dancing-around-reality

If I understand right this is somehow condensing the forward rate structure data into a single number for each point in time? Interesting that this year’s market lurches did nothing more than briefly mildly decelerate the pace at which the shadow rate was increasing. Not much China worry in evidence there.

“Future of US shale oil lies in Permian basin” (FT article on how Permian production is more nascent than Bakken or Eagle Ford and is hanging in there even at low prices.)

http://www.ft.com/intl/cms/s/0/653e5ec0-8c3d-11e5-a549-b89a1dfede9b.html#axzz3rfztsrJH (If you get a paywall, try accessing the story via Google News and hitting escape quickly when the page loads).

—–

In a similar vein, check out the Pioneer (PXD) and the coverage of it by analysts and in earnings calls transcripts, etc. The company is very heavy in the Permian and still drilling very aggressively. This has provoked all kinds of catcalls from peak oil shale skeptics (as completely irresponsible), but the stock market has rewarded them rather than punishing them. Seems like the market buys their story which is that drilling in the Permian still makes strong sense even with oil in the $40s.

WTI dipped briefly into the 30s today.

http://www.wsj.com/articles/oil-prices-rise-on-u-s-inventory-data-1447847709

Article emphasizes high supply as the main factor affecting price: “everyone is pumping like crazy”.

Natural gas inventories are at 4 TCF (a record.) Flow volumes are at record highs. Price is flirting with below $2.3 for DEC delivery.

http://www.bloomberg.com/news/articles/2015-11-19/u-s-gas-rises-after-storage-gain-to-4-tcf-falls-below-forecasts

Shale. Gale.

Saudi’s seek to quell supply glut concerns:

http://www.ft.com/intl/cms/s/0/9c0bc3f0-8ed3-11e5-a549-b89a1dfede9b.html#axzz3s27eydpE

Note the implicit insights about the cartel. If the cartel is/was irrelevant, if SA pumps all they can, why the news? Why do the markets watch OPEC? Is oil in the 40s an aberration or is hundred dollar oil the aberration?

P.s. As of this posting, oil is again dipping its toes in the 30s. Just barely, but still. Love the look of it!

A….and natgas is at 2.20 (DEC contract). God I love the smell of shale fracking in the morning. 😉