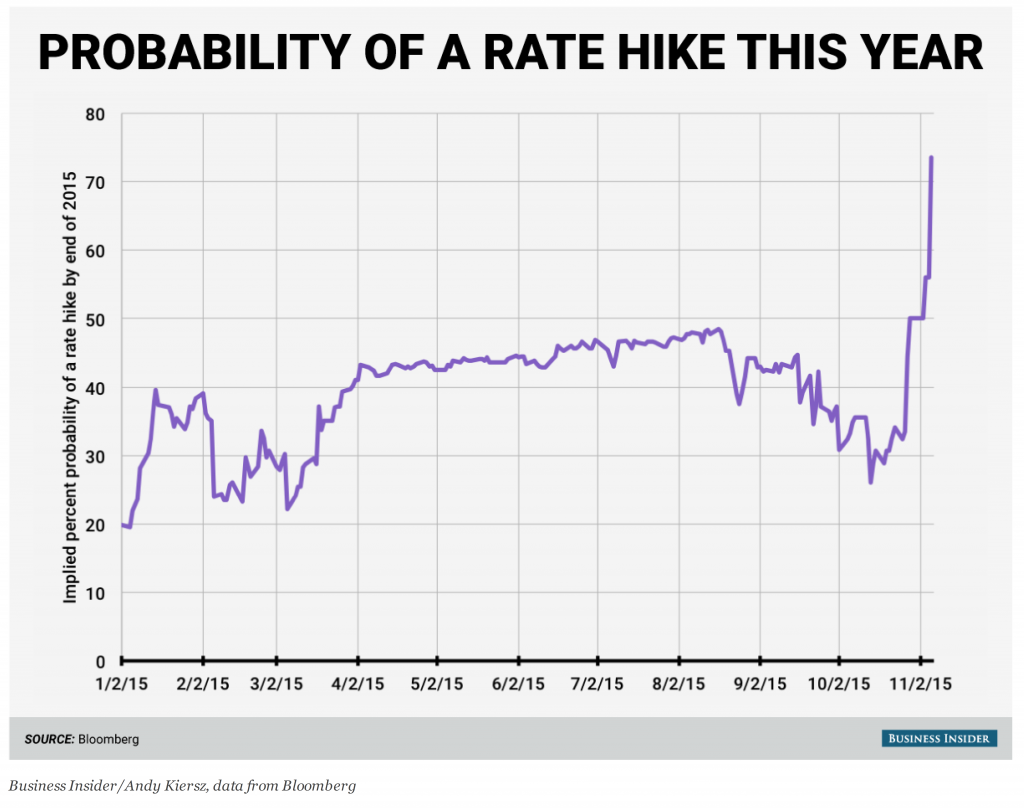

Just an observation regarding the impact of the employment “news” (see [CR]) and inferred expectations of a rate hike in December, and the announcement effect on the dollar’s value.

Source: Kiersz, Business Insider.

Source: Bloomberg.com (accessed today).

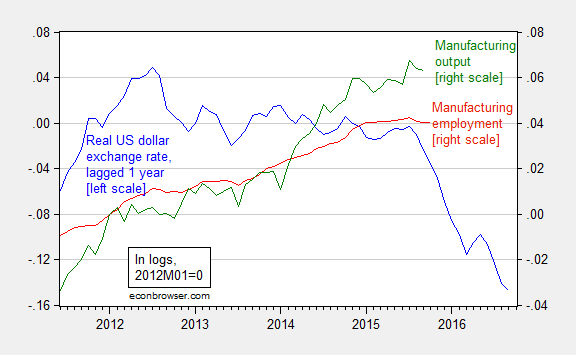

So it seems markets expect tightening. I still think tightening is a mistake. The employment release noted flat manufacturing employment. I update the fourth graph from Monday’s post.

Figure 1: Log real dollar exchange rate against a broad basket of currencies, lagged one year (blue, left scale), and log manufacturing employment, s.a. (red, right scale), and log manufacturing output, s.a. (green, right scale), all series normalized to 2012M01=0. Exchange rate defined so down is a dollar appreciation, so that the three series should exhibit positive correlation. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, BLS, and author’s calculations.

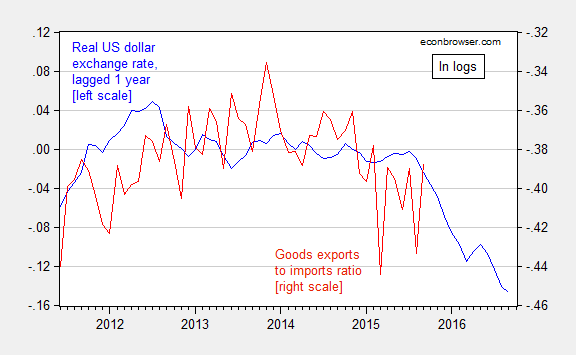

In addition, the recent trade release suggests continued effects from the appreciated dollar.

Figure 2: Log real dollar exchange rate against a broad basket of currencies, lagged one year (blue, left scale), normalized to 2012M01=0, and log ratio of goods exports to goods imports. Exchange rate defined so down is a dollar appreciation, so that the three series should exhibit positive correlation. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, BEA and author’s calculations.

The 12-month average of the payroll receipts and wage and salary disbursements implies that the 12-month average of the YoY rate of employment growth is well below 1% vs. the reported 1.78%. This has persisted for about a year now.

Were payrolls/employment growing 1.75-2% with wages and salaries growing 4.5%, the implied real final sales/GDP would be 3.25-3.5% rather than the 4-qtr. average of ~2.1%.

Moreover, the cyclical change rate of receipts is decelerating to the rate in summer-fall 2008 and fall 2001 (2-3 qtrs. to nearly a year after recessions had begun).

The acceleration of money velocity to private GDP is in a deep recessionary contraction.

Corporate risk spreads to Treasuries remain wide, indicating persistent credit risk (as in 2008, 2001, early 1980s, and the 1930s).

Health care spending is again accelerating to a rate of TWICE or more that of GDP, which historically was recessionary.

The oil states’ leading and coincident indices indicate that recession in these states began earlier this year.

The broad equity market has entered a bear market (7-10 mega-cap, higher-beta, leading stocks are holding up the cap-weighted indices such as the S&P 500 and Nasdaq 100, whereas the NYSE, value, and small- and mid-cap stocks are outperforming as is typical early in a bear market).

The Fed historically has NEVER raised rates under the foregoing conditions. In fact, the Fed was cutting the funds rate under similar conditions.

According to the Fed’s monetary policy objectives, we are right now at the desired unemployment level – so no particular reason to ease – and September’s annual headline inflation rate was marginally negative, so about 2% less than their target – so no reason to tighten either.

If the unemployment rate continues to edge downwards whilst inflation remains an ex-parrot, what exactly is the point of a rate hike? I can’t see any reason other than to stop people from being weirded out by interest rates being so flat for so long, but that has nothing whatsoever to do with the Fed’s stated objectives.

I can see an oil price rise happening eventually since producers are not so big on new investments due to the current low prices, but pull the trigger on rate rises before that has happened while there’s still a 2% chasm between reality and target while the downside is the risk of a deflationary spiral? That’s madness, surely.

Definitely too soon to tighten.

Why should the Fed set policy based on conditions in one sector that constitutes less than 15% of GDP while the rest of the economy is doing reasonably well? Do services lead goods or do goods lead services?

neil,

“while the rest of the economy is doing reasonably well”

is the rest of the economy doing well enough to raise rates? we are in a recovery, not recovered. raising rates will most likely slow things down. why would one do that in a recovery? not sure why so many people are in such a rush to raise rates. i understand why the banking interest wants higher rates. and those who accumulate income from interest and other capital endeavors, would desire higher interest rates. but it is not clear to me why the average worker would have any strong desire to have higher rates. they are more likely to need a future loan than to expect interest payments on capital saved. with the demographics pushing boomers into retirement, there will be continued demand for interest paying tools such as bonds. this will continue to push downward pressure on rates, i would imagine. raising rates would appear to be a contrary to what the market would consider fair value today.

Ido agree with BC