For an economy with underutilized resources or too low a rate of inflation the traditional prescription for monetary policy is to lower the interest rate. Central banks around the world tried to do that in response to stubbornly weak economies, bringing the overnight interest rate in many countries all the way to zero. But when that didn’t seem to be getting the job done, the Bank of Japan last week decided to go negative, charging banks 0.1% interest for excess reserves. With this step Japan now joins the Euro system, Switzerland, Denmark, and Sweden, all of whom have had negative interest rate policies in place for over a year. Here I describe how negative interest rates work, what they are intended to accomplish, and some of the limitations of using this policy to try to stimulate the economy.

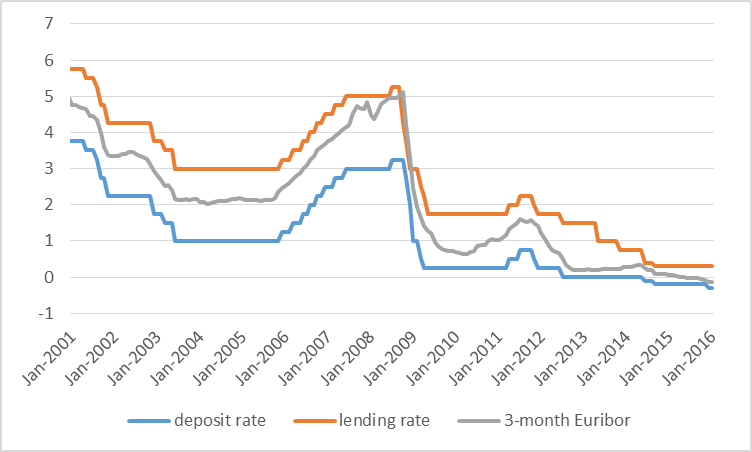

I’ll illustrate how negative interest rates can work by taking the European Central Bank as an example. Traditionally the ECB would set two interest rates: a deposit interest rate that the ECB pays to banks on excess reserves held overnight in the banks’ accounts with the ECB, and a marginal lending rate at which banks could borrow overnight from the ECB. The deposit rate would usually set a lower bound on the interest rate at which banks would offer to lend to each other– why would I lend to another bank at 2.5% if I can get 3% on my ECB deposits, which are in effect an overnight loan from my bank to the ECB? The lending rate likewise sets a ceiling– why borrow from another bank at 5.5% if the ECB will give me all I want at 5% through their lending facility? The graph below shows how this system worked historically, with the interest rate on 3-month loans between banks moving within the corridor specified by the ECB.

Average interest rate over the month on 3-month interbank loans (in gray) and end-of-month values for ECB deposit rate (in blue) and lending rate (in orange), January 2001 to January 2016.

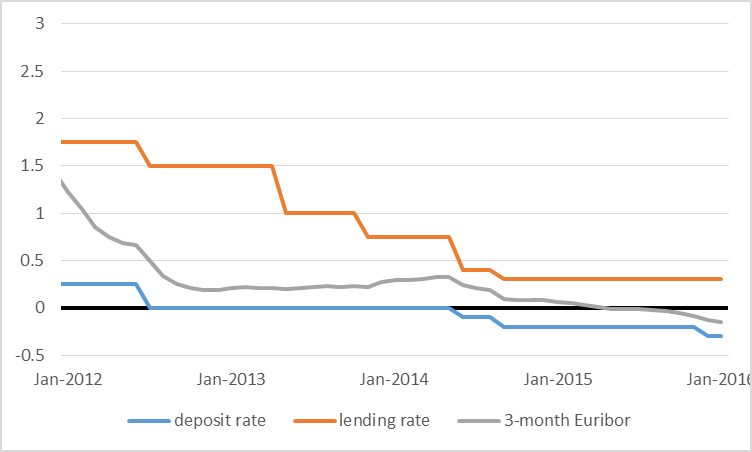

The ECB brought its deposit rate all the way to zero in July 2012. When that didn’t seem to be enough, they went to -0.1% in June of 2014, in other words, charging banks a fee (corresponding to a 0.1% annual rate) on their deposits held in excess of requirements. By last December the ECB had brought the deposit rate down to -0.3%. Here’s a more close-up view of the most recent data. It’s functioned just like the historical system, with banks lending to each other at a rate that is somewhere between the deposit rate (currently -0.3%) and lending rate (currently +0.3%). The average rate on interbank loans for January turned out to be -0.15%.

Average interest rate over the month on 3-month interbank loans (in gray) and end-of-month values for ECB deposit rate (in blue) and lending rate (in orange), January 2012 to January 2016.

Why would I pay another bank for the privilege of letting me lend money to them? It’s actually an easy call. If I keep the money myself, I’ll have to pay the ECB 30 basis points interest at the end of the day. If I lend the funds to another bank, those deposits become their problem, not mine. Paying 15 bp to another bank to take them off my hands is obviously a better deal than paying 30 bp to the ECB.

But why would my counterparty agree to the deal? It’s actually the same reason that the interbank rate traded above the deposit rate in normal times. Whether I pay interest or receive interest on my deposits with the ECB, these accounts are useful in their own right for a number of other reasons. Banks use them to make or receive payments from other banks throughout the day, and I never know for sure whether I’m going to end up with more than I need. Another dollar in deposits could well end up costing me another 30 bp, but given other benefits of having the deposits, the true opportunity cost is more like 15 bp.

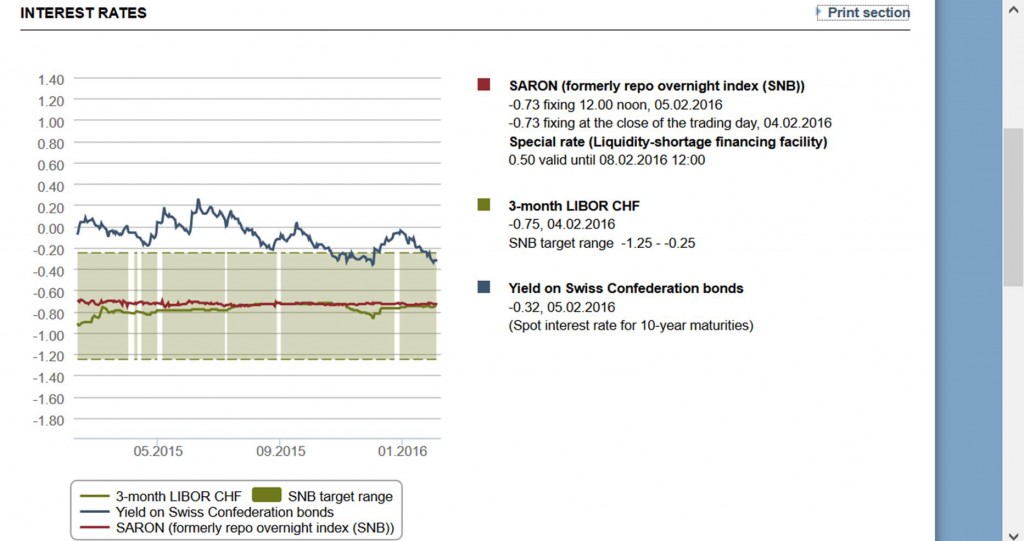

What are negative interest rates supposed to accomplish? Lending deposits overnight to another bank isn’t the only way I could try to get rid of them. Another thing I could do is buy a government security (another very low-risk option for my funds), paying for it by sending my ECB deposits to some other bank. That again would make the ECB deposit fee the other bank’s problem, not mine. If the government security pays positive interest and ECB deposits pay negative interest, the trade is again a no-brainer. But as all the banks try to buy the securities from each other, they will bid up the price of government securities above par. The result is that the effective interest rate on those government securities will go negative as well. In Switzerland, where the Swiss National Bank has moved its policy rate all the way down to -0.75%, the interest rate on 10-year government bonds is now -0.32%.

Source: Swiss National Bank.

The same kind of arbitrage should bring all interest rates including those on riskier securities down, though not necessarily into negative territory. The hope is that by making it cheaper to borrow, more spending and investment by consumers and firms would be encouraged.

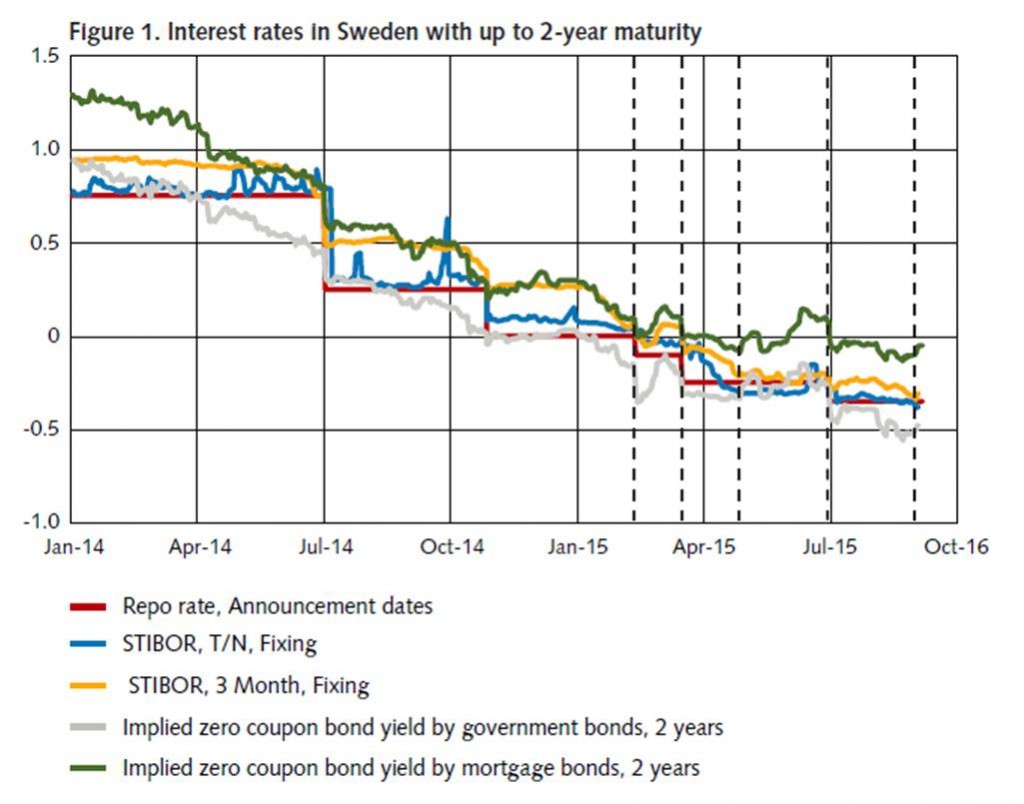

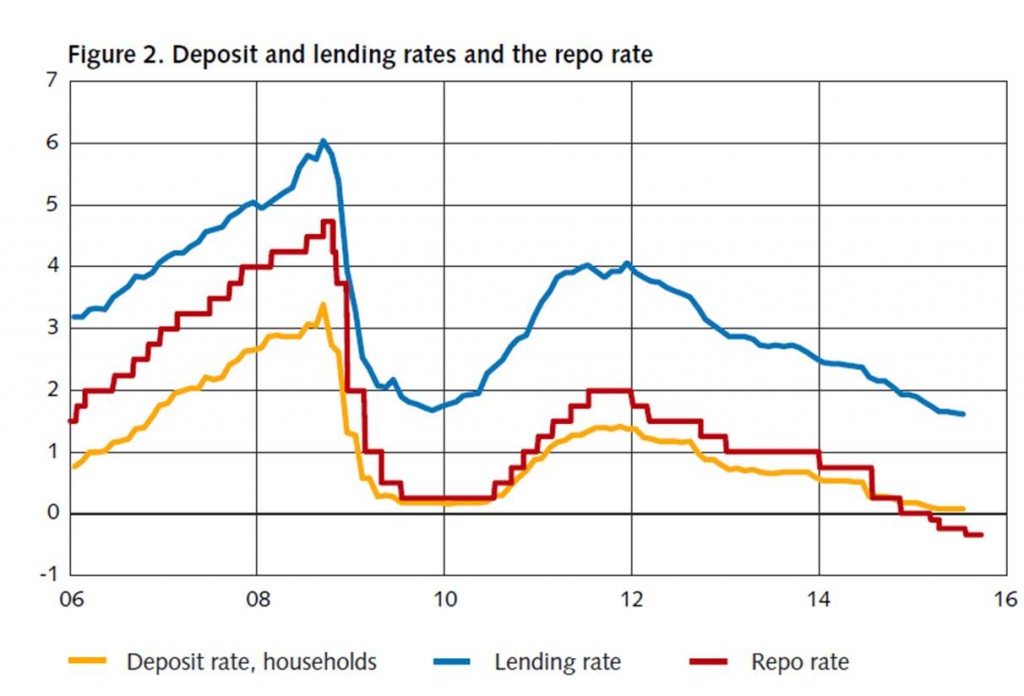

Source: Economic Commentaries, Nov 2015.

A bigger economic stimulus may come from the exchange rate. When safe interest rates are negative in Europe and positive in the United States, investors around the world are going to want to shift their holdings out of euros and into dollars, depressing the euro’s value. A cheaper euro may encourage European exports, which again could be a way to boost economic activity in Europe.

Other issues come into play if the negative yields start to spill over into retail deposits. Banks are understandably reluctant to charge customers to deposit in the bank. For example, in Sweden retail deposits historically paid a lower rate than the central bank’s policy rate. But today customer bank deposits are still paying token positive interest despite the negative rates in the interbank market.

Source: Economic Commentaries, Nov 2015.

Are you willing to pay each month for the privilege of having a checking account or a money-market fund? Given the conveniences associated with both, the answer for many people might be yes. But the bigger the fee becomes, the more you would look for some other form to hold assets, such as cash itself, whose interest rate is never going negative. If cash is too inconvenient, you might start paying somebody to hold the cash for you, at a lower cost to you than the negative-interest money-market fund, but at a positive spread to the money changer, who pockets your fee in exchange for simply hoarding cash in a vault for you somewhere until you want to use your funds. Cecchetti and Schoenholtz explain:

Suppose, for example, that banks were to offer customers the ability to convert their deposit accounts into “cash reserve accounts” (CRAs) that only hold currency. Like the sweep accounts banks created in the 1990s to minimize reserve requirements, CRAs would minimize the holding of central bank deposits. The funds would be available just like a checking account during the business day, but would be swept into cash currency rather than being held as reserves at the central bank. Overnight, the piles of currency belongs to customers, during the day they are the asset balancing the CRA liability on the bank’s own account. Critically, the cash in the bank’s vault assigned to the CRAs is not available to be lent out….

There may be some legal or regulatory impediments to a chartered bank creating CRAs. If that is the case, as it was with the MMMFs, we expect that some clever lawyers will find a way to create a nonbank subsidiary to do it. Or, as has been suggested, maybe an exchange-traded fund.

All of this leads us to conclude that the sustainable lower bound on nominal interest rates is the marginal cost of supplying CRAs.

Allowing funds to flow out of traditional bank accounts and money-market funds into alternative cash-based schemes would be costly and destabilizing. And having real resources devoted to hoarding cash on behalf of depositors rather than seek useful physical investment opportunities would seem to defeat the whole purpose of the measures. When Reserve Primary Fund “broke the buck” on September 16, 2008 (customers’ money-market accounts became worth less than 100 cents on the dollar), it triggered an outflow from other money-market funds that in some ways resembled a bank run. The Federal Reserve was forced to implement emergency measures to restore an orderly market. The benefits of another 25-50 bp in stimulus that negative rates could get us are small and, in the case of the U.S. Federal Reserve, seemed to be outweighed by the costs.

But the fact that so many of our trading partners are going negative means that a little interest rate hike in the U.S. goes a long way. As a result of the Fed’s decision to raise interest rates off the zero floor in December, the fed funds rate has recently been trading around 38 bp and 3-month U.S. Treasury bills have been paying about 32 bp. Not much, but significantly better than having to pay for the privilege of lending to your government as is the case in some of our trading partners. That difference between U.S. and foreign interest rates has been a big factor in the surge of the value of the dollar. Cheaper import prices help keep U.S. inflation down, and a strong dollar also discourages U.S. exports and encourages U.S. imports. The change in U.S. net exports in 2015:Q4 subtracted almost half a percent from the quarter’s annual GDP growth rate. If what the Fed wanted with its little rate hike was less inflation and slower GDP growth, it must have been pleased with the results.

I do not expect the U.S. to follow other central banks in driving interest rates negative. But the fact that other countries are going negative while we are not means that the Fed got an unusually big kick out of that little 25 bp move in December. For this reason, it may take some time before we see another move up by the U.S. Federal Reserve.

Really nice exposition.

Negative interest rates are an effect of the predictable deflation of the debt-deflationary regime of the Long Wave Trough. Deflation results from excessive indebtedness to wages and GDP and debt service to after-tax income.

Productive capital, labor, and gov’t receipts for social goods suffer from excessive rentier claims by the top 0.001-1% to 5-10% on current and future investment, production, profits, employment, and purchasing power. This is politically incorrect, to be sure, but it’s basic distributional math with elements of the Marxian falling rate of profits condition and proletarianization of the professional middle class next 5-9% below the top 1%. Too much debt means too much unearned income and related rentier flows are going to the top 1%, being hoarded in the form of overvalued assets, and not circulating in the productive economy.

With the secular trend rate of real GDP per capita near 0% and nominal GDP per capita below 2%, any acceleration in prices beyond the aggregate of productivity and labor force growth constrains growth of profits, real wages and purchasing power, profits, investment, etc.

Rising prices under these conditions, i.e., what is referred to as “inflation”, risk periodic stall speed and further deflationary effects.

The only way out is debt forgiveness (debt and asset deflation) to wages and GDP and increasing non-inflationary labor share of GDP for the bottom 80-90%. Running larger deficits and running up sovereign debt levels, ZIRP, NIRP, QEternity, and currency intervention only exacerbates asset bubbles, non-productive net flows to the financial(ized) sector(s), and the pernicious effects of inequality, and are merely a means to postpone the mathematically inevitable debt-deflationary “adjustment” of the Long Wave.

Z-z-z-z-z-z . . .

https://www.project-syndicate.org/commentary/bank-of-japan-negative-rates-mistake-by-adair-turner-2016-02

Yes, however, the Fed may be anticipating faster growth (reflected in the Atlanta GDP-Now model). I agree, the FOMC should tighten more slowly. The consensus a month ago was a 1.25% Fed Fund Rate by the end of 2016.

The Fed may be expecting faster wage increases, from a tightening labor market, and low commodity prices, including oil, to continue.

It may want to let some air out of any asset bubbles slowly than (potentially) suddenly later. It seems to be a cautious move, at this point.

The disconnect between this sentence “The hope is that by making it cheaper to borrow, more spending and investment by consumers and firms would be encouraged” seems quite large. Japan has invested vast sums in infrastructure but through government borrowing, not private investment. So is that hope real? I don’t see it. If anything, it appears to send a strong signal that the investment climate is terrible.

I’ve been trying to think of a good example. My experience is mostly in real estate and an essential truth is that stuff is cheap for a reason. Like Detroit has been cheap because it’s Detroit, meaning a shrinking, poor, aging, under-educated population with little employment. That it has become so cheap, some people are moving into it has bumped up prices but that’s an indicator of the investment climate changing at least somewhat: external factors, meaning the expense of living elsewhere, made parts of Detroit an “opportunity” for artists or others seeking cheaper living . Or NYC in the 1970’s: dirt cheap, buildings sold for a song. Fast forward and the exact same stuff is worth mega bucks but the cheapness in the 1970’s didn’t draw investment but rather discouraged it until external factors changed the economy, with that in large part being the extraordinary rise of the financial industry. So what bothers me about the Japan, etc. idea of low interest rates and that “hope” of “encouragement” to invest is that it relies on internal factors generating this demand when I see it being driven by externalities. And that speaks to the size of the problem because the US is largely tapped out as the great consumer, meaning we’re a mature market which has already incurred a lot of debt. We always then turn to China and India, et al but does anyone see India driving this kind of global externality to shift investment?

“And that speaks to the size of the problem because the US is largely tapped out as the great consumer, meaning we’re a mature market which has already incurred a lot of debt. We always then turn to China and India, et al but does anyone see India driving this kind of global externality to shift investment?”

We have turned to China, they are now ‘tapping out’ too. I am also sceptical about India being able to become the new ‘big spender’ (i.e. ‘big borrower’) in the global economy.

It’s important not only to make it cheaper to borrow, but also easier to borrow. An increase in borrowing will raise spending and investment to generate income and employment. When a virtuous cycle takes hold, that raises income = consumption + saving and move the economy towards full employment, then borrowing can become more expensive and more difficult to slow the expansion to a sustainable rate. There are still massive idle resources, e.g. labor and capital, that need to be employed. The economy is underproducing between $1 1/2 trillion and $2 trillion a year.

At the moment, the US Fed isn’t looking at negative rates but at raising the existing Fed Funds rate and the rate of interest on excess reserves.

That puts upward pressure on the dollar and creates an enormous, unsolvable conundrum for China. Countries can have an independent monetary policy or they can have a fixed exchange rate (in this case pegged to the US dollar), but no country can have both at the same time. So with the appreciation in the dollar and the Yuan peg, the Chinese are tied to a tightening US monetary policy when their economy is in desperate need of easing.

What they would like to do is devalue the Yuan and possibly even allow it to float freely . . . . . . though China has the largest stock of foreign currency reserves in the world at about $3.2309 trillion, in January the reserves fell by $99.5 billion and in December by $107.6 billion. Since the IMF and other expert observers estimate that China needs $2.7-$2.8 trillion to keep their financial economy functioning smoothly, they have a serious problem with capital flight and one wonders, “Why don’t they get it over with and just let the Yuan go down?”.

The critical problem they face is that over the past few years, dollar-based borrowing in China has increased substantially (an understatement) and there is now something akin to $1.2 trillion in US denominated debt outstanding. One suspects that China has about 3-6 months to figure out how it wants to take its medicine, and the end result is not going to be pretty.

In other news, J.P. Morgan raised its probability of a U.S. recession within 12 months to 25% (hat tip: Business Insider):

http://tinyurl.com/gsuj9c3

Except negative rates in Japan is just driving more capital and cheaper cost to leverage debt for companies. That lowers a US recession risk and raises the potential of another consumption bubble. People did not learn from 97-2001.

Japan has the oldest society on earth. The Japanese labor force peaked in 1998 and has declined every year since and is mathematically certain to shrink every year going forward for at least 18 years in the absence of immigration – and Japan culturally has a tradition of not importing guest workers.

So, in the world’s oldest society, a nation of savers, the Government is going to stimulate the economy by reducing the return on savings. How is that going to work?

Interest rates should be seen as a form of pressure within a financial system. Negative interest rates mean that there is actual negative pressure building within our global financial framework. This means that liquidity is evaporating at an alarming rate, and the banking system is close to collapse, world wide.

Of course, I can see the US having these negative rates within a few quarters to ease the pressure. But that won’t be enough.

Central banks will literally begin crediting the population directly with money, routed through the government. That’s when the jet fuel will hit the fire.

What a bizarre time we are witnessing. It will end in tears of course.

One more good post to learn from you.

E2016 will see more than 1,25 %, as we have an election year,

and Clinton, say NYCjewishClub, wants lots of success for her

donors. Hello, Larry Silverstein.

Why negative interest rates?

Negative interest rates can exist on several levels, but are really simple to understand. Think of negative rates as dissuaders. Their purpose is to dissuade holders or potential buyers from either holding or buying.

Level I – between central and member banks.

If a central bank is charging a negative rate to its member banks, it is desiring that the banks no longer park their available funds with them. The central bank instead wants its members to use the funds in the purchase of productive investments, or in the loaning out of funds to stimulate a troubled economy. [Adding liquidity to the system.]

Level II – between banks and their customers.

If banks are charging customers for holding funds, then they want the customers to withdraw their funds and spend them to boost the economy, or to purchase securities. [Increasing spending in the economy stemming from a savings drawdown {dishoarding}.] (Also, it should be noted that the easiest way to extract money from an economy being bombarded with monetary increases by the central bank is through purchase and sale of rising equities, dividend payments, or bond interest.)

Level III – between popular financial instruments and foreign holders or potential foreign purchasers.

If the negative rates have been extended to popular domestic financial instruments, the purpose is to dissuade foreigners from either holding the instruments or purchasing them. This will put a downward pressure upon the price of the domestic currency and assist exports in remaining competitive and guard against “hot money” inflows. [Keeping the domestic currency from appreciating & avoiding “hot money” inflows.]

An unintended consequence of negative rates is hoarding. Why spend money to jump start a moribund economy when one’s own financial situation is uncertain? It’s better to conserve one’s precious funds by placing them in a lock box, under a mattress, or under some inconspicuous rock in the back yard. However, abandoning physical currency in favor of digital money will make everything crystal clear to the tax collector, allow for easy fund confiscation as in a wealth tax, and guarantee that negative rates will result in spending, or else!

In the absence of digital currency, some form of negative rate aversion will occur. This cannot be good for the banking system, as it will ultimately drive the depositors to other venues, which will certainly have to reduce commercial activity – sort of a reverse-“Lombard Street” phenomenon. It should be noted that negative interest rate ploys are a severe measure, applied only when all else has failed. They are short-term measures enacted by desperate bankers, and to me, signify the arrival of one or more monetary regime endgames. They are NEVER good news to anyone at all!

“The benefits of another 25-50 bp in stimulus that negative rates could get us are small and, in the case of the U.S. Federal Reserve, seemed to be outweighed by the costs.”

JDH, the other issue with negative US rates is that we don’t really know what the overnight rate will look like when we go into negative territory. Given that GSEs are allowed to enjoy 0% shelter from negative IOR, banks will try to avoid a negative IOR penalty by contracting overnight with GSEs for shelter. Instead of the the leaky IOR floor that has prevailed over the last seven or so years (where the overnight rate trades below IOR) we’d see a sticky ceiling, where the overnight rate trades somewhere above IOR. Where exactly it would trade I’m not sure.

LOL 1.25% by the end of 2016? Absolutely zero chance of that. My guess is they drop it back down .25 early next year after the recession hits.

Anonymous, This year after the recession hits.

We didn’t run big enough deficits to spur the economy to growth!!!

You mean the boom hits, they will raise rates and make it worse. Terrible post.

You are predicting an economic boom this year? Get real. Terrible post.

I would note that while they were not policy targets and more along the lines of extraordinary events at odd points, we have been seeing negative nominal interest rates appearing, if just briefly, for about two decades, with the first such appearance in the mid-90s in Japan and later in the US. It is only since the 2008 crash that we have seen them as policy targets, one that the US Fed is clearly not going anywhere near soon given that they are still getting over their obsessino with raising target rates.

I also note that Willem Buiter has long touted the virtues of negative target rates under certain circumstances, dating back to before we saw them.

As it is, the recent performance of the Fed should remind us that the there is both a social dynamic within the FOMC that works itself out over time, as well as a dynamic regarding public announcements that ties the Fed up in various ways as it struggles to maintain its public credibility. So, the push for raising target rates built up over a long time within the FOMC, led by those who were never happy with the later stage QEs. This hawkish view finally gained an edge last spring, and it ihas been noted by people like David Beckworth that a substantial part of the contractionary impact of changed Fed policy followed on last spring’s annoncement that the Fed would be raising target rates in the future.

Well, this set the stage for the credibility game. There they went, saying they would raise target rates. So come September the votes were reportedly there to do it, but then China went weird and the markets got all cranky, and apparently Janet Yellen went arouind privately and convinced a handful of FOMC members to change their votes to not raising rates in September. But a deal was clearly cut that if US labor markets performed well in the fall, rates would rise in December. Well, they did, and so to maintain its cred, the Fed raised the target rates, only to have stock markets unhappy along with most commentators. With Japan and others going into negative territory, the Fed is still stuck with their previous projections of steadily rising rates (three or four times this year?), but this is now clearly completely out the window. So, the question is when are they going to publicly admit and back down off these now completely incredible and obsolete projections of further rate increases in the near future. Ain’t gonna happen.

Rate projections actually are irrelevant. Raising rates would draw in more capital and further the case for another consumption bubble.

Latest on CNBC.

http://www.cnbc.com/2016/02/08/obamas-oil-tax-plan-wont-work-commentary.html

For some reason Progressives believe that if they give something a fancy name it will work magic. That is the case with negative interest rates. Interest is a charge of a lender to a borrower for the right to use the lender’s property over time. Negative interest rates are simply a fee charged to warehouse property. Those countries that are playing with “negative” interest rates are finding out that lenders are treating it as a cost not an interest rate. Even the professor’s explanation describes a cost not an interest rate.

“Negative” interest rates are much like “gay” marriage. It redefines a word that actually removes meaning and confuses the meaning so much that the original meaning is lost and the word actually begins to have no meaning. It becomes simply what ever the person using the word wants it to mean and all linguistic precision is lost.

it takes a certain world view to be able to compare “negative interest rates” to “gay marriage”!

Negative interest rates – a symptom of the utter ineptitude and corruption of central bank policies of the past seven years that have driven the global economy deep into a box canyon, with policy resources now so depleted that central banks are bereft of anything even remotely sensible to do next!

are you suggesting the central banks should have had higher rates over the past seven years?

The real question is: in a cashless society, such as they are striving to create in Europe, is there any limit to negative rates? You can’t create a CRA if there is no cash (or limited cash, relative to deposits).

When central bankers come up with answers the world will freeze over , here comes the barter system that’s a good thing .

“Another thing I could do is buy a government security (another very low-risk option for my funds), paying for it by sending my ECB deposits to some other bank. That again would make the ECB deposit fee the other bank’s problem, not mine.”

A little ashamed of the question, but how does bank A buy government security (bonds?) and pay for it using deposits that were lent to bank B? Wouldn’t Bank A pay 15bp on the dollar to Bank B, and then receive interest (assuming gov security is paying positive) from the government bond?

Learning Econ: Bank A has deposits with the ECB and is deciding what to do with them. One thing it could do is just wait until tonight and pay the ECB 30 bp annual interest rate. Another thing it could do is buy the government security on the open market. Let’s say the customer who sold the security to Bank A has an account at Bank B. Then Bank A pays that customer by instructing the ECB to send its deposits to Bank B. Bank A has gotten rid of the excess deposits but now Bank B faces the same problem.

Got it, thank you very much.

I am not an economist but commend you for writing an overview that makes this complex issue a little easier to understand. That being said I do run a small business and this is my interpretation of this soon to be bigger mess: 1. The ECB penalizes banks for excessive reserves with the view of HOPING they will lend more money, stimulate business growth etc.. 2. The Federal Reserve is encouraging negative interest rates. 3. The gap between the deposit and lending rates is closing so CRA’s might be an option to avoid excessive charges for the banks and consumer but this doesn’t help growth and is simply a stop-gap for the money grabbers 4. A lower valued currency creates export opportunity while at the same time import opportunity (China, Canada have been doing this for years with the US so not such a big issue but could be better to stimulate domestic growth). The question: If the underlying driver behind negative interest rates is to stimulate growth by encouraging banks to manage reserves and avoid hoarding of cash; then why are the central banks HOPING this will happen and not providing a well laid out plan to ensure this will happen. For example, for every stick there should be a carrot. Is it possible for the central banks to work with other government counterparts to provide tax incentives to banks to lend money to small businesses for better use and yield of these excessive reserves. I know this is their hope but remain concerned with out a counter-push the banks and wall street will create another security trading unit that will only benefit them and not the over-all economy. I am concerned and curious…. and yes, not an economist so forgive me for asking such a basic question.

curious, you hit on the question which has been asked for nearly 8 years. the central bank can promote monetary policy, and they have by keeping rates as low as possible to stimulate economic activity. the hope has been the congress would promote fiscal stimulus at the same time. unfortunately, other than the when obama was able to promote the ARRA stimulus, other fiscal stimulus has been lacking. in fact, some fiscal response has been outright austerity. in an aggregate demand drop, like we encountered in this recession, supplied side tax incentives do not help if the consumer is unwilling to spend. if you had a tax incentive, would you have produced more in an economy with lack of demand? would you have taken the tax incentive as a means to drop the cost of your product in order to sell more? your profit would be the same with the incentive, but you would be promoting deflation, to your detriment when the incentive disappears.