Or, breaking up the big banks might provide some visceral joy, but it’s not clear to me that solves the key problem of financial fragility in modern capitalist systems.

I recently talked on C-SPAN’s BookTV about my book, Lost Decades, coauthored in Jeffry Frieden. In it, I recounted the story of how, by hubris and ignorance of the basics of finance, we mired ourselves in the biggest financial crisis in living memory.

It strikes me it is useful to place assessments of the cause of the global financial crisis, over-simplistically for sure, into two categories: (1) moral hazard due to implicit government guarantees incentivizes financial entities to become overly large (aka Too Big Too Fail); or (2) government deregulation and/or financial innovation to circumvent existing government regulations such that leverage rises. While elements of both are no doubt part of the story, apportioning the relative blame is critical for determining what are the most appropriate public policies. If you believe the former, then breaking up the banks is the way to go. If you believe the latter, then measures to reduce leverage, either by implementing higher capital levies on systemically important financial institutions, and/or by making all financial institutions hold more capital against assets (and correctly risk-weighting assets) is the more efficacious route.

In Lost Decades, Jeffry Frieden and I document how hubris and ideological blinders led the G.W. Bush Administration to pursue deregulation of banking, and allowed other policymakers to ignore the hazards of high leverage (based on arguments that self-interest would induce sufficient capital holdings). The argument that it’s all “too big too fail” fails to explain why in the past massive crises of the 2008 variety did not appear (big institutions have always existed), and why the collapse of a relatively small financial institution — Lehman Brothers (not a commercial bank, by the way) — sparked such a calamity. It also fails to explain why the losses associated with many bankruptcies among many often-small savings and loan institutions necessitated such a large US government-financed bailout in the early 1990’s. So don’t focus too much on Glass-Steagall’s repeal, such as in this set of proposals. Instead, we should focus on leverage. It’s leverage that kills.

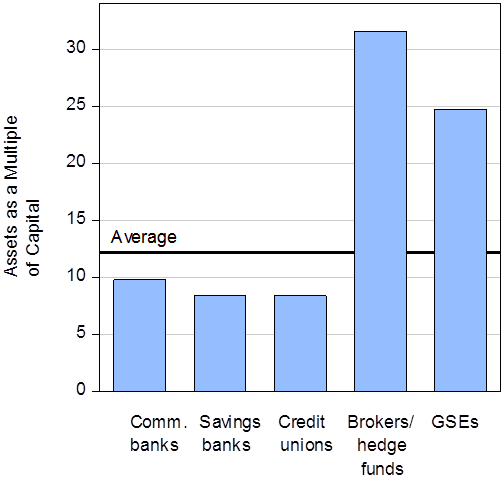

Figure 1: Leverage in 2007, measured as capital as share of assets. Source: Source: Greenlaw, Hatzius, Kashyap, and Shin (2008)

.

In other words, the vote in favor of the Commodity Futures Modernization Act of 2000 was a bigger error (one shared by many) — I think almost all informed observers would now agree — than Glass-Steagall repeal.

Finally, it is useful to understand that higher capital charges (requiring greater holdings of capital against risk-weighted assets) (see documentation here) is already making the financial system more robust, and incentivizing downsizing of financial institutions.

Krugman discusses. Much more analysis here, and in a Hoover Institution book chapter here, as well as in Lost Decades.

Update, 2/9 8:15am Pacific: Noah Smith has a more comprehensive assessment of the irrelevance of many of Bernie Sanders’ financial regulatory proposals.

“…..why the collapse of a relatively small financial institution — Lehman Brothers (not a commercial bank, by the way) — sparked such a calamity. ”

Or why that one , special , final straw broke the camel’s back.

These are the puzzles our best and brightest are made to ponder.

There’s a very simple answer to why Lehman Brothers sparked the calamity – the Principal Reserve Money Market Fund, the oldest money market fund in the country, owned so much Lehman commercial paper that it “broke the buck”. Worse yet, the Principal Reserve Money Market Fund refused to allow its investors to withdraw their funds. This debacle sparked a run on money market funds across the US. These outflows meant that on balance, major financial institutions such as Morgan Stanley and Goldman Sachs and GE Capital couldn’t “roll” their short-term paper, and thus were going to be out of business in short order.

http://pages.stern.nyu.edu/~sternfin/mkacperc/public_html/commercial.pdf

Are there any upsides, in terms of externalities, to large banks? For example, regulators might prefer to apply leverage against a single institution with a known C-Suite, than approaching an eclectic group of smaller bank teams with idiosyncratic processes. I would love to hear from a former regulator about interactions with large banks vs. small banks of the same aggregated asset size.

As far as I can tell, the US’s post New Deal financial system was sturdy and stable in an environment where at at least one of the following conditions was true over a 4-year window:

a) Annual nominal GDP and wage growth averaging greater than 7% and even going as high as 20%, with inflation ranging from 3% to 12%

or

b) Falling central bank interest rates

I cannot picture a real-world regulatory regime that can produce financial stability in the US without at least one of the above conditions being true.

The problem with dividing the solutions in this way is that it ignores connections between the two explanations. Big banks are big political actors, not merely big repositories of moral hazard. The Commodity Futures Modernization Act would not have been passed except for the political strength of those large financial institutions. Regulators would have been less supine had they been dealing with less powerful regulated institutions–bluntly, with institutions who effectively owned fewer US congressmen and senators. You do understand that finance, insurance and real estate is the largest source of campaign funding and the largest source of lobbying expenditure in US politics, right? I think it is obvious that the drive to break up the big banks is at heart less an economic prescription and more of a political reaction to their privileged position in the scheme of things–which was on very public display back during the financial crisis. The average citizen observed that when the man on the street got into financial trouble, they were calmly allowed to suffer, but when large politically connected organizations got into trouble, the laws were instantly rewritten to make the trouble go away. You just can’t un-see some things.

One problem with your statement is that bank efficiency doesn’t seem to improve beyond a certain size. Banks aren’t generating more aggregate profits by clumping together. Your hypothesis requires either a reduction in aggregate profits, or a significant coordination problem between the banks post-breakup. It’s not obvious why breaking up banks reduces political power.

Bigger banks may not be more profitable to their shareholders, but they are much more profitable for their executives, and particularly for the top executives who control lobbying policy. (That is, bank CEO compensation tracks quite directly with institution size.) There is every PERSONAL incentive for these people to lobby intensively for the ability to grow their institutions, whether it rewards their shareholders or not.

Also, during periods of stress, bigger banks clearly enjoy the financial advantages of being too big to fail, allowing them to fund themselves more cheaply than small banks. While that funding advantage may drop in calmer times, it almost certainly never goes away. This is fully rational, as I doubt anyone would really be willing to bet that the authorities would let a Citi or a JP Morgan Chase go under.

Of course, the real solution to reign in the outsize influence of banks and other self-serving parts of the economy (healthcare, defense, agriculture, etc.) would be to take steps to move the US government away from its current form–that is, an “auctionocracy” where policy is put up for bid, allowing yesterday’s winners to write the rules for tomorrow–and make it more democratic. I suspect a good first step would be public funding of elections, although that wouldn’t be a panacea.

William Meyer: I agree that finance exerts a disproportionate influence on the political arena. I also remember that the S&L crisis was driven by well-connected individuals associated with relatively small financial institutions. If you’re asking me whether we should try to mitigate the influence of the financial sector, I’d say yes. If you asked me whether breaking up the banks (as opposed to making the banks and financial non-banks less profitable by way of higher capital charges) would do the trick, I’d say, I’m not sure.

exactly. these criticisms are frankly myopic.

Breaking-up large banks is not a solution to a systematic problem created by government, i.e. too-big-to-fail. The market will determine how much a bank, an automaker, or any other public firm is worth.

Banks will find ways to make money, even if it means diversifying risk on a global scale. However, banks don’t make risky loans. An economic downturn makes sound loans risky. So, some regulation is needed.

And, banks don’t need encouragement by government to make risky loans, e.g. in the housing market of the 2000s.

“However, banks don’t make risky loans.”

you really believe this statement? banks created financial instruments which allowed them to securitize mortgages and sell those risky loans off to other investors. the problem was the banks ability to generate significant leverage in the system, and then pass that leverage off to others. they had no long term skin in the game at that point, which was bad enough. but then they turned around and sold insurance on those risky products! this was not government policy. simply the private sector searching for yield, and making a huge mistake in the process.

Without a giant government social program, Congress believed it didn’t have to pay for, good luck getting a loan with no job, no income, no down payment, and marginal credit.

“Without a giant government social program…”

peak, you again are speaking from a fantasy land. why not simply acknowledge the obvious, the private market made very, very poor decisions on risk, and it turned out to have devastating consequences. you sound like rubio in the debate, whose robotic canned response is “the government made them do it.” these businesses made very poor decisions without consideration of future consequences. you seem to forget many of these soured loans were private sector originations, not fannie and freddie. “government social program” is simply an excuse for reckless business decisions.

Baffling, you remain in denial. I guess, you believe it was a massive right-wing conspiracy “the private market” “made very poor risky decisions without consideration of future consequences.”

Michael Bloomberg, former Mayor of New York City:

“It was not the banks that created the mortgage crisis. It was, plain and simple, Congress who forced everybody to go and give mortgages to people who were on the cusp.

Now, I’m not saying I’m sure that was terrible policy, because a lot of those people who got homes still have them and they wouldn’t have gotten them without that.

But they were the ones who pushed Fannie and Freddie to make a bunch of loans that were imprudent, if you will. They were the ones that pushed the banks to loan to everybody. And now we want to go vilify the banks because it’s one target, it’s easy to blame them and Congress certainly isn’t going to blame themselves.”

peak, congress did not force any banks to give out poor quality loans. congress certainly did not stop them from giving the loans, but that is completely different from forcing them to make those loans. congress could have imposed restrictions on those loans, but that would have been an increase in regulations. something you have clearly shown to be adamantly against.

peak, there is no conspiracy going on here. private markets made very poor decisions. that is not at all unusual. look at the dot com bubble and bust. private sector is not immune to stupidity.

Baffling, you’ll say anything, no matter how ridiculous, to protect your politician-lawyers, who “made very poor risky decisions without consideration of future consequences.”

So, you don’t believe it was a mass conspiracy after all, just a mass stupidity.

And, I have not “clearly shown” I’m against regulation. You have clearly shown you just make things up.

peak, you need to admit that a free market ideology does not always lead to the ideal outcome. the financial sector was deregulated, and that free market produced a catastrophe-but that is against your ideology. free markets can never do wrong, so you look for a scapegoat, for which the government serves as a convenient target.

“So, you don’t believe it was a mass conspiracy after all, just a mass stupidity.”

not mass stupidity, but lots of money being directed by stupidity. watch “the big short”, or better yet, read the michael lewis book, to understand what i mean by stupidity. yes it was dramatized a bit, but your unshakable faith in the smarts of the private sector is not substantiated by the actual behavior of the private sector.

the private sector has a habit of chasing yield, just like the dog chasing the car. its only when the dog actually catches the car does he realize what a foolish move he has made.

That’s an overrated factor. It exaggerates the role of the principle-agent problem in the financial crisis, and ignores market demand for increasingly aggressive lending by non-depository institutions. The more important questions are why the market demand became so optimistic with respect to housing, and why did that optimism turn so sour?

I don’t understand how the passage of the CFMA can be treated as a separate event from the drawback from the separation of investment banking from commercial banking. Both the CFMA and the 2005 BAPCPA are all part of the same process.

The whole modern derivatives market could not exist without the drawback from Glass Steagall’s principles that started in the 1980s. These markets rely on the liquidity that only commercial banks (not stand-alone investment banks) can provide.

Does anyone have information regarding the specific regulations that Brooksley Born wanted to implement at the CFTC?

Mike: Born never got to the point of exploring “specific regulations.” When she issued a concept paper proposing to gather information on the derivatives market to determine whether regulation was needed, she was told she was going to “cause the worst financial crisis since World War II” and was shut down by regulators who were upset that law clearly granted the CFTC jurisdiction over many derivatives.

http://www.washingtonpost.com/wp-dyn/content/article/2009/05/25/AR2009052502108.html

http://alumni.stanford.edu/get/page/magazine/article/?article_id=30885

http://economicsofcontempt.blogspot.com/2009/05/brooksley-born.html

Also, if American legislation is to blame, why did contagion spread to Europe?

Is America in a bubble?

Why not spread to Europe?

Europeans want easy money too.

“It’s leverage that kills.” Isn’t it true that the Fed had the authority to set capital requirements for bank holding companies prior to 2008 and failed to use that authority?

Gene: As suggested by Figure 1 in the post, the problem was not so much the bank holding companies for commercial banks, but high leverage in the “shadow banking system”, which to my knowledge is not an issue central to Senator Sanders’ proposals.

Menzie,

When you say the problem was not so much the bank holding companies……but high leverage in the shadow banking system…..”

the bank holding companies had highly leveraged Special Investment Vehicles (SIVs) as subsidiaries. As I understand it, these were off-balance sheet subs, but arguably the holding companies stood behind the debt. Moreover, TARP injected capital into the bank holding companies, and presumably that would have been less necessary if those companies had higher capital ratios before the decline in asset values.

That’s 100% correct. Toward the end of 2008, Citibank had about $1 trillion of assets on its balance sheet, and another $900 billion in assets off balance sheet in SIVs and Conduits – SPEs that in GAAP theory Citibank was not on the hook for, but in fact they had to stand behind. Unlike Enron, which did the same thing on a smaller scale and where 2 of the top execs went to jail (Skilling and Fastow) and a third (Ken Lay) would have if he hadn’t died suddenly, NOBODY at Citibank went to jail.

Some would argue – I might even be one of them – that Citibank had special political cover by virtue of people like Robert Rubin. Recall that Rubin was a very well-connected Secretary of the Treasury in the Clinton Administration, where his last act before leaving was to dissolve Glass-Steagall. And then he collected his “payola” in the form of a job as Executive Vice Chairman (with no operational responsibilities) at Citibank for a cool $8-$9 million per year.

The WSJ pretty much confirms what Peter Schaeffer contended about illegal immigration.

http://www.wsj.com/articles/the-thorny-economics-of-illegal-immigration-1454984443

Working inside banking institutions, including non-US ones, during the period that the trading room lunatics took over the asylum, convinces me that Prof. Chinn is 150% right this time.

Making the kind of clever dickheads who run them sit on more capital will keep them closer to the ground, whatever their desires and venal instincts.

Remember that successful trading is an instant gratification activity in terms of bonuses and that these folk want to be seen as macho, as well as rich and smart. Trading is what a real man does.

Many/most shareholders might have preferred boring banks and the higher stock multiples that go with boring but they weren’t consulted or simply ducked.

Dear Menzie,

I agree with all of this, but would put it slightly differently, and would appreciate seeing your opinion. In my versión, it is the banks taking the government guarantee that Fannie Mae and Freddie Mac implicitly provided as a guarantee housing loans could not go bad, because the government wouldn’t default. The notion that housing prices could never come down was an application of this belief. So it’s not size of the Banks, implicitly, so much as what they do.

“The Big Short”, which shows the financial intermediaries not doing the due diligence on the CDOs and the like, because the loans were commoditized into something that was guaranteed, seems an application of this as well. If you take all the assumptions behind the CDOs at face value, there is nothing to prevent a CDO of car loans, or businesws equipment loans. But it has never happened because there is no government guarantee for these.

And by the way, with the assumptions behind Value at Risk analyses, which asume an essentially stationary statistical distribution that does not depend on economic variables like GDP growth or inflation or oil prices, but provides a seemingly precise answer as to the riskiness of a portfolio, isn’t the mechanism really still in place?

Julian

Julian Silk: The problem with CDOs as structured is that they were inappropriately rated AAA, and this meant that the capital held against them was too low. This would probably have been true even w/o the government guarantee, as long as the rating system was gamed to attribute overly-low risk to top tranche CDO’s. (What securities lost most value? I think it was private label).

I agree moral hazard was in play due to implicit guarantees given to Fannie and Freddie. Thank goodness there were restrictions on the types of mortgages that the two GSEs could securitize. However, I do not see any proposal by any candidate (please correct me if I am wrong) about privatizing either agency.

When Basle put the standards together, they were much too generous in their treatment of mortgages. IMHO, that’s where the mindset first took root with the European banks, and then gradually over time spread out into structured finance. Of course, even the most fundamental credit ratings were horribly flawed: GE was AAA rated in 2008!

So when the crisis hit, there were multiple problems: (a) there was too little risk capital allocated against AAA rated bank assets, (b) most of the AAA rated assets shouldn’t have been rated AAA to begin with, and (c) many of the mortgages underlying much of the structured finance products didn’t meet the FICO minimums to have been pooled in the first place.

The CFMA had two principal objectives:

– To allow banks to use retail deposits as collateral in their own securities and investment activities. (Leveraging Main Street).

– Subordinating all other securities to the bankers’ own derivative instruments. (Increasing Main Street’s risk by decreasing potential default recovery by conventional creditors).

The seemingly endless spawning of new security instruments enabled by the CFMA increased credit as it escalated risk. Things really got out of hand after the dot-com crash, when the FED ignored reserve requirements on Eurodollar accounts, allowing even more leverage on money creation.

I would interject that I agree with Menzie that “Leverage Kills”… The biggest continuing leverage problem being that Total US Credit (loans and debt securities) is north of $60 Trillion or 350% of GDP. Debt Securities are about 2/3rds of the total or about 240% of GDP. Most frightening is that World-Wide Debt-Securities are ~290% of GDP. High debt levels highlight the problems with global banking, stock markets and trade. Fasten your seat belts, its time to deleverage.