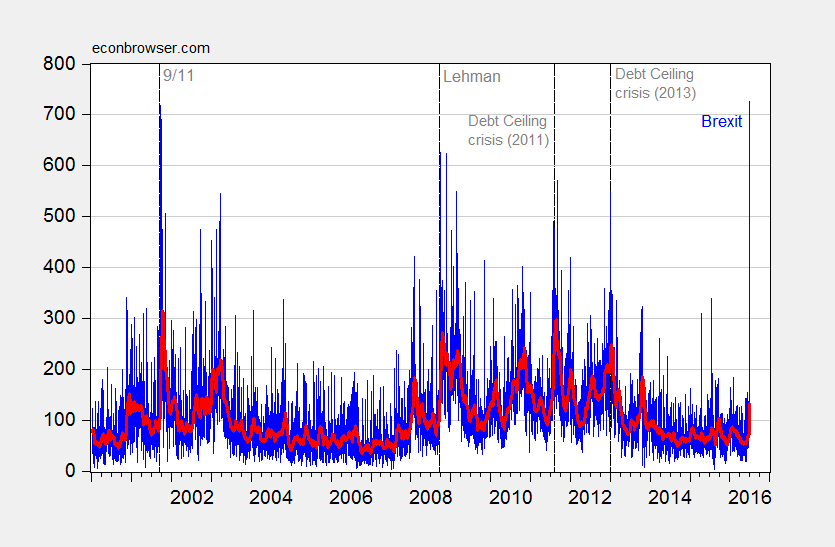

I find it remarkable that, going by the numbers, economic policy uncertainty is now higher than after the bankruptcy of Lehman — and even higher than in the days after 9/11.

Figure 1: Daily economic policy uncertainty index (blue), and 30 day moving average (bold red). Source: Baker, Bloom and Davis, via Economic Policy Uncertainty accessed 6/27, and author’s calculations.

It would be interesting to know what economic policy uncertainty is in the UK as of today, but only a monthly index is available. Even so, the May index was at 417.13, exceeded only by the previous two months (March was 479.33, a record).

This has been written about in the Wall Street Journal, CNBC, and various financial and economics rags. It’s called “presidential election year”. This one’s a barnburner.

In his book “The End of Alchemy” Mervyn King writes that people’s faith in currencies depends more on their assessment of how stable the political institutions backing the currencies are than on analysis of economic and financial data. Same here with Brexit. Brexit and Trump are part of the same movement to fundamentally rewrite decades old rules of how the most important phenomenon of our time is conducted: globalization. In the last 3 decades a political framework was created that determined the losers and the winners from globalization and also took any decisions about globalization out of the hands of the populace and into the hands of the establishment. Now the commoners are trying to gain control of the process and write new rules and this terrifies the elites. Any movements in the value of assets over the next 4 months will be reflecting much more the elites’ faith in their ability to hold off the barbarians that are swarming the gates than any particular economic or financial data.

Doesn’t this observation sort of make this indicator flawed? This is not Lehman. I don’t think that is a controversial thing to say.

Agreed.

It was viewed as a big negative initially, and certainly an unexpected shock (the bookies and the polls got it wrong). However, it quickly became viewed as less negative.

Menzie, it looks like the big spike just got revised away.

Neil: Yes, agreed. Although at 564 on 6/25, it’s still not far below post Lehman at 626.

DJI is back to pre Brexit levels, but that has been supported by lowering futures on US interest rates, which themselves are down because of Brexit recession fears (e.g. Yellen’s statement reflected Brexits impact). It is also hard to compare Lehmans to Brexit and say which is worse – Lehmans was truly terrible as a financial shock but potentially narrower in scope, while Brexit is less damaging on impact but may be worse long-run if global trade and pro-growth centrist policies in Europe unravel. Ever since WWII these policies have helped promote European growth, and in a post-EU world Southern Europe could swing wildly to the left and Northern Europe become more insular. As a Brit currrently in Greece this is definitely causing a lot of local angst, much more than I remember Lehmans did.