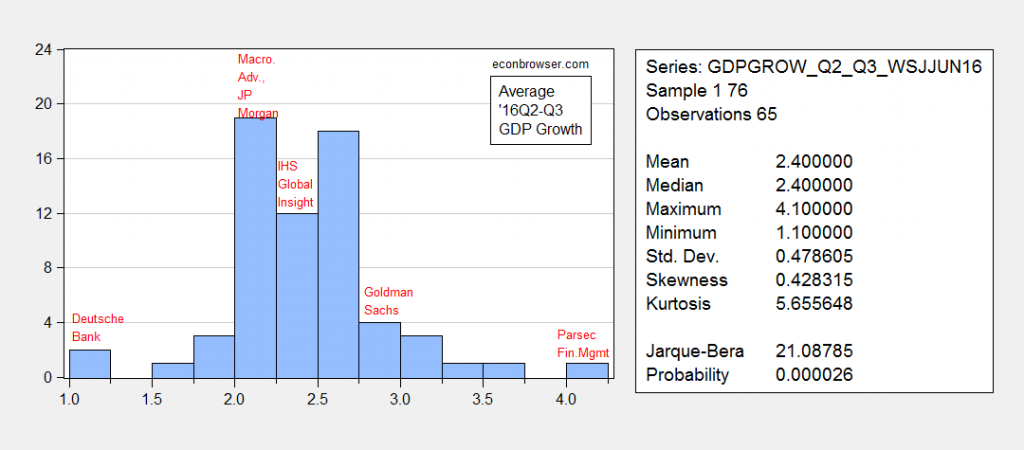

The Wall Street Journal‘s June survey of economists is out. Interestingly, no one’s mean forecast is for two quarters of negative growth in 2016Q2-Q3 (or even one quarter!), but the assigned probabilities of recession remain elevated.

One point 1, see this histogram.

Figure 1: Histogram of average growth rates for 2016Q2-2016Q3 (SAAR). Source: June 2016 WSJ survey for economists, and author’s calculations.

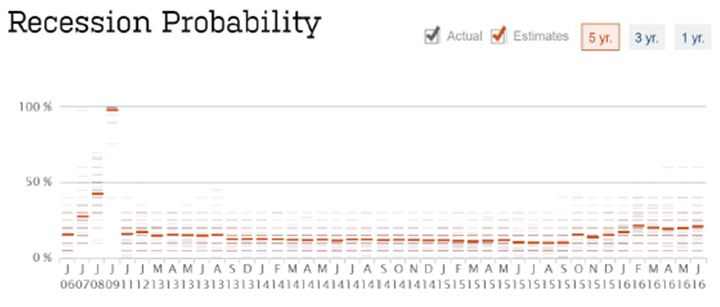

On point 2, see this time series of recession probability assessments:

Figure 2: Recession probability assessments. Source: June 2016 WSJ survey for economists, and author’s calculations.

The mean probability assessment is 20.7% for a recession in the next 12 months. So while not a single forecaster predicts 2 quarters — or even a single — of negative growth in 2016Q1-Q2 (as shown in Figure 1), some forecasters do perceive substantial downside risks. The risks they see are recounted in Josh Zumbrun’s WSJ RTE post

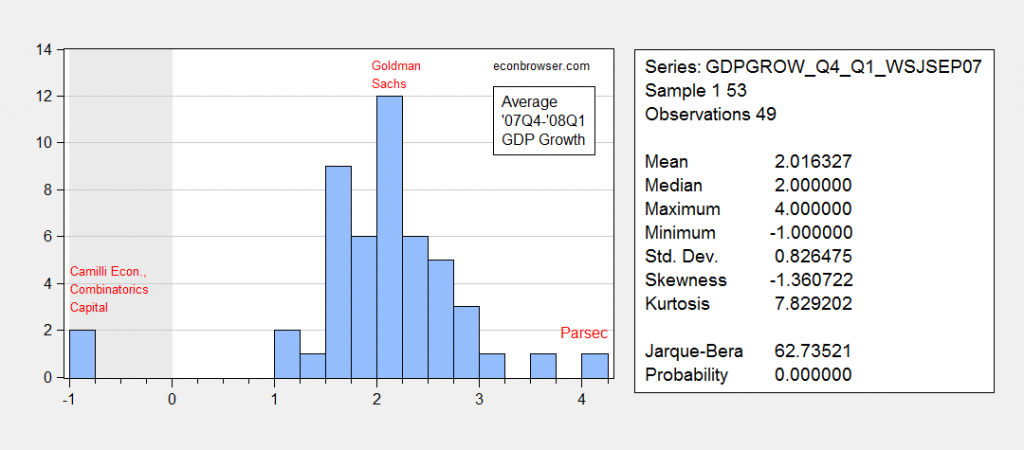

So I won’t say definitively we are not in, or not close to, a recession (i.e., I won’t “Pull an Ed Lazear”). But Figure 1 contrasts strongly with the situation in May 2008, when the WSJ survey looked like this (as shown in this post), and several forecaster were predicting negative growth.

Figure 3: Quarter on quarter SAAR growth forecasts for 2008Q2, from Wall Street Journal May 2008 survey. Source: WSJ.

In fact the modal forecast was negative 1% when then CEA Chair Lazear said we were not in a recession.

Update, 2:30PM Pacific: New Deal democrat asks who in 2007Q3 foresaw a recession in 2007Q4. Figure 4 shows who forecasted average negative growth in 2007Q4-08Q1: Camilli Economics, and Combinatorics Capital.

Figure 4: Histogram of average growth rates for 2007Q4-08Q1 (SAAR). Source: September 2007 WSJ survey for economists, and author’s calculations.

Update, 9AM Pacific 6/12: James Nason brings my attention to this statistical analysis of the WSJ survey.

Menzie, the chart I would like to see is from Q3 2007. If I recall correctly, very few on Wall Street saw a recession coming.

Unfortunately the link is dead now, but the evidence is that the large majority of forecasters simply project recent trends into the future, so few see the peak or trough ahead.

New Deal democrat: Two forecasters (out of 47 respondents) predicted average negative growth in 2007Q4-08Q1. I’ve added the histogram. All the spreadsheets are available at WSJ‘s forecast page.

Thanks, Menzie.

Even in November 2007, only 3 firms saw negative GDP ahead.

That continued throughout the first 8 months of 2008.

Even as of September 1, 2008, the average forecast was for positive Q3 2008 GDP!

Finally in October 2008, they saw the light.

In June 2009, 13 firms still forecast negative GDP for Q3 2009.

The bottom line:

1. Wall Street forecasters are consistently too optimistic.

2. Subject to number 1, they project current trends into the future until *after* the trend has definitively changed.

New Deal democrat: Yes, but as of Nov. 2007 survey, average probability of recession was 33.5%. On (1), not sure I’ve seen econometric documentation of this (especially over long spans of time). On (2), I think that is correct, from my reading of the literature.

Menzie, Here’s a link to what Mark Thoma published about forecasting over a decade ago:

http://economistsview.typepad.com/economistsview/2005/08/the_use_of_lead.html

And here’s the quote from the underlying article, which is now a dead link:

“Forecasters Rely on Today to Predict Tomorrow, Caroline Baum, Bloomberg: …The sentiment shift, based on high-frequency data, is even harder to understand in light of the economy’s steady performance. … Weak numbers yield a weak outlook. Strong numbers mean good times ahead. Where’s the forecasting?

The Index of Leading Economic Indicators, which isn’t a bunch of randomly selected components, is signaling slower, not faster, growth ahead. The 10 components of the LEI were all chosen because of a demonstrated ability to predict future economic activity. … The level of the LEI, which “has an average eight to nine months lead time at peaks and troughs — shorter at troughs — has flattened out after strong growth in 2003 and 2004,” Ozyildirim said. As long as the weekly and monthly numbers come in strong, economists will be guided by mostly contemporaneous indicators released with a lag. How come no one follows the leaders?”

Professor Chinn,

Is it reasonable and is there enough historical WSJ data to use a Bayesian model or probit model to determine the accuracy of probability forecasts of a recession given a threshold probability level related to economists’ forecasts of a recession?

AS: Don’t think so. The WSJ surveys that are online go back only to December 2002, so only one recession is in the sample. There might be earlier surveys not online. Also, I don’t think the “recession” question is always asked.

Labor Market Conditions Index is looking ugly.

https://research.stlouisfed.org/fred2/series/FRBLMCI

Business Investment is nasty too.

https://research.stlouisfed.org/fred2/series/W790RC1Q027SBEA

Maybe Congress will do the right thing and enact some fiscal stimulus like infrastructure spending on roads, bridges, airports, etc. LOL

The Bottom doesn’t look that “ugly” at all when you adjust for energy component. The top is a poor index that will be forced to reverse in coming months. Lessons are going to be learned and the hard way. Mid-cycle correction looks over imo.

Professor Chinn,

Do I understand correctly that last June the mean forecast for the June 2016 bond interest rate was 3.03%? If this is a correct observation, it is interesting to look at the 95% confidence range of the forecast. Again, if I understand last year, the surveyed economists’ 95% confidence level of June 2016 bond rate was 3.03 +- 1.96 x 0.525 or 2.0 to 4.06. Also, I see that one respondent forecasted a rate of 5.8%. How useful are these forecasts for investors or business planners?

AS: Are you looking at last year’s WSJ survey for June 2016? I don’t see the numbers you are citing for the June 2016 WSJ survey.

There is a very large literature on bias and efficiency of individual forecasts; see e.g. Batchelor (International Journal of Forecasting, 2007), and Dovern and Weisser (International Journal of Forecasting, 2011).

Sorry for the lack of clarity. I downloaded the June 2015 WSJ forecast summary to view the individual forecasts, then used EViews to view the histogram and find the mean and standard deviation of the forecasts.

I will try to read the articles you mention, but would benefit from your expert opinion.

Thanks

My effective demand model is putting a 70% chance of recession by year’s end. And contraction by summer of 2017. I have been seeing this develop since 2013, when I projected the peak of the profit cycle for end of 2014. Which happened on schedule. My model shows that the economy is trending toward a recession. A good model for others is the LMCI which is trending down firmly.

Edward: Could you please share some article describing your model and its current forecast? Thanks!

Andriy Moraru,

Here is a link to the basics of my model…

http://effectivedemand.typepad.com/ed/synopsis-of-the-effective-demand-research.html

The link does not include the aggregate supply-effective demand model, nor the relationship between effective demand and productivity. The AS-ED model had a pattern start to appear as early as 2009 pointing to the eventual peak of the profit business cycle in 2014 with a real GDP of $16.1 trillion. And that came to pass… Here is a link to that post.

http://effectivedemand.typepad.com/ed/2016/02/project-recess-2013.html

The expected growth chart for late 2007, early 2008 is an interesting addition to the post, thanks to New Deal democrat.

If I recall, the yield curve inverted earlier in 2007 and pointed to a recession by year end.

I do not see a US recession any time soon, but have to wonder if the Orlando mass public shooting will put a damper on growth. Da’esh brutality outside of the US appears to have frightened many Americans.

It is all fine and dandy for candidate Clinton to say she will do everything in her power to combat lone wolf attacks. It is her to imagine what she could actually accomplish given the level of hyper vigilance since the 2001 September 11th attacks.