What if you promise to withdraw from free trade agreements [1], limit capital mobility [2], and heighten immediately policy uncertainty? What will you get? We have early returns from an unnatural experiment in the UK.

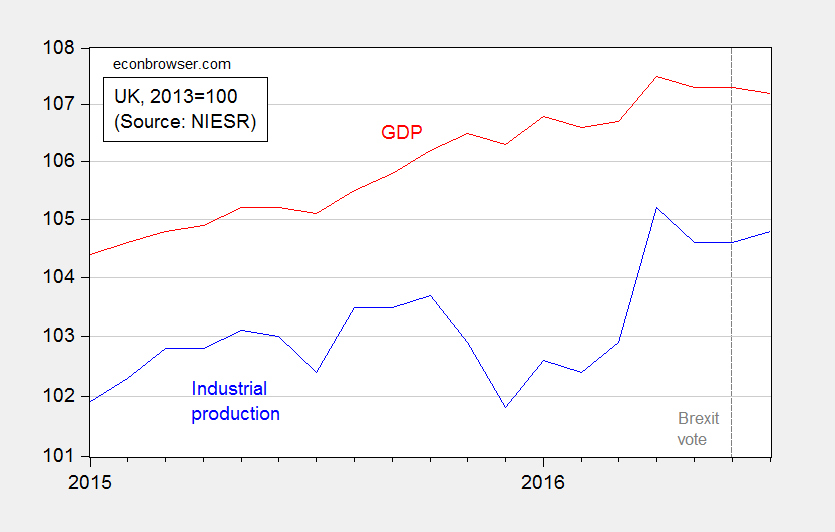

The first bit of news is early estimates of monthly GDP, from the NIESR:

Figure 1: Industrial production (blue), and real GDP (red), both 2013=0. Log scale. Source: NIESR (August 9, 2016).

Our monthly estimates of GDP suggest that output grew by 0.3 per cent in the three months ending in July 2016 after growth of 0.6 per cent in the three months ending in June 2016. The month on month profile suggests output declined in July by 0.2 per cent. This estimate is consistent with our latest quarterly forecast, which forecasts a contraction of 0.2 per cent in the third quarter of this year, as a whole. We estimate that there is an evens

chance of a technical recession between the third quarter of 2016 and the final quarter of 2017.

The press release for the 3 August forecast is here.

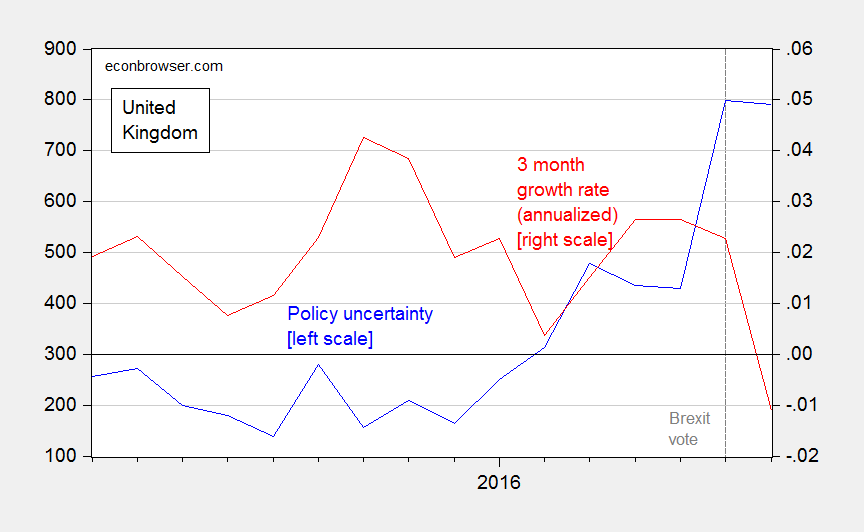

Transforming the monthly GDP data into 3 month percent changes yields Figure 2, which is plotted against the Baker, Bloom and Davis policy uncertainty index for the UK.

Figure 2: UK policy uncertainty index (blue, left scale), and three month change in real GDP, annualized (red, right scale). Source: NIESR (August 9, 2016), Policyuncertainty.com, accessed 8/12/2016.

In other news, house prices have declined markedly.

These are real side developments that were presaged by the collapse in consumer confidence, the flattening of the yield curve, and the persistent depreciation of the pound. (The latter is “real” in the sense that given price stickiness, the real exchange rate has depreciated, resulting in a terms of trade loss to the UK, as pointed out by Simon Wren-Lewis).

It’s going to be interesting to see how Brexit does actually affect the economy.

Menzie Chinn: Please explain what an ‘unnatural experiment’ is relative to a ‘natural experiment’.

As you and others have no direct control over UK political decisions, I would be inclined to call the experiment ‘natural’. What am I missing?

Erik Poole: Well, the yes vote on Brexit was not strictly exogenous with respect to economic conditions, including GDP growth. GDP growth was predetermined, but not exogenous. That’s what I meant. Sorry for the lack of clarity.