Today, we are fortunate to present a guest contribution written by Rasmus Fatum, at the University of Alberta. This post is based upon the Dallas Fed working paper by the same title.

Two weeks ago, on 1 October, the Renminbi became part of the SDR basket. This marks a symbolically significant step forward for the importance of the Chinese economy and its currency. But does it imply that the Renminbi is now a safe haven currency on par with other SDR currencies such as the JPY and the USD?

While some market participants argue that the Renminbi is already a safe haven, others dismiss this notion and assert that the Renminbi is not sufficiently liquid, not easily convertible, and will not become a safe haven currency until Chinese economic and broader institutional reforms are implemented.1 By contrast, the academic literature is hitherto silent on whether the Renminbi is a safe haven currency. Despite the fact that, simply put, nothing stops a market participant, regardless of location or type, from entering and exiting Renminbi denominated cash asset positions in the offshore market. Since there is no technical hindrance for market participants to consider and employ the Renminbi as a possible safe haven currency, a timely and highly topical research question is whether the Renminbi is becoming or has become a safe haven currency. This is the research question of our paper.

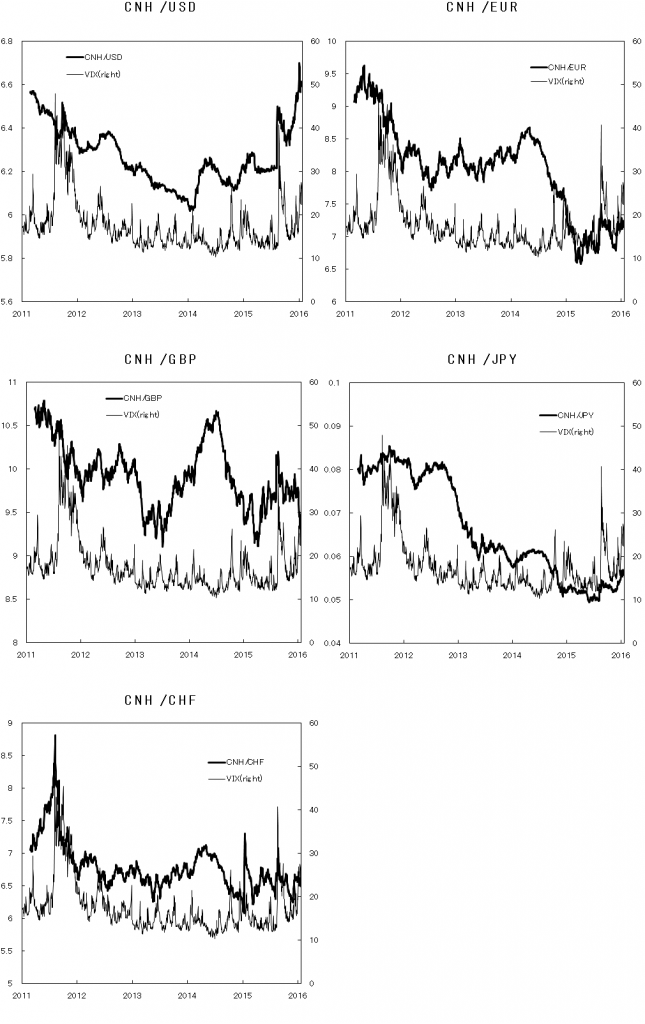

To answer our research question we consider the relationship between market uncertainty and the relative value of the Renminbi against the USD, the JPY, the EUR, the GBP, and the CHF, i.e. against currencies that are traditionally considered as possible safe haven currency candidates, over the 28 February 2011 to 30 April 2016 sample period. We define a safe haven currency as a currency that increases its relative value against other currencies as market uncertainty increases and follow Habib and Stracca (2012) and many others in using the VIX, the measure of implied volatility of S & P 500 options, as our main indicator of market uncertainty.

Figure 1: Exchange Rates and VIX Series

In the focal part of our analysis we employ the band spectral regression (BSR) procedure originally developed by Hannan (1963) and Engle (1974, 1978). By doing so we are able to take into account the possibility that the relationship between market uncertainty and the relative value of the Renminbi is frequency dependent. We also employ standard linear regressions with robust errors as well as non-temporal threshold modeling.

We find for the full sample period that an increase in market uncertainty is on average associated with a decrease in the value of the Renminbi relative to the USD and the JPY and an increase in the value of the Renminbi relative to the GBP and the EUR. Put differently, our full sample results suggest that the Renminbi is “less safe” than the USD and the JPY but “safer” than the GBP and the EUR. This provides evidence consistent with some degree of safe haven currency behavior of the Renminbi. However, when considering more recent sub-samples separately, using the 30 November 2015 SDR basket inclusion announcement and three other key institutional events as possible sample demarcation points, we find that the relative value of the Renminbi vis-à-vis all traditional safe haven currency candidates decreases as market uncertainty increases.

The results of our BSR models reveal that during the recent period the relative weakening of the Renminbi as uncertainty increases is due to the high-frequency variation of the Renminbi while the low-frequency variation is generally associated with Renminbi appreciation as uncertainty increases. These findings underline the relevance of distinguishing between high versus low frequency variation in our particular context and lend credence to the suggestion that as market participants consider the Renminbi to be less safe off-setting currency management actions are undertaken as market uncertainty rises.

Overall our findings do not support the suggestion that the Renminbi is currently a safe haven currency and in that sense question the notion that the Renminbi is progressing towards safe haven currency status.

1. To illustrate the discrepancy of views regarding whether the Renminbi on the one hand is, or on the other hand cannot yet be, a safe haven currency, a Credit Agricole market strategist states that “the CNY has proven to be a safe haven in an environment of a strong USD and it will continue to perform this role” (Harjani 2014) while a leading scholar on the internationalization of the Renminbi, Eswar Prasad, posits that “the Renminbi will not be seen as a safe haven currency unless economic reforms are accompanied by broader legal, political and institutional reforms that are necessary to inspire the trust of foreign investors” (Drezner 2015).↩

References

Drezner, D.W., 2015. The modest rise of the redback. The Washington Post December 2, 2015.

Engle, R.F., 1974. Band spectrum regression. International Economic Review 15, 1-11.

Engle, R.F., 1978. Testing price equations for stability across spectral frequency bands. Econometrica 46, 869-881.

Habib M.M., Stracca L., 2012. Getting beyond carry trade: what makes a safe haven currency? Journal of International Economics 87, 50-64. ECB WP version

Hannan, E.J., 1963. Regression for time series with error of measurement. Biometrika 50, 293-302.

Harjani, A., 2014. Has the yuan become a ‘safe haven’ trade? CNBC October 8, 2014.

This post written by Rasmus Fatum.