In tonight’s Presidential debate, the moderator Chris Wallace stated:

Secretary Clinton, I want to pursue your [economic] plan, because in many ways it is similar to the Obama stimulus plan in 2009, which has led to the slowest GDP growth since 1949.

[Entire transcript here]

Oops. I don’t know where Mr. Wallace learned his economics. I think he’s got the causality wrong — the big stimulus was a response to a deep recession and big negative output gap. Time to consult data (like the data mentioned in Monday’s post) on the question of what we should have expected in terms of growth.

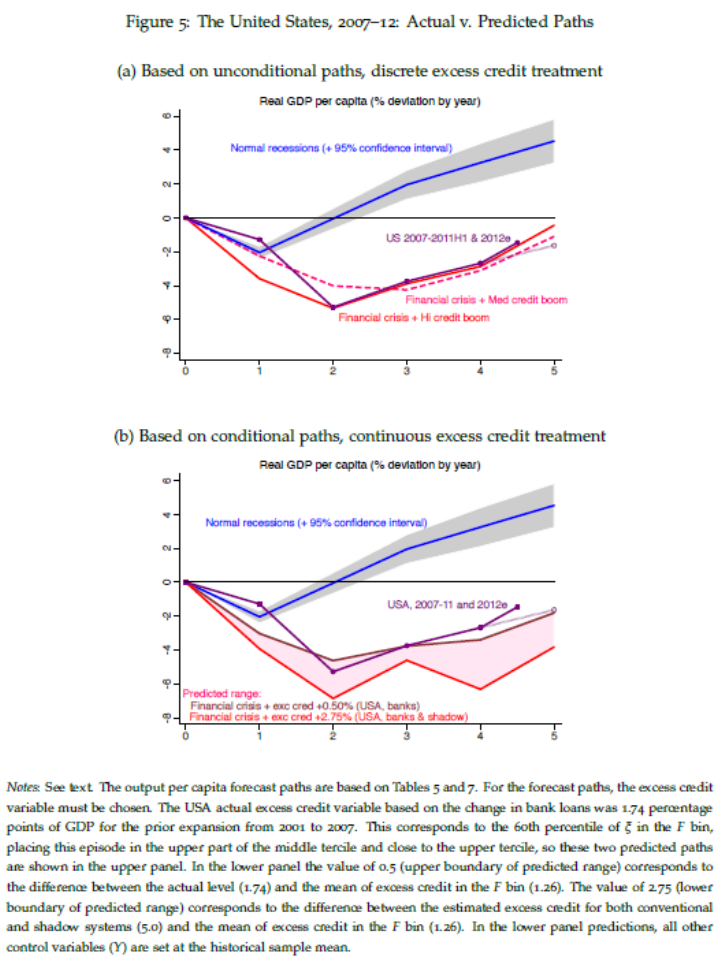

The question is whether the economy is outperforming what should have been expected in the wake of a financial crisis following excessive credit growth. Jorda, Schularick and Taylor (JMCB, 2013) addressed this question (ungated 2012 wp), and provided their assessment, based upon a cross-country econometric analysis. The US experience was placed in context in their Figure 3 (see discussion in this 2013 post).

Source: Jordà, Schularick and Taylor (2012).

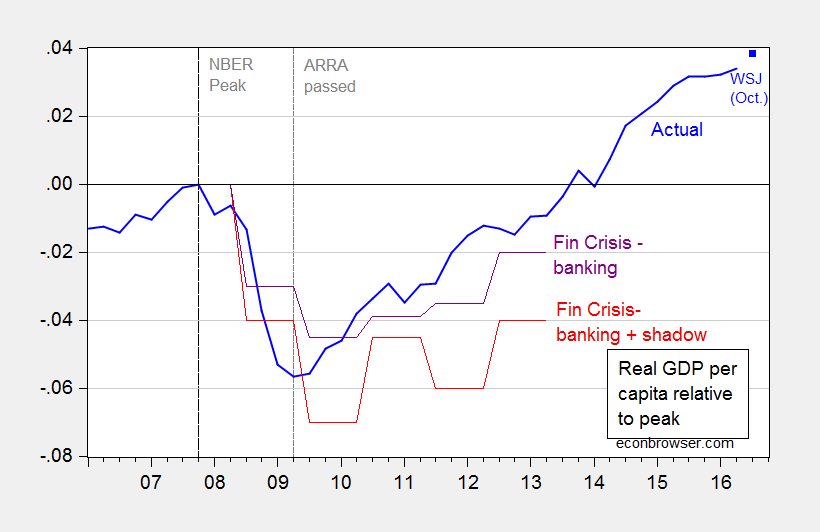

The US was outperforming what was to be expected in the wake of a recession combined with a financial crisis occurring after a credit boom. It struck me a useful exercise to update this graph. I eyeballed the lower and upper bounds, and show per capita real GDP through 2016Q2 (with the WSJ forecast for 2016Q3).

Figure 1: Log real GDP normalized to 2007Q4 (blue), predicted GDP – value of 0.5 corresponds to the difference between the actual level (1.74) and the mean of excess credit in the F bin (1.26) (purple), predicted GDP – value of 2.75 corresponds to the difference between the estimated excess credit for both conventional and shadow systems (5.0) and the mean of excess credit in the F bin (1.26) (red). 2016Q3 value of real GDP is based on WSJ October 2016 mean forecast and population growth through 2016Q3. Source: BEA, WSJ October 2016 survey, Jordà, Schularick and Taylor (2013), and author’s calculations.

In other words, economic growth, as measured by GDP, has outperformed the counterfactual based upon a rigorous and comprehensive statistical analysis. As I noted four and a half years ago, criticisms of an overly slow recovery are based upon an approach that conditions on depth of recession, but not on financial crisis/credit boom.

It should be noted, prior financial crisis recessions were huge negative shocks. The economies were smaller, relatively poorer, and less diversified. There were contractions in the money supply (no Fed, or money based on metals) with little or no fiscal stimulus (without Keynesian economics and little tax collection for tax cuts). Certainly, no TARP. A huge positive shock was often needed to get out of the depression, e.g. a first or second industrial revolution, massive immigration, a world war, etc..

Too bad Trump wasn’t President at the time. He’s promising 6% GDP growth, just like India and China.

This election reminds me of a memorable portion of the “Jurassic Park” novel, where a character is being eaten alive by a dinosaur. He just wanted the suffering to end.

“The question is whether the economy is outperforming what should have been expected in the wake of a financial crisis following excessive credit growth.” it should be clear that Menzie wants to change the discussion to suit his own desires. Additionally, Menzie is seemingly ignoring the yuuuuge impact of monetary policy by implying growth “outperformed the counterfactual” when the discussion is about current & future fiscal policy.

“In other words, economic growth, as measured by GDP, has outperformed the counterfactual based upon a rigorous and comprehensive statistical analysis. As I noted four and a half years ago, criticisms of an overly slow recovery are based upon an approach that conditions on depth of recession, but not on financial crisis/credit boom.” I don’t see where last night’s moderator implied anything different. You seem to be making a rookie economist error (or elementary reading comprehension error) in confusing “slowest GDP growth since 1949” with “we’re better than we could be, we think.”

‘You seem to be making a rookie economist error (or elementary reading comprehension error) in confusing “slowest GDP growth since 1949” with “we’re better than we could be, we think.”’

I laugh (and am glad someone else has noticed Menzie’s SOP).

I also see that the CEA has put out a campaign slogan…er, analytical paper promoting monopsony as the source of all our labor market ills. So, I’m eagerly anticipating Menzie promoting that yet again as an excuse for raising the minimum wage (without stopping to think about the evidence any longer than usual).

Patrick R. Sullivan: Welcome back after a long absence.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

As to your comment, I am unsurprised that you missed the main point of the quote: the problem is the assertion the stimulus package slowed growth. Please keep on trying to distract from the obvious error (and your refusal to acknowledge your gross error — but I am happy to keep on reminding you each time you post!).

Menzie,

I’m LMAO over this one!

You should’ve been a defense lawyer (ex: the twinkie defense). This is getting to be very creative.

The only point you make here is that the boom and bust cycle of capitalism is indefensible and too destructive today to continue.

Obama has been such a disaster as president people should stop trying to defend him; yes, the GDP average from 2009-15 is 1.5%, the worst since 1949 and despite other recessions, etc since then. His policies are the root cause of it. He absolutely has no qualifications to be president other than giving speeches.

==

I voted this week. It’s the worst presidential election I’ve ever seen since I started voting.

Here are a couple of things to start the weekend on:

Al Czervik Caddyshack tribute (the original Donald Trump):

https://www.youtube.com/watch?v=Ai_imjgKPas

Rodney Dangerfield & Johnny Carson:

https://www.youtube.com/watch?v=cQLv7CG10B4