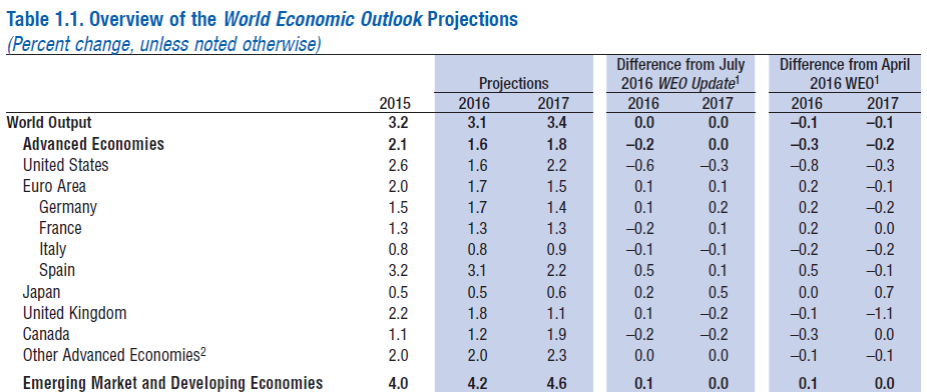

Today, the IMF released forecasts of substantially downwardly revised growth estimates for the US. UK 2017 growth revised down 1.1 percentage points relative to pre-Brexit forecast (World Economic Outlook).

The entire report is here. Chief Economist Maury Obstfeld’s blogpost is here.

The U.K. can emerge stronger from the uncertainty and restructuring.

Unfortunately, for the U.S., it’s more of the same.

The U.S. needs to reverse the anti-growth policies and implement pro-growth policies to get us out of this expensive depression.

The economy needs to be in a much stronger position before the last of the Baby-Boomers reach 65 in 2029.

“The U.S. needs to reverse the anti-growth policies and implement pro-growth policies to get us out of this expensive depression.”

is this simply hyperbole, or do you have a definition of economic depression that is different from everybody else? perhaps share your definition of depression?

regarding baby boomers, one approach would be policy which encourages them to spend their retirement savings rather than trying to pass it on to their heirs. in a consumer led economy, that is a lot of money on the sidelines. low interest rates indicate there is not great demand for those funds as investment. i think people underestimate how the transition from defined benefit to defined contribution retirement policies have affected spending behavior in the latter stages of life.

I think, a non-recovery from a severe recession is a depression.

https://www.advisorperspectives.com/dshort/updates/2016/09/29/q2-real-gdp-per-capita-0-71-versus-the-1-4-headline-real-gdp

so you have a rather odd definition of depression. noted. and you have called it a weak recovery in the past. now it is a non-recovery. perhaps you could share your definition of a non-recovery as well?

PeakTrader: You are quite right about this being a depression. In common parlance, the depression of the 30s lasted a decade. Compute the average growth rate of real GDP from base year 1929 to 1939. Compute the same from base year 2007 to 2017. Use 2% to fill in the last year-and-a-half, though growth will surely come in below this in 2017. You will find there is a trivial difference between the growth rates of these two decades. If that was a depression, then this is too. It is only the shape not the substance that is different. Who is there like a Joan of Arc to come on the field and make this country great again?

Data from the BLS on spending by retirees: http://www.bls.gov/opub/btn/volume-5/spending-patterns-of-older-americans.htm

Data from the BLS on average spending by all households: http://www.bls.gov/news.release/cesan.nr0.htm

Not seeing a big gap there. Maybe everyone should spend more. Your assumption that retirees are saving their money to pass on to heirs may be true for the upper decile, but I’d guess that most retirees are frugal knowing that their income will be eroded by inflation as they age.

“but I’d guess that most retirees are frugal knowing that their income will be eroded by inflation as they age.”

that is one of the issues in the move from defined benefit to defined contribution retirement packages. between this item and passing along any excess funds as an inheritance, we have a lot of future retirees with an uncertain financial outlook into retirement. this causes them to become more frugal, to begin to protect against running out of money at an old age. but this does not help grow the economy.

however, in a low interest rate environment, inflation is also low. so why should they be worried about inflation, as you note? it is not a problem if low. we have been trained to believe higher interest rates are the norm, but we are in a glut of savings. those relying on low risk, passive, high rates of return have probably made the wrong financial bet in retirement. boomers were the driver of such an economy for several decades. but they have created unrealistic expectations going forward, once they begin to scale back their contributions.

If you have purchased food or vehicles or health insurance or medicine or many of the “everyday” necessities, you will know that inflation hasn’t been at zero. Sure, housing costs tumbled when the market crashed, but most retirees are not in the housing market. Their expenses are going up.

The real problem is the government trying to displace the marketplace with mandates… very expensive mandates… while household incomes are going nowhere. Still, you are arguing for more spending which, it would appear, would be based on accepting more personal debt. However, the IMF just warned about the current debt levels, both public and private (see the link I provided in a comment below).

Given all of the government stimulus efforts and the fantastic recovery which resulted, why should Americans be concerned about economic growth. It’s under control; it’s a done deal; Keynes won.

bruce

“If you have purchased food or vehicles or health insurance or medicine or many of the “everyday” necessities, you will know that inflation hasn’t been at zero.”

is that inflation, or simply the free market reaching an equilibrium price. there is a difference. rising prices do not necessarily involve inflation. i bought a honda crv almost twelve years ago-still runs well. recently looked at a new crv-same model-offered at same price i bought mine over a decade ago. i would not characterize automobiles in the inflation category.

bruce, i think you conveniently mischaracterize the free market outcome with inflation, when it suits your argument. a boomer retiree may want to blame inflation, but that is probably shifting blame from inadequate savings and retirement preparation-ie inappropriate understanding of their income stream in retirement.

“Still, you are arguing for more spending which, it would appear, would be based on accepting more personal debt.”

false. that is a straw man argument for you to rail against debt. i argued that boomer retirees already have a savings of cash-and that they should spend that cash rather than continue to save or pass it on to their heirs. that will boost expenditures, without taking on debt. please read more carefully.

And, there’s already a policy for Baby-Boomers to spend and borrow: Low interest rates.

Anyway, each household will spend and save the best way they see fit.

We can adopt some of Trump’s economic plan, e.g. repeal and replace Obamacare, limit low-skilled immigration to raise low income wages, make sure the rich pay a reasonable amount in taxes, cut taxes for the middle class, open markets to exports, spend on national defense and infrastructure, freeze or reduce regulations, and stop crony-capitalism.

“repeal and replace Obamacare” with what? glad you indicate replace. have yet to see a comprehensive alternative solution that works, that would not be called romneycare!

low interest rates should not be considered a policy. they are a result of expected future economic conditions. those would be improved if boomers spent more of their retirement savings. look, the spending has to come from somewhere if you want future growth-its is not a supply side problem. continuing to plow money into savings has produced a glut of money for safe assets-hence the low interest rates. either spend the money as a consumer, or capitalism needs to begin allocating investment money in a far more productive manner.

Supply and demand are two sides of the same coin.

There are enormous problems on both sides.

We tried the spending in 2009-11 till Congress had “spending fatigue.”

Did that get the desired result?

peak, we also had extensive tax cuts. same result.

you have a demand problem, and you want to grow the economy at the same time. supply side is not your primary problem, because you already have overcapacity.

Baffling, so, you want to ignore the supply side. Let’s look at a few of the supply side problems your beloved government created, in education, health care, housing, and energy.

The high price of a college education, where many students take remedial classes, because of the poor primary and secondary public education system, while they pile up enormous debt. A health care system where you get higher prices or bigger deductibles and less health care (the opposite of the free market system). Expensive housing, in part, because wages were depressed or jobs not created by high compensation costs and excessive regulations. Much higher energy prices, thanks to fanatical anti-fossil fuels policies.

So, we have lots of high debt and low income Individuals, who don’t have much to spend on anything else, or we make individuals spend too much on some goods & services.

“A health care system where you get higher prices or bigger deductibles and less health care (the opposite of the free market system).”

deductibles and costs were rising prior to obamacare, when the free market system was supposed to exist. don’t blame government, blame free markets.

“Expensive housing, in part, because wages were depressed or jobs not created by high compensation costs and excessive regulations. ”

expensive housing because of depressed wages and lack of jobs???? huh??? really? perhaps you should revisit the concept of supply and demand.

“Much higher energy prices, thanks to fanatical anti-fossil fuels policies.”

gas, oil and coal are lower. mostly due to increased supply created during the obama administration. oil prices rose during the bush administration.

peak, every one of your arguments begins with a fallacy, and degrades from there. you seem to simply live in a fantasy world-devoid of the facts of the world. as the donald would say, “sad really”.

Coincidentally, this was published today: https://www.theguardian.com/business/live/2016/oct/05/brexit-fears-pound-lows-dollar-euro-service-sector-imf-business-live?page=with:block-57f4ba20e4b0afec6ad16f7b#block-57f4ba20e4b0afec6ad16f7b

Relative to the Fed’s projections released after its September FOMC meeting, the IMF’s projections are lower than the range for 2016 (1.7 – 2.0) and at the high end of the range for 2017 (1.6 – 2.5).

It’s fascinating to read various arguments for more spending (presuming higher taxes also which somehow would not be an anchor on the economy), but the IMF is not only suggesting that growth may be slowing, but is warning about the danger of the $152 trillion in global debt (2.25 time global GDP).

Might there just be a connection to those dots?

https://www.theguardian.com/business/2016/oct/05/world-debt-has-hit-record-high-of-152tn-says-imf

Bruce:

Global debt-to-GDP is at a record historic high. All time for all history. This debt is the main impediment to global growth. The debt ratio is increasing at an exponential rate, easily seen by fitting a second degree polynomial to BIS data available from 2002 on. That the burden of debt is a severe impediment is well understood by anyone who thinks outside the box and has gotten their hands dirty with the data. Reinhart Rogoff come to mind.

The corollary, however, is far, far more interesting. Central banks are manifestly flooding the globe with liquidity by boosting the assets on their balance sheets by bond buying. At an exponential rate! Why? They can only be trying to increase credit growth. That is, bolster aggregate demand through artificial means. This and nothing but this is the case, though credit stimulus is only an intermediate step between central bank policy and economic growth. Yet increased credit growth only pushes the debt ratio even higher into the already dangerous territory it currently inhabits!

Perhaps the lurkers on this site will contemplate this, and those amongst them open-minded enough will come to an epiphany. Such is the fodder of Thomas Kuhn’s scientific revolutions.

Hmmmm…I thought I was going to econbrowser but I seem to have inadvertently linked to zerohedge.com.