The Wall Street Journal reported on Thursday:

OPEC said its members agreed that they need to cut crude output to reduce the world’s supply glut, a shift for the 14-member group that was enough to send oil prices higher, even though reaching a deal remains far from certain.

Members of the Organization of the Petroleum Exporting Countries said they reached an understanding after a six-hour gathering in the Algerian capital, but deferred until November the fraught task of finalizing a plan to make those cuts. OPEC officials said a committee would be formed to determine how much each country would have to cut and then report to the group at its next meeting on Nov. 30 in Vienna.

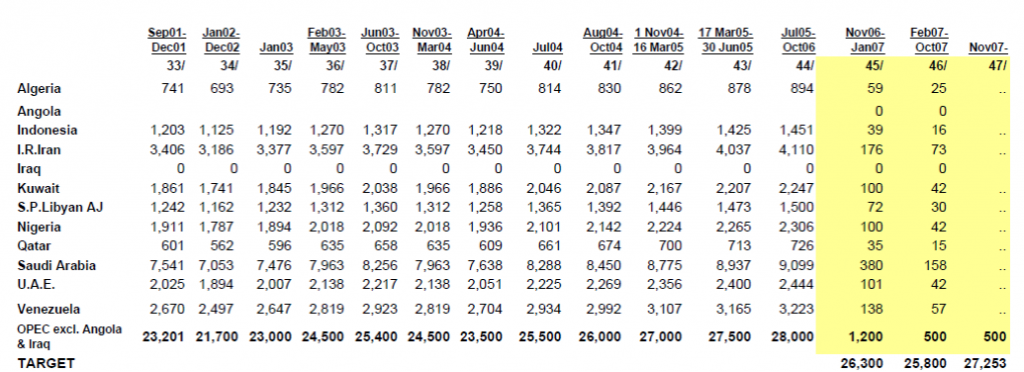

Once upon a time, OPEC regularly published crude oil production allocations for each of its members. If it were a functioning cartel, these would be interpreted as quotas or ceilings for each individual country. Here for example is how those production allocations were being reported by OPEC in 2010 (you can see this for yourself by looking up http://www.opec.org/home/quotas/ProductionLevels.pdf with the Wayback Machine).

Whatever those numbers meant, they were hardly a description of what individual countries actually did. Venezuela’s production was significantly below the allocation, while Saudi Arabia’s was often well above.

Notice also the yellow columns in the OPEC statement beginning in 2006. Here the “agreement” was that whatever level the country had been producing (acknowledging that this often had little relation to the official allocation), the countries supposedly agreed to cut production from those amounts by 1200 barrels/day between them. OPEC eventually dropped even this fiction, and the only way to see these today is with the Wayback Machine.

Does last week’s announcement mean that OPEC is going to return to the regime of a decade ago? The Wall Street Journal adds these details:

The group proposed cutting its collective output to between 32.5 million barrels a day and 33 million barrels a day, down from August levels of 33.2 million barrels a day, national oil ministers said.

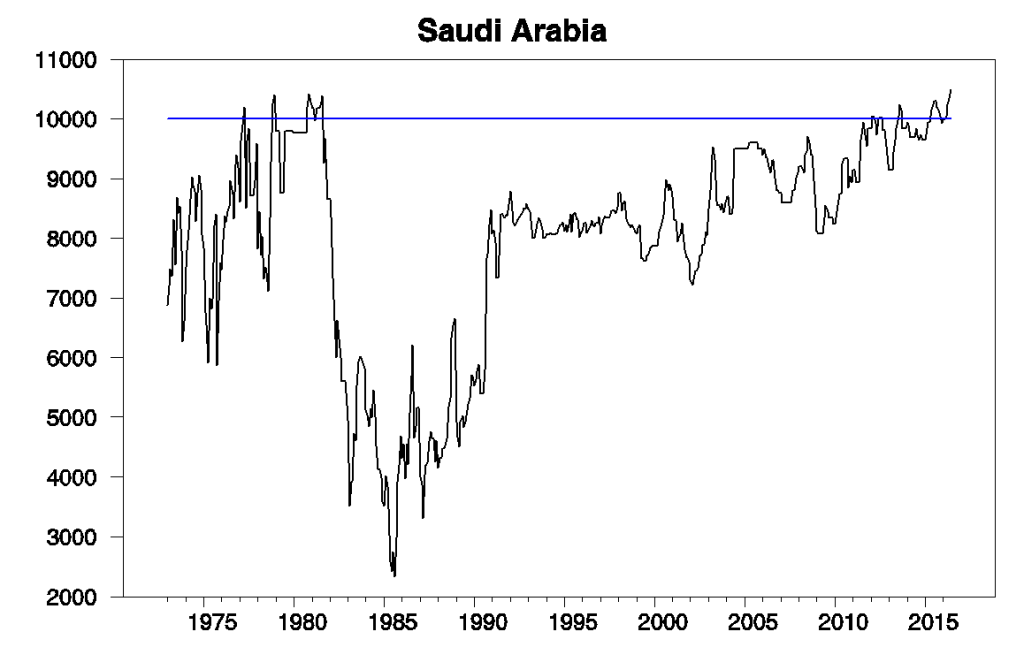

So they didn’t actually agree on who was going to cut, or on how much it would be? Let’s break this down. Saudi Arabia was producing 10.5 mb/d in June. Historically, the kingdom has rarely pumped over 10, and on the few occasions when it did, it didn’t last for long. Even if you knew nothing of recent politics or the price of oil, a rational forecast might have called for lower levels than they’ve recently been producing.

Saudi Arabian field production of crude oil, in thousands of barrels per day, monthly Jan 1973 to June 2016. Blue line drawn at 10 mb/d. Data source: EIA Monthly Energy Review, Table 11.1a.

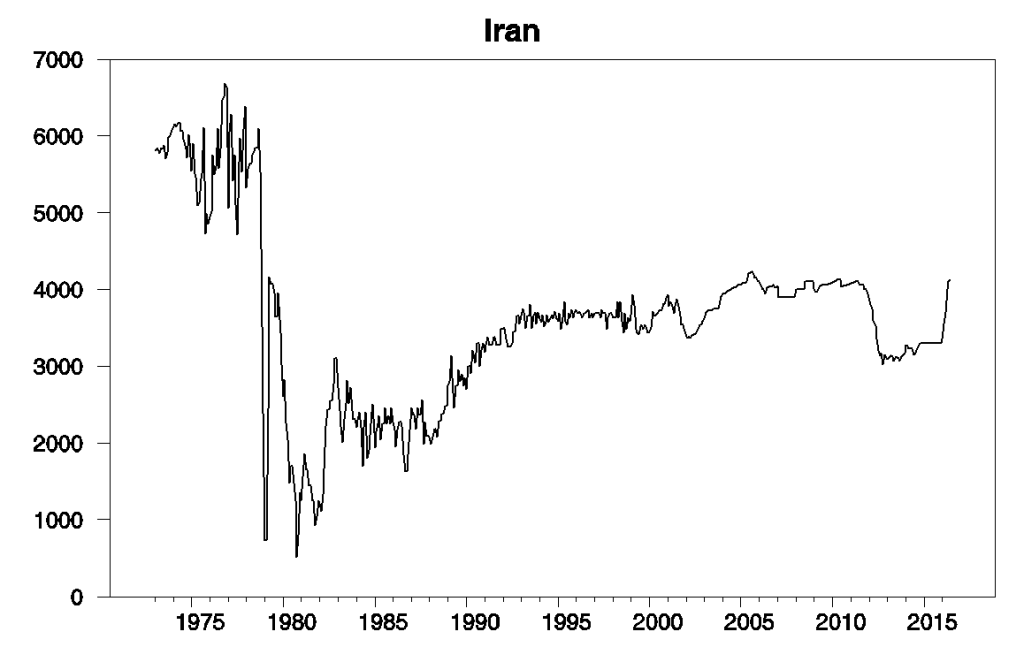

Up until this year, Iranian production had been depressed as a result of sanctions. With those lifted, it’s now back about where it had been historically. Although Iran had announced ambitions of producing much more than their maximum levels of the last three decades, it again would not be that big a surprise if it turns out they won’t (or can’t) achieve that.

Iranian field production of crude oil, in thousands of barrels per day, monthly Jan 1973 to June 2016. Data source: EIA Monthly Energy Review, Table 11.1a.

It is certainly in Saudi Arabia’s interest to stop Iranian production from increasing further. If the kingdom was planning to ease away from recent production gains for other reasons, it makes sense to try to use this as a bargaining chip. And Iran has reasons of its own to play along.

So are we returning to the old OPEC regime? Perhaps we are, if by that you mean a regime in which OPEC announces with great fanfare plans which the individual members had already decided to pursue on their own.

That doesn’t mean it’s completely without news value. As I mentioned, before last week’s announcement you might have expected Saudi Arabia to move back in the direction of its historical ceiling of 10mb/d.

And now you can have a little more confidence that is what is going to happen.

Okay! Great news for North American producers. The days of OPEC calling the oil shots are pretty much over. They are caught between fracking production worldwide and their own falling income. But my guess is that OPEC is falling apart and it will each producer for itself. The world has already made up the slack from Venezuela’s completely inept far-left socialist mismanagement.

With the relative ease of ramping up North American, Russian, Iraqi, Iranian, and other sources of oil, as well as pretty stagnant demand, the OPEC cartel is becoming a party without participants.

You are too political. This is not an economic analysis and this site is mainly for economists.

Really? Have you not read some of the posts about Wisconsin and Kansas? Politics and economics are entwined on this site. Besides, what is so political about pointing out that U.S. producers will benefit from artificially restrained production by OPEC and that Venezuelan oil has taken a bit hit under the far-left socialist regime? Are you denying reality?

https://www.aei.org/publication/venezuelan-apocalypse-ii-more-updates-on-the-epic-failure-of-socialism-in-oil-rich-venezuela/

A significant challenge for US oil & gas companies is the high rate of decline from existing wells.

For the rate of decline from existing US gas production, I use the Citi Research estimate for natural gas, about 24%/year, which suggests that we need about 18 BCF/day of new gas production per year, just to offset declines from existing wells (which is more than Canada’s current gas production).

For oil, I think that a plausible estimate is about 15%/year, which implies that we need about 1.3 million bpd of new Crude + Condensate (C+C) production every year, just to maintain current US C+C production.

In any case, the US remains a large net oil importer, and US net crude oil imports are increasing, i.e., the US is becoming increasingly dependent on imported oil, with US refineries currently dependent on net crude oil imports for about half of the C+C inputs into US refineries.

Thank you for your article Mr. Hamilton. What is the limiting factor for Saudis seemingly not being able to exceed 10 million b/d? They have capital, they have labor… It seems to me that their opex per barrel is as low as $10 and full-cycle cost of marginal production is $35. At they $50, can’t they bring more rigs online?

A look at the supply of total petroleum liquids exports, from the point of view of net oil importers:

Global Net Exports of oil (GNE)

For a few years now, I have tracked the combined net exports from the (2005) Top 33 net oil exporters, which I define as Global Net Exports of oil (GNE), using EIA data.

The EIA is now fully two years behind BP, in regard to updating total liquids consumption data. The problem with relying solely on the BP data base is that while BP has complete production data for the Top 33, they don’t have complete consumption data (and EIA production data are not completely updated for 2015).

So, in order to update the Top 33 data base, I used the BP production data base for all of the Top 33.

I used BP consumption data for the countries for which BP has consumption data.

For the other countries for which BP does not have consumption data, I used the EIA consumption data, and for 2014 and 2015, I assumed no change in consumption for these countries, e.g., Iraq.

Based on the foregoing, GNE increased from 39 million bpd in 2002 to 46 million bpd in 2005 and fell to 44 million bpd in 2015 (total petroleum liquids). At the 2002 to 2005 rate of increase in GNE, it would have been up to 80 million bpd in year 2015.

Available Net Exports (GNE less CNI)

Using the BP data base, Chindia’s Net (total petroleum liquids) Imports, or CNI increased from 5.1 million bpd in 2005 to 10.9 million bpd in 2015, which I would round off to 5 and 11 respectively.

Following is a link showing my GNE/CNI chart for 2002 to 2011, using EIA data:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zpsu5daownl.gif

Note that the extrapolation (based on the 2005 to 2011 rate of decline in the GNE/CNI Ratio) shows the ratio falling to just below 4.0 in 2015, on track to approach 1.0 (the Chindia region theoretically consuming 100% of GNE) by 2030.

Using the updated data, the GNE/CNI Ratio fell to 4.0 in 2015 (44/11), on track to approach 1.0 by the year 2032. What I define as Available Net Exports (ANE, or GNE less CNI) fell from 41 million bpd in 2005 to 33 million bpd in 2015. This is the volume of Global Net Exports of oil available to importers other than China & India.

In other words, we have continued to slide toward a theoretical point in time that we cannot arrive at and still have a functioning global economy.

Saudi, if I understand the story correctly, voluntarily offered carve-outs for Iran, Libya and Nigeria. That represents a radical departure in policy.

The stumbling blocks to a deal:

– Iraq doesn’t want to cut. But it will, with Saudi probably taking more of the burden net.

– Angola has 380 kbpd of deepwater production slated to come online in 2017. By their very nature, these projects may be difficult to slow down.

I am personally of the view that trying to force OPEC-wide cuts is a bad idea, notably because some of the proposed cuts are impossible to monitor effectively. For example, Algeria’s proposed 17 kbpd cut amounts to one supertanker equivalent every four months. Are we going to be able to detect so small a change? I doubt it, with the result that OPEC’s integrity will be called into account in these minor markets without any corresponding benefit to balances even with compliance.

I would leave compliance issues purely to Iraq, Kuwait, UAE, Saudi, and if they participate, the Russians. I’d make the upside for Iran comfortable enough to insure their desire to comply. And then there are carve-outs for Libya and Nigeria, and some consideration of Angola.

It all comes down to Saudi intent. If the will is there, we’ll see a cut of some sort.

Here’s my full read on the matter:

http://www.thenational.ae/business/energy/saudi-arabia-prefers-higher-oil-prices-to-higher-production-volumes

What’s Derailing Greece’s Plan to Sell State Assets? Its Own Government

http://www.wsj.com/articles/the-greek-government-is-both-for-and-against-its-own-privatization-plan-1475428917

I saw this many times when I was working on privatization in Hungary.

Here’s the remedy, again: http://www.prienga.com/blog/2015/2/19/a-program-for-greece