Today the idea of a 10% across-the-board tariff rate increase was mooted. As Noland et al. (2016), pp.9-10 observe, the President has authority to undertake such measures. However, as a member of the WTO, other members have a right to dispute. More likely, they’ll retaliate.

A quick observation — retaliation need not occur in the trade sphere. Even setting aside retaliation in the political dimension, ample possibilities arise in the economic sphere.

Let me focus on China, since it has been a key target of the incoming administration [1]. Suppose tariffs go up by 10%; that effect on import prices can be nullified by a 10% depreciation of trading partner exchange rates.

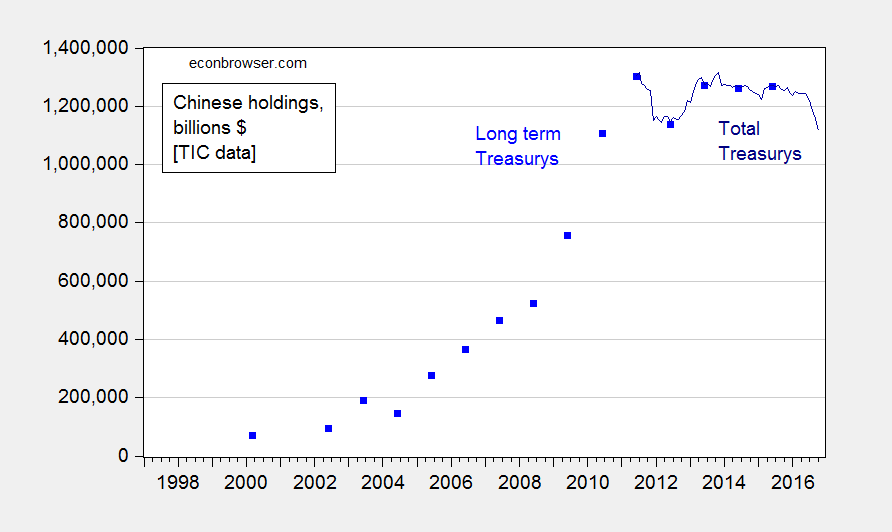

I’ve been thinking about other ways in which retaliation could occur. In the past, I’ve said it was unlikely that China would unload its stockpile of Treasurys, because it would be self-defeating from China’ perspective as it would have resulted in a large capital loss for the PBoC.

Now, however, the PBoC could more aggressively support the value of the RMB by selling Treasurys at a faster pace. To the extent that this maintains the value of the RMB, this might be to the Trump Administration’s liking (even if the higher interest rate on Treasury yields would be unwelcome). But because the Chinese maintain a panoply of capital controls, in principle the Chinese could let the RMB depreciate and sell Treasurys by loosening those capital controls.

Figure 1: Chinese holdings of US long-term Treasurys (blue square), and of Treasurys (dark blue), in billions of US$. Source: Treasury International Capital.

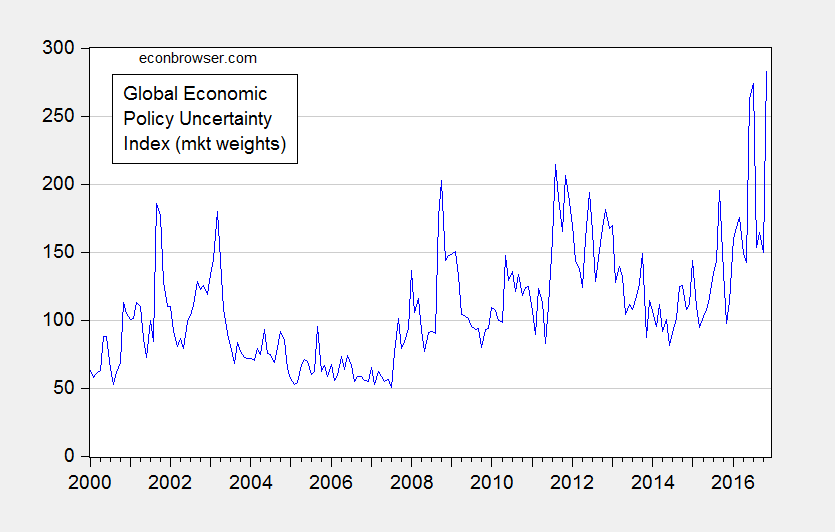

Of course, the success along each dimension (decumulating Treasurys, depreciating the yuan) depends on the pressure on the external balances. However, if President-elect Trump’s agenda of large tax cuts is implemented, and accompanied by lots of policy uncertainty (I think we can bank on that last point), then the pressure will likely persist.

Figure 2: Global Economic Policy Uncertainty Index, market weights (blue). Source: policyuncertainty.com accessed 12/22/2016.

Do recall, however, that a 10% tariff combined with a 10% dollar appreciation means net zero impact on the relative import prices, but a 10% worsening of export competitiveness.

“Today the idea of a 10% across-the-board tariff rate increase was mooted”

Mooted is one of those funny English words. It can mean both 1-“To bring up (a subject) for discussion or debate” or 2- “To render a question irrelevant.” It can mean either we started discussion, or made it irrelevant.

Since I almost always use it to mean “made irrelevant,” and very rarely hear or see it used for #1, imagine my surprise that we took the 10% tariff off the table!

You have re-invented the Lerner Theorem: tariffs are a tax on exports. If we wish to reduce the trade balance (Why would one want to do that? Or would the objective be to raise the relative price of tradable goods like manufacturing relative to non-tradable goods?) it would be better to do it with an across the board tariff AND an across the board export subsidy.

Interesting points Thomas Hutcheson. Raising the relative price of tradable versus non-tradable goods would be consistent with the general direction of what we know or certainly pretend to understand about Trump economic policy.

This is neither here nor there but the Lerner Symmetry Theorem is a relative price story, and Menzie uses a monetary policy/foreign investment channel story to arrive at the US currency appreciation result.

“Do recall, however, that a 10% tariff combined with a 10% dollar appreciation means net zero impact on the relative import prices, but a 10% worsening of export competitiveness.”

this could very well occur. trump does not appear to look at issues holistically, but targeted segments which allow him to say won or lost. i do not believe he would have any problem claiming a 10% tariff as a successful punishment of his perceived enemies. he would simply not acknowledge the damaging effects which occur downstream. he really is a master of controlling the conversation. the general public understands clearly the direct effect of a 10% tariff on imports. the public has no interest in understanding the implications of export competitiveness. this was clear in the debate results. clinton got lost in explaining important topics the publics was not interested in learning about. trump succeeded in producing great sound bites without detailing their implications long term. that is the public’s interest-at least today.

My immediate reaction was that this story was a hoax or that Menzie was digging deep down into the rumour-conspiracy theory barrel. Nope, this is the real thing. Impressive… as I choke back my surprise.

Perhaps the Trump team floated the idea in order to let Trump voters know the Trump team is ‘taking action’ on unfair trade? Perhaps it is a signal to let trading partners know that future negotiations will be tough, tough, tough?

Good argument Menzie. I readily can see how the US dollar would appreciate against trade partners. And even sky-rocket in the worst case scenario such as a major global trade war where the USA increases tariffs across the board and everybody retaliates in-kind.

In that low-probability scenario, the global economy goes into a deep recession and the value of the USA as a safe haven for capital shoots up. The surge in net foreign investment pushes the US dollar all the higher further putting US domestic manufacturers at a disadvantage.

The resulting wealth destruction would only compare to the magnitude of past global conflicts.

On the bright side, spinning the global economy into a deep recession would certainly slow the growth in carbon and small particulate matter emissions. Resource development would grind to a halt. The backcountry, wilderness lover could grow to appreciate the Trump administration.

If the stock markets continue to power up, that may further embolden Team Trump to float more outlandish, dangerous policy ideas. Could it be time to shop hedges against a dramatic plunge in equity values?

Or will the mantra of lower taxes! lower taxes! dominate all the other silly stuff? If taxes are all that matter, stock markets will continue powering up well beyond just ‘fully valued’. Markets could be assessing this well. The long-term social outcome may not be attractive but near-term US firms stand to grow earnings thanks to the President-elect’s policies, sketchy as the details currently are.

There should be a significant tariff on some goods American corporations offshore. It’s likely the American firms will pay the tariff when foreigners make little producing and shipping the goods. For example, foreigners make 20% and Americans make 80% on the retail price of a Barbie doll. I think, Mattel – the American corporation – will pay the tariff. It may result in a higher retail price or a lower profit for Mattel. Given competition, Mattel may make less profit. And, it may find it would make more profit manufacturing the good in the U.S., given much higher U.S. productivity.

With a significant tariff, a lower corporate tax, and less regulation, we can bring some manufacturing back to the U.S..

Professor,

As I understand your argument, China could sell off US Treasurys, while weakening the Yuan through easing some capital controls.

While I agree in principle, I am stuck on stuck on a question. What does China do with the proceeds of the sale?

They aren’t going to increase the pace of of local currency purchases. They could buy German debt, but there is under $2.4 billion in German debt outstanding so they wouldn’t be able to buy very much. Maybe JGBs, but I am not sure if that is, politically speaking, going from the frying pan into the fire.

Equity markets could absorb some of it, but wouldn’t they want to avoid dollar denominated equities? Otherwise they would still be supporting the US capital markets.

I’m sure I am missing a simple answer. I would appreciate reading your views on this question.

Thanks

Jammer1297: The PBoC would be spending Treasurys to support the value of the yuan. There would not be a need to switch into another foreign currency asset like JGBs or Bunds. In other words, with enough pressure from capital outflows effectuated by way of relaxed capital controls, China could “dump” dollar assets and let the yuan weaken. This outcome relies on sufficient pressure arising from push factors like rising short and long term US interest rates, and elevated policy uncertainty (which is elevated, in Figure 2 in the post).