Since President-elect Trump has nominated Peter Navarro* to direct the newly formed Trade Policy Council, now seems a good time to review some trade data.

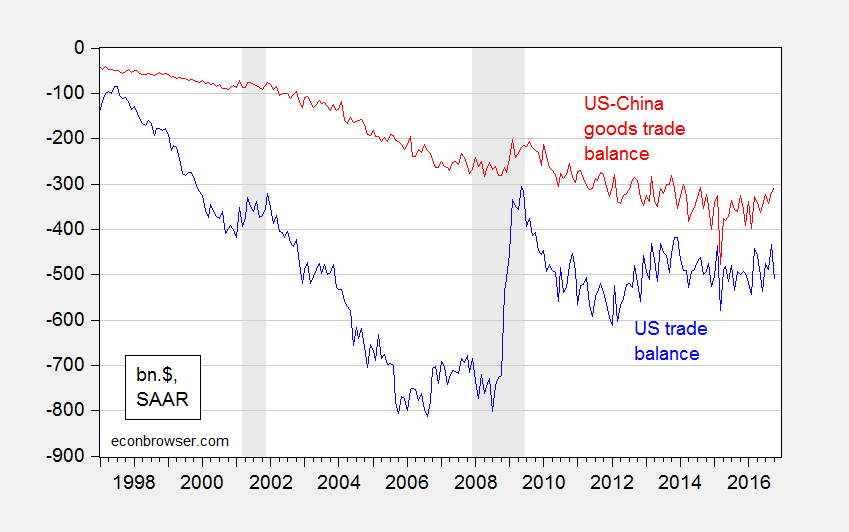

An inspection of the US-China trade balance would seem to highlight the need for some action, especially after comparing the US-China bilateral balance to the aggregate.

Figure 1: US goods and services trade balance, balance of payments basis (blue), and US-China goods trade balance, f.a.s. basis (red), billions of dollars, SAAR. US imports from and to China seasonally adjusted using ARIMA X-12. NBER defined recession dates shaded gray. Source: BEA, FRED.

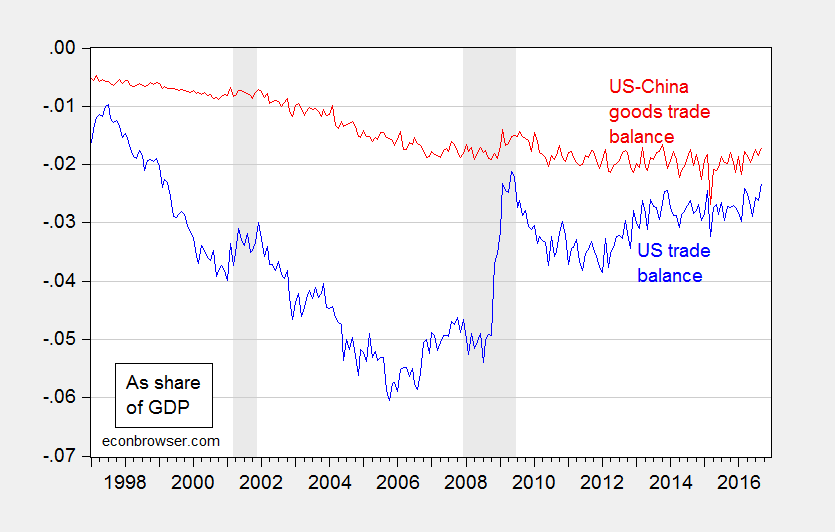

Figure 2: US goods and services trade balance, balance of payments basis (blue), and US-China goods trade balance, f.a.s. basis (red), both divided by GDP interpolated using quarterly match. US imports from and to China seasonally adjusted using ARIMA X-12. NBER defined recession dates shaded gray. Source: BEA, FRED and author’s calculations.

However, it’s of interest to note that up until now, the deficits as shares of GDP have been relatively stable since the end of the Great Recession, with the overall balance shrinking as a share of GDP.

The US-China (goods) deficit is some 60% of the total (goods and services) deficit as of October 2016. However, it’s important to recall that that the bilateral trade balance records the exports and imports from the last source location; hence a $100 widget imported from China, but incorporating $40 components from Malaysia and $50 components from Taiwan, and $10 of Chinese labor, would be counted as $100 worth of imports from China. The value added imported from China (the economically interesting variable) would only be $10 in this example, but $100 of imports is recorded.

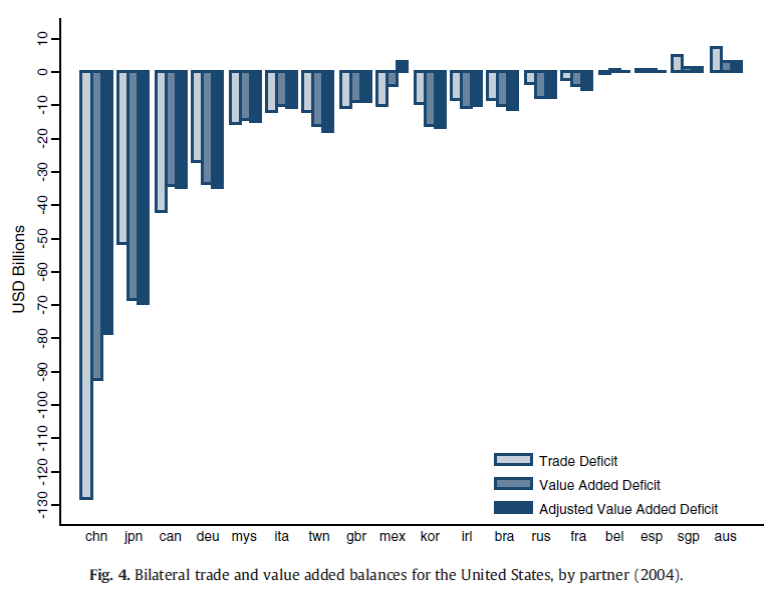

In other words, the calculation does not take into account the development of global supply chains. Johnson and Noguera (2013: 93) show that when accounting for trade in intermediates, the 2004 US-China trade deficit of approximately $125 billion is reduced by $35-$50 billion (30-40% reduction).

Source: Johnson and Noguera (2014).

Now, it’s likely that the domestic component of Chinese exports have risen over time. Nonetheless, it’s still likely true that the bilateral deficit in value added is less than that in gross goods.

It’s also likely that the impact on the trade balance of any restrictive measures on imports will be swamped by the impending dollar appreciation (and associated emerging market downturns).

See earlier discussion of value added and alternative measures of real exchange rates as competitiveness indicators, here. On value chains, see here.

* Full disclosure: I am a former coauthor with Peter Navarro [link].↩

One wonders how much of this is real trade and how much off-shored profits through transfer pricing belonging to US corporations.

Ha, quite brave of you to disclose your association with Peter Navarro 30-some years ago given his current fall from grace. Unfortunately Navarro is of that species of economists who was once smart but willfully decided to become stupid in his subservience to right-wing ideology. Congratulations on your narrow escape!

Solid post Menzie. It would be interesting to see how much of the improvement since 2009 has to do with the Great Recession itself and subsequent slower consumption growth in the US rather than more exports or substitution of imports for domestic varieties. The US economy is now something like 20-25% below it’s long-run trend. If they US economy were to have a full recovery (including in things like hours worked and GDP, not just unemployment rates), it’s likely the trade balance would get much worse.

Value-added? This is something that business tycoon President-elect Trump understands very well. So there should be no problem getting to the bottom of all this and bring his followers along with him.

In addition, expect to see a nation-wide value-added sales tax early in the mandate. President-elect Trump will implement a VAT to help US-based businesses.

Another implication of viewing trade on a value-added basis rather than a gross flow basis, in addition to better identifying the partner-country sources of imbalances, is the recognition that for the United States a large share of imported goods embody intermediate inputs exported from the U.S. to the country from which the U.S. ultimately imports finished goods.

This type of trade is important among the U.S., Mexico, and Canada under NAFTA, especially in motor vehicle manufacturing and other consumer durables. Large tariffs would most likely results in these intermediate goods exports from the U.S. shifting to other countries.