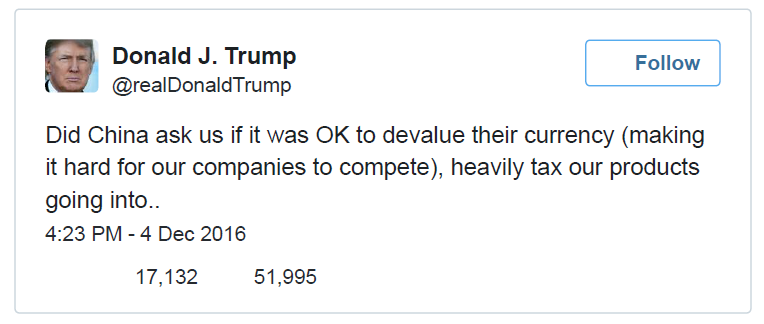

Via Twitter, yesterday afternoon:

(From CNBC)

China is currently expending reserves to support the value of the yuan:

Source: Setser, “China’s October Reserve Sales, And A New Reserves Puzzle,”Follow the Money, Nov 17, 2016.

This suggests at least three (or many more) possible interpretations of what the President elect has in mind: (1) China needs to keep its currency fixed against the USD for all time; (2) China cannot devalue, but revaluation is ok; (3) we need new international monetary regime where exchange rates are irrevocably fixed against the USD.

I think we’ve been at (3) before, or something close. On (1), I don’t think we’d always like the outcome. (2) is my take on the Trump framework, in which case it’s becoming clearer (if it wasn’t clear before) that if there is anything that characterizes the Trump Wirtschaftlichen weltanschauung, it’s mercantilism with a heavy dose of government intervention into the workings of private industry for the purposes of benefiting specific sectors within the economy.

Oh, and by the way, I doubt the yuan is very much undervalued, either by the price criterion, or a simpler balance of payments/basic balance approach. [1]

I have a feeling that after a few months of Predator Trump many of us will be more interested in the yuan/loonie exchange rate. What’s really scary is that his national security team is even more unhinged than his economic team.

If Predator Trump ever holds a news conference, I hope some reporter asks him to name the last three books he’s read within the last year….and his own ghostwritten books about himself don’t count.

You mean books like how the Republican Party became a regional party, why Hillary will win by a landslide, Nancy Pelosi – Leading the Way.

Or, maybe, Mad Dog – No More Appeasement, Learning to become most successful, How to remove the rust from Rust Belt.

Here comes Big Daddy capitalism.

Micro-management with swagger.

Trump has no idea what he is talking about. He makes Dubya look like policy genius.

Trump wouldn’t know Bretton Woods from James Woods. BW does have a golf course, however, so at least Trump would understand that.

Trump is just a con man pure and simple. Bernie Madoff is very envious. I wonder if they ever met. I would have loved to have been in that room!

China didn’t do this by selling rice cakes. http://www.bloomberg.com/graphics/2016-us-vs-china-economy/

They’ve done it because the U.S. and Europe have given away the store for quick profits based on cheap labor… or the Chinese have stolen it.

http://www.globaltimes.cn/content/988130.shtml

http://www.forbes.com/sites/anderscorr/2016/06/22/chinas-aerospace-defense-industry-sacks-us-military-technology/#44d9034d515f

http://www.economist.com/news/international/21697218-china-grew-richer-and-more-innovative-people-assumed-it-would-counterfeit-less-think

Perhaps it is time someone (Trump?) said “enough”.

China follows Keynesian principles of deficit spending and infrastructure construction on a massive scale. The U.S. did the same thing decades ago but now we live in abject fear of our national debt (which has never hurt us since we abandoned gold money 83 years ago) and the debt fear mongering pays big political dividends.

The Chinese are smarter than we are. Exhibit A – Trump

Especially all those new European/Americanized structures sitting empty. Just right enuff vacancy for all kinds of foreigners, under a forced labor regime, to clean up, fix up, when China takes over the US economy for real?

Of the three solutions to his globalization trilemma – golden straitjacket, global federalism, Bretton Woods Compromise – Dani Rodrik suggests that the last is the one most sustainable politically. If Bretton Woods Compromise is the solution Trump is groping towards, what is wrong with that?

Bretton Woods was based on a gold standard for money and fixed exchange rates. That is why it failed completely.

Paul’s right of course. Nixon’s revocation of the gold exchange mechanism (i.e., failure of Bretton Woods) had absolutely nothing to do with deficit spending to support the great society and Vietnam war. History proves again and again that governments can spend societies into prosperity. If only the deficit hawks would commit suicide so money could be free printed we could finally have free food, free college, free cars, free housing, free medical care and free sex for everyone! In fact, we don’t even need taxes to support government programs, we can just spend prosperity into existence. The only purpose of taxes is to take money away from those who, in their ignorance, don’t depend on the government and ruin things for the rest of us.