That’s a quote from candidate Donald J. Trump in May 2016. And today, he re-affirmed his predelictions, in his tax “sketch”.

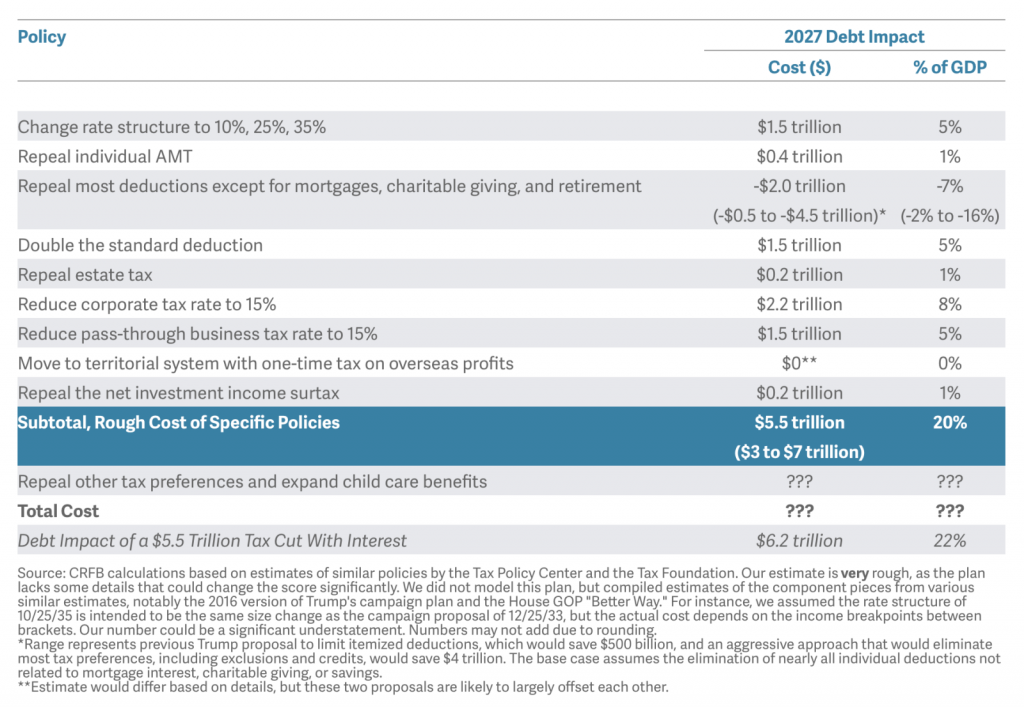

According to the Committee for a Responsible Federal Budget, the ten year central projection is for a cost of $5.5 trillion, resulting a $6.2 trillion augmentation to the debt.

Source: CRFB (April 26, 2017).

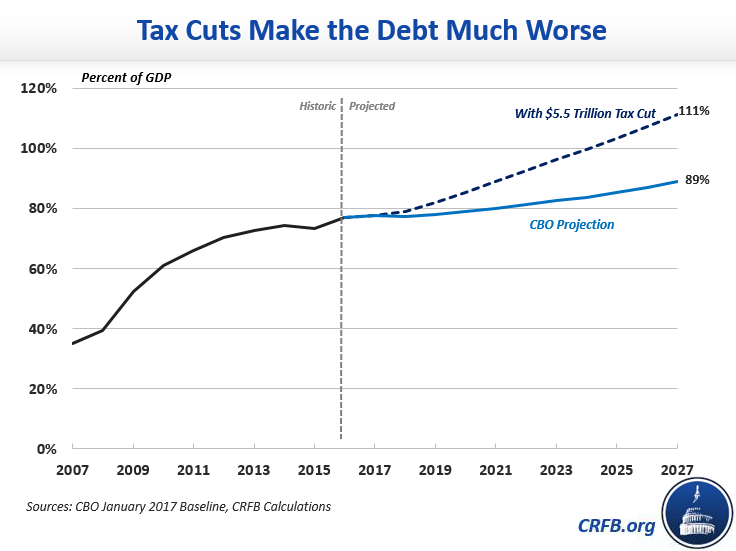

Ignoring dynamic effects, this is the picture (which is not pretty).

Source: CRFB (April 26, 2017).

There is of course a tremendous amount of uncertainty because, well, there are no details. The Treasury secretary has stated the tax cut will be paid for by economic growth. I simply do not know of any model that will deliver sufficient growth to make this plan revenue neutral. For those interested in dynamic scoring, read CBO as well as this discussion of the G.W. Bush Treasury report of 2006.

This plan seems so ill-prepared, so ill-conceived, and so implausible, that a cynical person might think the main objective of releasing this sketch is to divert attention from other issues.

“This plan seems so ill-prepared, so ill-conceived, and so implausible.”

Exactly.

Steven, I’m a bit surprised at you considering this is what Menzie cautioned at the end of his post: “There is of course a tremendous amount of uncertainty because, well, there are no details.”

Over at Bloomberg, some speculation: https://www.bloomberg.com/politics/articles/2017-04-26/trump-s-15-corporate-tax-seen-as-gambit-as-he-unveils-plan

From Stanford University: https://www.gsb.stanford.edu/insights/can-gop-fix-corporate-income-tax

From Financial Times: https://www.ft.com/content/cc1e629c-2ac6-11e7-9ec8-168383da43b7

Perhaps we should read the bill before we pass it… or reject it.

Well, we don’t have a bill, yet, only a proposal from the White House.

To pass reconciliation, the bill must be revenue neutral, else it will face a filibuster from the Senate Democrats as regular legislation. A giant black hole like this plan is not going to get Democratic votes.

But more to the point, we are running a 3.5% deficit at the top of the business cycle with a 75% debt-to-GDP ratio. Some people would refer to this as being broke.

You’ll recall I was a deficit hawk post-2010 and I remain one today. I argued that deficits do not correlate to GDP growth internationally, and they don’t. However, once you ramp up spending and create expectations in voters’ minds, it’s very hard to reduce that spending thereafter. (This is the entire Republican conundrum with respect to the Obamacare repeal.) In any event, we came out of the Great Recession with a much larger deficit than that which we went in with, and any fiscal conservative would have predicted as much.

Now, Tyler Cowen — rather shockingly to my mind — suggests the tax cuts are a kind of Keynesian stimulus and so, why not? If we were in the midst of a recession and not in the third longest expansion in the last century, I might credit Tyler’s point. But that’s not the case.

So, forget the Trump plan. The CBO base projection is itself entirely unacceptable. Moreover, plan on two recessions in the forecast horizon to 2027, yet neither the CBO nor the Trump plan seems to contemplate any counter-cyclical spending.

I personally want to get back to a world where govt debt is 30-40% of GDP and the budget is deficit neutral over the cycle. For me. that is the paramount goal.

What I wrote to a client:

“This whole budget proposal makes me believe in zombies. It’s been prepared by people who are completely brain dead, and yet somehow still walking around.”

“a cynical person might think the main objective of releasing this sketch is to divert attention from other issues.”

Given the recent U-turns on Russia and China,

the bombing of Syria without evidence,

chances are the deep state has something significant on Trump’s Russia connection

This plan will work as long as one assumes 6% annual growth during the 8 years comrade trump is in office.

inside of 100 days, trump has reduced the office of the presidency to the level where there is no credibility in anything the president says or does. unfortunately, it appears as though the conservatives in our country are very accepting of a president whose words and deeds have a lack of integrity. so sad.

I learned from Paul Krugman that it’s silly to worry about public debt. It’s just money we owe to ourselves.

Dan Nile: Then you read Paul Krugman incorrectly; running a deficit when there is a negative output gap is standard (i.e., textbook) countercyclical fiscal policy. Increasing the deficit at near full-employment is, well, not textbook.

Who can forget those heady days in the 2000 campaign when candidate Bush said following VP Gore’s plans “…could amount to over 2 trillion in bigger government in 10 years.” Better, apparently, to have followed Bush’s plan and enlarge the debt by $3.2 Trillion in just seven years and to have more than doubled it by the end of his second term.

It was, however, HIS vice president who explained very clearly that Reagan had proved deficits don’t matter.

ill prepared, ill conceived, implausible? In other words targeted specifically for the true believers (and those who’ll believe pretty much anything he says, anyway).

The Republicans in Congress won’t allow too much additional debt. They are a diversified and more independent group with conservatives, moderates, liberals, libertarians, etc., while the Democrats are unified and solid under liberals.

I think, a lot of spending and waste can be reduced in health care, education, and other parts of the government. And, repatriation will raise some revenue. Also, stronger growth from expansionary fiscal policy will pay for part of the tax cuts, and taxes can be raised later when normal growth is underway.

Ultimately, we’ll have a more efficient government that’s run more like a business. However, promoting stronger growth is the top priority.

And, borrowing at low rates, using leverage, and renegotiating loans, if investments don’t work out, helped make Trump a billionaire. So, of course, Trump loves debt.

You sound like the kind of person who believes in trickle down economic theory.

You sound like the kind of person who has no English comprehension.

So you don’t actually have a clue about Democrats? Good to know.

I know they line up well.

Certainly, it’s not the Democrats of the Kennedys, Moynihan, or conservative southerners, like Sam Nunn.

“Ultimately, we’ll have a more efficient government that’s run more like a business.” You are uninformed as the purpose of business is to make a profit; to seek competitive advantage to do so. Whereas the purpose of government is provide for the common good; while operating in a transparent manner.

So, you’re for a very inefficient federal government?

To quote :

PeakTrader

April 27, 2017 at 8:20 am

You sound like the kind of person who has no English comprehension.

Businesses also use limited resources efficiently. So, there’s money left over for other things.

PeakTrader: Yes, Enron did a *tremendous* job!

Menzie Chinn, I was thinking of businesses like Amazon.com.

PeakTrader: With every Amazon, there is an Enron (or possibly two or more…)

Perhaps you meant Exxon did a tremendous job … or was it Solyndra? /sarc

More to the point: businesses may or may not use their resources efficiently, but if they don’t they may not end up on this list … http://fortune.com/2016/06/08/fortune-500-most-profitable-companies-2016/

Government, on the other hand, always uses tax revenue or new debt efficiently:

http://thehill.com/policy/finance/241304-mccain-highlights-billions-in-wasteful-government-spending

http://www.investors.com/politics/editorials/federal-government-waste-exploded-under-obama-data-show/

https://www.washingtonpost.com/investigations/pentagon-buries-evidence-of-125-billion-in-bureaucratic-waste/2016/12/05/e0668c76-9af6-11e6-a0ed-ab0774c1eaa5_story.html

https://www.hhs.gov/idealab/2016/12/19/developers-help-us-stop-fraud-waste-and-abuse-in-government-healthcare-spending/

… and so many more.

So, perhaps Trump’s notions might make more sense if the spending side of the equation was more “businesslike”.

Bruce Hall:

1. Profitable does not equal efficient; monopoly can be profitable, without being efficient.

2. Where did I write government works efficiently?

I concur that this tax bill might be an opening gambit, much like withdrawal from NAFTA, declaring China a currency manipulator, and repealing/replacing ACA, and getting the Mexicans to pay for the big, beautiful wall were opening gambits. I hope that the tax “sketch” remains an opening gambit.

Actually, it’s amazing how many cutting edge energy companies have been founded by ex-Enron employees. Enron in many respects really was a revolutionary company, not without its excesses, but not without ground-breaking achievements, either.

The critique is monopolies is not a lack of efficiency. As they are profit-maximizers, they have an incentive to be efficient. The critique of monopoly has to do with social welfare effects. But you knew that, Menzie.

By contrast, politicians maximize political acceptability subject to budget constraints. As long as it meets the political interests of decision-makers or their constituents, any government spending can be considered ‘good’, regardless of its efficiency or effectiveness. The Iraq War is a nice example.

Further, because politicians face three (or more precisely, two of three) mutually exclusive objective functions in the Three Ideology Model, a principal-agent problem arises. If both low taxes and high spending are a virtue, then politicians have an incentive to resort to debt; hence, democracies has a deficit bias. The Trump plan s a nice example of that.

Steven Kopits: Oh. Better go back and rewrite all those microeconomics textbooks we have sitting around, where dead weight losses occur due to setting MR=MC where MR isn’t same as demand curve. Wow. Did you ever take a micro course?

I might also mention as an aside the concept of X-efficiency, by my one-time teacher Harvey Leibenstein.

I don’t know. Does a deadweight loss mean a monopoly produces a unit of output with more resources than absolutely necessary?

A deadweight loss is a social inefficiency, sure. But in terms of internal operations, a monopoly can be efficient as it is still a profit-maximizer. Is there some rule that suggests that monopoly management wastes money? That they invest in unproductive assets or hold unnecessary levels of labor?

On the other hand, if you’ve ever consulted for an SOE monopoly — and I have, for lots of them — then mis-investment, excess labor, poor stocking, waste of materials and the such is rampant, because SOE’s are operated to achieve political acceptability subject to a government budget constraint (ie, they will run a loss as big as the government is willing to subsidize).

So, yes, I stand by what I said. I’ve seen it empirically.

Steven Kopits: Well, as I learned in the textbooks, what you are calling efficiency is what was called “technical efficiency”. In neoclassical theory, monopolists would operate at minimum cost. However, as far back as Williamson (1963), we’ve known that firms do not operate thusly. For more, see Williamson, Oliver E. 1963. Managerial discretion and business behavior. American Economic Review 53 (December): 1032-57.

Now, if you are talking about SOEs, well, sure, I never said we should run the US economy as a big SOE. I’m just saying there are such things as agency problems.

By the way, I’ve been an employee in a private (manufacturing) firm. That was no paragon of technical efficiency…

Your statements would be more credible if they were based on studies by independent experts. For example study after study have reported on the efficiency of the Federal Government in the administration of Medicare compared to commercial insurance companies. Much but not all of difference in efficiency is due to the lack of profit motive, thus more of the amounts spent are for healthcare costs rather than administrative costs or profits.

Yes, they would be credible based on studies by independent experts:

https://www.google.com/amp/amp.nationalreview.com/article/331704/medicares-efficiency-robert-moffit-alyene-senger

Menzie, you are correct that monopolies can be profitable, but the only examples of profitable companies I reference were large, but certainly not monopolies or even oligopolies… especially in a global economy. Efficiency is only one aspect of potential profitability. New and revolutionary products are certainly helpful. Great service is a plus. A reputation for expertise goes a long way, too.

You didn’t write that government works efficiently or even effectively and that adds to your credibility. The point I was attempting to make through the links provided is that government is wasteful and perhaps more “businesslike” approaches might at least partially offset any loss in tax revenues.

As you said, “There is of course a tremendous amount of uncertainty because, well, there are no details.” The implication is both/either that the “plan” may be completely untenable or the criticism of a complete unknown is mere speculation. I don’t believe this is the case because there are enough indications of what the plan would entail to draw some very generalized conclusions… as long as potential ancillary changes to government operations are acknowledged or considered.

How about a “cut waste by 15% annually” as a potential change? I’m sure there are enough sources of identified waste to make that a reasonable goal.

Bruce’s point was that private sector firms are incentivized to use their resources efficiently. To which you replied that private companies can be profitable without being efficient, which is true, even with pure competition.

And of course all firms have agency problems. They are worse at SOE’s. Indeed, I had some very memorable meals with some really fine wine in the executive dining rooms of Italian and French SOEs. But private sector firms are not immune: Let’s not forget the Friend of Roger.

http://nymag.com/daily/intelligencer/2016/07/fmr-fox-booker-harassed-by-ailes-for-20-years.html

I think there is a question of ‘normal’ agency v ‘abnormal’ agency. ‘Normal’ agency is that a manager can keep his frequent flier miles, for example. Abnormal agency is orgies at Russian hotels. No firm operates with complete efficiency, but there is normal industry practice which is, I guess, ‘ordinary efficiency’.

One could make the case that agency problems are worse at monopolies, that the cost curve for monopolies is higher than for comparable firms operating in competitive conditions. I haven’t seen it done, but I could believe it.

What could possibly make you believe Republicans in congress actually care about debt, especially debt that finances tax cuts for wealthy people?

I fear the day when these kind of PR stunts will be considered by Mr. Trump to not suffice anymore, and that a much bigger distraction will be needed.

Trump only has two ideological values: high TV ratings and personal wealth. The tax cuts make him wealthier, so they aren’t a distraction (almost everything else is). When dealing with a simpleton, don’t mistake incompetence for deviousness.

OK, the cuts amount to 22% of GDP.

Making heroic estimates of the stimulative impact gives you 4% growth rather than 2% , for a 2% gain.

Subtract 2% from 22% gives you a net of 20% of GDP.

This will generate a major jump in the domestic savings-investment gap so it will require a massive

increase in foreign borrowing and the resultant trade deficit.

The dominate factor driving the trade deficit is the domestic savings-investment gap. Everything else that Trump keeps talking about are symptoms, not the underlying cause. It is like going to the doctor with cancer and he gives you pain medication. It makes you feel better, but meanwhile the cancer continues to grow.

The interesting question is where will the foreign capital come from. Under Reagan it came from Japan, but they no longer have a massive savings surplus. Under Bush it came from China but that seems to be drying up now. So where will it come from under Trump and what will he do when the trade deficit soars because of the federal deficit? Maybe this time crowding out will work through higher interest rates rather than a stronger dollar.

But if crowding out works through higher interest rates you will not get the jump to 4% real GDP growth.

OK, the cuts amount to 22% of GDP.

2015 U.S. GDP was estimated to be $18 trillion. @22% = ~$4 trillion.

From the CBO: https://www.cbo.gov/topics/taxes

REVENUE PROJECTIONS FOR FY 2017

(As of January 2017)

INDIVIDUAL INCOME TAXES

$1.7 Trillion

PAYROLL TAXES

$1.1 Trillion

CORPORATE INCOME TAXES

$320 Billion

OTHER

$283 Billion

So, according to your calculations, Trump is proposing more than 100% tax cuts.

Bruce Hall

One big difference between government and the private sector is their different attitudes toward risk. Private sector businesses must be risk averse. Governments should be risk neutral. To quote Kenneth Arrow and Mordecai Kurz:

“…we hold that the government’s choice should be risk neutral and that the proper procedure is to compute the expected values of benefits and costs and discount them at a riskless rate…”

—- Public Investment, the Rate of Return, and Optimal Fiscal Policy

As to Solyndra, a risk neutral approach means that many projects will fail. That’s okay. It’s supposed to work that way. It’s optimal. If you want to criticize Obama’s energy policies then you should complain that they were too risk averse. There were actually fewer failed projects than you typically find in the private sector. And even in the private sector most projects fail. How many business failures has Trump had over the years? In any event, the reasons for Solyndra’s collapse turned out to be quite good news for American consumers.

We don’t know the precise details of Trump’s plan, but we know enough to say with a high degree of confidence that it’s plain nuts. His growth assumptions are laughable given that the economy is near or at full employment. There is simply no way that a responsible Fed will not take away the punch bowl just as the party gets going. Trump is an economic illiterate. He doesn’t even seem to know that his Secretary of the Treasury wasn’t econ guy…he just worked at GS doing something or other. Good enough for Trump. All Trump cares about are tax cuts and his girlfriend Ivanka.

2slug, I agree that governments are less risk averse than businesses because the government shareholders (taxpayers) are relatively powerless compared to corporate shareholders. That doesn’t equate to “better”. More often it simply means wasteful, unproductive, and ill-prepared.

I ran across a good example of that: http://www.theverge.com/2017/4/27/15450334/nasa-astronaut-space-suit-development-deep-space

Excerpt:

“The state of NASA’s space suit supply looks bleak in a new report from the space agency’s auditor. NASA is still “years away” from having a new space suit ready for future deep-space missions, the report claims, even though the agency has invested close to $200 million on space suit development since 2007.

Meanwhile, NASA seems to be running out of the space suits it does have for the astronauts on the ISS. Only a fraction of the original space suit supply for the station is fully functional right now, and NASA may risk not having enough space suits to last through the end of the ISS program, currently scheduled for 2024.”

Elon Musk would not tolerate that.

Bruce Hall

governments are less risk averse than businesses because the government shareholders (taxpayers) are relatively powerless compared to corporate shareholders

That sounds like the kind of flippant remark I would have expected to hear on right-wing AM talk radio. But it does tell me that you don’t understand the basics of public finance economics.

2slug,

That sounds like the kind of flippant remark I would have expected to hear on right-wing AM talk radio.

… and why would you believe government is less risk averse (more willing to take risks) than startups/entrepreneurs? You are more willing to take risks than even the most risky businesses if you don’t fear any consequences. You can waste hundreds of billions of dollars annually and claim it was “for a good cause” and then increase the debt account and move on to the next “good cause.” Taxpayers? Put up and shut up.

Slugs –

The difference between the private sector and government goes far beyond the attitude towards risk. The objective function is fundamentally different.

For the private sector, maximize profits (of some proximate proxy, eg, revenues, market share, market reach (Amazon), profit ‘quality’, etc.) A company is run as a profit center.

For the government, attain minimum political acceptability subject to a budget constraint. That’s what I have observed in real life. Money is not currency in politics, merely a constraint in reaching political acceptability. The government is really run as a cost center.

When Did Our Federal Debt Ever Hurt Us?

• We had our highest debt-to-GDP ratio after WW II then increased the federal debt 82% and spending 725% over the next quarter century from 1948, producing our greatest prosperity ever: a 168% gain in Real GDP and a 70% increase in jobs. Today, that WW II debt is worth $0.08 on the dollar as inflation has consumed 92% of its value.

• By 2016, federal spending was 483% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. The result: Real GDP gained 159% and jobs increased by more than 54 million since 1981.

When Did Our Federal Debt Ever Hurt Us?

• We had our highest debt-to-GDP ratio after WW II then increased the federal debt 82% and spending 725% over the next quarter century from 1948, producing our greatest prosperity ever: a 168% gain in Real GDP and a 70% increase in jobs. Today, that WW II debt is worth $0.08 on the dollar as inflation has consumed 92% of its value.

• By 2016, federal spending was 483% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. The result: Real GDP gained 159% and jobs increased by more than 54 million since 1981.

Inflation and the Federal Debt

• We had our worst inflation of the past 60 years during the decade of 1973-1982 when the debt-to-GDP ratio was always less than 35%.

• In total, our debt as of 01/01/2017 is 886 times bigger than in 1933 at the nadir of the Great Depression. Were we better off then?

• Obviously, the federal debt has been essential to our ascendance as the world’s dominant economy with the reserve currency of the world’s economy.

Bruce Hall: “Elon Musk would not tolerate that.”

Rather amusing that you bring up Elon Musk as your example of private business vs government.

Tesla was founded using half a billion dollars of the very same Dept. of Energy funding that Solyndra used and which you previously disparaged as a terrible program. Meanwhile SpaceX, Solar City, and Tesla to this day all are being kept alive and nurtured by government money. Not one of those companies has made a profit on its own yet.

Glad you caught that about Musk since no one else noticed; you’ve completed the point.

Odd that Ford’s efforts have been ignored, but that’s because they didn’t take the bailout yet have quietly self-invested in all-electric/hybrid/self-driving/alternate-fuel vehicles. But they’ve done it judiciously where there were markets to tap.

The number of all-electric vehicles produced by all manufacturers is minuscule compared with the entire market. The government believes it is doing “the right thing”, but the subsidy cost per unit makes that a tough case to sell. It’s difficult to get people to buy a short-range (shorter in cold weather) all-electric vehicle when they can purchase a turbo-charged performance sedan for the same price and not worry about the weather or supporting infrastructure.

The government didn’t have to subsidize flat screen TVs for the market to accept them and replace the old CRT technology. The product was clearly superior and the wealthy who first bought them paved the way for industry to have the volumes necessary to lower the price and invest in technical improvements. Can you even find a CRT at Best Buy?

When cost/performance is superior to internal combustion engine vehicles, all-electrics will fly off the lots without government help. Until then, the government is wasting our money.

“I actually, this is more work than my previous life. I thought it would be easier.” Donald J Trump April 2017.

this is what happens when the back benchers are actually forced to govern. they accomplish very little. the dog finally caught the car. now what?

or you could say he accomplished a lot. no legislation. but he put out executive orders in record numbers. didn’t peak trader and rick stryker moan about executive overreach when obama issued executive orders? trump has completely overtaken obama on exectutive orders-and yet silence from those conservatives concerned about executive overreach. i find it fascinating that over three months into a government which is completely controlled by the republican party, they cannot pass any legislation and must resort to executive orders. health care? no. tax reform? no. you would even think a simple annual government budget, required to keep the government operating, would be approved. no. it seems as though the party which has complete control of the government cannot even create and pass a simple piece of legislation. the dog finally caught the car. what a disaster.

The Republican Party seems entirely devoid of serious policy analysts. And I say this as a fiscal conservative with socially conservative sympathies.

There is a lot of interesting conservative policy to be done. I could rattle of half a dozen initiatives which are new, but fiscally viable and not so plain mean. Instead, we get this retread stuff, reduced ideological dogma without any kind of finesse or insight.

This is not an advertisement for the Democrats, let me add. But their the least of our worries for now.

“The Republican Party seems entirely devoid of serious policy analysts. ”

could not agree more. there are plenty of ideas on the conservative side which could attract support from the political middle. the problem is they continue to be sabotaged by ideologues who have a failed understanding of their policy positions. or they continue to deny the reality of the data which suggests their positions are incorrect. as i have said often, the problem with modern conservative leadership is they have already developed the solution, and are in search of a world to apply those solutions. at issue, those solutions do not address the problems of the real world. paul ryan is the prime example.

Bruce Hall: “Glad you caught that about Musk since no one else noticed.”

You mean caught the fact that you completely contradicted yourself and can’t keep your points straight? And now you are trying to cover up your blunder by heading off in a new direction?

Thanks, but it’s no great feat and I wonder if it’s even worth the effort to point out the obvious contradictions in your reasoning to you. Pearls before swine and all that.

Joseph,

Thanks, but it’s no great feat and I wonder if it’s even worth the effort to point out the obvious contradictions in your reasoning to you. Pearls before swine and all that.

Well, I expected that, but hoped for better. Yes, indeed, I recognized the error in using Musk as an example because, as you say, he was the beneficiary of government largesse and has not yet turned a profit. My point was that even Musk would not spend a decade developing something like a spacesuit to replace an older version without ensuring that he had sufficient reserves of the old product to carry operations through until the new product was ready.

But, as I say, I erred in using Musk as an example; so you are completely justified in dismissing my point. Any CEO would have done as an example, but I was focused on the NASA space program example and Musk is running his own effort. So, you win. Government is all good; no waste, inefficiency, or ineffectiveness. It’s all for the common good so whatever the cost we should go for it.

Forest… trees, eh Joseph.