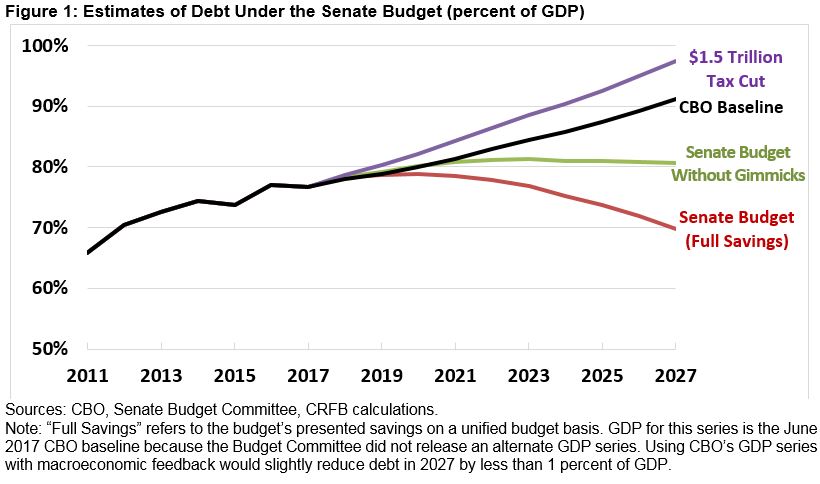

The budget will allow Republicans to pass a tax overhaul that adds up to $1.5 trillion to the deficit through a process known as reconciliation, which only requires 51 votes to pass in the Senate.

Here’s the implications for debt:

Source: Committee for a Responsible Federal Deficit (Oct. 18, 2017).

In other words, the legendary “true” Republican deficit hawk is a rare creature indeed.

If the legislation passes, my back of the envelope calculations (based on these estimates) suggest a 0.5 ppt of GDP increase in the current account relative to what would have otherwise occurred.

Paul Ryan has a plan to make sure that this tax cut does not raise the deficit. Cut Federal nondefense government purchases to negative 0.5% of GDP.

“Republican deficit hawks” believe it’s a spending problem.

Eight years into the “recovery” and half a trillion dollars annual budget deficits.

Something is wrong.

Try looking at http://www.bea.gov and their reporting of government purchases in real terms. Real purchases are NOT going up so any deficit is per se not a spending problem.

PGL, is that each year or cumulative over ten years?

Budget axiom: Everyone likes to pay less Federal taxes; everyone wants to receive more money from the Federal government.

From 2009: http://www.heritage.org/budget-and-spending/report/50-examples-government-waste

Bruce Hall: And so you’re good with another $1.5 trillion in Federal debt?

Please stop fear mongering about the federal debt.

FDR increased the debt 1000% to finance fiscal policy and win WWII.

Reagan tripled the debt and ran record deficits for many years.

Obama added more than $9 Trillion to the debt and had the highest deficit-to-GDP ratios since WWII.

Did such profligacy result in increasing inflation? Hardly. Inflation today is at a 50 year low: 1.3% for 2016. The Fed has not hit its 2% target on an annual basis since 2012 when it was 2.07%. https://fred.stlouisfed.org/graph/?g=gJ4#0

OTOH, the worst sustained inflation we have had during the last century – the decade 1973-1982 – occurred when deficits were low – averaging 2.4% of GDP and the federal debt never exceeded 35% of GDP.

Why do our most prominent economic policy people ignore the facts in favor of myths?

“Reagan tripled the debt and ran record deficits for many years.”

James Tobin noted that in real terms, he only double the Federal debt. Of course he said that with his classic grin.

Pres. Obama did not even double the debt and he reduced the federal budget deficit by 75% (as a percent of GDP) from FY 2009 through FY 2015 during a recovery from the worst recession since WW II—something that was never done during any previous recovery, but the “deficit hawks” relentlessly fear mongered about the debt and nearly caused a default over it.

The problem is not the debt, but the income and wealth inequality that results from GOP tax cuts. Of course, that’s exactly what they want — no point being rich unless you have the poor to lecture about their circumstances.

Bruce Hall Did you read the Heritage pamphlet? It’s a joke. And the author clearly doesn’t know what he’s talking about. For example, item #8 refer to the improper use of government credit cards. This is the same BS that Sen Grassley tried to peddle a few years ago. The government credit card (GOVCC) spending that they are referring to is the use of the GOVCC by government employees for things that the government considered improper. And there are regulations that prohibit certain kinds of uses of the GOVCC. For example, you can’t use the GOVCC for non-travel related expenses. That’s reasonable enough, but thanks to the public’s misunderstanding and Grassley’s lying about the problem, this got extended to having a beer with your meal while on official travel. But here’s the real problem….it doesn’t cost the government anything because 100% of the costs are billed to the employee, not the government. In fact, the government actually earns income because the credit card issuer rebates a fraction of its fee to the government. So there is zero…repear ZERO cost to the government. BTW, the reference to footnote #8 for item #8 is missing. Let’s also look at item #1. This program is what is used to procure commercial, inexpensive items in lieu of formal bids. The GAO report doesn’t really say that all of that spending is a waste, it says that some of the procedural rules may not have been followed to the letter (or GAO’s interpretation of the letter) of the law. And those procedural improprieties tend to be very, very trivial; e.g., did the card holder receive mandatory annual training on time; did the card holder buy something off the card that wasn’t on the GSA list even though the actual price paid might have been less? Those kinds of things.

Let’s look at item #3. Most of those costs to GSA showed up as a savings to DoD under the various BRACs. For example, a large logistics command in St Louis was BRAC’d and the command moved to Alabama, thanks to that good custodian of the public trust, Sen. Richard Shelby (R-AL). The cost of maintaining the physical structures was taken off DoD’s books (counted as a savings) and picked up by GSA as a vacant property. GSA than leased it to a charter school. It flopped and reverted back to GSA. Similar stories could be told regarding BRAC’d properties in New Jersey, Illinois, California, and Germany. Look closely and you’ll see that virtually all of the bad BRAC decisions were the brainchild of some GOP politician looking to turn a red state redder.

Is there government waste? You betcha. Plenty of it…especially in DoD and especially stuff that was pushed by Rumsfeld’s revolving door of undersecretaries who used their government positions to fatten their bank accounts.

Do you see any evidence that Trump is trying to drain the swamp? Far from it. Trump is trying to fill the swamp with all of his alligator friends.

Paul Mathis, I’ve explained to you before why too much debt is bad. See econ paper:

“Reinhart and Rogoff argue GDP growth slows to a snail’s pace once government-debt levels exceed 90% of GDP.”

The weak recovery, since 2009, added too much debt. Chart:

https://fred.stlouisfed.org/series/GFDEGDQ188S

And, I’ve explained to you before, Reagan had something to show for the debt: Strong economic growth and rebuilding the military, which won the Cold War and gave a peace dividend in the ’90s. Of course, he didn’t get the spending cuts promised by the Tip ‘O’Neill House.

Spending is too high, particularly at this point of the business cycle. Chart:

https://fred.stlouisfed.org/series/FYONGDA188S

We need to expand the economy at a faster rate to raise tax revenue and reduce spending on the unemployed and underemployed. Unfortunately, the huge amount of debt is a constraint.

Peak Trader relies on Reinhart and Rogoff’s discredited paper to lecture us on the dangers of government debt? Not that Peak Trader has much credibility before – but this destroys what little existed.

“Spending is too high, particularly at this point of the business cycle.”

Oh really? Your ratio in 2016 is the same as it was when St. Reagan left office. St. Reagan is a socialist? BTW – real growth during the Reagan/Bush41 years averaged 3.0% as compared to 3.5% the 3 decades before or 3.6% under Clinton.

Peak Trader’s spin is just amazingly fact free. But that R&R paper???

Pgl, you’re the one spinning. Trade deficits subtract from GDP. Under Bush 43, it reached 6% of GDP. The U.S. was consuming more than producing in the global economy at full employment. Moreover, improved standards, including working and environmental, were taken into account, unlike before the ’80s. Moreover, GDP was likely overstated before the ’80s either because of quality differences or the beginning of the Information Revolution. Living standards improved much faster than reflected in GDP growth from 1982-07. It’s been shown too much debt slows growth and that debt is being paid. Moreover, stronger growth will increase interest payments. Don’t be so ignorant.

PeakTrader: Your comment makes absolutely no sense on many dimensions.

1. If we care about production, GDP calculated by deducting imports makes perfect sense. Are you saying we should be using a consumption metric?

2. Hedonic adjustment *is* more common post 1980; but that means growth pre-1980 didn’t account for quality adjustments (except in the most rudimentary fashion) and hence official measurements of the pre-1980 period understate growth relative to the post-1980 period.

3. How were “working standards” incorporated into GDP in the 2000’s?Not in GDP as far as I know. What are you talking about?

Menzie Chinn, U.S. consumption has been greater than U.S. production in the global economy.

Before 1980, were quality declines reflected in GDP growth?

Higher labor standards are production costs that reduce negative externalities, e.g. safety standards.

peak repeats the same zombie remarks on each post by menzie. he has no interest in truth or learning, only promoting his discredited zombie ideology. over and over and over again.

Notice how his zombie remarks basically tried to change the subject. I guess we should be glad that this blog comment section has only one such troll.

“Too much debt is bad.” Really?

• We had our highest debt-to-GDP ratio after WW II then increased the federal debt 82% and spending 725% over the next quarter century from 1948, producing our greatest prosperity ever: a 168% gain in Real GDP and a 70% increase in jobs. Today, that WW II debt is worth $0.07 on the dollar as inflation has consumed 93% of its value.

• By 2016, federal spending was 483% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. The result: Real GDP gained 159% and jobs increased by more than 54 million since 1981.

OTOH, in 1929, the debt-to-GDP ratio was 16% after 10 straight years of budget surpluses. So according to your wisdom, the U.S. did not have any serious economic problems in 1929.

Today, the debt-to-GDP ratio is over 100%, as it has been for the past 5 consecutive years. According to your wisdom, therefore, the U.S. must be on the verge of economic disaster albeit the unemployment rate is at a 16 year low, inflation is at a 50 year low and hasn’t been over 2% annually since 2012.

Federal debt held by the public as a percent of GDP is about 75%:

https://fred.stlouisfed.org/series/FYGFGDQ188S

PeakTrader Ugh. To begin with, the R&R paper has not stood up to close scrutiny. In fact, the paper never passed the peer review process; it was just a letter that was inserted into a top journal….a letter that was included only because of the reputation of its authors. It turns out that R&R confused cause and effect. Weak economies lead to higher deficits, not the other way around. As to Reagan’s strong economic growth, it was pretty much par for the course back then. But where you really go off the tracks is with your naïve nonsense about Reagan ending the Cold War. [Historical note: Reagan was no longer President when the Cold Ware ended.] Instead of the triumphalist claptrap you’ve been reading, try reading some serious stuff on the Cold War. A good place to start would be “The Collapse: The Accidental Opening of the Berlin Wall” by Mary Elise Sarotte. It’s fairly representative of some of the more recent and less triumphalist research on the collapse of the Soviet Union and the unravelling of the Warsaw Pact. BTW, in the past I’ve asked you to identify a single significant weapon system that was deployed under Reagan that was not already at Milestone A or B during the Ford and Carter years. Do you have any idea how the DoD weapon system life cycle actually works?

Unfortunately, the huge amount of debt is a constraint.

And the GOP budget improves the debt problem??? You’re kidding, right?

“Debt is a constraint.” Really?

Under FDR, the debt more than doubled from $22.5B in 1933 to $49B in 1941. But it was clearly no constraint because the debt more than quintupled to $269B just 5 years later while the economy expanded enormously. Where exactly was the constraint?

2slugbaits, the paper is supported by mainstream economists. We have $500 billion annual budget deficits, because the economy is weak, not because budget deficits are greater. Reagan wasn’t president either when subsequent presidents benefited from the “peace dividend.” Even Keynes believed we should be running budget surpluses by now:

“…spending, deficits, and tax. These tools could be used to manage aggregate demand and thus ensure full employment. As a corollary, the government would cut back its spending during times of recovery and expansion. This last precept, however, was all too often forgotten or overlooked.”

“the paper is supported by mainstream economists.”

R&R? No Peak – this is blatantly false. And you followed this by more meaningless babble? When in a deep hole the best advice is to stop digging.

PeakTrader No, the R&R “paper” is no longer supported by mainstream economists. Yes, when it first appeared a lot of mainstream economists were inclined to agree with R&R based on their reputation and on their more detailed (and excellent) book of 800 pages. But when economists started to dive into R&R’s data, their case fell apart. For example, see this analysis:

https://qz.com/88781/after-crunching-reinhart-and-rogoffs-data-weve-concluded-that-high-debt-does-not-cause-low-growth/

And since then the author of that analysis has gone even further, arguing that time series analysis fails to capture the obvious fact that you cannot aggregate data by country across time when there are huge differences in that country’s regime; e.g., half of the history is under a monetary union and the other half isn’t.

Even Keynes believed we should be running budget surpluses by now

Keynes was also wrong. We should be on a glide path of steadily lower primary deficits. No modern macroeconomist would recommend an abrupt change to a total budget surplus.

Serious question. When was the last time you read a graduate level macro textbook that was written in the last (say) five years? Ten years? Twenty years? Reading a lot of your posts I get the sense that your econ knowledge is stuck in the disco era. New wine in old casks?

2slugbaits, the 90% tipping point holds:

https://scholar.harvard.edu/files/rogoff/files/reinhart_rogoff_responding_to_our_critics_nyt_042513.pdf

Note, the response says:

“A leading expert in time series econometrics, James D. Hamilton of the University of California, San Diego, wrote (without consulting us) that “to suggest that there is some deep flaw in the method used by RR or obvious advantage to the alternative favored by HAP is in my opinion quite unjustified.” (He was using the initials for the last names of the economists involved in this matter.)”

You are all over the map with this stuff. But I do see you are consistent with the childish insults. That last paragraph alas is beneath responding to.

Federal Spending: Killing the Economy With Government Stimulus

https://www.google.com/amp/s/www.forbes.com/sites/dougbandow/2012/08/06/federal-spending-killing-the-economy-with-government-stimulus/amp/

Doug Bandow for Forbes????

“I am a Senior Fellow at the Cato Institute. A former Special Assistant to President Ronald Reagan, I also am a Senior Fellow in International Religious Persecution with the Institute on Religion and Public Policy. I am the author and editor of numerous books, including Foreign Follies: America’s New Global Empire, The Politics of Plunder: Misgovernment in Washington, and Beyond Good Intentions: A Biblical View of Politics. I am a graduate of Florida State University and Stanford Law School.”

Yea – give that guy a Nobel Prize in economics.

Thanks for the comedy Peak. Did you even read Bandow’s anti-Keynesian claptrap?

Note the date: Aug. 6, 2012. Then consider the subsequent facts to this Bandow statement:

“President Barack Obama’s presidency hangs in the balance after another disappointing employment report. He continues to advocate new government “stimulus” programs to boost his reelection campaign. However, Washington is awash in government “stimulus,” without effect.”

In July, 2012, the unemployment rate was 8.2%. Since then, the economy has added 12 million private industry jobs under the Obama fiscal year budgets. https://fred.stlouisfed.org/series/USPRIV

Only the brain dead still argue against Keynesian stimulus, but I realize it is almost Halloween so the zombies are out and about.

The only zombies here are putting lipstick on an eight year old pig – the Obama “recovery.”

PT: for real zombieism, how about the guy who stated categorically that the increase in the national debt was much steeper index Obama than under Reagan? That, of course, would be very fuzzy math.

After all, it took 191 years for the national debt to reach a Trillion. But it took Reagan only eight years to nearly triple that.

PeakTrader You haven’t been keeping up with the literature on the R&R paper. R&R’s reply refers to some very early criticisms. Since then some significantly more in-depth looks at the R&R data have pretty much overturned their results.