That’s what Ironman asks at Political Calculations, and he answers his question thusly:

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis.

Here’s my assessment.

First, it is in my mind hazardous to infer too much from the household survey based labor market series, because the sample is usually relatively small, so that there is substantial measurement error. (Ironman focuses on the decline in the 12 month moving average Labor Force Participation Rate, LFPR) As I documented in this post, even for a state as large as California, revisions to the household series are particularly large (while corresponding revisions to the establishment series are usually fairly small).

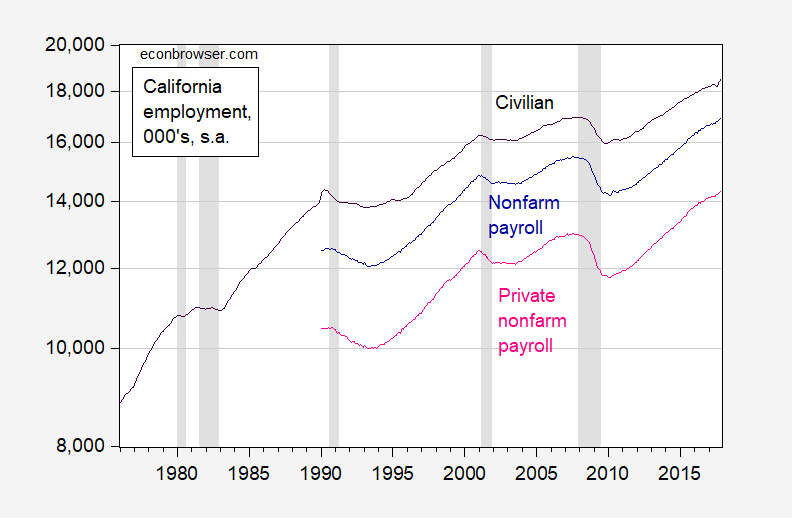

In any case, the latest vintages of both household and establishment based employment data point to continued expansion.

Figure 1: California civilian employment over age 16 from household survey (black), nonfarm payroll employment (dark blue), private nonfarm payroll employment (pink) from establishment survey, all in thousands, seasonally adjusted, on log scale. NBER defined recession dates shaded gray. Source: BLS and NBER.

(California’s LFPR has increased 0.2 ppts over the last year through October.)

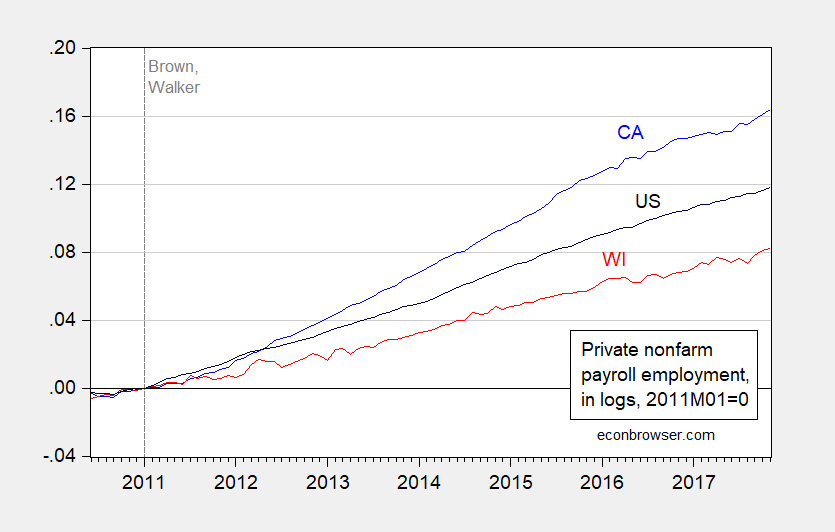

Second, establishment data suggest California continues to outpace the US (as well as Wisconsin; no need to plot Kansas as you’ll know the answer there).

Figure 2: Log nonfarm payroll employment for California (blue), Wisconsin (red), and US (black), seasonally adjusted, normalized to 2011M01=0. Source: BLS and author’s calculations.

In fact, the one sector that Dan Walters/Mercury News highlights (and Ironman quotes) relates to manufacturing lagging. On this, Wells Fargo observes:

California’s manufacturing employment growth will also likely be revised higher in March. The CES estimated California lost 8,100 manufacturing jobs over the year in June, but the QCEW showed California actually gained 3,400 jobs.

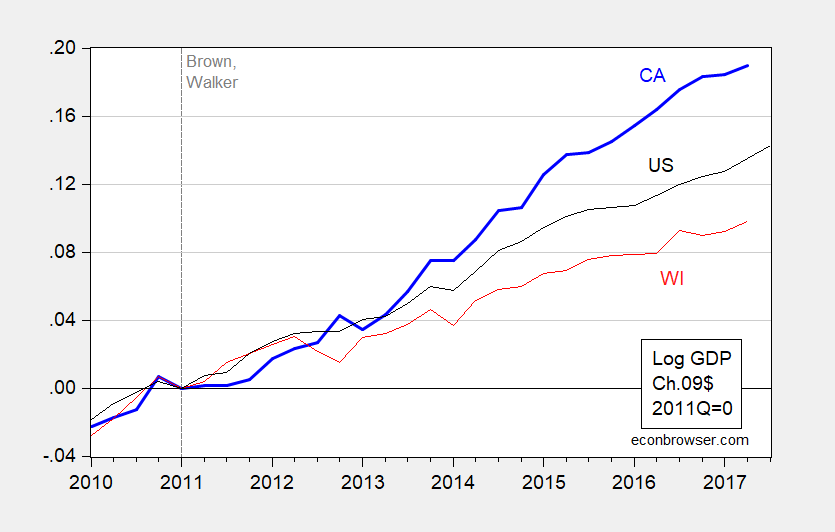

Third, GDP in California year-on-year outpaces that of the Nation as a whole.

Figure 3: Log GDP for California (blue), Wisconsin (red), and US (black), all SAAR, in Ch.2009$, seasonally adjusted, normalized to 2011Q1=0. Source: BEA and author’s calculations.

California GDP growth in 2017H1 was an annualized 1.35% (log terms), compared to the overall Nation’s 2.12%. While slower, California GDP growth was not negative. Over the last year through Q2, California grew 2.61% vs. the Nation’s 2.18%.

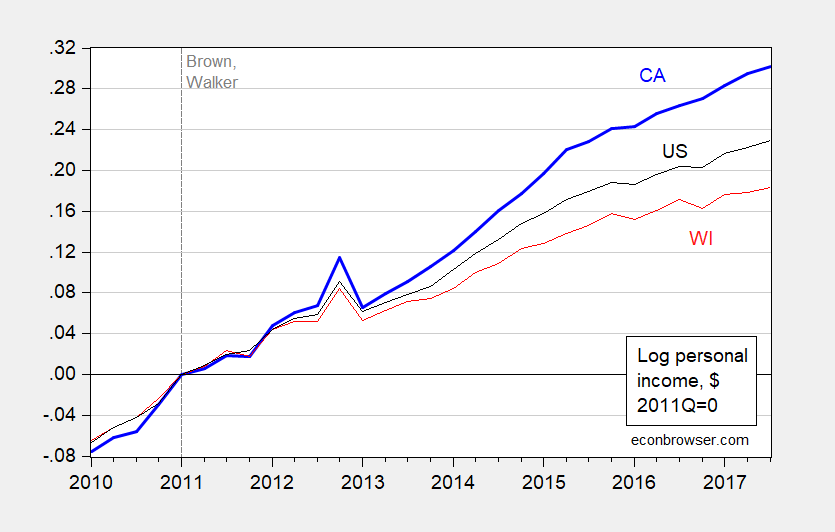

Fourth, the same pattern is true of personal income, which extends through 2017Q3.

Figure 4: Log personal income for California (blue), Wisconsin (red), and US (black), all SAAR, seasonally adjusted, normalized to 2011Q1=0. Source: BEA and author’s calculations.

Not only are current indicators suggestive of continued growth, forward looking measures indicate continuation of growth. The Philadelphia Fed leading indices forecast positive growth in California over the next six months (2.41%, October release) exceeding that forecasted for the US (1.72%).

The UCLA Anderson Forecast released on December 7th indicates:

The Forecast for 2017, 2018 and 2019 total employment growth is 1.2%, 1.5% and 1.1%, respectively. Payrolls will grow at about the same rate over the forecast horizon. Real personal income growth is forecast to be 1.6%, 3.1% and 3.6% in 2017, 2018 and 2019, respectively.

Now, just because current and forward looking indicators do not suggest recession, I won’t Pull an Ed Lazear and declare no recession (even when several key indicators were going down as of May 2008, when he made that declaration). All these indicators get revised. But I just don’t see an obvious case for a California recession in the data through November 2017.

Question: Why is Breitbart so fixated on a California recession? Could it be a bit of Schadenfreude?

Why?

CA, NY, IL, PA, NJ together account for a full 1/3 of US GDP. Yet these states are specifically targeted by the GOP tax “reform” bill that just passed. The meme must be that any state that voted against the Dotard will assuredly suffer. “Blue” states have to be in recession, because nobody knows which bathroom to use. Or something.

I think the dollar is down almost 9% against the index this year. These 5 states are also export powerhouses. So…I guess we need to go against exports next. My 2018 prediction. Exports down. Imports up! Please note – My record at predicting the future is somewhat suspect, however.

“Question: Why is Breitbart so fixated on a California recession?”

Simple. The opening of their story was “Governor Jerry Brown”. Breitbart hates liberals.

From Calculated Risk, the Philly Fed State coincident indexes show California in deep Green (not a recession)

http://www.calculatedriskblog.com/2017/12/philly-fed-state-coincident-indexes.html

Reference Breitbart always hoping California and other Blue States fall on their faces, it is called motivated reasoning. Liberals like me feel the temptation as well going the other way, but the facts are facts (especially when reading bracing stuff from Paul Krugman and Dean Baker). (Brownback and Walker will go down in history as disastrous governors, but the recent economic poor performances of both Kansas and Wisconsin probably have more to do with long term secular trends that hurt both states in different ways.)

At least through the first half of next year the economy will keep growing, mildly spurred by the recent tax and wealth effect of a rising stock market and revived housing prices (which by the way is mostly a continuation of the economy under Obama since the relaxation of austerity in late 2013). The second half of 2018 will be dicier, and it will keep getting dicier in 2019 and 2020, as the FED will move aggressively to raise interest rates with unemployment dipping below 4%, inflation or no inflation, and both the tax bill and the FED interest rate cycle probably will reverse the dollar weakness of the last 12 months. This will send imports up and exports down or flat, both manufacturing and commodities. How Trump responds to rising trade deficit and manufacturing weakness will make for an interesting year (withdrawal from NAFTA? trade sanctions on China, Korea, Japan, and EU?) which could trigger a fall in demand and/or disruptions in supply.

Also, it appears that Trump and the Ryan/McConnell Congress will also be imposing a Federal spending austerity program on non-defense discretionary spending and entitlements as a cure for the deficits created by the tax cuts. This will shift money from those with a high propensity to spend (on food, shelter, and health care) to those with a low propensity to spend (do I need that 3rd Matisse, or that chalet in the Italian Alps, or should I just roll that extra $2 million into that tax exempt bond fund?) and that will be a weight, along with the higher current account deficit, on aggregate demand. Unemployment 4% or or lower usually does not stay at this level very long given FED reactions of the last 45 years when it falls this low. https://fred.stlouisfed.org/series/CIVPART

Finally, there is always a wild card that a major war could erupt in Northeast Asia or in the Persian Gulf given current occupant in the White House. In the past, wars would always create a demand boost to the economy (can’t spend money to educate people, treat their illnesses, clean up and enhance their environment, or make their daily commute better, but we sure can spend money on blowing things up and killing them dark looking “furiners “), but a war in Northeast Asia, one that could drag in China and Russia at least as proxies and Japan and South Korea, might prove very economically disruptive (and a long war would also mean bringing back the draft – always a popularity enhancer – NOT). A war in the Middle East with Iran and the other Persian Gulf states would be a great boost to both Putin Inc and Koch Industries as it would send oil and gas prices skyrocketing, but again, the last 40 years show that such spikes are always followed by a recession as people stop spending on other stuff and services as the Petro enterprises suck up all the money. I am just a fount of optimism for 2018, ain’t I.

From Calculated Risk’s story:

“In November, 37 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.”

Deep Green (which includes California as you noted) had the larger increases. Light green was given to those states with minor increases.

Interesting article on how to revive the Rust Belt:

*

https://www.bloomberg.com/amp/view/articles/2017-12-26/a-road-map-for-reviving-the-midwest?__twitter_impression=true

*

Re: Midwest Education

My mom was packed off to a religious school, RLDS, in Iowa back in the early 1920’s so she wouldn’t marry one of the local louts. She wrote my daughter a nice note of her trip via train to Iowa. What I noted was at every stop, youngsters would be met by folks from the local college.

BTW grandpa did not make a good choice for my mom. Granddad moved the family from San Luis Obispo, Cayucos, so his daughters wouldn’t marry the local Catholic boys. Bad idea!!!

It may be they are looking there for the first signs of one, as a leading indicator, which it may be, just not this early.