Wisconsin real personal income in Q3 is less than it was a 2015Q4, and since 2011Q1, cumulative nominal income is 5% lower than that in Minnesota (and the US). Wisconsin GDP growth through Q2 lags Minnesota and US.

Figure 1: Wisconsin GDP (blue) and personal income deflated by US PCE (red) in mn. Ch.2009$, SAAR, both on log scale. NBER defined recession dates shaded gray. Source: BEA, and author’s calculations.

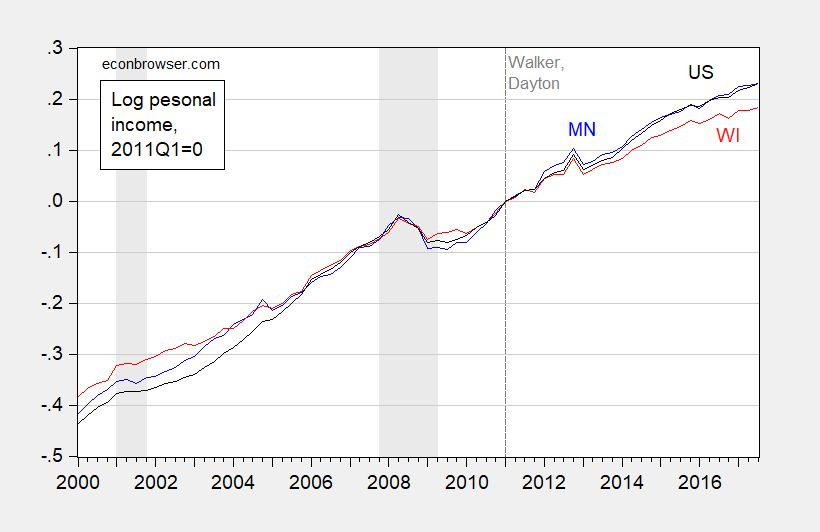

Here is Wisconsin personal income compared to Minnesota and the US.

Figure 2: Minnesota nominal personal income (blue), Wisconsin (red), and US (black), all in logs 2011Q1=0. NBER defined recession dates shaded gray. Source: BEA, and author’s calculations.

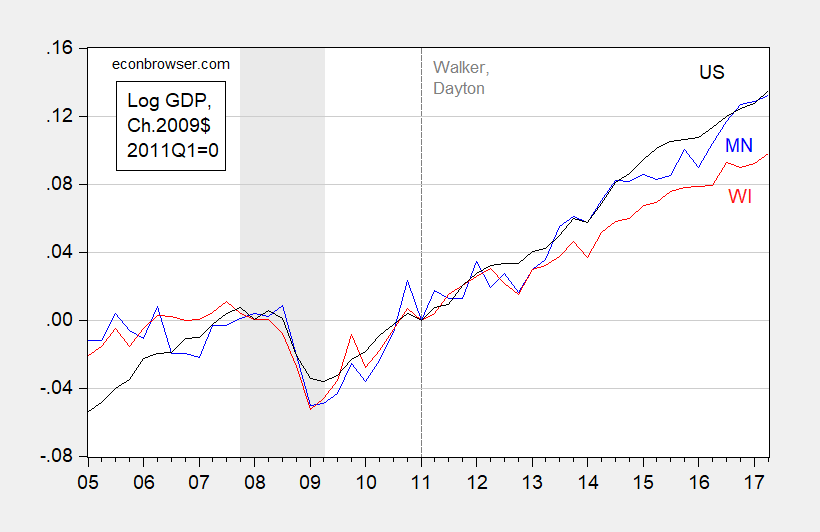

Here is the same comparison, but for GDP (extending up to only 2017Q2).

Figure 3: Minnesota GDP (blue), Wisconsin (red), and US (black), all in logs 2011Q1=0. NBER defined recession dates shaded gray. Source: BEA, and author’s calculations.

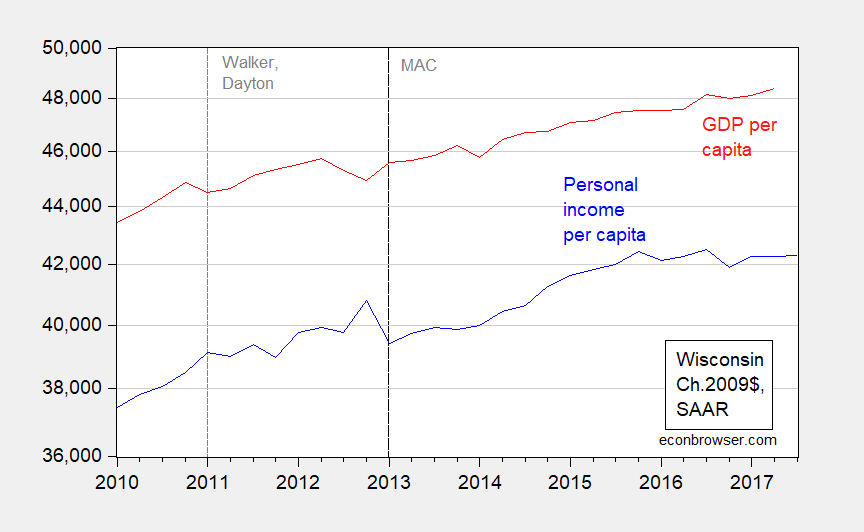

Finally, here is the Wisconsin aggregates in per capita terms.

Figure 4: Wisconsin GDP per capita (blue) and personal income per capita deflated by US PCE (red) in Ch.2009$, SAAR, both on log scale. NBER defined recession dates shaded gray. Long dashed line at 2013Q1, implementation of Manufacturing and Agriculture Credit. Source: BEA, and author’s calculations.

Here’s best wishes for a better year in 2018 than 2017.

Wouldn’t you consider private payroll employment a “Macro Aggregate”? Because it looks like over the last year at least, private employment in Wisconsin has climbed about 0.5ppt faster than in Minnesota. The November data were released last week.

Why consider only private employment as opposed to total employment. Here is the FRED series for Wisconsin:

https://fred.stlouisfed.org/series/WINA

Their increase in employment over this past year is virtually the same as that in Minnesota.

Of course it also matters what kind of jobs as income per person does not always correspond to employment.

Neil: Sure, although from 2011M01, Minnesota has cumulatively grown 11.4% vs. 9.5% for Wisconsin (log terms). And remember, the last year’s data has not been benchmarked against QCEW; my recollection is that it’s likely that the establishment series will be moved downward when benchmarked.

What do the revisions say about Minnesota? Is one getting revised up and the other down? Then I could see your point.

Neil: Not sure, would need to get QCEW data to confirm. Going from 2016 to 2017, the Minnesota series was barely revised.

Lately, the term BitCoin has been circulating all around, but do we actually know anything about it?

On a discussion with the students of AAB College and other attendants of the discussion, it’s been discussed about BitCoin as a digital currency and whether it is accepted or not.

The panel consisted of 4 wise men, including here: The governor of the Central Bank of Kosovo, a professor, an analyst and a BitCoin user.

‘’It is a technology that was founded 7-8 years ago. It is indeed a complicated process for those who don’t deal with technology.’’

‘’Years ago, you saved a value by investing it into real estate, but now people want to invest in something which is independent from the government, state or banks.’’

‘’At first, BitCoin was distributed for free to around 100 people and now everyone wants to buy BitCoin. Is this a good thing? I don’t know. I am fearing it, but also it is not cheap, neither fast enough. 1 BitCoin equals to about 15000 euros.’’

The Central Bank governor said: ‘’We released a press conference where we warned that we will not be responsible for people’s investments in BitCoin, because these are individual risks.’’

Meanwhile Professor Rexha said: ‘’The demand and profit is incredibly huge, but there are risks.’’

‘’Knowledge on this field is needed when it comes to those who want to invest in BitCoin, because it is a future discovery. Also, you should be careful because by not having knowledge, you may contribute to terrorism or money cleaning.’’

‘’It can be considered a global platform. Until now, 600 billion dollars have been invested in it. It can’t either be hacked, because it costs a lot more than buying a BitCoin.’’

When asked if governments can stop it, he said that each government has its own interest, but generally they are not including themselves much, yet. Meanwhile, the Central Bank of Kosovo governor said that they will react as the Central Bank of Europe does.

‘’As long as there’s a lot of request, there is no problem, but in the moment of decrease, then there will be a big risk.’’

https://aab-edu.net/