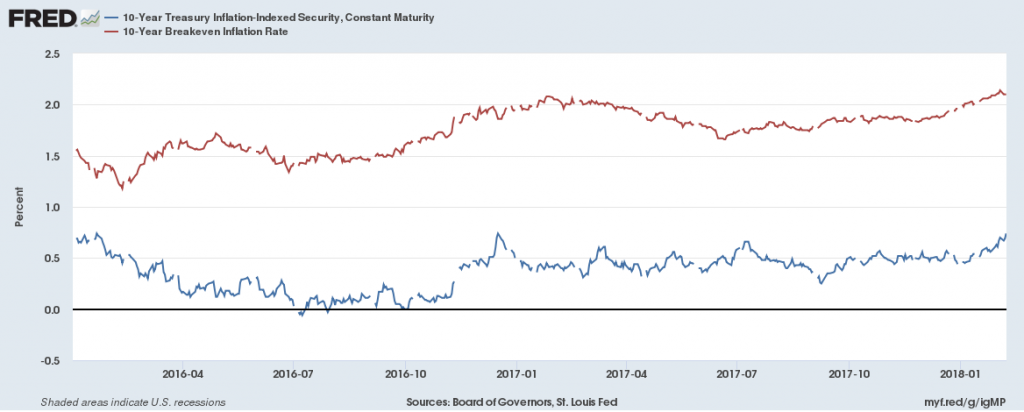

How much of the increase in the 10 year constant maturity Treasury yield is from higher real rates, and from higher expected inflation?

Source: Federal Reserve Board via FRED.

Recalling the Fisherian identity:

it = rt + πet

One can take the total differential:

Δit = Δrt + Δπet

Hence, of the 0.49 percentage point change from December 15 to February 7 in ten year Treasury yields, 0.27 percentage points is accounted for by a real interest rate increase, and 0.22 percentage point by inflation expectations boost (abstracting from liquidity premia, etc.).

Over the five year horizon, of the 0.41 percentage point change, 0.28 percentage points is accounted for by the real rate change, and 0.21 percentage point from higher expected inflation.

All about why nominal rates are rising, in interview with Marketplace (Stan Collender comments too). We talk about the standard things — tax cuts, spending increases, Fed QE unwinding and rate increases, and (my contribution) the deceleration of foreign central bank Treasury purchases (graphical depiction here on page 6). Discussion of the last point with respect to China here.

Barkley Rosser made an interesting comment to your last post but I had to add a little bit of context with respect to interest rate developments. It seems we are on the same page!

That’s a very elegant looking equation.

Fisher introduced this concept back in 1907. A man ahead of his time!

Based on the January jobs report: “…rising wage pressures and inflation could force the Federal Reserve to raise interest rates higher than the market was expecting.”

There is also some fear the Fed is behind the curve.

A strengthening of the economy is needed, and rate hikes will give the Fed more ammunition to deal with the next recession. However, the risk is the Fed will tighten too much causing a recession.

First you claim the FED should have raised interest rate and then you say we need more aggregate demand. I guess you have no idea that you have blatantly contradicted yourself. Then again – I bet the same stupid language appears in the transcript of this morning’s Fox and Friends.

You’ve been watching CNN too much, which is why you make no sense. Also, I suggest, an economics class to start.

You mean like the “economics” class you took through Trump University? Your mom must be so proud of her Trump U graduate!

Look, you contradict yourself all the time. You’re the only one who doesn’t seem to be aware of it. That should tell you something. Your “economics” is some mish-mash of part Larry Kudlow/Art Laffer/Stephen Moore, part Bernie Sanders and part Rand Paul.

Larry Kudlow/Art Laffer/Stephen Moore are masters of flip flopping nonsense. But the real master these days is clearly Peaky Boo Boy. He has taken this to a new art form.

Pgl wouldn’t be accepted to the economics program I took, which was the scientific method of neoclassical economics. Taking him to a few classes at Trump University would be a huge improvement. And, I made no contradictions. Stronger growth and higher interest rates, for example, is not a contradiction. If you want to find real contradictions, see the Obama years, e.g. one foot on the accelerator and the other foot firmly on the brake, for an expensive depression.

PeakTrader: In a neoclassical model, higher interest rates are merely a reflection of higher expected inflation, and Fed policy with respect to raising the Fed funds rate should be irrelevant to the real side of the economy (money is a veil in a neoclassical world). Did you dispense with your training?

Menzie Chinn, are you saying my statement above is wrong?

And, do you believe the Fed is done raising rates?

The market may be doing some of the Fed’s work.

PeakTrader: Just sayin’ what you’ve been writing is not consistent with “the scientific method of neoclassical economics” which you say you were trained in.

Menzie Chinn, a sound general equilibrium model of a large economy cannot be done under the scientific methodology, given so many dimensions. Nonetheless, you can piece together and create a crude model based on the scientific method learned in a rigorous program of several economic fields. The fiscal and other economic policies in response to the Great Recession were inappropriate and wasteful. I’ve presented my response to improve the economy.

PeakTrader: If you’re neoclassical, then (1) prices are perfectly flexible, and (2) there are no information asymmetries, and (3) there are no other rigidities such as adjustment costs. In the case of (1), monetary policy is irrelevant. If you are neoclassical and intertemporally optimizing, then tax cuts are irrelevant. Government spending might or might not increase GDP. If (2), then there is little reason to think any boom/bust is welfare-decreasing.

You do know that I quoted you in citing the “the scientific method of neoclassical economics”.

Really, I do wonder what kind of textbook you used in the graduate program you say you attended.

Menzie Chinn, you know, those are conditions to make models workable and don’t apply in the real world.

I used similar textbooks. I’m willing to bet you I have degrees in economics, since you’re suggesting there’s doubt.

PeakTrader: These days, we can numerically or closed-form solve models with model-consistent expectations, intertemporal optimization, sticky prices…they’re called New Keynesian DSGEs.

I believe you went to a university program … I just wonder what books they used.

Menzie Chinn, I don’t recall the textbooks, along with supplemental books, but I know they were very difficult as a student. And, I know a Ph.D with years of experience knew the subject very well. However, I’ve been out of academia for a while, which is very rigorous in economics, and mostly generalize what I learned.

“You’ve been watching CNN too much, which is why you make no sense.”

First of all I do not watch CNN. I did read your contradictory BS. If you do not realize you contradicted yourself – then you know nothing about either economics or basic English.

Given all your false narratives, including I make contradictions, you’re a perfect reflection of CNN.

Have some choice comments for “Marketplace” related to Paul Ryan, but I’m gonna go ahead and keep them to myself since they were perceptive enough to invite Menzie on. I’m not good at biting my tongue on these things, so, that actually takes a decent amount of self-restraint.

Great post though. Will have to crunch out that Fisherian identitiy for fun later this year and see if I can make the numbers make sense. I presume these are the type equations Jeffrey Gundlach can do from inside of his head. Unfortunately I don’t have Gundlach’s mathematical dexterity and need paper and pen.

Washington politicians top priority after the 2018 election should be massive entitlement reform to get government spending under control and create more taxpayers to reduce budget deficits dramatically.

“Pgl wouldn’t be accepted to the economics program I took, which was the scientific method of neoclassical economics.”

Seriously? I have taught classes on neoclassical macroeconomics as well as Keynesian macroeconomics. But yea – I did receive a D in 1st grade art class so your class which likely required drawing with crayons is one that I would not enroll in.

Look – when you write utter babble, we will say so. When you pretend your babble is justified by your alleged superior knowledge of economics, you become the Class Clown.

“If you want to find real contradictions, see the Obama years, e.g. one foot on the accelerator and the other foot firmly on the brake, for an expensive depression.”

Peak thinks Keynesian business cycles are consistent with the neoclassical model? Wow! Aggregate demand policies affect real GDP in a neoclassical model? Sorry Peaky but you did not take a class in neoclassical macroeconomics. Your own writing proves that. And he wonders why we say he contradicts himself!!!

Pgl, you just make things up hoping to fool people. I doubt you’d be allowed to teach 7th grade economics. None of your comments are based on any extensive or rigorous education in economics. Looks like you read a few articles on aggregate demand and real interest rates. So, now you think you’re an economist. What a joke! Let me know when you really say something that reflects more than a few articles you read. I feel sorry for anyone, who read an “economics” article you wrote. Why don’t you start with contradictions you assume I made, since you can’t explain any economic contradictions under the Obama Administration.

This is from the same fellow who admitted he does not remember what text books he used? You were the one who introduced the neoclassical model here and it is clear you had no idea what this model is all about.

peaktrader is not interested in consistency in his arguments. he is interested in pushing forward his ideologies. this is why he can make inconsistent statements in a single response, and have no concern whatsoever about those inconsistencies. trump is the same way. neither is interested in learning anything new-because they already know it all-they are simply interested in winning the current battle.

I like real economics, whether it comes from the right or left.

PeakTrader: The issue is not right or left economics. John Taylor was one of the earliest New Keynesians (staggered contracts), Mankiw a little later (Keynesian cross, etc.). Both of these economists’ works stressed price rigidities. Both are solidly Republican.

The key issue is what set of assumptions is most reasonable. I don’t think full-information or symmetric information models are appropriate, for instance.

I ran your same graph for the earliest data FRED had on 10-yr TIPS B-E and CPI, starting in 2003, and the TIPS B-E is always much higher. I think there are a lot of reasons for this, but one I haven’t seen is just a clientele effect. The TIPS B-E is not the “market’s forecast of inflation”. It’s really the forecast of inflation, combined with the level of risk aversion, of a particularly risk averse clientele, and a particularly high-inflation-biased clientele.

Those who invest heavily in TIPS are not “the market”, the distilled wisdom of the smartest and most expert and informed investors in the world in a risk-neutral unbiased way. Those who invest heavily in TIPS tend to be the very risk averse, willing to get a far lower expected rate of return in exchange for the highest level of safety. These are not risk-neutral investors pushing the price to their exact forecast of inflation at all. And another group tending toward TIPS is those who are extremely biased and inexpert in their inflation predictions on the positive side, as, of course, they would be much more attracted to TIPS than the average investor.

So, these clienteles will push the implied inflation forecast of the TIPS B-E very much higher than the true, or most expert and informed, expectation. And it’s not possible to short sell TIPS to counter these clienteles – unless you’re the US government, which implies that it would make sense for the government to fund much more with TIPS.

I was going to do a post on this, but I haven’t had time to do all of the background research and vetting I like to do first.

http://bit.ly/2s67De9

The stagflationist (advocates of equilibrium interest rates, R*, and targeting N-gDp parameters), “suggest a higher inflation target” (Phillips curve rendition).

“One of these key parameters that should be rigorously reassessed is the very low inflation targets that have guided monetary policy in recent decades. We believe that the Fed should appoint a diverse and representative blue ribbon commission with expertise, integrity, and transparency to evaluate and expeditiously recommend a path forward on these questions. We believe such a process will strengthen the Fed as an institution and its conduct of monetary policy, and help ensure wise policymaking for the years and decades to come.”

Yours,

Dean Baker

Laurence Ball

Jared Bernstein

Heather Boushey

Josh Bivens

David Blanchflower

J. Bradford DeLong

Tim Duy

Jason Furman

Joseph Gagnon

Marc Jarsulic

Narayana Kocherlakota

Mike Konczal

Michael Madowitz

Lawrence Mishel

Manuel Pastor

Gene Sperling

William Spriggs

Mark Thoma

Joseph Stiglitz

Valerie Wilson

Justin Wolfers

Jun 7, 2017. 03:34 PMLink

The Phillips Curve has been denigrated

So all these professionals just became wrong.

There are 6 seasonal, endogenous, economic inflection points each year. These seasonal factors are pre-determined by the FRB-NY’s “trading desk” operations, executing the FOMC’s monetary policy directives (in the present case just reserve “smoothing” and “draining” operations, the oscillating inflows and outflows, the making and or receiving of interbank and correspondent bank payments by and large using their “free”excess reserve balances).

Every year, the seasonal factor’s map (economic time series’ cyclical trend), or scientific proof, is demonstrated by the product of money flows, our means-of-payment money X’s its transaction’s velocity of circulation (the scientific method).

Monetary flows (volume X’s velocity) measures money flow’s impact on production, prices, and the economy (as flows are driven by payments: “bank debits”). It is an economic indicator (not necessarily an equity barometer). Rates-of-change Δ, in M*Vt = RoC’s Δ in AD, aggregate monetary purchasing power. Thus M*Vt serves as a “guide post” for N-gDp trajectories.

N-gDp is determined by the volume of goods & services coming on the market relative to the actual, transactions, flow of money. RoC’s in R-gDp serves as a close proxy to RoC’s in total physical transactions, T, that finance both goods and services. Then RoC’s in P, represents the price level, or various RoC’s in a group of prices and indices.

Monetary flows’ propagation, are a mathematically robust sequence of numbers (sigma Σ), neither neutral nor opaque, which pre-determine macro-economic momentum (the → “arrow of time” or “directionally sensitive time-frequency de-compositions”).

For short-term money flows, the proxy for real-output, R-gDp, it’s the rate of accumulation, a posteriori, that adds incrementally and immediately to its running total.

Its economic impact is defined by its rate-of-change, Δ “change in”. The RoC, is the pace at which a variable changes, Δ, over that specific lag’s established periodicity.

And Alfred Marshall’s cash-balances approach (viz., a schedule of the amounts of money that will be offered at given levels of “P”), viz., where at times “K” is the reciprocal of Vt, or “K” has the dimension of a “storage period” and “bridges the gaps of transition periods” in Yale Professor Irving Fisher’s model.

“According to the elementary logic of the so-called equation of exchange, any change in either the supply of or demand for money , to the extent that the change is not immediately and fully reflected in an (equilibrating) change in the price level, will imply changed values of real output and employment.”

To quote economist John Gurley, ‘Money is a veil, but when the veil flutters, real output sputters’.

“Moreover, because monetary disequilibrium also involves a distortion of relative prices, its real effects are not limited to mere alterations in total quantities of output and employment but also involve qualitative changes in the composition of each, to the detriment of all-around well-being.”

“All of this suggests that well-designed monetary arrangements and policies are important to the success of any free-market economic system.”

GDP (NOW): Latest forecast: 4.0 percent — February 6, 2018 vs. 2.6 percent in the 4th qtr. 2017.

“Neutrality of money means that money is neutral in its effect on the economy. A change in the money stock can have no long-run influences on the level of real output, employment, rate of interest, or the composition of final output. The only lasting impact of a change in the money stock is to alter the general price level.”

“The neutrality of money theory is a core belief of classical economics. It was first proposed by David Hume (1711-1776). And the phrase: “neutrality of money” was coined by Austrian economist F.A. Hayek in 1931.

Nobel Laureate Dr. Milton Friedman “gave the example of the (neutrality of money) ‘helicopter drop’ to explain the neutrality of money. Imagine a community in perfect economic equilibrium, when suddenly the following occurs:

“Let us suppose, then, that one day a helicopter flies over our hypothetical long-stationary community and drops additional money from the sky equal to the amount already in circulation-say, $2,000 per representative individual who earns $20,000 a year in income.”

”The money will, of course, be hastily collected by members of the community. Let us suppose further that everyone is convinced this event is unique and will never be repeated….”

“…People’s attempts to spend more than they receive will be frustrated, but in the process these attempts will bid up the nominal value of goods and services. The additional pieces of paper do not alter the basic conditions of the community. They make no additional productive capacity available.”

”They alter no tastes….the final equilibrium will be a nominal income of $40,000 per representative individual instead of $20,000, with precisely the same flow of real goods and services as before.”

———–

No, money flows, the rate of expenditures, are robust (as concentrations and distributed lags that are mathematical constants clearly demonstrate), not neutral, as hypothesized and mathematically modeled by Bankrupt-u-Bernanke (Brookings Institution), in either the short-run or long run.

See: January 2004 “Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach” – with Jean Boivin, Piotr Eliasz: w10220

“Measuring The Effects Of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach,” Quarterly Journal of Economics, 2005, v120(1,Feb), 387-422.

Leastways, the neutrality of money is denigrated by secular strangulation. I.e., the quantity of money does not just: “determine only absolute prices and their level” but does affect the level of income, interest, rate of capital formation and employment. No, the long-term effect of a deceleration in aggregate demand has a long-term impact on the demand for capital goods.

See: See: “profit or Loss from Time Deposit Bank” in Banking and Monetary Studies Comptroller of the Currency Unites States Treasury Department, Irwin, 1963, pp. 369-386.

Money flows do impact “employment, income and output by means other than by just “labour, capital stock, state of technology, availability of natural resources, saving habits of the people, and so on”.

No, money flows may simply adjust existing overstocked inventory levels (e.g., during the X-mas holidays). David Beckworth: “What makes this really interesting is that these wide swings in economic activity are not matched by similarly-sized swings in the price level.” “Macro and Other Market Musings”: “It seems, then, that more could be learned about broader business cycle theory from studying GDP and other time series in their raw non-seasonally adjusted form. That will have to wait, however, until the BEA starts releasing the data.”

See: http://bit.ly/2BQgF4z

Money obviously influences R *, the “equilibrium rate of interest” (and not just because the monetary fulcrum of wedged inflation inverts). A change in M does not cause a proportionate change in P in American Yale Professor Irving Fisher’s truistic “equation of exchange”. Shifts in the money supply do not affect all goods and services proportionately.

See the 10yr:

https://yhoo.it/2sd7iGp?p=^TNX

There is obviously “money illusion” as well as shifts in the distribution of income: “the central feature of the modern business cycle: a systematic relation between the rate of change in nominal prices and the level of real output. The relationship, essentially a variant of the well-known Phillips curve, is derived within a framework from which all forms of “money illusion” are rigorously excluded: all prices are market clearing, all agents behave optimally in light of their objectives and expectations, and expectations are formed optimally.

Even with a mis-named “liquidity trap”, idled money exerts a dampening economic impact.

I am the greatest market timer in all history

Vi (income velocity) is a seasonally mal-adjusted # (for both the money stock and N-gDp figures). And Vi includes the currency component (the same error as with the monetary base). If you remove currency, and use NSA #s, then you get an increase, the first in several years, in Vi beginning in the 2nd qtr. 2017. That explains a lot. The Trump bump has been resurrected.

In the last 10 years, there’s been a huge shift in the volume and ratio of currency held by the non-bank public to commercial bank transaction based accounts (from .78% in 9/2007 to 1.39% in 8/2017). So if currency turns over slower than transactions based account balances (non-m1 components rate-of-turnover is negligible in comparison), then the Fed’s income velocity figures are understated. And RR’s underweight changes to Vt, as the seasonal pattern just signified (albeit

RRs are driven by payments).

In the transactions velocity of circulation: “Money is spent and re-spent.” Whereas with income velocity, inflation analysis is delimited to wages and salaries spent. To the Keynesians, aggregate monetary demand is N-gDp, the demand for services (human) and final goods. This concept excludes the common sense conclusion that the inflation process begins at the beginning (with raw material prices and processing costs at all stages of production) and continues through to the end, (“raw materials, intermediate goods and labor costs, which comprise the bulk of business spending are not treated in N-gDp”), etc.

bit.ly/2yrcZEa

“There is a positive relationship between the currency ratio and income velocity”

bit.ly/2zyoKWZ

Bank debits reflect the ratio of transaction account payments to balances.

“The hybrid and invalid nature of income velocity is affirmed by Keynes”: “A Treatise on Money”, New York, Harcourt Brace, 1930, vol. 2, pg. 24.

“It is though we are to divide the passenger miles traveled in an hour by the passengers in trams, by the aggregate number of passengers in trams and trains and to call the result velocity.”

“Quantity leads and velocity follows”. Cit. Dying of Money -By Jens O. Parsson

P*T “≠” Milton Friedman’s (nY).

“Bank transactions are not limited to transactions in connection with current production…they reflect the sale of capital assets, income transfers, and money market dealings…”

See: bit.ly/2zDsNl5

“A Federal Reserve survey, for example, that finds that physical currency turns over 55 times per year, i.e. about once a week.1”

As the article states, cash is spent slower than transactions based bank deposits. And bank debits to transactions based accounts already count for some volume of cash transactions (duplicative) as it’s debited to those accounts for withdrawals in preparation for spending.

A gradual upward movement of prices engenders and is associated with increased incomes and increased stability of employment. The elements of certainty combined with the expectation of higher prices makes goods more attractive and cash less attractive with the result that people spend their balances with greater alacrity. The more rapid utilization of balances causes demand to increase even though there has been no increase in the total means of payment. Thus an increase in the velocity of currency and deposits could, and often does, bring about the very conditions which foster an expansion in the volume of currency and demand deposits.

The Fisher equation and its implied spread between nominal market rates and *real* rates, has open issues — which maturity of nominal rate to use and which price index ? a government rate, some a private sector rate, an overnight rate, a 90 rate, a 10yr?

“a government rate, some a private sector rate, an overnight rate, a 90 rate, a 10yr?”

Menzie and I were both using the 10-year government rates. Now if you have a real issue with this choice – care to offer your alternative?