The algebra and graphical analysis (from my undergrad course) is here. If you don’t understand it, don’t bother commenting.

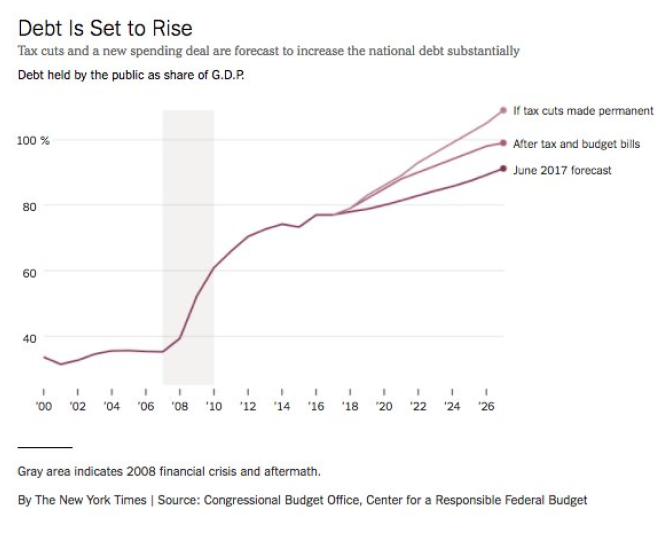

Source: Irwin, NYT, 9 Feb 2018.

Back in 2000, when I was an economist on the Council of Economic Advisers (under Bill Clinton), we worried about what would happen when the Federal debt was all retired, particularly with respect to the implementation of monetary policy. George W. Bush and the Republicans in Congress solved that problem with two sets of tax cuts, and gave us record deficits in subsequent years (little help — around a trillion — coming from the Iraq invasion). In 2017, we didn’t need to worry about retiring the Federal debt, nor did we need to worry about a negative output gap. But Mr. Trump and the Republican Congress will likely help solve the problem of too low sovereign interest rates.

Mission accomplished!

“If you don’t understand it, don’t bother commenting”. Menzie, I know you a very good person, and a very good teacher, because I’ve read a large swath of your book, and have read your blog (at least off and on) for the last roughly 9 years. And I think I MAY know EXACTLY WHO that sentence was directed towards. But “newbies” to your blog may not know what a good guy and teacher you are and misinterpret that, that if they don’t understand the post they shouldn’t ask questions. I mean to say it may be “put offish” (discouraging questions) to those wanting to learn on these blogs, and would sincerely read ALL of your post, but not “get” it all. And knowing you to be a good person/teacher, I doubt that is how it was intended.

Moses Herzog: Probably it was a little harsh, but I was trying to have the debate refined to the point where people were actually arguing about models and parameter values…and crowding out has different meanings to different people.

@Menzie

Fair enough. I knew that’s not how you meant it so I wanted to take the liberty of kind of putting my own asterisk on it for blog newbies. If you felt the same anger I did last night watching the Senate vote in the late hours, and then thinking of the odds that Pelosi (and I’m honestly not trying to be vicious here) with her early stage dementia was going to put up a road block on this—it’s amazing you didn’t write the post in a rage, because that’s kinda how I felt.

I’ve studied this stuff before (and even have a copy of Keynes famous book and remember some of his references to Hicks in different sections of the book). But I have forgotten small sections of what most people would call “101”. This has been very useful, kind of “brushing up” on things I had forgotten. I really appreciate the class links. I had forgot what some of the variable symbols were, so there are some blank spots there for me, but, I got about 80% of the “intuitive” part down, and about 15% of the algebraic breakdown. Once I identify the variable symbols I might get the algebraic part. after a 3-4 days.

The obvious things are (referring to the congressional Bill passed early morning Feb 9)

1—- this (relatively speaking) greatly increases the supply of bonds

2—-this will cause interest rates to rise, maybe semi-dramatically in the short term

3—-this will probably cause rates to “shift” upward over a very long period of time

4—-It probably will not increase output or GDP a whole hell of a lot, if at all.

And hopefully I might have a deeper insight or deeper question for Menzie after I kind of soak up the mathematical parts more.

@Menzie

OK, I am wrong about #4 in my above comment, right?? Because very basic IS-LM would predict an INCREASE in output, at least on a short-term to medium-term time horizon, yes?? But long-term (future) output could actually decrease yes?? Because of the money tied up (“gun powder spent”) to pay off the already issued government bonds??

Also, as I am still trying to decipher some of these variables meanings, I am thinking we will never ever have to worry about figuring out the equation for “BuS” ever again, right?? (semi-joking)

I didn’t mean to bold print all that, but my 2 questions basically are the same.

Wow. You referenced the old money multiplier. Haven’t heard that term in decades. Does the Fed even track that anymore? By coincidence, a few days ago I was (literally) dusting off some old books from college daze (my wife made me do it) and I stumbled upon David Laidler’s book on the demand for money…pages falling out and filled with yellow highlighting. I’ve always thought Laidler’s short book was one of the best primers on IS-LM.

I’m not a professional economist, but I always thought that at the intermediate macro level the “big picture” intuition was best explained by showing what happens when the IS and LM curves are each shown as nearly vertical and nearly horizontal. For example, the LM curve is horizontal in a liquidity trap. And the relative slopes of the two curves show which one has the most volatile effect on output. Decomposing the IS and LM curves is important, but a lot of the variables are assumed to be domestic variables. So wealth is domestic wealth. The money multiplier is the domestic money multiplier. The interest rate is the domestic risk free rate. Etc., etc., etc. And this leads to my next point. One thing I’ve never liked about the IS-LM approach is that it largely assumes away the rest of the world (except for Mundell-Fleming tacked onto the model). For example, wealth shouldn’t just be domestic wealth, but global wealth. As we’ve seen this week, equity and bond markets across the globe all tend to move in the same direction across time zones. Fifty years ago you could probably ignore foreign equity and bond markets. And during the Great Recession you could probably assume that all OECD countries were in a liquidity trap. But today the EU, China, Japan and the US economies are too integrated to support an IS-LM decomposition of the kind I learned many decades ago in Laidler or Dornbusch & Fischer, or Samuelson back in high school.

IS (≠) LM. And interest is the price of loan funds. The price of money is the reciprocal of the price level.

And it’s not that personal savings are low. It’s that 10 trillion dollars of personal savings are idled within the commercial banking system. If the commercial banks were driven out of the savings business, that is the banking oligarchs are broken up leading to their divestiture, the economy would boom – as savings will be released and put back to work.

It is simple accounting. Savings flowing through the non-banks never leaves the payment’s system. There is just a transfer of ownership of existing commercial bank deposit liabilities, an increase in the supply of loan-funds, but no increase in the supply of money, a velocity relationship. The NBFIs are the DFIs’ customers. That’s why money has velocity has decelerated since 1981 and further decelerated after the remuneration of IBDDs (a monumental monetary blunder the consequences of which precipitated a doubling of the Federal Debt).

The expiration of the FDIC’s unlimited transaction deposit insurance on Dec. 31st 2012 (which lead to the “taper tantrum”), as I predicted, is prima facie evidence. The 1966 S&L credit crunch (where the term was coined), is the antecedent and paradigm.

Never are the commercial banks intermediaries in the savings-investment process. Every time, from the standpoint of the macro-economy, a commercial bank makes a loan to, or buys securities from, it creates new money somewhere in the payment’s system. Commercial banks do not loan out existing deposits, saved or otherwise. The deregulation of commercial bank’s deposit rates was a mistake, one that caused the S&L crisis. But do you think the most powerful lobby in Congress will ever get religion?

If this error is not corrected, the U.S. (and the world), will enter into a protracted economic downswing.

In your model with portfolio crowding out, you say: “This means that in this model, output can actually fall in response to an increase in government spending (that is, nothing rules out Y1 ending up less than Y0).”

This is not correct. If output falls, saving falls, which means wealth falls …. since wealth(t) = wealth(t-1) + saving (t). The decline in wealth lowers the demand for money, shifting the LM curve right., not left. The portfolio effect of a bond-financed rise in government spending can dampen the rise in output (in the fixed price IS-LM model with lump-sum taxes that are constant), but it can’t eliminate it.

The other implication of the portfolio effect in these not-so-realistic models is that long-run equilibrium occurs when saving = 0, otherwise, the LM curve shifts every period. This means equilibrium requires g = -[i(r)], where g is government spending, i(r) investment, and r is interest rate. In other words, the model implies complete crowding out regardless of how far actual output is below full employment.

Opps, the comment above is to Menzie, not 2slug. It is in reference to the algebraic/graphical IS-LM analysis that Menzie attached to this post. .

“Back in 2000, when I was an economist on the Council of Economic Advisers (under Bill Clinton), we worried about what would happen when the Federal debt was all retired, particularly with respect to the implementation of monetary policy. ”

Hilarious. The 1990s was probably the very best decade in American history. The USA had won the Cold War with the Soviet Union, made possible by the Soviet Union imploding under its own weight. NATO 2-track policy was costly but few died as a result (except people in Central America and Afghanistan who do not politically count.) Everybody with intelligence, advanced degrees and creativity wanted to work in the USA.

Now? So much for the peace dividend. I guess Americans are like sharks. If Americans stop killing people and taking resources by force, they become bewildered, confused, disoriented and eventually drown.

I look forward to the magnificent parades of American military hardware. Is there anything better to signal American decadence and decline?