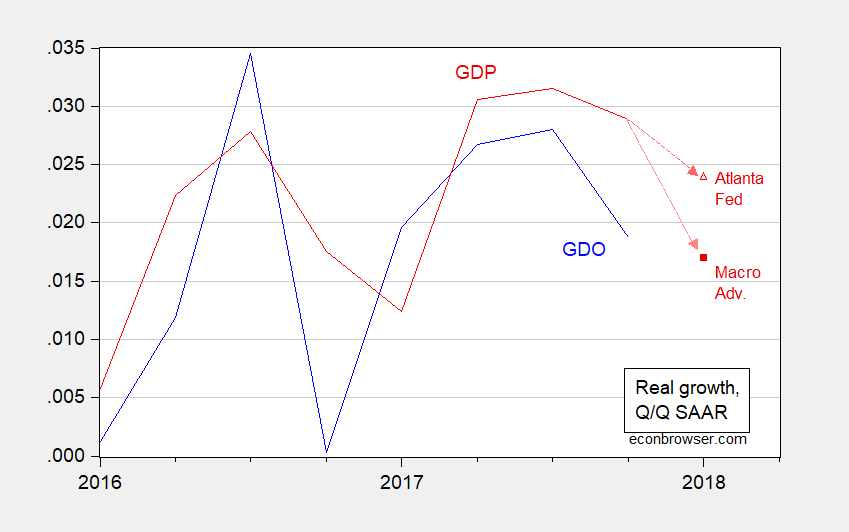

Third release numbers on GDP are out. Growth of Gross Domestic Output — the average of GDP and GDI — is down much more than that of GDP: nearly a percentage point.

Figure 1: Quarter-on-quarter output growth as measured by GDP (red), and by GDO (blue), SAAR. 2018Q1 figures are forecasts as for March 29, from Macroeconomic Advisers (red solid square) and from Atlanta Fed (red triangle). Source: BEA, Macroeconomic Advisers and Atlanta Fed.

The downshift in Atlanta Fed nowcasts from 5.5% to 2.4% is pretty interesting.

Menzie

Fortunately I am not a betting man because the smart bet tends toward your forecast when you make them rather than to just refer to elsewhere’ But a couple of things of note, Big 3rd revision of 4th quarter raise to 2.9% (with small up of 2nd to 3.2%) and the Atlanta Fed now cast is up again from previous of 1.8% nowcast to 2.4%. Interesting times with highly volatile predictions. Is this unusual? And then again recent history of 1st quarter GDP has been decidedly disappointing.

Ed

@ Menzie

Menzie, I rarely criticize your graphs and charts because in fact I think you do a stupendous job with your visuals and explanations and take a lot of unsubstantive criticisms on them. But……. (you knew that was coming didn’t you??), I think the dashed lined in between the real GDP and the forecasts is not very clear as a dashed line. That’s probably more of a criticism of your software to make the graphs than it is of you. If there is a way you can make it more visually definitive as a dashed line, it might be beneficial.

Looking at this, I think it would be interesting, if you could make it scale out correctly, to overlay the S&P 500 index on top of the above graph (or say a 5 year graph and/or 10 year graph, laying the S&P500 on top of Real GDP. I think the equities market has so much of a bigger part in this than in the years before Roth and 401k became so common. I wager the equities are playing a larger part in this than people realize. I just skim-read 3 white papers on it—all of them mentioning Dimson, Marsh, and Staunton. But at least 2 of the 3 that I skim-read (all done post 2010) said that there is reason to believe when when using short-term time horizons that the connection may be stronger than believed by the “DMS” 2002 study. Equities being the “instigator” (again on the short-term horizon). Of course “short term” can be defined many ways. In my own mind I am thinking anywhere in the 3–9 month time range (and even that maybe making it a tad on the wide side).

People have been calling a “bubble” in the Chinese real estate and construction markets for a long time now (Jim Chanos, etc) Really it’s near impossible to call the timing on such a thing when the Chinese Politburo is ready to rush in as the savior at any time. But from a fundamental basis, I personally believe a bubble is there (as far as market value being way over true intrinsic value). But whether that can be taken advantage of on the exchanges is a shaky proposition. Anyways, for any China watchers (including those who get a kick out of their version of creative accounting). I give you the following from “Alphaville”:

https://ftalphaville.ft.com/2018/03/29/1522312567000/Accounting-for-China-s-real-estate-boom/

I’m a bit of a night owl sometimes. So I get into some of my better reading (at least “current news events-wise”) late in the night. You know, I have stated before that I spent an extended amount of time in mainland China. And in these blatherings I have mentioned that many Chinese speak better English than native speakers. That could be vocabulary, grammar, or a broad mix. Certain native English speakers come to mind when thinking of those Chinese (I’m specifying born and living in mainland) English speakers that can do circles around them–that is those who murder the English language. I commonly told my Chinese friends to ignore “W” Bush as the man regularly murdered the English language (Chinese logically tend to assume the #1 leader of a country can speak that country’s language well). So who is another man who has murdered the English language over many years?? Senator Chuck Grassley. The man can hardly get 3 consecutive sentences out of his mouth without F’ing up the grammar. So, when I read all this tonight, none of it is a surprise to me. Including something Menzie thought silently to himself every time he reads Moses Herzog’s comments “Be careful when ingesting the ramblings of a blog commenting looney”.

https://www.propublica.org/article/jason-foster-the-senate-staffer-behind-the-attack-on-the-trump-russia-investigation

It will be interesting to see how the economy responds as the Fed, filled with mostly hawkish, hard currency, white men, raises interest rates at least another 75 basis. Gas prices are rising, and that always impacts the consumer demand coming from the lower 90% of the income scale. I would probably go long on oil for this summer and fall with John Bolton going in as NSA and Mike Pompeo going in as Secretary of State as both are strongly motivated Iran hawks and believe the current “Islamic Republic” must be destroyed as the key to Middle East “peace.” I suspect Bolton believes Iraq was a splendid success, except that Bush got faint hearted and of course Obama did not want to further pursue the war. For Bolton, a million dead Iraqis was a good start. So time to back in and see if he can add 10 million Iranians, Syrians, Kurds, and Iraqis Shia to the death toll.

Of course the side effect of another oil crisis and spike in prices will probably wreck the economy and make impeachment of his boss popular even with Republicans!

I think the Fed actually does have a little more diversity than most people imagine. I’ve seen a pretty large amount of minority people on their research staff—now yes those aren’t “leaders”, but honestly before Trump nominations I don’t think it was a glaring issue. It is true though that color is a big bugaboo for some people:

https://youtu.be/7MHjmXkoiVo?t=5m4s

@Mozes: I find Menzie’s charts to be about as crystal clear as they can be, the one above being no exception. If most of us cranked out charts at the rate Menzie does for this blog, most of us would probably make a lot more mistakes and the output would be far harder to understand. Count me as most impressed.

Gross Domestic Output: I must have been asleep at the wheel when the CEA came out with this hybrid measure. My first reaction? Nothing but cynical contempt.

@ Erik Toole

“Contempt” for GDO for what reason?? (I can’t wait for this bullsh*t answer)

Note for Toole: “Because the statistic was created/used by a CEA staff under a dark-skinned President” is not a real reason.

Erik Poole: Jim Hamilton discusses the use of the average of GDI and GDP, which is GDO.

Not that it’s the end of the world, but the Jeremy Nalewaik link on Brookings no longer functions.

Here is one breakdown over on “Alphaville” that I would say is better than average,

https://ftalphaville.ft.com/2011/09/26/683896/the-case-for-gdi-a-qa-with-jeremy-nalewaik/

https://www.clevelandfed.org/newsroom-and-events/publications/economic-trends/2016-economic-trends/et-20160114-does-gdi-data-change-our-understanding-of-the-business-cycle.aspx

https://www.vox.com/2015/7/31/9076859/gdo-gross-domestic-output

Hope it’s useful to whoever.