A recent article on the predictive abilities of yield curves (Shrager/Quartz) includes a nifty interactive which allows you to look at yield curves over time. Below, I do a snapshot comparison, across the world.

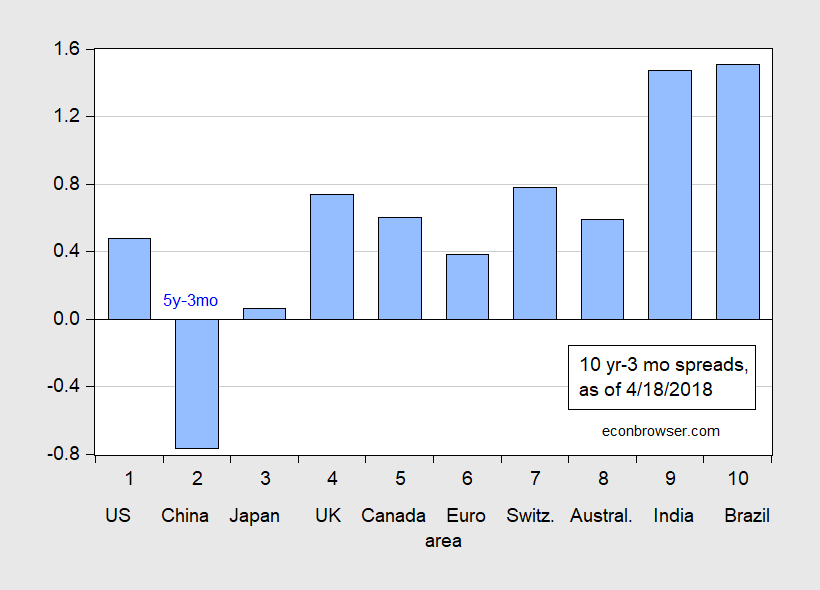

Figure 1: Ten year-three month term spread (blue bars), as of 9 July 2016. China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist, data as of April 18.

It’s hard to compare across countries, particularly without knowledge of what is the average term premium in each country. (See Chinn and Kucko (2015) for a cross country assessment of the predictive power of yield curves for eocnomic activity and recessions.) However, one can easily compare what the spreads have done since a last check (in this case July of 2017). This is shown in Figure 2.

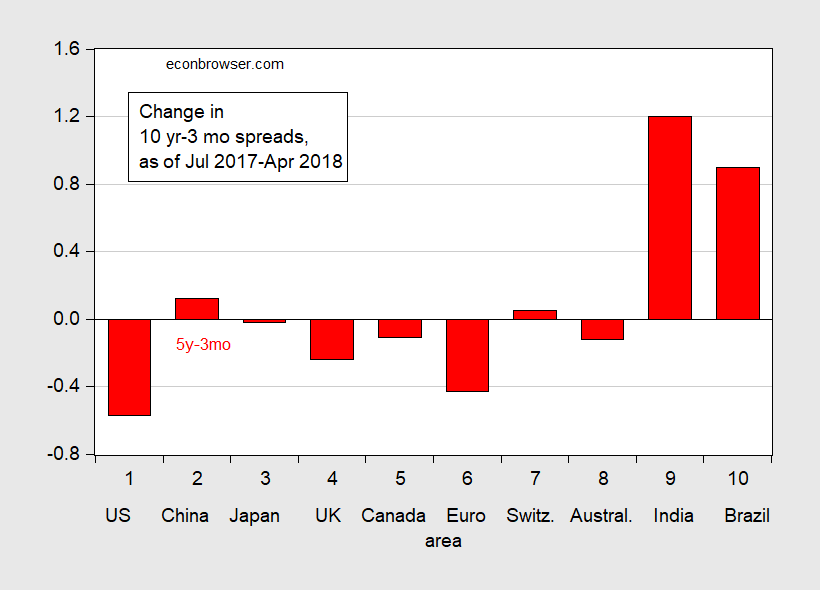

Figure 2: Change in the ten year-three month term spread (red bars), from 5 July 2017 to 18 April 2018. China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist, and author’s calculations.

It’s clear yield curves have flattened for four high income countries plus the euro area (as proxied by Germany’s yields). In Chinn and Kucko (2015), we found that the yield curve was a useful predictor of recessions for US, Germany, France, and Canada — but not the UK (we did not evaluate Australia).

One pertinent question is whether the flattening is due to higher short term rates or to lower long term rates. (Wright emphasizes a term spread regression incorporating the level of short rate, for instance; in Chinn-Kucko, we find a specification w/o short rate works better.) Figure 3 provides a graphical depiction of the decomposition of changes in spreads shown in Figure 2.

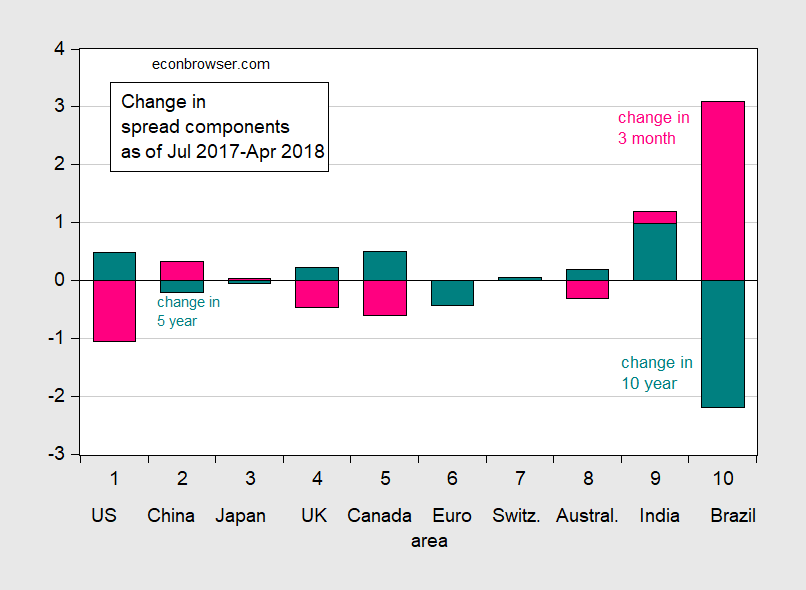

Figure 3: Change in the ten year rates (teal) and negative of change in three month rates (pink bars), from 5 July 2017 to 18 April 2018. China observation long rate is five year rate. Euro ten year rate is for Germany. Source: Economist, and author’s calculations.

For the US, UK, Canada and Australia, the component accounting for most of the flattening is the higher short rate. For the high income countries, only for the euro area is the majority of the flattening associated with a declining long rate. (Contrast this with what was happening in 2016, as recounted in this post).

If the pure expectations hypothesis of the term structure w/time invariant term premium applied, we could attribute the decrease in German long rates as purely a drop in expected future short rates. It’s not clear we can do that; it’s also not clear to me we can’t. Conversely, the rise in long rates in the US could be due to a reversion of the term premium to its longer run average.

From Bullard’s presentation:

“There is a material risk of yield curve inversion over the forecast horizon if the FOMC continues on its present course of increases in the policy rate”

Your graph shows China already has an inverted yield curve. Ponder the risk of the two largest economies (US and China) both have recessions.

I was puzzled why the 5-year Chinese government bond rate was used instead of the 10-year so I started searching for what is publicly reported finding this:

https://www.ceicdata.com/en/indicator/china/long-term-interest-rate

There is a 10-year interbank rate but not a 10-year government bond rate? I try to keep pace with what is reported in each major nation but I still struggle with financial market data for China.

Unless I’m missing something this doesn’t seem like a huge secret, unless these are just Hong Kong rates.

https://www.marketwatch.com/investing/bond/ambmkrm-10y?countrycode=bx

I think the site you gave is geared specifically for “institutional investors”, not the individual investor folks who trade with Fidelity or something.

Let’s see If I can rundown some things I wanted to mention without it turning into 4 different comments. Here is another article related to 10-year Chinese government bonds (slightly dated):

https://www.marketwatch.com/story/this-chart-suggests-us-treasury-yield-will-follow-its-chinese-peer-higher-2017-11-16

Also, I’ve said it before and I’ll say it again, if you’re looking for “white dudes” to tell you about the Chinese financial markets (I think we can safely assume some Chinese based Chinese can/do know more), Michael Pettis is hands down the guy to read:

http://carnegieendowment.org/chinafinancialmarkets/75355

Pettis also tends to attract some great commenters as well, so reading the comments section tends to be a blast. It’s like the old blogger’s joke “Come for the blog post, stay for the comments.”

This Bloomberg article also discusses some things about China’s bond markets, and there are 2 articles underneath that are interesting, one relates to U.S. commodities shipments to China, and the other about China’s unhappiness with some tech components being withheld from China.

https://www.bloomberg.com/news/articles/2018-01-31/china-s-11-trillion-bond-market-is-winning-foreign-investors

And although I can’t speak to the trustworthiness of the source (“CSOP Asset Management”), and this is a little “dated”, maybe a year old, this seems like a pretty good breakdown on the structure and breadth of the Chinese bond market. Make sure to click the blue rectangle where it says “expand chart” because it also gives some info there:

https://csopasset.us/markets/bond-market

Good links. Thanks! China’s interest rates are higher than ours which explains why their currency has appreciated with respect to the dollar:

https://fred.stlouisfed.org/series/DEXCHUS

Menzie earlier mocked that Trump tweet that complained about the Chinese devaluing its currency as US interest rates were rising. I guess his economic team does get everything wrong!

I caution against inferring too much about government bond yields in China, given the presence of state owned banks, heavy regulation on purchases/sales of local govt. vs. national bonds, and capital controls. I suspect the 5 year bond might constitute a thicker market. But not sure. In any case, there is little evidence on the term spread as a predictor for recessions in China.

@ Menzie

I’m glad you stated that and made sure people realized it. Mainly I wanted to show the data was “out there”. And also for any hobbyist “China watchers” in your readership.

But can the average guy go out and purchase Chinese gov bonds?? My personal time in China was basically the first decade of the new millennium. And I know in some aspects that might as well have been a century ago. But….. I knew people from ALL socio-economic classes there, they tend to gravitate to foreigners (or did at that time). But most of my friends were probably in the “upper middle class” socio-economic group, and I never heard them discuss bonds, and I doubt that has changed. A few would ask me about what I thought about the Chinese equity market because I had a finance degree and they knew I loved to follow the markets. This seemed to me more looking to “verify” moves they had already made, than actual curiosity or respect for my thoughts on Chinese stocks. I would then tell them (knowing full-well they didn’t really give sh*t what I thought) that I thought Chinese markets were way overvalued, too much used as a gambling casino by the lower classes, and that you couldn’t trust the Chinese balance sheet numbers much more than you could trust “evil Japanese invaders”. This general advice went over like a led balloon and they went on doing whatever they were doing before.

I think the numbers to me that I like to watch on China, are real estate markets there, and business defaults (I guess that’s semi-connected to Chinese corp bond defaults). In my personal opinion those are “the two biggies” to watch in China. And even those really you don’t know, because you never know when Beijing will swoop down and save them (similar to W. Bush’s boy Henry Paulson getting on his knees to Pelosi) in an effort to avoid the domino avalanche.

Fair enough. Haver properly reported the 5-year government bond rate but they seem to be confusing a 3-month interbank rate with the 3-month Treasury bill rate. Unless we do not trust the reporting from the People’s Bank of China.

A note of caution from an old yield curve junkie.

The reason is as important as the flattening.

It is is because of Central Bank moves on short term interest rates then be worried. Be very worried.

If it is because of the bond market then ignore.

As Pro Growth Liberal says ( well implies )it is occurring in China because their Central Bank and if it occurs in your Land it is the same.

Of course if you are a Neo-Fisherian this will increase inflation!!

Terrific post Menzie, as per usual.

I think I saw a Bloomberg reference to this issue recently, and if I find that i’ll put it up in this comment thread later tonight. Here is a pretty good related post from the guys over at “Bond Vigilantes” which if you like the post above then you should also enjoy this:

https://www.bondvigilantes.com/blog/2018/04/17/u-s-yield-curve-predict-wider-credit-spreads-also-goodbye-hamish-watson/

OK – he is right about the BBB credit spread being really high in late 2008/early 2009 but that was after the collapse of Lehman Brothers. Nothing like that is on the horizon. At least I hope not.

as usual indeed

From the People’s Bank of China:

http://www.pbc.gov.cn/english/130727/index.html

10-year rates near 3.5% as of April 18 and 30-year rate near 4%. 1-year rate at only 3% with lower rates on shorter maturities. So is their yield curve inverted????

Menzie notes his chart is based on data in the Economist which cites Haver Analytics.

I’m looking at the PBC’s ChinaBond Government Bond Yield Curve and Haver reports the same yield for the 5-year government bond but the PBC is reporting a 3-month government yield less than 2.6% not 4.1%. Haver seems to be using some other measure of short-term interest rates, which may carry a credit spread. This would be like looking at the 3-month LIBOR rate instead of the Treasury bill forgetting that there is a TED spread. Recall this TED spread was really high after the collapse of Lehman Brothers.

pgl: I think the Economist is looking for “representative” rates. It might be that the three month T-bill rate is not representative in their mind. You’ll note that the column for 3 month rates does not indicate they are government yields, while the 10 year are govt bond yields.

@ pgi

It’s time to play “The Question Is Moot”, with the Honorable Reverend Jesse Jackson:

http://www.dailymotion.com/video/x54vjte

(My dad, an age 57 white dude in 1984, ALMOST voted for Jesse Jackson in the primaries, before he would later vote for President Obama in 2008) My Dad decided not to vote for jackson, after he learned of Jackson’s infamous “Hymietown” quote.

Another SNL classic! Thanks! But getting financial information correct is moot? If Haver Analytics confuses interbank rates with Treasury bill rates, then anyone using their data is being dumber than the “economists” at Team Trump. And the folks on Wall Street can play this confusion for megabucks!

@ pgl

I was referring specifically to the question of whether the yield curve was inverted or not, as it holds less predictive value than here in America (and with no predictive value, question of inverted or not is therefor “moot”). That’s my mistake, I should have been more clear what I was referring to. It was intended for humor mainly.

As far as the rate, I’m not a fan of “The Economist” magazine, I think they are highly over-rated as a publication. Nonetheless, I doubt if “Economist” is going to pull those numbers out of the sky, and I doubt Menzie will quote them if they don’t have some validity. The bottom line is as Menzie is saying, there’s not enough liquidity in the Chinese markets or “free flow of capital” to really know what an accurate yield is—there is a “grey area” and will be some “grey area” until the day the folks in Beijing ever decide they are tired of “playing God”—which isn’t going to be anytime soon.

I’m not a fan of their using Economist as their title. They are decent journalists but not economists. We know where they got their data – Haver who puts out lots of data. But even Haver is a second hand source. Lots of entities sell lots of data. I prefer checking primary sources in the day job even if that takes more time. Then I have to endure international tax lawyers who make Ed look like a nice guy.

Who were the men who enthusiastically stood up to support Adolf Hitler in the very early days of his burgeoning power?? Are they remembered with admiration and affection by today’s history books??

Mark these names down in your personal journal somewhere:

1. Representative Robert W. Goodlatte of the Judiciary Committee

2. Devin Nunes of the Intelligence Committee

3. Trey Gowdy of the Oversight Committee.

Bastards, one and all. Will they face a trial one day?? Just keep walking down that path guys—keep walking down that path and see where it goes….

https://www.nytimes.com/2018/04/21/us/politics/rod-rosenstein-justice-department.html

These 3 men, are attempting to take on the Justice Dept, in a similar way that McCarthy did the U.S. Army. Things didn’t end well for McCarthy. He died as a complete disgrace to himself and his Senatorial colleagues, at the age of 47.

3 hours of discussion on that here—maybe save it for next weekend: https://www.youtube.com/watch?v=9SnS0muq_5w