There’s a lot of discussion of the flattening of the yield curve, and what it portends, in the US (see this post, Irwin/NYT). Interestingly, yield curves are flattening around the world, even in some emerging markets.

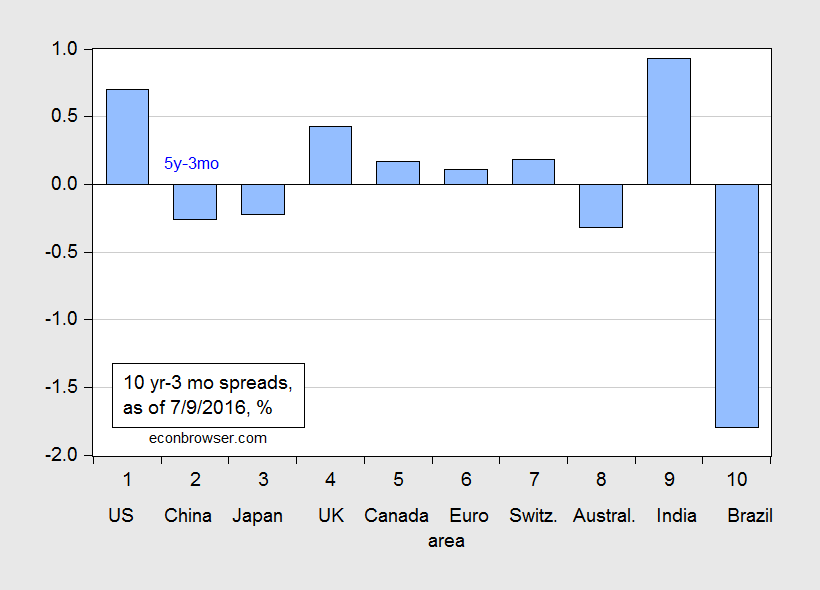

Figure 1 shows 10 year-3 month term spreads for selected countries.

Figure 1: Ten year-three month term spread (blue bars), as of 9 July 2016. China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist, July 9 issue.

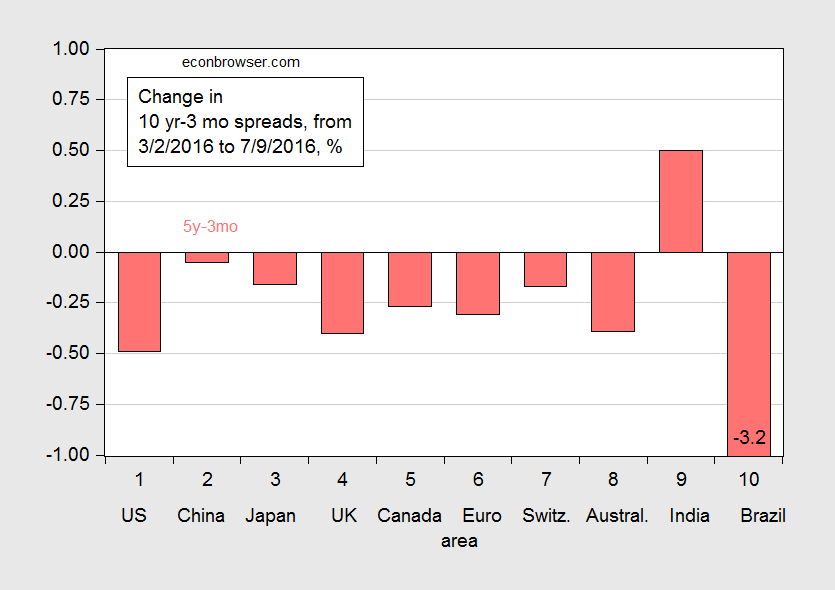

In general, these spreads are smaller than they were four months ago. This is shown in Figure 2, which depicts the change in term spreads since 2 March 2016 (my last post on spreads around the world).

Figure 2: Change in the ten year-three month term spread (blue bars), from 2 March to 9 July 2016. China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist, July 9 issue, and author’s calculations.

Negative values indicate a flattening of the curves. Only India stands out as a country with a steepening yield curve.

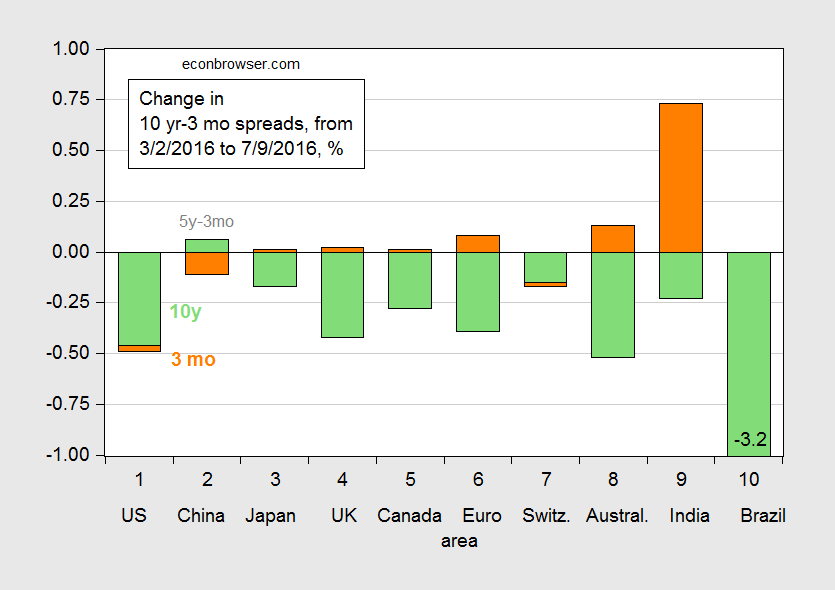

One interesting aspect of this flattening is that the change is being driven, in a mechanical sense, by falling long term rates, rather than rising short term rates, as has been true in the past (as noted by Spencer; see this nifty interactive graph for the United States). Figure 3 decomposes the change into that arising from falling ten year yields (green) and from rising three month yields (orange).

Figure 3: Change in the ten year-three month term spread arising from change in ten year yield (green bars), and from change in three month yield (orange), from 2 March to 9 July 2016. China observation is Five year-three month term spread. Euro ten year rate is for Germany. Source: Economist, July 9 issue, and author’s calculations.

The decomposition indicates that — by far — long term yields account for the largest portion of the flattening of the curves.

Now, does this matter? If the pure expectations hypothesis of the term structure is an accurate depiction of the world, then maybe not: a declining long term rate is merely representing a decline in future expected short rates, associated with an imminent recession. If, on the other hand, long term government bonds of different maturities are imperfect substitutes, then one has to ask whether there are special aspects of the post-Crisis world that are pulling down long term bond yields. Regulatory requirements, decreased emission of Treasurys, overseas demand, and decreased risk appetite, should all exert a depressing effect on long term bond yields [1] [2].

This is not to say we shouldn’t worry about a yield curve inversion. But thinking about why the yield curve is flattening might lead to a more nuanced view of economic prospects.

Is there any reliable method of inference to distinguish technical effects from shifts in expectations? Economists caution against using TIPS breakevens as a pure expectations proxy, but I’m not clear on how to determine the confounding liquidity effect without first determining the “correct” inflation expectation.

A: See this post by Jim.

Really nice post. Thanks.