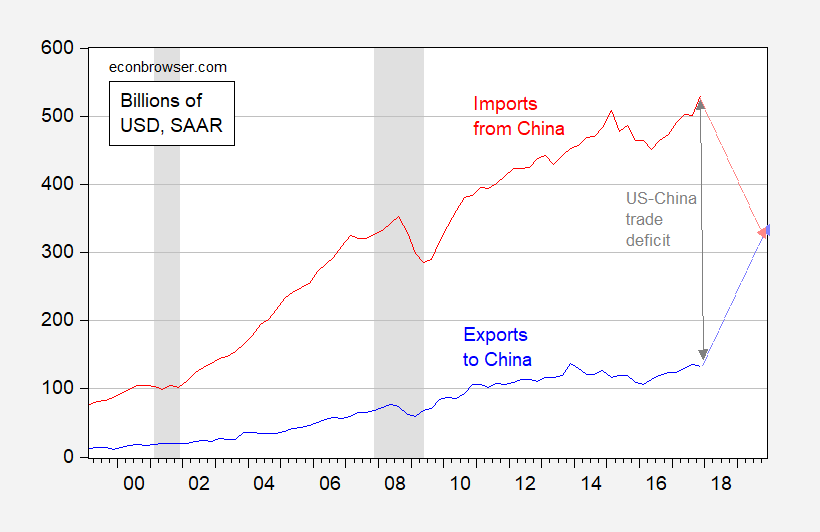

Jim Tankersley/NYT discusses how hard it will be to reduce the $337 billion US-China gross trade deficit by $200 billion by increasing exports (as I point out in this post, our trade deficit in value added is probably about half the $337 billion).

The enormity of the task of cajoling the Chinese into buying $200 billion more is shown in Figure 1 (see the light blue arrow).

Figure 1: US exports to China (blue) and US imports from China (red), in billions of USD, SAAR. NBER defined recession dates shaded gray. Increasing exports to China by $200 billion over two years (light blue arrow); decrease imports from China by $200 billion over two years (pink arrow). Source: BEA/Census, NBER, author’s calculations.

A much simpler way to reduce the deficit; instead of browbeating the Chinese into buying $200 billion dollars more, just throw the US economy into a deep, deep recession, and reduce US imports from China (the pink arrow).

In Cheung, Chinn and Qian (Review of World Economics, 2015), we estimate the income elasticity of US imports from China is in the range of 2.6 to 3.4 (Table 3). $200 billion is about 0.40 of $506 billion (US imports from China). Assuming a high income elasticity of 3.4, all we need to do is reduce US GDP by 11.6% (about $2.32 trillion in for US nominal GDP of nearly $20 trillion in 2018Q1). Of course, this is ballpark, particularly because many things would not stay constant — the USD/CNY exchange rate would doubtless change, as would US exports to China. But you get the idea.

Now one could say this is a crazy idea; I say it’s no more crazy than building a wall with Mexico and forcing them to pay, banning all immigrants from s***hole countries, doubling Amazon’s shipping costs with the US postal service, collaborating with the Russians on cybersecurity, implementing a border adjustment tax, arming teachers to protect students, and a myriad of other Trump musings.

Brad Setser noted an easier way – have those smart phones assembled in Vietnam and not China. Gross imports from China would fall by $70 billion even if value-added diverted would be a mere $4 billion. Oh wait – that gets us only 35% there so we need to figure the rest of the $130 billion. But there are so many other forms of processed trade sectors where the same game could be played. So no problem!

Pgl, oh no!!!!! That’s bad because it’s “trade diversion”. Why didn’t you get the memo? Sigh.

CoRev: The $200 billion reduction in US-China trade deficit is the Administration’s goal, not pgl‘s. Between some trade diversion, or engineering a massive recession (or selling an aircraft carrier to China), I’d opt for some trade diversion. So this is theory of second best. Personally, I view the US-China trade deficit as a “stoopid” thing to focus on…(and you would too if you undestood some international economics).

We could easily do what Brad Setser was alluding to without any trade diversion. See my most recent comment about the magic of transfer pricing games.

The issue of measuring bilateral trade balances in the presence of process traded does not have anything with respect to what Viner wrote back in 1950. I thought you had no clue what trade creation/diversion was about. Thanks for confirming as much!

Pgl, you are correct (I think if you could write a complete sentence). I admit to being sarcastic because of your and other’s responses to “trade diversion” in the other thread. So now in your example you admit “trade diversion” can be good. OK, got it. Liberals are hypocrites.

CoRev: Must confess I don’t understand what you’re writing about. Viner’s partial equilibrium model did not inform the issue of what the trade balance was (either on a bilateral or multilateral basis). Rather it refers to the sourcing and quantity of imports.

CoRev My understanding of “trade diversion” comes from Kindleberger and does not resemble anything you are talking about. Trade diversion as I understand it is about elasticities, price and tariff differentials between a home country, a customs union trading partner and the world price. If the relative demand and supply curves are inelastic between the trading partners and costs are high, then we have a bad case of trade diversion. On the other hand, if the relative demand and supply curves are elastic between the trading partners and the costs are low, then we have what Kindleberger calls “trade creation.” So the effect of tariffs on the home and partner countries is ambiguous. It can be good or bad. So liberals are not hypocrites, they just have a better grasp of the math behind the trade models. And oh by the way, Kindleberger calls all this “…another example of the theory of second best”, which I believe is a phrase that Menzie just used.

I never said anything about being good or bad. It was you that was opining on something that completely ignored what Viner’s analysis has to offer, OK – you still refuse to learn the basic literature and yet you offer your uninformed opinion about what might be good or bad policy.

I went back and read Menzie’s previous post on gross value v. value-added and the comments. I made a similar comment there too. Of course PeakStupidity had to add his two cents:

‘No one is forcing you to buy an iPhone – so, quit whining and complaining.’

Yep – his usual off topic dumb rant. BTW – I do not own a iPhone. Try Samsung Galaxy. We all await the next piece of irrelevance from PeakyBoo.

Speaking of irrelevance, have you read this comment?

Peaky’s comment – yes I did read it. It was irrelevant!

Another dumb Pgl comment – no one is forcing you to buy anything from Apple, yet, you still whine and complain.

Lord – you really do have to prove you haven’t a clue what the discussion is about 24/7. Please stop as your poor mother is beyond embarrassed.

There is another possibility. China spent years in the 2000s depressing the value of its currency in order to prop up its manufacturing export industries. So what if China spent the next decade doing the reverse, using currency manipulation to push up the value of its currency. If it can do one, certainly it could do the other.

This would have the affect of stimulating domestic consumption in China and increasing imports from U.S. manufacturers.

Let’s see – the People’s Bank of China runs a monetary policy a lot like what Volcker did back in 1981/82 so its net exports could fall (US net exports going in the other direction). Nice boost for U.S. aggregate demand if China could magically avoid its own recession. Of course with high real Chinese interest rates, their investment demand would fall as would their net exports. So how would they avoid a massive recession? Maybe they could adopt a massive fiscal stimulus by doubling their defense spending budget. I’m sure this will all work out smoothly!

This is already partly in progress. The easiest way to reduce the deficit would likely be to reduce the US federal budget deficit. China has always been a great manufacturer, though. It imports commodities, including US commodities. The shale revolution is in significant part import substitution for global oil exports finding their way to China. I find all this frustrating because it distracts from more substantive issues with China, intellectual property, cyber espionage, etc. And frankly, there is precious little the Chinese government can really do about the trade deficit.

On the other hand, once again, the South China Sea is the albatross around China’s neck. The accompanying picture on the article linked below did more to set back China’s perception in the world than fortifying every reef in the SCS brings it benefits.

https://e.vnexpress.net/news/news/chinese-tourists-wearing-nine-dash-line-shirts-in-vietnam-was-unacceptable-gov-t-3751751.html

https://www.straitstimes.com/opinion/did-the-ruling-sink-the-rule-of-law

Kopit, https://www.straitstimes.com/opinion/did-the-ruling-sink-the-rule-of-law

Kopit, here is another piece on the ScS tribunal ruling

https://www.brookings.edu/wp-content/uploads/2016/07/Limits-of-Law-in-the-South-China-Sea-2.pdf

“There are four basic reasons that the arbitration tri- bunal can make only a very limited contribution:

1. Despite much confusion in the media, all concede that the tribunal has no jurisdiction to decide any issues of “sovereignty” over the islands and rocks in the South China Sea, even though these “sovereignty” issues are the heart of the many controversies.

2. All concede that China was within its legal rights under Article 298 of UNCLOS after ratifying the treaty in explicitly exempting it- self from compulsory dispute resolution of a wide swath of issues concerning “sea bound- ary delimitations” (basically, sorting out over- lapping maritime rights between nations), “historic bays or titles,” or “military activi- ties,” so the tribunal will not decide any of these contentious issues.

3. Assuming, as of course we should, that the tribunal will continue to play it straight in deciding the legal issues presented, the Phil- ippines is unlikely to win all of its 15 claims against China. The tribunal is likely to con- clude that it lacks jurisdiction over a number of the Philippines claims and to rule against the Philippines in some of the other claims…..”

Look at a map! Do you think the Koreans and Japanese think of China as a leader or a threat? Should the US view China as a leader or a threat? And those tourists with the SCS T-shirts. How do you want the Chinese to be viewed? As leading citizens or colossal jerks? How do you want to position China in the public imagination? Should Japan arm itself with nukes or not?

As I have said many times before, China’s biggest risk is at the Strait of Hormuz. No one will lose bigger on the Iran sanctions — now essentially unfolding automatically — than China. It is the primary stakeholder in the deal. Are its interests at the table properly represented? Is China an integral member of the international community or an existential threat? If you’re an integral member, then you also speak for Korea and Japan, because their oil also transits the SCS, and they are US allies. If you are a threat, making common cause is harder.

Chinese claims — and they are purely unfounded as currently construed — restrict the country’s room for maneuver in other theaters. For the unsophisticated, the SCS looks like an asset. But Chines claims inspire jingoism among the Chinese themselves (hence the T-shirts), countered by unvarnished hatred from China’s neighbors. The SCS makes enemies out of neighbors and rivals.

Is it worth the cost? Not even close, in my book.

Kopit, in your opinion, those ScS islands belong to whom? On what basis? As long as the country is not China?

https://www.everycrsreport.com/reports/R42784.html

There may be an easier way of reducing the bilateral trade deficit than Brad Setser’s suggestion that Foxconn move the assembly of the iPhone to Vietnam. Foxconn is a Taiwan based multinational with a lot of Chinese manufacturing affiliates. The Chinese affiliate purchases the components for say $190 per phone, spend $10 on labor, and they bills Apple $205 booking $5 of profits in China taxed at 25%.

Now one play may be for a Singapore affiliate purchases the components for $190 and sell the finished product to Apple for $205 and then use China as a toll manufacturer. China books the $10 in labor costs and then gets say cost plus 40% for toll manufacturing services or $14 per phone. The other $6 in profits stay in low tax Singapore.

No real change in operations but a massive reduction in the worldwide tax bill. And rather than seeing $205 per phone in U.S. imports from China, we would see $205 per phone in imports from Singapore.

Yep – it is really easy to game bilateral trade balances. And no CoRev – this has nothing to do with trade diversion. Jacob Viner is rolling over in his grave at you with laughter.

BTW – moving assembly from China to Vietnam might be trade creation if the cost of labor in Vietnam was less than the cost of labor in China. Jacob Viner’s model properly applied to the real world could address this other issue but do not count on CoRev to do the estimates as he has no clue what the basic model even is.

So, you are saying Viner was wrong? Moving Foxconn assembly of the iPhone to Vietnam does not eventuate in diversion of this ” trade process” from China to Vietnam if the cost of labor in Vietnam was more than the cost of labor in China or the added transportation cost was higher than in China production, or any other parts of the process change added costs to the end product? And what could be those other parts of the process: taxes, competing TA(s), exchange rates, political stability, etc. (if you want more we can discuss)? You see REAL WORLD considerations properly applied to the Viner model May prove your proposal wrong.

Considering your example resulted from discussion of political impacts and economic of tariffs and how China had been a less than open player in international trade. You justified China’s actions, and compounded them with your own proposal. Yep – you place Chinas’ well being above the US’s. Only liberals afflicted with TDS blame bilateral trade balances on Trump. This nation’s founders would be rolling over in their graves listening to you and your fellow travelers

Your need to make a point against Trump and conservatives just enhances the impression of your inability to think logically ending with just more meaningless points and more blather.

CoRev … blame bilateral trade balances on Trump. This nation’s founders would be rolling over in their graves listening to you and your fellow travelers

First, I don’t know why anyone cares about a bilateral trade balance. It’s completely irrelevant. The only living people today who seem to care about it are Trumpsters. As to the Founding Fathers, you’re probably right that they would be rolling over in their graves. But then again, the Founding Fathers were embarrassingly ignorant about trade theory. They operated in a wrongheaded mercantilist view of the world. We’d have to wait for at least another generation before David Ricardo came along.

“You justified China’s actions, and compounded them with your own proposal.”

Can there be a DUMBER rant. I am not justifying anything China has done. Nor have I offered any particular proposal. All I have said is let’s get the accounting right.

Look – it is time to just ignore CoRev as he has no clue what these discussions are about.

Lord – more uninformed rants. Clearly you have never read Viner. And at this point – I do not see any reason to read your uninformed rants.

pgl: If CoRev won’t read an introductory international economics textbook, how can you hope to have him read Viner, and understand?

So, if we actually have free, and legal, trade with China, how much will the trade deficit shrink?

Democrats, particularly at CNN, sure like Dick Durbin’s s***hole remark.

We need new ideas, because many of the old ones aren’t working or fair.

“how much will the trade deficit shrink?”

ZERO! Which is approximately your IQ!

Pgl, do the math using the whole of Viner’s model focusing on the values assigned to Peak’s (free, and legal, trade) instead of projecting just more meaningless points and more blather. As is your argument and the the example provided is simple and incomplete. It is because of this Viner is rolling over.

Please stop. Your anger and lack of logic is embarrassing your Mama.

My anger? You are on the one on some tirade over things you clearly do not understand. I’m done with your insanity, You should give this up until you actually learn basic economics.

pgl I feel your frustration with CoRev. I sometimes feel the same frustration with some of the community college students that I tutor. But it’s a burden we have to shoulder. Someone has to lead them out of Plato’s cave. Remember my motto: “Missionary Work Among Savages.”

Menzie notes you need to start by reading an introductory international economics textbook. And I’m silly enough to think you might read and comprehend what Viner wrote? Silly me.

How about closing down some 800 oversea military bases, reducing the 700b usd annual military budget for a start? Also raising US low saving rates, accounting for and bringing back to US the thrillions profits US corporations kept oversea?

The U.S. has a global empire to defend. And, deters or stops aggression. We lowered corporate taxes to repatriate overseas profits. Stronger growth with higher interest rates will increase saving. Trump shamed our allies to pay their fair share to support the U.S. military.

Peak, and which country is obligated to balance such overconsumptions.

Anyone dumb enough to write the following will not get your point here:

“Stronger growth with higher interest rates will increase saving.”

PeakStupidity has also confused a movement along a supply (savings) curve with a shift in the supply curve. You see he flunked Econ 101 and the rest is history.

Another dumb and ignorant comment by Pgl hoping people are stupid.

Onward Christian soldiers? This is the kind of neocon nonsense that led to that stupid decision in March 2003. I bet you dodged the draft in the 1960’s along with Cheney and Trump!

“The U.S. has a global empire to defend. And, deters or stops aggression.”

That is a very elegant justification for school yard bullying. 🙂

Peak, one serious obstacle is the US refusal to sell what China wants to buy. In such cases China should be absolved of the blame of trade imbalance.

Benlu, other serious obstacles include tariffs, subsidies, piracy, state owned enterprises, coercing and stealing intellectual property for production, unfair rules on foreign firms doing business in China, etc..

China is to blame for creating its $375 billion a year trade surplus with the U.S..

PeakTrader: Is China to blame for US aggregate net exports deficit of $637 bn (2018Q1 SAAR)? And here I thought it had something to do with insufficient private and public saving (latter, read budget deficit), relative to investment. Silly me.

Menzie Chinn, I’m not saying the entire trade imbalance is caused by the factors I cited.

PeakTrader: Then logically at least part of the deficit run with China must be due to US macro factors — unless there is a strange dichotomy between trade balance between US and Rest-of-world ex.-China, and trade balance between US and China.

The trade deficit could not be solved as exactly because US are jumping all over the issues until yesterday an official list of issues were pinned down.

and China could address each.

China agreed to buy more U.S. goods today, thanks to Trump’s deal making:

https://www.google.com/amp/s/www.cnbc.com/amp/2018/05/19/china-agrees-to-bolster-purchases-of-us-goods-in-move-to-substantially-reduce-trade-gap.html

Mnuchin threw you under the bus:

https://talkingpointsmemo.com/livewire/mnuchin-were-putting-the-trade-war-on-hold

“China and the U.S. have mutually agreed to “substantially reduce” the yawning trade imbalance between the two countries, a joint statement read on Saturday, in a move that will involve the Chinese boosting more of what they buy from American producers.”

This is like how Chris Christie agreed to substantially reduce his waist line. But he still does not exercise and eats in the extreme. That waist line of his is as big as ever.

We already did the diversion thing.

In the 1990s, the US imported 6.2% of all merchandise from China, 15.7% from Japan and 10.6% from the NICs.

In the 2010s, it has been 20% from China, 6% from Japan and 5.7% from the NICs.

Diversion accomplished.

I do wish you and CoRev would read Viner and understood what he meant by “trade diversion”. Yes we buy more from China and less from Japan. Wonder why? Compare unit labor costs in the two nations and you will see. Of course CoRev will not see the simple point as he has no clue what unit labor costs even means.

If I understand you correctly, you’re confusing Manufacturer No. 1 in Country A being replaced by Manufacturer No. 2 in Country B.

What I’m point to is Manufacturer No. 1 moving from Country A to Country B, and doing the same thing from a different location.

Yes, there is a cost savings; otherwise, no one would move.

No, it isn’t the same as simply buying from a different supplier.

And, yes, the trade deficit should be smaller overall, but larger between the importer and Country B.

I.e., relocating the imbalance from Japan and the NICs to China.

And, “diverting” the political heat.

Well it appears that Trump’s China strategy (tariff threats, ZTE sanctions, etc) have resulted in preliminary trade agreements/, https://www.nytimes.com/2018/05/18/us/politics/trump-china-trade-talks.html “China Pledges $200 Billion in U.S. Purchases by Overhauling Trade Rules” No Viet Nam, no hypothetical, just real world negotiations.

Perhaps, pgl, Menzie and Not Trampis can use Viner to calculate the values for each trade sector under negotiation. They might also calculate the cost/benefits for the non-trade issues also included in the negotiations. Just curious.

Or we could just wait for the numbers as they are announced after negotiations are completed. For sure those numbers will be tracked by both China and the U.S. as well as the TDS driven doubters.

Oh, BTW, where’s that ole trade war?

CoRev: If you read the latest communique (you’re quoting something already somewhat overtaken by events), you’ll see that they agreed to disagree for now, and continue talking. No mention of $200 billion, no mention of ZTE.

Yes, we could wait until an agreement was come to. But seeing as I teach at a policy school, I like to know what are the likely effects of what is proposed before proceeding. Call me crazy for knowing consequences before acting.

CoRev I realize that your TV only picks up Fox News, so you probably missed this; but on Meet the Press this morning Larry Kudlow walked back and fudged a lot about this supposed $200B agreement. Basically he wanted to change the subject and talk about 3% growth, even though 1Q2018 was only 2.3%. Kudlow did make one interesting and revealing comment. He specifically referred to this $200B number not as the a reduction in the trade deficit, but as a reduction in the GOODS trade deficit. In other words, that makes achieving this goal even harder, trickier and less likely than if we were talking about an overall $200B reduction.

And you still haven’t addressed just how you think all this could be achieved. Do you think the US could ramp up manufacturing and industrial production by $200B just out of thin air without affecting inflation, interest rates, exchange rates and additional imports?

Another comment that proves who have absolutely no clue what Viner wrote back in 1950. Your use of terms you do not understand exceeds all expectatations!

Menzie, perhaps in your zeal to discredit you missed these terms: “preliminary trade agreements and preliminary trade agreements”? Since you “…like to know what are the likely effects of what is proposed before proceeding”, then I strongly suggest you stop the negative conjecture in your articles. and if you persist then yes, I will “Call (you) crazy for (not) knowing consequences before acting (or writing negative articles).” (My clarifications) 😉

/sarc off

CoRevNope. You’ve got it wrong. The initial story put forward by Team Trump was that China had agreed to a $200B reduction. The real story was not that they had agreed to negotiate this or that amount, only that they would discuss reducing the bilateral trade deficit. The headline story from Team Trump was a specific number: $200B. The Chinese said the $200B number was untrue. It turns out that this was a number that the Trump folks thought the Chinese should agree to, but the Chinese themselves never agreed to it. They only said they would agree to further talks. And if you listened to Larry Kudlow this morning it was pretty clear that the Trumpsters were just winging it with that $200B figure. Kudlow was squirming.

Menzie earlier noted that about half of that $337 billion bilateral deficit is due to confusing gross with value-added. A simple accounting correction could get us 85% of the way to Trump’s magic number without a single thing changing.

pgl: Yeah, but if Mr. Trump has a hard time remembering services are included in the overall reported trade balance, how can we hope to convince him about the meaningfullness of trade in value added…?

My favorite is when he says our trade balance is $500 billion per year. Yes – we imported $500 billion from China in 2017. Is Kudlow telling Trump that our exports to China are zero?

CoRev Also, note the date on the NY Times article in your link. That story was first reported on Friday. In Trump World that’s an eternity. The Friday story is “no longer operational”.

Some of the more concrete things that come out of this round of trade war negotiation are probably there is now an official US shopping list of things that US wants China to do. China could now pin down, focus on and address each without US hopping around all over issues. The tracking of progress on addressing each issue could now be officially done by both sides.

I forgot to add that there are now official specific channels, organization and mechanism for both sides to resolve the issues.

Treas. Sec. Mnuchin just threw CoRev and PeakStupidity under the bus:

https://talkingpointsmemo.com/livewire/mnuchin-were-putting-the-trade-war-on-hold

Trade War on hold!

I feel sorry for the folks over at talkingpointsmemo.com. They have to watch Fox News so the rest of us don’t have to. TPM deserves an award. But I am surprised that a dedicated Fox News viewer like CoRev somehow missed the Chris Wallace interview with Mnuchin.

I hope Josh Marshall pays his staff very well.

TPM staff just unionized, with Josh’s support.

The price of going at a topic unprepared.

Kopit,

http://m.chinadaily.com.cn/en/2017-02/07/content_28130855.htm

“…The Cairo Declaration – the outline of the Allied position against Japan during World War II – and the Proclamation Defining Terms for Japanese Surrender Issued at Potsdam, ruled that Japan must return the Chinese territory it took during the war, including the Nansha Islands, to the Chinese people, Wang said.

He made the remarks at a news conference after meeting with his Australian counterpart Julie Bishop on Tuesday in Canberra, the Australian capital. He was asked to comment on whether China and US are heading toward military conflict in the South China Sea….”

Kopit,

https://www.reuters.com/article/us-southchinasea-china-usa-idUSKBN15N04N

……The 1943 Cairo Declaration and 1945 Potsdam Declaration clearly state that Japan had to return to China all Chinese territory taken by Japan, Wang said.

“This includes the Nansha Islands,” he added, using China’s name for the Spratly Islands.

“In 1946, the then-Chinese government with help from the United States openly and in accordance with the law took back the Nansha Islands and reefs that Japan had occupied, and resumed exercising sovereignty,” Wang said…..

Kopits. With an ‘s’, Benlu.

China’s claim to the Paracels, at least a portion of them, in well-founded and traditional. The claim to the Spratlys comes from a map the nationalists drew up in 1949. If it were a good claim, UNCLOS would have recognized it. It’s really not. (No one else’s claim is that good, either. These islands were not inhabited. Hence the 200 mile exclusion zone.)

As for the Senkaku / Diaoyu Islands, China’s historical claim is well nigh zero.

So how should we treat China? As a pariah nation, or a pillar of the international community?

Kopit, you think the values of ww2 Cairo Declaration and Potsdam Declaration zero as well. Look at the map, where is Hawaii, Guam, Marshall Islands, Falklands, Diego Garcia,….? If China should be pariah for claiming ScS islands, dioyutai, what about the other claimants and occupants of Islands thousands of miles from home shores?

I hope you realize WHICH Chinese government was party to those agreements.

For CoRev, and the rest of you:

A Conservative Hierarchy of Needs

https://www.princetonpolicy.com/ppa-blog/2018/5/21/a-conservative-hierarchy-of-needs

It discusses the distinction between conservatism and fascism.

Kopit,

What is pariah should be the UNCLOS tribunal:

1. The temporary tribunal was approved to be formed by Yanai, a Japanese diplomat and then president of the International Tribunal for the Law of the Sea (ITLOS), also Abe’s legal aide drafting the japan post pacifist constitution. Japan is also interested party as Japan was also involved in similar islands disputes with China, Korea and Russia. Yanai appointed four of the five-member arbitral tribunal on the South China Sea case, each judge was paid millions(while Philippines claimed it had no budget for such payments so the millions probably came from US or Japan).

http://foreignpolicy.com/2016/06/21/beijing-japanese-judge-means-south-china-sea-tribunal-is-biased-china-philippines-maritime-claims/

2. Yanai and this tribunal ignored the facts:

a) that no less than 2 agreements had been signed between China and Philippines to adopt negotiations for dispute settlement. This meant yanai illegally overridden the dispute settlement agreements. No international allows what Yanai did.

b) UNCLOS provision that it has no jurisdiction over matter of sovereignty of China (so the tribunal ruling is ultra vires UNCLOS provision itself).

3. The temporary tribunal has no semblance of an honorable court with tight systems governing the appointments, compensations and integrity of judges, counter check for bad ethics and wrongful decisions(particularly in view of the great importance and long term impacts of such decisions on sovereignty of another country) like a standard courts hierarchy for appellate functions.

Further, what kind of status or weight could one accord such a tribunal where all the judges were appointed and paid by one party of the dispute?