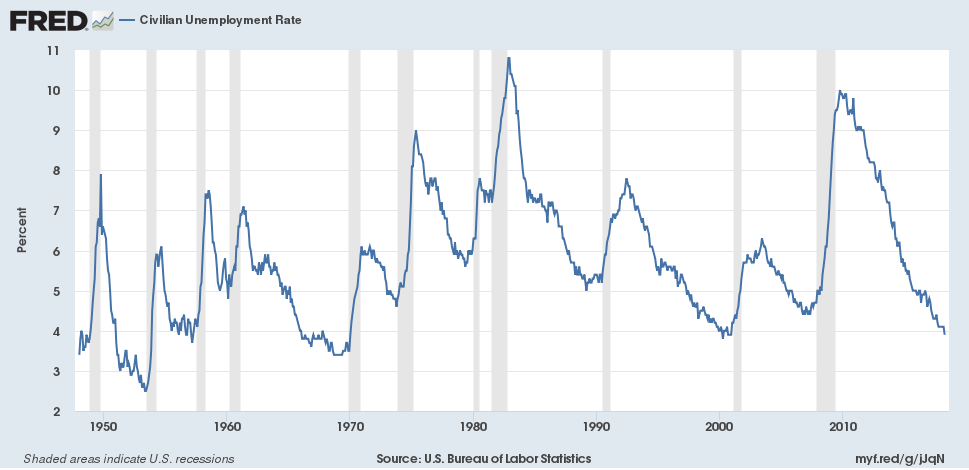

The Bureau of Labor Statistics announced yesterday that the unemployment rate was down to 3.9% in April. That’s nearly as low as it’s been any time in the last half century. Does that mean the U.S. economy faces some problems ahead?

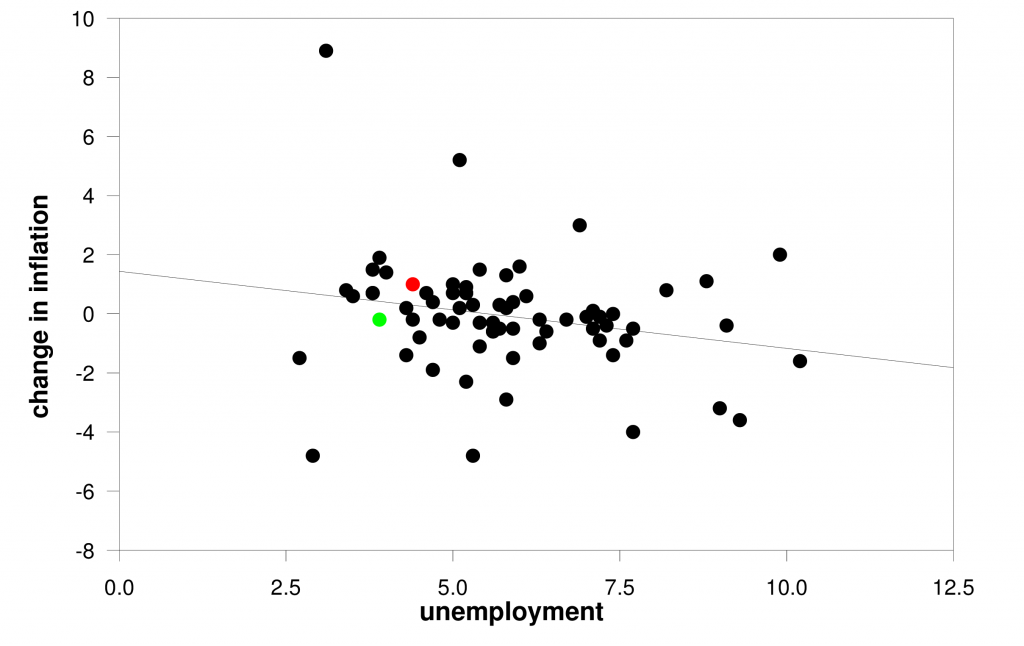

Worries about the unemployment rate getting too low are usually framed in terms of the Phillips Curve. One simple formulation describes the Phillips Curve as a negative relation between the change in the inflation rate and the level of unemployment.

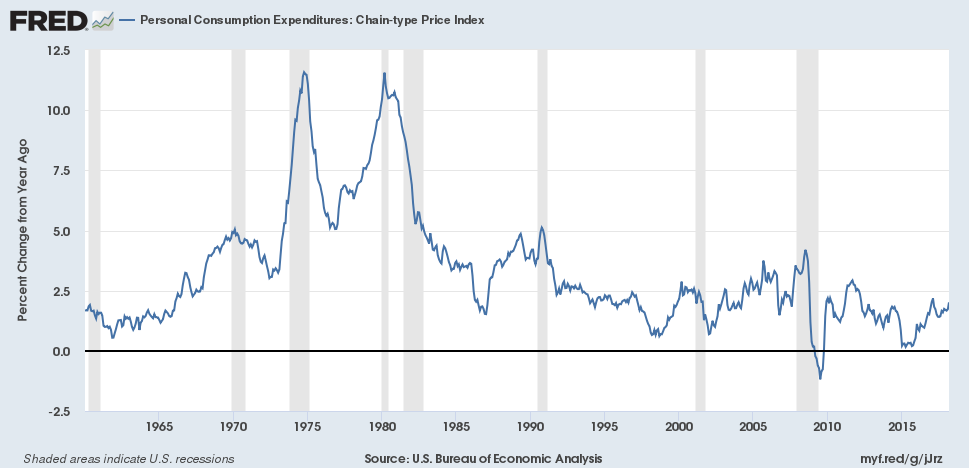

Vertical axis: year-over-year change in the inflation rate, where the inflation rate is measured as the year-over-year percent change in the quarterly implicit price deflator on personal consumption expenditures (first quarter to first quarter, 1949-2018). Horizontal axis: unemployment rate in April of each year. Red dot is 2017 and green is 2018. OLS regression line has R2 of 5% and Newey-West t-statistic (with 2 lags) of -1.96.

That estimated relation says that if the unemployment rate was at 5.5%, inflation this year would be expected to be the same as last year. With unemployment at 3.9%, inflation this year would be expected to be 0.4% higher than the year before. But in fact, inflation over the last year was 0.2% lower than it had been the year before, as represented by the green dot in the figure.

As I’ve noted before, that kind of miss is pretty much par for this relation. Indeed, the standard error of estimate for the regression is 1.9. In other words, when the unemployment rate is at 3.9%, we expect this year’s inflation rate to be 0.4% higher than the year before, plus or minus 3.8%.

Still, if the claim of the fitted Phillips Curve is accurate, it certainly means we could not stay at 3.9% unemployment forever. If we were to try to do it for 5 years in a row, for example, it would predict an inflation rate at the end of 5 years that would be 2% higher than when we started. We could easily live with 2.4% inflation. But 4% inflation would be a problem.

On average, inflation recently has been closer to the Fed’s 2% target than it had been for some time. But note that the FOMC statement from the Fed’s meeting last week significantly added the word “symmetric” to the expression “2% objective.” In other words, the Fed says that it is equally keen to avoid the 1.6% and below inflation numbers of previous years as it is the possibility of 2.4%

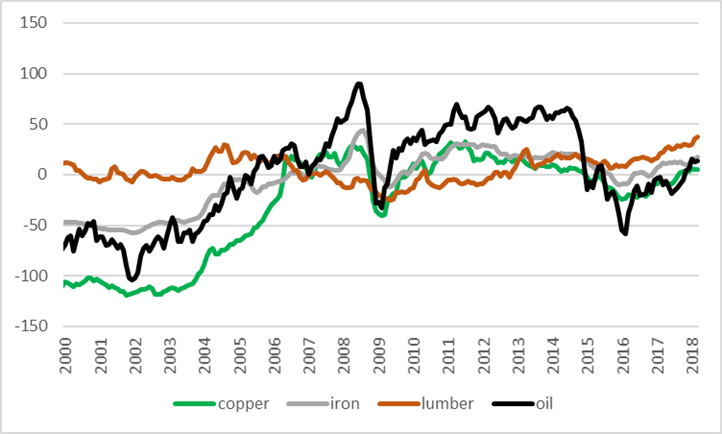

It is worth noting that commodity prices, sometimes viewed as a leading indicator of inflation, have been moving up. Since the start of 2017, oil is up 18% (logarithmically), copper 15%, iron and steel 10%, and lumber 18%.

100 times the difference in the natural logarithm in month t and the natural logarithm in Jan 2007 in the spot price of West Texas Intermediate (WTISPLC) and in the producer price indexes for copper, iron and steel, and softwood lumber.

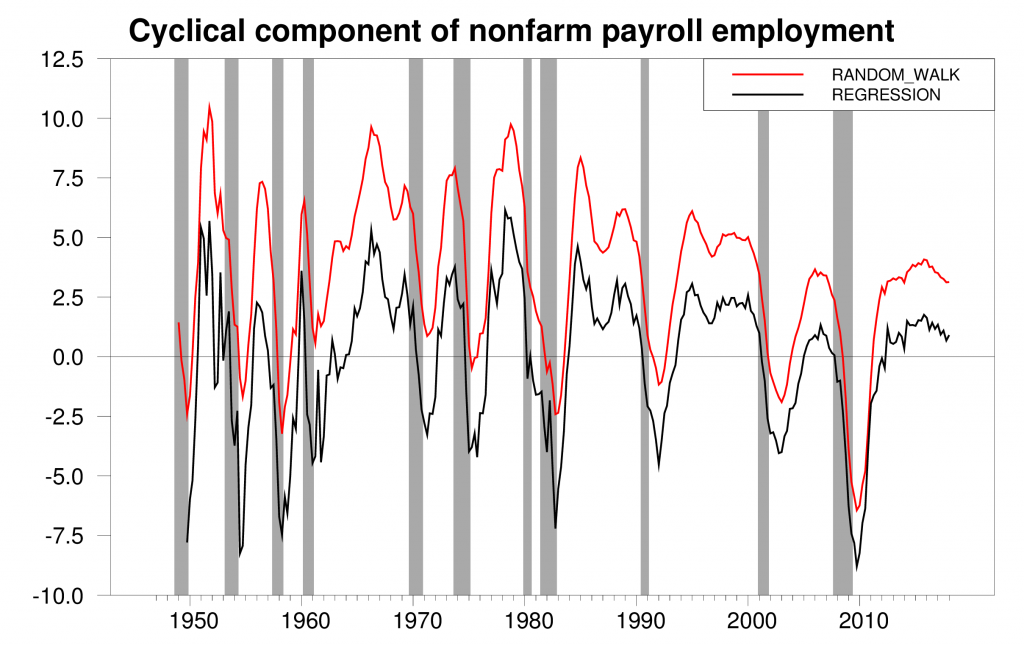

There’s one other aspect of the recent BLS employment numbers I’d like to mention, and that is the nonfarm payroll counts from the BLS’s separate establishment survey. I was interested to update my calculations of the cyclical component of this series, shown in red and black in the graph below. The cyclical component typically starts to turn down several years before a recession. And it’s now started to turn down.

So let me return to the question I posed in the title. Is the economy overheating? My answer is no. But the Fed better keep an eye on the stove.

A conservative estimate is there remains substantial slack in the labor market. Over the 10 year period 2008-17, we added an average of 78,000 jobs per month.

However, we needed up to 159,000 jobs per month to keep up with population growth, subtracting retirements, and adding discouraged workers (or those expected to re-enter the workforce, if the “recovery” wasn’t so weak).

The conservative estimate, based on 100,000 jobs per month over the 10 year period, means we needed 2.6 million more jobs through 2017. So, at least, an additional 2.6 million jobs, above the 100,000 per month, is needed in 2018 and beyond to reach full employment.

This year, in January, we added 239,000 jobs; in February, added 324,000 jobs; and in March added 164,000 jobs, all well above 100,000 per month. Wage pressure remains subdued.

if the economy is overheating then wages would be surging. It does not appear they are.

This leaves me perplexed. What is happening in your land?

@ Not Trampis

1) Oligopoly power 2) crushed unions 3) corporate lobbyists 4) captured regulators 5) “Citizens United” ruling 6) Republicans over 37 years starving public education of funds/resources which makes for a very dumb electorate 7) District Attorneys and State Attorney Generals refusing to prosecute white collar crime because the same criminals funded their run for DA/State Attorney General and then there’s…….

I could go on, but at some point you’d assume they’re injection McDonald’s hamburgers with a drug which has made all Americans masochistic.

Moses, your reference to McDonald’s hamburgers brings to mind Peter Schiff’s take on the economy: https://seekingalpha.com/article/4170368-peter-schiff-look-mother-busts?ifp=0&utoken=df4498533d05f10a9a0af277ff1807d5

“According to that (Big Mac) index, the US economy is smaller today than it was back then (pre-recession) because it’s worth fewer Big Macs. So, if you just figure out how many hamburgers the US GDP can buy today versus what it bought when the recovery began, we buy fewer. And what that means, obviously, is the price of a Big Mac has gone up a lot faster than the US GDP. And I think that Big Mac gives you a pretty good estimate of the overall rate of inflation.”

“The Big Mac doesn’t lie. The price is the price. You can see, the hamburger ain’t changing. So, what’s changing is the cost of creating it and that’s because the value of our money is going down. That’s because we have inflation.”

Of course, Peter has his own agenda.

I do not eat Big Macs so I do not care if its relative price rises. I guess Peter only consumes Big Macs since he wrote such a bizarre statement.

“Peter Schiff: Look Out For The Mother Of All Busts”. I just wasted my time reading this really dumb discussion. Please do not link to this stuff again as reading it only makes us dumber.

Bruce – your source presented no figures so permit me to do so. Over the last decade the CPI rose by 16.9%. I just went to the Economist and they say Big Macs cost $5.28 now as compared to $3.57 a decade ago – a 47.9%. Like I said the relative price soared. If Peter Schiff thinks this is the right way to measure the cost of living – then he is really a very stupid person.

Googling Peter Schiff on monetary policy:

https://www.google.com/search?ei=iFjvWoeOMcPq_Aajw66gBA&q=peter+schiff+monetary+policy&oq=peter+schiff+monetary&gs_l=psy-ab.1.0.33i160k1.2065.10997.0.13022.9.9.0.0.0.0.109.741.7j2.9.0….0…1c.1.64.psy-ab..0.9.738…0j0i67k1j0i20i263k1j0i22i30k1j33i21k1.0.OITSiWfNDvw

Fair warning – Schiff is your standard gold bug nut case. His other views of to the right of Paul Ryan and Rand Paul. Why Bruce Hall thinks anyone should consider his batsh^t insane ideas is beyond me/

As I wrote in my first comment: Of course, Peter has his own agenda.

It was more about Moses’ reference to Big Macs than taking Peter seriously.

“Of course, Peter has his own agenda.”

and he should NEVER be referenced on an economics blog, whatever the reason.

NT, two things come to mind to explain what is going on.

1) Peak’s answer re: slack in the labor force is real

2) Lag – how long for jobs to go unfilled before employers raise wages.

If you were here you would see much turn over in lower paid jobs, many hiring/help wanted signs, and an increase of upwardly mobile job hopping. Job hopping was discouraged by the recession and Obama’s anti-business policies. Because of this lowered job hopping, employers were able to hold wages down. A recent example was the slow pick up experienced players in US Baseball: ” Maybe 2018 will feel less like MLB’s owners are colluding” https://www.sbnation.com/mlb/2018/1/2/16840430/mlb-free-agent-rumors-offseason

This is just one example of what MAY have been going on with jobs.

MLB owners have been playing this game since baseball began but I doubt many would worry too much about how Bryce Harper is underpaid.

Pgl again in his zeal to make another meaningless point claims: “… I doubt many would worry too much about how Bryce Harper is underpaid.” Bryce Harper? Who even mentioned Harper who is not a free agent. Also, it is a rare season when the star “free agents” have not been signed by Spring, but that’s what happened this year. For example Arrietta didn’t sign with Philly until ~1 month after Pitchers/catchers reported for Spring training camp. That is a relatively rare event for that caliber of talent to be signed that late.

Why did you ignore my two points which directly address your later comment re: “Some economists are noting the Labor Force Participation Rate…”?

Most baseball players are well paid. So why did YOU single this group as exemplifying the plight of labor?

Pgl, I see lost the bubble again in his zeal.

The key in my view is the employment to population ratio which fell from 60.4% to 60.3%.

The last graph with the two red and black lines is pretty powerful empirical stuff if you ask me. I would say “nerd p*rn” but I’m afraid Menzie’s Mom reads her very cerebral son’s blog sometimes (friendly joke). I tend to think this plays right into Paul Krugman’s and Larry Summers’ ( ick!!! Am I actually referencing him?!?!?!?! ) argument on “secular stagnation”.

No big surprise, the Krugmeister himself has a related post:

https://www.nytimes.com/2018/05/04/opinion/is-the-great-recession-still-holding-down-wages-wonkish.html

I’m assuming there will be “a bevy” of similar posts in the blogosphere over the next week. If I see 3 or 4 pearls I will put the links in this thread or any related Menzie posts. Thoma’s blog is also a good place to hunt stuff out.

Employment at be,low 4% is not consistent with Secular Stagnation however Kruggers explanation is somewhat although it still being influential with Unemployment below $% is somewhat problematic.

It is wages f growth that Central Bankers worry about otherwise inflation will not rise substantially at all.

Was Marx right in a wrong sort of way?

The Labor Force Participation Rate (a dead horse I have been beating to death for awhile now, holding an MLB specs aluminum bat, looking askew at other observers’ blank faces as blood spurts out of the horse’s head) plays stronger into this than either Krugman or Chinn are apparently willing to admit. And I don’t know why economists want to ignore this number, other than the fact that if they call attention to the LFPR it forces economists to admit the official unemployment rate is largely bullcrap–which very few “professional” economists want to do.

I’m feeling a little dumb. Thought I read that pretty well and just noticed it was Hamilton and not Menzie. I’m assuming their opinions are pretty close on this topic, but if I attributed any opinions to anyone they didn’t have I apologize.

Some economists are noting the Labor Force Participation Rate which declined from 63% to 62.8% last month:

https://fred.stlouisfed.org/series/CIVPART

This rate is not going to bounce back to 67.3% (early 2000) but why it seems stuck at 63% is the big debate.

The interesting part about the LFPR is the shift in the demographics: https://www.bls.gov/emp/ep_table_303.htm . By 2026, it is estimated that the participation rate among those over 65 will be nearly double that in 1996. Conversely, the rate among 16-24-years old drops from almost 2/3 toward 1/2, probably because of the emphasis on graduating from high school and going to college (where they can accumulate massive debt).

It seems the older folks are finding it necessary to work longer as private pensions (as opposed to government pensions) have been phased out, healthcare costs have increased, Social security payments haven’t kept up with inflation for the goods/services the older buy, and they are living longer which depletes their savings.

So, is the economy overheating? From a LFPR perspective, the answer is “it depends.”

Demographics explains half of the decline in LFPR but that’s it. It would be around 65% if we were at full employment.

BLS is forecasting a really low LFPR for the 25-54 crowd. I do not see the logic in this forecast.

A lot of contradictions here. If 16-24 year olds are accumulating a lot of debt in order to afford college, then someone has to buy that debt. In just about any flavor of a life-cycle model that “someone” would be current period workers saving for their retirement. Put another way, it’s those 16-24 year olds who are providing retirees with the economic assets needed to carry them through retirement. And of course going to college improves the quality of the labor force, which improves productivity, which helps finance future retirements.

And I’m afraid my conservative friends are not always consistent with regard to SS and inflation. On the one hand we have conservatives complaining that SS is a bad deal and should be replaced by a privatization scheme because SS benefits are too miserly and don’t keep up with inflation. But then we have those same conservatives arguing that the SS inflation formula is too generous and should be replaced with a chain index formula. This was pushed by Bush 43 and the congressional Republicans. And then we have the conservatives who complain that the interest on SS Trustee Bonds is too high and should be reduced. I really don’t see how over the years the very same people (some of whom post here regularly) have, from time-to-time, made all of those arguments without ever seeming to recognize that they’re all contradictory.

BTW, government pensions are being phased out as well. And it’s not entirely true that people are living longer. Today’s downscale white male will not live as long as his father, per a famous and recent study by Nobel laureate Angus Deacon.

2slug, I suggest you read the SSA take on it, even if it is a few years old: https://www.ssa.gov/policy/docs/ssb/v72n1/v72n1p59.html

Don’t presume it is simply my “conservative” take. Are you arguing that the SSA is disregarding “those 16-24 year olds who are providing retirees with the economic assets needed to carry them through retirement“? The fact is that the retirees are working more rather than buying up the debt of 16-24 yr. olds and sipping their brandy at the club.

Also, it is not politically correct to say that the privileged, white males are facing a future less privileged and long than their fathers. We need our scapegoats.

Those would be among the same conservatives who supported Bush’s plan to privatize SS by borrowing an additional $4-5 Trillion? The same privatization plan that was largely undone by congressional….Republicans?

Bruce Hall I’m afraid you have badly misunderstood what I was saying. You really should try and understand how a life-cycle model works. Also, I didn’t say privileged white males were facing lower life expectancies, I said downscale</b white males were facing life expectancies less than their fathers'. Here's the famous Angus Deaton paper:

https://www.brookings.edu/wp-content/uploads/2017/03/6_casedeaton.pdf

2slug,

Didn’t you know that all white males were privileged? https://www.huffingtonpost.com/rev-dr-john-c-dorhauer/an-open-letter-to-white-m_b_7857790.html

So, even “downscale” white males are privileged even if they are living shorter lives than their fathers. You need to keep up with the latest accusations.

Menzie

I swear by the contents of the comments, no one read your post. I did, and found it quite well done. I am curious what you would see as indications of over-heating, since so far it is not there. Continued unemployment % reduction, rising inflation that either the FED has trouble containing or makes surprise rate increases, continued or faster wage growth, continued or accelerated commodities rising price? A combination?

Ed

Ed Hanson Menzie didn’t write this post; JDH wrote it. So given that you got the authors confused, you’ll forgive me if I question your interpretation of what other posters were saying. I suspect that they did read JDH’s post. I also thought it was pretty clear that JDH did not say that the economy was overheating, but that the cyclical component (as opposed to the trend and irregular components) of non-farm payroll was beginning to flash an amber warning sign. It’s true that so far there isn’t a lot of wage pressure, but some of that weakness could be do to an increase in monopsony power in labor markets: http://www.nber.org/digest/may18/w24307.shtml.

So even if there isn’t strong upward pressure in labor inputs, there is some evidence of upward pressure in other production inputs, such as commodity prices. And capacity utilization is around 78 percent, which approaches the 80 percent level that signals an overheated economy. Not there yet, but we could very well be there by the end of the calendar year, so the Fed is likely to take that into account in the August FOMC.

Slug

Just rack me up in the numbers that did not read the post very well. All you say is true but also none of indicators are not enough to determine a overheated economy. And certainly an overheated economy is not the worse thing ever, except that it may bring about those in power to decide that intervention is on their part is necessary and that is always a cause to be worried and watchful. So with apology I ask Professor Hamilton what he considers the level or combination of indicators that concern him about overheating.

Ed

Speaking of heating up – SNL nails the Michael Cohen, Rudy G., Donald Trump, and Stormy Daniels mess.

https://www.youtube.com/watch?v=K1K8s-tQGqY

We’re in a very unusual business cycle. We had a severe recession followed by a weak expansion that’s now nine years old. Perhaps, the question in the back of many people’s minds is how long will this expansion last? This may help explain why wage growth is low. Perhaps, it will also dampen capital spending. Although, expansions die from excesses rather than old age, a self-fulfilling prophecy may end this expansion. However, it may be a mild recession with a strong recovery.

There are some powerful and positive headwinds. We may get concessions from China on intellectual property theft and coercion to shift more production and exports to the U.S., the children of the Baby-Boomers are entering “prime-age,” and less regulation and lower taxes, particularly for corporations and small businesses, will drive stronger growth.

Meant tailwinds

Of course, the longest expansion was the 10 year expansion of the 1990s. It was a much different economy — the height of the Information Revolution, Nasdaq stocks rising to nosebleed levels, the Baby-Boomers at their peak productive years, oil declining to $10 a barrel — strong disinflationary growth. Old economic laws were obsolete in the “New Economy.”

seems to me the best thing for the Fed to do is to wait until inflation actually occurs, let it go for a short while and then bring it down by increasing interest rates

Some local overheating is going on. San Jose houses for example. I Zillowed my old, 1949, rental. $1.7mil!!!! Unpossible. This thing is going down I tell yah!!!

This is a little off-topic, but the last time I looked at the unemployment rate history it was to check the CBO’s 10-year projection, which shows the average 10-year unemployment rate falling to an all-time low of 4.4%. That’s a level that’s only ever been reached once before, in the first 10 years of your unemployment rate chart, which means it depended on conscription. (The lows in the early ’50s and late ’60s have a lot to do with the Korean and Vietnam Wars.)

Since you’ve written about the CBO’s debt projections as well, here’s a link that ties the two together for anyone interested – it shows what might happen to debt-to-GDP ratios if the CBO continues to underestimates future unemployment as it has in the past.

8 Things To Know About Last Week’s CBO Report

I think your analysis is about right. Might not be quite that bad, but say, 108-110% of GDP in not out of the question.

Personally, I think there is a Kansas moment in there somewhere, maybe around the next recession. I think we move off the trajectory at some point, but until then, I think your analysis largely aligns with my own feelings.

Daniel

I too like most of your analysis. I especially like your more realistic observation of how the appropriators will likely spend more than less. And besides realistic, it pinpoints, even more than you allow, the real cause of deficits and the mounting debt. In the past, the spenders relied on FED to mitigate the debt, at least short term, by raising the inflation rate, reducing the cost of old debt, and at the same time causing tax rate increases by bracket creep. The FED seems to have learned its lesson, and many taxes are inflation adjusted today. The loss of such mitigation does not seem to effect the appropriators.

About the only major disagreement I have is with GBO GDP projections. What we have in common is the observation of how often they are terribly wrong. This is how I see it and it is limited to the last decade or so. As you report, the CBO GDP forecast during the President Obama years was consistently wrong and too high. That is quite true. But I have observed a remarkable change. The CBO has already demonstrated how wrong it can be in forecast, but now the CBO has consistently too low. I don’t believe this is from political bias but from over dependence on Keynesian type demand-side economic theory. These type of theories do not have a good record during volatile swings of the economy. Also these type theories are uselessly bad forecasting GDP change from supply-side tax and regulation changes. I would adjust your debt forecast by a greater GDP average through the years.

Ed

If you look at the old measure of average hourly earnings of non-supervisory workers rather than the new measure of all workers you get a different picture of wage pressures. That measure shows wage growth in a clear up trend. Moreover, the three month growth rate ( SAAR) has been stronger than the Y/Y percent change since January, 2018.

You would think the divergence between the old and the new measure of wage growth would get more attention.

Spencer England thinks he has the answer at Angry Bear. The last three months shows wages are on the increase as you would expect them to be.

aggh, He said it here.

What a dope ( that’s me not him)

Trump’s economy swamp 😉 earlier versions.

“The federal government took in a record tax haul in April en route to its biggest-ever monthly budget surplus, the Congressional Budget Office said, as a surging economy left Americans with more money in their paychecks — and this more to pay to Uncle Sam.

All told the government collected $515 billion and spent $297 billion, for a total monthly surplus of $218 billion. That swamped the previous monthly record of $190 billion, set in 2001.

CBO analysts were surprised by the surplus, which was some $40 billion more than they’d guessed at less than a month ago….”

https://www.washingtontimes.com/news/2018/may/7/cbo-says-april-was-best-month-history-us-budget/

The same effect is going on in most state level revenues. What was it you guys said was about to happen earlier in the year?

Overheating? No, but catching up to where it could have been. If Trump avoids Bush’s bad luck, book end recessions, and the 1st is already passed, then Trump’s policies will be vindicated.

@CoRev,

A bit of the surplus was that check I mailed on 17 Apr. While DoD withheld payment on broke F-35’s reduced cash tossed to the trough.

A lot of other folks miss calculated their 2017 taxable……….

Good luck in Seattle losing orders for 30 737 Max……. and another order for 60 jets!