I keep on hearing about the supply-side miracle associated with the the Reagan era tax cuts. What do changes in estimated potential versus actual output suggest?

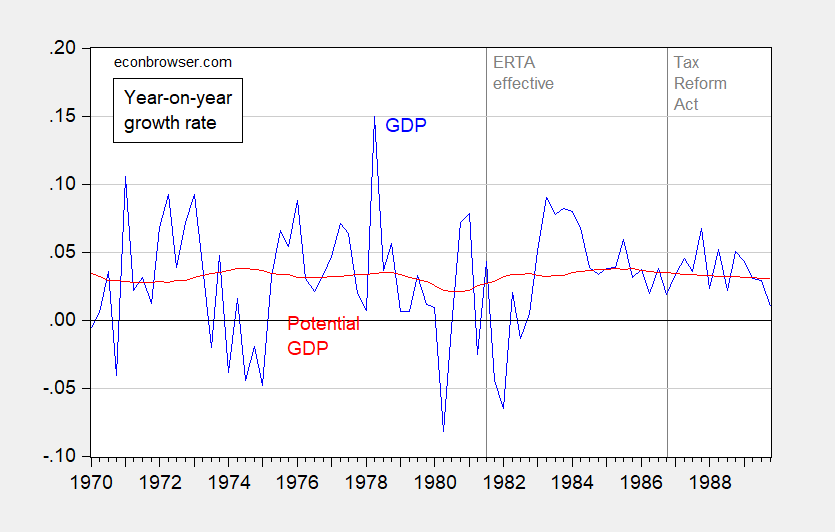

Figure 1: Year-on-year growth rate of real GDP (blue), and of potential GDP (red), calculated as 4th differences of logged values. Dashed lines at effective dates for Economic Recovery Tax Act of 1981 and Tax Reform Act of 1986. Source: BEA, CBO.

The variation in actual output clearly exceeds that of potential GDP, suggestive of a nonvertical aggregate supply curve. (It’s also interesting to see that potential GDP growth was accelerating before the enactment of the first Reagan tax cut; it also decelerated after the 1986 Tax Reform Act.)

Now, it could be that CBO mismeasured potential GDP. Is there another way to determine whether supply side or demand side effects dominated? The answer is yes: examine the covariation of the price level and output.

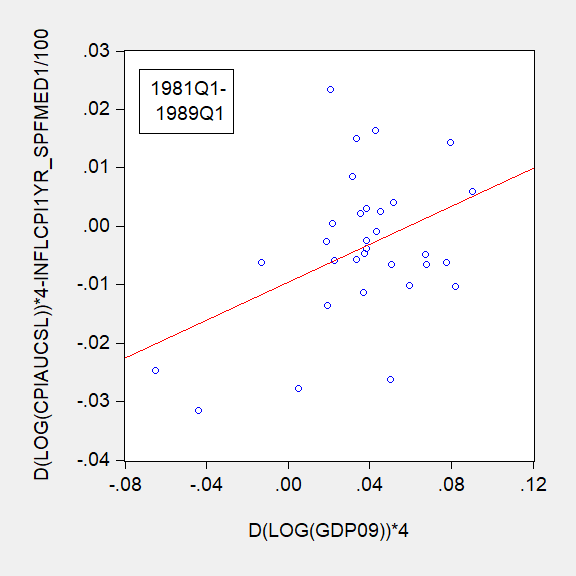

Consider first what inflation adjusted by expected inflation did, vs. GDP growth.

Figure 2: Q/q annualized CPI inflation minus expected one year CPI inflation versus q/q annualized GDP growth, 1981Q1-1989Q1. Source: BLS, BEA, Survey of Professional Forecasters, and author’s calculations.

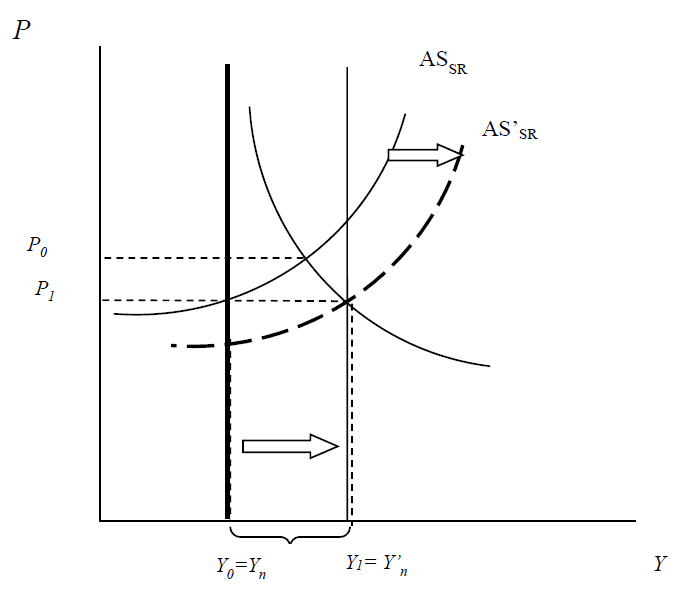

Notice the upward slope in the scatterplot. Now, second, consider what the pattern of observations would be if the supply side scenario of an outward aggregate supply curve shift occurred (Figure 3); potential GDP Yn increases to Y’n.

Figure 3: Rightward shift in long run aggregate supply curve.

The observations would line up along a downward sloping line, corresponding to movement along the aggregate demand curve.

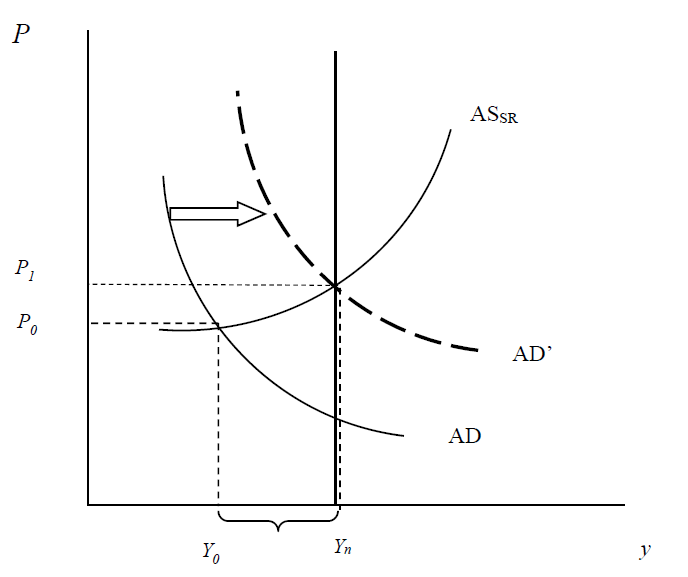

Third, if the aggregate demand curve shifted, it would trace out an upward sloping line, corresponding to movement along the short run aggregate supply curve, as shown in Figure 4.

Figure 4: Rightward shift in aggregate demand curve.

This set of outcomes does not deny the existence of some supply side effect — the dots in Figure 2 don’t line up exactly on a straight line — but the overall pattern seems to be more consistent with an AD shift from the tax cuts and spending increases (combined with monetary policy relaxation) as opposed to a supply-side scenario as laid out by Wanniski and Laffer.

Things to keep in mind as we consider the likely consequences of the Tax Cut and Jobs Act.

Update: Bruce Bartlett, who was there at the inception, reminds me of Barry Ritholtz’s review of Reaganomics. See also Bartlett’s piece on the subject.

“This set of outcomes does not deny the existence of some supply side effect”

There was a supply-side effect in the sense that the fiscal stimulus lowered national savings and investment – a negative supply-side effect. Which is why potential output growth fell from 3.5% to only 3%. And yea – the overall change in actual output over the 1981 to 1992 period was also only 3% per year.

Don’t believe me. Republican economist Greg Mankiw explained it all in his first macroeconomics textbook.

The argument for the 1981 tax cuts that supply siders were making before the tax cut was enacted was based on three testable claims:

1. The substitution effect would dominate the income effect and labor effort would increase.

2. Personal and national saving would increase.

3. The tax cuts would pay for themselves.

How did those three claims pan out?

1. Average hours worked per week actually fell slightly.

2. The personal saving rate declined and deficits increased, so national saving fell.

3. The deficit sharply increased, as did the debt held by the public as a percent of GDP.

Those were three clearly stated predictions from supply side advocates. All three predictions failed badly. Anyone who still believes in the supply side legend is either gullible or a hypnotized Fox Noise viewer. Oh wait, there’s no difference between the two.

Excellent summary. We should also note that the real interest rate rose dramatically as the fall in expected inflation (ala Volcker) was much greater than the fall in nominal interest rates. Yes the reduction in national savings did reduce private investment. We also saw a massive US$ appreciation which led to a rather large trade deficit. These are all facts. That Kudlow, Laffer, and Moore ignore these facts demonstrate either they are incredibly stupid or they are incredibly dishonest.

So, there were appropriate adjustments, like tightening the money supply and raising taxes to slow the economic boom, and some of our trading partners selling dollars, when the dollar appreciated too much. The fact is it was the beginning of the long boom, from 1982-07. You can praise Reaganomics later.

A worker, who gets a raise in disposable income will unlikely tell his boss he wants to work fewer hours. And, it’s typically high marginal taxes that prevents working overtime. A more likely explanation may be women working less to raise their children. The Baby-Boomers entered their peak productive years in 1982 and lower taxes could allow wives to work fewer hours.

These two comments are all you got? Babble on!

What??? Thats totally wrong lol.

Under Reagan, GDP = consumption + saving rose. Of course, Reagan didn’t get the promised domestic spending cuts by the Tip O’Neill House, which added to budget deficits.

Huge tax cuts, ramping-up defense spending, and deregulation, along with optimism, generated a powerful V-shaped recovery — it was mostly Keynesian stimulus initially.

“Under Reagan, GDP = consumption + saving rose.”

Except this is just an incorrect equation. What happened to net exports? The role of the government. No wonder you write such stupid babble. You do not have a clue what a basic national income identity looks like.

Let’s do an example to show us how dumb Peaky’s latest is. Let Fred be earning $100,000 in 1980 of which $20,000 went to net taxes in 1980. Fred consumed $70,000 and saved $10,000. The next year thanks to the tax cut and tax planning that is WAY over Peaky’s head, his taxes were only $10,000 so he consumed $75,000 and managed to saved $12,000. Add it up and Fred’s income fell by 3%. But Peaky failed preK arithmetic and concluded his income rose from $80,000 to $87,000.

Yes – Peaky has never had a clue!

Pgl, you’ve shown you do an excellent job proving you’re dumb.

I said under Reagan, GDP = consumption + saving rose, which is the case when there’s a substantial increase in (real) GDP growth. Under Reagan, output = GDP = income didn’t fall – it rose at a much faster rate.

And, if Fred pays $10,000 less in taxes, his disposible income increased by $10,000, which he’ll either spend or save (I doubt he will burn 3% of his income).

“I said under Reagan, GDP = consumption + saving rose”

Except for the fact that GDP = consumption + savings + taxes. So you are so dumb that your preK teacher has given up on you.

slug

1. Unlike the 1970’s which saw substantial decrease in average annual hours worked, from the worse of the recession (1982) through 1989 saw a generalize rise in hours worked.

2. Your claim about savings rate is dead wrong. Supply-side policy, at the margin, is intended to increase resources taken, some from savings, some from loans, and some from human capital, and be put at greater risk due to the expected greater rate of return.

3. Your claim is partly true and partly false. Supply-side policy did bring claims of paying for themselves at a faster rate than history shows. The learning curve has shown us that the time period is longer, and was the basis, among other changes for eventual balanced budgets in the late 1990’s. You are partly false because the substantial cause of the deficits was the result of the increased spending by the appropriators in Congress. I remind you of three things, the fictitious promise of the democrats to cut spending, Tip O’neill quote “dead on arrival” of the Reagan budget proposals, and the important and necessary defense budget increases.

Ed

Man, Trump being successful must really frighten you liberals. Federal revenues set a record, unemployment is reduced at records set decades or never before. Minorities are beginning to awaken to these facts. Trump’s popularity if rising in spite of ~90% negative press, and his foreign policy is already more successful than Obama’s and perhaps other presidents.

Just think we could have had Hillary, and she too would have had successes, but what would they have been?

“Federal revenues set a record, unemployment is reduced at records set decades or never before. ”

Wow – even dumber than PeakyBoo. Federal revenues in nominal terms over time??? Have you not learned a single thing here?

BTW – the reason the unemployment rate is lower is that the labor force participation rate fell. Employment/population fell to 60.3% last month.

Yep – you have not learned a single thing here. Damn!

Pgl, if you want to contradict US Dept of Treasury on how to do accounting, go for it! But, here’s a little hint: total revenues in minus expenditures equals deficit for any period measured in a fiscal year. I know that simple grade school math does not compute for you educated economist,, but it is that simple. I also note you did not dispute any of the record claimed just waffled about why they happened.

I’ll repeat: Man, Trump being successful must really frighten you liberals.

It was certainly a fiscal stimulus but Keynesian it was not. No liquidity trap to be seen at all. Keynes would have said no stimulus except that by automatic stabilisers. Leave the heavy lifting to monetary policy which Volker was in the process of doing.

Indeed a Keynesian would argue against the large increase in the structural deficit.

On supply side Slugsy has beaten me to it.

Supply side economics, e.g. reducing business and personal taxes, less regulation, and fewer unions lowered production costs, facilitated business start-ups and expansions, and raised compensation.

Supply side economics helped generate the V-shaped recovery, the longest peacetime expansion in U.S. history (up to that time), and strong per capita real GDP growth of 3.14% on average in the 1982-90 expansion.

“facilitated business start-ups and expansions, and raised compensation.” More babble.

Yes consumption rose aka a reduction in national savings which raised real interest rates and LOWERED business investment. Stop babbling and learn basic economics.

I recall, working in a union — the CWA. My union co-workers would tell me not to work so hard, because it made them look bad, although, I don’t believe I was working that hard. It seemed, some would purposely make mistakes to justify the hours they worked. Moreover, many would drink alcohol at lunch. I felt, I was in an episode of Barney Miller working there. However, the pay and benefits were great, including picking any dentist to see with only a $5 co-payment for anything, like a root canal and gold crown. Also, I learned, most of the workers were Democrats and almost all were white. There were very few black people and no Hispanics!

PT: Your extensive union expertise portends plenty of trouble for Trump’s wall building. Based on your experience, we can expect lots of slowdowns from all the union guys (and women) who will have jobs building it. (After, of course, plenty of court battles and eminent domain proceedings). But the thought of all those Teamsters, Heavy Equipment Operators, , Iron Workers, Pavers (plenty of new road will be necessary for Teamsters to deliver all necessary materials), and laborers in general purposely working slowly (especially when temps reach 110–or more– in the desert summer) suggest a completion date sometime in the late 20’s or early 30’s.

Last I saw, entry scale union laborers employed on public works projects earn $35/hour plus benefits. And this will be a BIG public works project, the biggest, best, and most beautiful ever, believe me. Skilled workers, of course, can earn more. And I seriously doubt the Trumpers will want to mess with those union members from the Midwest and Pennsylvania–those lazy white former Democrats you describe– who may well have provided their victory margins in 2016.

With unemployment numbers approaching all time lows, simply getting enough workers will be interesting, made worse by all those lollygaggers who want big money but don’t want to work for it. Well, there’s hope. There will be plenty of those immigrants–undocumented of course–who’ll work for lots less. But they can sleep four or five to tent and…..

“Supply side economics helped generate the V-shaped recovery”

How much stupidity can be packed in such a short sentence. Supply-side deals with potential output. Recovery refers to actual output getting back to potential aka Keynesian economics. Except it was not the Reagan fiscal stimulus as much as it was Volcker’s FED (see Ed Hanson’s comment below).

C’mon Peaky – we get you have no clue what you are babbling about. But do you have to make it so incredibly obvious?!

Pgl, you certainly pack a lot of stupidity, along with lots of ignorance, with your ridiculous statements.

The powerful effect of Reagan’s expansionary fiscal policy, with supply side economics, overshot the recovery.

The Reagan recovery was so powerful, the Fed had to tighten the money supply, to slow the economy.

“The Reagan recovery was so powerful, the Fed had to tighten the money supply, to slow the economy.”

We have a winner for the dumbest comment EVER! I guess you missed the 1981/82 recession in its entirety. And monetary policy turned expansionary when the economy bottomed out in late 1982.

Hey Peaky – please stop trying so hard. You have won the Crown of Stupidest Man Alive! Donald Luskin will just have to try harder.

I suspect, potential output was much lower in the 1973-82 long wave bust period, similar to the 1930s and 1870s, when average per capita real GDP growth averaged only 0.98%, in that 10 year period. Also, quality improvements may have been overstated compared to prior and subsequent periods.

Pentagon trough filling is part of a Keynesian stimulus just there are so many better ways to stimulate an economy. Like not allowing highway bridges to corrode and exceed spec’ed age………….

In the early 80’s I transitioned from maintaining combat readiness for AF weapon systems to the buying side, the maintenance stuff for new systems. One observation of ’85 when I got in to program management: we could not spend fast enough. In one case our office saw no sense in spending for a new project and were going to let the money “lapse until OSD wrote a letyter to my boss directing we buy the nearly useless equipment.

It was not as wasteful as buying 100 B-1 bombers which had no use nor much successful testing. Come to think of it no major system designed since Reagan has been good as F-16 and A-10, I was Air Force. And F-16 and A-10 like most modern weapons were quite far expensive to run than expected. Peacekeeper a MIRV’ed ICBM the rage of the pentagon trough has been retired for years. The multiplier for war spending is not so good, however, unlike the war to support Sunni terror most of the Reagan trough money was spent here not for contracted third nation combat support contracts where only the profits come home.

I have come to agree with Thomas Wood (and Frederic Bastiat) , war spending is almost always a drag on the economy hosting the pentagon trough.

New “defense” build up.

Sixteen years after W Bush’s massive pentagon spending spree with a couple of years of the “base” imposed “sequestration” slowing the rate of flow into the pentagon trough Trump is going full up Reagan starting from a much deeper trough. Yuuge!

https://www.defensenews.com/breaking-news/2018/02/07/congress-reaches-budget-deal-with-huge-defense-boost/:

“Senate leaders have reached a two-year deal that would set defense spending at $700 billion for 2018 and $716 billion for 2019.”

Authorization bill: tells the appropriation committee what the pentagon is allowed to spend. See the raise the army section of legislative part of US constitution.

“The caps, excluding OCO or Department of Energy funding, limit the Defense Department’s base budget to $549 billion for fiscal 2018 and $562 billion for fiscal 2019.”

Will it be enough to occupy Iran?

“One of the most curious and least edifying sights in the Reagan era was to see Reaganites completely change their tune of a lifetime. At the beginning of the Reagan administration, the conservative Republicans in the House, convinced deficits would disappear immediately, received a terrific shock when asked by the Reagan administration to vote for the usual annual increase in the statutory debt limit. These Republicans, some literally with tears in their eyes, …were doing it just this once because they trusted Ronald Reagan to balance the budget from then on…..The rest, alas, is history and conservative Republicans never saw fit to cry again. Instead they found themselves adjusting rather easily to the new era of huge permanent deficits…”

Murray N. Rothbard, “The Myths of Reaganomics”

It didn’t take long to see that Reagan proved deficits–thank you, Lafferites– don’t matter. Or rather they didn’t until Jan. 2009.

https://www.youtube.com/watch?v=uhiCFdWeQfA

Professor Chinn!!!!!!! [waving arms vehemently in the air] Professor Chinn!!!!! [exasperatingly sighs in frustration] Professor Chinn!!!! [fires a flare gun inside the classroom, igniting the ceiling tiles]

https://youtu.be/XchwE9zVdnw?t=1s

Keynesian Stimulus!!!!!

Well, leave it to PeakTrader to entertain us with his spasm of ad hoc after-the-fact rationalizations. Poor deluded fella, he doesn’t have a clue. What we are treated to is all kinds of “long wave” mumbo-jumbo; measuring average GDP from trough to peak; avoiding the main question, which was why potential GDP didn’t respond as promised; refusing to acknowledge that the three explicit predictions from supply siders failed to happen; etc. I can just picture the pathetic creature at the Church of the Holy Supply Sider genuflecting before the statue of St. Ronnie while desperately clutching his rosary and reciting the Laffer Prayer. So sad.

Every economic expansion ends in accelerating inflation and monetary tightening. However, supply side economics has a lasting effect in generating greater output.

Unfortunately, in the Obama years, Obamacare reduced middle class discretionary income, Dodd-Frank made it harder for many households and small businesses to borrow, excessive regulations were destructive to businesses, including smaller banks, along with more legal challenges, greater progressive taxes dampened growth, wasteful spending, with high government debt and large budget deficits, continued, and just too many other dumb policies, like Cash-for-Clunkers — paying people with their own tax money to destroy their cars and driving-up used car prices.

It’s no wonder average per capita real GDP growth was only 1.40% in 2009-17, after a severe recession.

“Every economic expansion ends in accelerating inflation and monetary tightening. However, supply side economics has a lasting effect in generating greater output.”

Seriously? Do you even know how to read? Look above. The supply side effects were negative. Less business investment and even as YOU stated – less labor supplied. So with less capital and less labor – only an upside idiot could talk about positive supply side effects.

Let us know when you stop walking on your head!

Pgl, you don’t know what you’re talking about, as usual. There was much greater employment in the labor intensive and capital abundant economy.

Do you have a quota – three dumb comments per minute. You’re doing great with that one!

Menzie

First, I would thank-you for your Fig. 1 above by including the 1970’s, as it is critical to the understanding of the 1980’s. As can easily be seen, the volatility of GDP growth rate was extraordinary, I would describe it as seesaw. A brief history of some of the cause of volatility may be useful. The 1970’s was a time of testing the independence of the FED, which it did not exhibit much until Paul Volcker began exerting his authority both over the Board of Governors as well as to the political establishment in the face of the double-dip recession of the early 1980’s. Of course his authority was enhanced at the time because he had President Reagan complete backing to reign in the growing inflation.

President Nixon is famous for the pressure he placed on the Fed pre-election not to tighten, as he had always blamed the tightening of the Fed for the cause of his loss to President Kennedy. Post-election, this soon brought on wage and price controls which the Congress gave the President the power to declare. The controls were supposed to be short lived, but were extended, until it became obviously clear that business had learned to work around the rules and demonstrating the failure of the policy. Watergate soon followed, which brought us the care-taker Presidency of Gerald Ford. During his time, the FED continues to fall up? the Phillips curve still attempting to reduce unemployment by pumping and increasing the inflation rate. The FED either ignored or did not believe what Friedman and Phelps demonstrated, any relationship between inflation and job growth ended when the public was no longer fooled, and began anticipating future inflation. If fighting unemployment was the goal, the FED failed badly, for from 1975 and on the unemployment rate was below 6% only once until 1987. The voters certainly saw the failure of government President Carter and chose a new direction by electing President Reagan in a landslide.

The FED accelerated inflation throughout the President Carter’s administration in its pursuit affect . This policy brought on a taxing event that should be noted on Fig. 1 above. The taxpayers suffered through bracket creep, an unlegislated tax rate increase, due solely to continuing inflation. The government and the political class took advantage of the over 2% increase in its take of GDP, spending liberally, but surprisingly, still unable to end the deficit. It took awhile but President Carter finally realized that the country was on the verge of uncontrolled inflation, and attempted to make a change. But unfortunately, his change was to appoint William Miller as FED chair. Realizing that failure lead to the very good appointment of Paul Volcker, but much to late in his term to help. Inflation, unemployment and finally, the Iran Rose Garden Strategy lead the country again to a change of direction, this time electing President Reagan.

One last thing needs to noted, the increase of Social Security contributions and the change of future retirement dates in the 1980’s should be included as a major tax event should be noted on Fig. 1.

ED

P.S. In an attempt to shorten the post, this brief history does not mention the recurring oil import crisis, nor the opening of diplomatic relations of Red China. Both these events greatly effected the future.

The economy indeed was driven by the FED. Both the 1982 recession as well as the recovery from that recession. PeakyBoy above got really confused in so many way here. He credited a Keynesian recovery driven by monetary stimulus starting in 1983 as if it were a fiscal driven supply-side effect. Then again PeakyBoy has no clue what any of these terms even means. That is what one gets when one thinks Fox and Friends is conducting economic classes!

the FED failed badly, for from 1975 and on the unemployment rate was below 6% only once until 1987.

Actually, the unemployment rate was below 6% a total of thirteen times between 1975 and 1987. All thirteen times were during the mid-Carter years when the Fed was running the economy hot.

https://fred.stlouisfed.org/series/UNRATE

slug

You seem to be awfully proud of what can be averaged up. But I guess a low of 5.7% works when grasping for straws. But in an era of your precious Phillips curve it is a terrible rate. Later on when after the devastation caused by inflation, the oil crisis, President Carter and then the fighting the FED tightening; coming down to below 6% was quite meaningful.

Ed

Ed Hanson Actually, the low was 5.6%, not 5.7%. And it was below 6% for most of the time when the Fed was running a loose money policy.

To the extent that the unemployment rates fell due to fewer structural and cyclical factors, that’s a good news story. To the extent that unemployment rates fell due to less frictional unemployment, that’s probably not a good news story because it suggests less labor mobility. In fact, one of the concerns that labor economists have with today’s exceptionally low unemployment rate is that it suggests today’s workers are less mobile than workers were 40 years ago. And there’s a lot of empirical evidence that tells us workers are less mobile…and that’s true across all age groups, not just older workers. That is one explanation for the disappointing productivity numbers we’ve been seeing since the early 2000s.

slug

Still looking for that leftist utopia, aren’t you. Well, it isn’t going to happen. Problems for people will always exist, even in good times. The best mitigation is getting away from those who try to control decisions and options of the individual and family. In today’s world that essentially means government, Federal, State, and Local. Each has control of too much resource and each attempt to dominate decision making. If you want wealth, if you want productivity, if you want diversity, return more power to the citizen.

Ed

It’s obvious from your reply that you have absolutely no idea what I was talking about. The giveaway is when you instinctively retreat into some ideological comment about freedom, big government, black helicopters, the deep state, blah, blah, blah. I probably should have linked to something from the labor economics literature, but I doubt if you would have read it.

2slugs, in the flavor of pgl, you’ve out done yourself with bias confirmation without evidence: ” In fact, one of the concerns that labor economists have with today’s exceptionally low unemployment rate is that it suggests today’s workers are less mobile than workers were 40 years ago.” My own empirical evidence, as shown by the yuge number of hiring/help wanted signs, tells my you are talking out of your lower orifice.

No reference, no definition and no caveats. Gotcha, you have even another opinion, and since it is your it is “the troof”.

CoRev

You want references? Fine. Here are a few:

http://www.nber.org/papers/w20065

http//www.nber.org/papers/w20479

https://mobile.minneapolisfed.org/research/wp/wp697.pdf

https://obamawhitehouse.archives.gov/sites/default/files/page/files/20161025_monopsony_labor_mrkt_cea.pdf

Take some time off and read them. We’ll be waiting for your review and comments. Let me know if you want more.

Eddie boy does not get that the natural rate is not constant over time. Who says so – Edmund Phelps … the conservative economist who invented this theory with Milton Friedman. We need better right wing trolls.

2slugs, I responded to you comment two days ago and it got lost. To summarize, you did your usual trick from changing a discussion from “unemployment” to “interstate migration”, and then trying to discuss that as an issue. Your never did answer: “No reference, no definition and no caveats. Gotcha, you have even another opinion, and since it is your it is “the troof”.” Job “mobility” does not require interstate moves.

Menzie

I am certain that some here read your Fig. 2 as intended, but it can be misleading. Just to be clear, inflation from 1983 through 1987 was fairly constant and not consistently rising. As well, the small increments of the vertical should be noted by all. Even assuming the BLS, BEA, Survey of Professional Forecasters were in the right ball park, the slope is quite small, and may not be a good measure for the subsequent supply curve nor the demand curve. Just too little change of a difficult measure.

In addition, it would be informative if a chart of the Fed Fund Rate could be included. It is quite closely related to the second dip of the recession, as well as the subsequent taming of the inflation cycle. The use and extent of policy by the FED give credence to its new found independence.

Ed

PeakTrader keeps spinning wild theories. Reminds me of Ptolemy and cycle, epi-cycles, epi-epi-cycles, etc. all in a vain effort to continue believing that the sun revolved around the earth.

Ed Hanson What? No comment about the potential GDP graph? After all, supply side economics was supposed to increase the growth rate of potential GDP. That clearly did not happen.

2slugbaits, I agree, politically biased nonsense is clear to you.

Did you see Peaky’s comment “I recall, working in a union — the CWA …”

I’m worried that he has truly gone insane.

slug

As you know potential GDP is a Keynesian (New and Old) calculation which can not be claimed as accurate for any time until years later. Any use by the FED and budget designers is at best tenuous in real time. The question for you Keynesian is did the output gap close on the with the potential calculated at the time.. Personally, I have no idea if it did so, but really do not care. The actual high and sustained GDP growth during the Reagan years is the better measure of the time.

Ed

Ed Hanson: Who said potential GDP is a Keynesian calculation? I have to revise my textbook draft. I have to also tell Blanchard, Mankiw, Dornbusch, Hall, Taylor, et al. to revise their textbooks.

Please, please, please, if you’re planning to post more, read an intermediate macroeconomics textbook sometime…

Menzie It might be a little hard for Rudi Dornbusch to revise his textbook. :->

2slugbaits: Sad, but very true, point … but Stan Fischer can do it.

Krugman might help Fischer with the edits – once he gets over laughing at the idea that only Keynesians care about potential GDP!

Menzie

I suspect you are right, I should have said New and Old Keynesian used output gap in calculations.

I got this from a quick read of the following Economic Synopses from William T. Gavin at FRED.

https://research.stlouisfed.org/publications/economic-synopses/2012/04/20/what-is-potential-gdp-and-why-does-it-matter/

The article spends sometime discussing the difficulties caused by contemporary CDP potential measurement, this for 2009 to 2011. In this case:

https://research.stlouisfed.org/publications/economic-synopses/2012/04/20/what-is-potential-gdp-and-why-does-it-matter/

“Continued moderate growth of GDP is forecast over the next few years. In the minutes of the January Federal Open Market Committee meeting, the participants projected, on average, that real GDP would grow about 3 percent over the next three calendar years. This growth rate is too slow to get GDP back to current estimates of the trend. If the projections hold true, the estimates of the level of potential GDP will fall even further. This pessimistic outlook is also supported by Keynesian (and New Keynesian) theory, which predicts that a negative output gap should lead to falling inflation. But instead, we have seen a modest rise in inflation.

If the theory is correct, the gap may be closing faster than we thought because potential GDP is lower than we thought. And, if potential GDP is lower than expected, then interest rates may have to rise sooner than expected to prevent an acceleration of inflation.”

Sorry my quick read was than less than precise, but as I wrote, potential GDP measurement pales in comparison to actual GDP measurement.

Ed

Ed Hanson: Classical and New Classical economics allows for potential GDP. In New Classical models, an output gap exists, although will not typically exhibit much persistence.

Like I say, please, please, please read an intermediate macro textbook if you plan to keep on talking about macro concepts.

Potential GDP is not a conservative nor liberal concept. Oh wait – those Bernie Bros who hate Paul Krugman thinks it is some right wing conspiracy. So I guess Ed is the conservative wing of the Bernie Bro party!

@ Menzie

Don’t forget the guy who co-wrote my first college economics textbook— Alan Blinder. Where’s the LOVE man???

https://www.youtube.com/watch?v=tymWpEU8wpM

Ed Hanson Did you learn nothing from these exchanges?

did the output gap close on the with the potential calculated at the time.. Personally, I have no idea

Then scroll up to the first graph. The answer is literally in blue and red.

The actual high and sustained GDP growth during the Reagan years is the better measure of the time.

And if you only want to look at growth rates of real GDP, then you’ll have to explain why real GDP under Carter grew at almost EXACTLY the same rate under Reagan. In fact, the difference is literally a rounding error.

Finally all

this should be a good time to answer slug’s exception to my use of nominal GDP previously. I consider that calculation valid but slug may be right in that it seems to indicate higher wealth growth than it should. I only remind you all that we live in a nominal GDP and is still an important measure.

https://fred.stlouisfed.org/series/GDPC1/

Billions of Chained 2009 Dollars Seasonally Adjusted Annual Rate

1981 1st quarter 6635.726

1989 1st quarter 8697.711

2007 1st quarter 14375.018

2017 1st quarter 16903.240

2018 1st quarter 17385.831

Monthly GDP growth over the two terms of President Reagan

ReaganGrowthRate = ( 8697.711 / 6635.726 )^(1/32) – 1 = 0.0085

Monthly GDP growth over the two terms of President Obama

ObamaObamaGrowthRate = (16903.240 / 14375.018)^(1/32) – 1 = 0.0051

As can be seen, President Reagan supply-side policy had a substantial greater monthly growth rate than did President Obama’s demand side policy. But let’s see what a difference that makes for all our lives today. Instead of the actual results of President Reagan’s growth policy, lets substitute the results of President Obama’s growth policy to the 1980’s.

What would GDP in 1989 1st quarter be at ObamaGrowthRate of 0.0051 ?

ObamaCalcGDP = 6635.726 x (0.0051 + 1)^32 = 7808.816

Projection of GDP reduction = 8697.711 – 7808.816 = 888.895 (all ready a lot}

It is necessary to know the quarterly growth rate actually experienced from the end of the President Reagan 2nd term to the present.

ActualGDPGrowthRate = (17385.831 / 8697.711)^(!/!!6) – 1 = 0.0060

Taking the calculated President Obama growth rate from the end of the 1st quarter of 1989 to the 1st quarter of 2018, you get a calculated current real GDP of:

CalculatedGDP = 7808.816 x (0.0060 + 1)^116 = $15629.711

The difference 17385.831 – 15629.711 = $1,756.120

$1,757,120,000,000 is real wealth that would have been lost to us all now. And a word of concern, because the poor demand-side policy from President Obama, it informs us the lost of future wealth will be substantial in the future. That loss is baked in, but fortunately a new round of solid supply-side tax rate cuts for personal and, more importantly, business, has been passed. So far the increase GDP growth has been excellent, giving hope that this solid increase might last as long as the decades of the President Reagan policy effected.

President Obama administration failed us all. And that is why the revitalized growth so far, because of President Trump’s policy, gives hope for a better future. President Obama legacy would have been set if he would have simply implemented a long term supply-side tax rate cut rather than the temporary demand side rate cuts as well as the redistributive policy he implemented. He would have achieved higher GDP growth rate, bringing us out of the recession in a much better position than we found ourselves at the end of his 2nd term.

Ed

Ed Hanson Ugh! You keep arguing with a straw man. No one has ever said that post-Great Recession growth rates exceeded growth rates in the 1980s. Or the 1950s. Or the 1960s. Or the 1970s. Or the 1990s. The argument is about whether or not so-called “supply side” policies would have changed that story, and there’s zero evidence that things would have been any different. That’s the whole point of comparing Reagan’s growth rates (which you like to call “supply side”) with growth rates under Carter or Clinton or LBJ (which you like to call “demand side”). If growth rates under Reagan were no better or even worse under other presidents, then you’re simply not entitled to assign some special status to Reagan’s “supply side” policies. This ought to be painfully obvious. Did you ever have to write a professional analysis? Or even a freshman college term paper?

$1,757,120,000,000 is real wealth that would have been lost to us all now

Actually, that’s not true. You are confusing wealth and income. Wealth is a stock variable; income is a flow variable. GDP measures flows, not stocks. And even more strictly speaking, GDP measures output flows, which is not exactly the same as income flows (that’s GDI). And those are GROSS measures, not NET measures. Economic welfare is usually thought of as NET income because depreciation is lost. If you want to comment on this blog, then not only should you take Menzie’s advice about reading a macro textbook, but you might want to learn the lingo as well. Wealth and GDP/GDI are not the same thing.

President Trump’s policy, gives hope for a better future.

Only if your future is very near term. Of course, that describes the lifetime horizon of a lot of Trump voters. It’s also why young voters are strongly against Trump’s policies; they know that Trump is mortgaging their future.

slug

You are right, that 1 trillion 575 billion 120 million represents mostly income. Our stock of wealth is so much larger because of President Reagan policy rather than a demand-side policy.

The question whether the President Trump expansion continues is certainly one that I have referred to several times in my post. The future is always an unknown. But the long term growth from President Reagan’s policy gives hope that given time and good management another long term expansion is ahead of us. Time and the electorate will see if it so.

Ed

“I only remind you all that we live in a nominal GDP and is still an important measure.

https://fred.stlouisfed.org/series/GDPC1/

Billions of Chained 2009 Dollars Seasonally Adjusted Annual Rate”

I had to stop reading your latest rant right here. The link is to real GDP but you say nominal GDP growth is “still an important measure”? Damn – your confusion is even worse than the silliness we get from Peaky Boo.

Your all forgetting about the Boomer peak growth in the 70’s and 80’s. Population growth to GDP was at 2.7%. So you could do nothing and grow 2.7%. By the 90’s this was down to 2.2%. Today? 1.7%. My point? 80’s expansion was no better than the 2010’s expansion and grew about .5% above trend in the same fashion. It may have initially surged faster than the 10’s, but the 10’s better consistency caught it back up. 74-95 was a long run secular recession in US history. High inflation and sub par output.

Thank you. The proper metric should be output per person. But this goes way beyond the abilities of our right wing friends.

Don

You are right about how population helps in GDP growth, but only if people are employed. Both Reagan and Obama had very high unemployment rates to fight, and it is one of the facts that make comparison between the two valid. But I am afraid you are suffering from the leftist pessimism of very small growth of the pie. Currently, President Trump’s tax and regulation policy is proving, in spite of historically low unemployment, the economic pie can grow at a rate that demand-side economist can only calculate then revise down. The question of course remains, how long good growth will last. But one thing we know for reasonable certainty, such growth would never had happen if Clinton and her policies had been inflicted on us.

Ed

“Both Reagan and Obama had very high unemployment rates to fight”.

Reagan’s problem started in 1982 after his insane policies had their adverse effects. The Great Recession was raging during the latter part of the Bush43 Presidency. BIG difference. Get a clue.

Reagan was fortunate to enter a favorable period that helped him achieve stronger growth:

1. Carter was a fiscal conservative, which allowed a greater fiscal expansion, after the inflated bust of 1973-82.

2. The Baby-Boomers (born in 1946-64) were entering “prime-age (35-54),” which accelerated the Information Revolution, till it peaked in 2000.

Praising the Carter years will get you kicked out of the KKK club!

BTW Carter raised taxes so maybe you are right that his fiscal conservatism would have led to more investment had it not been for Reagan’s stupid decision to squander this Carter attempt to raise long-run national savings.

Ed Hanson You won’t like this because it comes from a couple of well known Keynesians, but it’s something to think about if you believe the cure for the Great Recession is supply side policies. These are the NY Fed slides:

https://www.frbsf.org/economic-research/files/eggertsson.pdf

Go about 20 slides in and you’ll see what can happen to the AD curve if the market clearing interest rate is negative. Then see what happens if you push out the AS curve. Output contracts.

Here’s the actual paper. It made quite a splash back when it was written.

https://www.princeton.edu/~pkrugman/debt_deleveraging_ge_pk.pdf

Speaking of Lafferites–and where are they now?–how about that Bobby Jindal miracle in Louisiana? Plenty of tax cuts to stimulate the economy and he left the state only a billion+ short of what’s needed this year. And they’ll only be $2 Billion short next year! Look out Kansas! Here comes Louisiana!

Ed Hanson

1. Unlike the 1970’s which saw substantial decrease in average annual hours worked, from the worse of the recession (1982) through 1989 saw a generalize rise in hours worked.

The issue wasn’t whether or not average hours worked rose after the Reagan recession; the issue was whether or not average hours worked were less than or greater than average hours worked under Carter. Go check the BLS and FRED data. Here’s what you will find according to their average hours worked index:

CARTER

Mean index value: 107

Max index value: 108.13

Min index value: 105.28

REAGAN

Mean index value: 105.43

Max index value: 106.58

Min index value: 104.16

So you’re wrong. Labor effort fell during the Reagan years relative to the Carter years.

2. Supply-side policy, at the margin, is intended to increase resources taken, some from savings, some from loans, and some from human capital, and be put at greater risk due to the expected greater rate of return.

This is gobbledygook. Private saving from disposable income fell during the Reagan years.

https://fred.stlouisfed.org/series/A072RC1Q156SBEA

Deficits also rose during the Reagan years. The sum of private savings plus the government surplus equals national saving. Deficits subtract from national saving. This is basic national income accounting. National saving fell during the Reagan years. That’s one reason why the exchange rate appreciated!

3.Supply-side policy did bring claims of paying for themselves at a faster rate than history shows. The learning curve has shown us that the time period is longer, and was the basis, among other changes for eventual balanced budgets in the late 1990’s.

Here you’re just making stuff up as you go along. That kind of BS’ing might work with the boyz down at the local watering hole, but not here.

the substantial cause of the deficits was the result of the increased spending by the appropriators in Congress.

Sorry, but you stepped in it here. If you total up all of the budgets that Reagan submitted and compare them to the budgets proposed by the Democrats, it turns out that Reagan proposed $11B more in total spending. Spending in very different areas, but the total was $11B more than the wish list proposed by the Democrats.

Two issues.

The Reagan fiscal expansion was NOT Keynesian. There was no liquidity trap at all Monetary policy world very well thank you. Stop calling it Keynesian.

That is why I call the increase in the structural deficit irresponsible. It wouldn’t be if it were Keynesian!

Next my memory fading as it is has Volker changing from monetary aggregates to interest rates. That is why it is called the Volker recession. Volker has Reagan’s support until he wanted inflation below 4% that was when the ‘whispers’ started .

From the time Reagan took office until now, the federal debt is 20 times larger.

So what? Inflation and interest rates are historically low while unemployment rates have been falling for years as employment hasP increased to record highs.

Fear mongering about the debt and deficits is nonsense. The real threat is the Trump anti-trade policies which are in fact socialist: the government determining

prices and production of steel, aluminum and even washing machines. Trump is also a nationalist. Putting the two together creates a wicked result.