(as referenced by Larry Summers, quoted in this post).

As I watched Secretary Mnuchin on Meet the Press (before discussing his taxpayer funded trip to view the recent eclipse) state :

…the president is not going to sign something that he believes is going to increase the deficit.

I was struck by an overwhelming sense of déjà vu. Of course, the caveat “he believes” is important. Mnuchin mentions “dynamic scoring”, but most economists agree that it is not plausible that the tax cuts as currently sketched out would lead to a revenue neutral outcome.

This sheer implausibility is laid out by Bruce Bartlett in his illuminating retrospective, informed from his vantage point at the inception of supply side economics:

Extravagant claims are made for any proposed tax cut. Wednesday, President Trump argued that “our country and our economy cannot take off” without the kind of tax reform he proposes. Last week, Republican economist Arthur Laffer said, “If you cut that [corporate] tax rate to 15 percent, it will pay for itself many times over. … This will bring in probably $1.5 trillion net by itself.”

That’s wishful thinking. So is most Republican rhetoric around tax cutting. In reality, there’s no evidence that a tax cut now would spur growth.

The Reagan tax cut did have a positive effect on the economy, but the prosperity of the ’80s is overrated in the Republican mind. In fact, aggregate real gross domestic product growth was higher in the ’70s — 37.2 percent vs. 35.9 percent.

Moreover, GOP tax mythology usually leaves out other factors that also contributed to growth in the 1980s: First was the sharp reduction in interest rates by the Federal Reserve. The fed funds rate fell by more than half, from about 19 percent in July 1981 to about 9 percent in November 1982. Second, Reagan’s defense buildup and highway construction programs greatly increased the federal government’s purchases of goods and services. This is textbook Keynesian economics.

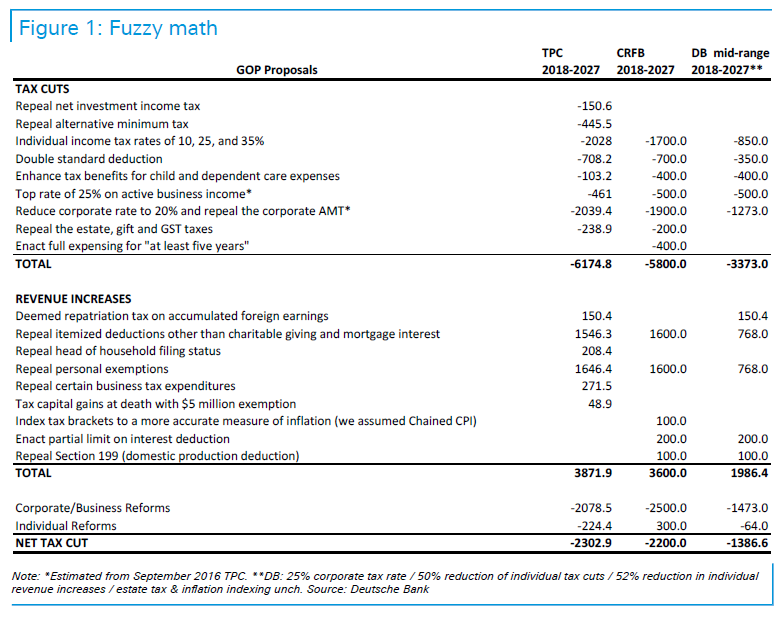

Here is a summary of assessments by two organizations (CFRB, TPC) and Deutsche Bank:

Source: Luzzetti, et al., “Trump Tax Plan: Tough Sledding Ahead,” US Economic Perspectives, Deutsche Bank, September 29, 2017.

Incorporating dynamic scoring is unlikely to lead to big changes in these overall numbers.

As former CBO head Douglas Holtz-Eakin noted:

“If it is a well-designed tax policy, it will partially offset the cost,” said Douglas Holtz-Eakin, a conservative economist who served in the George W. Bush administration and advised John McCain’s 2008 presidential campaign. But, he added, “there’s no evidence anywhere that a tax cut of that magnitude, regardless of composition, will offset” the entire $1.5 trillion.

I think the likely output impact is even more limited given that by many measures (and most importantly, the Fed’s), the output gap is essentially zero, so fiscal stimulus is likely to be met by offsetting monetary policy. That, too, is textbook.

I think this is about right.

Two points:

First, unlike the late 70s and early 80s, I don’t sense the overwhelming demand by the American public for tax reform. I’m not sure that many people feel the system is particularly broken, even if it is more cumbersome and complicated than it need be. I don’t hear corporations, either, complaining about the tax rate, even if they would like it lower. Thus, tax reform seems more like a nice-to-have, rather than a must-have. Given the special interests which reform would offend, I doubt lukewarm enthusiasm will offset bitter opposition.

In addition, all the fabulous tax cuts will blow out the deficit, and I don’t think the administration will find 51 Senators to sign on. As with healthcare, we will see a handful of holdouts, and that will torpedo the initiative.

Put it all together, and I doubt meaningful tax reform will be passed.

Steven Kopits I mostly agree. Where I would quibble is with the words “tax reform.” The Trump Administration is not talking about anything that most economists would understand as tax reform; it’s basically just tax cuts. Or perhaps tax deform. True tax reform would focus on eliminating tax loopholes that cause deadweight losses and economic inefficiency while promoting greater income equality. The Trump plan does none of these things. It simply cuts taxes for the rich. Yes, over the short run some low income folks would see some very small tax cuts; but those cuts would be swamped by future interest payments created by the yawning deficits. And repealing the estate tax would make the problem of inequality even worse. It would also have a negative effect on potential GDP. Just about every study has found that while repealing the estate tax might have a slightly positive labor effect on those who build-up estates, that positive effect is more than offset by the contraction of the labor supply curve of those who inherit estates. The Trump proposal is just another dumb idea that will likely (and sadly) bamboozle and confound low information voters who are the backbone of today’s GOP.

I used to do tax returns for poor through upper class folks.

I quit doing it because the income tax system is insane. And, of course, congress has cut funding for the IRS so that it cannot do it’s job. The funding cuts are a boon to the rich tax cheats. The real way to fix IRS would have been to simplify the thousands of pages of the tax code, but congress did not want to do that. And, I’ve heard but I haven’t verified, that the IRS spends more resources chasing Earned Income Tax Credit cheaters than rich cheaters.

You make $20K/yr and you need a professional tax return preparer to do your return.

Who are you kidding?

Anybody who says it isn’t broken, like you Steven Kopits, can only say that because

1. they keep their eyes closed,

2. they are wealthy enough to hire someone to do their taxes who know how to take advantage of all the hidden tax breaks and

3.the current tax code benefits them and changes will hurt them.

I asked my investment adviser if I could get my income taxes down to the same rate Mitt Romney pays.

He told me no way.

After tax reform, we need entitlement reform, then tackle Obamacare.

I see – entitlement reform aka get rid of Social Security and tackling Obamacare so Medicaid expenses go to zero. That will pay for all those tax cuts for the rich! Your platform!

We need entitlement reform. Tax reform is largely optional.

“Incorporating dynamic scoring is unlikely to lead to big changes in these overall numbers.”

Doesn’t CBO already do dynamic scoring? Oh – it is not the magic fairy dust from the Art Laffer crowd type of dynamic scoring!

PeakTrader: “After tax reform, we need entitlement reform, then tackle Obamacare.”

Enough with the deceitful euphemisms. Call them what the really are:

tax reform – tax cuts for the rich

entitlement reform – benefits cuts for the poor

tackle Obamacare – cut health insurance

Whenever you hear Republicans say “reform”, it always mean “cuts.” Why not be honest? I suspect honesty would be a hard sell.

Bruce Bartlett is not “illuminating” stating: “…prosperity of the ’80s is overrated in the Republican mind. In fact, aggregate real gross domestic product growth was higher in the ’70s — 37.2 percent vs. 35.9 percent.”

It’s true aggregate real GDP and real per capita GDP growth were almost exactly the same between 1970-79 and 1980-89. However, the increased current account deficits in the ’80s subtracted from GDP:

https://fred.stlouisfed.org/series/BPBLTT01USQ188S

Also, there was a structural bear stock market from 1965-82. I suspect, rather than a decline in real GDP in the ’70s, there was a real decline in quality of goods produced. For example, it seems, the quality of autos, particularly after 1973 till the early ’80s declined, and Detroit gave us autos like the Gremlin, Vega, Pinto, Chevette, AMC Pacer, etc.. Moreover, environmental damage peaked in the ’70s. So, U.S. living standards improved at a much steeper rate in the ’80s than ’70s.

PeakTrader Good. So now you agree that environmental regulations and CAFE standards and mandatory safety features all improved living standards. Welcome to the Comintern, Comrade PeakTrader.

“the increased current account deficits in the ’80s subtracted from GDP”.

This was not some exogenous event. It was caused by the toxic mix of Reagan’s tax cut and the Volcker tight money that was a reaction to the stupidest fiscal stimulus in my life time. Ever charted what happened to the exchange rate? Didn’t think so.

Negative net exports subtract from GDP = C + I + G + NX.

And, consuming more than producing, e.g. at full employment, in the global economy raises living standards.

The Reagan tax cuts helped achieved a V-shaped recovery, a strong expansion, and the longest peacetime expansion.

What are you saying about exchange rates? – a stronger dollar means foreigners receive fewer dollars.

“The Reagan tax cuts helped achieved a V-shaped recovery, a strong expansion, and the longest peacetime expansion.”

The spin machine continues. No – it was the Volcker monetary stimulus starting in 1983 once he killed inflation. I thought everyone knew this by now.

So, fiscal policy had nothing to do with it.

Greenspan and Bernanke lowered the Fed Funds Rate even more.

is it the level to which they lowered the rate that is important? Or the amount of change? volker dropped the rate from 20% to 6% during the reagan administration-that is a HUGE relative drop in rates. your expansion had much more to do with huge monetary stimulus than tax cuts peak.

And, it should be noted, increased U.S. demand also boosted world GDP.

The U.S. was the main engine pulling the rest of the world’s economies.

Here’s what James Fallows said about China:

James Fallows studied American history and literature at Harvard, where he was the editor of the daily newspaper, the Harvard Crimson. From 1970 to 1972 Fallows studied economics at Oxford University as a Rhodes scholar.

January/February 2008

Through the quarter-century in which China has been opening to world trade, Chinese leaders have deliberately held down living standards for their own people and propped them up in the United States. This is the real meaning of the vast trade surplus—$1.4 trillion and counting, going up by about $1 billion per day—that the Chinese government has mostly parked in U.S. Treasury notes. In effect, every person in the (rich) United States has over the past 10 years or so borrowed about $4,000 from someone in the (poor) People’s Republic of China.

Any economist will say that Americans have been living better than they should—which is by definition the case when a nation’s total consumption is greater than its total production, as America’s now is. Economists will also point out that, despite the glitter of China’s big cities and the rise of its billionaire class, China’s people have been living far worse than they could. That’s what it means when a nation consumes only half of what it produces, as China does.

Neither government likes to draw attention to this arrangement, because it has been so convenient on both sides. For China, it has helped the regime guide development in the way it would like—and keep the domestic economy’s growth rate from crossing the thin line that separates “unbelievably fast” from “uncontrollably inflationary.” For America, it has meant cheaper iPods, lower interest rates, reduced mortgage payments, a lighter tax burden. The average cash income for workers in a big factory is about $160 per month. On the farm, it’s a small fraction of that. Most people in China feel they are moving up, but from a very low starting point.

This is the bargain China has made—rather, the one its leaders have imposed on its people. They’ll keep creating new factory jobs, and thus reduce China’s own social tensions and create opportunities for its rural poor. The Chinese will live better year by year, though not as well as they could. And they’ll be protected from the risk of potentially catastrophic hyperinflation, which might undo what the nation’s decades of growth have built. In exchange, the government will hold much of the nation’s wealth in paper assets in the United States, thereby preventing a run on the dollar, shoring up relations between China and America, and sluicing enough cash back into Americans’ hands to let the spending go on.

And, foreigners trade valuable goods for U.S. Treasury bonds that earn a much lower rate of return:

Income Flows from U.S. Foreign Assets and Liabilities

Federal Reserve Bank of New York

November 14, 2012

Foreign investors placed roughly $1.0 trillion in U.S. assets in 2011, pushing the total value of their claims on the United States to $20.6 trillion. Over the same period, U.S. investors placed $0.5 trillion abroad, bringing total U.S. holdings of foreign assets to $16.4 trillion. One might expect that the large gap of -$4.2 trillion between U.S. assets and liabilities would come with a substantial servicing burden. Yet U.S. income receipts easily exceed payments abroad.

As we explain in this post, a key reason is that foreign investments in the United States are weighted toward interest-bearing assets currently paying a low rate of return while U.S. investments abroad are weighted toward multinationals’ foreign operations and other corporate claims earning a much higher rate of return.

U.S. investors earned a much higher rate of return on multinationals’ foreign operations and similar corporate holdings than did foreign investors here, 10.7 percent versus 5.8 percent, respectively.

The superior U.S. rate of return on FDI, as well as the greater tilt in U.S. foreign investments toward FDI, accounts for the $322 billion income surplus recorded in this category in 2011…The United States has earned a substantial premium on FDI investments at least since the 1960s.

When did US aggregate demand boost the world’s GDP? In 2009? Could you stop with these absurd comments? Please!

You’re the one proving to be absurd.

Please, get some economic literacy.

Just a note that the widening of the current account deficit. it is already included in the real GDP data you already cited.

The current account deficit is equal to the domestic savings-investment gap which the republican tax cuts widened. Interestingly, if the federal budget had been in balance since 1980, savings would have exceeded investment every year since 1980 except in the late 1990s capital spending boom and federal budget surplus. Economists generally all agree that a current account deficit to finance larger capital spending is a desirable outcome but a current account deficit to finance more consumption is an undesirable outcome.s

Agreed. The main driver of US current account deficit is our low national savings rate. National investment as a share of national income is not all that high but the national savings rate is incredibly low.

Spencer, the U.S. had the Information Revolution – a capital investment boom – where today the U.S. not only leads the world, it leads the rest of the world combined, in both revenue and profit. The same with the U.S. Biotech Revolution.

They took place simultaneously with faster improvements in living standards through U.S. consumption.

A large tax cut was needed a decade ago, since U.S. consumers bought foreign goods and foreigners bought U.S. Treasury bonds, to allow the spending to go on.

And, it should be noted, the U.S. offshored older industries with declining prices, imported those goods at lower prices and higher profits, and shifted limited resources into emerging industries, high-end manufacturing, industries with more market power, etc..

Peak Trader — I pointed out the boom of the 1990s in my comment.

I am well aware of the information revolution, and it does not negate the point that business fixed investment as a share of GDP peaked during the Carter administration and feel almost continuously during the Reagan administration.

When you compare business fixed investment as a share of GDP to the marginal tax rate the correlation is negative, not positive the way many republicans claim.

Spencer, the height of the Information Revolution was 1982-00.

Less business fixed investment is needed, because the U.S. economy became more efficient, e.g. manufacturing plants shifted offshore, internet shopping, etc..

And, lower prices or interest rates reduce saving.

These are positive developments.

unfortunately Republican have form on ‘tax reform’ that blows the budget

More sage Republican economic promise to those who will always believe: we’ll continue trying to do that voodoo that you really believe we do so well. We know we don’t, but promises ARE promises.

So we can promise–with straight faces–that we’ll wave a magic wand and all your tax cut dreams will come true. Score us DYNAMIC!

I’m so old I can remember the days when Rick Stryker vehemently denied that Trump was claiming 4% growth – FakeNews he cried — when we could see with our own two eyes that very number on Trump’s White House web site.

Well, that’s old news. Now Trump is claiming that his tax plan will produce more than 6% growth in a talk with House Ways and Means Committee members.

A wise economist once said that you don’t even need to look at the details in a Republican tax plan. The higher the Republican growth forecast, you know the worse the actual deficit effects of the tax cut plan. That’s because the worse the revenue numbers are the bigger growth they need to invent to cover for it. Given the 6% growth forecast, you just know the tax plan is going to be a record budget buster.

Fast becoming the Rodney Dangerfield School of Creative Economics. They don’t get no respect, but they do make people laugh.

Your Fed point at the end isn’t quite right, though I completely agree with everything you write here. The supply-siders argue–against evidence!–that the cuts will boost the supply side of the economy–eg, labor supply, capex. The Fed then recognizes the supply-side expansion and thus doesn’t raise rates to offset growth, which they now view to be non-inflationary.

Peak Trader’s trolling just goes on and on. He is his reply to my discussion of the 1983/84 recovery:

“So, fiscal policy had nothing to do with it.”

The fiscal stimulus was in 1981 not 1983. The Volcker overreaction in 1981 did lead to the 1981/82 recession while the mix of these two toxic policies drove up real interest rates and the exchange rate lowering investment demand and net exports. Once the damage was done – Volcker declared victory over inflation and decided to run expansionary monetary policy.

So the 1981 fiscal stimulus started this mess with Volcker’s overreaction turning it into a macroeconomic disaster. Yes the 1981 tax cut had a lot to do with the carnage that followed. This is very well known but right wing trolls like Peak Trader have to spin in high praise of St. Reagan.

Pgl, that’s a very odd statement. The Fed tightened the money supply to cause a severe recession and of course, since it achieved a severe recession, it eased the money supply substantially, in the recession. The subsequent strong recovery caused the Fed to tighten the money supply again. Expansionary fiscal policy, along with other policies, e.g. deregulation, drove the expansion.