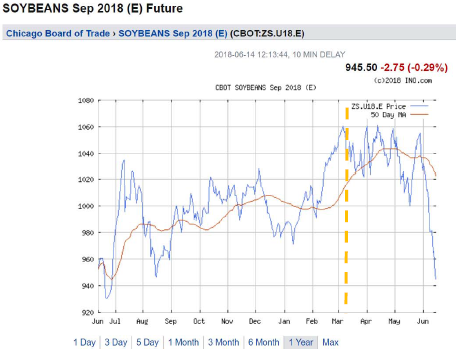

(Apologies to P.F.S./B.McG) Soybean, hog prices and corn prices dove even before the Section 301 import tax hit list was announced. (Orange dashed line denotes Trump announcing imminent Section 232 tariffs). Why?

All graphs downloaded from ino.com today.

Several observers (e.g., [1]) have argued that the downward slide in soybean prices are due to weather/crop planting developments. I would be the last to deny that conventional ag supply/demand factors are important (e.g., Argentine weather and soybeans). However, there were no developments in Argentina affecting the outlook for corn (but corn is certainly on the EU hit list). Certainly not for hogs (which is on the Mexican hit list). Interestingly, wheat has not exhibited the same pattern, as shown below (this is on the Chinese hit list, but China doesn’t import much, around $350 bn mn in 2017). Abbreviated summary of targets here).

So, the fact that the selloff is in three highly targeted commodities, and not in one little-targeted commodity, suggests to me that the threat of retaliation is weighing heavily on prices. (For soybeans, see here on the primacy of trade concerns.)

By the way, why look at futures prices? Because.

Update: As of 12:19PM Pacific, nearest month soybean futures down 2.05% today. I do not know of any market moving information regarding plantings/weather coming out today (6/15), but I would welcome hearing.

@ Menzie

I like your musical reference. Great taste. But I’ll see your “Disruption” and raise you 1 poker chip of suitable song titles:

https://www.youtube.com/watch?v=7xxgRUyzgs0 (plus a cool guitar solo)

“as an economist, you should know that commodities are subject to global competition and demand, and both upward and downward pricing pressure.”

Well yea – Bruce Hall is correct here but no one ever denied this. And yes Brazil is important for the soybean market. Check out the 10-K filing for Bunge!

Now CoRev might lecture us that we should note what this 10-K says about Trump’s trade war. Last I checked, the people who write these things were not doing sophisticated economic models. So all your efforts are much appreciated.

Menzie, as a scientist you are failing. You have shown a clear bias as Trumps Tariff threats and implementations as the MAJOR cause and a tendency to select only data and periods for it that support that bias. A longer look at the data shows USDA harvest projections have a higher and quicker price impact than trade barrier impacts. Don’t get me wrong trade barriers do impact pricing in the long run, but quick drop like this in recent history are influenced more often by harvest projections. Steep price drops occurred in 2013 and again in 2015 after USDA projected increased harvests.

So what was the June 12 2018 USDA harvest projection: ” Price forecasts for 2018/19 are unchanged this month. The 2018/19 season-average price for soybeans is forecast at $8.75 to $11.25 per bushel; soybean meal and oil prices are projected at $330 to $370 per short ton and 29.5 to 33.5 cents per pound, respectively….

A higher trend yield for the 2018/19 Brazil soybean crop reflects harvest and yield results for the 2017/18 crop, which is increased 2 million tons to 119 million.With higher production, soybean exports for Brazil are revised up for both the 2017/18 and 2018/19 marketing years.” The buyers driving these price fluctuations obviously follow these data closely. The USDA projections: http://www.usda.gov/oce/commodity/wasde/latest.pdf

As i pointed out in the previous article, US predictions of planting and emergence success was that both increased by this time last year. That bodes well for US harvest yield with the obvious and constant caveat if the weather holds.

Menzie, you are letting your bias drive your research and not keeping an open mind to other causes. And, its getting worse!

Just to be clear, your own reference said this: “The downturn of soybean futures was a result of weak demand from China,as well as pro-crop weather conditions in the U.S. Midwest, said market observers.” http://www.hellenicshippingnews.com/uncertainty-of-u-s-trade-policy-leads-to-sharp-weekly-fall-of-soybeans/

What the Trump haters never mention is that we are in very expansive trade negotiations with many of our premier trading partners. During trade negotiations it is not uncommon for them to have a temporary effect on prices and/or trade as the parties maneuver for position. China has dramatically reduced its imports of US soybeans, whilethere’s an abundant Brazilian supply from its ongoing harvest. We had a preliminary commitment from China of an increase of $70B in trade, but the US request was for a total of $200B. Will we eventually settle on $70B or will China offer more. Still TBD.

CoRev: Look…at…corn…too. That was the entire point of putting up 4 graphs.

CoRev: Go to the ino website and at the graph, and look at when prices start dropping. It’s before 6/12 release.

Menzie, yes I saw that the drop started before the USDA projection. There is no question that the Tariff talk has/had an effect. Your point in these several articles has been that it is entirely due to Trump’s tariff threats/implementations. Some of the drop is due to Trump’s negotiations, but not ALL of the drop is due to them. That was my point, especially when we have seen similar drops after USDA projections of increases harvest yields. In one of my references was a projection that more corn would be used this year for ethanol.

My main point was that objectivity was either missing or diminished in your analysis because similar price fluctuations are evident in recent history without tariff issues.

CoRev: Er, so what information regarding plantings/weather came out today to drive the September futures down 2.37%.

please don’t ask corev logical questions with the expectation of a logical answer. facts are not of interest to an ideologue.

Pgl, I dunno, please tell us. The INO had the day’s drop not quite as severe as your source. I’m happy to say mine’s smaller than yours. 😉

We have asked CoRev to think in terms of events studies before. Maybe that is too hard. Maybe he needs to bone up on the difference between static analysis v. comparative statics.

“My main point was that objectivity was either missing or diminished in your analysis because similar price fluctuations are evident in recent history without tariff issues.”

CoRev – this stupidity of yours is really getting beyond annoying. NO ONE ever said only tariffs affect market prices. But for you to suggest tariffs are not driving prices in the world soybean market denies all logic and evidence.

Please stop this trolling and take a course in basic economics. Damn!

Pgl, the only troll is you and baffled. Which kind of study ignores objectivity and ignores contradictory data? you are correct: ” NO ONE ever said only tariffs affect market prices.” It is just implied in this phrase: “…suggests to me that the threat of retaliation is weighing heavily on prices. (For soybeans, see here on the primacy of trade concerns.)” AND several others have also made similar assumptions or implications.

Pgle, why must you resort to outright lies: “But for you to suggest tariffs are not driving prices in the world soybean market denies all logic and evidence.” Where have I said or even asserted that? You also did it with my comment about transitory. Show us or slink away as you so often do when confronted with truth.

You so seldom add value to the discussion it is easiest to ignore most of your comments unless one is directed at me or such an obvious stretch as these.

Pgl, “We have asked CoRev to think in terms of events studies before.” Pgl please define what is the event being studied? Please define the impact of that event in price changes? Please define the support for your analysis. Please show us the support for your analysis in Menzie’s article(s).

I’ve done that in my comments, you could have refuted any or all of that in your comments, so please do so now, so that a further discussion can be fruitful.

If you ever bother to do research – then your critiques might have a wee bit of merit. We have repeatedly asked you to write your seminal paper and send it to the American Economic Review. Why haven’t you done so? Oh yea – you are afraid of the referee reports!

Menzie, it wasn’t this article: ”

CoRev

June 14, 2018 at 8:59 am

Menzie, of course there are examples of semi-permanent trade barriers. History is replete with examples of relenting action of trade barriers. What was your point?

Maybe pgl can help with examples of each?

CoRev: No, you said that you had mentioned semi-permanent before that post. I couldn’t find a mention. There is one and only one reference to semi-permanent trade barriers, and that’s your rejoinder to my comment.

CoRev is spinning so much that one would think a gym would hire him as an instructor.

Menzie, are you now resorting to a semantics argument? Before is applicable to this post only, and for some strange reason answering another comment, a rejoinder, is some how inadequate?

“Don’t get me wrong trade barriers do impact pricing in the long run”.

Just yesterday you lectured all of us how tariffs are temporary. Such contradictions will get noticed by the AER referees. Maybe you should submit your research to the National Review. Otherwise – it will never get published.

Pgl, the actual term was transitory, adn the subject was trade barriers. “Hint for pgl and the other “know little” about this industry, trade barriers are transitory. They can be raised and lowered by administrative order in short order. That is why their effect on price fluctuations are also transitory.”. They have a life determined by the implementers, removing or reducing them, which happens often. Using transitory in both sentences to the logical mind would indicate some correlation between implementing and the length of their implementation.

As an economist can you tell us whether those price impacts are constant? O do markets change?

CoRev: Do you know why there is a 25% tax on imported trucks? Google Chicken War. The tariff has been in effect since 1964. That is transitory in the context of the age of the universe. But that means that tariff is almost as old as I am. Geez.

Menzie, I said there were semi-permanent barriers, and you provided an example. Thank-you what is your point?

Transitory, “tending to pass away : not persistent ” As an example of transitory in the short term: “Trump grants tariff exemptions for EU and others on steel and aluminum” http://money.cnn.com/2018/03/22/news/economy/steel-aluminum-tariff-exemptions/index.html

What was the shelf life of that tariff for those countries? Long term? Transitory?

I wonder if CoRev realizes how long we have imposed barriers to importation of sugar!

Forbes covers this Chicken War!

https://www.forbes.com/sites/brycehoffman/2018/03/03/if-you-arent-worried-about-a-trade-war-you-dont-know-about-the-chicken-tax/#3d978d5d5455

Pgl, thanks for another example. It has had trade barriers so long they be considered permanent.

CoRev: I find no reference to semi-permanent in your comments on this post.

Seriously CoRev? In high school, we used to have this joke about the “Master Debater”. You would have been the brunt of those jokes. I’d spell it out for you but then Menzie would have to delete my comment.

Pgl, please graduate form puberty, your comments are becoming even more childish.

U.S. and China announce new tariffs in escalation of trade war

Washington Post

June 15, 2018

“President Trump followed through Friday on his threat to crack down on China for its “very unfair” trade practices, announcing that he is imposing a 25-percent tariff on $50 billion in Chinese imports…Beijing quickly responded…said it would impose trade barriers of the “same scale and the same strength.”

Today’s action follows an administration report in March that complained China had forced foreign companies to surrender their technology secrets in return for market access and had pilfered other advanced U.S. technologies through a campaign of cybertheft and investment in Silicon Valey start-ups.

“These practices . . . harm our economic and national security and deepen our already massive trade imbalance with China,” Trump said. “These tariffs are essential to preventing further unfair transfers of American technology and intellectual property to China, which will protect American jobs,” the president said.

The Chinese government is pursuing a $300 billion program of subsidies to enable its companies to dominate next-generation technologies such as artificial intelligence, robotics and quantum computing.

Chinese officials, who had signaled their intention to retaliate if Trump went through with his tariff plans, are targeting the president’s supporters in farm states and the industrial Midwest.“

“Today’s action follows an administration report in March that complained China had forced foreign companies to surrender their technology secrets in return for market access and had pilfered other advanced U.S. technologies through a campaign of cybertheft and investment in Silicon Valey start-ups.”

Of course Team Trump lies about these things and PeakDishonesty dutifully provides the echo chamber.

Notice something PeakStupidity – the U.S. is raising trade barriers. So all your claims that Trump wants to lower trade barriers were clearly lies.

KellyAnne Conway is so proud of you!

I just saw a list of hi tech goods China makes that Trump does not want us to buy from them.

Now if the issue is “stealing IP” as PeakDishonesty keeps harping about – this is SOOO backwards. If we don’t buy their high tech goods, we lower the prospects for stealing their IP.

Yes PeakDishonesty has been listening to Fox & Friends too much as each day that he does – he gets dumber and dumber. And we thought that was not even possible!

Pgl, WaPo is not peak. The desperation again????

WaPo is Fox on Fifteenth Street. Oh – it seems you have sent them your resume. Good luck on the job interview!

Now we’re just pissing off the Chinese to no good effect. I would expect Xi to dig in here, just to make a point.

You can burn a lot of goodwill with these kind of stunts.

because you have leadership which are idiots. trump lives his life day to day, with no concern about the future. those messes are for somebody else to clean up. look at his business record. it is littered with failed and bankrupted businesses, which occurred after trump extracted his value and then left the mess for somebody else. you expect he will govern in a different way?

Steven, it appears the $70B offer from the Chinese wasn’t close enough to the $200B goal.

Menzie wheat has not exhibited the same pattern, as shown below (this is on the Chinese hit list, but China doesn’t import much, around $350 bn in 2017).

That can’t be right. Sure it’s not $350 million?

2slugbaits: Yes, absolutely, typo.

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c5700.html

has the data. $352,171,000 to be precise!

US pork producers aren’t worried.

https://www.producer.com/2018/06/u-s-pork-producers-confident-in-mexican-exports-despite-tariffs/?module=author-bio-recent&pgtype=article&i=

“Mexico consumed 800,000 tonnes of U.S. pork in 2017, representing 25 percent of total exports. It is a major market for shoulders and variety meats, which are often hard to move, so its value as a market goes beyond gross tonnage. So far, U.S. pork imports have just faced a 10 percent retaliatory tariff, but that rises to 20 percent on July 5. While those tariffs will boost the price of U.S. pork to Mexican processors, many can’t easily switch to other sources, said hog market analyst Steve Meyer. “We don’t think that frozen hams are a direct substitute,” said Meyer in an interview. Mexico is a huge consumer of fresh U.S. hams. Frozen hams are available from many global suppliers, but if processors are set up to use fresh meat they can’t swap out fresh for frozen.”y

Hey – in honor of the World Cup, maybe I should try a Mexican restaurant for dinner!

Best I can tell, US soybean prices are discounted about 35 cents per bushel of around $9.10, so a 4% price discount, call it. That’s not immaterial, but two factors will continue to reduce that arb over time.

First, southern hemisphere and northern hemisphere crops are counter-seasonal, ie, when the Chinese want to buy during the US summer / fall, there will be little in the way of Brazil crops to offset. They will pretty much have to buy a good amount of US crops, tariffs or no.

Second, buyers are changing their purchase patterns, with Europeans dumping Brazil imports for imports from the US.

Soybeans will be fully fungible over time, just as with any commodity. Eventually, Chinese tariffs will just be a tax on Chinese consumers, much the same as US steel tariffs will be a tax on US consumers.

https://www.bloomberg.com/news/articles/2018-06-14/china-may-end-up-paying-more-for-soybeans-amid-u-s-trade-spat

https://www.agricensus.com/Article/Buyers-unwind-Brazil-soy-deals-seek-US-beans-as-trade-spat-opens-arb-1249.html

Your Bloomberg story relies on some dude named Sam Funk:

https://research.rabobank.com/far/en/authors/Sam-Funk.html

Of course prices for soybeans in China will raise. That is part of the incidence of a tariff. Of course China will buy more soybeans from Brazil, which means they will will buy less from U.S. farmers. I’m sure Mr. Funk’s model has somewhere in it the incidence of this on the prices received by U.S. farmers. If he doesn’t, Menzie is trying to document this effect too.

But I bet Menzie’s message is getting lost given all the criticisms from the Usual know nothing Suspects here.

I was relying on the graph halfway down the page.

From your second story:

“The shift in buying patterns has left Brazil FOB cargoes at a steep 40 to 50 cents per bushel ($15-18/mt) premium to US beans for loadings in June, equivalent to a 30-cent premium on a delivered CFR basis into China.

“The vast majority of the Chinese are still paying up 30 to 35 cents per bushel ($11-13/mt) to buy Brazilian, with only a few trades from the US to China, and most of those are taken in house by large traders,” said Charlie Sernatinger, a futures broker with ED&F Man.”

Translation – US soybean prices down and Brazilian prices up. Isn’t this what Menzie has been showing too?

Steven Kopits: Well, you said when you commented on this post, let’s wait and see. But prices have now fallen. They’ve fallen in futures out to November and farther out. What are we to take from that? Whether the Chinese pay a higher price depends (as noted in the post) on whether the US is lowest cost producer. If it isn’t, then the tariff will merely depress the price US farmers receive.

As to prices in summer/fall , as China is “forced” to buy from Northern countries — could be markets are irrational. For sure, they can be wrong (biased). But for now the market seems to have a certain view, as soybean prices are down 2% today.

No fair. Actual economic modeling. Now you are really going to get CoRev all riled up!

I wrote

Let’s see how prices evolve. Tariffs will only be effective if 1) country of soybean origin can be reasonably determined and 2) Chinese customs is actually motivated to enforce the tariffs.

Otherwise, per Slugs, I think it comes down to incremental logistics and administrative costs.

Best I can tell, there’s a 4% differential between US and Brazil soybean prices at present — not 25%. That differential will be arbitraged away, with the remainder comprising incremental logistics and administrative costs. That is literally what traders do.

Why would anyone expect a 25% difference between these two prices? Lord man – you modeling skills are worse than those of CoRev!

What price difference would you expect?

Steven, pgl can’t answer this question: “What price difference would you expect?” as it would point out his ignorance and the weakness of his arguments. I doubt anyone else will try either. I’ll wait and see, and be pleasantly surprised if we even get an attempt to answer and even greatly surprised it it makes any sense.

To quote Scott Sumner: “Never reason from a price change.”

“…soybean prices are down 2% today.” So what? Oil prices are down 3.5% today. Are China tariffs having an even bigger effect on oil prices?

The darker read is that all this is beginning to unravel the global economy.

Steven Kopits: And that’s why I don’t read Steven Sumner…

I’m gonna tell the readers of this blog something I strongly suspect many of you “don’t get”. In fact Menzie is a very very reserved person. He is very kind/considerate person, and often “holds his tongue” (can you “hold your tongue” communicating on the internet??). Menzie more than takes the extra measure to hear out opposing views and “give a fair hearing” to opposing views. He “goes overboard” to make different views welcome and allow even some views he no doubt finds personally offensive on some levels.

That short sentence on Scott Sumner—-is really as vicious as Menzie ever gets. By Menzie standards, that was vicious.

Scott is a two bit monetary economist. As far as I can tell – he has zero expertise with international trade.

But I guess anyone can pretend to be an expert on this. Next they will be citing Nobel Prize winner Donald Luskin!

Sumner is out of season? Well he is down under!

That’s apparent in your analysis.

Prices can change for many reasons — particularly commodity prices. It can be supply, demand, or investor sentiment.

If you are arguing that tariffs have reduced US commodity prices, then you would want to show those against commodity prices in other countries. It’s the differential, not the absolute value, that is indicative of tariff effects.

Further, you’d want to show comparative volumes of exports if you wanted to demonstrate the effect on farm income.

You didn’t do any of that. To Scott’s point.

Steven Kopits: Yes, but I don’t have ready data on trade volumes on a daily basis. Do know this:

Some of this price increase in Brazil is due to transport issues, but the fact that there’s a jump on Friday is suggestive. The premium is about 15% for September delivery (which is Fall, the time which you said prices would normalize), by the way.

@ Not Trampis

All friendly ribbings between “the States” and Australia put aside, the few Americans that are observing the situation closely (of which I would consider myself one) would say your average Australian is way more intelligent than Scott Sumner. How about we arrange some “international trade” here?? America takes John Quiggin and you get Scott Sumner??

Too Extortionate?? OK, I admit sticking Australians with Scott Sumner is very punitive to an American ally. We’d even be willing to pay a tariff to Australia to get rid of Sumner. Whaddaya say mate?? Or how about this, you choose the best seafood place in Sydney you wanna eat at, we give you 6 months of FREE shrimp dishes there, and you just take Scott Sumner?? Worse comes to worst, you could stick him in a medium size box with some air-holes on an unmanned raft floating off to New Zealand. Just don’t label the box before you shove it off-shore.

Caveat Emptor on Scott Sumner: NO RETURNS

Menzie, any idea how many contracts were accepted at that price?

CoRev: Not for Friday. Thursday seems pretty active, more active than in the past. See here: http://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_volume_voi.html?optid=320#tradeDate=20180614

Menzie, I too have been watching the CME numbers. The preliminary Friday numbers are available: http://www.cmegroup.com/trading/agricultural/grain-and-oilseed/soybean_quotes_volume_voi.html?optid=320#tradeDate=20180615

and the changes are primarily negative in volumes.

I translate this to mean the risk associated with this September price remaining low to be less likely.

http://www.chinadaily.com.cn/a/201806/15/WS5b23d81da310010f8f59d3ff.html

US Chamber of Commerce opposes tariffs against China

‘Imposing tariffs places the cost squarely on the shoulders of consumers, manufacturers, farmers, and ranchers in the US, he said. “This is not the right approach,” Donohue said. Kevin Brady, US House Ways and Means chairman, said, “While it’s encouraging that not all of the initially proposed tariffs will be implemented – as a result of the comment period that Congress called for – I am alarmed that additional products are now placed on the list for possible future action.” “These tariffs make it more difficult to sell more ‘Made in America’ products globally and expose many of our industries – particularly agriculture and chemicals – to devastating retaliation,” he said in a statement on Friday.’

The price of soybeans from Brazil is going up simultaneously with the price of U.S soybeans going down. This is exactly the price adjustment you would expect from the expectation of a Chinese tariff on U.S. soybeans.

Joseph, sigh! Your example is also the kind of price adjustment expected with a freshly harvested versus older stored crop. Admittedly, some price adjustment should be expected due to the tarrifs, but we are talking about single digit %s adjustments.

And given that soybeans are a storable, fungible commodity, if a glut of soybeans in the U.S. were the cause of the U.S. price decline, as some are arguing, then you should see a similar price decline in Brazil. Instead you are seeing a price increase in Brazil in anticipation of tariffs on U.S. soybeans.

Well said – I wish the Usual Suspects here would get basic modeling like you have. CoRev? It seems the American Economic Review has lost interest in reading your paper.

The differential, not the absolute values, are of interest. Again: See the graph.

We all have seen your graphs. Think man as you are making Menzie’s point over and over even if you think you are rebutting it.

Joseph gets the economics. Maybe someday you will too.

Joseph, sigh again. Which price graphs are you comparing? The glut (actually not glut but increased yield) of soybeans is for the 2018 harvest not current stock. Menzie’s graph is also for Sept.

Since we are talking commodities, how many contracts do you think were accepted at Menzie’s price? Here is a hint, those accepted now are probably clearing their storage bins before Summer harvest. Do you know what that implies? If you have safely stored product you don’t sell low.

Over the years it has been strongly implied, if not out-right stated as fact, that Asians benefit from quota laws on entrance into accredited 4-year Universities. I will confess (in the name of honesty) that there was a time in my life I would have bit down hard on that fish bait. I really do not anymore. Not to mention the fact, and I am aware this will sound “racist”, Asians largely get into University by their own merits unlike some other minorities which will go nameless in this comment.

https://www.nytimes.com/2018/06/15/us/harvard-asian-enrollment-applicants.html

There is only a slight, small exception to that, and that is in very recent/modern times (this would have been long after Menzie’s “era” I believe). Some ultra wealthy Chinese will pay for their child’s visa and Joy ride to the USA/Europe/Australia/NewZealand which ends up being a tourist holiday in the name of “education”…… those are still a small ratio of Chinese students, but if we tabulated the numbers, people would probably be surprised.

I am going to wager (although I very well could be wrong, I am only largely guessing) that segment of contemporary Chinese students getting the tourist joy ride from their parents make Menzie’s blood boil more than anything I have said in this comment, as he remembers pretty clearly what his Mom/parents and himself went through to get where he is now.

“Affirmative action” is probably how I should have worded that instead of “quota”, although you could argue it’s pretty near to the same thing. Yeah, I sometimes can’t believe it either, but English is in fact my first language. Here’ is another pretty good article on that. Although I disagree with a large portion of it, is still worth reading. It ends up kind of sounding “whiny” in tone.

https://www.newyorker.com/news/news-desk/the-uncomfortable-truth-about-affirmative-action-and-asian-americans

What she doesn’t seem to get is, “whites” are also expected to prove they are “different from other whites” in the admissions process to an Ivy-league school or other outstanding institution. It doesn’t mean it’s “racist” to expect a “white” to be “different from other whites”. The idea is to standout in any form or fashion, or what is the point?? It’s my personal opinion (yes, as one of those evil and “privileged” white males) that, at least in mainland China, there is this kind of “victim” culture. Certain people simply cannot face a hard fact of life—even good and outstanding people (gasp!!!! even “privileged” whites!!! Oh God NO!!!!) will not make the cut to Harvard. It sure is nice for mental health though to say in your head “Well, I guess I was ‘too Asian’ for these folks”. Thereby getting a mental health pass and reaffirming possibly the only thing treasured above academic excellence—your being identified as remarkably Chinese.

Meanwhile at the Russian hosted World Cup. Portugal 3 Spain 3. Ronaldo was awesome!

I never can get used to the “new” Renaldo (although the number of Latin American men that have this name is probably staggering). When I hear the name Renaldo I always think of the guy from Brazil, who was big in the early 2000s. He is the best player that I ever saw. Henry of France was a close 2nd all time fav of mine. And most of the white soccer players bore the hell out of me, but Rooney was fun to watch sometimes (I’m sure pgi, you remember him). Honorary mention of Tim Howard. Goalies bore me in general, but he was fun to watch.

Of course, you’re just gonna have to trust me that watching LIVE on a large screen TV, with some “rowdy” Chinese friends nearby and some good quality regional Chinese beer, Renaldo of Brazil was much funner to watch:

https://www.youtube.com/watch?v=SPZD3SutK00

https://www.youtube.com/watch?v=200UXfWgMQM

And here’s a couple Henry (originally of France) links. Incredibly quick feet, made other players look like they were standing still half the time:

https://www.youtube.com/watch?v=Hwux8Y5D9t0

https://www.youtube.com/watch?v=_jBfu0FHzjU

Spain 3 Portugal 3. Hat trick for Ronaldo! Perhaps the best match I ever watched. And this World Cup just got started.

Menzie

Interesting topic. Education factor from you and the knowledgeable commentators are quite good. I would advise less friction on your part when comments show a different perspective. The future is tough and I never seen a single answer as all true except we will all die.

One comment and I leave it to others if it means anything. Previous post you concentrated on June and July futures, who contracts are now close to coming due. Lean hogs prices of those futures are close to one year highs. Soybeans as you have shown is another matter.

Ed

Ed Hanson: I say this in the nicest way I can. If a student used NSA data in his/her term paper when there was no good reason to, I would fail him/her. If a student wrote in his/her term paper “the US-Canada quarterly bilateral trade balance” was the same as the US-Canada merchandise trade balance (yes, it’s a separate table in the release), I would fail him/her.

I used September in these posts because Steven Kopits was going on about how soybean prices in the Fall would switch back to ante-tariff levels. Well, to the extent that soybean futures for September are a relatively unbiased measure of soybean prices (as documented in my paper w/Oli Coibion), then we have falsification of the Kopits hypothesis. If you were to re-graph all those graphs using front-month (June) futures, you’d get a similar pattern.

Menzie

I am not complaining about the change of futures month, All I thought the need to mention the other futures (June and July) which prominently appeared in your past posts. Do you have some objection to this? After all, prices go down and prices go up. That is the life of the speculator. And the consequences of being too dire in your implication hog prices. I hope you did not jump in at the low with the thought that prices would go lower yet. Academic and economic exercises are much less consequential but should have a conclusion.

Ed

Ed Hanson: I’ve put up an educational post for you.

Menzie, I think Ed is asking have you tested your conclusions by playing the futures market? ” I hope you did not jump in at the low with the thought that prices would go lower yet.”

I guess my question you expect these prices to spot market prices in September? Followed with how many contracts do you expect to be fulfilled at the time and price?

From the Sac Bee today: “California farmers, politicians won’t fell full impact of Trump tariff wars until fall”

“David Phippen’s almond orchards in Manteca are a few months away from harvest…That gives him some breathing room before China’s tariffs on almonds–California’s largest agricultural export–and other crops really bite.”

Phippen said he’s just finished selling the 2017 crop but, by the middle of October, “…when the new crop is coming in, we’re going to be real excited if China isn’t actively buying almonds.”

Problems on the horizon for Trump’s toadies–including, but not limited to Nunes and McCarthy– in the Central Valley (and all over the state): “Trump’s moves this spring to levy tariffs on China, Mexico, Canada, and Europe have prompted those countries to hit back with tariffs of their own, many that would hit major California exports.”

Which major California exports in addition to almonds? wine, walnuts, pistachios, and table grapes, “which rank second, fourth, fifth, and sixth in export value…”

That should be especially disturbing news to McCarthy –Trump’s “My Kevin”–since Kern County grows and exports most of those in abundance. Twenty five percent of the work force in Kern County is in agriculture. The job multiplier connected with agriculture is significant.

And not to forget or neglect his next door MC–the dimwit Nunes– Canada and Mexico plan to hike tariffs on dairy products, the number one export from Tulare County, the heart of Nunesland.

Besides those two there are three other Republican congressmen in the valley attempting to dance around the tariffs and keeping their constituents–most importantly. large numbers of normally conservative farmers and growers–happy. As well as Trumpers, who have no clue as to what may hit them and their pocket books just about election time.

noneco, ” As well as Trumpers, who have no clue as to what may hit them and their pocket books just about election time.” Or not! I don’t know at what level of offer from China that Trump will accept, and which tariffs or at what level he will offer in response.

Everyone seems to forget these are underway negotiations.

CoRev: Section 232 tariffs are in place. As is Chinese retaliation. You are right, Mexican and Canadian retaliation not yet in place. But for 232, no meetings are scheduled, and there are only 2 weeks to figure something out. If that’s your definition of “underway”, ok, my becoming a world-class sprinter is “underway”.

I didn’t think this would happen, I am “on the record” more than once on this blog. I thought that this would end up being “hot air” and exhibitionist rhetoric to placate Trump’s illiterate fan base. Didn’t think the VSG would “follow through” with severe tariffs. I like to think I am the type guy that will admit he was wrong when he was wrong, so let me say it:

I was 100% wrong, I didn’t think Trump would actually follow through on the import tariffs EITHER to China or to our allies. I got it 100% wrong

My question would be, now that it has gone from an apprehensive and anxiety producing possibility and transformed into a deeply worrisome fact of reality:

What happens when you crap on your allies?? What happens when you take a big dump on your best friends in the world??—The friends you needed when you were in a bind and need an arm to pull you up out of the abyss??

http://ottawacitizen.com/news/local-news/we-will-always-be-grateful-american-saved-by-1980-canadian-caper-says-thank-you-to-canada

https://www.reuters.com/article/us-usa-canada-trade/at-odds-with-trump-over-trade-canadians-say-they-will-avoid-u-s-goods-poll-idUSKBN1JB2X7

I don’t know if whoever reads this blog believes in “God” or “bad Karma” or whatever, but I can tell you this much—Nothing good in life EVER came out of, or resulted from, crapping on your best friends. And you can wear a dumb red colored cap, put your hand on your Bible that you choose not to follow the precepts therein, wave your American flag all day long, and nothing is going to change that FACT.

I’m not a big fan of tossing out Bible quotes, but I do think there are rare times, when they are appropriate:

Habakkuk Chapter 1, verses 5–11

5 “Look among the nations and watch—

Be utterly astounded!

For I will work a work in your days

Which you would not believe, though it were told you.

6 For indeed I am raising up the Chaldeans,

A bitter and hasty nation

Which marches through the breadth of the earth,

To possess dwelling places that are not theirs.

7 They are terrible and dreadful;

Their judgment and their dignity proceed from themselves.

8 Their horses also are swifter than leopards,

And more fierce than evening wolves.

Their chargers charge ahead;

Their cavalry comes from afar;

They fly as the eagle that hastens to eat.

9 “They all come for violence;

Their faces are set like the east wind.

They gather captives like sand.

10 They scoff at kings,

And princes are scorned by them.

They deride every stronghold,

For they heap up earthen mounds and seize it.

11 Then his mind changes, and he transgresses;

He commits offense,

Ascribing this power to his god.”

Menzie: ” But for 232, no meetings are scheduled, and there are only 2 weeks to figure something out.” and schedules never change and negotiation meeting subjects are in concrete?

I wish you luck in your goal of becoming a world class sprinter. As I wish the Trump administration success in improving the current offer(s) of all the negotiating parties so that they may be accepted and the US trading position is even more improved/fair.

As in all wishes reality often intrudes and the then current conditions accepted. Our differences center on when THEN is, and which conditions are acceptable. I long ago gave up any wish to be sprinter. I’m more concerned about keeping my major joints usable so that I can walk and work in my workshop.

Sigh. actually, big sigh.

Those socialists at the California Farm Bureau are very concerned. California’s top three export markets are China, Mexico, and Canada. Plenty of ag exports also go to Japan, S. Korea, and Hong Kong.

But when you’re gambling with $21 BILLION in state ag exports, the tendency of those who have a stake in tariff fights is to be cautious, rather than supporting the chest beating nationalists who appear more concerned with protecting jobs in Ohio and Pennsylvania than with those in California.

BTW, when discussing California employment, the Central Valley is THE area where unemployment numbers are far above those in the state as a whole, currently 3.1%. If you’re uninformed, this area lives and dies with what it grows and produces.

Kern county is currently around 8.7%, Tulare County 11%, Fresno County , 8.7%. A tariff war will obviously affect these counties, as well as those to the immediate north. Their concerns are quite understandable, and Trump’s two main toadies there–while likely not in danger in this election–should be concerned.

More sighs.

Oops! Current unemployment numbers. As of June 15, California 3.7%, Kern 7.7%, Tulare 8.4%, Fresno 6.9%.

Meanwhile, in the socialist bastions to the north: San Francisco, 2.1%, Santa Clara 2.3%, San Mateo 1.9%, Alameda 2.6%, Contra Costa 2.8%.