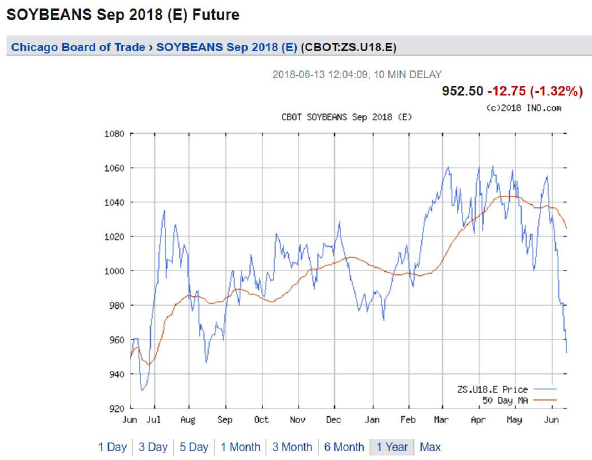

Soybean prices continue to collapse…

Source: ino.com, accessed 6/13.

Note that the peak was in early March, just as Mr. Trump hinted at Section 232 tariffs on aluminum and steel. This additional pain is unwelcome, given that even as of March, soybean prices were some 40% below their mid-2012 peaks.

From Progressive Farmer – Washington Insider today:

Anxiety Rising In US Farm Circles On China Trade

The U.S. has signaled it will make its intentions known by Friday on duties on some $50 billion in Chinese goods over intellectual property issues.U.S. ag interests like the American Soybean Association (ASA) are planning a full-court press to try and convince the administration to not take actions that would negatively impact U.S. soybean and other ag trade as China has threatened to respond with retaliatory trade actions against U.S. products like soybeans and other ag goods.

It’s not clear whether the U.S.-North Korea summit was enough to have the U.S. willing to hold off on imposing sanctions against China. But there are also still likely other steps in the process before U.S. sanctions go into place.

The U.S. has to publish a formal determination on the duties in the Federal Register, with up to 30 days after that point for the duties to come into effect. Plus, indications are the Trump administration is studying taking up to another 180 days before putting the duties in place.

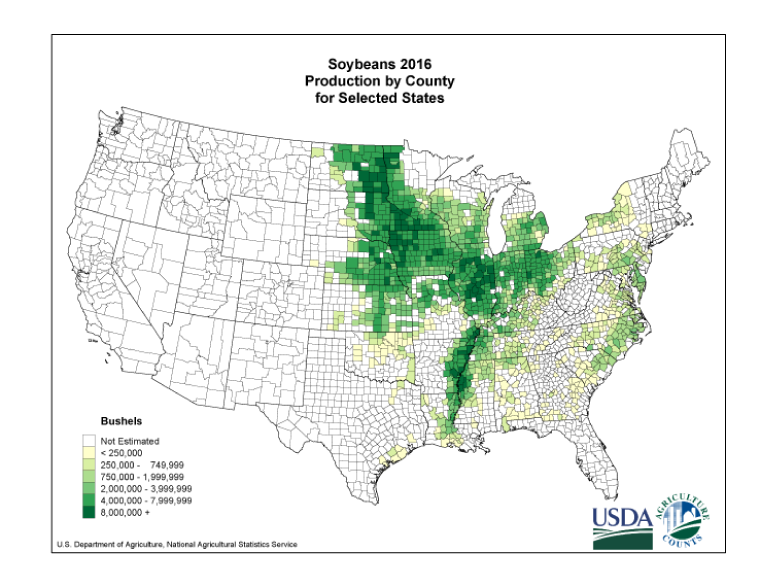

As a reminder, here is a map of soybean production.

Source: USDA.

You should add corn futures as a basis of comparison.

“U.S. ag interests like the American Soybean Association (ASA) are planning a full-court press to try and convince the administration to not take actions that would negatively impact U.S. soybean and other ag trade as China has threatened to respond with retaliatory trade actions against U.S. products like soybeans and other ag goods.

How dare they? I bet they are a bunch of pinko Democrats!

I know these type of pinko Democrats. They have no “family values” and won’t protect Evangelicals values with disingenuous lip-service. You can smell them from three houses down the block (STD infections from being a “germophobe”??) and are the same type that would invite feckless porn stars to the Oval Office:

https://goo.gl/images/MUnDjZ

Don’t know that I can see it export volumes.

https://apps.fas.usda.gov/esrquery/esrq.aspx

I was just in the “thumb” area of Michigan where I noticed a lot more corn and hay being grown and less soybeans, including my brother’s land. They must have been lucky to make that decision. No way they could have anticipated a commodity price drop because farmers are so ill-informed. Oh, wait, there was some news about that in early April before the planting season. Well, still just lucky.

Too bad farmers are locked into soybean production. https://www.bloomberg.com/news/articles/2018-03-29/soybean-corn-prices-surge-after-u-s-plantings-trail-estimates

So, what’s the REAL story? Prices down? Prices going up? Planting down? Planting going up? I suspect agricultural prices and production are a lot like oil with considerable flexibility in both.

The date of your link is March 29, 2018. Menzie’s chart and a lot of other charts are taking into account information since then. Hint, hint – we are in mid June.

In case Bruce pretends not to get my simple point, I provided a link to soybean prices. On March 29, 2018, this price was $10.30 per pound. Since then it has dropped by almost $0.80 a pound.

It should be obvious to all of us that Menzie has painted what we know in Finance as an Event Study.

C’mon Bruce – get with the program!

Pgl, you obviously know nothing about farming. Also, you appear to have not read the article. “Menzie’s chart and a lot of other charts are taking into account information since then.” And the farmer who needs to purchase fertilizer, sees, order fuel, and procure the loan to purchase these ag productions essentials for planting as soon as the weather allows as early in Spring as possible. And the decision of which crop to plant is the precursor to all these other decisions.

Hint, hint – in most areas these decisions are made well before March 29, and changing them is costly. Noting the date of the article was just an ignorant statement.

None of what Menzie wrote denied farmers had to decide to plant earlier than March 29. Way to deflect CoRev. This is all about the market’s reaction to a new tariff which affects foreign demand for our products. But leave it to CoRev to go LALALALA Menzie needs to consider all sorts of other facts followed by CoRev going LALALALA, you guys do not know farmers cannot change their supply decisions after the facts.

I hope you realize how utter confused you come across. But maybe not!

“wen confronted with a logical dissent to your econ-centric articles you change the subject.”

CoRev accused Menzie of this? Excuse me CoRev but this is your MO. BTW is spelled “when”.

Pgl accusing me of deflections did this: ” None of what Menzie wrote denied farmers had to decide to plant earlier than March 29. Way to deflect CoRev.” Which was in response to this comment: Pgl, you obviously know nothing about farming. ” Yup! I deflected to Menzie from pgl — Oh wait that was pgl’s approach.

How desperate are you to make a point? Even when that point is a complete a lie?

Bruce Hall: If you were an economist, you’d know that’s not the right comparison. The proper comparison is, if the administration hadn’t imposed sanctions on national security grounds that sparked retaliation on soybeans, what would be the profits that could have been earned on soybeans, rather than on other crops.

Please, please, please, read an Econ 1 micro textbook, focusing on opportunity cost section.

Careful Menzie, with talk like that you’re apt to scare off the likes of “Princeton” Kopits. When analyzing the soybean markets, “Princeton” Kopits works super hard at copying down oil rig counts off the Baker Hughes data that has been available for the last 65+ years. Deep insight like that does not come along everyday. I just feel sad “”Princeton” Kopits hasn’t pulled out the candlestick charts yet. The village idiots that are “Princeton” Kopits target demographic always salivate over those.

Menzie, please quit mis-applying Economics issues over agricultural or any other industry. Instead of what would be the profits that might have been have been provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand.

Ag especially is dominated by weather (world-wide) and area planted. Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage. For the Farmer one severe storm, early or late frost, too much rain, too little rain, rain at the wrong time, fire, etc. can wipe out a year’s worth of work. Only after the crop is being harvested or in planning what to plant can the farmer really worry about prices.

There’s far more to discuss on the ag business/trade barriers issue, but economics is only the heart of discussions on blogs like this. You want a proper comparison? Pshaw, only in the blinkered econ environment is it econ-centrist. Before someone makes a snide comment again about this being an econ blog, the subject is actually political.

I think this kind of point is what i was trying to make in my comparison of Micro/Macro econ. But that’s just me another boy raised in farming country with farmers throughout the family.

CoRev: If you want to compare bona fides, I can tell you I grew up in Eastern Washington, wheat country. And I’ll bet my dad planted more rice than you ever did. By hand.

But even if he hadn’t, I think given your commentary thus far on matters economic, you really should read an econ textbook sometime.

Menzie, wen confronted with a logical dissent to your econ-centric articles you change the subject. Bona fides? And my dad hoed more miles of sugar beets than your dad.

But the issue was the risks in ag production and acreage planted are more important to prices to the farmer, the basic decision maker, than tariffs.

This boy left the farm, but the farm never left the boy.

CoRev: Sigh. Then what happened in the last week with respect to weather and acreage to push down soybean prices? Well, here’s something from some city-slicker communist publication called FarmFutures:

Menzie, sigh, did you notice you are citing “futures” prices? Also, I never said that there was no effect, just not the primary effect you are implying. The article said this: “Soybean futures sank nearly 2%,…” Did you notice the very next paragraph of th article you referenced talked about the weather conditions?

My point was that farmers face a 100+% loss every year they plant due to weather. You probably understand that. Pgl clearly is clueless about it. Today’s ~2% price drop just means farmers and granaries holding soybeans probably didn’t sell today.

CoRev: Of course other things matter, but commodities are quasi-asset-like, then “news” affects them and over the course of the past week, I’d say the new “news” is G-7/Sec.232/Sec.301 retaliation.

CoRev – before your next uninformed rant – please read up on “Event Study”. Menzie has been very clear about what he has been arguing but it seems this stuff is way over your head.

Menzie, we agree prices react to negative news, but it most often is a transitory effect reflected by the news cycle. The ongoing trade negotiation have both positive and negative news, and you are concentrating on the negative side only. These effects are on the fringes of the pricing, and primarily effect the negotiators’ home markets.

The other weather and planted acreage related effects have an effect reflected by the planting cycle. Like news these cycles are both good and bad effects, but often deeply the core of the prices. Even more importantly at the individual producer level, the farmer, the effects can be at the extreme levels from bust to bumper. Surprisingly, both extremes have negative effects and since they effect core pricing will often have a world-wide effect depending on the size of the region under weather duress.

When these negotiations end their effects will on price fluctuations also end and what will be left is that ole rule of supply and demand. Can you guess what will be the deeper and wider effect, trade barrier negotiations or weather and planted acreage? Why would an economist focus on this transitory and less important aspect of pricing? What is the agenda here?

Hint for pgl and the other “know little” about this industry, trade barriers are transitory. They can be raised and lowered by administrative order in short order. That is why their effect on price fluctuations are also transitory. Point studies do not add a great deal of value to industry decision makers, unless they are done in a time frame to influence their decisions.

“trade barriers are transitory.”

One would hope so. The Bush43 steel tariffs were nothing more than a ploy to get Bush-Cheney reelected. Yes they lied to their voters and then stabbed them in the back in 2005. And of course they also lied about the alleged economic benefits from these tariffs.

Thanks CoRev for reminding us that Republicans use tariffs as a dishonest tool to win elections! Of course you are basically saying Trump is lying to his base too. If so, I agree 100%.

Let me comment on this entire statement here:

“Hint for pgl and the other “know little” about this industry, trade barriers are transitory. They can be raised and lowered by administrative order in short order. That is why their effect on price fluctuations are also transitory. ”

NO ONE said price changes are permanent. NO ONE. What CoRev is doing here is the worst form of trolling. It is called the straw man argument. CoRev is the master of this bait and switch.

Sorry dude – but this is pure and simple intellectual garbage.

CoRev: There have been antidumping duties that have been in place for years…

Menzie, of course there are examples of semi-permanent trade barriers. History is replete with examples of relenting action of trade barriers. What was your point?

Maybe pgl can help with examples of each?

Menzie, as an economist, you should know that commodities are subject to global competition and demand, and both upward and downward pricing pressure. It may well be that Trump’s actions caused soybean prices temporarily to fall beyond “normal” (let’s not confuse that with “stable” which doesn’t happen) market conditions.

But it seems that maybe Brazil has had some effect on Iowa’s soybean market:

• https://www.prnewswire.com/news-releases/china-soybean-industry-report-2018-brazil-was-the-largest-source-of-imported-soybeans-to-china-300656671.html

• https://usda.mannlib.cornell.edu/usda/current/oilseed-trade/oilseed-trade-06-12-2018.pdf

But the bad news might be temporary as the second article concluded:

Despite the prospect of Brazil clearing out the 2018 crop this year, limited yearover-year

growth in Brazil’s soybean production, rising global demand, and

smaller supplies in Argentina and Uruguay following this year’s drought should

sharply curtail exportable supplies in the latter half of 2018. Despite a weak real,

this should reduce competition in the global soybean market, boosting U.S. exports

in 2018/19.

Of course, I could be reading that wrong, eh, pgl. Oh, 6-12-18 isn’t current enough, right?

Bruce Hall: If the assessment about the second half of 2018 is valid, then I wouldn’t have expected to see the dive in the future for delivery in November I see here.

But heck, I only published one peer-reviewed paper on the subject. Who am I to say?

Menzie, when I look at the chart using the 200 day average i don’t find any worries about the recent dailies, but do wonder about the lows a year ago. After a second of research I found this: “…Therecent drop in soybean prices indicates the large South American crops may finally have impacted prices despite the difficult start to the planting season in the U.S. The June 1 soybean stocks estimate this year may not provide much new information but the implications for soybean prices contained in the Acreage report could make for a long summer of depressed prices.”

http://farmdocdaily.illinois.edu/2017/06/soybeans-and-the-june-30-usda-reports.html

If the assessment about the second half of 2018 is valid, then we should see another rebound and perhaps rise in prices.

At this time acreage planted is less important then weather, as that what to plant decision is long past in most states. The numbers to look at are % planted and % emerged because that indicates early planting season weather conditions. So far 2018 is above 2017 which was a pretty good year and 2018 is far above the past 4 year average. So far it may be a good year for soybean production, and if negotiations end on a positive for the US prices should actually rise well above the level of your chart.

Menzie,

I’d say that your link to this fall’s futures are consistent with the article from cornell.edu that I referenced and reflect Brazilian supplies and currency impact as much as “Trump’s war”:

Another record Brazilian soybean crop, currently estimated at 119 million tons,

will provide ample supplies for export in 2018. Adding to the competitive pressure

is the recent weakening of the real relative to the dollar as political and economic

uncertainty has helped drive it to near 3.8 to the dollar. This is nearly 20 percent

below the level in January 2018 and approaching the near-term record low of 4.04

observed in January 2016. With elections in Brazil scheduled for October, the

same forces pushing the real lower today are likely to persist through at least the

U.S. harvest if not through the latter half of 2018.

As the exports from Brazil play out this year, the pressure on U.S. producers will be felt. But then there was the concluding statement which I quoted earlier:

Despite the prospect of Brazil clearing out the 2018 crop this year, limited yearover-year

growth in Brazil’s soybean production, rising global demand, and

smaller supplies in Argentina and Uruguay following this year’s drought should

sharply curtail exportable supplies in the latter half of 2018. Despite a weak real,

this should reduce competition in the global soybean market, boosting U.S. exports

in 2018/19.

So, I’ll go back to my original comment and say that:

t may well be that Trump’s actions caused soybean prices temporarily to fall beyond “normal” (let’s not confuse that with “stable” which doesn’t happen) market conditions.

“No way they could have anticipated a commodity price drop because farmers are so ill-informed.”

Are you saying farmers do not form expectations rationally? There is a lot of literature that they do. But the rational expectations model has people basing expectations based on all available information. Given Trump’s chaotic twitter policy machine, there were events over the past couple of months no one – including the sharpest people on Wall Street – did not anticipate.

Soybean prices over time since 1971. Of course this $ price per bushel should be expressed in real terms when comparing over a 40 year period:

http://www.macrotrends.net/2531/soybean-prices-historical-chart-data

That soybean prices today are about the same as they were 40 years ago means their relative price has declined considerably!

OTOH, not one of the farm state senators or congress persons have complained publicly about the dire situation farmers face as a result of Trump’s tariffs. They are all so afraid of the Trump cultists that they dare not say a word against Trump. It is as if we are living in North Korea.

Try to remember the old saying “You can fool almost all the dumb-dumbs all of the time, and all of the time you can fool almost all of the dumb-dumbs but you can’t fool the dumb-dumbs……. Baby!!! Baby!!!! Baby!!!! oh….Baby!!! Baby!!! Baby!!!!” ………..?? I’m sorry, I just had a “W” Bush moment.

https://www.youtube.com/watch?v=XGdbaEDVWp0

I’ve never attempted to get a pelvic gyration through the Menzie filter. Cross your fingers kids.

This blog comment sponsored by “Middle-Aged White Guys Trying Too Hard to Get Attention” LLC as a joint venture with “Positive Gender Role Models For A Brighter Korean Future” LLC [I said role models…….. I say, I said role models……role models…… nevermind

However, Paul they do have lots of time to spend worrying about who’s kneeling during playing of the Star Spangled Banner.

US exports to China can be found here:

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c5700.html

In 2017, total soybean exports were just over $22 billion. Over $12 billion of that is to China. Both figures are down from where they were a few years earlier.

BTW, off topic, but indirectly related—-I suspect there is a lot of illegal and anti-free market (anti-competitive) behavior going on the the sales of soy seeds. Using different levers, collusion for example (why did that word come to mind??), to manipulate prices. Also if “big ag” corporations intentionally create problems and diseases which then need a “remedy” (genetic modification) it becomes an endless source of revenues. You can literally create “new markets” out of thin air.

Now, overall I respect the profession of Economics and economics professors. But one might ask the question why economists seem very fascinated by commodity price movements but very little academic discussion or research papers about “big ag” manipulation of seed prices?? Perhaps externally financed department chairs aren’t always conducive to academic honesty [cough!!!! cough!!! George Mason U cough!!!! cough!!!]?? Let the gentle reader decipher. Perhaps one of our greatest American economists (0% sarcasm there) with that sharp and ever curious Chinese mind of his, might want to dive down that rabbit hole???

http://ageconsearch.umn.edu/bitstream/28680/1/sp98-10.pdf

Moses, why link to a paper that is about 20 years old and whose story has often been told? A lot of years ago I worked at a trade association and was doing some work on agricultural biotechnology. I helped draft a number of technical papers on food safety and the impact of biotech derived seeds on the environment. Certainly the corporations doing the research (and it should be added many land grant universities as well) were addressing problems that real farmers faced. With respect to soybeans, the only modification I’m aware of is to make the plants resistant to glyphosate (Roundup) so that it can be used for weed control. It was and still is a useful modification and provided farmers with another choice for improving crop yields. I take no position on the intellectual property issues between Monsanto and farmers. Farmers don’t have to buy the genetically modified seeds and can of course rotate crops as well. I’m not sure what you are getting at in this post.

@ Alan Goldhammer

You answered your own question when you said “A lot of years ago I worked at a trade association”.

Most farmers know what I am talking about. Most non-farmers understood what I was saying in that particular comment. I’m asking that more research be done, but not just research that feeds the bank accounts of “big ag” or silences and assuages the intellectual curiosity of Agriculture department chairs or Economics researchers at D-1 schools and the like.

The paper in the link, yes, is about 20 years old. But relatively speaking, when you’re talking about large cases of market corruption, that’s not that long ago. I suppose you would be baffled why people were discussing and writing brand new books about the Pecora Commission during and after the credit derivatives crisis of 2007–2008. In fact, there were a multitude of lessons to be learned there from the Pecora Commission. Where would you have us put the “cut off” point for learning from history or the past?? HINT: The last time you made an alimony payment is not the correct answer.

What is the over/under as to soybean farmers getting bailed out at the end of the planting season if prices continue to drop?

I’ll bet the over if Ivanka and Jared find a way of making a profit out of this.

Dear Menzie and commenters,

Three things.

1) Brazilian soybean production was boosted by the same weather people are blaming U.S. production for, as in

https://apps.fas.usda.gov/psdonline/circulars/production.pdf

This is relatively recent. Note that the end of the harvest in Brazil just occurred.

2) Might the Trump attempt to get rid of immigrants affect agricultural labor, and thus diminish farm profits regardless of the weather?

3) Prices have started to rise for other goods and services, so the farmers will be especially hit by this.

J.S.

Julian, thank your for your reference. It confirms that weather and acreage are important in harvest levels which effect core prices.

Fear not. Congress has been quite generous in providing payments for the bulk of many growers crop insurance. This has helped replace the generous subsidies—I.e., Cash-paid to growers of rice, corn, wheat, cotton, and soybeans.

My MC has pocketed over $5Million in subsidies since the mid 90’s, and his fellow Republicans are paying more than 70% of his crop insurance premiums. Such generosity can certainly alleviate fears of weather related crop failures.