Reader Ed Hanson asks if it makes a difference to look at front month or back month futures in discerning the impact of news on soybean prices. The answer is no.

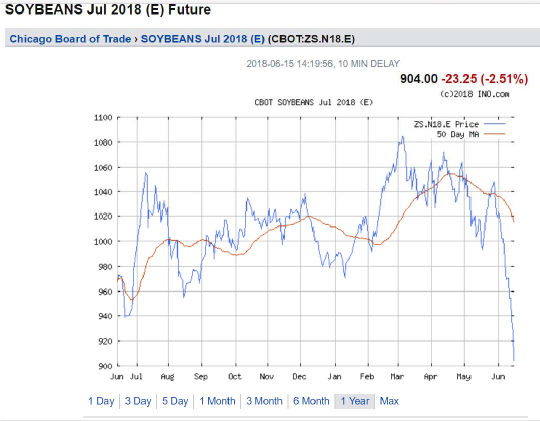

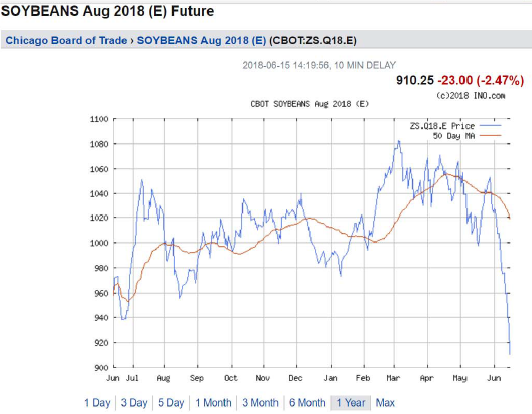

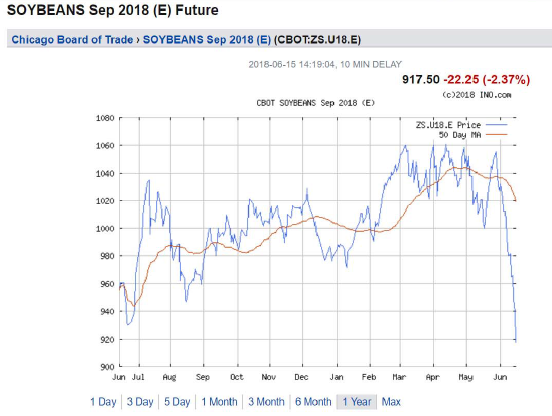

Below, I present graphs of soybean futures over the past year for contracts expiring in July, August, September, November, and January 2019 (all accessed on 6/15, from ino.com):

Those who are familiar with finance, and futures in particular, will recognize this pattern for any semi-storable commodity, as in soybeans.

Storable agricultural commodity future prices act like typical asset prices, to a first approximation, so that they respond to news, pretty much impounding new information rapidly. This is not to say futures prices (or even spot soybean prices) behave like a random walk. Theory doesn’t predict that stock prices should follow a random walk — just an approximate one. Similarly for futures.

In Chinn and Coibion (2014), we document the fact that at the three and 12 month horizons, futures outperform a random walk and ARIMA. Moreover, futures are an unbiased predictor of future spot prices. (I keep on coming back to this as I’m inordinately proud of this paper, which took 13 years from CEA memo to publication; you can see the intermediate NBER WP version here.)

By the way, you should not extrapolate this message of unbiasedness to other commodities, particularly precious metals. And not to currencies.

@ Menzie

Like your honesty about being proud of the paper. You should be proud. I think musician Jimmy Page, talking about juggling 8-track tapes and things to make guitar overdubs in the studio back in the ’70s, called it “A labor of love”. It’s funny I remember starting reading your paper when you put it up (weeks ago yeah??) and I can’t remember if I finished it or not (which is a horrendous habit of mine reading some really great pieces of literature, academic or otherwise).

It’s actually a fascinating topic because there are so many layers to it (my personal battle is with the equations and sometimes just the meaning of the variables (greeks), even though I often understand quite well the underlying thing the equation encapsulates). But it’s a personal frustration for me as I want that feeling of doing the math of the equation and getting that final answer that matches up right to like the 5th decimal out.

And actually, I find it pretty humorous in some moments. Is that a “sadistic” thing?? But in a slightly twisted way it ends up being amusing, like when “Princeton” Kopits thinks he is teaching you about arb trade. I mean if I was you and some pseudo-intellect half-wit was thinking he was lecturing me on the subtleties of arb trade I’d be wanting to take a crowbar to the computer monitor at that point. But for me it’s like 1/3 infuriating and 2/3 just funny. Reading “Princeton” Kopits is kind of like watching an old episode of “The Andy Griffith Show” and watching Barney Fife talk about his proficiency with a pistol.

My mind is kinda weird sometimes, and I get certain questions, and I wonder “has anyone else tossed this specific question around in their mind??” I can give you a semi-random example.

One of the big questions on commodities prices is the overall cost function yes?? This is why storage becomes a huge factor on futures prices, yes??—-so here is my “weird question”. Could it be some/many oil companies do not want people to know their true/real cost function??–>> as if people (“people”=the general public) knew the true/real cost function, they would lose the power/rationalization to overcharge people for their product/service—–create an exorbitant profit margin. I believe in free markets—-however I think this happens much more often than people (and even academics) believe.

IF we look at the rate banks charge to “facilitate”. Do we REALLY believe some of these charges/rates are adding up?? Could that be another reason why financial apps have been taking off so quickly recently?? Community risk pools (using phone apps, etc) as an alternative to bank loans…..etc. This is scaring/frightening many large banks now. Frightening them. How many things cause TBTF banks fear?? WHY all that fear??? Because “TBTF” banks are fully aware they are overcharging for that “facilitation”, and that there is a BIG market opportunity inside of the rate that they charge to “facilitate”.

Here are some soybean statistics:

https://www.ers.usda.gov/topics/crops/soybeans-oil-crops/related-data-statistics/

No interpretation today? Huh! As I look at this data which is through 2016, two things jump out. U.S. production steadily rose AND U.S. exports of soybeans also rose. So U.S. soybean farmers fared really well under Obama.

Pgl, only you and your cohort would say this. You note the things you think are important and miss those that really are important:

U.S. Soybean Prices

Farm price for soybeans:

2012 crop year average: $14.40 per bushel

2013 crop year average: $13.00 per bushel

2014 crop year average: $10.10 per bushel

2015 crop year average: $8.95 per bushel

2016 crop year average: $8.30-$9.80 per bushel (forecast)

and this

Farm cash value, soybean production:

2012: $43.7 billion

2013: $43.6 billion

2014: $39.5 billion

2015: $35.2 billion

2016: $38.0 billion (forecast)

I would make a different assessment than you. What kind of name would you call yourself for making such an obvious mistake? You have my permission to use it.

You do have a way of cherry picking data ignoring the data I noted. CoRev – you are indeed the Master Debater!

Pgl, what an ego! I didn’t ignore your data I refuted your bad conclusion by misinterpreting all the data. You call yourself an economist, and I hope you don’t consult. If you’re playing an analyst in your non-blog life I pity your clients.

The challenge must have hit home.

An economic lesson for CoRev:

“As I look at this data which is through 2016, two things jump out. U.S. production steadily rose AND U.S. exports of soybeans also rose.”

There was an outward shift of the supply curve and CoRev is surprised that market prices fell? C’mon CoRev. This is taught in the first week of freshman economics!

“I didn’t ignore your data I refuted your bad conclusion by misinterpreting all the data.”

CoRev can’t read. It was Peaky’s link not mine. And all the data? CoRev notes prices fell as I explain this as a supply shift as production was clearly up. So who is misrepresenting the data? Oh wait – CoRev has this magical econometric model but it will not show us his homework!

Pgl, digging his hole even deeper says: “CoRev can’t read. It was Peaky’s link not mine.” to my comment: “I didn’t ignore your data I refutedyour bad conclusion by misinterpreting all the data.” He was correct in claiming it was Peak’s USDA data. What was pgl’s mistake? Not blaming Peak for using USDA data, but his conclusion: ”So U.S. soybean farmers fared really well under Obama.”

Let’s look at the numbers pgl claims were due to Obama’s policies. Even though soybean harvest amounts increased by up ~38%, prices went down a whopping ~37.15%. Both fell in the last half of Obama’s term leaving the Farm cash value, soybean production dropping ~17.5% (estimated). Which left farmers planting ~ 8.4% more acres increasing their costs for less value. Without doing the math it is clear that Yield per acre probably went up in that same period.

My conclusion is pgl is an Obama stooge for thinking Obama was responsible for these increased yields. Factors determining yields can be broken into two categories: 1) Farmers’ direct decisions (seed type (best appropriate for farm) , soil type (where on the farm), when (closest to optimum planting time) etc. and 2) weather conditions effecting all three farming seasons , planting, growing, and harvest.

Notice that policy has no place in those factors. Unless of course you include policies controlling/impactingClimate Change. Most farmers laugh at that climate change claim.

Menzie, “Moreover, futures are an unbiased predictor of future spot prices. ” Is this the message you have been trying to get across? If so why has it been so hard to discern? Why all the confusion re: Trump tariff reactions? The risk associated with futures and the uncertainty associated with the current trade negotiations are easily translated to current spot prices, as shown in your many graphs, what are you trying to say with these many articles re: uncertainty and pricing?

What is your scientific hypothesis from which you are working? That has not been clear in all these articles, because it has been muddled by anti-Trump rhetoric. Which takes preference, your hypothesis or your anti-Trump message?

I see. All economic research should be prefaced by the following – “Trump is the wisest leader ever”. OK CoRev – have you finished your paper for the American Economic Review. I suspect your modeling is confused and your evidence is suspect but since you had this standard opening – it will be published and you will get the Nobel Prize.

corev and scientific hypothesis should not be in a paragraph together. corev, you would not understand the scientific process if it hit you upside the head. it annoys me to see armchair idiots act like they understand the scientific process. corev, you have a tendency to ignore facts to pursue your agenda. you have no right to argue about scientific hypothesis based on most of your comments on this blog in the past.

“you have a tendency to ignore facts to pursue your agenda”

He did this today after I pointed out the data in PeakIgnorance’s own link. Ignoring the data in their own sources. The art of the troll!

I seem to recall a certain “tribe” of folks, getting pretty self-righteous with the phrase “Never Again”. Yeah, I agree with the concept/intent.

However, above Dana Millibank’s pretty well written WaPo editorial we see a woman by the name of Lena Epstein who “co-chaired” Trump’s Michigan campaign and we see Miss Epstein’s MAGA visual doodads in the photo. Is this dumb goy (dumb goy referring to myself) the only one who sees the extreme irony of a woman with the last name Epstein doing Trump propaganda as they round up Mexican children and separate them from their parents?? Does this not bring any past visuals of history to Jews minds when they cart off Mexican parents from their children to put in ICE Detention Centers?? Are ANY alarm bells going off for the “Never Again” Jewish contingent??—>> or are we only worried when this happens to “us”?? I subtly suggest Miss Lena Epstein and some other Jews (Netanyahu etc), just maybe, I mean “just maybe” might want to ponder that one a little. Who will Trump be looking to next to “round-up”, and does Miss Epstein want to be part of the modern day brown shirts?? Or does Miss Epstein want to play the coy game, “uh yeah, I’m kinda associated with those ICE goons separating children from their parents, but uh, my last name is Epstein, I’m not Mexican—so I don’t really give a shit”.

https://www.washingtonpost.com/opinions/this-is-the-way-of-the-cult/2018/06/15/9a9c9346-70ad-11e8-afd5-778aca903bbe_story.html

No pictures or video allowed—of course they claim for privacy reasons “for the children”. The decision to disallow photos and video “has no connection” to the “optics” of how it makes a bastard named Donald Loser Trump look like.

https://www.youtube.com/watch?v=6JelgiJJ0oY

https://www.youtube.com/watch?v=3Ay-noNhZ6Q

Hope all those rural white women who voted for Trump remember to blame their “sexist” and “Misogynist” husbands for this, or Hillary Clinton is gonna get super confused about what all of this means. But remember, it is the FBI’s fault Hillary had a personal server, because she is a of a gender we must be gentle with when discussing truths. Those truths about who decided to use a personal server (not an adult female with a Yale Law Degree) might create a magical glass ceiling that forces women to get a personal server when the evil patriarchy told her it was breaking the law. Why did Comey, the FBI, and the evil patriarchy “force” an adult woman who graduated Yale Law School to not be an adult woman making her own decisions on the personal server??? Why did the evil patriarchy do that to Hillary?? Only rural white women who voted for Trump can say for certain. Or Hillary might say, if she, as an adult female with a Yale Law Degree, knew who decided to use the personal server—but only the evil patriarchy knows that, but the evil patriarchy can’t say because of a softer gender which wants to be treated equal—but…………….no, it wasn’t an adult female with a Yale law degree who decided to use a personal server.

I have only scratched the surface on your paper, but one thing I am picking up (at least circa 2013) is that if a man wants to “make his daily bread” he stands a much better chance in agriculture options than in metals options. Which makes me wonder if anyone has ever consistently (over a period of years, or say, at least a decade) made a large amount of money trading metals contracts?? And I’m not talking about the shysters that make money off commissions and fees over many years, I am talking any traders in metals that made money off the increased value of their principal metal holdings?? I remember reading in a 10k how some of these companies actually short the same materials they produce, as an obvious hedge against market downturns–which would probably surprise the average joe out there.

Menzie, if you read the newspaper, going from the back page to the front, does it still contain the same information as reading it front to back??

In my city, the tabloids put the sports on the back page which is why most people start there!

In fact, Japanese books are written and read from back to front.

@Menzie : in case you might have some time left, could you please fabricate a blog post about the definition of “random walk”, just say’in for the average non-economist reader. You have a fan base out there in the prairie.

Menzie could also explain to Ed Hanson how apostrophes are used in contractions, but a man only has so much time in life.

While there is no doubt that the “trade war” between Trump and Xi is depressing soybean prices, one has to question just how much that is the problem and how much oversupply is the problem:

• https://www.wsj.com/articles/corn-soybean-prices-drop-as-usda-boosts-supply-outlook-1439403298

• https://farmlead.com/blog/grain-markets-today/soybean-prices-argentina-peso-woes/

• https://www.brecorder.com/2018/06/12/422689/corn-soybeans-drop-to-new-lows-as-rains-soak-us-midwest/ . CHICAGO: US corn and soybean futures dropped to fresh multi-month lows on Monday as widespread rains across the Midwest farm belt bolstered production outlooks for recently planted crops.

Too much of a good thing?

So you’re saying that your brother should have planted more cherry & apple trees rather than soybeans and corn??? :->

Over supply has been a chronic problem with a lot of ag commodities, but I don’t see a lot of congress critters from rural areas arguing for less generous subsidies. Most of the corn that we grow is unfit for human consumption and ends up in cattle, “sports” drinks and our gas tanks. We’d all be better off eating less corn fed beef, consuming less high fructose sweetened products, and using more economical fuels.

2slug,

The agricultural market is not monolithic despite what futures prices might indicate. Local markets may vary considerably. By planting corn, my brother has the option of selling his crop for feedstock, foodstock, or biofuels. Now, he might not get more than anyone else for his corn, but his market might be less oversupply. He could have planted wheat, but not had buyers in the area. He could have planted hay and sold it to dairy farmers. Naturally, each choice involves a different set of buyers and opportunity. With regard to corn and human health, well certainly fructose (sugar) is a problem, but beef doesn’t have to be an issue. Certainly, the environmentally conscious (okay, that’s sarcasm) are strong advocates for ethanol (remember how E-85 was the big thing?).

He’ll do well with his corn crop because the concentration of dairy farmers in the area provide a market. His apple trees are used to smoke his venison.

Whenever you are a commodity producer, your product is fungible. It doesn’t matter to large buyers if the product was produced in Iowa or Argentina since the price-fixing process is controlled by middlemen (exchanges). Smaller buyers may be willing to pay locally for freshness/quality, availability, and other considerations.

Bruce Hall E-85 is a big thing if your name is Archer Daniels Midland, but if you’ve ever studied the economics ethanol is a disaster. It’s also an environmental disaster.

Oh gee – the 1 millionth comment that other factors matter! Of course nothing Menzie has posted denies that.

BTW – doesn’t an increase in world supply lower prices globally? Of have you not noticed – the Chinese is paying more for soybeans.

Bruce? Follow your 2nd link to this:

https://farmlead.com/blog/breakfast-brief/

This notes that US exports of these goods have declined even as weather conditions should be increasing their supply.

Lord – have you done even the most basic modeling or what? This is text book comparative statics for the effect of a tariff.

I’m beginning to think Menzie’s persistent critics think Google searching is some substitute for basic economic reasoning. Folks – it is not!

pgl,

If you read my comments in addition to the links, you see that I pointed out several factors:

• tariffs – negative for pricing

• weather – positive for U.S. supply and negative for South America supply later in the year; net potentially positive for 2019 pricing as South American drought reduces supplies from Argentina and Brazil for early 2019.

• global supply – Brazilian impact increasing from 2017/18 supply increases (combine this with the point above for current supply situation)

• currency differences – Argentina and Brazil benefiting from their declining currency valuation and strong dollar, suppressing dollar pricing in markets

I’m glad you read the links, but consider more than extracting a small piece of the whole. Prices are more than one-dimensional. Welcome to agriculture and here’s to assigning everything to politics and ignoring the entire picture.

Yes Bruce – we all know that market prices depend on several factors. DUH! So why all this grief when Menzie talks about tariffs since it is on YOUR list of factors as well.

The key thing that you and CoRev do not get has something to do with comparative statics. As in what new event has led to the observed changes in market prices and quantities.

pgl,

Pointing out the market dynamics is “grief”?

Okay, how much of the pricing change do you assign to:

• tariffs

• weather in the U.S. and South America

• impact of currency changes in Argentina and Brazil

• changes in global supply

If that’s too much “grief”, I’ll understand.

“how much of the pricing change do you assign to”.

Bruce joins CoRev in trolldom extreme. We have been asking to the two of you to at some point provide us with your grand econometric ag model. Nothing from either of you and now you want me to do your modeling for you? Talk about lazy!

pgl,

Not attempt at deflection (well, really not that great of an attempt).

All you have to do is be honest an say, “Yes, we can delineate the factors, but we can’t quantify them.” Then we move on.

Menzie Trump’s mo is to create new blog posts in an effort to call out commenters in a childish and authoritarian way over often trivial issues. This instead of keeping the discussion in the relevant thread’s comments. This isn’t to say new posts related to prior posts aren’t ever beneficial. However, Menzie Trump just seems to obfuscate the original discussion and, because of Menzie’s quantity over quality approach to blogging combined with this childish deameanor, there’s always a new blog post to top off the blog creating new “discussions” as the continual piling of the trash heap burys prior discussions in favor of Menzie’s emotional and subjective flavor of the minute. His approach doesn’t seem beneficial towards fruitful discussions/debates.

I suppose that’s the benefit of having one’s own blog???

rtd: Mr. Hanson asked if it mattered whether I used September vs. earlier use of July. I answered the question. Kill me for responding.

“burys”?

rtd, do you have another solution to correct some of the idiots who create the posts menzie must respond to? or is it ok to let these idiots post false statements without recourse? maybe menzie should give them all participation trophies and a little pat on the butt-good job snowflakes. as i recall, i admonished you in a past post for similar issues. you seem to be ok with letting idiots post wrong information, often times to support their ideology. i asked at the time if you would stand up and be counted, but you stay silent only to criticize menzie. you see the garbage posted on this post all the time by peaky, corev, bruce, ed and others. and yet i cannot recall any time you challenged them on their falsehoods? just calling it like i see it, rtd.

Whenever I see comments like rtd’s latest, I guess their start their own blog. That way the rest of the world can just ignore them.

rtd, again i will ask of you. why would you give menzie a hard time, and give a pass to the racist and elitist on this blog like peaky, corev and others? when you take your holier than thou stance against menzie and give a free pass to the idiots on this blog, it demonstrates you are really a political hack. keep it up.

The economics of tariffs and their effects on farm prices are trivial issues? Careful there as the good citizens of Iowa might be very, very upset with you.

pgl: Since rtd wires in from NYC area, I suspect that he does believe ag is trivial.

I live in Brooklyn and even I realize that agricultural economics matters. Then I grew up in Georgia. As in Eat a Peach!

I’m not disagreeing on the “rtd” hypothesis, but some New Yorkers are more pro-farming than we might imagine. Menzie was probably specifically referencing the city but there’s a decent amount of farmland in “upstate” New York and it’s actually very beautiful up there in the winter time. If you can avoid the ice, going North on I-95 up to Canada you can catch some nice Christmas card views. And until you hit the border of Quebec, the people get kinder the farther north you go.

Menzie,

This is a great issue of your childishness, inability to comprehend, and assuming the erroneous.

Where a server resides is wholly irrelevant.

I was born and raised in a rural area 100s of miles from NY.

I never said at is trivial.

I appreciate your comments which further support my issues with your blogging. Keep it up, your comments remind me of Rudy Giuliani comment’s meant to “help” the president.

Seriously, Menzie this is one of the most ignorant statements from an educated individual I’ve read in a long time. You should be ashamed at stereotyping an entire geographic area. Pitiful.

rtd: In response to my fourth post on ag futures, you wrote:

So, excuse me if I took that as a commentary on whether ag futures needed more than one post. Now that you have made clear your views on the importance of ag, I hope I have your permission to write another post — the next one in fact — on the subject of soybean prices.

Let’s play a game of who said it?!?!

“Since rtd wires in from NYC area, I suspect that he does believe ag is trivial.”

Was it

A) Professor Menzie Chinn

B) President Donald Trump

C) Bill O’Reilly

D) Steve Bannon

Menzie,

The primary problem as you continually lay out is your quantity > quality approach.

@ rtd

That was a really thorough, meticulous, and well fleshed out analysis of the Chinn and Coibion paper you gave in your comment. “rtd” you always have a way of raising the dialogue here, and we all appreciate it much more than can be expressed online. I always feel my mind has been expanded after you arrive in threads (usually a singe “hit and run”) to take cheap shots at a man whose education obviously far exceeds yours.

“rtd”, I think Menzie is going to have to invite you along to make comments at the next Jackson Hole Wyoming Symposium, as I get the sense they might all be lost without you.

Soybeans are currently in contango, with the front month at 905, rising to 958 for the July ’19 contract.

Since 2014, soybeans have typically closed in the 900 – 970 range, so the current value is far from unprecedented in recent times. Having said that, the futures are mostly above 918 from November of this year, and below it prior.

Thus, the futures curve — taken only with historical prices since 2014 — suggests the market is pricing in a short term disruption in market dynamics, but with the impact fading in Q4. The market does not expect the trade war to last, or does not expect the effect of the trade war to last. (Probably the former.)

In any event, Friday’s close cash price appears to be about 4% discounted to a neutral value; the next quarter’s futures are discounted about 1.6% on average. I would note that China announced soy tariffs just yesterday, and traders are apt to over-react the news, in my experience. So let’s see if the market calms down come Monday.

I would add that I am more pessimistic than the market on the nature of this trade war. Wars often start over matters of principle (although I am not entirely clear what principle the US is fighting for), but they can fairly soon transform into very personal matters relating to dominance and control — independent of underlying, substantive issues. I think Xi digs in here, as I have said before, and then it becomes a battle of wills against a US president who prefers conflict over reason. The visibly complete marginalization of US policy staff sets up a bad outcome.

https://www.barchart.com/futures/quotes/CLY00/interactive-chart

https://www.barchart.com/futures/quotes/ZS*0/all-futures?viewName=main

Barchart is a good source for futures data.

Steven Kopits says: “…a US president who prefers conflict over reason.”

Obviously, you believe a level playing field is unreasonable and Trump shouldn’t be trying to force communist and socialist leaders to be fair.

Trump just wants to create conflict, because he’s unreasonable.

You obviously believe in parroting every lie from the Trump White House.

You’ve obviously been watching too much fake news.

Yea – I do skip your show…Fox&Friends!

Use this chart for soybean historicals

https://www.barchart.com/futures/quotes/ZSY00/interactive-chart

Thanks for the charts, Steven. Looking at the 5Yr and 20Yr time frames show an interesting pattern of price reductions. Of course looking at their monthly averages puts the current price drop in perspective. The 20Yr chart shows many monthly losses greater than what we are seeing. (Caveat that June 18 stays at or near the current level.)

Just for pgl the last few years of Obama’s administration soybeans appear to have lost ~1/3 of their value.

CoRev: What happened to soybean pries from 2010 onward…Where were soybean prices in Jan 2017 relative to Jan 2009?

I provided this chart a couple of days ago:

http://www.macrotrends.net/2531/soybean-prices-historical-chart-data

CoRev had to see it but he chooses to ignore this even as he lectures me for ignoring the data? Seriously?

Menzie, to what are you trying to refute? 2010 onward had rising prices until a peak in 2013 thereafter a gradual drop down settling a little just above the post recession low. 2017 was near the 2009 low. I know of no obvious Obama trade policy that impacted prices; however, during the period there were several droughts and the dollar stayed low.

CoRev: Not trying to refute anything, but put into context the drop in prices you had stressed. The rise and fall of soybean prices is in part associated with the weakness of the dollar. To the extent that expansionary fiscal policies push up the value of the dollar, this is keeping commodity prices low, as discussed here.

Menzie, did you NOT NOTICE my: ” during the period there were several droughts and the dollar stayed low.“

I provided a time series chart on soybean prices the other day which you chose to ignore. I provide it again.

Could you take your cherry picking dishonesty somewhere else?

If one looks at Obama’s first term – soybean prices rose quite a bit. Of course this was the period where we were using fiscal stimulus and QE to pull us out of the Great Recession which started under Bush’s watch. Yes soybean prices fell later but later is after the fiscal austerity imposed upon us by Republican majorities in Congress and a lot of state governments.

CoRev wants to make everything Republican v. Democrat but he as usual shot before looking.

Pgl, why must you lie to make a point? You erroneously concluded: “CoRev wants to make everything Republican v. Democrat..” Yet it was yourself who brought politics into the discussion. Even this comment is exemplary.

Pgl starts by claiming Obama’s 1st term soybean prices rose,blah blah blah policies. He then adds: “Yes soybean prices fell later but later is after the fiscal austerity imposed upon us by Republican majorities…more blah, blah”.

If anything can be said about this series of articles, I have described policies as having fringe impacts upon Ag prices, and I don’t remember referencing Republican v. Democrat except as a possible rejoinder to another’s erroneous conclusion/analysis.

So, I ask again, why must you lie to make a point?

corev, why must you continue to spew incoherent commentary. you simply make a bunch of half points (half truths) in all of your commentary. it is boring.

Troll. Add some value.

more incoherent commentary from corev. what an idiot.

Menzie

I am sorry for not responding to your post lead by my name. I have been most busy and suffered a temporary computer malfunction. I appreciate your response to my second observation that soybeans were another matter. More on this in another paragraph.

I did notice a complete lack of responding to first and primary observation. Lean Hogs futures, June and July as were exemplified in your earlier post)show no similar response to tariff threats as you have contended is happening to soybeans. But no graphs in of Lean Hogs in this post. Why?

You know of my recurrent theme of context and perspective. Steven brought excellent perspective to your charts by linking to 5 and 20 year charts. it shows that soybeans are subject to steep a periodic declines in price. It seems the nature of the commodity. It brings to mind the ideas of Corev that soybeans price is subject to many factors and limiting and emphasizing it to single cause is plain wrong.

Ed