Nearly a year ago, I asked Are Global Imbalances a Source of Concern?. At a minimum, we know they’re back. And the IMF certainly thinks so.

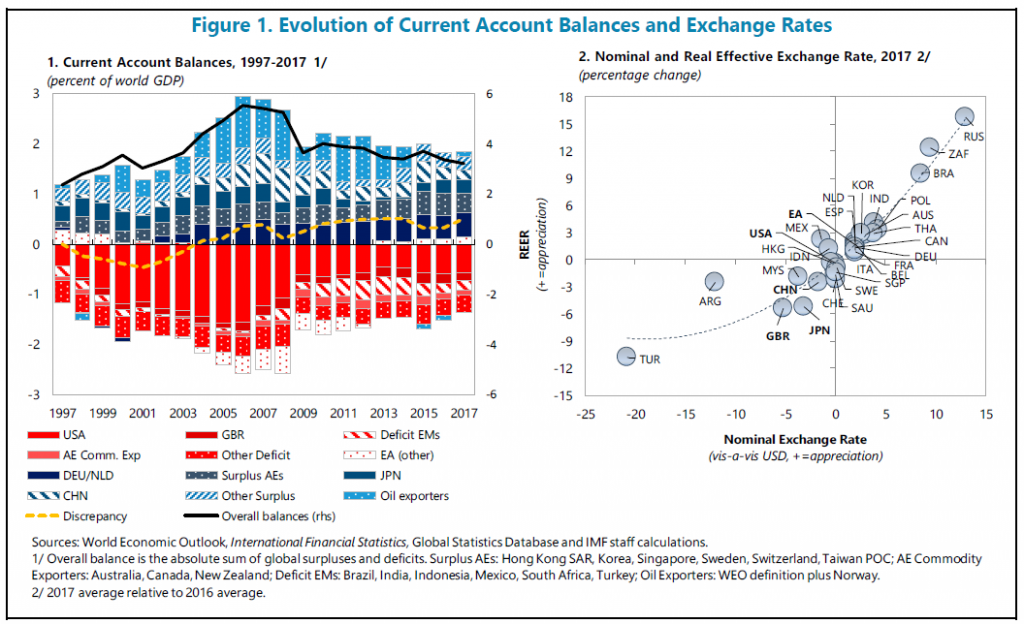

Figure 1 from IMF External Sector Report, 2018

Their reasoning is documented in the voluminous external sector analysis, entitled “Tackling Global Imbalances amid Rising Trade Tensions”, released yesterday.

In IMF Chief Economist Maury Obstfeld’s blogpost, he asks: “How to tackle imbalances?”, and provides the following answer:

In the current conjuncture where many countries are near full employment and have more limited room to maneuver in their public budgets, governments need to carefully calibrate their policies to achieve domestic and external objectives, while rebuilding monetary and fiscal policy buffers. In particular:

- Countries with lower-than-warranted external current account balances should reduce fiscal deficits and encourage household saving, while monetary normalization proceeds gradually.

- Where current account balances are higher than warranted, the use of fiscal space, if available, may be appropriate to reduce excess surpluses.

- Well-tailored structural policies should play a more prominent role in tackling external imbalances, while boosting domestic potential growth. In general, reforms that encourage investment and discourage excessive saving—through the removal of entry barriers or stronger social safety nets—could support external rebalancing in excess surplus countries, while reforms that improve productivity and workers’ skill base are appropriate in countries with excess external deficits.

Finally, all countries should work toward reviving trade liberalization efforts while modernizing the multilateral trading system—for example, to promote trade in services, where gains from trade liberalization could be substantial. Such efforts may have small effects on excess current account imbalances, but they can have big positive effects on productivity and welfare, while reducing the risk that current account imbalances trigger counterproductive protectionist responses.

Interestingly, the US under the Trump regime is pushing pretty much exactly the wrong direction for stabilizing these global imbalances.

The U.S. needs massive entitlement reform. We can reduce entitlement spending substantially and create more workers simultaneously. Therefore, less government spending with more taxpayers will reduce budget deficits.

We can eliminate the option of collecting Social Security at 62, eliminate the earned income tax credit (and raise the minimum wage), create savings accounts for medical and dental services, along with reducing healthcare regulations, and place more restrictions on food stamps. We can also save on education spending, e.g. reducing loans and grants for non-STEM fields, or providing more assistance for fields in high demand.

I stated before:

I would promote work through less entitlement spending. For example, Social Security benefits starting at 68 with a minimum $1,500 a month and freezing any cost of living increases for several years, if individuals are expected to receive over $2,000 a month. Require only catastrophic employer health care insurance and allow savings accounts for all other health care needs. So, consumers can shop around to reduce costs. Tighten eligibility for food stamps or limit it for two months (children living in parent’s basement are no longer eligible). Providing Social Security at 68 will remove the disincentive to work at 62, and Medicare eligibility will be 68 instead of 65 (employer health care and savings accounts will offset much of Medicare, along with reducing healthcare costs).

i guess a failed banker who never worked up a sweat would propose such retirment requirements. but curious how a guy who has worked construction or steel mills his whole life continues such labors at 67 years old? sure, let that 67 year old carry a 50 pound bag of asphalt shingles up the ladder and across the rooftop in vegas in july, so that peak can continue to collect his retirement welfare at full throttle for the next decade. since he now has an artificial hip, or as peak would describe it-bionic, it should not be a problem at all. in peaks approach, most hard working american’s would probably die off before they could collect social security and medicare. certainly solves the entitlement problem and reduces costs.

Baffling, making up fairy tales doesn’t help your cause.

When Social Security was enacted, life expectancy was much lower.

Someone, who really need a disability payment, gets it.

I don’t hear you saying anything about construction workers being paid a lot less, because of the flood of poor and illegal immigrants. After all, you really only care about votes.

“making up fairy tales doesn’t help your cause.”

Say this to the mirror over and over.

“When Social Security was enacted, life expectancy was much lower.”

What a dumb statement. Yes we have fewer infant mortalities. But the correct measure is life expectancy dating from when one retires – not from birth. If you do not know that – you have zero credibility on this issue.

Oh wait – you have zero credibility PERIOD. Never mind!

“When Social Security was enacted, life expectancy was much lower.”

the average life expectancy of a blue collar worker has not increased all that much over the decades, so your statement, while a cute soundbite, is not correct in the context of social security. social security has issues not because people are living longer-which is the argument you are making with your new age limits. social security has an issue because there are fewer people working today per retiree. all your approach will do is make a 67 year old collect unemployment until they can receive social security-it does not solve the problem or help the blue collar worker in the least.

“I don’t hear you saying anything about construction workers being paid a lot less, because of the flood of poor and illegal immigrants. ”

actually these are false arguments. construction workers are paid well. in fact, there is a shortage of construction workers-hence the low number of new housing units. seriously, peak, do you even know the truth anymore?

Pgl, so, are you saying there hasn’t been improvements in lifestyles, sanitation, antibiotics, medicines, surgeries, etc. to extend life expectancy significantly, along with living healthier lives?

If you believe that, you’re even dumber than anyone can imagine.

Baffling, safety standards alone increased life expectancy.

Construction workers are paid less than in the past.

Some of it has to do with the decline in unions and some of it in labor supply and demand.

PeakIgnorance fails to realize that the payout is less if you take SS benefits at 62. Actuarially (i.e., as an average over the entire population of beneficiaries) SS pays the same amount regardless of when benefits begin.

Dave fails to understand what I’m talking about:

Creating taxpayers and reducing the explosion in entitlement spending.

You do not understand what you are talking about. Which is what happens when one is Steno Sue for this White House.

PeakTrader Quite a long laundry list of central planning targets. Don’t have to scratch you too deep to find a closet socialist.

BTW, Social Security is actuarially neutral regarding the age of retirement. Over the length of a statistical life it makes no difference whether you retire before or after the age of full retirement benefit.

Peak wants to take our Social Security contributions and hand them out to the Hampton crowd. So sweet of him!

“The U.S. needs massive entitlement reform.”

Another off topic rant. OK – throw granny off of her Social Security so she has to work hard and save. That will do it. But asking the Hampton crowd to do their share is so unTrumpian.

PeakPathetic values!

We could just remove the income contribution cap on Social Security and other benefits, as well as enabling it for all forms of income. That should cover the needed funds for the programs to effective perpetuity.

Do they know or even understand?

It does not appear so viewing this from down under

Menzie, if balanced acounts is the goal, then why do you believe/say this: “Interestingly, the US under the Trump regime is pushing pretty much exactly the wrong direction for stabilizing these global imbalances.” Do you actually believe imbalances should be stabilized or reduced?

If “Lower-than-desirable balances remained concentrated in the United States, the United Kingdom, some euro area debtor countries, and a few vulnerable emerging market economies (Argentina, Turkey).” what is the solution for those “HIGHER” balance countries? How is Trump;s current efforts wrong for balancing international trade?

If the Report accurately claims: “Surplus and deficit countries alike should work toward reviving liberalization efforts and strengthening the multilateral trading system—particularly to promote trade in services, where gains from trade are substantial but barriers remain high.” How does opening foreign markets, as is Trump’s goal and effort aimed the wrong direction?

We obviously see thing differently.

Do we have to draw this in crayons for you. Trump says he wants to increase net exports but his policy actions will lower net exports. But do babble a bunch more gibberish while you are at it.

“Countries with lower-than-warranted external current account balances should reduce fiscal deficits and encourage household saving, while monetary normalization proceeds gradually.”

C’mon Maurice. No one in this White House will have a clue what your mean here. They will not even know you are talking to them. With Trump and his crew – you need to spell it out slowly and clearly preferably using crayons.

Don’t besmirch and sully the good name of Crayons. A fine tool in the right hands. At least wait until the new Crayon dedicated to trump’s face comes out—“leathery orange”

Menzie on September 27, 2017:

“Since current account surpluses and deficits are primarily macroeconomic phenomena, driven by saving and investment decisions, attempts to reduce the United States’ trade deficit by way of protectionist trade measures, such as anti-dumping tariffs and countervailing duties, and withdrawals from free trade agreements, are unlikely to be effective. Instead, they will redistribute the trade balances between our different trading partners. On the other hand, fiscal policy measures – such as the large tax cuts on the order of $2.2 trillion over ten years currently envisaged by the Trump Administration and the Republican led Congress – are very likely to drastically increase budget deficits and hence current account deficits.”

While that was well said – it is clear that the Republicans failed to understand any of this. OK, it is time for economists to learn how to write on a preK level as our political leaders are incredibly stupid.

Yep. That’s the core problem, and it’s on display here. The average voter does not understand macro and has no real interest in actually learning any. We see it here every day. Commenters regularly brag about not knowing or caring about textbook macro. Instead they prefer to believe in politicians with supernatural “magic touch” powers. The arrogance of ignorance is worrisome.

4.1% GDP growth! OK all you naysayers explain to us how anomalous this is. Remember all those farmers harmed with the May surge in soybean exports? Neither do I, but it helped the GDP increase as will the EU buys later in the year.

One quarter, while very good, does not a full year make. 4.1% is good enough to be in the top 10 quarters since 2000. https://www.calculatedriskblog.com/2018/07/top-ten-gdp-quarters-since-2000.html

But ANNUAL GDP growth hasn’t topped 4% since 2000. I don’t expect annual GDP growth for 2018 to top 3.0%

Yes we had a TEMPORARY rise in exports as farmers sold goods before the tariff walls came hammering down. We also had a rather large in crease in defense spending which makes John Bolton happy as he may get his wish – spending our young kids off to another needless war.

But maybe you did notice. Investment demand declined. And we were told that we would have an investment led boom. Of course those that told us that either were clueless or lying.

Trump said these numbers are “sustainable”? If he thinks exports will continue to grow by 9% per year in real terms – he is dumber than any of us ever gave him credit for!

CoRev, thanks for pointing out that much of the second quarter real GDP growth was foreigners buying soy beans before the new tariff on beans kicked in.

This implies that the 4.1% surge in real GDP was a one time event that will not be repeated. Actually, as soy bean exports fall it should be a major dampening of real GDP for the rest of the year.

Note that the year over year growth of real GDP is 2.8%, only up from 2.6% in the first quarter and about the same as the 2.9% reported in 2015.

To be exact, exports accounted for 1.27 percentage points of the 4.1 % bounce in 2nd Q real GDP.

That is some 30% OF 2ND quarter real growth.

That is more than double exports contribution over the last few years

Correction, exports contribution was only 1.12 not 1.27 percentage points.

I read the wrong line in table 2.

Sorry

Trump today claimed these numbers are “sustainable”. Is Trump this delusional or does he think the rest of us are very stupid.

He has made a highly successful career assuming we are all that stupid.

Trump did better than just say those numbers were sustainable. He said that he could achieve 8 or 9 percent growth by cutting the trade deficit.

https://www.cnbc.com/2018/07/27/trump-suggests-economy-could-grow-at-8-or-9-percent-if-he-cuts-the-tra.html

Good God this man is dumb.

“President Donald Trump told talk show host Sean Hannity that he could imagine the economy growing at eight or 2018Q3nine percent on Friday — just hours after the Bureau of Economic Analysis showed that the GDP rose 4.1 percent in the second quarter. The claim is far higher than economists predict.

The president said that the gains could come from cutting the nation’s trade deficit “in half.”

“I look forward to seeing next quarter … I think the 4.1 is just a stepping stone,” Trump said.

First of all he was talking to the right wing tool known as Sean Hannity so he was supposed to lie. Trump thought the number would be 8% to 9% so 4.1% was far below his prediction. I’ll bet 2018Q3 will be less than 4.1% aka Trump is stepping in it. But suppose by magic we see net exports rise a lot. That could happen if we see massive reductions in consumption and investment. Factor that into one’s macroeconomic model. Oh wait – Kudlow does not have a model – just a lot of cocaine!

CoRev,

Lets check back in the next GDP print. If 4% is sustained, I’ll stop commenting about how ignorant every single thing you write appears. If 4% is not sustained, will you agree to leave this board forever?

-Dave

Trade Liberalization, IMF, and the US under President Trump.

Menzie says, “Interestingly, the US under the Trump regime is pushing pretty much exactly the wrong direction for stabilizing these global imbalances.”

Let’s examine the current news to see if Menzie is right. The EU, under pressure from the US policy, is now willing to go to zero tariffs on most goods from the US This does not seem to fit what Menzie has written. And perhaps it is the first crack in the European custom union. The US has done its part, so lets see if the IMF or the WTO can open Europe custom union to free trade with the rest of the world. But don’t bother watching, those organizations are mostly all talk, unless it is dealing with a small country they can bully. But that is the stabilization the IMF and, by inference, Menzie wants.

Corev has already pointed out that the US also doing its part bith excellent GDP growth, a kind that the socialist agenda of the other party could never achieve. Nor could the countries following the IMF agenda.

Ed

Trade Liberalization? If you believe this nonsense, we in Brooklyn have a bridge to sell you.

Actually from 2012 to 2016 under Obama there were 6 quarters when the year-over year change in real GDP exceed 3%— that about 30% of the time.

The number you cited included the great recession Obama inherited from Bush. In contrast Trump inherited an economy in the middle of an expansion phase.

Spencer, and pleased we are that Obama and the Dems were able to recover, although slowly, from a deep recession. Furthermore we are especially pleased: “In contrast Trump inherited an economy in the middle of an expansion phase.” upon which Trump was able to kick into a higher rate of growth. Now, if he can normalize international trade to a freer version than we have had, then some of the imbalance can be reduced.

Free trade via a massive trade war. Lord – you say the darndest things!

Ed,

The US and EU were in a serious negotiation called the Transatlantic Trade and Investment Partnership (TTIP) since 2013. Among its stated goals was to reduce tariffs on industrial goods to zero, exactly the goal that Trump is now touting for his new negotiations. Canada and Japan started such negotiations with the EU and reached agreements that have been ratified since Trump assumed office. However, he shut down TTIP when he got in, calling it “one of the worst trade deals in history.” Now he is reviving some abbreviated form of it, a neo-TTIP, and declaring it a great victory. The hypocrisy as well as stupidity in this stinks to high heaven.

Barkley and the other naysayers, “The hypocrisy as well as stupidity in this stinks to high heaven.”

I suspect that Obstfeld’s comments were too opaque for some folks here, so let’s give them the “Dick, Jane and Sally” version. Bottom line is that the IMF believes the US needs to shrink its budget deficits. That means higher taxes, less government spending and increased personal saving. The just released GDP numbers are hardly encouraging in that regard. Virtually all of the 4.1% GDP growth was due to an unsustainable 4.0% growth in personal consumption spending and an equally unsustainable increase in federal spending. You have to go all the way back to 2010Q2 to find a larger increase in federal government spending. And while we don’t yet have data on personal saving, the spike in personal consumption spending is not encouraging. It appears that consumer spending was pumped up by temporary dissaving. We actually saw negative growth in total domestic investment. The global imbalances really reflect policies that are contractionary for countries that ought to be pursuing expansionary policies (e.g., Germany), and expansionary for countries that ought to be pursuing more contractionary policies (e.g., the US).

Dick, Jane and Sally get what you are saying. But for the Trump crowd – we will need to dumb this down even more.

slug

I find it interesting the point you make of increased government spending. Would you please link to the data? And if it is not already linked, a break down of the types of Gov spending increase? Do these links show historical spending?

I guess I am wondering that without any new spending programs passed by Congress, where is the spending going?

Other questions. “We actually saw negative growth in total domestic investment.” a decrease from a very high level is of little concern. a decrease from an already low level would be quite concerning. Which is it?

And by the way, a country should never pursue contractionary policy. Rule of thumb, growth will make many problems go away while under contraction these same problems are unsolvable.

Ed

Ed Hanson: The omnibus spending bill passed last year relaxed constraints on spending. The Center for a Responsible Federal Budget has the numbers…

Menzie

You mean the highly bipartisan bill passed by Congress at a point in time of forcing President Trump to sign the bill in order not to cause a greater harm to the economy? Who do you wish to blame? In the House, more repubs voted for it than dems, but more repubs voted against it than dems. In the Senate, only 9 dems voted against the bill while 23 repubs voted no. Did you like the bill? It certainly achieved one of your major goals, even if you deny it, of increasing government. And to answer the same question, I did not.

Ed

Ed Hanson: No, I’m only pointing out that government spending did increase, contra what you suggested.

Menzie

I never said nor implied that spending did not increase, but wished for the data on how much the increase was and where it was spent. Neither you nor slug nor anyone has been able to link directly to the data.

Ed

“I never said nor implied that spending did not increase, but wished for the data on how much the increase was and where it was spent.”

Ever checked out http://www.bea.gov? Lots of excellent data. You might also Google OMB. Or is basic research too much for you?

Ed Hanson A good place to start would be with the OMB authorization tables. If you want the nitty gritty detail, then you’d have to pull up the Treasury and DFAS disbursements by function and subfunction. But spoiler alert: the BEA data clearly shows that it’s in defense spending. Defense spending is up 5.5% while non-defense federal spending is only up 0.6%. Overall federal spending is up 3.5% with state and local government spending only rising 1.4%. So even though total government spending is only up 2.1%, the big driver here is defense spending.

And yet, no one has answered Ed’s request. Show him the data so that h/we can compare your claims.

Ed Hanson I thought you knew how to link to BEA data. You don’t???

a decrease from a very high level is of little concern.

Not sure where you got this. I suspect you just made it up.

a country should never pursue contractionary policy

Please try and publish this theory at one of the blue chip econ journals. Or maybe you’d like to present your idea to the Fed at the upcoming Jackson Hole conference. If nothing else I’m pretty sure they’d give you points for originality and bold thinking.

Ed is under strict orders from his political masters NOT to cite BEA data.

You can get the data directly from BEA

Private investment fell because inventories were cut, although private investment in business equipment — excluding high teck –contribution to growth also fell.

Maybe some of you will remember that a year ago I argued that it would be easy for Trump to achieve 3% growth. A major cause of weak growth under Obama was the austerity budgets passed by the Republican Congress. Private GDP growth had been almost 3% in recent years and all Trump had to do was let federal government purchases expand and real GDP growth would exceed 3%.

Excuse me for bragging, but one of the basic rules of economic forecasting is that if you are ever right ,do not let anyone forget it.

Note the jump in Federal spending did not come from a jump in nondefense spending. No – it was a yuuuge jump in defense spending. As I noted earlier – this makes Bolton all giddy as he is itching to get us into another stupid war.

Why should the US want to reduce savings?

A large share of US economic problems stem from inadequate savings.

What Maurice and Menzie are saying is that we need to increase national savings. I think we can all agree with that but the morons in this White House are indeed trying to cut what is already inadequate savings.

PeakTrader: “Tighten eligibility for food stamps or limit it for two months (children living in parent’s basement are no longer eligible). “

Oh, the irony.

Especially since a major reason food stamps were created in the first place was to help get rid of the massive food stocks accumulated by the government supporting agricultural prices.

Obama mere 1.9% growth. Trump a respectable 2.7%. In just a year and a half. And he is only getting started! There is way more to come.

Phase II is about to get underway. Corrupt elements in the federal bureaucracy and judiciary had to first be removed and replaced. In record numbers, members of Congress are not running again. Clue up. This is happening before your eyes while you munch on hogs and soybeans and vacuous scribblings out of Harvard.

Phase II is by far the most important. Corrupt elites in all walks of life go before the bench. Soon enough this will be visible to all America as the fake news media will have no choice but to report on it.

How can patriotic Americans not applaud draining the swamp? Each swamp dweller is like a tether holding back the economy. Imagine what the rate of growth will be once the corruption is fully exposed to the light of day and has gone through the wash-rinse cycle.

Lord – the dishonest and stupid babble has no bounds!

What swamp dwellers. The Trump admin is the most corrupt in the entire history of the nation. It starts at the top with Trump the first president ever to be charged (accurately it appears) with violating the emoluments clause of the Constitution. You are in serious la la land, JBH.

JBH Have you been tuning into RT lately? Trump is the king crocodile in the swamp. He’s corrupt as hell. His father was corrupt as hell. His father’s lawyer (Roy Cohn) was probably the most corrupt lawyer in American history. And Trump’s grandfather was a mob boss. Jared’s father was corrupt as hell and Chris Christie sent him to prison. Crime is the Trump family business. His name should have been Don(ald) Corleone. He’s been found guilty of civil crimes at least six times and only escaped justice thanks to the efforts of his corrupt sister Maryanne, who sat on the 3rd Appellate Court. Having fewer corrupt politicians would be nice, but smarter voters would be even better. Your posts do not improve the collective IQ on this blog.

Maybe JBH is confused. trump does like to “launder” many dirty things. And after all, no one has ever called Scott Pruitt a crocodile.

https://newrepublic.com/article/143586/trumps-russian-laundromat-trump-tower-luxury-high-rises-dirty-money-international-crime-syndicate

Kevin Drum of Mother Jones wants to form a team to combat disinformation:

https://www.motherjones.com/kevin-drum/2018/06/614795/

Menzie belongs on this team. Kevin weirdly calls it a “disinformation team”. We all know the Usual Suspects here are a team to SPREAD disinformation!

I second the nomination of Menzie to Kevin Drum’s team.

Had often imagined a “dream team” of bloggers. But I suppose things such as “Project Syndicate” have already semi-killed that idea. Not that I ever had the resources or respect to put it together, just one of those fun musings.

I called for PeakDishonesty to get the issue of life expectancy with respect to the Social Security correctn. Did he? Of course not as this is the intellectual garbage he decides to fire off”

‘Pgl, so, are you saying there hasn’t been improvements in lifestyles, sanitation, antibiotics, medicines, surgeries, etc. to extend life expectancy significantly, along with living healthier lives?’

Look we all know PeakDishonesty is a Russian troll who lies and spins 24/7. But does he have to make it so incredibly obvious?

Baffling gets this issue:

“the average life expectancy of a blue collar worker has not increased all that much over the decades, so your statement, while a cute soundbite, is not correct in the context of social security. social security has issues not because people are living longer-which is the argument you are making with your new age limits. social security has an issue because there are fewer people working today per retiree. all your approach will do is make a 67 year old collect unemployment until they can receive social security-it does not solve the problem or help the blue collar worker in the least.”

Oh yea – Peaky replied with his usual feeble nonsense.

It gets worse. Recall that Nobel laureate Angus Deaton found a falling life expectancy for white non-Hispanic men with a high school education (i.e., the typical Trump voter).

https://www.brookings.edu/wp-content/uploads/2017/03/6_casedeaton.pdf

peak

“As Table 1 indicates, the average life expectancy at age 65 (i.e., the number of years a person could be expected to receive unreduced Social Security retirement benefits) has increased a modest 5 years (on average) since 1940. So, for example, men attaining 65 in 1990 can expect to live for 15.3 years compared to 12.7 years for men attaining 65 back in 1940.”

https://www.ssa.gov/history/lifeexpect.html

so we have extended our retirement life by less than 5 years over a 75 year period!

“When Social Security was enacted, life expectancy was much lower.”

you want to revisit this statement. what do you consider “much”? i don’t consider 5 years “much”. all you want to do is make those folks work in old age. peak, once again you are either lying or intentionally misleading in your arguments. i imagine it is both, hack. at least be honest in your arguments.

Thanks for getting this issue right. Of course this will not stop the disinformation campaign from PeakDishonesty.

Baffling, you’re trying to mislead.

Many more Americans are reaching 65 and living more years past 65 today than in 1940.

See table 1.

And, since life expectancy has been extended “five years,” why not increase the age for receiving Social Security benefits?

And, I’m suggesting collecting more Social Security benefits starting at 68.

The data in this article support everything I’ve said:

https://www.google.com/amp/amp.slate.com/articles/health_and_science/human_nature/2006/03/bygone_age.html

My Lord – Will Saletan is even dumber than you are.

I thought I had heard something about William Saletan’s research skills. It seems Saletan wrote about how race was a factor with respect to intelligence. But his sources turned out to be white supremist. DeLong gets this:

http://www.bradford-delong.com/2018/05/no-there-is-no-reason-for-william-saletan-to-have-his-job-why-do-you-ask.html

I wonder if PeakRacist gets it too. Leave it to PeakRacist to rely on such a sloppy researchers to school us on Social Security!

PeakTrader Apparently you didn’t know that SS actuarial estimates already took increased life expectancy into account when FICA taxes were raised under St. Ronnie. The major problem with SS financing is that a lot less of gross income falls under the FICA scope. Income above $128,700 (for year 2018) is not subject to the FICA tax. One consequence of extreme income inequality is that a smaller share of gross national income is subject to FICA. Raising the maximum threshold such that FICA captured the historical norm (around 90%) would go a long way towards solving Social Security’s long run funding problems. According to a 2017 Congressional Research Service report:

Since 1982, the Social Security taxable earnings base has risen at the same rate as average wages in the economy. Because the cap is indexed to the average growth in wages, the share of the population below the cap has remained relatively stable at roughly 94%. However, due to increasing earnings inequality, the percentage of aggregate covered earnings that is taxable has decreased from 90% in 1982 to 83% in 2014.

Raising or eliminating the cap on wages that are subject to taxes could reduce the long-range deficit in the Social Security trust funds. For example, phasing in an increase in the maximum taxable earnings to cover 90% of earnings over the next decade would eliminate roughly 30% of the long-range shortfall in Social Security. If all earnings were subject to the payroll tax, but the base was retained for benefit calculations, the Social Security trust funds would remain solvent for over 60 years.

https://fas.org/sgp/crs/misc/RL32896.pdf

“Baffling, you’re trying to mislead.”

No that’d be you. The comments above undermine your lie totally. OK – you are too stupid to get what this issue is about so hey!

It seems you cannot get past the intellectual garbage spewed out every morning on Fox and Friends.

I thought this was pretty humorous and would make for good weekend viewing. It’s a segment from Seth Meyers. ENJOY

https://youtu.be/h2rizTeeKHM?t=53s

I’ve never been able to figure out why this guy doesn’t have a regular column at NYT or some other such “major” newspaper. He is one of the better editorial writers or columnists out there in my personal opinion. Maybe he’s just not enough milquetoast for them. That would have to be my assumption at this point. Even Susan Rice’s column in NYT comes across as a damned love letter, because heaven forbid we offend any Republican that subscribe to the paper.

http://www.ginandtacos.com/2018/07/27/wingin-it/

He reminds me of James Kwak, who used to be one of my favorite current events writers (say roughly around 2008–2013 time span) until Kwak got into this “default decision” crap (more snob “I know better than you” sh*t) and the columns became sparse. The reason he reminds me of Kwak (roughly pre-2014) is he talks about things that badly need to be addressed and are vitally important, yet everyone acts as if they see nothing (Dodd Frank rollback being a great example).

“Baffling, you’re trying to mislead.”

i am not the one who stated

“When Social Security was enacted, life expectancy was much lower.”

at which point you were shown to be incorrect. then you switched gears and said folks should not be allowed to retire early as this is the cause of entitlement explosion. but as noted on this blog, actuarily it makes no difference whether one retires early or not, as your payout is reduced in early retirement. so you were wrong again.

now 2slugs has pointed out that you can close the social security gap by actually allowing fica taxes to apply on income above $120k per year, rather than let the regressive tax cut continue for the wealthy. but you do not want to solve the problem. you simply want to penalize others by making them work labor until they are 68. not sure why the anger. your immigrant blood must dislike natural born citizens? so lets be very clear here peak loser. the only one misleading is you. after being shown your ignorance on the SS issue, it would be best if you kept quiet on the topic going forward. nothing you have stated thus far has been true, simply your belief in an ideology that is incorrect.

my household makes significantly more than the fica threshold. if you extend that tax without limits, sure i will pay more, but it really does not affect my lifestyle one bit (or anybody else in a similar position). this is a solution with little punishment overall. however, peak loser would rather make a senior citizen labor for another 6 years rather than be able to retire early from a labor job. now that is a punishment, possibly even life and death. just curious, do you agree with the common practice of allowing police and firefighters retire early due to their job hardships?

hopefully this puts to rest anymore stupid comments from peak loser on the issue of social security.

I had to crack up when Peaky cited something written by William Saletan as his source. Seriously?

Has it been 13 years since Bush II suggested replacing traditional SS with private accounts?

How sad. Doing so under the Bush plan would have required borrowing another $4-5Trillion over a 15 year period. Had the plan been adopted, the national debt would have been, oh, approaching at least $4 Trillion more, and who–in these heady times–could disagree with that?

Instead of a simple $1Trillion deficit next year, the budget would be even more out of balance. But the “King of Debt” would have been right in his element.

Trillion deficits as far the eye can see? Ha! You ain’t seen nothing yet.

This is the type stuff “SNL” used to do, before they started sucking A__ and having the same cast members on for 20 years straight:

https://www.youtube.com/watch?v=QKvCA3yrp30

I’ve always wondered what Menzie is doing when he doesn’t post for 3–4 days. Now that I’ve finally found out, it just all seems so unseemly:

https://www.thedailybeast.com/how-an-ex-cop-rigged-mcdonalds-monopoly-game-and-stole-millions