On reading my admonition to consult my paper with Oli Coibion, reader Ed Hanson writes:

Do you really have a problem explaining to those who can not follow your paper? I hope you do not teach undergraduate beginning economic courses. Unless. of course, your intention is to decrease economic understanding in the world. But then again, I suspect that exactly what you want, because only the economic illiterate and the power elite could support socialism.

Confessions:

- I do teach undergraduates.

- My teaching evaluations have always been above mean.

- My intent is not to decrease economic understanding.

- I am not intent upon supporting socialism. I have never been, nor am I now a member of the Communist Party.

Observation:

- The term The Power Elite is closely associated (if not effectively coined) by C. Wright Mills who observed the close interconnections between military, corporate and political elements. Mr. Hanson’s deployment of the term is ironic, to say the least.

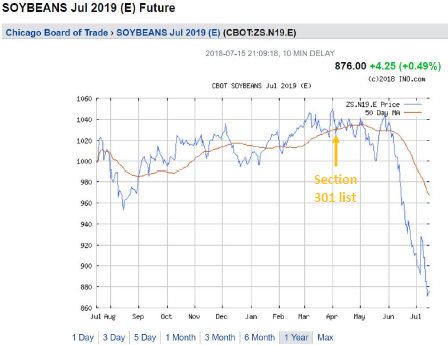

So, here for the Ed Hanson’s of the world is a simplified summary of the paper’s implications for interpreting the outlook for soybeans (geez, I never thought I’d write so much about soybeans, and writing at such a basic level), in light of this graph.

Figure 1: Soybean futures for July 2019. Source: ino.com, accessed 7/15/2018.

- The statistical relationship between the basis and actual changes in the price is close to one-for-one (unbiasedness).

- The futures today for a trade k periods hence is the best guess of the spot rate k periods hence (minimum variability of forecast errors).

- Given these historical correlations, the drop in prices for futures can be interpreted as expected drops in prices for future spot prices.

- Hence, the best guess on average of what the price in July 2019 is the futures price as of today for a July 2019 delivery.

- These conclusions do not necessarily apply to other commodities, such as metals.

Menzie See what I mean about “missionary work among savages”?

This is among Menzie’s most Trump-like immature commentary to date.

Calling out people like a child.

Being braggadocious about the size of his hands being above the mean… oops “teaching evaluations have always been above mean”. Menzie’s evaluations are yuuuuuugeee. He has the best evaluations.

Not understanding your intents may not align with action.

Claiming you are now a republican when you were a democrat – I mean that you haven’t been a member of the Communist Party (I couldn’t care less about the reality of this bit moreso that Menzie’s “proof” is laughable).

Being pathetically condescending and rude: “geez, I never thought I’d write so much about soybeans, and writing at such a basic level” (not to mention “you are dense” from earlier).

You are the left-leaning version Trump’s bad attributes within the econblogosphere. Menzie, so how are you enjoying Helsinki ?

rtd Are we to understand from your comment that you too could not understand the paper? Can you tell us which sections gave you problems? Or did you not even attempt to read it? If that’s the case, then who’s the arrogant one here?

If via my comment you gleaned any info re: my ability to understand the paper and/or attempt thereof, you may have a reading comprehension problem as nowhere did I make any such claim. To answer your question, the assumptions you chose to make you the arrogant one here.

Well then, don’t keep us in suspense. Did you understand the paper or not? Did you read the paper or not?

@2Slugbaits

I did read the paper and understood it… but that’s irrelevant to my comments and President Trump’s… I mean Dr Chinn’s behavior.

You imply something deep and important. There is nothing to glean from rtd’s parent comment.

I would say rtd is acting like a child but then I would be insulting children.

@pgl: I’m okay with your thinking that I’m “acting like a child” if it’s truly how you feel. However, I’m curious the specifics of why you feel that way. Additionally, I’m curious if you think Menzie is “acting like a child” in this post. Just an honest and objective assessment.

@ reactive trump dolt “aka” rtd

Good to hear you’re against communism. Maybe you can tell your personal hero donald j*ckoff trump that it’s not a good idea to say “Oh baby, faster!!! Faster!!! Oh Vladi Baby!! Give it to me!!! Give it to me now!!!” While you’re being sod*mized by a communist leader on live international television.

https://youtu.be/dzyKhDJWdyk?t=22m59s

Trump’s actions in Finland were treason. Putin and company seemed really happy. Go figure!

Militarism’s Herald,

Being a cold war veteran, long and deep in nuclear warring support, I am aghast at the ragings of the center war party’s and the yellow journalist mainstream media because an American president works to lessen tensions. Why is it “war, war , war” for imaginary slights and “treason, treason, treason” in your brave new world for the slightest effort at making peace?

https://www.politico.com/magazine/story/2018/07/16/trump-is-right-to-meet-putin-219012?utm_source=Sailthru&utm_medium=email&utm_campaign=ebb%207/17/18&utm_term=Editorial%20-%20Early%20Bird%20Brief

Rand Paul has a clear vision of the craziness of the war centrists, when the left and right get together………

rtd,

Professor Chinn is more than civil!

If you view Trump’s meeting as seeking peace, islm, how do you explain his plans for a defense budget that will increase from $634 Billion in 2017 to $734 Billion in 2019? (RON Paul has noted that there is a difference between increased defense spending and increased military spending, noting his support for the former and his distaste for the latter).

Trump campaigned as a warrior. He fed his base tales of our weakness and how he’d stand up to those who would do us harm. And, most importantly, how he’d bring fire and brimstone to the party.

Personally, I have no problem with his insisting NATO nations pay more for defense or with him meeting Putin. I have real problems, however, with his verbal attacks on our allies and his subservience while meeting with Putin. Add to that the millions spent in various intelligence agencies investigating interference in the 2016 election, which apparently, has been a huge waste of time and money because the Russian president SAID there was no meddling.

Not sure of Trump’s place in the war party or of the role of intelligence in government since he’s justifying the spending of another $82 Billion and at the same time turning a deaf ear to those entrusted with the nation’s cyber safety whose work has been largely ignored.

Trump campaigned on NATO being ‘anachronism’! I agree, since the advent of ICBM’s and IRBM’s. NATO, and US’ “security blanket” to nuke the world if NATO loses has been an expensive “nuclear tripwire” since 1965.

What do you see as inconsistent between dumping NATO and throwing more money into the pentagon trough?

The pentagon is a 70 year money pit, with very little real use. Despite NATO being useless as well.

As to believing the US spook agencies, I did not believe them about Iraq WMD, nor Libya, Syria etc.

Tell me how WikiLeaks, whether from Putin or some insider angered by the DNC meddling to dump Sander, revealed anything that was not true, stuff that voters should know about!

An informed electorate was sustained by AQssange

I love reading posts on EconBrowser, but am a tad worried by the exasperated tone of the pieces lately. Can we just ignore the annoying comments? They seem to be a sign of the times and we’ll have to content with them for a while to come…

Neal: Apologies. When somebody de facto calls me a socialist, and a lousy teacher, with no evidence at all, I get irritated. I also get tired of answering the same question over and over again, without the commenter understanding my answer. So I apologize for the exasperated tone.

Of course you used to get politically motivated BS from the far left as economic know nothing PeterK. Your replies to his BS was quite professional which made him run away. Of course when I stupidedly venture back to Mark Thoma’s place and remind Christopher H. (he had to change his name as Mark had had enough), he fires off some stupid insult of what you are reading here.

Alas the internet brings out the crazies from both the far left and the far left. But thanks for keeping it real here.

pgl,

You have descended to their level and I’m not sure they are beating you.

See Mark Twain on arguing with stupid people. They beat you with experience, but you are with them as a novice.

I’m with Neal on this one but I’ve zero evidence that Menzie Trump is capable.

Neal was certainly not endorsing your trolling.

And I certainly didn’t think that Neal was endorsing my trolling. My point, however, stands.

Avoiding annoying comments is a really good idea. The old adage “don’t feed the trolls” comes to mind.

Komraad pgl, if not feeding the trolls we miss the opportunity to comment on their mistakes like this: “Alas the internet brings out the crazies from both the far left and the far left. ” Although, we do agree there are a lot of crazies on the far left.

No self reflection I see. You are indeed a far right troll but at least you are less crazy than RTD and Ed. I really low bar. Now if you could only be less dishonest less PeakDishonesty. Another really low bar. BTW – good luck on that pre-K arithmetic final!

Konrad pgl, sigh! And you called rtd childish? BTW, that’s the 2nd near compliment in the past few days/ Wassup? You not well?

You’ve had your 15 minutes of infamy. Now run along – your mother is calling.

Most teachers don’t make a lot of money (at least base salary wise, I wager Menzie is a clever man and has done well for himself by other means than base salary). At the end of the day, what do most teachers have?? Their good name and reputation, and Menzie’s is stellar. Look at the names of the men/women/colleagues who have both co-authored and refereed papers Menzie has published. Some of them are very near icons of the economics profession. Keynes level or Friedman level?? Not quite, but in the very close 2nd tear group (even “2nd tear” seems the wrong way to word it, but most people get my meaning). I even consider Menzie as ranking above a Larry Summers. Why?? Both in terms of his scholarship and ethics—if Menzie Chinn had been my Treasury Secretary or Head of my NEC (he sure as F___ would have been on the short-list) Menzie Chinn never would have made the unethical and immoral phone call to Brooksley Born as she was warning working class America of eminent danger. No one would have to tell Menzie not to make that phone call—the morality is encoded in his “DNA” and his upbringing by his Mom.

Now Menzie is supposed to apologize for defending himself?? What a world….

Here is the real problem. Economics requires actual thinking. Being an actual economist requires taking the various models to attempting to explain the real wortld which is really challenging.

Most people find this incredibly hard. So they go into other intellectual pursuits. Which is cool.

But the right wing wants to pretend they understand economics and no one else does. Or course what they peddle is inconsistent with both economic theory and the evidence from the real world. But they must persist.

So they turn to marketing which is by definition lying to customers so their product gets purchased by mental midgets. And of course the Ed Hansons really want to believe the marketing campaigns of right wing politicians. And when confronted with reality, they get really really mad. Not at the marketing campaigns from the dishonest campaigns of right wing politicians but at the economists.

Look Greg Mankiw is often a Republican toady but he is also a good economist when he wants to be. And of late he has been saying a lot similar to what Menzie has written. I wish he would open his blog to comments as I would praise him for this. But of course Ed, CoRev, and PeakStupidity would like pollute the comment section with garbage like Ed’s latest. So maybe Greg is smart for closing the comment section.

@pgl

“But the right wing wants to pretend they understand economics and no one else does. Or course what they peddle is inconsistent with both economic theory and the evidence from the real world. But they must persist.” is an incredibly ignorant and divisive statement. Some on the right are this way. Some on the left are this way. Some on the right are not this way. Some on the left are not this way.

“Look Greg Mankiw is often a Republican toady but he is also a good economist when he wants to be. And of late he has been saying a lot similar to what Menzie has written.”

This is incredibly unfair to Mankiw as I’m certain he always strives to be a “good economist”. You may disagree with Mankiw’s economics and that’s because economics is, as you state, challenging where the “answers” are often not known ex-ante or even ex-post. Your (seemingly) inability to only notice (or at minimum comment on) the “faults” of those on one side of the aisle shows your biases.

“So maybe Greg is smart for closing the comment section.” Mankiw may, in fact, be smart to close the comment section but, IMO, the impetus to the sh*t show comment section on Econbrowser is Dr Chinn. He seems to be the common denominator as his style seems to drive the behavior of the comment section of his posts. It doesn’t seem to me that Dr Hamilton’s posts are as full of these comments and it’s because of Dr Hamilton’s style. Menzie’s communication style is very Trump-like and the comments following his posts resemble Trump’s twitter replies (not to mention replies in general).

Do you even have a clue why Mankiw closed the comment section down? He got tired of people reminding him that state and local governments also impose taxes.

It is well documented that Mankiw drank the Bush Kool Aid. You on the other hand are drunk on Putin’s vodka!

He disabled comments because the dialogue wasn’t civil. It does make one wonder why? Was it due to a prescient “Trumpist Economic Discourse” in 2007? Or maybe “Romneyist Economic Discourse” or how about “Obamaist Economic Discourse”. Couldn’t be the latter because only “the right wing wants to pretend they understand economics and no one else does. Or course what they peddle is inconsistent with both economic theory and the evidence from the real world“. Whether Romneyist or early-Trumpist, it had to be the right wingers who are to blame… amirite?!?!

rtd: So uncivil discourse merits disabling comments? How about banning?

Menzie,

I don’t understand your question…

For econbrowser.com, you’d have to ask yourself and Dr Hamilton what merits disabling comments and/or banning.

For gregmankiw.blogspot.com, you’d have to read his blogpost on what he felt merited disabling comments and/or banning.

rtd: Thanks. I’ve decided that you have been uncivil. See e.g., here.

@ reactive trump dolt “aka” rtd

Menzie’s posts/comments do not and have never resembled Trump’s. One can take a subjective stance on something, and avoid telling lies. And therein is the (am I allowed to say HUGE??) difference between Menzie and Trump. Even Menzie’s “subjective” comments are nearly 100% supported by objective data. Even if some of Menzie’s posts or comments may not prove something absolutely, that’s not the job of an academic researcher. The point is often to “shed new light” or “strong evidence” on things which could benefit society. For example, knowing the future price of soybeans could save a farmer from going into bankruptcy, or losing farmland he has used as collateral on a bank loan. The farmer could use options trading to balance out some of those loses. These are real life “on the ground” issues that benefit others. Menzie has been doing this for decades, while Trump has been twisting bankruptcy laws, stiffing contractors, and abusing the H2-B visas to hire the “rapists and murderers” who he can abuse and skirt labor laws which he could not do with native born Americans.

Regular readers here know your process “rtd”, your method is very see-through, you chose the trump/Orange Excrement “analogy” to Menzie as you figured it has the best chance of “getting a rise out of” Professor Chinn. But one can imagine how sad someone’s own life is, whose big thrill in life is working hard at upsetting people who contribute to the society around them. Which is why your comments really don’t dig in to people as much as you fantasize to yourself they do.

“rtd” I’d tell you “You’re going to have to try a little harder”, but it’s kind of lamentable how much effort you make as it is now.

It would be interesting to know the percentage of university professors whose students walk out on their class en masse. If we took the late ’60s and early ’70s protests out of the equation and tabulate those numbers post-1980 what would that percentage be?? I’m going to take a wild guess and say that the percentage is very small and that this has never happened to Professor Chinn. So the question arises, what kind of extreme politicization of a classroom would a professor have to do to “create the impetus” for a planned walk out??

http://www.businessinsider.com/harvard-students-plan-walk-out-of-greg-mankiws-class-to-show-solidarity-with-occupy-movement-2011-11#ixzz1cUbHmsiq

Maybe reactive trump dolt “aka” rtd can answer that question for us.

Gee, an economics blog authored by two professors of economics where math/statistics are frequently utilized for explanation(s). Problem? Well, some of those who believe they know-it-all are reduced to knowing very little.

Who’s to blame? Not their own mathematical shortcomings. Must be the high-falutin’ language and equations that nobody can understand, especially Professor Chinn’s bedraggled econ students who must always be on the defensive at the head pounding they’re receiving.

Such comments as those that raised Dr. Chinn’s ire are quite obvious indications of the distrust of institutions–universities in particular– and the intellectual pursuits of those who specialize in specific fields. After all, the common perception of many on the right is that little–other than radical leftist indoctrination–happens in college classrooms. The idea that upper level students can’t deal with higher level math is a non-starter. Many are likely the kids who completed algebra in seventh grade and geometry in eighth.

Students at Wisconsin and at UC San Diego didn’t arrive on those campuses as innocent and untrained babes in the education woods. Those who do won’t last long.

If I don’t understand what I’m reading, I’ll make an effort to learn more. If I don’t that’s on me. Ad, yes I know. I’m an econ illiterate (have been since I spent Econ 1A staring at the blond in front of me) who at least can’t fail an economics blog.

Holy moly! I never thought I would see a U.S. President stand on a stage in a foreign country and take the side of a thuggish dictator against the United States and a Constitution he has sworn an oath to defend.

And all of the Republicans will tut-tut and then do absolutely nothing as long as they get their tax cuts for the rich.

Traitors, every one of them. Actually, they don’t consider it treason — just advancing the mutual interests of the rich.

Precisely! Thanks for saying that.

American presidents regularly stand on stage with brutish thugs, however most thugs are favored by the centrist war party like Mohamed bin Salman (Yemen, Syria, Iraq, Afghanistan, Libya each thuggery sited makes Putin look like a Russian Orthodox Saint).

The new “remember the Maine” blithery is “treason by Trump”!

It’s all “war war war if you disagree it is traitor, traitor, traitor”

I do not like this brave new polity.

Menzie

You are a socialist, in philosophy and acts. You believe in telling people how they can live by forcing your brand of economics on them. Big Government, elite dictatorial laws and regulation, high taxes, and greater and greater redistribution of others earnings are your desires to be put into practice. That is modern socialism. That and as well you more than tolerate the socialist here who are honest enough to call themselves what they are, encouraging both their political leanings and agenda as well as their leftist rude behavior.

I did not call you a lousy teacher, but commented on how you could become a better one. You seem to be a bit sensitive to think that is what I wrote. And by the way, I have previous called you a socialist and it came without the denial.

This would be a good time for you to post a link to student evaluations. I read yours several years back but never thought it was my place to comment on them. So be happy with your Lake Wobegon moment, where every child is better than average. Being better than the mean is not a bragging point.

Back to the point at hand, what did the futures a year ago say about the present price of soybeans? If they were accurate, then what is the fuss of the present price all about. Or if the prediction was inaccurate, why?

Ed

Ed Hanson: If you read “RateMyProfessor” as valid measures of student evaluations, then I have a bridge to sell you. Let me just say two words, that you can look up: “censored sample”. So for the scores, you’ll have to take my word for it, or file a FOIA request.

I don’t have ready access to Bloomberg futures from a year ago…and I’m not driving over to the B-school to access the University’s lone Bloomberg terminal to check. *But* you could look at the graphs in the paper to take a look at the historical record, if you can’t understand the statistics in the tables.

Menzie BS! “I don’t have ready access to Bloomberg futures from a year ago.” Since we are talking about predictions, and they are approximates, then looking at historical prices of a year ago will more than suffice as input to your model. The link has been posted in these articles several times. If you need it here: https://www.macrotrends.net/2531/soybean-prices-historical-chart-data. Loading the data is so EZ even non-economists can do it. Last year the price on 2017-07-17, was: $9.8500.

Please tell us what your model estimates are for this data.

CoRev: Let me say this as simply as possible.

1. The MacroTrends source you reference is for spot prices.

2. The Chinn-Coibion paper concludes that *futures* prices for one year horizon out-predict a random walk.

3. If I use the spot price one year ago to predict the spot price today, then that is a *random walk w/o drift* prediction.

4. So using that data merely gives me the random walk prediction, which I have been asserting is outpredicted by futures.

Do … you … understand … why … the … data … you … referenced … is … insufficient … to … the … task?

Menzie, even more BS????? As I explained: “Since we are talking about predictions, and they are approximates, then looking at historical prices of a year ago will more than suffice as input to your model. ” and your response: ” If I use the spot price one year ago to predict the spot price today, then that is a *random walk w/o drift* prediction.” You seem to think you are supposed to predict today’s price. No you are supposed to run your model for its results to compare against today. It’s typically called model validation.

Using the spot price is no different than using today’s future price. They’re both just starting points. A year ago’s spot price, results in today’s spot price reality. It may very well be a random walk, and may very well not be, if you believe in efficient markets and the impact of tariffs, but it will definitely be reality.

Your prediction will still be your prediction starting from that year old spot price.

If you are claiming your model out performs other models then to what are you comparing their outputs? What predictive quality exists when none are validated against reality? Any models predictive value are only as good as they match a future reality.

Are you telling us you have not validated your model’s results? Or at least not against real prices?

CoRev: The Theil U-statistic is the ratio of the RMSE of the model to the random walk (comparator) RMSE. That is the way the models were validated. That is what is reported in Table II of Chinn/Coibion.

You are simply not making any sense in this comment. If anybody can make sense of it, please step in.

Menzie, so you have not validated your ?prediction? to reality.

Do … you … understand … why … the … prediction … you … referenced … is … insufficient … to … the … task?

BTW, I’ve modeled my Blue F350 and it predicts it is the closest to the factory original blue of all Ford trucks ever made since. My model compares the photo-oxidative, mechanical, chemical, and biological degradation associated with all those other tested F350s and those associated with my F350 could not be matched. Accordingly, my care of the F350 is superior to all others.

You might note the failure to classify the the factory original blue. You can wrap the BS in whatever you want, but it is still…

CoRev: Ignoring your insult, your analogy makes no sense. The spot today and the futures price today for a trade a year hence can differ substantially. That object is called “the basis”. I can assume away the basis, i.e., that it’s zero — but then we are comparing the predictive power of a random walk against… that of a random walk.

Do… you … understand?

CoRev Let me see if I’m understanding you. It sounds like you are saying that these two models are equivalent:

(1) spot price at time (t) used to predict spot price at time (t+k)

(2) futures price at time (t) used to predict spot price at time (t+k)

Is that what you’re saying?

Menzie, ignoring my insult? Why is my copying your non-insult now an insult to you? This is a non-distinction: “The spot today and the futures price today for a trade a year hence can differ substantially.” and that’s why you claimed your model predicts futures prices?

Menzie says: “… I can assume away the basis, i.e., that it’s zero ?Why would you do that? Why would you fall back to a random walk model? I’m assuming your model calculates basis. Do you not trust your model to predict futures or spot prices better than a random walk, the best forecast of tomorrow’s price is today’s price plus a drift term (or not), for 3 months, 6 months and 1 year?

2slugs, yes. If the time series data is there for both, then the trends should match and the predictions similar for the 60, 90 and 1 year time frames differentiated by the (cash/spot) and futures difference.

CoRev: You explicitly referred me to a website that provides only spot rates, and then tell me to calculate the implied forecast from my model? Clearly, you do not understand what is going on.

Menzie, MacroTrends appears to be futures not spot data. The historical data is: Jul 16 2018 8.2950. Yesterday’s Iowas spot price was 7.7X (not including basis).

CoRev: If the MacroTrends series is futures, then it’s front month as proxy for spot. What is needed for the calculation you wanted (compare my forecast from a year ago against today’s price), is the futures for trade in July 2018 as predictor – not the front month futures.

Menzie, modelers who ferociously defend not using their models when requested ALWAYS make me suspicious. If your model requires a predictor then please move the start date to allow for the existing MacroTrends data to be used.

I also noticed you ignored all the questions on how the model was validated, which increased my suspicion. You may not feel a need to alleviate my suspicions, but don’t over react, and demean, when those suspicions are not corrected.

You’ve insisted that your model shows a futures price out-predicts a random walk (model) to predict spot prices for one year horizon. You can make us wait or show us with existing data.

I see you do not get the difference between the spot market versus future prices!

I would ask if you could be more stupid – but that question was asked and answered many times.

Komrad pgl, if you remember one of my first questions to Menzie was why was he comparing FUTURES prices, since I knew of several differences between spot and futures pricing. You, OTH, have shown no knowledge at all. Worse, when questioned/challenged have run away.

BTW, we are starting to see some bounces in short term futures prices. Are we at or near the bottom? Too early to tell, but it has taken a little longer than I expected, but that might be because of the incessant Trade War blather in the press while farmers sat on the sidelines waiting out the drop.

Menzie:

Could it be that there’s a sampling bias in the opposite way that you see to be assuming?

In any case, your hands are bigly… they’re yuuuuuuuuuuggggggggggeeeeeeeee!!!!

I just checked out the Rate My Professors for Menzie. The good students absolutely loved him. Yes there were a few who hated him but then in intro courses one always gets the lazy ones who have to sound off with fury that the course was too hard. Hey if the lazy ones want an easy economics course, they should be attending a community college.

Check out Mankiw’s:

http://www.ratemyprofessors.com/ShowRatings.jsp?tid=627493

It is the same bimodal distribution. The dolts rank him as awful because the tests are too hard. And yet some of these Harvard students love his class.

So even conservative economists would be rated as awful by folks like Ed who really abhor being required to think.

I’m not saying ratemyprofessor is a great metric or not, but Mankiw’s 3.5 and Chinn’s 2.9 seem interesting for you to compare.

Also, I found the person claiming Menzie’s attempts to supplement the textbook “basically turn into him showing off and adding extraneous material for no reason” Hahaha. That sounds very familiar.

Ed,

Is someone forcing you to make a fool of yourself on this blog? There’s no harm in saying “I don’t get it. please explain further.” That’s how learning takes place. Or at least how it should.

No need to hide your own inadequacies behind questions of Dr. Chinn’s student evaluations. That smacks of modern McCarthyism and has little to do with discussions of soybean prices or whatever the current topic may be. (“I see, Dr. Chinn, you have not denied being a socialist……”)

Better always to stick to “the point at hand, ” rather than blathering on constantly with personal attacks and general right wing angst about perceived economic evils.

Rather than being a willing punching bag here, wouldn’t you be much happier on a blog where your ignorance would go unchallenged? At least occasionally?

Ed Hanson I have no idea where you hatched your ideas regarding socialism, but they sure sound like the kind of stuff you might have heard from a really bad high school civics teacher more interested in coaching football. Like a lot of people who have not been formally trained, you confuse political ideology and the science of economics as practiced by actual economists. Socialists usually believe in a command economy where production and output are determined by the state rather than markets. As best I can tell there are only three political entities that still believe in that kind of central command economics: North Korea, Cuba and the Pentagon. You and I might both agree that socialist economics is bad economics; but the difference is that I know why it’s bad economics and you don’t. You just know that you don’t like it, not why it’s wrongheaded economics.

telling people how they can live by forcing your brand of economics on them.

This statement makes no sense. It’s like saying a teacher is forcing their brand of algebra on a student. It’s nuts. If you think the teacher has made a math error, then first learn the math and then explain the error.

Big Government, elite dictatorial laws and regulation, high taxes, and greater and greater redistribution of others earnings are your desires to be put into practice. That is modern socialism.

Sounds to me like life in Alabama or Texas. You’d be hard pressed to find more intrusive state governments or ones that apply higher marginal tax rates on the poor. Or states that live off tax dollars from blue states being redirected to cronies and good ol’ boyz. And if you’re upset about dictatorial laws and regulations, then why do you support Trump’s dictatorial tariffs? If that’s not a perfect example of socialist centralized planning, then I don’t know what is. I’ve read enough of your posts to know that of all the folks who post here, you’re probably the biggest fan of socialist economics. You just don’t know it because you’ve not been formally trained.

Ed. You are an embarrassment. Please stop.

A lot of comment sections across the interwebs have been trashed by Trumpists. Just read the blogs. Ignore the comments.

Randomworker, actually a lot of liberal blogs, at least those which still allow conservatives to comment, are being enlightened by conservative comments. Note my caveat, as too often liberals react by banning conservative commenters or resorting the type of anti-conservative tribalism shown here. Don’t misunderstand that tribalism is solely a liberal issue, but class banning is primarily a liberal reaction.

This has been going on for years, and the results are evident in the failure to understand and then accept the last results of the last election. The MSM has become a bastion of liberals, and misrepresents the general populace, causing the liberal reaction to the election.

BTW your advice: “Ignore the comments.” is an erroneous and arrogant approach to learning. Arrogant because it allows only two views of the article/blog points, yours and the authors. Erroneous because no two views are complete and accurate. To think so isa sign of arrogance. I hope you noticed the closed and circular logic of you view.

If you think you comments are enlightening, then you are dumber than we give you credit for.

Menzie Chinn, don’t feel too bad. Ed declared me a socialist for suggesting a higher minimum wage, so the bar is pretty low.

I’m guessing that being a proponent of Medicare for All makes me Pol Pot.

I knew Pol Pot. I served with Pol Pot. Pol Pot was a friend of mine (not really) but sir you are no Pol Pot!

Sorry I could not resist finding an excuse to put up the classic from the 1988 Vice Presidential debate!

https://www.youtube.com/watch?v=uWXRNySMW4s

slug,

You missed Venezuela and Zimbabwe in your list.

As for Socialism, its means have evolved since the Fabians, the national socialist as in Nazis, and the international socialist of Lenin, Stalin, and Mao. No longer do they strive for nationalization of the means of production, but because they found other means of control of business not written in the 19th century, does not mean they are no longer socialist. Evolving means to its goal does not change the name, it is socialism. I can not believe that you think the state can not force their bad economics on people. Just look at how often price setting is used by governments, both disastrously like Venezuela, and more benign in creating substantial criminal penalties for what the government considers price gouging at times of crisis. And other ways not just price control, even now, China is commanding farmers of more than a million acres to change their production decision and plant soybeans. China is doing this by command, not by incentive nor allowing the adjustment to price to create agriculture change, nor even letting the farmer simply choose what is in the best interest to plant. It may not be the disaster as the Chinese Command to produce steel and dig canals that happen during the great leap forward, but it is the kind of power governments should not have. As for mistakes that State governments make, State governments are easier to change, and a person can always walk, which is not true for most with a centralized government in Washington. For further reading about President Trump tariff power, I posted a longer post to Menzie.

Joseph I possibly called you a socialist because you clearly are, but I doubt if the call was limited to your desire of government mandated wages, rather than market driven wages. If I did so, please quote and link what I wrote. As for single payer medical, the speed of Pol Pots killing may not be achieve but the delays and incompetence of centralize command certainly will make its mark.

Ed Hanson I did not realize that Menzie supported price setting. I did not realize Menzie ever advocated that the government should set soybean production quotas. Those are all things that you see as characteristic of modern socialism. To the best of my recollection the last President to institute wage and price controls was some rabid, far left pinko commie named Richard Nixon. BTW, did you vote for Nixon? Twice, I’ll bet. And it seems to me that Trump is the one setting a domestic steel production floor. Wasn’t that the effect of his invoking section 232?

Donald Trump: “Launch the missiles!”

24 hours later, after checking the polls and reading from a script: “I meant to say ‘Don’t launch the missiles’ .”

This cretin has no business being in the White House. He is mentally incompetent as well as being a sociopathic liar.

I just wanted to say I love the blog, the worked examples, and I often go out and try to replicate them for fun using R / Bloomberg.

I don’t really understand why people would yell at you for not “being clear” [to them] when you are doing this for free.

I also don’t get why people would yell about not understanding stuff that is frankly, complex. Life’s hard, and sometimes stuff just requires reading multiple different inputs in the hope that the penny drops.

I certainly don’t get how a post about the predictive content of commodity futures went into socialism.

In case you missed it, Dave, liberal, socialist, and socialism are all convenient four letter words. Any mention of them is a call to action, especially to those who see themselves as saviors of free enterprise, capitalism, God, and the American way. And not necessarily in that order.

Just about anybody who disagrees with a self defined real patriot must be a socialist (or liberal/socialist/Marxist/communist). That’s especially so if the real patriot has trouble understanding a contrary view to his and is unable to understand the vocabulary or the mathematics that have caused the disagreement.

In that world, a discussion of commodity futures can easily devolve into scathing examinations of an offender’s background and his nefarious purposes in obfuscating the obvious. The ghost of Joseph McCarthy is alive in Wisconsin.

Thus, you may think you know soybeans, but you don’t. Because, really, what socialist knows anything about soybeans?

Dave

In case you missed it, the socialist either proudly state there membership, or hide it, depending on the political trends of the day. A few months ago when prospects of a blue wave seem quite possible the socialist claimed their allegiance in full glory. They celebrated Bernie return from the dem party, back to his socialist party in his state. And even recently the celebration was real, although careful, about the socialist win in NYC over another dem. But lately the blue wave seems less likely so the socialist reeled in their declaration, but they are still socialist. Don’t listen to the name they call themselves at any given time, but observe the policies they endorse, especially those that may not be politically realistic today but they highly wished for, and call them for what they are. I to used to allow them to name themselves depending on political fortunes, but now I am simply too old to let it go by,

In Europe the socialist are more honest and proudly declare their name, The US socialist simply won’t. It is not McCarthyism to call them what they are, but cowardice on the socialist side not to always proudly wear the name. Unless of course the socialist are ashamed to be one, so it can be somewhat understood.

Ed

Ed Hanson: Wow. Let’s just use the Ed Hanson definitions of who are whom.

And we should say that by his actions, Mr. Trump is not alt-right but…

Corev

This is about you current debate with Menzie about how accurate are futures and year out predictions. It is my observation and my approach, for what it is worth.

First point: Menzie is an honest person, he does not lie any blog.

Second point: Being honest is not the same as forthcoming. What Menzie does not say is sometimes blaring.

Third point: Start with one and two above and don’t be upset when Menzie does not respond to comments that just might undo the ideas he puts forth. (This last point is blog only, I have every reason to believe he acknowledges and responds to academic comments and challenges to the papers he writes.)

An old example. Remember the many graphs comparing economic performance between Minnesota and Wisconsin under each governor. Remember he normalized to zero the graphs to the year 2011. Every data point was accurate, but the presentation was meant to mislead the casual observer that Minnesota’s performance was politically caused. When a long term economic graph was linked to in the comments, (the per capita state gdp if I remember correctly) and it showed the trend of Minnesota growing faster than Wisconsin was decades old, not just a recent governor created phenomenon. Menzie never commented on how the historical graph gave context to his normalized graphs. He is honest, so never denied the point, he did not have to; because if you dug deep enough in his graphic presentation, the long term trend could be found.

It is also the case of the present futures predictive powers. Read what Menzie does not write, Menzie suspects, as do you and I, that futures from a year ago are wrong about the current price. But he does not want to show this on a blog. So he honestly makes the reason that the data is not easy to find. Remember it is an honest reason, but not necessarily forthcoming, such as it would be if he just wrote what he suspects.

So don’t get upset when Menzie does not seem to respond. Just do your best to read into it what Menzie does not say. Don’t be upset because you must remember that in his writings, Menzie is quite honest, a trait which is becoming rarer on the net.

Ed

P.S Also remember it is dangerous to read what people don’t write. But sometimes it is necessary.

Ed Hanson: I’m not afraid of data. They are what they are. I have responded to your assertion that I misled by omission (or no reply) with my latest post.

Now, if you can actually study a (1) intro macroeconomics textbook, and (2) learn a little about econometrics, I would be much obliged.

Ed, I’m not angry or upset with Menzie, just a little disappointed. I agree we need too often to read/understand what he did not say instead what was said, especially when it is a deflection. I also believe it is appropriate to give back what was given, and Menzie has made me his target in several posts lately. Accordingly there is a little pay back in my comments. Just look at my approach to commenting with pgl.

I’m also not a virgin to developing models, at least physical models, and know what to expect as answers. Non-answers do stand out.

” Menzie suspects, as do you and I, that futures from a year ago are wrong about the current price. ” Of course, I also believe he thinks that he made a mistake when finally goaded into estimates from this low point. His estimate is threatened by either Trump changing the game by declaring victory at any time, or the ag. environment changing dramatically. We should see a shift in the next two planting seasons. I also believe he knows that the Chinese tariffs perturb the market and that it will adjust relatively quickly.

And finally, although the implication is that farmers have lost a great deal of $$$s to date, but that is just not true. Some few have been forced to sell into this market, but the bulk of the soybeans have long been contracted or already delivered at the pre-tariff prices. if conditions don’t change by late harvest, Nov-Dec, then more farmers will lose, although some will be covered by insurance.

Ed Hanson It would have been helpful if CoRev could have clearly stated what he wanted. I for one still have no idea what he was after. For example here’s a clear request: Please make available all of your data sets used in your paper in order to try and replicate the study’s results. That would have been a clear request. It also would have been an insanely ridiculous request. CoRev is not an academic referee with econometric credentials and software. CoRev is an amateur with an Excel spreadsheet. A request like that coming from an amateur should also come with cash or a check to cover time and materials.

2slugs, I have little doubt that Menzie knew what I wanted, and why. I am not surprised by this: “I for one still have no idea what he was after.” You’ve repeated this several times during these many articles now, when if you knew more about the ag. business instead of statistics you would have understood many of the business points.

Tariff threats have been flying back and forth before the Spring planting season. Some concerned and experienced farmers would have anticipated and hedged their planting plans and or included price support in their insurance.

Your eyes should have opened a little when I asked you to calculate the farmers loss on a 100 acre basis, but your inexperience made it harder than needed. Most experienced farmers have a very good knowledge of the costs to raise a specific crop on his land, and can estimate a good “break even” price with soil samples and a few calls to calculate prices for materials. After that they are at the whims of weather and markets for which he has insurance.

CoRev: This website is the one you should have cited to provide the requisite data for my preferred forecast (not the MacroTrends one which provides as far as I can tell nearby month futures).

Close on July 13 2017 for July 13 2018 expiring soybeans future was 1011. Hence, that was my forecast. July 13, 2018 expiring futures closed at 814. That means the error for July from “my model” (i.e., futures) was 197.

The relevant question for assessing model accuracy are (depending on your loss function) mean error, and root mean squared error, over some number of observations. Those are exactly the criteria used in Chinn/Coibion.

CoRev A farmer that only covers breakeven costs won’t be a farmer very long. And a farmer has to know more than the cost to raise a crop on his land; he also has to estimate the likely price he’ll get. Acres are not equally productive, so a farmer will not plant if the marginal return from an acre is less than the marginal cost to harvest on that land. I don’t think you understand the difference between marginal costs and average costs.

BTW, today’s statewide average for Iowa soybeans was $7.78/bushel.

You might want to think long and hard what Menzie meant by this statement:

…over some number of observations.

2slugs, all those statements are essentially true, but what was your point? It does confirm what I said. most farmers most farmers know what the costs are to raise a specific crop on his land. You again added minutia without understanding their meaning over all.

Menzie, if you want a different site, OK. What I have with the MacroTrends down load is daily futures prices.

You have claimed several time now: “Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans….” Not ” Hence, that was my forecast. July 13, 2018 expiring futures closed at 814.” Actually IA spot prices closed on July 13 at ~775 not 814. That means the error for July from “my model” (i.e., futures) was 236 or 23.3%.

I disagree, “The relevant question for assessing model accuracy are (depending on your loss function) mean error, and root mean squared error, over some number of observations.” The value of a model which claim predictive capability is the error for each observation. Mean error and/or RMSE, hides too much detail on the actual errors of the predictions. Evaluations of those individual errors is what allows the model to be improved. Using means can lead to a false assumption of the model’s performance.

I didn’t expect your model to actually predict accurately, as you probably wouldn’t still be teaching today. 😉

CoRev According to the Iowa Dept of Agriculture site the statewide average for #1 soybeans closed at $7.54 / bushel on 13 July. One thing to keep in mind about Iowa spot prices is that 72% of the grain goes to co-op elevators rather than commercial elevators, so the price will be lower.

The value of a model which claim predictive capability is the error for each observation.

I’m struggling to understand what that means.

Mean error and/or RMSE, hides too much detail on the actual errors of the predictions.

No. It’s how you evaluate forecasts. Mean error (e.g., MAD) assigns a linear loss function to each error. RMSE assigns a quadratic loss function to each error. Which one you choose depends on your risk tolerance for large errors. Sometimes the errors will be large and sometimes they will be small. The way you compare errors across aggregates is to look at MAD or RMSE or DM or whatever. That’s why I italicized Menzie’s comment about “some number of observations.”

The point of Menzie’s paper is not to announce some new found way to get rich quick in the commodity markets. The point of the paper is to investigate whether or not there is useful information content out there that’s better than a random walk. The answer is that no time series model such as an ARIMA model outperforms a simple random walk, but using futures prices does for some commodity categories. That does not mean the forecasts are expected to be good; only that there is some valuable information content in futures prices and if a trader doesn’t use all predictive information, that trader is leaving money on the table.

2slugbaits: You should know by now that this explanation makes no sense to CoRev. To him, it is all “blah, blah, blah”, as he shows no inclination to study up at all.

2slugs & Menzie, the point of any prediction is to forecast a future outcome. The value of that forecast is its accuracy to the actual future outcome; therefore, the value of the model making that forecast is the value of its forecasts to actual future events. Menzie’s selected model took futures prices to predict spot market prices at specific future time frames. The test of that model’s predictions is very, very simple, and takes only simple arithmetic to determine how close was the prediction to the actual outcome event (spot market prices). 2slugs your response to that basic understanding of predictions was: “The value of a model which claim predictive capability is the error for each observation.”

2slugs, when I noted: “Mean error and/or RMSE, hides too much detail on the actual errors of the predictions. Evaluations of those individual errors is what allows the model to be improved. Using means can lead to a false assumption of the model’s performance.” the 2nd sentence was ignored completely. The response to the 1st sentence was doubling down with the claim statistical tests were the referred method for evaluating predictive results. The sum of your comments showed you know very little about “physical”, reality-based models, and nothing about the iterative process used to improve them.

Menzie’s claim was that his model was more accurate than a random walk with lower average of mean errors. OK! But, when asked to confirm his model’s predictions to reality, future spot prices, there was silence. I had to assume that the random walk was compared to a spot price reality to create a baseline for comparison, but that was never explicitly made nor asked. When Menzie, changed his comparison from his claim of “spot prices” to futures prices”, I was left with the assumption the models was not validated against the claimed actual outcome, spot prices.

So far I am unconvinced that Menzies’s model was validated against his claimed outcome target, spot prices, and that the model can even predict the sign of its price trend “DIVERGENCE” versus the target outcome. Remember, that is spot prices and not results from a random walk model.

2slugs, thanks for the more accurate IA price: “According to the Iowa Dept of Agriculture site the statewide average for #1 soybeans closed at $7.54 / bushel on 13 July.” That price SLIGHTLY increases the error of Menzies July 13 prediction.

If that’s blah, blah, blah to you and Menzie, then you should probably review your own claims.

CoRev 2slugs your response to that basic understanding of predictions was: “The value of a model which claim predictive capability is the error for each observation.”

What? The quote was from your comment. I was quoting you! I said that I didn’t understand what that meant.

But, when asked to confirm his model’s predictions to reality, future spot prices, there was silence.

No, all you had to do was look at the errors. The errors tell you the difference between forecast and actual.

Using means can lead to a false assumption of the model’s performance.” the 2nd sentence was ignored completely.

Before we go any further, do you understand what a “loss function” means? Do you know the difference between a linear loss function and a quadratic loss function? If you want to try various forecast accuracy tests without having a strong math background, then try downloading “R” and go to the “forecast” package. It’s a very general package and is free. It also has the Econometrica seal of approval. Go find the argument “accuracy” and select one of the many different tests: https://cran.r-project.org/web/packages/forecast/forecast.pdf

Menzie also used the Diebold-Mariano test. If you want to use that to test against a random walk, then look up the argument “dm.test”.

The response to the 1st sentence was doubling down with the claim statistical tests were the referred method for evaluating predictive results.

Well, yes. That’s how you evaluate forecasts.

you know very little about “physical”, reality-based models, and nothing about the iterative process used to improve them.

You’re confusing forecast evaluations and some kind of six-sigma exercise. That’s not what the paper is about.

That price SLIGHTLY increases the error of Menzies July 13 prediction.

Which tells you a lot about the strength of the exogenous tariff shocks.

Corev

Yes, Menzie can be quite disappointing, but not to the toadies he has attracted. He plays, on this blog. to the audience he wants to. And by the way, it is an honor that Menzie singles you out. What he isn’t saying but it comes out loud, is you are countering his misleading presentations effectively. Keep it up, you bring perspective to this blog.

This is not misleading, but econotalk in all its glory. Menzie wrote in conclusion to a post directed at you in which he admitted how terribly wrong the futures prediction was over the last yearl; “The relevant question for assessing model accuracy are (depending on your loss function) mean error, and root mean squared error, over some number of observations. Those are exactly the criteria used in Chinn/Coibion.”

Econotalk? Oh yeah. The real measure of the prediction in the real world is how much money would be made or lost using the predictive method. And the last year would have been a whopper of a loss. “depending on the your loss function” can’t be taken to the bank.

Ed

Ed Hanson The real measure of the prediction in the real world is how much money would be made or lost using the predictive method.

Do you have a better predictive model? If so, let’s see it. Do you have some other approach that can beat a random walk out-of-sample?

And the last year would have been a whopper of a loss.

And thank you, President Trump.

“depending on the your loss function” can’t be taken to the bank.

I think most bankers would insist on it.

Menzie, I withdraw my comments about validation of your model. I had only scanned the paper, and finally sat down and read in detail. My apologies for misinterpreting your silence.

To be clear my withdrawal is limited to validation of spot prices at this time.