“I don’t like all of this work that we’re putting into the economy and then I see rates going up.”

and a tweet on Saturday:

Tightening now hurts all that we have done.

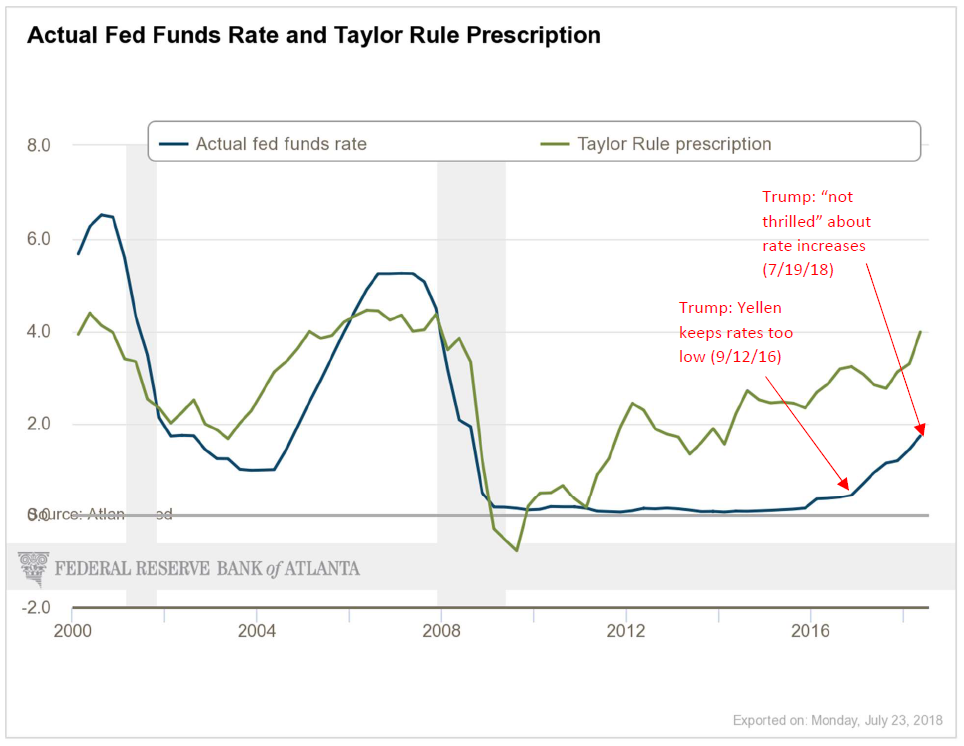

And yet, using the default settings on the FRB-Atlanta Taylor Rule utility (2% real natural rate, CBO output gap, 2% PCE-core target):

The inconsistency associated with Mr. Trump’s criticisms is pretty glaring, but one should not be surprised by his continued assaults on all independent institutions.

Update, 7/23 12noon Pacific: Steven Kopits is exercised I have not adequately specified why I have selected the Taylor rule specified (namely the Atlanta Fed default settings). For his benefit, since he forgot he commented on the previous post on the subject, is the link to a post on the subject.

Many Presidents have been unhappy about Fed tightenings. Also, Bush 41 partially blamed his 1992 defeat on the Fed not easing fast enough, and strong GDP growth was reported right after he lost the election.

http://www.milkenreview.org/articles/federal-reserve-independence

Trump has good reasons being skeptical of many independent institutions, particularly when too many lawyers and politicians are involved.

“Trump has good reasons being skeptical of many independent institutions, particularly when too many lawyers and politicians are involved.”

If the FED were dominated by lawyers – one might agree with this. Under Obama – it was mainly economists. But of course how would you know? And I challenge you to show one time when Obama pressured the FED (hint – he did not).

PeakTrader Hmmm…weren’t you the one who not long ago was critical of the Fed under William Miller because it wasn’t independent enough??? And I didn’t know that the Fed was stacked with politicians and lawyers. I always thought the complaint was that the Fed and regional banks had too many commercial bankers…you know, people like you.

2slugbaits, my two paragraphs are responses to two different statements above.

PeakTrader What “two different statements above”? Yours was the first comment on this thread. In any event, your response is still inconsistent with what you’ve said in the past when you (correctly) criticized Miller for lacking political independence.

Give Peaky a break. His JOB is to write whatever Boss Trump wants him to write. So he must be inconsistent.

We would not want Peaky to be fired from this job as he ain’t getting a real job. Which means he goes back on the government dole again.

“Trump has good reasons being skeptical of many independent institutions, particularly when too many lawyers and politicians are involved.”

actually the fed is now a trump appointed entity. so this is a ridiculous statement. as usual, peak loser is simply a political hack. his attacks on independent institutions would appear to be in line with russian propaganda used to try and destabilize this country. i take offense to peaklosers attempts at undermining our democracy on every blog post. i used to think peak loser was simply a lousy banker, but i think he may be influenced by more nefarious efforts coming from the kremlin side of the globe.

“2% real natural rate”.

Is this a realistic assumption? Didn’t Yellen have a some what different version of Taylor’s rule? Not that it would fundamentally change Trump’s inconsistency but I would argue his 2016 complaints of rates being too low was the real problem here.

Peak: Corruption. You left out the word corruption. Corruption, corruption, corruption. It is everywhere in many forms at the highest levels from Hollywood to DC including the courts. Corruption is why Donald Trump came to Washington. And he is about to drive a stake in its heart. It is not he who is corrupt, though that’s what the corrupt-to-the-bone fake news media spins to the somnolent American public to keep them uninformed of the real goings on. Stay tuned. As I have posted before, the light show is about to begin.

Stay tuned. As I have posted before, the light show is about to begin.

Why “stay tuned”? Are you still awaiting orders from the Kremlin?

“Corruption is why Donald Trump came to Washington.”

Right – Trump sees an opportunity to abuse the Federal government for his own personal benefit. Corruption personified.

About to drive a stake through the heart of corruption not just in D.C. but EVERYWHERE.

My God, what drama!

Look! Up in the sky! It’s a bird! It’s a plane! It’s TRUMPERMAN!

Just as well he appointed a lawyer to head the Fed then???

Oh Menzie, don’t you know that what really matters is Trump’s “magic touch”. CoRev assures us that’s much more important than all that bookish Taylor Rule stuff.

2slugs, getting a little desperate, linking my name and Trump? I’m flattered, as it’s an indication my comments are hitting home.

You deny being Trump’s poodle? This is almost as funny as this classic – deny, deny, deny!

https://www.youtube.com/watch?v=yN2gU0XU5FU

i actually prefer to link the name corev to idiot. it is more fitting.

Trump calls him his useful idiot.

Baffled, it’s been so long since you actually added anything of value in your comments, having another to prove that observation is boring.

corev, you write so much on this blog and provide so little, it is only natural to call you an idiot. you really need to stay quiet and simply read this blog rather than provide your stupid commentary. if you notice, most of my comments lately are simply to point out your stupidity. but i will continue to call out you and peakloser rather than let you promote your propaganda as “truth”.

Baffled, I will enjoy your refutation to facts. It’s gotten so simple catching pgl lying, I will enjoy adding another name to double check.

You add value? Excuse me as I fall on the floor laughing!

Corev, you’re still an idiot.

From your 1st link:

‘He also said that higher interest rates will strengthen the US dollar too much, putting the United States at a “disadvantage” while central banks in Europe and Japan keep rates low.’

Stop the presses – Trump got something right for a change. We are having a replay of the early 1980’s: Reagan’s defense spending build-up, tax cuts for the rich, and the FED reacting to this by raising real interest rates. What could go wrong? Oh yea dollar appreciation leading to less net exports despite the trade protection we had under Reagan and now under Trump.

Of course the Usual Suspects aka our resident Trump cheerleaders try to deny this. It seems their fearless leader just threw them under the bus.

Interestingly, the OECD / Haver Analytics calculates the Taylor Rule for the post-2008 period vastly differently. Someone is wrong, and I would greatly appreciate if you could tell us which one.

https://www.princetonpolicy.com/ppa-blog/2018/7/23/dueling-taylor-rules

I think the Atlanta calculation is dead wrong, personally. Really, during 2011-2014 period the Fed Funds rate should have been 2-3%? Seems ridiculous.

By contrast, the OECD / Haver calculation indicates negative interest rates using the Taylor Rule during that period, which is what we would have suggested given all the talk of ZLB problems. The Haver approach implicitly gives depression, as opposed to recession, dating. That is, while the Taylor rate is below the Fed Funds rate, and it is at the ZLB, then real rates are too high and the economy will be sluggish. During this period, the interest rate loses its efficacy as a transmission mechanism due to the ZLB, and it is this feature which distinguishes a depression from a mere recession. In a depression, monetary interventions have to be directly to the balance sheet to be successful, which interest rate adjustments are adequate in a recession, Because both the central bank and the national government are reluctant to intervene directly in a depression (ie, unwilling to print money), a depression takes a long time to resolve, about seven years in this case.

During this time, fiscal and monetary expertise will be devalued, as policy makers will be largely ineffectual in reviving the economy. This in turn will bring into question the viability of the political system, prompting the electorate to far right or far left alternatives.

So, which Taylor Rule is correct? If it’s Atlanta’s, then the story ends there.

If it’s Haver’s, then indeed we have an objective measure for use in depression, as opposed to recession, dating, and an economic mechanism explaining the rise of extremist politics.

Steven Kopits: There is a link to the Atlanta FRB Taylor rule utility; you can put in pretty much any setting you want. I used default. I would usually use the Laubach-Williams 2 sided estimated real rate, but I wanted to use default so that people could see a “standard” estimate. Bloomberg as I recall had its own defaults, but I can’t recall them.

Neither is “correct” — even Taylor has advocated different versions at different times. So, I’d say read up on the academic literature; I can get you references later from my course website.

Of course, that is a major problem with the Taylor Rule — he regularly changes it whenever it does not give the results he wants.

By law, the Fed is charged with giving inflation and unemployment roughly equal weight and it does that by emphasizing

whichever one seems to be the worse problem.

The Taylor rule, in all its various configurations, always gives inflation much greater weight than employment.

Taylor really wants Fed policy under Volcker, when inflation was clearly the major problem, to be the norm.

“I would usually use the Laubach-Williams 2 sided estimated real rate”.

This was my plea. Maybe an update would do it this way.

If you have a spread of 300 basis points for the target rate from two versions of the same rule, then it’s not the same rule.

The same rule? You are not paying attention are you? Read what Taylor originally wrote. You might realize that within the context of his original construct, one has to make choices for the natural rate, the method for estimating the output gap, etc.

Until you actually read the literature – please stop making such stupid comments as all you are doing is embarrassing yourself.

Actually, I would like your opinion as a macroeconomist.

If it’s the Haver model, then we return to the whole Obama-3%-growth thing as resulting principally from the ZLB problem. Personally, I think that’s true. The flip side is that you could have catch-up growth on the back end, as we did from 1940-1946. Thus. low GDP growth would not be Obama’s fault, nor high GDP growth to Trump’s credit. It’s just the way depressions play out.

Are you on the Haver payroll – as their marketing agent? OK – they have their version of the Taylor rule. It is not the only version. Try actually READING the literature as Menzie suggested.

It’s not my job. It’s Menzie’s job. I would like an understanding of how different Taylor Rules can produce radically different results, and how we should think about the issue. If I understand correctly, today, if someone says “Using the Taylor Rule…” that’s a completely meaningless statement.

Steven Kopits: If you are too lazy to dig up a money and banking textbook, take a look at slides on Taylor rules in this UNDERGRADUATE course lecture notes and this handout. I linked to the Atlanta FRB utility because it gave you a lot of flexibility to design your Taylor rule, as much or more than Haver since it included other natural real interest rate estimates.

The one similarity that is shared between almost all Taylor rules is the output/employment and inflation gaps are included. That’s why it’s useful among knowledgeable macroeconomist to use that shorthand. There remains the debate about the normative vs. positive interpretation.

It is Menzie’s job? Are you paying him? LORD!

It’s Menzie’s job.

Steven Kopits: Well, Menzie did it nearly three years ago. You commented on it. Don’t you remember what you read and wrote?

I stand corrected. Menzie did do his job.

But why did you use the Atlanta Fed’s version here? Do you believe that is the correct rate? You think that the FFR should be 4%? The specification used above is different from every approach presented in your earlier post and higher for most periods. Have you discarded L-W? Do you think the natural rate is 2.5% or even higher?

If you believe the Altanta model, then Obama really must have been a terrible President. For four years, the FFR should have been above 2%, and still Obama couldn’t crack 3% GDP growth.

On the other hand, if you take the Haver Analytics approach — which I personally found matched my subjective sense of things at the time — then Obama, like Carter, was mostly a victim of circumstances. The Fed should have printed money until inflation rose (a kind of Scott Sumner view) and fascism would never have gotten started. That’s my take. But you seem to think Yellen should have raised rates much sooner. Why else would you present the Atlanta model?

And, yes, to that previous post, I replied: “Nice, but who cares?” I suppose I could say the same here. Like price elasticity of demand, we have an analytical approach that is appealing in theory, but so ill defined as to be useless in practice.

Steven Kopits: I used the default measure at the FRB Atlanta utility. Just like in my lecture notes, I focused on the 2% target inflation rate in the St. Louis Fed webpage. In other words, the FRB Atlanta utility default matched most closely the St. Louis Fed equation, and I used that for expositional purposes (i.e., to explain to people who don’t seem to know much).

Among the versions on the website, I prefer the version I cited, but using 2 sided Laubach Williams; these imply that in 2016Q3 *and* 2018Q2, the Fed funds rate should be raised. So message unchanged regarding the internal inconsistency of the Trump statements.

Steven Kopits: Thanks for your last line. I’ve done a new post motivated by it.

To 4%?

Steven Kopits: No. Use … the … default … settings … on … the FRB Atlanta … utility, … but … use … the … 2-sided Laubach-Wiliams … estimate … of … the … natural … rate. You … get … 2.13% target FFR.

Let me put it here:

On the graph you presented, it’s 4%.

Steven Kopits: Yes, I used the default because (1) it’s the canonical, and (2) easy to explain. Otherwise, one has to get into why one believes the 2-sided Laubach-Williams estimate makes sense. But in both cases, the actual FFR is below the implied FFR, at both points in time.

So you could have changed one button on the AFRB site and created the graph you believed in, but you didn’t do that.

OK.

So you appear to agree with Trump that Yellen should have raised interest rates in 2016.

And right now, the difference between you and Trump is 2.13% v 1.92% current FFR? Twenty-one basis points. That right?

“But why did you use the Atlanta Fed’s version here? Do you believe that is the correct rate?”

How dumb can Princeton Steve get??? It is an interactive tool that allows the user to change the underlying assumptions. Menzie has noted this over and over but Princeton Steve still does not get the very simple point? Just WOW!

Our favorite, Komrad pgl, comments: “It is an interactive tool that allows the user to change the underlying assumptions. Menzie has noted this over and over but Princeton Steve still does not get the very simple point? Just WOW!”

Wow, is exactly correct! Anyone who has used parameterized tools know the assumptions used in setting up those initial parameters can make such a tool support almost any story wished. Pgl, are you that ignorant or obsessively support the selected message?

Menzie, clearly understands this issue, as he admits: “…There is a link to the Atlanta FRB Taylor rule utility; you can put in pretty much any setting you want but I wanted to use default so that people could see a “standard” estimate. … In other words, the FRB Atlanta utility default matched most closely the St. Louis Fed equation, and I used that for expositional purposes (i.e., to explain to people who don’t seem to know much). ”

To be clear, i don’t fault these tools, just don’t read too much into their results, as they are more likely to be showing the desired results of the user. They could be as objective as the user wished.

You ended your post with “Will the real Taylor Rule please stand up”. Seriously? If you think there is a real Taylor rule I would submit you never even read John Taylor’s original paper or any of the subsequent literature on this.

OK – this Haver calculation does not show that “interest rates were kept too low for too long” which was a claim by Taylor after he stopped being an economist drunk on GOP Kool Aid.

But after looked at the Haver graph you posted – it suggests that the FED should have raised interest rates 3 years ago. Sorry but this claim strikes me as being batshit insane.

Stephen: Allow me to extend and clarify your thinking on the Taylor rule.

No variant of the Taylor rule in the literature is sufficiently correct from the standpoint of guiding monetary policy in an optimal way. (Menzie’s “Neither is ‘correct’ is correct.”) This brilliant rule by a brilliant economist has a fatal flaw. Taylor’s rule does not take into account asset price inflation. The only asset inflation important is that of residential real estate, the lion’s share of household wealth. Thus the need for an augmented Taylor rule with another difference variable on the rhs of the equation accounting for home prices.

You yourself can construct such a rule. If you do, you will see that from 2000 on the funds rate was kept doubly below where it should have been under a more optimal augmented rule. Thus the devastating 2008 crisis, for which the Fed was fully culpable in the sense of providing far too much liquidity to the system.

If the BLS did not use the inane methodology of OER in the CPI – badly distorting one-quarter of the index – augmentation may not be necessary. But carefully think though this. Look at the paths of all relevant variables during the housing boom. And momentarily set aside your preconceptions from the literature, that may not be valid since most peer-reviewed articles on a given subject rarely look at things from a sufficiently comprehensive vantage point. You will then see at least the sense of this, if not the truth of it.

If I am correct about the need for augmentation, with each passing month we move closer to another housing crisis. Still far off, though. And of course since some things have changed, like regulating toxic securities, the next housing crisis would not be an identical replay. Nor would it be an identical replay if the Fed were to hew to the ordinary Taylor rule, as it manifestly did not during the housing boom.

At this current juncture, the housing bubble is 50% of the size of the bubble at the peak of the crisis. Home prices are rising in excess of 6% while goods and services prices are rising at just a 2%. More crucially, home prices are rising at twice the rate households can comfortably service their PITI payments.

Finally, you can construe all this as an hypothesis with a prediction. Home price inflation will outpace CPI inflation and growth of national income for at least the next two years – at a bare minimum. This because the Fed is doubly behind the curve – firstly on the Taylor rule with its two traditional rh variables, and secondly because of the shadow augmented variable that’s barking even though it is not there in visible form.

Way to transform something that should be straight forward into something as garbled as it gets. You – like Princeton Steve – need to read the actual literature.

I agree with the problem you are positing. But the underlying problem is the long run decline in interest rates. So what is the ‘right’ rate? In an aging society with population decline, the natural rate of interest could be effectively zero. Seems to be in Japan. (See my article on this topic.)

So can we still use the Taylor Rule (whatever that means) in its older form? Should we raise rates to combat non-existing inflation? Or should we now be targeting asset prices? And if so, what should asset prices be in a post-peak economy? If interest rates are in secular decline, then assets will continue to revalue., no?

Real rates now are below where they were in 1993 when Taylor wrote his original paper – the point I have been raising.

Please note Menzie is on the right track with using the Laubach-Williams 2 sided estimated real rate.

Now if you have no idea what this means, Google it, and then READ something.

It is not Menzie’s job to make up for your lack of economics.

Stephen: I have read you over the years and gauged your understanding of the economy and rates. There is no substitute for getting your hands dirty with the data to increase understanding. You say that the problem is the long-run decline in interest rates. I take this to mean decadal decline. But why would that be a problem? Inflation has declined, as has trend real growth. Don’t confuse yourself by bringing in aging population, what happened in Japan, etc.

I surmise that much of your quandary has to do with the washout of the Great Recession, and the Fed’s policy of ZIRP and QE. It would then do little harm to your analysis if you simply ignored the relationship between the Taylor rule and the actual fed funds rate from 2009 until Dec 2015 or so when the Fed started the latest upcycle. Chop that data out and use truncated and spliced series. If it helps, keep in mind that my augmented Taylor rule series lay well below the green line on the chart posted here from the time of the housing bust until Spring 2012 when home prices stopped falling. Of course this perturbation had to affect the unobservable neutral rate! For that matter so did the exceptional plunge in oil prices from mid-2014 until early-2016, with reverberations for another year beyond.

I’d start the analysis at least as far back as 1990. Eliminate or ignore all observations from 2009 though calendar 2015 or 2016. Use Taylor’s original setup with a 2% neutral. The next variant would be to substitute 1% neutral here in this current time segment. Present estimates including those of Williams fall between 1% and 2%, not much above or below. You do all this analysis for the purpose of learning.

I understand your frustration with Menzie’s graphic. If it was correct, inflation should be accelerating a lot more by now. Using the Atlanta utility, how does one go about choosing a neutral rate from the options given? You do so by having an excellent command of what was going on over all this time. That command is not easily acquired. Basically you had to live it to understand the changing context of the times and the nuances. Were I to select one neutral from the options, it would be the Holston-Laubach-Williams model one-sided estimate.

Why? It best fits what happened back then and what is happening now. Pull up the utility and select HLW. Notice the gap in the early-2000s. Very important. Fed was too easy. Notice the gap today where the Fed is behind the curve. Inflation is picking up and there is no end in sight. We have passed through the storm of the crisis years and QE. One might say we have entered back into normality. Much art is required here. No easy thing forecasting interest rates. Of course there is art. Just look at the range of choices for the neutral rate in the utility, and the wide range of paths they plot out. Menzie can’t just point to one and say “that’s the one.” Nobody can. What I’ve tried to do here is encourage you to get your hands dirty with the data so you can make the choice on your own.

My forward view is that the real rate – that is the neutral rate – will move higher and approach 2% as the rate environment becomes more and more normal. I believe no way the Fed stops hiking the funds rate at 3%. This view is based on judgment informed by years of experience. And on the observation that trend real growth is a solid piece of data modulating the movement of the neutral rate. Because I believe a sea-change is underway in trend growth, I believe the neutral rate is edging higher in line with the HLW path. Of course what I said in my initial comment regarding augmented should also be taken into account.

Wow!! Someone’s meds are not working anymore. Time for a consult.

Relax, Dilbert.

The Donald does not cope well with criticism.

I like your comics.

Historical question. The label at the top of the graph refers to the “Taylor Rule prescription.” My understanding was that initially Taylor proposed his rule as a way to describe Fed policy. At what point did the Taylor rule description become the Taylor rule prescription?

Good point. People need to read what Taylor originally wrote back then (as opposed to the rather arrogant BS Taylor is writing now).

OK, so let’s have a post on the different versions of the Taylor Rule and why that’s a good or bad thing. If logs can get, what, there or four posts, then surely a digression on the Taylor Rule variants is warranted.

Steven Kopits: Geez. Here is an entire post on the subject. At the time, a certain Steven Kopits wrote:

That other Steve probably thought economics was too hard to actually read. Or was that his twin brother Ed.

Regardless of Trump’s hypocrisy and lying about interest rates, the public has good reason to question the Fed’s independence.

Yellin and now Powell have given numerous speeches over the last 10 years saying that the stubbornly low inflation rate is an anomaly, a mystery, unexplained. They have also given speeches over the last 10 years saying that stubbornly low wages are an anomaly, a mystery, unexplained.

So the Fed chairs have admitted that their two mandates, inflation and employments, are a mystery, yet somehow they are certain that now is the time to raise interest rates. This isn’t science. This is just faith or religion.

The problem is that the Fed is run by bankers and serves bankers and is biased to the concerns of bankers. They aren’t “independent” at all. If you want to have a true independent Fed then they should be one third bankers, one third labor, and one third consumers. After all, their mandate is employment and inflation, not just banking.

A people’s FED? Did I just wake up over the comment section of Mark Thoma’s place or what?

On the graph you presented, it’s 4%.

Steven Kopits: Like I wrote several comments ago, I used the defaults on the FRB Atlanta website, for expositional purposes. I think more plausible the 2-sided Laubach-Williams version. Do you want me write that again and again and again?

Some time ago Taylor disagreed with Glen Rudebusch of the SFFed on the Taylor rule. Rudebusch wrote a very good article on implications of Taylor rule for the USA way back then.

It is totally informative on this topic.

I have to say Rudebusch is one of my gave writers on any of the Regional Feds.