Reuters has an interesting article, entitled “Inside China’s strategy in the soybean trade war”.

Mu Yan Kui … ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.

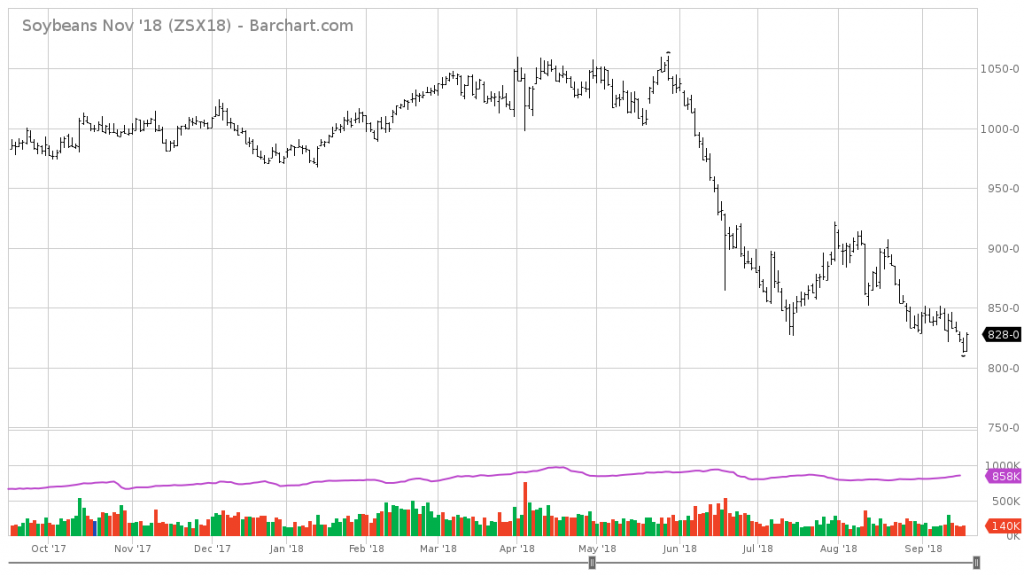

Source: barchart.com.

…“Many foreign business people and politicians have underestimated the determination of Chinese people to support the government in a trade war,” said Mu, vice chairman of Yihai Kerry, owned by Singapore-based Wilmar International (WLIL.SI).

The comments echo a growing confidence within China’s soybean industry and government that the world’s largest pork-producing nation can wean itself off U.S. soy exports – a prospect that would decimate U.S. farmers, upend a 36-year-old trading relationship worth $12.7 billion last year, and radically remap global trade flows.

…

Just one prong of the strategy Mu detailed – to slash soymeal content in pig feed – could obliterate Chinese demand for U.S. soybeans if broadly adopted, according to Reuters calculations.

Cutting the soy ration for hogs from the typical 20 percent to 12 percent would equate to a demand reduction of up to 27 million tonnes of soybeans per year – an amount equal to 82 percent of Chinese soy imports from the United States last year. Chinese farmers could cut soymeal rations by nearly half without harming hogs’ growth, experts and academics said.

Soy meal provides the protein and amino acids that pigs need to thrive, but reducing their use will be easier in China than elsewhere because farmers here have long included more soy than needed to keep their hogs healthy, according to industry experts in China and the United States.

Now, the expert from Purdue University, Wallace Tyner, was skeptical because of the costs entailed in switching feed sources (his cost analysis assuming a 30% tariff on US soybeans, discussed here).

I am hardly an expert in Chinese policy making. However, nobody who has been regaled with stories of the Opium Wars and the Unequal Treaties (as I have) can discount the burdens the Chinese leadership is willing to bear to avoid losing face, despite the ultimate pragmatism of the Party leaders. Hence, it remains to be seen whether the Chinese will relent as Mr. Trump has asserted, or whether they will tough it out.

The investment bank economist assessments indicate that both sides are settling in for a long period of heightened tariff levels, consistent with the Chinese not relenting. In other words, I do not think they believe “home before the leaves fall” is a good prediction.

Soybean futures confirm (price per bushel today for November futures, $8.28, compare against maximum on 5/29 of $10.60).

Those Democratic political operatives at Reuters! This is an interesting exchange:

“The executive from one of China’s biggest soybean crushers sat on a panel at a Kansas City agricultural exports conference, listening to an expert beside him explain why China would remain dependent on U.S. soybeans to feed its massive hog herds. When his turn to speak came, Mu Yan Kui told the international audience of soy traders that everything they just heard was wrong. Then Mu ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.”

We heard this in the latest Star Wars!

https://www.youtube.com/watch?v=atDXtvo6hIg

“Amazing. Every word of what you just said.. was wrong.!

I never doubted Chinese resolve. On the other hand, resolve against what? I still don’t know what we want from China beyond reducing the trade deficit, which Chinese authorities really don’t control.

As for the price of soybeans, I am surprised the price differential has remained this open. If soybeans are fungible, then users in neutral third countries should be willing to sell their, say, Brazilian soybeans to China and buy US soybeans instead. Or perhaps soybeans live at some razor’s edge of substitutability.

But are people transacting at this price, or only seeing small volumes transacted and holding inventory hoping for better times? Don’t know. But we can say that the differential between US and other supplier’s soybean prices are not being arbitraged away right now. So either soybeans are not fungible, soybeans are easily substituted by a proximate commodity, or very little is being transacted at the posted price and US soybean producers are speculating long.

The problem, of course, is that this is now a political, rather than economic, issue, so the blood will continue to flow until someone is exhausted politically. And that could be a long time. Or maybe just until November.

Steven Kopits, it’s very clear what the Trump Administration wants from China. To stop coercing and stealing intellectual property, and to open its market by at least reducing its numerous trade barriers. That will raise U.S. exports to China and reduce U.S. trade deficits. Negotiations is a goal, but China refuses to negotiate, at least in good faith.

Peak –

If it’s IP theft, then pass some laws in Congress enabling US companies to obtain generous compensation through the US court system. Don’t need China for that!

As for trade barriers, sure, China has them. The US has them. But which ones really matter? What constitutes victory? Do you have any idea? I don’t.

Steven Kopits, I just told you what’s “victory.”

You’re not listening.

And, “generous compensation” from where?

If Trump actually had to go to battle his strategy would be to shoot himself in the foot and then declare victory as they would let him go home. Winning – feh!

You could conceivably allow offsets from other Chinese assets, for example, the US assets of Sinopec or any Chinese bank. You could prohibit those companies from exporting to the US or using the US banking system, etc., just as we do with Iran, for example. You could extend Magnitsky type legislation to Chinese companies. There are options not related to trade.

Some of these are pretty draconian, but conservatives are in power, no?

Here’s Navarro’s laundry list, Peak.

Which of these is really important? How many are actually improper or illegal? Is reverse engineering bad? I don’t believe it’s illegal in the US. How many of the list must be addressed through tariffs, rather than using other tools? How many and which one of these do we need to achieve to claim victory?

Why don’t you pick out the top three from your perspective and tell us what victory would mean in terms of implementation.

https://www.whitehouse.gov/wp-content/uploads/2018/06/FINAL-China-Technology-Report-6.18.18-PDF.pdf

PeakTrader … reducing its numerous trade barriers. That will raise U.S. exports to China and reduce U.S. trade deficits.

So in your mind reducing the trade deficit is just as simple as increasing exports. Sheesh. You’re a joke. Typical mercantilist view.

Hint: Think about how budget deficits affect trade deficits.

2slugbaits, so, you don’t believe China lowering its trade barriers will increase U.S. exports.

PeakTrader Whether or not China lowers its trade barriers will have almost no effect on the overall US trade deficit. We don’t have a trade deficit because China has trade barriers; we have a trade deficit because we have a very large budget deficit. And you really need to get over this fetish you have concerning bilateral trade deficits in the goods market. That’s what makes you a mercantilist. Get beyond the 17th century. No wonder you bombed in econ.

2slugbaits, you continue to prove you’re ignorant.

It’s not only budget deficits that cause trade deficits.

China has many trade barriers that reduce U.S. exports.

And, I was awarded degrees in economics by Ph.D economists, who graduated from top schools.

PeakTrader: If the financial account (capital flows) are exogenous with respect to the current account, then a reduction of US exports to RoW induces a reduction of US imports from the RoW, to first approximation.

Read Menzie’s class notes. OK – they lower tariffs and we get to export more farm products. Cool. But then the dollar appreciates and then what Peaky? Oh wait – you do not know. Again – read Menzie’s class notes. Geesh!

Pgl, China has many more trade barriers than tariffs.

The communist leadership can just order Chinese not to buy American products.

And, a large proportion of the yuan is pegged to the dollar.

PeakTrader: The Communist Party can “order” the Chinese not to buy American products? Can you verify?

What does it mean “a large proportion of the yuan” is pegged? Do you mean partly pegged? Lots of countries peg and quasi-peg to USD. Do you have evidence that CNY is undervalued? I would welcome reasonable discourse on these questions.

Menzie Chinn, Communist China has many trade barriers:

China wields power with boycott diplomacy

https://www.ft.com/content/c7a2f668-2f4b-11e7-9555-23ef563ecf9a

And, regarding Pgl’s comment, since the yuan is pegged to the dollar (largest weighting), when the dollar appreciates, the yuan appreciates.

“I still don’t know what we want from China beyond reducing the trade deficit, which Chinese authorities really don’t control.”

Interesting comment. Trump thinks he can control our trade deficit. To date – his policy moves has utterly failed per this narrow goal as they have caused incredible damage to what really matters to farmers, exporters, aka real people.

Our King of Insults has already lost the trade war with China:

The concept of face (mianzi) in Chinese culture is a complex one. It’s easy for a foreigner to unwittingly cause an embarrassing situation. One of the worst things that can happen to someone in Chinese culture is to “lose” face. A Chinese idiom goes, “Men can’t live without face, trees can’t live without bark.” Accordingly, after having lived in China for a while, you will start to notice the ways that Chinese people go out of their way to save face for each other.

For the Chinese, causing someone to lose face on purpose can make an enemy for life and is at the root of many conflicts. As a foreigner, it will often be assumed and accepted that you do not mean to cause someone to lose face. Nevertheless, to avoid uncomfortable situations for your Chinese friends and colleagues (and so you’re not left wondering why so-and-so suddenly stopped speaking to you), it is important to try to learn at least the basics of this fundamental part of Chinese culture.

There is a pretty good chance we lose here. If I don’t know what we’re fighting for — and I am at least making the effort — does the Iowa farmer know? Do they feel they are taking part in some sort of necessary and productive initiative worth the cost? Or are they thinking, “You know, the President’s only real talent is ticking people off, like Canada, Mexico, Britain, Germany, Korea, and most Muslim countries. He’s great a stirring up the hornet’s nest, but that’s the sum total of his skills!”

Meanwhile, the Chinese think we’re being overbearing and unfair — which has the added disadvantage to us of being true! So they are going to think they are holding the high ground, and that means they’re not going to move very easily.

Now, all this is a recipe for a long stalemate, the primary achievement of which will be higher prices for consumers and a selective destruction of a couple of key US export sectors.

So, the Trump Administration should allow the communist Chinese elite to continue coercing and stealing, compete unfairly, treat its people horribly, and take over other countries territories, because it may lose face?

What about Taiwan and the masses under the communists. Aren’t they deserving, or do you hate Trump that much you’re willing to side with a totalitarian regime.

PeakTrader: If you are so concerned about those under totalitarian rule, suggest you say a word or two about Mr. Trump’s lovefest with the Russians.

Menzie Chinn, I doubt very much Trump would’ve lost Crimea to the Russians.

PeakTrader: What evidence do you have to that effect? After all, the 2016 Republican platform, post-Trump, evidences a willingness to bend over backward to accommodate Russian interests. Mr. Trump is unwilling to confront Putin on interference in US elections, what makes you think he’d expend one bullet to defend the Crimea?

Menzie Chinn, obviously, there’s no “evidence.”

However, Trump takes hard lines, e.g. against ISIS, Syria, Iran.

I doubt it would be an illusionary red line.

PeakTrader: Hard line against the Syrians? I missed the memo.

Menzie Chinn, I guess, you missed the Syrian missile strikes commanded by President Trump.

PeakTrader: I saw those, saw the annihilation of rebel (non-ISIS) forces too…and use of chemical weapons with no US respose. Did you see those events too?

PeakTrader Did you see how subservient Trump acted when he was in Putin’s presence? Trump was an embarrassment. But yet you seem to believe Trump would have stood up to Putin over Crimea??? Really? And if Trump threatened Putin with a military response, would you have volunteered to be the first casualty? Or is it all just chickenhawk bluster?

2slugbaits, working with world leaders doesn’t mean Trump is “subservient.”

Maybe, he believes he can change Putin or the North Korean dictator.

I mean to support Menzie’s argument here, a solid argument which is in no need of my “help” when I say that I doubt PeakIgnorance or what I think “pgl” has aptly termed our “usual suspects”, really give a damn about what is happening in Yemen either (which I don’t know but would wager a tidy some of money that Menzie is well aware of).

America has blood on our hands. Of course as America rightly focuses on Orange Excrement’s circus freak show in the White House, we are losing track of the reality that America is actively and very diligently assisting Saudi Arabia murder women and children in Yemen.

https://www.youtube.com/watch?v=p9bVsHhwo4A

https://www.youtube.com/watch?v=eFOyCwCRTgw

https://www.hrw.org/sites/default/files/report_pdf/yemen0818_web2.pdf

When America is done assisting Saudi Arabia murder multiple women and children in Yemen (dozens?? hundreds?? thousands??) We will all sit here 15–20 years from now, scratching our heads at why the few Yemen children who survive the American assisted slaughter of their countrymen hate America to their core as adults in the year 2033 etc…..

“I doubt very much Trump would’ve lost Crimea to the Russians.”

You can believe and doubt a lot, that does it not make reality.

What could the USA have done? Nothing. Trump produces a lot of hot air which does not impress the Russians.

Is Crimea (the Balts, Georgia, Macedonia, al Qaeda parts of Syria, et al) worth a war, even the fictional little ‘low cost, containable’ war they are ‘selling’? I see ’tilting’ with Russia same as Bismarck saw tilting in the Balkans………. despite all the money to be made occupying Poland, Rumania, etc.

BTW AF Secretary says “we” need 25% more squadrons………… think 20 or 27 airplanes in a fighter squadron. Except F-35 which needs more plane per squadron to fly missions older less breakable fighters could fly. The list of new squadrons in not all bomb droppers!

Now that $700B a year is not enough to do the plans……..

PeakTrader Maybe, he believes he can change Putin or the North Korean dictator.

In other words, Trump is delusional.

Peak –

I am concerned that a poorly defined trade war is giving the Chinese government exactly the latitude it needs to pursue some of the policies you mention.

The massive internment of Uighurs should be a central topic in US-China relations. However, if we are enemies through trade anyway, then the downside of these sorts of policies is reduced. If China is facing tariffs regardless, how much more can the US do? And moreover, if the US is being the bad guy, then the Chinese can more easily be rallied around Beijing. The trade wars suck up the headlines and reduce our political leverage.

https://www.nytimes.com/2018/05/15/opinion/china-re-education-camps.html

To my point,from today’s NYT:

https://www.nytimes.com/2018/09/20/world/asia/south-china-sea-navy.html

As someone who spent 7 years in China, none of this surprises me AT ALL. It is deeply rooted in the mainland Chinese psyche that they will not be “stepped on” or “looked down upon” by foreigners. In fact, at the risk of royally pissing Menzie off (which I do not like to do as I genuinely like Menzie as a person and respect him) I would go so far as to say there is a significant portion of the mainland Chinese population that is xenophobic. And here I must make the obligatory (instead of subtext understood) statement that large portions of America are xenophobic (as shown by 2016 presidential election and the “after effects”). Mainland Chinese have some very justified reasons for this and some not so justified (I’m sorry but the victimization thing via Japan can only be strung out for so long). If China had won the war (looking at their war with Japan in a “bilateral” fashion) are we to believe Chinese soldiers in isolated areas would have taken Japanese female prisoners to a 5-star hotel and attached chastity belts to them to ensure their safety?? Color me “cynical” if I say, that one is “a stretch” for me.

All that being said, many Chinese would probably cut off the digits of their own hand, if they felt it would exhibit the current reality that they do not “take sh*t” off of foreigners, especially Americans or Japanese. So yes—if the Chinese politburo tells the Chinese mainland population there are food goods that they can substitute for soybeans (and/or any other USA import with tariffs or quotas applied) you better damned well believe Chinese consumers will do their best to use and consume those substitutes as needs be.

Would Americans be that obstinate or unbending to refuse consuming Chinese goods?? NO. Only under extreme circumstances. And in this particular case I mean this as more a compliment to mainland Chinese’ tenacious national unity and a mild insult to most Americans’ spoiled attitude.

Menzie,

“saw the annihilation of rebel (non-ISIS) forces too…and use of chemical weapons with no US respose. Did you see those events too?”

Term “rebels” (these are not the Syrian equivalent of Scots-Irish from Wilmington NC in 1864) in regard to Syria is wrong, best you can say for the ‘rebels’ are they are foreigners, funded from GCC and NATO. Most of those insurgents are at best Salafi radicals at worst ISIS lite, and the term ‘used to al Qaeda’ is malarkey.

As to staged chemical events in Idlib 2017 and Douma 2018 doubt remains and I do not rule out ‘false flags’ instigated by HTS (al Qaeda lite if you will buy the propaganda about ‘rebels’) including ‘prop’ staging in both places by White helmets with no regard for chemistry and physics.

While OPCW releases are BS in most cases.

For all you almond lovers, I found a USDA interactive search engine that allowed me to trace annual almond prices received by the farmers. They skyrocketed from $1.65 a pound in 2009 to $4 a pound by 2014. But then market conditions took the price down to $2.39 in 2016.

The good news for farmers (bad news for consumers) is that prices rose to $2.53 a pound during Trump’s first year in office. Go farmers? Well no – Trump’s trade wars has led China to impose 50% tariffs on almonds imported from those Democratic commies in CALI who voted for Hillary anyway. That should serve them right and we almond lovers will see a price break soon we hope. GO TRUMP! We are winning!

New York Times article – December 2017

“A government-led effort to help Chinese companies at home and abroad has set up a potential trade battle with the United States, as a growing number of American businesses complain that Chinese trade practices like forced technology transfer are putting them at a disadvantage.

“…growing frustration that China is demanding too many concessions from companies that want to compete in the country.”

“The challenges of China’s regulatory environment — its opaqueness, unpredictability and basic problems of market access — make it difficult for U.S. companies to realize their full potential.”

China wants its giant national companies to be world leaders in sectors like electric cars, robotics and drones, but the authorities are accused of curtailing foreign firms’ access to Chinese consumers.” “You can get WeChat in America, but you can’t get Facebook here in China.”

https://www.nytimes.com/2017/12/06/business/china-global-business-xi-jinping.html

“a growing number of American businesses complain”.

No mention of WHICH companies are complaining? C’mon man – do try harder to communicate. BTW – a lot of American companies complain when they see anyone competing with them. Good to know you support monopolists ripping consumers off!

“China wields power with boycott diplomacy”.

I see that PeakTrader has never seen the last speech given by Martin Luther King, Jr. The one given in Memphis back in 1968 just before some white racist murdered him.

“since the yuan is pegged to the dollar (largest weighting), when the dollar appreciates, the yuan appreciates.”

It seems that PeakTrader thinks the yuan/US$ is permanently fixed. FRED?

https://fred.stlouisfed.org/series/DEXCHUS

I have not checked the numbers in detail, but it is my understanding that since Trump started putting tariffs on other nations, the trade deficit of the US has mostly been rising.

Balance on current account per Table 4.1. Foreign Transactions in the National Income and Product Accounts (www.bea.gov)

In 2016, this was a $445.8 billion deficit. In 2017, it was a $472.5 billion deficit. So yep – the deficit was up in 2017. Let’s see what BEA says about 2018!

Googling for monthly data I found a report form Aug. 28 that the trade deficit rose from $67,9 billion in June to $72.2 billion in July. It is 7% higher than a year before, although apparently it was higher in February. However, the July number is higher than any month since Feb.

America is winning the trade war

https://www.google.com/amp/s/www.cnbc.com/amp/2018/09/20/america-is-winning-the-trade-war-heres-proof-market-watcher-says.html

Concessions will increase the volume of global trade.

Another PeakTrader fishing the bottom of the barrel ala a Google search. What blow hard babbling fool did Peak turn up as his “economic expert” this time?

Steve Chiavarone, portfolio manager at Federated, told CNBC

Falling on the floor laugh. Ah Steve – why are we winning the trade wars again? The stock market is up? What a moron!

PT,

Yes, Trump himself also thinks this is all about stock markets. Two things you need to know about the Chinese stock markets. The first iis that it has been extremely volatile while having nearly zero connection with actual economic performance. We have seen several years in the recent past, most recently just two years ago, when the Chinese stock markets fell more than they have this year so far. But while it is gradually decelerating, the Chinese GDP growth rate has been very stable, tstill between 6 and 7% compared with 3 to 4% for the US economy. By GDP growth rate measure, they are “winning” the trade war, as well as by trade balance numbers that Trump thinks are the Real bottom line, US trade balance going more and more into deficit, whoooops!

The other point is that a far smaller percent of the Chinese population owns stocks than does the US population, something under 10% versus over 50% in the US, although in both countries the vast majority of stocks are owned by a tiny percentage of the population. The stock market is simply not that big of a deal.

And as it is, for all the whooping Trump and pals have been doing about the US stock market it is only as of yesterday that it (the Dow actually) got back to where it was back in January when the tax cut was passed, which was supposed to be great for the stock market. Basically through this period of tax cuts and trade wars the US stock market has gone nowhere, so this whole story is even exaggerated, silly as it is.

Barkley, China’s GDP growth is overstated and can’t be trusted. Its social costs, including negative externalities, offset its GDP growth by a huge margin. Also, Industrial indicators don’t match up with GDP growth.

Capital is likely flowing out of China and flowing into the U.S.. China is an export-led economy and much less diversified than the U.S.. It’s in a much weaker position to engage in a trade war with the U.S..

PeakTrader: Capital has been flowing out of China for the past 25 odd years; that’s what it means to have a current account surplus.

Menzie Chinn, it’s been flowing mostly into U.S. Treasury bonds.

There’s likely less flowing into the Chinese stock market.

PeakTrader: Well, yes if it’s flowing into US Treasurys, the capital flows are going to the US from China…by definition. I don’t understand what you are trying to get at.

Menzie Chinn, the U.S. and China stock markets may be pricing-in the U.S. will gain some concessions.

“Its social costs, including negative externalities, offset its GDP growth by a huge margin”

OK but then US GDP is also seriously overstated. And your boy Trump is going to make this worse. Yep – Peaky has just told us not to trust U.S. GDP growth figures!

“PeakTrader

September 20, 2018 at 3:16 pm

Menzie Chinn, it’s been flowing mostly into U.S. Treasury bonds.

There’s likely less flowing into the Chinese stock market.”

Where in any economic text book does it say that if a nation’s current account surplus does not flow into its stock market, then it does not really count? Menzie does not understand what you are trying to get at. Which is cool as neither do you.