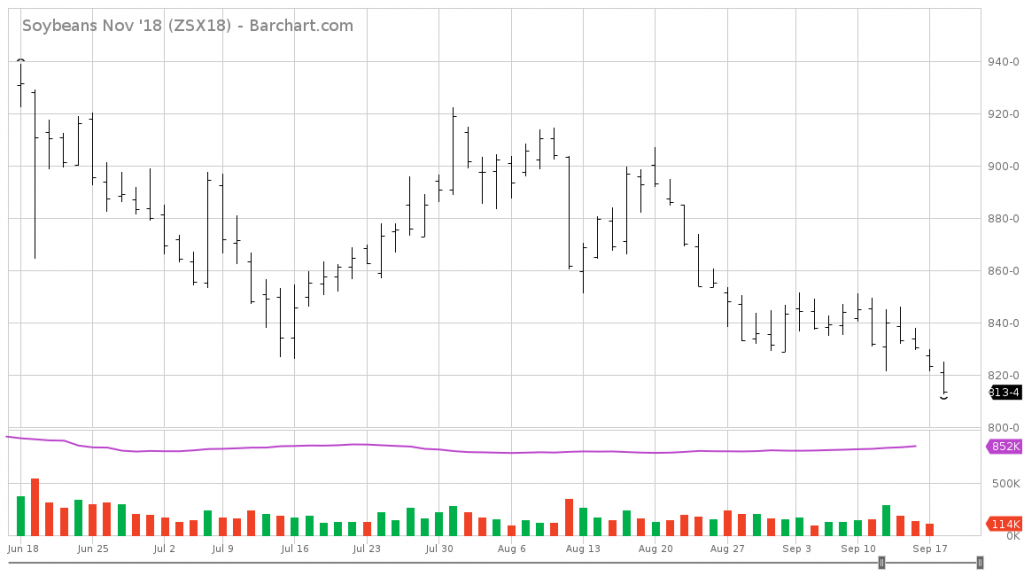

November soybean futures keep on going down. And the US-Brazil spread has proven durable.

Source: barchart.com.

For those who argued Chinese tariffs would be immaterial to prices because of arbitrage/relabeling (see this post, and associated comments), the following graph is, I think, dispositive, as the gap in US and Brazilian soybean prices has proven very durable (more so than I had expected). One could argue weather/harvesting yield news could (should) affect the level of soybean prices, but should not affect the tariff-induced spread. Lo and behold:

Source: Javier Blas.

I ask: Are US soybean farmers tired of “winning” yet.

Javier Blas is using information from the Bloomberg machine. I suspect our Usual Suspects will fire back that Bloomberg has declared he is now a Democrat. Now that likely does not change the reliability of market information reported by his former firm but I do expect counter information sourced from those economic experts at Fox and Friends.

This is funny. Poland’s prime minister is smiling and praising Trump as Trump tells us his usual stupid line as to how nations that export more to us than they import from us are stealing from us. Didn’t Kudlow brief his stupid boss? We imported $7.1 billion from Poland in 2017 and exported only $4.5 billion to Poland. No wonder the Poland PM was smiling. Trump did not know that the Poles are stealing from us blindly per Trump’s own definition. Lord – our President is the dumbest person EVER!

Not just soybeans – also almonds:

http://www.xinhuanet.com/english/2018-07/08/c_137310226.htm

We produce 2 million tons of almonds compared to the rest of the world producing 1 million tons. China has imported a lot of the almonds from California. But now that the tariff rate has been increased to 50%, California almond farmers will likely see even lower prices than they were already experiencing.

2016 CA almond exports were worth $5.16 Billion. Tota CA l farm/ag exports were valued at over $20 Billion. Lot of almonds grown in districts represented by Trump bootlickers. Same for pistachios and walnuts, also Billion+ exports.

Fun (sorta) fact. That $20 Billion California growers received for 2016 exports was more than twice what the state of Wyoming budgeted for state services that same year.

Looking ahead to next year, I’m curious what some of your readers suggest a Midwestern grain farmer should plant. Some may have insight into what this administration is planning or what policy they may follow. Do you “plant corn and pray” as they say? Or do you double down on soybeans and hope the trade war is resolved and the Chinese come back to U.S. for soybeans? Also, keep in mind, profitability of grain commodity farming is highly dependent on debt/interest rates for inputs. And bankers will be reviewing your balance sheet from last year.

Samuel Good question. Maybe you plant hay and pray.

FWIW, both corn and beans are down. Here are today’s Iowa interior cash market prices:

Closing cash grain bids offered to producers as of 1:30 p.m.

Dollars per bushel, delivered to Interior Iowa Country Elevators.

US 2 Yellow Corn Prices were mostly 5 cents lower for a state average of 2.92.

US 1 Yellow Soybean Prices were generally 9 – 11 cents lower for a state average of 7.10.

Iowa Regions #2 Yellow Corn #1 Yellow Soybeans

Range Avg Range Avg

Northwest 2.81 – 3.01 2.93 7.06 – 7.16 7.11

North Central 2.86 – 2.98 2.92 7.04 – 7.15 7.11

Northeast 2.76 – 2.97 2.89 6.88 – 7.24 7.07

Southwest 2.88 – 2.99 2.95 7.07 – 7.19 7.11

South Central 2.89 – 3.08 2.95 7.09 – 7.14 7.11

Southeast 2.63 – 2.95 2.87 6.91 – 7.16 7.08

Corn basis to STATE AVERAGE PRICE for the CBOT DEC contract -.51

Soybean basis to STATE AVERAGE PRICE for the CBOT NOV contract is -1.04

https://www.ams.usda.gov/mnreports/nw_gr110.txt

Corn below $3.00/bushel and soybeans flirting with going below the $7.00/bushel threshold.

It will be interesting to see if the drop in the cost of production for hogs offsets the decline in demand over the next five to six months (typical amount of time needed for raising hogs to market).

@ Samuel

Ever thought of starting a Soybean farm in Brazil??

Warning: American soybean farmers with prior cardiac problems should consult a doctor before viewing the following Brazilian Tourism Bureau video:

https://www.youtube.com/watch?v=KSScp7AONwI

Possible dangerous side effects of the Brazil video could include but are not totally excluded to or totally encapsulated by the following: Increased heart rate, motion sickness, cramps in the neck, eyeballs popping out, perverse visions, homesickness for a country you’ve never been to, shortness of breath, non-verbalised questions in your mind of why God cursed you with trump, a sudden desire to learn all Brazilian words related to carnal activity……..

[edited by MDC]

Earlier hadn’t known ~1/2 soybean crop was forward contracted at near peak prices. Now it will be interesting to see who is holding those contracts and where they are shipped. Couple that fact with the Govt subsidy and for this year many soybean farmers will be made whole.

The question is what will they plant and how much of it for next year. Certainly farmers will consider what makes up their break even price in consideration of what to plant.

Oh joy – more unconfirmed speculation as to how Iowa farmers are winning … even as all the economic research cited on this blog suggest they are not. But what do these agricultural economists who actually study real world markets know? They need to studiously examine CoRev’ brilliant comments (just for the laugh)!

Pgl, the ~1/2 crop being contracted was in the WaPo article discussed here a few weeks ago IIRC from a USDA Report. The subsidy deployment was also discussed here. You even responded in that thread. If you have any other complaints please in the future be more specific by citing/copying the actual text.

“Couple that fact with the Govt subsidy and for this year many soybean farmers will be made whole.”

This statement is NOT in that USDA report. As usual, you just make up intellectual garbage and then get offended when someone takes out your trash.