Interesting news even as we are flying partly blind (some government series are still lagging).

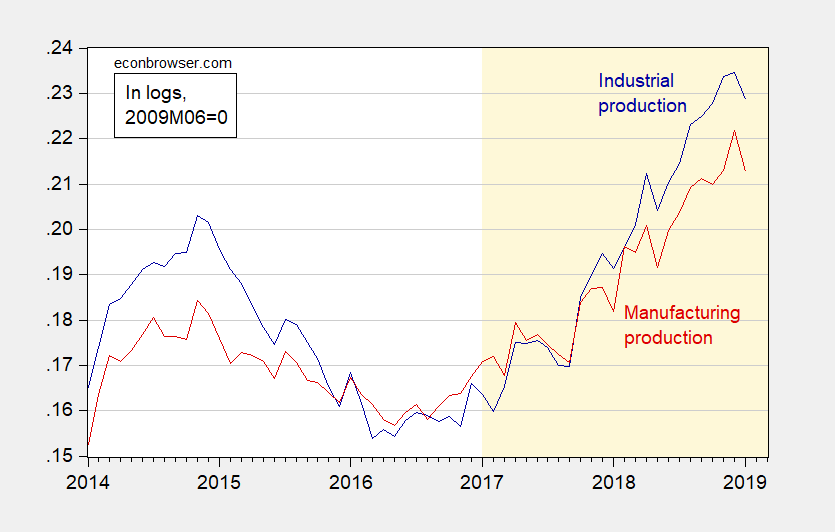

Here’re industrial and manufacturing indices, normalized to 2009M06=0 (recession trough).

The 0.9% and 0.6% declines in m/m manufacturing and industrial output compare to 0.55% and 0.5% standard deviations over the 2009M06-2013M01 period. The manufacturing decline is therefore statistically significant. Last month’s numbers were also revised down. As noted in Reuters, automobile production seems to be driving this latest movement.

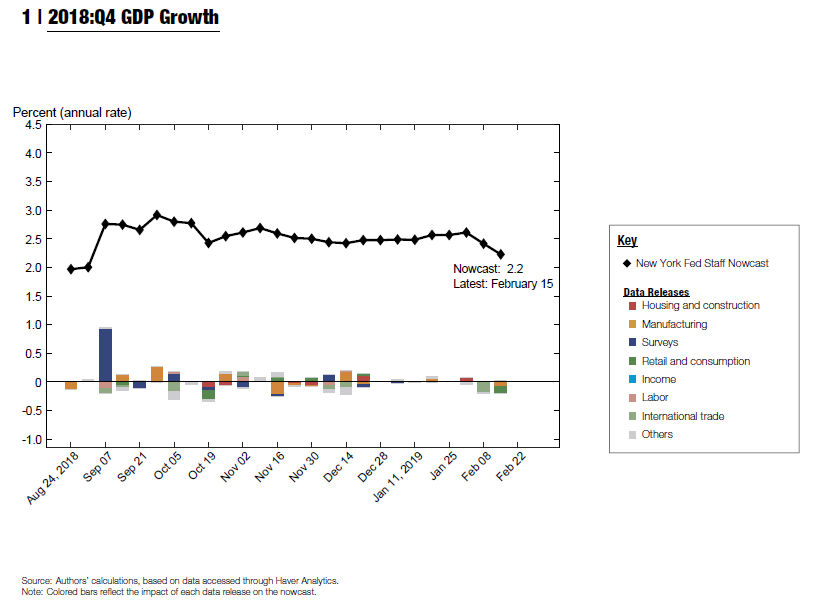

This data follows the retail sales data released yesterday which drove down nowcasts of GDP.

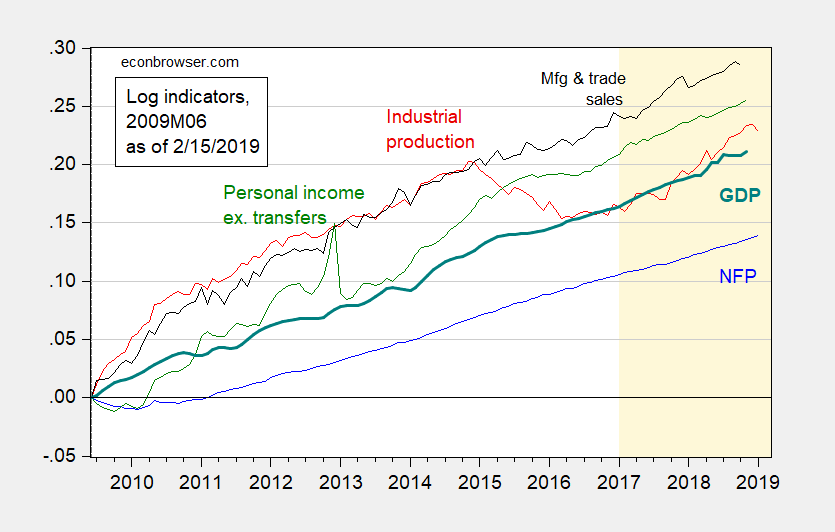

Do we know what this means for the overall economy? Not really, because we are still lagging behind in reports for two of the indicators the NBER Business Cycle Dating Committee has historically focused on: real manufacturing and trade sales, and personal income excluding transfer receipts (latter will now be released on 3/1). Hence, the below graph looks pretty similar to that I presented nearly a month ago in this post.

The advance and second release of GDP will be releaseed (as an “initial” release) on February 28. Until then, keep on guessing!

Update, 3:45PM Pacific: And…today’s NY Fed nowcast for the first quarter of 2019:

@ Menzie

I swear to God I was gonna put that Atlanta GDP Nowcast up in comments either early this morning or late yesterday night. I think my computer randomly shutdown or something got me off track—they had it up in a ZeroHedge post. Menzie–notice they keep revising the GDP numbers down—now maybe I cannot claim “victory” on this GDP thing, but come on, I don’t look so crazy on my criticism of the BEA’s GDP number you and 2Slugbaits were nudging me on yeah?? It doesn’t look so crazy listening to my gut now does it?? Come on, do I get 1/4 point credit on that??

Menzie Trivial and nitpicky comment, but check the note for Figure 2. It refers to GDP for 2014Q4. Obviously you meant 2018Q4.

Oops, yes, will fix. Clearly living in the past…

From AEIR:

Weak industrial output for January continues a string of disappointing economic data and justifies a cautious outlook. However, a robust labor market, reasonably high levels of consumer confidence, generally solid balance sheets for the private sector, and a neutral Fed outlook suggest continued economic expansion remains the most likely path. The major risks are primarily associated with trade policy and global economic uncertainty.

https://www.aier.org/article/manufacturing-output-retreated-january-vehicle-production-plunged

The issue isn’t expansion versus recession but the lowering rate of growth. Going down to the 2% and maybe lower in 2019 might make it harder for trump to argue the 10 year expansion under his 2 years is the greatest in the history of the US. But then again he could always blame the Dems or the investigations or immigrants or the Fed or….

Three comments about the steep December drop in retail sales, which account for more than two-thirds of economic activity:

“The data also conflicts with other reports of holiday shopping, including Mastercard SpendingPulse, which said holiday sales rose 5.1 percent from Nov. 1 to Dec. 26, the best in six years, and online sales rose 19.1 percent.”

“These numbers are astonishing, and impossible to square with the Redbook chain-store sales survey, which reported surging sales in December and a record high in the week of Christmas, on the back of the plunge in gasoline prices.”

“It could be a reaction to the stock market” (the decine from the high in early October accelerated in December).

Just out of curiosity, what happened in 2015? Didn’t find any articles specifically about that? It didn’t seem to have much impact on the total economy.

https://www.federalreserve.gov/releases/g17/Current/ipg1.svg

Bruce Hall What happened in 2015 was two quarters of decent growth (2015Q1 & 2015Q2) followed by three quarters of very anemic growth (2015Q3, 2015Q4 & 2016Q1). Not formally a recession, but skirting the edges of one.

Well, yes 2slug, that’s the obvious part. But what happened to cause the downturn in the IPI? No trade wars, low inflation, unemployment dropping,…. Was it the European flu? Was it China (2014-15 was weak)? The present change in U.S. IPI is relatively small versus the 2015-16 decline.

Bruce,

At the time, there was a big sell off in the Chinese stock market (30+%) due to worries about a slowdown in their economy, coupled with the Greek debt crisis in June.

I believe there was a large decline in commodity prices

I guess this would be another example of “efficient markets”?? We’re often told by CEO blowhards (more the Jack Welch, Lee Iacocca version of blowhard than the Cliff Claven breed of blowhard) that in “private business” and in “private corporations” you can’t just operate with a blank check. They say “You can’t just run red ink all the time.” Really?? What if banks keep selling garbage bonds to naive investors with bogus ratings assigned by the debt ratings agencies that take fees and commissions off those bond/debt sales?? I’m having a hard time deciphering how “market mechanisms” are making the corporate bond market picture look all that different from America’s national debt problem. Maybe the Koch brothers, Sheldon Adelson, or Rupert Murdoch can explain that one to me. But, anyways, here is a quote from Jeffrey Gundlach in a Yahoo interview online:

“Well, I think the biggest risk– and it may not materialize for a little while longer– is that when the next recession comes, there’s going to be a lot of turmoil because the corporate bond market is extraordinarily leveraged. The ratings of the corporate bond market are very low. There’s a study by Morgan Stanley research that said that if you use leverage ratios alone– and there are other variables that the rating agencies used, but the most important, of course, is leverage ratios of a corporation. And if you use leverage ratios alone, that 45% of the investment grade bond market would be rated junk right now. RIGHT NOW.

So if there’s a recession, obviously, these ratings will have to be lowered. For now, the rating agencies are listening with sympathetic ears to reassuring statements by some large corporations that they’re aware that their leverage ratios are kind of high, but they plan on addressing that sometime in the next few years. If there’s a recession, it’s obvious that the leverage ratios will not be addressed, and the ratings will have to go. So that’s a really big risk.”

https://dailyreckoning.com/get-used-to-the-powell-put/

This relates to Brainard’s comments, relating to returning to “normalcy” and the amount of treasuries. When these treasuries mature it takes liquidity out of the market, and I think Miss Brainard has suggested she thinks it might be better to pause that for awhile.

https://www.zerohedge.com/news/2019-02-15/feds-balance-sheet-shrink-whopping-435bn-today

I think Miss Brainard is relatively objective here, and again I put a decent amount of weight/respect to her shrewdness and market appraisals, but it would be interesting to see how Powell and some others would be reacting if they weren’t afraid the man inhabiting the White House would bad mouth them the very next day. There’s no way we can go to that imaginary world—but it would be fun to see the difference in FOMC board member behaviors.

Moses,

Here you claim to respect her but twice you call this married woman “Miss.” What is with you and this incessant desire to insult these women with a false titel? Again, Lael Brainerd is a married woman, and no married woman should be addressed or referred to as “Miss.” Can you not get this through your thick skull?

I suspect he was trying to type Ms. but I’ll let him explain. Her marriage status and intelligence are not related traits, anyway.

I’m curious to see how everything gets spun in the next few years. You know it’s going to get spun. Plus, it will be just as interesting to see who gets hit when the economy slows and who doesn’t. I don’t have predictions for either of those.