“The Coalition for a Prosperous America” releases what it burbles as a “Groundbreaking CPA Study…” entitled “Quantifying Economic Growth and Job Creation from a Competitive Dollar”. Don’t be fooled by all the footnotes and the numbers. At the basis of the analysis is the aphorism: “Neither a borrower nor a lender be”.

Here’s how the email from CPA described the study:

A new study of the US economy fromthe Coalition for a Prosperous America (CPA) economics team shows that the US dollar is overvalued by 27 percent. Adjusting the dollar to a competitive level would yield large benefits to the economy, including an estimated $1 trillion in additional GDP and up to an additional 6.7 million new jobs over six years.

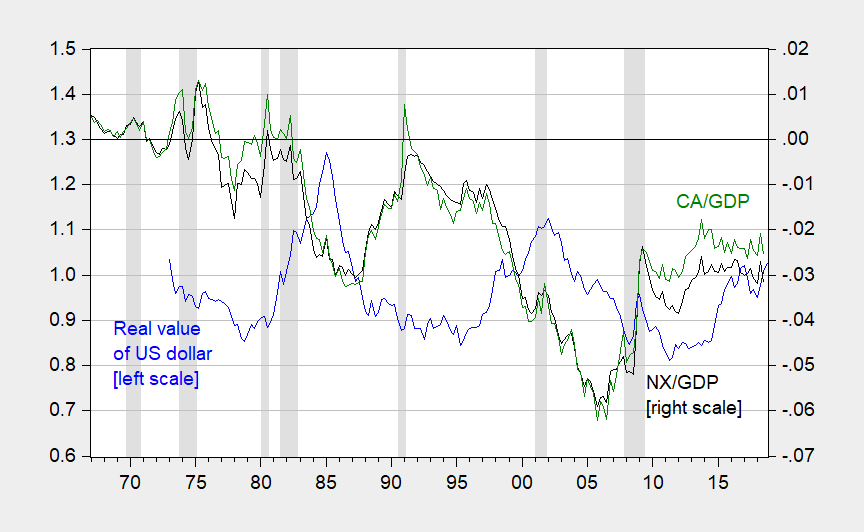

Here’s the basic picture we’re working with:

The current account surplus equals the amount a country lends to the rest-of-the-world. So, setting the “right” CA balance at zero means one believes countries at equilibrium should neither borrow nor lend.

At some point, the authors switch from discussion of the current account balance to trade balance, but since the two differ by only about 0.2% of GDP, the change is not consequential.

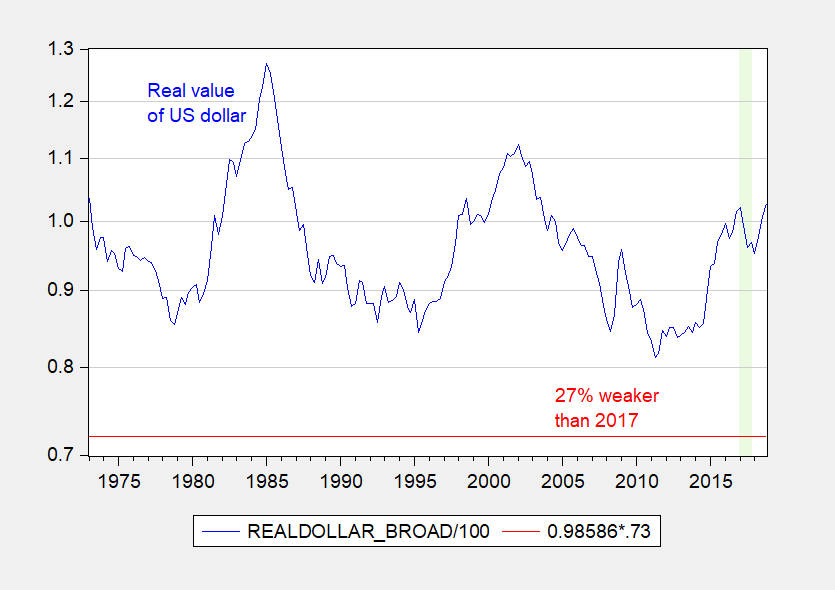

The authors reverse engineer the amount of exchange rate change (hence import price change) necessary to balance trade. This number turns out to be 27%.

The sheer implausibility of this estimate is that a 27% reduction of the value of the broad trade weighted value of the US dollar from 2018Q4 levels would take us to levels never recorded…

I could spend a lot of time wondering about the econometric methodology (and how one can have the dollar drop 27% and have no other financial macro variables change — think about the question of where the 27%). But really, the fundamental question is … why is balanced trade the right metric for equilibrium?

A more nuanced approach is in the IMF’s EBA, extended and described in the IMF External Sector Report. In essence, estimate what the current account should be given demographics, fiscal policy, and then work backwards to implied exchange rate levels.

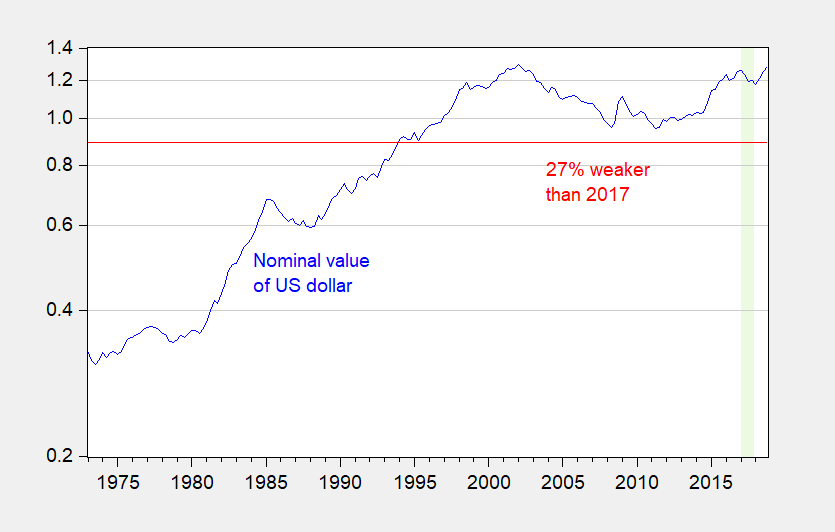

Addendum, 2/17 12:45PM Pacific: The CPA report works off of exchange rate pass through from nominal exchange rates to import and export prices. However, foreign inflation has trended downward since the last time the nominal value of the dollar was 27% weaker than in 2017. Nonetheless, I report below what 27% percent weaker in nominal terms looks like.

Achieving 27% depreciation in nominal terms given inflation and exchange rate change trends are no longer like those in 1994…

Yes it is certainly nothing like the international economics I learnt at Uni down under

I guess depending on how quickly you did the devaluation of the U.S. dollar, the first fear (negative side-effect) would be a pretty drastic increase in inflation. YES??

I guess depending on how quickly you did the devaluation of the U.S. dollar, the first fear (negative side-effect) would be a pretty drastic increase in inflation. YES??

Also, let’s say there’s a global economic downturn right around the bend (in the near-term future, late 2019, early 2020) would we even know that a devaluation would increase export demand?? Risking how much domestic inflation, in exchange for (no pun intended) what % increase in export demand in a global downturn??

Here is the Real Trade Weighted U.S. Dollar Index: Broad:

https://fred.stlouisfed.org/series/TWEXBPA

They are suggesting the exchange rate should return to where it was in June 2011. Did we have a zero current balance back then? Of course not.

Does this crowd even get that our exchange rate is market determined? Or the fact that if national savings remains low relative to investment – we are going to continue to run current account deficits?

@ pgl

You don’t necessarily have to have a peg or fixed exchange rates to devalue a currency. There are many ways to maneuver devaluation without a peg—and it’s very common. Obviously Menzie is against the 27% number, as it is both arbitrary and ABSURD. But I am going to take up my intermittent vice habit of trying to guess what Menzie might think about this. And at the risk of offending Menzie for putting words in his mouth, or having the unmitigated gall to attempt to read Menzie’s mind (probably a bad idea as Menzie is at minimum two dozen IQ points above me), I am going to hazard an educated guess here and say even Menzie would not be against America “leaning against the wind” with some of its currency policy (i.e. a mild, strategic, staggered currency devaluation).

“Defensive” currency intervention may be quite an excellent idea for America under certain circumstances, especially when worked out together with trading partners (i.e. giving friendly trading partners like Canada and Japan a “heads up”). I believe at one point in the recent past we even had an intelligent and competent President, named Obama, who may have at least intellectually entertained that action a couple times.

I may be stealing some words here written by others with an annoying ability to sound much more intelligent than myself [ cough cough ] Fred Bergsten [ cough cough face turning red ] and Joseph Gagnon [ cough cough, mutters F-bomb vulgarities, “damnded collegemuhejumuhcated schmucks!!!!” ] :

“But there is nothing wrong with intervention per se. The problem is with intervention that impedes needed adjustment. The goal of countervailing currency intervention would be to promote needed adjustment, by providing a much more muscular deterrent to that particular form of intervention—one that ideally would not have to be used much if at all. Theory posits that the harm from foreign official distortion of exchange rates is optimally rectified by intervention in the opposite direction. Committed supporters of markets and opponents of government intervention should thus be the strongest proponents of countervailing currency intervention.”

Your first sentence is spot on but your 2nd one is something I must object to:

“Obviously Menzie is against the 27% number, as it is both arbitrary and ABSURD”.

If you look at the nominal exchange rate series in this paper I can see how you would think this. But twice I have provided a link (FRED) to the real exchange rate. Menzie should have noted this but no bad as I decided to do so. Take a look at the appropriate real series and you might get what he is not being arbitrary and absurd.

OK my apologies for not reading the rest of your comment. I will do so now.

Reading their paper was painful. They seem to lament the switch to a floating rate exchange rate in 1973. Their cherry picked economic history makes it out that every event out there was some grand conspiracy to make the dollar stronger. Now I linked to the real exchange rate for a reason but note that they did:

‘Figure A shows that an index of the US dollar’s foreign exchange value has risen from about 32 in 1973 to 128 at the end of 2018, despite persistent US current account deficits totaling several trillion dollars over that time period.’

Nominal exchange rates over a 45 year period even those US inflation was likely less than the average inflation rate than our trading partners? And these two authors call themselves economists? PLEASE!

Catch this BS:

“2. The rate of real gross domestic product growth is 1.2 percentage points higher than baseline growth resulting in an economy nearly $1 trillion (or 4.8%) larger

than it would otherwise be in 2024. 3. Job creation accelerates dramatically, resulting in up to 6.7 million additional jobs in 2024 over the baseline case”.

Oh yea – if we had a yuuuge increase in net exports with no downward adjustment of domestic demand, then maybe their arithmetic works out. But wait – we are near full employment right now so what is going to magically increase potential output this rapidly. Even Gerald Friedman’s paper from 3 years ago was not this incredibly stupid.

The E.U. economy will continue to slow or drag down the U.S. and global economies (Italy fell into recession):

“The EU’s executive Commission cut the forecast for this year to 1.3 percent from 1.9 percent in their earlier forecast issued in the autumn. The eurozone probably grew 1.9 percent last year, slowing from a 10-year high of 2.4 percent in 2017…Germany, Italy and the Netherlands all saw sizeable downgrades for their growth outlook.”

And, of course, China’s huge negative externalities, massive inefficiencies, excessive debt, etc. or “growth-at-any-cost” can’t go on forever.

More irrelevant rants from our Russian bot. I guess Peaky got lost and has no idea what Menzie’s last post was even about. Your irrelevant rants are very similar to Trump’s incoherent babbling yesterday.

Many E.U. governments provide generous benefits for those wanting to work less or unwilling to work.

And, the cost of doing business is high, e.g high taxes, excessive regulations, and high minimum wages.

Smaller, and limited, governments are needed.

And, China exploits labor and the environment, along with the vast majority of its people.

More gibberish which does not have a single thing with the current post. C’mon Peaky – your mom has been embarrassed enough already!

Pgl, you’re showing you have no clue what causes trade imbalances.

And, don’t even understand productivity can raise output.

Real economics is not one of your strengths.

You don’t even understand what you write!

Like you understand international economics? Hey Peaky – I would ask you to grow up but that is a bar too far.

“Real economics is not one of your strengths.”

Do you even know what “real” v. nominal means? I just gave a very partial respond to something Moses wrote. Moses at least is engaged in the actual discussion so let’s give him a lot of credit for something you never did. He also challenged our host for saying 27% overvalued being beyond the pale which anyone looking at nominal changes might think is arbitrary and absurd. Moses would be right in his criticism until one looks at the REAL exchange rate series I provided not once but twice already.

But does PeakStupidity get this important and basic point? Of course not because as usual you have no clue what this discussion is about. No clue at all!

Pgl, don’t be so ignorant.

The adjustments I stated will adjust other variables to narrow the trade balance.

There’s a shortage of demand in the E.U. and a surplus of supply in China.

“PeakTrader

February 17, 2019 at 4:07 pm

Pgl, don’t be so ignorant.

The adjustments I stated will adjust other variables to narrow the trade balance.

There’s a shortage of demand in the E.U. and a surplus of supply in China.”

Give PeakStupidity the Nobel Prize as he has solved the trade balance problem. Well maybe not because his proposed adjustments would likely lead to an even strong dollar. Robert Mundell explained it all over 50 years ago. But of course PeakStupidity has no clue who we are talking about. So Peaky just babbles on his usual incoherence!

“The adjustments I stated will adjust other variables to narrow the trade balance.”

just for clarification, peak, are you arguing that we need a trade balance of zero? an imbalance is bad?

Goofball inflation report 2-17-19. Could get “bang” energy drink for $1.47 about a month ago, now had to switch back to “Monster” energy drink at $1.54 per can because they raised price on “bang” to $1.68. These are tough times kids. Moses will press on, Ever onward…….. The bastaaaaawwwwwwds!!!!!!!!

Let’s piece together a few things that exposes how stupid their paper is:

“The United States has recorded trade deficits in every year since 1976, a run of 43 consecutive years of deficit unprecedented for any nation in history. Between 1945 and 1975, US international trade was generally in surplus, due to our competitive advantage over other industrial powers. In the 1970s, the US trade balance deteriorated as imports grew faster than exports, for a variety of reasons. At the same time, the abandonment of the Bretton Woods fixed exchange rate system in 1973 led to rapid growth in international capital flows. Freely floating exchange rates for the world’s major currencies created a need for central banks, corporations, and investors to hold assets in several of the world’s major currencies, especially the dollar. At the same time, deregulation of international financial markets increased the opportunities for investors to profit by investing in financial assets denominated in currencies other than their home currency. Demand for the US dollar drove the foreign exchange value of the dollar—its “price” in other currencies—to new highs.”

Are these clowns arguing Nixon taking us off of fixed exchange rates led to an undervalued exchange rates? Let’s take a look at the real exchange rate over time:

https://fred.stlouisfed.org/series/TWEXBPA

From 1973 to 1978, the real exchange rate devalued by 25%. Nixon realized that our high inflation during the start of the Great Inflation had led to a real appreciation of our currency creating current account deficits. The authors note that we avoided current account deficits but fail to note it was the Nixon shock and its resulting real devaluation that gave us our most recent trade surpluses. Yes by the late 1970’s, our high inflation led to trade deficits but this would have been much worse under fixed exchange rates. How could any economist miss this reality? Oh wait:

“Figure A shows that an index of the US dollar’s foreign exchange value has risen from about 32 in 1973 to 128 at the end of 2018”

That’s right – these clowns looked at a nominal exchange rate index over a 45 year period which gives a very different picture than looking at a proper real exchange rate index. This error alone would get them an F in any course in economics. Are they trying to spin things or are they really this incredibly stupid?

Trump sends Stephen Miller to defend his “National Emergency” on the Sunday news shows:

https://talkingpointsmemo.com/news/miller-cant-name-example-of-emergency-declaration-for-funds-congress-rejected

“White House adviser Stephen Miller on Sunday couldn’t name another instance of the President declaring a state of emergency in order to secure funds Congress had rejected during the appropriations process.”

Miller utterly embarrassed himself even on Fox News. OK – Chris Wallace actually tries to be a real reporter. Go figure! I guess Miller was underserved by those “many stats” Trump talked about on Friday. But that’s what one gets when one relies on CoRev for statistics and PeakTrader for one’s “analysis”.

there is absolutely no substitute for a complete lack of preparation.

Off-topic

Thought this was pretty good and Menzie and some of the regular visitors here might enjoy it. I’d like to see the ICE cages, because I think some abuses are happening there we have no idea about. Some towards women and children.

https://www.youtube.com/watch?v=gBvxN1dP-bg

One of the BEST journalists on planet Earth posted this story today in her Twitter thread.

https://www.washingtonpost.com/business/economy/build-the-wall-it-could-take-at-least-10-years-even-with-10000-workers/2019/01/09/62d5eaae-1376-11e9-803c-4ef28312c8b9_story.html

You know how to find stories like the one linked just above??? Just follow this sharp and hardworking lady on Twitter. Like, do yourself a favor, and do it NOW

https://twitter.com/ZivaBranstetter

You hate donald trump?? Then follow Ziva Branstetter, because it’s walking on Earth angels like her who are going to bring this bastard trump down.

Let’s a take a look at the current account over time:

https://fred.stlouisfed.org/series/NETFI

This paper states:

“The United States has recorded trade deficits in every year since 1976, a run of 43 consecutive years of deficit unprecedented for any nation in history.”

Well they are sort of ignoring 1991 but let the spin continue:

“In the 1970s, the US trade balance deteriorated as imports grew faster than exports, for a variety of reasons. At the same time, the abandonment of the Bretton Woods fixed exchange rate system in 1973 led to rapid growth in international capital flows. Freely floating exchange rates for the world’s major currencies created a need for central banks, corporations, and investors to hold assets in several of the world’s major currencies, especially the dollar. At the same time, deregulation of international financial markets increased the opportunities for investors to profit by investing in financial assets denominated in currencies other than their home currency. Demand for the US dollar drove the foreign exchange value of the dollar—its “price” in other currencies—to new highs”

The authors are abusing the broad nominal exchange rate, which I have noted a few times is misleading. The real exchange rate broad index paints a very different picture about our exchange rate over the past 45 years. As I also noted earlier, the authors blame the current account deficits over time on the decision to shift from fixed exchange rates to floating rates. But this makes no sense since Nixon decided to abandon Bretton Woods in 1973 precisely to allow for a real devaluation. And notice we did not see large persistent current account deficits until the 1980’s. Let’s see – what happened then? Oh yea that Reagan massive fiscal stimulus accompanied by dramatic increase in real interest rates. The Mundell-Flemming model would have suggested a massive real appreciation of the currency, which exactly what we got. And per our FRED chart, it was then we turned to large current account deficits. Of course this really dumb paper fails to mention this reality.

pgl,

While the US ran a current account surplus in 1991 it ran a trade deficit that year to the tune of $-66 billion. The current account also includes services, which the US generally runs a surplus in. The last year the US ran a trade surplus was indeed 1975.

Barkley – thanks for the information. Now one should always ask what is the appropriate metric. If a nation is running a services surplus – then even under the weird doctrine of neither be a lender nor borrowing be (to paraphrase Menzie) I would think an equal and offsetting good deficit is appropriate.

Of course my main problem with this paper is how they cherry picked all sorts of things. Including the dancing around whether we are talking about the current account versus the merchandise trade balance.

Checking with FRED and the current version of http://www.bea.gov – detail information from what I have seen dates back to 1992 (not 1991). We know, however, that the current account surplus for 1991 for just shy of $8 billion. The current account actually includes 3 things:

(1) Trade balance in goods which was negative in 1991

(2) Trade balance in services which was positive in 1991 as you note

(3) net income from abroad which is generally positive as well

Alas I do not have at my fingertips the 1991 data for all 3. But I still contend omitting both (2) and (3) is either dumb or cherry picking.

pgl,

One other item making 1991 different from most years is that this was the end of the First Gulf War. Unlike the fantasies of the Bush Jr. crowwd about what would follow the US invading Iraq and overhtrowing Saddam Hussein, in fact the Kuwaiti government was both grateful for the US-led intevention that pushed Saddam’s forces out of their nation and they were well off and had the ability to pay money to cover at least part of the esxepenses for this intervention. Those payments happened in 1991 after the war ended. I am not exactly sure where they showed up in the US blanace of payments accounts, but it s quite likely that they showed up as either services or more likely income from abroadde, thus increasing by quite a few billions of dollare the non-trade surplus part of the current account for that year.

The US also received “in kind” consideration from other NATO allies that would not or could not actively fight in the Gulf War. For example, Germany donated its nuclear/biological/chemical “sniffer” vehicle to the US Army and Marines as part of Germany’s financial obligations to offset the cost of the war.

https://www.army-technology.com/projects/m93a1-m93a1p1-fox-nbc-reconnaissance-vehicle/

You are right about this. The other thing about this time period was the Bush41 recession which assuredly lowered imports.

Taking a longer view – the Reagan tax cuts a decade earlier cut the national savings rate in half. National savings has never materially recovered albeit we did get a bit of an increase during the Clinton years. But we also had that Silicon Valley investment boom. With investment exceeding national savings even at full employment, we are destined to have current account deficits.

Funny the authors of this report failed to even remotely grasp this basic concept.

In an open economy with a current account deficit the equilibrium or market clearing interest rate is the one that attracts sufficient foreign capital to finance the deficit with a stable currency. If the currency is rising interest rates are too high. If the currency is falling then rates are too low. Of course, there is always the possibility that a higher ( lower ) currency is the desired outcome.

Granted. Simply put – the exchange rate under a floating exchange rate regime is like any other price. It adjusts such that the current account balance the difference between a nation’s savings and its investment. No where is this report did either of these two “economists” remotely grasp even the basic issues.

Actually, the secret that Menzie has not admitted to here is that there is no universally accepted definition of an equilibrium exchange rate. Spencer’s pointing to a rate that is not changing suggests ome possible criterion, but a rate may not be changing due to massive intervention by a central bank or ministry of finance in the markets. There may also be speculative bubbles going on, all sorts of things. There are several widely used definitions in the literature, and they tend not to be too far apart, but differ both on assumptions and models lying behind them.

He is right, though, that having a zero current account balance is not a widely used definition and is only meaningfully an equilibrium condition if a whole lot of other conditions hold.

Equilibrium REERs should TREND with the productivity differentials across countries, as Ragu Rajan has pointed out while he was at RBI. Since our trading partners (e.g. China) have certainly seen massive TFP growth since 1980, the USD reer really should have trended down enormously. There are strong a priori reasons for thinking this is nonstationary.

Let’s explain what REER stands for:

http://datahelp.imf.org/knowledgebase/articles/537472-what-is-real-effective-exchange-rate-reer

“What is real effective exchange rate (REER)? REER is the real effective exchange rate (a measure of the value of a currency against a weighted average of several foreign currencies) divided by a price deflator or index of costs. An increase in REER implies that exports become more expensive and imports become cheaper; therefore, an increase indicates a loss in trade competitiveness.”

I provided a FRED link to such a real measure – noting that the paper misled readers by noting only the nominal index. Once one adjusts for changes in nominal prices over time, our REER has seen periods of both real devaluations and real appreciations. However, your point is very well taken especially in light of the fact that China has seen an tremendous increase in productivity over the past 45 years.

FRED reports REER for China:

https://fred.stlouisfed.org/series/RBCNBIS

formereconomist: There are many definitions of equilibrium exchange rates; a short review is here. My presentation to the US Treasury on the subject, here.

“Relative PPP can be expressed as:

s = μ + p – p*

where lowercase letters denote log values, s is the price of foreign currency, p is the price index, and * denotes a foreign variable, and μ is a constant arising from the fact that p and p* are indices.”

It is interesting that the paper we have criticized defined this as s = μ thereby ignoring inflation differentials over a 45-year period. No competent economist would do that but they did.

Slide 15 got my attention:

“Combination of Balassa-Samuelson, real interest differential (UIP with sticky prices), nontradables, and portfolio balance motivations (see Cheung, et al. (2005))”

Well – the heading BEER is what got my attention. Maybe I’ll get a beer and read this 2005 paper!

Thanks for the link on the various definitions, Menzie. It is also my understanding that there seems to be some tendency to moving towards an aveerage of these measurements. as a widely found empirical result.

Dear Menzie,

Admittedly, I am a bit of a dope, unlike the majority of your respondents. But suppose you did have neither a trade surplus nor a trade deficit. Exactly what is a zero trade balance supposed to do for you?

Julian

Julian Silk: As most trade models assume balanced trade, a zero trade balance would allow one to reap benefits of comparative advantage. But a zero current account balance (which equals the trade balance if net factor income and remittances are zero) implies *no* intertemporal trade. I.e., countries could not borrow, nor save.

Dear Menzie,

Thank you for this. But I am still a bit confused. Supposedly all trade, that is completely voluntary and well-informed on both sides, allows the partners to gain benefits of comparative advantage. I appreciate the point about not borrowing and saving, which is part of this. So suppose a zero trade balance maximizes comparative advantage gains for both countries. Doesn’t this have to be weighed against the costs it imposes, not just the unemployed workers and the like, but the failure to invest? The assumption that laissez-faire maximizes investment, because all these entrepreneurs, finally free of government interference, go out an invest brilliantly, seems to be a part of this assumption. Even if you don’t get loans and the like from abroad, if you can get government to invest with a nonzero trade balance, because the government isn’t terrified, while the private investors are, can’t this override the problems of not having maximized comparative advantage? It’s what you do with the gains, and not just the gains themselves, which would seem to matter to me.

Julian