That title from an article in FoxBusiness.

“With that kind of income growth there’s going to be consumption growth, there’s going to be GDP growth, we’ve got all this capital spending—it’s just impossible,” he said.

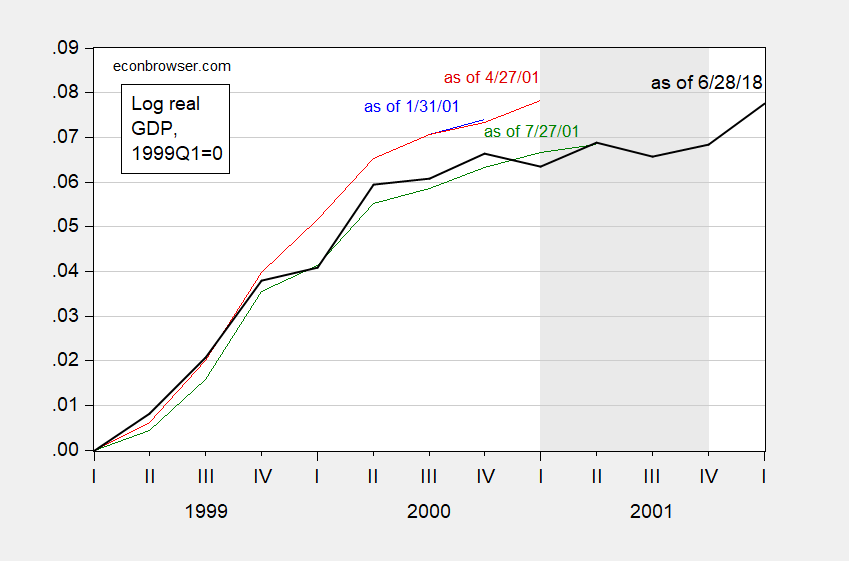

My view (from my experience being on CEA staff in March 2001, when that recession began): beware data revisions. Figure 1 below shows how the data available in April 2001 differed from that reported many years later.

Figure 1: Real GDP normalized to 1999Q1 as of 1/31/2001 (blue), as of 4/27/2001 (red), as of 7/27/2001 (green), as of 6/28/2018 (black). NBER defined recession dates shaded gray. Source: ALFRED, BEA, NBER, and author’s calculations.

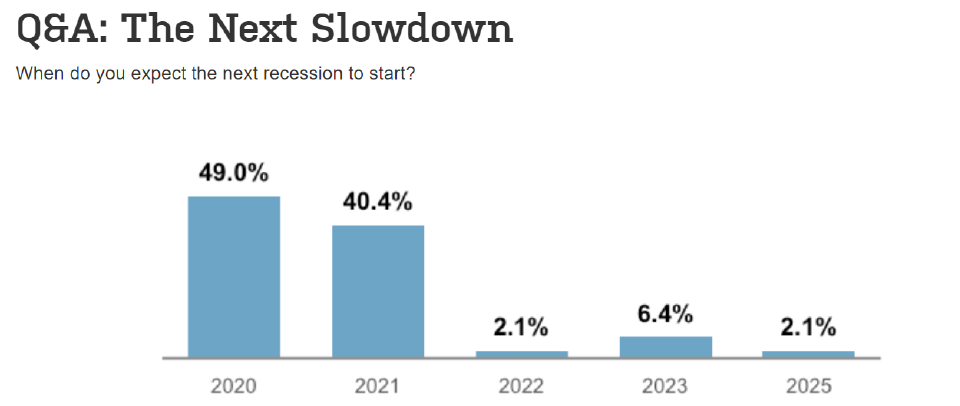

Secondly, just as in the case of CEA Chair Ed Lazear, I think there is some potential for someone to be surprised. Private macroeconomists have a different take.

Source: WSJ April 2019 survey.

I believe my poor man’s Alan Blinder (I wish) forecast was ANYTIME July 1 2019 to July 31, 2020. I may be fudging a month there, but that is how I was honestly think of it in my mind. If you wanna get nit picky I’m adding an extra month there for a 13 month window. A large segment of that is just gut feeling. But I’m sticking to my guns. Some of that (maybe like 40%) is based on some hard numbers. I’m not falsely claiming I’m running “a model” or anything. Just a few big numbers and my gut mixed in.

All apologies to Alan Blinder for tarnishing his good name in my blathering.

There’s a shout out to Ted “I Love Cory Chase” Cruz on page 40 of the Mueller Report. Just keeping you peeps up-to-date on the crucial stuff here. Just the FACTS

https://www.youtube.com/watch?v=gxhuUdZzGYw

Job growth accelerated under Trump indicating a way to go before reaching full employment:

“…job growth has averaged 180,000 thus far in 2019 (through March) compared to 223,000 in 2018.”

https://www.bls.gov/web/empsit/ceshighlights.pdf

Current expansion will be the longest in U.S. history at 121 months in June.

GDPNOW is 2.8% in the historically slow first quarter.

We may have a soft-landing and then growth re-accelerates. I heard, the Fed allowing $50 billion of bonds to mature each month without replacing them on its balance sheet is equal to about a 50 basis points increase in the Fed Funds Rate each year. So, the Fed may have to slow or stop the bond run-off.

Next Friday, the first estimate of Q1 GDP will be reported.

The consensus forecast is 1.5%.

I wonder how many of those economists believe we’re beyond full employment or close to “overheating.”

PeakTrader: And the FRB NY Nowcast is 1.4% (as of 4/19).

And what did you and Professor Hamilton say was the best way??—take the GDPnow forecasts (and or others) and average them out for your best call?? Of course that seems quite reasonable—but just between these two alone NYFRB seems to get it more right (for the last 5 quarters or so anyway). Of course as I have said to the point of being a broken record, the Atlanta FRB website is MUCH more user friendly. And another thing I have been broken record on—if real GDP (yes your BEA number) is consistently below 1.5% (like 2 consecutive quarters) I believe that has the best chance of cooking trump’s goose as anything does.

I mean “going into” November 2020, whichever the last two publicly announced BEA quarter numbers would be

“Current expansion will be the longest in U.S. history at 121 months in June.”

Well yea – the Obama recovery was a lot longer than the recovery that started in 1983. Then again there some idiot running around here that told us we had a 1983 to 2007 recovery (ignoring the Bush41 and first Bush43 recessions). Who was that idiot? Oh yea, that would be YOU!

Job growth since Trump took office has averaged 191,000 monthly.

This compares to monthly job growth of 204,000 from 2012 to 2016– the last 4 years under Obama.

Yes, job growth was way too slow under Obama.

Only 78,000 jobs per month were created in the 10 years 2008-16.

We needed 100,000 to 160,000 jobs per month in that 10-year period, because of the huge job losses in the recession.

That is, job growth should’ve been much stronger after the recession, particularly given the monetary and fiscal boosts.

“Yes, job growth was way too slow under Obama.

Only 78,000 jobs per month were created in the 10 years 2008-16.”

Dude – Bush was President in 2008 and there were massive job losses. An honest approach would use the period from 2010 to 2016. But you do not do honest. As usual you lie. And you are dumber enough to think we do not see through your lies.

BTW – 2008 to 2016 is 9 years not 10 years. I know, I know – you flunked preK arithmetic!

Right, 2008-17, only 78,000 jobs per month created.

What’s dishonest is not including the job losses in the jobs recovery.

“PeakTrader

April 22, 2019 at 11:50 am

Right, 2008-17, only 78,000 jobs per month created.

What’s dishonest is not including the job losses in the jobs recovery.”

Seriously Peaky? Do you really want us to believe Obama was President in 2008? You truly are an IDIOT!

Here is what he wrote:

“This compares to monthly job growth of 204,000 from 2012 to 2016– the last 4 years under Obama.”

Not 78K Moron. 204K! Then again Spencer knows labor market data and is an honest person. Two traits you lack!

Some parts of this are kind of funny. For example the blacked out (redacted) portions at the top of page 44. There’s nearly no one else it could possibly be discussing other than Roger Stone. The only other person it could conceivably be, is that fat porker who can never move his lips without lying. jerome Corsi. But, if I understand correctly, Corsi’s connection was through Wikileaks or Assange and it was not Guccifer 2.0.

Now, I know one of our know-it-alls here might chime in “well legally they have to do that” and I get it. Still, you have to admit it’s humorous when we can 98% bet it is Roger Stone being discussed here.

PeakTrader Before you get too excited about those employment numbers, you might want to read this:

http://antoniofatas.blogspot.com/2019/03/the-2020-us-recession_12.html

The pattern of US unemployment recessions suggests that low levels of unemployment are a strong predictor of sudden increases in unemployment, associated to crises. We do not observe in the data any sustained periods of low unemployment.

Sometimes PT is a cute little trump fanboy isn’t he?? Don’t you just wanna squeeze his dimples sometimes?? NO late night Cinemax or that crazy rap with the adult advisories, he’s not ready yet. PTA is Tuesday.

A couple short interesting papers , ” Predicting the Yield Curve Inversions that Predict Recessions: Part 1 & Part 2″ on the St. Louis Fed website relate housing permits and starts as predictors of interest rate inversions. In addition to the statistics provided by the authors, take a look at the year over year percent change in FRED data series, PERMIT and HOUST. The year over year percent change looks rather worrisome as related to prior recession starting dates. Maybe Professor Chinn could provide some expert opinion.

Links for the St. Louis Fed articles:

https://research.stlouisfed.org/publications/economic-synopses/2019/04/12/predicting-the-yield-curve-inversions-that-predict-recessions-part-1

https://research.stlouisfed.org/publications/economic-synopses/2019/04/15/predicting-the-yield-curve-inversions-that-predict-recessions-part-2

The lesson here seems to be that Housing permits could be used in conjunction with a yield curve to predict recessions?? Not certain I agree, but the STLFRB dudes writing the essay make a solid argument and present it well with the graphs.

I still believe credit markets sometimes aren’t getting the attention they deserve, either in general or in that essay. Credit markets also includes the “shadow” markets outside of the traditional bank sector, one of the very very few things I don’t recall Menzie discussing on this blog, that I feel Menzie is highly capable of discussing and would make a great blog post topic.

But I suppose you could argue there is credit market information carried inside of that yield curve and that there is mortgage loan market data in the housing permits data, and therefor they/you are still including credit markets in these two recession foresight barometers.

I suspect Hassett has consulted with Kudlow’s forecasting model which we all know has an amazing track record – right? Track record for always being wrong of course!

Of course if there is an absolute certainty that consumption and investment will keep booming – then why all the Trump tirades about interest rates being too high?

I doubt Hassett consults or queries Kudlow about anything, other than which coronary doctors have managed to keep him going all this time.

You buried the lead!

“Two-thirds of U.S. CFO’s expect a recession by summer of next year, but White House Council of Economic Advisers Chair Kevin Hassett believes the economy shows no signs of slowing down.”

Hassett really shuffled on that question about Trump pressuring the FED!

I had to do it – listen onto their discussion of USMCA. So much dishonesty – so little time. Hassett made Barr look honest by comparison.

RUDY G. goes on the TV to excuse Trump by declaring there is nothing wrong with treason!

https://talkingpointsmemo.com/news/nothing-wrong-with-taking-information-from-russians-giuliani-spins-mueller-report?fbclid=IwAR1X0Nn9I1gEh1i53ATxYv5ZSJK4oqU7lV_XPZBDKciyUQO993W0wsKLmGM

pgl,

treason you say!

There is everything wrong with the popular definition of “treason” which seems to be: “not hard enough on Russia” for liberal democrats, the neocon war mongers both guided by neo Nazi ultra nationalists in places like Ukraine and Hungary..

As to Barr, and Mueller: what do you call conclusions drawn with out indictments or evidence?: immoral and wrong.

The only traitors I see are guilty of using the FBI to plumber the Trump campaign to shove Clinton on US.

Uh ILSM – you protest too much. I hear the Southern District of New York is about to indict you for treason! Get a good lawyer who is willing to represent Russian trolls!

Did Hassett lie about what the International Trade Commission report said. My latest blog suggests so:

https://econospeak.blogspot.com/2019/04/usmca-international-trade-commission.html

But yea – I need to read this report for myself. That interview with Stuart Varney was pathetic even by Fox Business News standards.

OK – now that I found the ITC report, I have updated my Econospeak post. Hassett put forth the long-term effects as if they would occur in the first year. Kevin Hassett is a liar!

I have spent a lot of time questioning people’s [who were doing jobs for my programs ]budget and schedules and how they will deliver a product……..

I often heard “you can not lie with an estimate” which I kept quiet not needing to get chewed out again! for not being a “team player”.

The estimates do not lie! No, no, the assumptions and ground rules might be “skewed” but is it lying?

Why don’t you be a “team player”?

Oh Lord – I always thought you did not know how to read the English language. This stupid and off point comment proves out what I thought. Try following the argument goof ball. He LIED about what the ITC wrote. Got it – moron?!

Possible: Dow hitting 36,000.

He will never live that down.

Well – it has managed to pass 26,000. Of course he said it would hit 36,000 about a generation ago!

https://finance.yahoo.com/quote/%5EDJI/chart/#eyJpbnRlcnZhbCI6ImRheSIsInBlcmlvZGljaXR5IjoxLCJjYW5kbGVXaWR0aCI6Ny44NDU1Mjg0NTUyODQ1NTMsInZvbHVtZVVuZGVybGF5Ijp0cnVlLCJhZGoiOnRydWUsImNyb3NzaGFpciI6dHJ1ZSwiY2hhcnRUeXBlIjoibGluZSIsImV4dGVuZGVkIjpmYWxzZSwibWFya2V0U2Vzc2lvbnMiOnt9LCJhZ2dyZWdhdGlvblR5cGUiOiJvaGxjIiwiY2hhcnRTY2FsZSI6ImxpbmVhciIsInBhbmVscyI6eyJjaGFydCI6eyJwZXJjZW50IjoxLCJkaXNwbGF5IjoiXkRKSSIsImNoYXJ0TmFtZSI6ImNoYXJ0IiwidG9wIjowfX0sInNldFNwYW4iOnsibXVsdGlwbGllciI6NiwiYmFzZSI6Im1vbnRoIiwicGVyaW9kaWNpdHkiOnsicGVyaW9kIjoxLCJpbnRlcnZhbCI6ImRheSJ9fSwibGluZVdpZHRoIjoyLCJzdHJpcGVkQmFja2dyb3VkIjp0cnVlLCJldmVudHMiOnRydWUsImNvbG9yIjoiIzAwODFmMiIsInN5bWJvbHMiOlt7InN5bWJvbCI6Il5ESkkiLCJzeW1ib2xPYmplY3QiOnsic3ltYm9sIjoiXkRKSSJ9LCJwZXJpb2RpY2l0eSI6MSwiaW50ZXJ2YWwiOiJkYXkiLCJzZXRTcGFuIjp7Im11bHRpcGxpZXIiOjYsImJhc2UiOiJtb250aCIsInBlcmlvZGljaXR5Ijp7InBlcmlvZCI6MSwiaW50ZXJ2YWwiOiJkYXkifX19XSwiY3VzdG9tUmFuZ2UiOm51bGwsImV2ZW50TWFwIjp7ImNvcnBvcmF0ZSI6e30sInNpZ0RldiI6e319LCJzdHVkaWVzIjp7InZvbCB1bmRyIjp7InR5cGUiOiJ2b2wgdW5kciIsImlucHV0cyI6eyJpZCI6InZvbCB1bmRyIiwiZGlzcGxheSI6InZvbCB1bmRyIn0sIm91dHB1dHMiOnsiVXAgVm9sdW1lIjoiIzAwYjA2MSIsIkRvd24gVm9sdW1lIjoiI0ZGMzMzQSJ9LCJwYW5lbCI6ImNoYXJ0IiwicGFyYW1ldGVycyI6eyJoZWlnaHRQZXJjZW50YWdlIjowLjI1LCJ3aWR0aEZhY3RvciI6MC40NSwiY2hhcnROYW1lIjoiY2hhcnQifX19fQ%3D%3D

I have carefully avoided making any predictions about when the next recession will arrive and do not know whey it will.

That said, Hasssett’s claim that it is “impossible” for a recession to arrive by next summer is simply ridiculous, as ridiculous as his still unfulfilled forecast from two decades ago that the Dow would hit 36,000 in the near future. Still yet to happen.

Of course if no recession arrives by next summer, which certainly has a non-trivial probability, he will claim he was right. But it will not support his claim that it was “imposslble.” Heck, a lot can happen in the coming year that cannot now be foresen.

You know some commenter was getting upset about the discussion of college degrees in a different thread than this one (related to signatures supporting Stephen Moore). Obviously Menzie wasn’t making value judgements about people or saying that there aren’t exceptions to that rule (very sharp people sans uni degree), but rather making a in general or broad point about people’s credentials and why they might be more apt to sign their name to such a “petition”.

This has been a sensitive topic for me (especially in my younger years) as my father hardly went a day of his life (or seemingly to me a single hour) berating someone he personally knew or some celebrity saying “He doesn’t even have his college degree” or “He never bothered to get his college degree” in tones that made you think whoever he was discussing had made a pact with Satan for the soon to be unleashed apocalypse. And my father also made it clear (without necessarily saying it in a direct way verbally, but little intimations or facial expressions) that I had fallen short as a human being for not at least getting a Master’s.

Why am I blathering on about this?? Well—for these reasons it is something I find myself (nearly involuntarily) obsessing over. So I’m reading about Jerome Corsi in the Mueller Report (who I LOATH as a “human being”). He is the slimeball of slimeballs SOB, a weasel, and I wanna take an hour long scolding hot shower whenever I see the bastard on TV or listen to him. You know that man who can’t open his mouth without a lie jumping out has his doctorate in political science!?!?!?!?!? I haven’t been that shocked about someone’s educational background since “Princeton”Kopits told us he has his bachelor’s degree.

Looking at

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.1. Percent Change From Preceding Period in Real Gross Domestic Product

One thing jumps off the page. Federal nondefense purchases showed a rather large decrease in 2018QIV.

Anyone know which budgets this White House decided to receive a massive reduction? FEMA relief? Infrastructure? Programs that provide for the truly needy?

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

Shows real Federal nondefense purchases fell by $7.6 billion. It also shows that real state/local purchases by $6.5 billion.

Odd – Hassett never mentioned that. I would presume he is working with a sensible macroeconomic model where austerity reduces aggregate demand. Or maybe not if he is looking towards Kudlow for his macroeconomics!

There are many important lessons to be drawn out of reading all of the Mueller Report. And by reading I mean reading, as in, taking in and comprehending what you are reading, instead of buzzing through it by Friday night so you can tell everyone you already read it (which many douchebags, female or otherwise do).

If you look at the bottom 2/3 of page 61 there is an important lesson, especially for the more youthful among us, that is “Never attempt to con a con-man”

Dear Folks,

This is the first time I am really worried about a recession in 2020. Hassett more or less guarantees it, doesn’t he?

J.

I fully expect a slowdown, if not a full blown technical recession in 2020. It may be earlier, it may be later, but it is going to happen. It’s just the business cycle, which has not been repealed. Construction will slow, as will everything else as demand gets sated and supply overshoots. Nothing new here.

Middle of page 72 of the Mueller Report

“However, Cohen recalled conversations with Trump in which the candidate suggested that his campaign would be a significant ‘infomercial’ for Trump-branded properties”

Putin stooge donald trump sure does have a lot of respect for the electoral process doesn’t he?? We are fortunate enough to have inherited that electoral process from men who gave their lives in wartime. The orange colored mammal referred to as “captain bonespurs” views his run for the Presidency as an “infomercial”.

https://www.youtube.com/watch?v=BPIROCHgE-o

https://www.youtube.com/watch?v=uo60wYali-E

Dumb son of a b*tch looks more like he’s got indigestion from McDonald’s fries than any respect for the generations that died for his freedom. This is the same guy who wants to scapegoat blacks because they are sick and tired of eating shit from local cops. Those blacks were intelligent enough to notice that no one gave a tinker’s damn when black people were killed by cops—so they wisely thought of something that WOULD get attention. This orange colored walking blasphemy to humanity looks like he’s about to upchuck during the USA anthem, and he’s angry at NFL players!?!?!?!?