CEA Chair Kevin Hassett has stated a recession by next summer is impossible. I’m wary of such definitive statements.

From a May 2008 WSJ article:

“The data are pretty clear that we are not in a recession,” Council of Economic Advisers Chairman Edward Lazear told a meeting of editors and reporters from the Wall Street Journal and Dow Jones Newswires.

…

“I would be very surprised if the NBER, looking back at this period, would date this as a recession,” Mr. Lazear said. There are even indications that revised first-quarter estimates would be slightly stronger than 0.6%. “The optimists seem to have been closer to right on that than the pessimists,” he said.

From a September 2008 article by Donald Luskin of Trend Macrolytics (and a supporter of Stephen Moore’s candidacy for Fed Governor):

Things today just aren’t that bad. Sure, there are trouble spots in the economy, as the government takeover of mortgage giants Fannie Mae and Freddie Mac, and jitters about Wall Street firm Lehman Brothers, amply demonstrate. And unemployment figures are up a bit, too. None of this, however, is cause for depression — or exaggerated Depression comparisons.

Overall, the pessimists are up against an insurmountable reality: In the last reported quarter, the U.S. economy grew at an annual rate of 3.3 percent, adjusted for inflation. That’s virtually the same as the 3.4 percent average growth rate since — yes — the Great Depression.

For the record, NBER dates the beginning of the recession at December 20172007, five months before CEA Chair Lazear’s statement, nine months before Don Luskin’s admonition.

The Yield Curve — Prescient or Not?

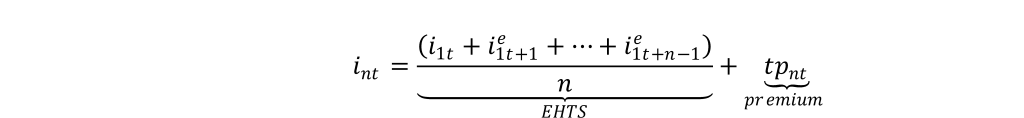

A conventional 10yr-3mo term spread model implies about 31% probability of recession in a year (Lenoel/NIESR). What about statements like, “this time is different” for the yield curve…? I have more sympathy for this view, although I’m still worried. One of the reasons that is offered for putting less weight is the argument that yield curve is less informative due to quantitative easing. To see this argument, consider the following expression for the long yield:

The long yield is the sum of two components: (i) EHTS, expectations hypothesis of the term structure, and (ii) tp, the term premium (Benzoni et al. (2018) further decompose the term premium.) The first component is the relevant one for predicting the business cycle. A long rate is the average of the expected short rates, so a EHTS component lower than the current rate means expected rates are lower than the current rate. However, the EHTS component is unobservable, so this is not a directly testable proposition. However, an average positive term premium is consistent with on average upward sloping yield curve, which is what is observed. Figure 1 displays the term spread and the EHTS over the past two decades.

Figure 1: 10 year-3 month Treasury spread (dark blue), and 10 year-3 month spread minus Kim-Wright estimate of 10 year term premium (red). NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER and author’s calculations.

Recall, in 2006-07, the “conundrum” — attributed in part to foreign central bank demand for US Treasurys — was tagged as a reason for believing the inversion would not signal a recession, by both Greenspan and Bernanke. Yet, in a sample including the 2007 recession, Chinn and Kucko still found inversions an empirical determinant.

In principle, quantitative easing/credit easing in the form of Fed purchases has the same impact as foreign central bank purchases of Treasurys. Hence, the relevant question is whether the EHTS component is at the same level as that before the last recession. The answer is no. Johanssen (2018) notes that using the adjusted term spread leads to lower estimated probabilities of recession.

In fact, as of December, the EHTS component is 1 percentage point above zero, compared to it breaching 0% in January 2006. An alternative term premium estimate from the NY Fed yields a similar pattern.

Indicator Variables Recorded As of Today

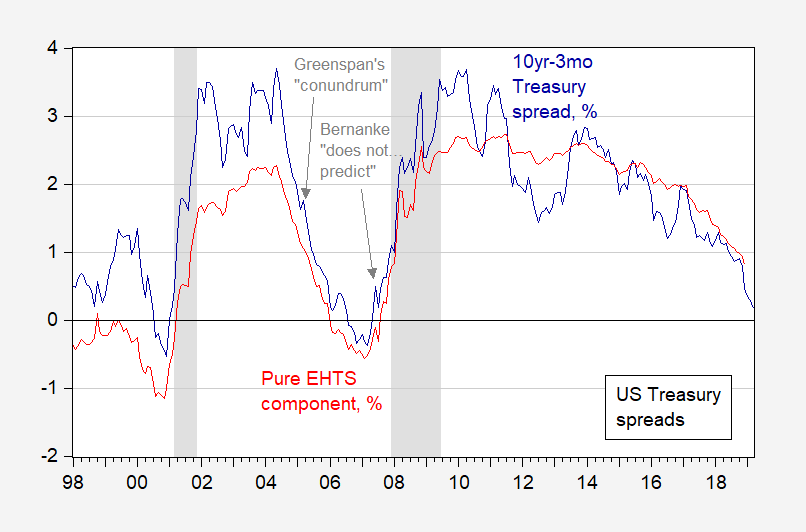

The key indicators that the NBER Business Cycle Dating Committee follows yield a mixed picture.

Figure 2: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2018M12=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers, and author’s calculations.

If one compares this graph to the one I generated at the beginning of the spring semester (1/19), one will see that in that previous graph, all series were strongly rising. No longer true…

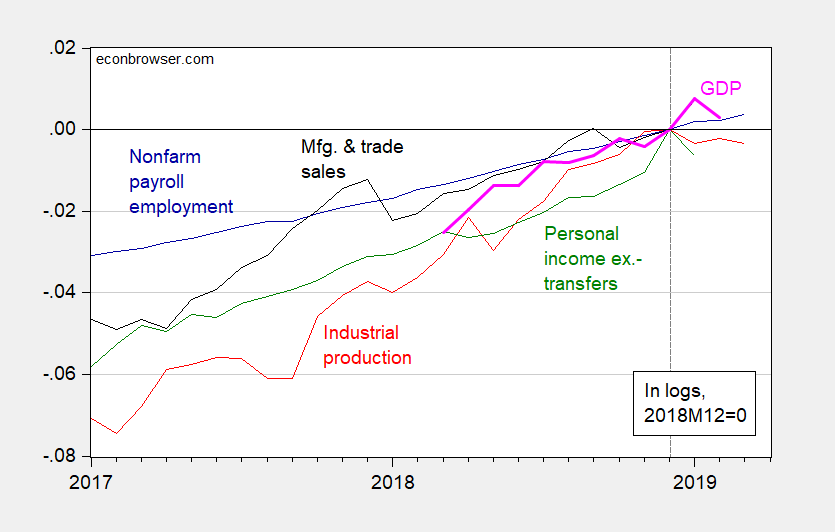

Housing

Housing remains on a positive track, with nominal indices still rising, albeit modestly. In real terms, prices are flat.

Figure 2: Case-Shiller national house price index (teal), and 20 city house price index (red), both deflated using core CPI. NBER defined recession daes shaded gray. Source: Moody’s via FRED, BLS via FRED, NBER, and author’s calculations.

This should put a crimp on consumption, given stabilization in real household wealth.

The Policy Response to Another Recession

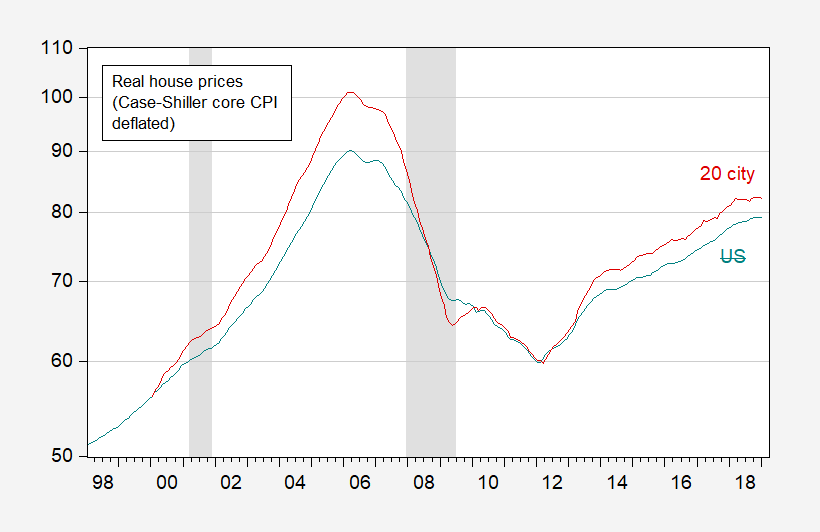

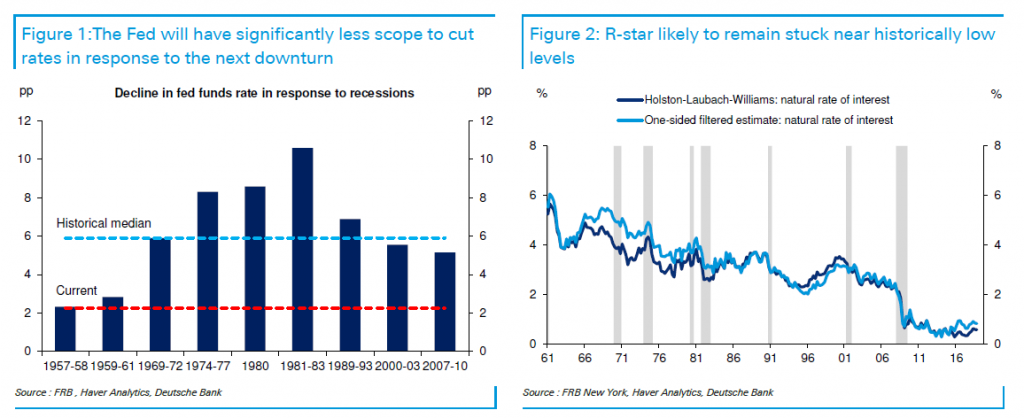

This is what keeps me awake at night. Conservatives used to focus on the fact that the extended period of Fed stimulus meant that the Fed funds rate was low, meaning little room for stimulative rate cuts. This is shown below:

Source: Luzzetti, et al. “US Econ Monthly: Growth risks improve despite market recession fears,” US Economic Perspectives, Deutsche Bank, April 16, 2019.

With the natural rate of interest likely to remain low, it’s likely that monetary authorities will hit the zero lower bound before being able to deliver much stimulus.

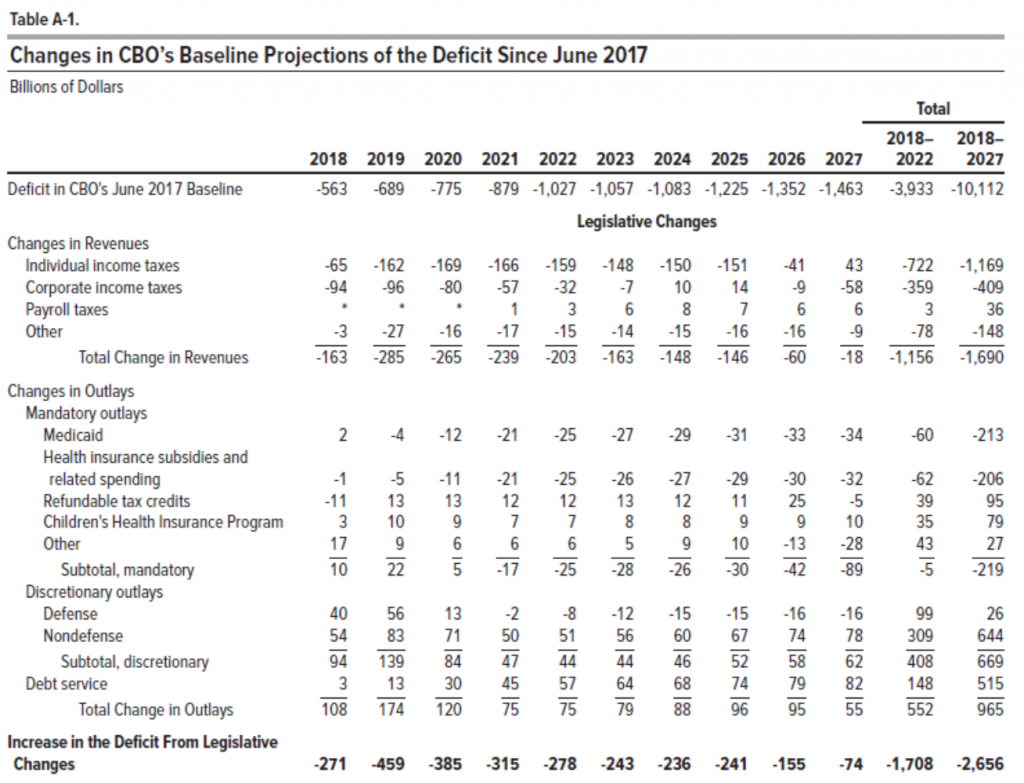

Personally, I worry more about the lack of fiscal space. The Tax Cut and Jobs Act — a paragon of how not to conduct counter-cyclical fiscal policy — combined with the omnibus spending bill blew an enormous hole in the US budget. This is shown in the CBO depiction of the budget outlook for FY 2018, going from June 2017 to April 2018.

Source: CBO, Budget and Economic Outlook, April 2018.

With $1.7 trillion of legislative changes over five year horizon and an estimated $400 billion economic response, the cumulative five year deficit worsens by $1.3 trillion. (The tax cuts alone — dynamically scored — cost $600 billion over five years.)

But Hassett has his ITC paper that predicts a yuuuuge and immediate benefit from USMCA (sung by the Village People)! Oh wait – the report says the long-run (not immediate) effect is a mere 0.35% of GDP. Then again – Hassett works for Trump so his job is to lie about everything!

The current situation is even gloomier if you use total business sales instead of manufacturing and trade sales:

https://fred.stlouisfed.org/graph/?id=TOTBUSSMSA,

But I suspect the downturn is temporary, due to the government shutdown.

Outstanding post.

My father was a man who believed in TRUTH. And generally, he set the example. My father believed in FDR, Carter, Obama, and men who stood for something. The very same men a large contingent of Americans has enjoyed cursing and bad-mouthing for years, and clear up to this very day…..

https://www.youtube.com/watch?v=07m39CQRJXw

My Dad voted for Walter Mondale. My father knew when he voted in 1984 that at least by the next morning that the guy he voted for would have no chance in hell of winning. I would have loved to have voted for Mondale, but I wasn’t an adult yet. Now, I’m old enough I can walk around and pretend i’m 1/4 of the man my Dad was. Of course, we watched the election results come in that night—-stunned. Not that Mondale had lost, my Dad was sharp enough that when he told me Mondale had no chance in hell of winning, I took it to the bank—-but the gap, or more like gargantuan gulf between the states that voted for Mondale and the states that voted for Reagan stunned me, and I think to a degree it stunned my father as well. In a democracy people get what they ask for. If they ask for politicians who LIE to them—that is indeed what they will get.

I often wonder what the more intelligent Chinese (i.e. educated ones that go on for their secondary education at the better Chinese universities) think of us, when they see we have the right to vote, and we throw that great power into the garbage, like a snot filled Kleenex. Or the more intelligent Russians, like a Yeltsin, a Gorbachev, a Mikhail Khodorkovsky, or a Masha Gessen thinks looking at us, observing our elections, when they see large swaths of the American public who just can’t be belabored or burdened enough to read a newspaper semi-regular or read The Mueller Report with their own eyes instead of just listening to the blonde c___ on FOX news?? What must the citizens in countries that have no right to vote think about us?? I am perceptive enough (or presumptuous enough??) to think I know.

“For the record, NBER dates the beginning of the recession at December 2017, five months before CEA Chair Lazear’s statement, nine months before Don Luskin’s admonition.” Typo, obviously Dec. 2007, not Dec. 2017.

John Zak: Thanks! Corrected now.

You might want to correct a typo:

For the record, NBER dates the beginning of the recession at December 2017,

You meant December 2007, and most reading your posts will know that. But the typo might confuse those not so familiar.

I’d keep an eye on shale oil production.

Historically, it’s been hard to create a recession without an oil price spike. With US shales growing production at a 1.7 mbpd / year pace until very recently, it’s very hard to push oil prices very high.

On the other hand, we now have a couple of months of really weak production growth at the same time rig counts keep falling. If US shales falter — possible, but far from certain yet — oil prices will rise right back above $100, and that should be enough to push us into recession.

More here: http://www.prienga.com/blog/2019/4/22/rigs-spreads-and-eia-dpr-april-19-rigs-falling-production-easing-back

“I’d keep an eye on shale oil production.”

This from Princeton snake oil sales man. We have a new nominee for stupidest comment EVER!

“Historically, it’s been hard to create a recession without an oil price spike.”

Take a look at this graph – old clueless wonder!

https://www.macrotrends.net/1369/crude-oil-price-history-chart

I’m sorry – you will not get it without some help. We had a massive recession in 1981/82 even as oil prices were rapidly coming down.

Princeton Stevieboy wins – dumbest troll ever!

Steven,

On the matter of oil prices we have Trump suddenly dropping the other shoe on Iran oil sanctions, demanding that China, India, Turkey, Japan, and South Korea ceease importing Iranian oil or face sanctions. Price of Brent crude already up 3%. Maybe this will all blow over, but Trump has had a lot of ability to enforce his illegal sanctions on many nations. This could get really bad, with Iran possibly even moving to block shipments through Straits of Hormuz if these nations kowtow to Trump. And then there is his also intervening in Libya, which could help shut down oil production there, although it looks he is betting Hiftar will win (not happening yet).

So, watch this, not shale, at least in the near term. Several of Trump’s advisers reportedly warned him against this move, but I think he thinks this will distract the masses from the ongoing debates over the Mueller Report, given that all the chanting of “no collusion! no obstruction!” does not seem to be convincing anybody already not wired into Fox News. He has so far not faced much feedback in the US for his awful Iran policy, but this could do it, and not to the economy’s or his favor.

Trump’s Iran policy is about as dimwitted as it gets, but assuming it is reasonably effective in tightening oil supplies, I wonder if there will be a supply response to the higher oil prices. Higher oil prices will tip the scales towards a recession which could dampen demand, so that could work against a supply response. The other thing is that Big Oil isn’t going to want to invest in exploration and development if (as seems likely) the Trump policy on allies buying oil from Iran goes out the door with Trump in Jan 2021. The smart play might be to just sit pat and enjoy the temporary windfall with higher oil prices. But it’s Earth Day, so maybe we should thank Trump for his contribution to lower greenhouse gases by way of higher oil prices.

2Slugs,

I have just posted on this on Econospeak at some length, but a bit more here.

It is seriously unclear what will happen to oil prices in the near term. Reportedly KSA, UAE, and Iraq have offered to increase production to offset declines by Iran. That news may have halted the rise in oil prices today. Of course, this sort of thing might just trigger Iran to mess them up by blocking the Strait, if indeed it cannot sell any oil.

While I do think mostly Trump is doing this now to distract from the Mueller Report, there is also the fact that people like John Bolton have been pushing for regime change in Iran. They supposedly want a new and “better” nuclear deal, but it increasingly looks like heading into invading Iraq. But this could get a lot worse than that, not just because Iran is a lot larger and better armed than Iraq was. All this has already pushed the leadership in Iran to get harder line, with the Revoluitonary Guards getting a new very hardline leader who is talking about having Hezbollah fire off thousands of missiles into Israel. Netanyahu may get something he was neither expecting nor wants.

Anyway, this is now seriously dangerous territory, well beyond what happens to the price of oil.

Oh, and btw, some are saying that all this will break apart recent OPEC deals, with prices going down to $40 per barrel. I do not think that is too likely, but this is gossip in the oil market and a sifn of just how volatile the situation has become. I think Trump has gotten in over his head on this.

It’s very hard to track the Trump administration’s policies. Often they say things to have them subsequently qualified. I do not sense any great confidence there is sticking to a given policy.

On the other hand, if US shales can continue to increase production above 1.7 mpbd / year, then that can more or less compensate for Iran over a finite period, say, six months. If, however, shales fall back to, say 600 kbpd / year, then OPEC will let the price slide up, regardless of Iran.

In any event, I take your point, but I suppose I assume the Trump administration will cave when the oil price gets high enough.

Steven,

Certainly US shale is part of the current supply situation. But this has become highly volatile now with several parts possibly going off into large changes, with Venezuela another one that could see further declines in production in the near future, on top of the rest of this mess.

Thinking this through a little more, an oil shock caused all kinds of problems in the ’70s. I don’t expect that kind of thing to happen now, but what with Europe and China having their issues, the whole tariff fiasco, and everything else, turmoil of any kind in the oil supply cannot help. We are nowhere near as dependent upon oil as we once were, making it limited, but it’s just one more drip in the process of eroding the economy into recession. Give it until roughly mid-2020 and the cumulative effect of the crazy will take root. I sure don’t see any sign that the administration will avoid being erratic. The administration may try some kind of gimcrack to provide a short term boost before the election, but that’s about it.

I’m not sure about the fiscal space argument. It’s certainly a political concern because the austerity crowd is likely to use it when the next recession does eventually hit. However, in terms of the macroeconomics I’m not convinced by it. The Trump tax cuts were unsound and will make us worse off over the long run, but they’re really a sunk cost and shouldn’t affect whether or not we will need fiscal stimulus in the future. If fiscal stimulus to fight the next recession would have made sense without the Trump deficits, then fiscal stimulus should still make sense even with the Trump deficits. We’re going to be worse off because of TCJA, but that’s not a reason to make our future selves worse off by embracing austerity with the next recession. Still, I’m sure we’ll hear from the usual hypocrites and deficit scolds. We’ll hear the usual bad arguments about how government should tighten its belt when families have to tighten theirs. It will be the same old song and dance from the usual suspects. But that’s the political problem. As far as the economics is concerned, I don’t think we should think of the fiscal space issue as a constraint on how we handle future recessions.

“I’m not sure about the fiscal space argument.”

I’m not either. Your comment is excellent. But takes a look at the decline in real nondefense Federal purchases and real state/local purchases during 2018QIV (i put a link to the BEA tables in an earlier comment). I have no idea what’s going on here but this is certainly concerning.

“For the record, NBER dates the beginning of the recession at December 2017, five months before CEA Chair Lazear’s statement, nine months before Don Luskin’s admonition.”

Should this be 2007? When the next recession comes along, the response will be different from earlier responses, for a whole lot of reasons. You can bet the house on the fact that the “conservative” side of the aisle will decry deficits as soon as they are out of power. They don’t fail to do this, even if it means inflicting misery on a large population of ordinary American citizens. I don’t expect such a deep recession this time around, but I do expect one.

WIllie: Thanks! Corrected now.

Looks like all of us were actually reading. Who woulda thought such a thing could happen.

2017?????????f Maybe fat fingers meant to type 2007????

dilbert dogbert: Thanks! Corrected now.

Good news on the FED appointment issue!

Herman Cain is out!

https://theweek.com/speedreads/836610/herman-cain-withdraws-from-doomed-fed-nomination

And the village idiot Stephen Moore is sexist!

https://www.cnn.com/2019/04/22/politics/stephen-moore-federal-reserve-kfile/index.html

‘Trump Fed pick Stephen Moore called it a ‘travesty’ that women ‘feel free’ to play sports with men’

This story has a lot of choice quotes from the sexist idiot known as Stephen Moore. The opening of the interview as even funnier as Moore brags about being a “budget analyst” when he was only 25. Worst budget analysis EVER!

BTW Stephen Moore dare not take the basketball courts of Brooklyn when the ladies are playing as they would kick has arse!

The one thing most absurd about this interview with Moore is his twin claims:

(a) this is allegedly the strongest economy EVER (Rah Rah Trump) and

(b) the FED had to lower interest rates.

This makes no sense from a macroeconomic perspective of course but then Stephen Moore likely flunked macroeconomics even at GMU!

Cain out is indeed good news, pgl. What we need now is a few reasonable GOP senators with at least a few guts to step up and oppose Moore. Not clear it will happen.

His sexist articles written for the National Review back in the early part of this century has caused a stir. Of course now Moore says he was just joking. In other words – Moore admits he routinely lied to his readers at the National Review. Good to know!

So GDP actually fell? First i have heard of that, although quite likely the shutdown. Guess we shall wait and see, but it does seem that Hassett is being a bit overly pollyannaish.

As it is, I am convinced, although I have not had it confirmed in private discussion, that the reason Janet Yellen was supporting interest rate increases over the last few years was not because of fear of inflation, the official Fed line, but to get rates up while the economy was growing reasonably welll so that there would be room for the Fed to provide some stimulus when the inevitable next recession would arrive. That would have gone against the groupspeak of the FOMC, but I suspect she was not the only one there with this in the back of their minds. Of course, Trump has shut that effort down, although with the economy apparently weakening at least somewhat, probably time to do it. Too bad they could not get the rates up just a bit further, especially since clearly Trump and his pals in Congress have shot the fiscal policy wad.

Barkley Rosser: It’s Macroeconomic Advisers’ monthly macro series that decline in February. Official (BEA) series has not shown a decline.

How did I not see this earlier?

“PeakTraderApril 22, 2019 at 9:53 am

Yes, job growth was way too slow under Obama.

Only 78,000 jobs per month were created in the 10 years 2008-16.”

Dishonest and really incredibly stupid at the same time. First of all, this is a 9 year period not a 10 year period. Yea, I get it – PeakStupidity never pass pre-K arithmetic.

But wait – Obama was not President when the Bush43 recession began (December 2007) and the job losses for the period of 2008 and the first part of 2009 were enormous. So we see PeakDishonesty at it.

Had an honest bone in his body – he would have calculated the average job gain over the 2010-2016 period. But he is as dishonest as it gets.

BTW Peaky – before you take your shoes off, let me inform you that is a 7-year period!

Pgl, this is what I originally wrote, and you need to include job losses in a jobs recovery (even a six year old would know that!):

Over the 10 year period 2008-17, we added an average of 78,000 jobs per month.

However, we needed up to 159,000 jobs per month to keep up with population growth, subtracting retirements, and adding discouraged workers (or those expected to re-enter the workforce, if the “recovery” wasn’t so weak).

The conservative estimate, based on 100,000 jobs per month over the 10 year period, means we needed 2.6 million more jobs through 2017. So, at least, an additional 2.6 million jobs, above the 100,000 per month, is needed in 2018 and beyond to reach full employment.

In 2018, job growth increased to 223,000 per month.

Wow – that’s never happened. Except under Carter as well as under Clinton. Give it up troll. Your dishonesty has been well established already.

Oh dear, PT, you really are asking for it. I imagine pgl is on the case here, but just in case he misses it, I checked.

Average monthly job growth in US, 2010-2016, 199,000 per month (this avoids the recession period that started under Bush)

Average monthly job growth in US, 2017, 176,000 per month.

So, guess what, PT? Average job growth for 2017 and 2018 is just about the same as from 2010-2016, a point I think Menzie made in an earlier post, which led to all sorts of whining by you and some others about data sources. Sorry, but while Trump was able to goose that growth up a bit with his wildly irresponsible tax cut, that is wearing out.

You don’t have a credible story here, not for the first time.

Barkley, you and Pgl have a tough time understanding simple concepts.

You want to include the job losses in the recession for the jobs recovery in the expansion.

We should’ve had much stronger job growth at the beginning of the jobs recovery and slower job growth towards the end, closer to full employment.

The Trump business tax cuts and deregulation ramped-up job growth.

At least, you’re not dishonest and dumb, like Pgl, just dumb.

We didn’t recover the 2009 job losses till late 2012.

Jobs added or lost by year

2018: Added 2.68 million

2017: Added 2.18 million

2016: Added 2.34 million

2015: Added 2.71 million

2014: Added 3 million

2013: Added 2.3 million

2012: Added 2.15 million

2011: Added 2.09 million

2010: Added 1.05 million

2009: Lost 5.06 million

PT,

Are you unaware that what happened in 2008-09 was the worst economic decline since the Great Depression? Are you also unaware that in general economic downturns are faster than upturns? Your comments on how awful it is that Obama needed several years to get employment back up to pre-recession levels is just silly. I would note that the performance on these matters in the US under Obama was a lot better at the time than most other high income nations. Your effort to diss Obama’s performance does not fly.

“Over the 10 year period 2008-17, we added an average of 78,000 jobs per month.”

That’s a lie. You wrote 2008-2016. But OK you corrected the minor point. You attribution of what happened in 2008 to Obama was the BIG lie. Lead to write AND learn to read. DUH!

Oh this is rich! Stephen Moore wrote several very sexist articles for the National Review – all of which he says now were spoofs. Good to know that Moore so disdained the readers of the National Review he would lie to them!

https://www.mediaite.com/trump/trump-fed-pick-stephen-moore-responds-after-his-sexist-articles-are-unearthed-it-was-a-spoof/

So let’s catalogue his writings to see which lies he told to the National Review:

‘In the articles, which were unearthed by CNN and dated from 2000 to 2003, Moore made sexist comments about a number of women — ranging from his wife to female sports journalists. “Women are sooo malleable! No wonder there’s a gender gap,” he said in one article from 2000 mocking his for voting for Democrats.’

OK!

‘In another article that year, he argued that “women tennis pros don’t really want equal pay for equal work” and instead “want equal pay for inferior work.”’

Hey Stephen – take the court with Serena Williams and see how you would fare!

‘Moore, writing in a 2002 piece, opined about the “un-American” problems rising up in the NCAA March Madness basketball tournament — mainly, women. “Here’s the rule change I propose: No more women refs, no women announcers, no women beer venders, no women anything,” he wrote to commemorate the 2002 tournament. “There is, of course, an exception to this rule. Women are permitted to participate, if and only if, they look like [longtime ex-ESPN and CBS sportscaster] Bonnie Bernstein.”’

First of all – I’d love to see Muffy McGraw take this on! And yea – this adulterous pig would view women on how they look and not on how well they played their sport. Besides Janet Yellen is only 5’3” and not a superstar model so how did she end up on the FED?

On Yellen and her appearance, it was always an amusing contrast between her and IMF Chief, Christine Lagarde, there before Janet and still there now that JY is out, although when both were in, JY had the clear edge on Lagarde in power, if not in looks and overall pizzazz, with CL tall and definitely more noticeable.

On that I remember seeing a funny photo from the middle period when both were in (and they reportedly generally got along well). I think it was a G-7 meeting with several finance ministers and a couple of central bankers. Lagarde and Yellen were sitting next to each other. Several male fin ministers, or whatever were next to Lagarde, and I think there was one next to Yellen. Like three of these males next Lagarde were blatantly leaning over towards her overtly drooling while she looked at them mildly amused although obviously used to such attention. The man on Yelllen’s side was talking to somebody else and ignoring her. She was just quietly sitting there with a slight smile on her face, completely unbothered by any of it.

I also remember that there were at least two meetings, among their joint first, where Lagarde and Yellen showed up virtually identically dressed. It was clearly the power woman central banker outfit of the day, a black dress with a necklace of large white pearls. They both soon moved on.

Lagarde may be taller and more chic, getting attention from semi-intelligent finance ministers. But not only is Yellen a whole lot smarter and more knowledgeable than Lagarde, she is married to George Akerlof, who not only has a Nobel prize, but is one of the absolute nicest people in the entire economics profession (sure as heck nicer than mean old, me, :-)).

Interesting stories. I remember meeting the great Milton Friedman and his lovely wife some 35 years ago. He was only 5’0″ and she was a bit shorter. Both absolutely brilliant. And even at their age, they were like two teenagers in love.

None of this would come across to adulterers like Trump or Stephen Moore.

The comment section of this story on how Moore said he was spoofing has lit up on both sides! There are a few Trump trolls that first deny reality and when reality is pointed out a second time go after people with the usual juvenile insults Team Trump is known for. Sort of like all the denials of what is in the Mueller report.

Uh-ooooooh, someone interrupted our Razadyne medicine time again

https://www.nytimes.com/2019/04/22/us/politics/impeaching-trump-pelosi.html

Wait…… Wait! Wait!!!……. Wait!! Wait!!! Wait!!!!……. I know what I’m supposed to do here, I just have to find my Econbrowser cue card here. I put it by my keyboard here somewhere….. [ Reads in overloud voice as if I’m on a theater stage, monotone style with zero feeling ] “Nancy Pelosi is a very strong woman. She is a very very very strong woman, and does everything in a correct way, and anyone who says otherwise, is only saying so because she has ovaries.”

How’d I do guys?? How’d I do!?!?!?!! Do I get the part as the cuck in the theater production??? I’m really sick and tired of David Paymer stealing all my roles.

Hassett may be right. No recession by the summer of next year implies Hassett’s not ruling out June or thereafter. The probability of recession over the span of the next 9 months per my indicator has fallen considerably since its peak of 64% in Jan. The prob is now just 25%. Both the rebound in stocks and the employment situation have altered the picture dramatically since Dec. For completeness I’d also bring in the real wage. Unemployment claims are telling a big story. The labor market is tight and getting tighter. The BLS’s JOLTS reveals a growing excess of job openings over new hires. Real wage gains are surging, with no reason to expect this to slacken (but for rising crude oil prices deflating nominal a bit more). Wages plus payroll employment at around the current rate keep disposable income growth healthy. This propels consumer spending and everything else downstream. What is going to stop this? Only a financial crisis or exogenous shock. It looks like Jim Hamilton was right about no recession this year, as I in turn am looking wrong. Inflation pressures are going to build in this environment. Thusly the next move in fed funds when it comes now bodes to be up.

JBH No, Hassett is not right. Hassett said that a recession in the next 12 months is “impossible.” Even if we accept your 25% chance, that’s a long way from “impossible.” Now it could be that it might be close to impossible for NBER to have declared a recession within the next 12 months, but if that’s what Hassett meant he was being too clever by half. And as intellectually dishonest as Rudy Giuliani or Steven Moore or Sarah Sanders or Kellyanne Conway. In short, as dishonest as anyone who associates himself or herself with Trump’s stench.

So we then go back to Menzie. Menzie started this thread-degenerated-into-insults by plucking the word impossible out of its fuller context so as to emphasize it and thus put his CEA axe-grinder to work. According to the link Menzie provides, after pointing to momentum in the economy, Hassett said: Anyone with a reasonable command of the English language knows full well the fullness of the thought the speaker was trying to convey. In doing so he used three – count ‘em – adjectivals to modify the noun. Any normal clear-eyed person realizes that means which leaves open some space for the event of recession to actually happen in the timeframe of up to next summer, in itself a soft term. The word was further qualified by the additional softener The word seems means That is, it may or may not be true, but from all appearances looks as though it is. Then an even further conditioning word, starts off the softening process of the word which if left standing isolated on its own without any modifier adjectives, or adverbs acting as adjectives, is an absolute. So here we have an absolute modified three ways to Sunday, which full meaning of the four-word phrase ought to be perfectly clear to most readers, though note carefully I do not say readers as that would be an absolute which is not the meaning I wish to convey.

On the other hand, is a double absolute! With the word “No” slam bang emphasizing the phrase In other words, the commenter here has said that in no uncertain terms Mr. Hassett is outright wrong, no ifs, ands, or buts about it. We have here then something of a peculiar circumstance. The commenter is using an absolute to criticize, with full-out venom I might add, the wordage of something which is not an absolute for being an absolute!

This of course would normally take us to the rules of elementary logic. However, for this commenter, logic is almost surely a bridge too far. My reading, and it is just that, a reading, not something that I say I know definitively, with such definitiveness for example as is expressed by the “No, Hassett is not right.” My reading is that this commenter is still just an abecedarian in knee britches, in this case still learning the A,B,Cs, and has daringly jumped ahead his class to the far more complex subject of learning words.

In other words, might I say that it just seems impossible that the commenter here is an adult educated human being. To so mistakenly misunderstand the English language there is in fact some chance that this commenter may actually be a bot. For as the casual reader of Econbrowser is surely aware, there are a lot of nefarious bot-like things running around here on this site armed to the teeth with invective.

You wonder why the great von Hayek wrote in such convoluted language? Look no further. This faux pas by two slugs is a classic case of the extent to which one must go to be sure that one is not misinterpreted or misunderstood by the plentitude of minds so hermetically sealed against the nuances and facts of the real world that nearly everything that comes into their minds from the outside is interpreted by their minds squarely in line with their narrow immutable belief systems so tightly sealed in their containers. And only in line with …

What we have here then is one of the Obama brigade. Three manchilds and a truck. We not builders. We experts at tearing down.

JBH What part of:

Even if we accept your 25% chance, that’s a long way from “impossible.”

did you not understand? Even accepting all of those modifiers to Hassett’s “impossible” remark, that doesn’t get to your 25% chance. If you and others believed the chances of a recession were (say) only 2%, then you could plausibly claim something like “almost impossible” or “for all practical purposes impossible” or “highly unlikely.” But using your own estimate of 25% hardly falls within the realm of “impossible” regardless of how many modifiers you stick in front of it. And given the wild swing in your own estimate from 64% in January to 25% in April, that should make you even more circumspect about any claim, modified or not, that describes the chances of a recession as “impossible.”

Gosh, JBH,, all this discussion of language. Does this mean that instead of doing grad work in math and econometrics (where was that again?) you actually did grad work in the English language instead? Or maybe you did it in both. Wow!

Barkley Rosser: To assuage your interest, I went to state universities ranked 40th or so in economics. However what matters is not the school. It’s how one’s mind is trained to think like an economist. Think not just about economics, but about the broader world and the interstices between which are where most major scientific breakthroughs take place. For if one’s mind is open, the understanding and wisdom one can attain in life is unbounded. The sphere of economics is impinged upon by a larger more potent sphere. Few economists give any thought to this. They are too busy scribbling away in their own tiny hexagonal part of the hive. Even more, few have yet grasped that the Keynesian theoretical apparatus is faulty at its very core. So when people like Reinhart and Rogoff come along and talk about debt, they were attacked. This ossified science really didn’t want to know. None of which was a surprise if you could think, and had read Thomas Kuhn.

JBH: I know Reinhart. I know Rogoff. If you think they didn’t use basic New Keynesian logic when, for instance, Rogoff headed the IMF Research Department, you are then deluded. By the way, Reinhart and Rogoff got flak for overstating the robustness of an empirical nonlinearity they found in their data set. The belief in such a nonlinearity was neither Keynesian or non-Keynesian.

I’m tempted to make some comments here, but what Reinhart and Rogoff were arguing for is well on the record and anyone can read for themselves what the underlying political message was (and in my subjective opinion, there is no doubt there was a political message attempting to be made by Reinhart and Rogoff). Be that as it may…… Mike Konczal gives the best breakdown of the topic I have seen if you’re lazy like me and want the “CliffsNotes” version

http://rooseveltinstitute.org/researchers-finally-replicated-reinhart-rogoff-and-there-are-serious-problems/

Oh my, JBH, that is really assuaging, “state universities ranked 40th or so in economics.” More than one? Still for whatever reason not wlilling to name any of them? LOL.

I largely agree with both Menzie and Moses on R&R, although indeed there was an outright error in the data for the famous debt cliff paper that they let get used for advocating fiscal austerity back in 2011, an unfortunate matter that did lead to quite a bit of ridicule. But they were not particularly attacked prior to that, and their book on 800 Years of Debt is quite good with most taking it quite seriously. You really do not know what you are talking about, wherever you studies “math and econometrics.”

I have not met Reinhart, but I have known Ken Rogoff since he was at Wisconsin some time before Menzie got there. Very smart guy, could have been a chess grandmaster. Really too bad what happened with that paper.

As for Thomas Kuhn, well, not only have I read him (over a half century ago), I knew him, although not as well as I know Ken Rogoff.

I have it on reasonable authority from somebody that knows a guy, it it quite possible that he might have come back from the future and with certainty used the word “impossibe”. There you have it.

“It just seems almost impossible that there would be a recession by the summer of next year. Anyone with a reasonable command of the English language knows full well the fullness of the thought the speaker was trying to convey.”

Fine – almost impossible likely means only a 1% then.Whippie $hit. Anyone with a reasonable command of the FACTS would also recognize everything else Hassett said ranged from spin to outright lies. But yea – he is on Team Trump so his back benchers have to defend his intellectual garbage!

Can anyone tell me when I need to clear my calendar for William Barr and Nancy Pelosi’s marriage?? September love melts my heart, and I can’t imagine two people more matching in uselessness to the human race. I’m saving neighborhood dog-shit that nearby dog owners never picked up to use as confetti at their wedding. I know that seems an odd use of time, but I want to show these two lovebirds how much their love has moved me on a personal level.

I find it astounding. Economics already has a reputation as a field that is difficult for women to enter and advance. And every single time a female economist is mentioned on this blog, the discussion immediately turns to their appearance and sexual attractiveness.

It is no wonder that economics is perceived as field that is hostile to women. Esteemed women in economics are so rare they are perceived a a curiosity to be remarked upon.

joseph: I concur it is distressing that the topic of appearance comes up so often. I think the discussion remained on economic ideas and policies and developments, and where appropriate, the misguidedness of certain views.

As one who is assumed to be viewed as one of the worst transgressors on this blog in this aspect I have some relatively brief thoughts. Ok, not brief thoughts….. One can argue it is “tasteless”. One can argue the topic should be delineated from an economics blog. Those are fair points. But let me ask, when someone makes remarks about the appearance of Mitch McConnell, donald trump, Chris Christie, President Obama, Bernie Sanders (any jokes about hair ringing a bell??), I can make a pretty long list if you like. Late night talk show hosts: Letterman’s teeth (Letterman’s retirement beard). Jay Leno’s chin.

People can say “two wrongs don’t make a right” fine, but I don’t think society is going to stop making jokes or off-color comments about people’s appearances anytime soon. A blog can be a place of respect but it cannot become a quarantine. Maybe we can just stop assuming women are so “frail”/”delicate” or better yet, stop treating them like they are frail and they’ll get the maturation process a large % of women have been asking for???—fine—you got it. I’m going to treat you “equal”. That means when you have a high profile job you’re going to have to stomach some comments that just don’t sit well in those quiet moments later on in the day.

Here’s another one, ask women how they talk about one another at slumber parties, in the ladies bathroom, or any “get together” where one woman they don’t like isn’t present—let’s see if any honest answers come up there. I think there is a medium ground between donald trump fan boys and “SJW”s, and folks, I guess I’m going to hell because I find myself somewhere in the middle there.

Do I feel guilty about some things I’ve said about some women. yeah…… mildly. But when people like Sarah Huckabee (the type female I usually reserve those “choice” comments for) keep proving me right on what type person they are on the inside, uuuh, I’m really not gonna lose too much sleep on it.

https://www.buzzfeednews.com/article/tanyachen/mueller-report-sarah-sanders-james-comey-comments

Now, lastly, I’m gonna dare ANYONE (including Menzie) to go back over my archive of comments and find ONE SINGLE derogatory comment I have made about Yellen’s or Lagarde’s appearance. Then ask yourself why that might be that I never made derogatory comments about those two women’s appearance?? Just send your minds into warp speed turbo overdirve with the smoke coming out of your ears and see if you can figure out why I never made a derogatory comment about either of those two women’s appearance??

I have made some positive comments related to physical appearance about others, one, uh let’s just call her “G.G.”. If I am guilty on commenting on a ravishing flower and how that makes my day brighter seeing that flower?? GUILTY as charged

Oh gag, joseph. If this is a reaction to my comments on Yellen, then you did not get it. This is in reaction to the previously noted point that Trump reportedly at least partly did not reappoint her as Fed Chair because he considered her to be “too short,” something several of us have been mocking for some time I believe I made it clear that she is smarter and more knowledgeable than pretty much everybody else at the Fed and also than the supposedly more attractive Christine Lagarde at the IMF. Do try to read more carefully before you say silly stuff.

Of course there is the matter of the ongoing weird remarks by Moses Herzog, who more or less loses it here on a regular basis regarding several women, including just above, Nancy Pelosi, which seems not to have much to do with her appearance, other than she will not look too great if he succeeds in smearing her with dogshit, as he promises to do. As it is, it seems that his most insane remarks involve women who are politicians rather than economists, although he has occasionally gone off the wall about some of them as well.

Similar to Gita Gopinath—–Barkley Junior, makes my day much more enjoyable, only in a completely different way than Director Gopinath. Barkley makes my day more enjoyable through imaginary “skewed” distributions, that are actually uniformly distributed, and many other aspects of Barkley Junior’s Mr. Anderson sensibilities, which are of great humor to me:

https://www.youtube.com/watch?v=s4FqFrcFG60

A funny thing about Moses’s wildly erroneous nonsense about genes being “evenly distributed across populations” is that this all came fromhis earlier haranguing against Elizabeth Warren for her bungled statements about her miniscule Native American ancestry, which he turned into something worse than a federal crime. The specific issue was that the average amount of Native ancestry non-full-blooded Indians have is greater than the estimated amount Warren was found to have when she had her DNA test. Moses then charged in with his totally false claim that genes are evenly distributed across the population, so therefore Warren had less such an “average American” has.

The problem is that because this distribution is skewed, in fact the median American has zero Native ancestry, less than what Warren has. That the average amount is higher is because of the small percentage of the population that has a much higher percentage than she does. So Moses’ weird and screwed up obsession with repeating his false claims is tied to one of his more egregious attacks repeated furiously over a long time against a female politician.

For the umpteenth plus umpteen times, Moses, even distribution across a genome is not the same as an even distribution across a population. It may be that Peak Trader or a few others here with about your level of knowledge of math and genetics do not get this, but most do. Do again note that not a single person here has stepped forward to defend your ridiculous position, not one. Deal with it, buster, preferably before you attempt to smear dogshit on Nancy Pelosi.

Many experts in world geopolitics have said Page 89 of the Mueller Report is very possibly the most filthy and disgusting part of the entire document. You may be wondering why. Well, wonder no more…..

Indirectly, page 89 mentions Not Trampis’s home country….. TWICE

I know Menzie strongly dislikes vulgarity and crudities , but I thought even Menzie (or a part of Menzie) might even get a chuckle out of this one.

It’s a bumper sticker or back window sticker on an SUV.

https://i.redd.it/730xkt7wett21.jpg

https://www.youtube.com/watch?v=qWjKYQFyJZM

I think what they’re trying to say here is that Nancy Pelosi is a complete political coward. Among other words I could use for her. But hey, that could just be my take on it. Others may look at her sitting on the potty and can’t decide what she should do as being a sign of a strong woman. Yes, strong…… strong all the way, go team. You had months to go around your “caucus” and figure out if you were going to impeach a man for obstruction. Now you got the report you knew was coming soon. and “Oh, uh, this baby had red spots all over it and it’s running a fever of 107, but let’s take the baby’s temperature OME MORE time and then wait 20 minutes for a change before we notify anyone, we don’t wanna get wild here.”

When Pelosi heads to the nursing home (hopefully sometime very soon), she’s gonna violently elbow all the other elderly residents so she can have 4 bingo cards, and then sit there with the winning bingo number going “Uuuuuh, Let me take the emotional temperature of this dining hall before I call out this winning number, I don’t wanna lose my TV seat for ‘Jeopardy’ by pissing someone off”

I didn’t like Pelosi. I have changed my mind. She chews concrete and spits sidewalk, which is exactly what the Democratic Party needs right now. Will Rogers was right when he said that he didn’t belong to any organized political party, because he was a Democrat. Democrats are just as fractious as ever, to both their benefit and peril. The much more lock-step Republicans fall in line with whatever the party line happens to be at the time. The Democrats don’t do that. A tough operator like Pelosi is the only kind of person who can keep them at least somewhat focused.

Actually, Moses, it looks like she is doing exactly what is needed. Please note that the Mueller Report is missing certain crucial pieces that the crucial House committees are moving to get that will make it much more popular and provide crucial support for an impeachment move. She has not ruled that out, she has ruled it for right now while moving forward the investigations that make a stronger bid for impeachment that will not just embarrassingly fall on its face with Trump and Hannity and Barr et al laughing themselves silly.

The crucial stuff Mueller’s team dis not cover is Trump’s finances, which Trump “drew a red line” around that it appears Mueller respected. As it is, the taxes and and other financial information will strongly add to an impeachment proceeding. Trump has clearly violated the Emoluments clause, the first president ever to be accused of that. He has clearly been under finanvcial hock to the Russians and his lies about his schemes in Moscow have serious implications, with again Mueller just not investigating any of this, unless it is buried in the redactions.

Bottom line is you are just off your nut again regarding Pelosi. She is managing the House investigation so that it can move to a formal impeachment proceeding when they get some more of the crucial impeachable goods on Trump.

This has been as good a thread as I have read anywhere in a long time.

Until:

“experts in world geopolitics, in relation to Mueller s new ‘apocryphal gospel’ of “liberals”.

Please “define apocryphal gospel” I need a foundation to understand that form of “appeal to authority”.

Let me make my position on Janet L. Yellen precisely clear. I am her super big fan. I was the first person ever to call for her to be named Fed Chair. This was back in 2009 during a brief moment when it looked like Ben Bernanke not be up for reappointment. I have pointed out many times that she was he first person at the Fed to publicly express concern about the housing bubble and was shown by the WSJ to have the best forecasting record of anybody there. I have also noted, although not too loudly or extensively, that another reason she made a good Fed Chair is that she has exceptional diplomatic skills, and leading the Fed is very much a matter of herding a bunch of egomaniacal cats, which she was exceptionally good at, with the fact that almost nobody noticed that a sign of how good she was at it.

So then we had this farce of Trump not reappointing her substantially due to her appearance, too short and just not fitting his Central Casting version of a Fed Chair, presumably a tall, white-haired male in an expensive suit who is also a Republican, which fits Jerome Powell to a t, although he is far below Yellen in intellect and ability. So, there has since been all this mocking of Trump on this. But a funny aspect of this, which I now bring out more specifically, although it was previously implicit, is that her short and somewhat nondescript appearance actually helped her in her diplomacy within the Fed. Her ability to lead partly came out of being able to sort of almost disappear and not attract too much attention in meetings. This kept the egomaniacs at bay and not out to try to knock her down or go against her wise and carefully managed direction. Her shortness and lack of drama helped her very much in getting those cats to herd properly, and indeed one heard very little about fights or fussing in FOMC meetings when she was Chair. She was as good as they get.

@ Menzie

Menzie, I had a semi-random question I was hoping you’d humor me on. I had had this question wandering around the back of my mind for awhile, but don’t think I have ever asked it, and then I was piddling on the IMF site just now and it popped into my mind again.

I noticed a few economics analysts such as yourself are using Github more and more to share information and also use more “up-to-date” stats in their analysis. Do you personally find yourself using Github (or any similar such open-source programs) more recently for your analysis?? One of the reasons I greatly admire you Menzie is I know you are always trying to stretch yourself out and improve the field you work in, so if you aren’t already into this site, I wager you would find it fascinating. Here is the Github link to the IMF’s “Growth at Risk” offerings:

https://github.com/IMFGAR/GaR

Austan Goolsbee discussing government benefits and whether there is a funding problem and why there is a funding problem. It might have something to do with tax cuts for the rich and for corporations that don’t pay their share to begin with:

https://www.youtube.com/watch?v=lcbMJKXyjVk

“PeakTrader

April 22, 2019 at 4:09 pm

We didn’t recover the 2009 job losses till late 2012.

Jobs added or lost by year

2018: Added 2.68 million

2017: Added 2.18 million

2016: Added 2.34 million

2015: Added 2.71 million

2014: Added 3 million

2013: Added 2.3 million

2012: Added 2.15 million

2011: Added 2.09 million”

Lord – our Russian bot has lost it. In your debate with Barkley – maybe you did not notice that these numbers makes his point and proves you are one lying idiot! Game, set, match!

Russian bots generally fall apart when subjected to logic. Why would Peak Trader be any different. I’m a little confused why a bot would bother with a bunch of economists and geeky economist wannabes like me, but there it is.

Willie, you’re in no position to call anyone illogical, particularly given you agree with Pgl’s nonsense and stupidity.

You socialist/liberals act like the Russians, except you make them look more honest.

You may be a geek, but you’re not even close to being an economist.

You and Pgl may excel in rewriting history or left of left field political science.

And, Barkley believes recovering the 2009 job losses in late 2012 was done quickly, which is ridiculous.

And, he still doesn’t understand population grew from 2009 to 2012, to where another 100,000 additional jobs per month were needed.

It all goes way over the heads of the three amigos – Pgl, Barkley, and Willie. They’ll say anything to defend failure.

Oh gag, I have to o waste more time responding to your inaccurate drivel, TP?

So, employment maxes out in 2000 and then declined by about 2 million over the next two years to bottom out in 2002. It then began growing again, but it took until 2005 for total employment to actually exceed what it was in 2000 again.

The next max was in 2007, after which employment declined by about 10 million, about 5 times as much as in the earlier episode. Growth of employment after 2009 closely resembles the rate we saw after 2002. Indeed, you have understated how long it took. It was not until 2015 that employment again exceeded what it was in 2007.

Anyway, bottom line is that in earlier episode it took 3 years to recover 2 million lost jobs while in the later episode it took twice as long, 6 years to recover 5 times as many lost jobs, 10 million.

Do you realize how totally stupid you look, PT? And replying to a dumb comment on a newer thread highly unlikely Trump policies would have sped things up. I mean, in 2009 a trade war probably would have led to much worse retaliation fro abroad with much greater job losses all the way around. You are seriously in fantasyland.

And Hassett was the person who predicted that the housing market collapse will result in a short recession even though he knew from data it was frothing from the bubble. I even have Krugman’s power point on his comment from his article back then.