Reader Zi Zi writes:

Higher short rate actually precedes better [US GDP] growth (not lower): GBP3M

I … don’t … think…so.

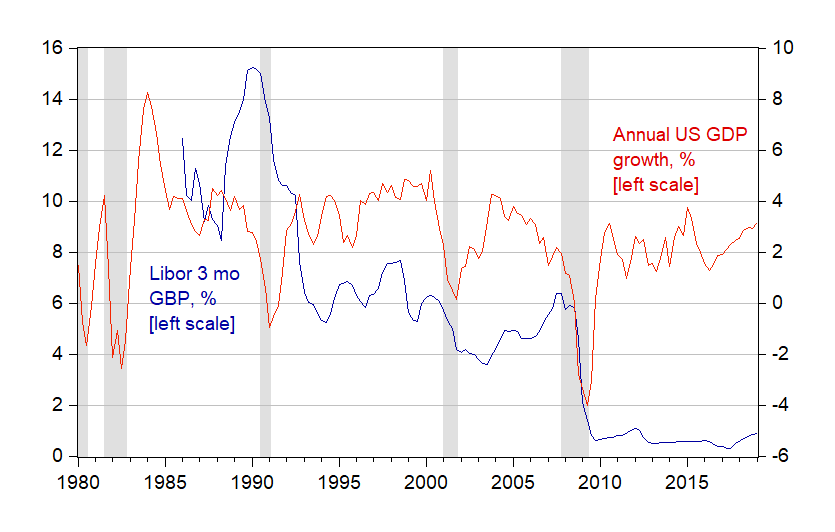

Figure 1: Libor 3 month based on British pound (dark blue, left scale), four quarter growth rate of US real GDP (red, right scale), both in %. NBER defined recession dates. Source: IBA, BEA via FRED, NBER, and author’s calculations.

Granger causality (2 lags) test fails to reject US growth rate causes Libor; rejects Libor causes US growth rate.

Shift of LM curve versus shift of LM curve? We should have Stephen Moore explain this to Zi Zi.

Dear Folks,

I think this is dependent on the system or circumstances involved. The article cited below seems convincing to me, although it goes against standard economic thinking:

https://voxeu.org/article/tax-hikes-are-not-always-contractionary

J.

Julian,

Please note this piece is about interest rates, not taxes. There certainly is a dramatic case of a tax hike that was followed by increased economic growth, that of Bill Clinton in the early 1990s. Of course part of why it sis not lead to reduced growth is that the Fed lowered interest rates in response (harrumph!). Of course, at the time all the GOPs in Congress voted against the tax increase, with many declaring absolutely there would be a recession, which did not happen. But this was followed by them taking Congress, so they certainly were rewarded for lying about what would happen and have not wavered on this nonsense since.

Wasn’t there an entire literature on nations that continued to grow after fiscal austerity? Of course as Krugman noted – each case involved the Central Bank lowering interest rates and allowing its currency to devalue. In other words, rising net exports and increasing investment demand can offset a fall in consumption.

No ad hominem, that was not so hard; was it?

You could have avoided the passive tense, been declarative, said an engineer avoiding the declarative!

Menzie, could you please specify which FRED series you were using for the graph in your previous post: https://econbrowser.com/archives/2019/04/equipment-investment-capital-goods-imports-and-the-impending-slowdown

I want to see what happens if the analysis is extended back before the 1990s, and also without resorting to YoY adjustments. But when I search based on your identification, I get hundreds of possibilities.

Thanks

Menzie, would you please identify which series on FRED are those you were using in the graph in your previous post, https://econbrowser.com/archives/2019/04/equipment-investment-capital-goods-imports-and-the-impending-slowdown?

I am trying to extend the analysis further back in time, and also to see what it looks like without having to resort to YoY comparisons. When I search using your identifications, I get hundreds of possibilities.

Thanks!

New Democrat,

I defer to Professor Chinn, but here are some thoughts.

I think Professor Chinn indicated that he used BEA as his source. You may want to look at BEA GDP, National Data(I used the Interactive Data function), Section 5; series: Table 5.3.5. Private Fixed Investment by Type for equipment. The price index is Table 5.3.4. Price Indexes for Private Fixed Investment by Type

Regarding just the equipment part of the analysis, the two FRED data series shown below seem to be equivalent to BEA although The FRED Equipment Implicit Price Deflators seem to differ very slightly from the BEA price index.

FRED Series: Y033RC1Q027SBEA

Gross Private Domestic Investment Fixed Investment Nonresidential Equipment, BEA Account Code Y033RC.

FRED Series: Y033RD3Q086SBEA

Gross Private Domestic Investment: Fixed Investment: Nonresidential: Equipment: Implicit Price Deflators

BEA Account Code: Y033RD

AS: Both series, precisely correct. From them you get real business equipment investment. Then ratio this to GDP so you can look at changes in real equipment spending appropriately, that is, are able to meaningfully compare across lengthy periods of time. Take this ratio and calculate the 4Q change. Then observe how it acts immediately ahead of recessions. Down not so much ahead of the 2007 recession. In units, these 4Q changes varied little during the four quarters of 2007, and ended up slightly at 10.7 in 2007Q4. In those same units, fell to 3.0 here in 2019Q1. Which looks risky. But, and Menzie did make mention of this, the 4Q change actually went negative including a zero for seven consecutive quarters during oil shock 2015 to 2016. That tentative recession was aborted by the unprecedented joint action of global central banks at the request of Janet Yellen. What is fairly obvious now, is that the economy is getting a similar boost as the Fed takes its foot off the brake and puts the car in neutral. Nor will there be much of an oil shock in the months ahead.

Why Libor?

Erik Poole: You need to ask Zi Zi. He posited the stylized fact.

I’m not trying to be funny here, I have suspected Zi Zi and “islm” as being propagandists from the start. They don’t even have to be bots you know, they actually have real people they pay to wander around online and do this stuff. I think Zi Zi may have made 1 intelligent comment in all the time he has commented here, and I think that was literally on accident. It tends to be anti-atate or things that encourage confusion. They often aren’t trying to even be “anti-American” often they are stating things in such a way as to encourage confusion or make people question which news sources are “real” or if they can in fact trust any news source. It doesn’t matter to them if the original post content is quite clear if the last comment the readers go over leaves them scratching their head.

Moses,

apropos to little or no bot-iness:

Today marks the 8th anniversary (technically 01 or 02 May depending on time zone perspective) of the videotaped “raid” on a walled compound within Abbottabad, Pakistan in which a person alleged to be Osama bin Laden was killed, flown to a US ship and dumped at sea.

I am not confused. Tell me is this the first time the US has executed “justice” with no legal process?

Do I confuse you or does questioning your beliefs cause angst?

Should we expect Nicholas Maduro to end like bin Laden?

you may be asking a bot or a troll farm…

@ baffling

You got a chuckle from at least one reader on that one. “Troll farm” is my wager and they literally exist. They have office buildings of them in both Russia, China, and certainly North Korea. Among other nations I am certain. I’m too lazy to hunt it down but you can read articles put out by NSA and journalists who follow NSA that actually know the exact buildings they work in and you can see Google/satellite photos of the buildings themselves. “Intercept” (Glen Greenwald’s media operation) is one of the better sources for that type journalism. It fits the exact definition of the term “open secret”—-which by the way, while I was in China was one of non-native English speakers favorite phrases—“It’s an open secret” when discussing less palatable topics. You can conjecture the cultural/sociological reasons for that amongst yourselves. In the current 2019 environment that’s one I keep my mouth/keyboard silent on. Even mainland Chinese will admit it to you at the dinner table or over some cold Harbin beers, but a white dude in America saying that??

Propose another interest rate such as 3-month Treasury bill. What would change?

Better question – why 3-Month London Interbank Offered Rate (LIBOR), based on British Pound.

Zi Zi was looking at short-term UK rates but he kept talking about the US economy. Menzie queried him on whether he meant UK GDP and he said US. I think.

Try being backwards looking

I was talking about the recent term, post Brexit, guys.

GBP3M “weakly” predicts SP500.

Zi Zi: You indicated it was US GDP growth. Well for S&P500, it fails too. see http://www.ssc.wisc.edu/~mchinn/granger_libor_UK_growthsp500.pdf

Menzie, don’t do regression over that long period.

It looks things are much hinged on assets on Fed Balance Sheet now. Market jittered for no more new M2 money at the beginning of 2019. But M2 could be predicted from WALCL.

You know what predicts WALCL? GBP3M.

Again, look at 2017, 2018, 2019.

Finally it was interesting discussion. Maybe you’d mind change the title of this post to a more neutral one?

So I think there could be some carry trade going on…

Maybe that’s why Brexit happened in a cantankerous way: GBP gets arbitraged, rates too low for the Americans but too high for domestic, London becomes intl. service centre and outside-London is going through a slow death, assets all owned by foreigners…

Look at the period around and following the moment GBP3M slumped to the lowest of low.