Almost exactly 12 years ago, I noted the decline in equipment and software investment and the contemporaneous plateauing of capital goods imports, and repeated my worries in mid-June. At the time, I didn’t dare suggest an impending recession. Jim Hamilton (in July) warns “All of which is a reminder that the latest GDP numbers do not prove that we’re out of the woods yet” as the recession probability indicator rises to 26.2%.

I was reminded of these developments as I read over the 2019Q1 GDP release Jim discussed in Friday’s post. Here is what I found of interest.

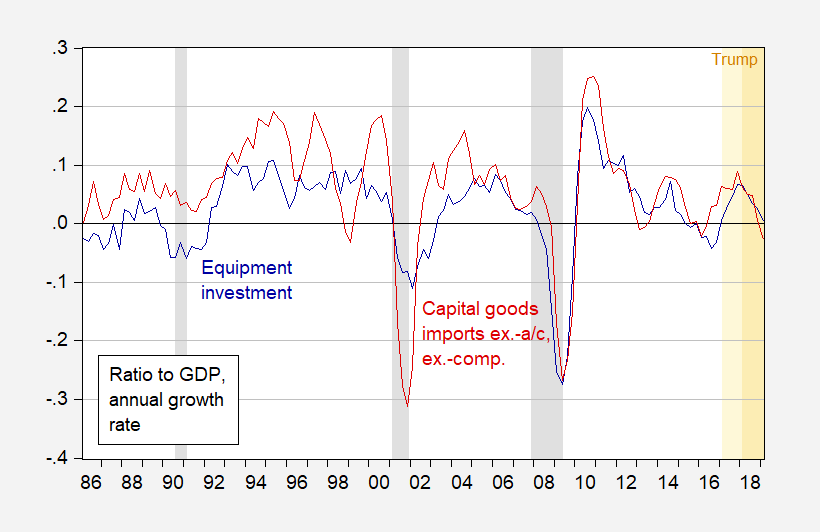

Figure 1: Equipment investment (dark blue), and capital goods imports excluding aircraft and computers (red), four quarter change as log ratio to GDP, all in 2012Ch.$. NBER defined recession dates shaded gray. Light orange denotes Trump administration. Orange denotes TCJA in effect. Source: BEA 2019Q1 advance, NBER, and author’s calculations.

Capital goods imports (as a share of GDP) growth is now below zero, while equipment investment growth is at zero. Concurrent negative growth rates signalled the beginning of the 2001 recession, and the worst part of the 2007-09 recession. Of course, concurrent negative growth also signalled the mini- (but not actual) recession of 2016 (2015Q3).

Estimating a probit regression using the investment variable as coincident (not leading) variable, one obtains (1986Q1-2019Q1):

Pr(recession) = –1.57 – 12.05dinvgdp + u

McFadden R2 = 0.36, n = 127. bold denotes significance at 5% msl.

The current implied probability of recession as of 2019Q1 is 5%; in 2007Q3 (using latest revised data), the probability was…4%.

If you can get rich by suppressing wages and cutting taxes and stifling competition, why would anyone take unnecessary risks to increase investment and productivity?

Maybe that is why foreign multinationals have decided to invest LESS in U.S. factories! Wait, wait – that is the opposite of what Kevin Hassett told us would happen!

“Capital goods imports (as a share of GDP) growth is now below zero, while equipment investment growth is at zero.”

Let’s translate this. Investment in equipment – whether produced locally or imported – is growing slowly. Just enough to keep the capital stock/GDP constant. Of course we were told by Team Republican that we would see a surge in equipment investment.

Now since imported capital goods are rising by even less, more of this stuff is being made in America. The Trump trade wars is winning!!! Whatever that does for us.

pgl Just enough to keep the capital stock/GDP constant.

Actually, that’s not quite right. The GROSS equipment investment is at or near zero, which means NET equipment investment is negative. We have capital thinning. As you said, this is not what Kevin Hassett promised. The Trump tax plan was supposed to result in capital deepening, and without that capital deepening it just becomes a giant and transient shock to aggregate demand that will leave us poorer over the long run. This is exactly the scenario that those of us on this side of the aisle feared and predicted would happen.

This also goes a long way towards explaining the growth in employment. Chronically low wages and monopsony power in labor markets has allowed owners of capital to essentially milk past capital investments by substituting more labor and less capital. So when we look at the BLS productivity data for manufacturing, what we see is declining labor productivity (i.e., more labor inputs needed to produce the same output). That makes the employment numbers look good; but it also means that real wage growth (if any) won’t be tied to higher productivity. That’s not sustainable.

I worry less about trying to predict the next recession and a lot more about the longer run trend in productivity growth. There are business cycle forces that can make an economy ripe for recession, but the actual trigger is usually some unpredictable random shock. The exception might be FED directed recessions as endogenous responses to inflation. But recessions due to supply shocks and financial panics are almost always triggered by some variable that is exogenous to a basic NK model. I’m not overly concerned about weak aggregate demand due to a fall in capital spending thereby leading to a recession, but I am concerned about capital thinning and anemic productivity numbers.

You are correct. We need to be doing NNP accounting not GDP accounting – a point I made in a comment over at DeLong’s place when Brad was ripping Robert Barro.

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.7.5. Relation of Gross Domestic Product, Gross National Product, Net National Product, National Income, and Personal Income

Less: Consumption of fixed capital (domestic business) – private is line 7 which shows depreciation = $2,219.9 billion per year.

Table 1.1.5. Gross Domestic Product – line 9 is Nonresidential fixed investment, which was $2893.5 billion per year.

OK – let’s do the first grade arithmetic our Usual Suspects are incapable of doing. Net investment is running a mere $673 billion per year.

This is a far, far cry from the capital deepening story Team Trump told us about. In fact, we have capital shallowing right now which will lower the capital to labor ratio over time thereby reducing real wages. Team Trump in its zest for a tax cut for the rich lied to us.

I had not thought about it in those terms before. It makes sense, and it makes long-term sense. It’s also a bit chilling. Capital is treating the economy as a cash cow, not as a growth project.

This is another conflicting economic signal that leads me to believe the expansion is going to falter in the next year to 18 months. Current higher growth notwithstanding. Never mind policy miscues. Those miscues didn’t cause the slowdown in 2016.

Professor Chinn,

As you know, I enjoy trying to duplicate your models as a learning experience. Thus my questions are asked for enlightenment, not as a challenge.

Do I understand correctly, using equipment as an example, you are taking the four quarter change in real equipment as a ratio to real GDP and then taking the log of the ratio(this seems to be the calculation referring to prior posts)? If the four quarter change is negative, how do you compute the log of the ratio?

Also, the only table at the BEA that I could find with data going back to 1986Q1 relating to real equipment is Table 5.3.3. Real Private Fixed Investment by Type, Quantity Indexes. So, I am not certain if I am on the correct path.

AS: Sorry the exposition wasn’t entirely clear.

Let X = real equipment investment in Ch.2012$, Y = real GDP in Ch.2012$. I then calculate ln(X[t]/Y[t]))-ln(X[t-4]/Y[t-4])) .

X is calculated by taking nominal X, and dividing by the price index of X. The data goes back to 1967

Thanks!

Color me obtuse, but am I correct in perceiving that Menzie thinks the difference between the 4% and 5% is a big deal??

I’m kind of assuming that Menzie is saying that 1% difference between the 4% and 5% is a pretty big deal but the semi-abrupt way the post ended I wasn’t quite sure.

This is kinda doubly confusing, when in my personal opinion the tone of the two most recent posts in the blog are pretty strikingly different (again, from my subjective viewpoint).

BTW, I can tell Barkley Nostradamus Junior why his Thoma link didn’t work if he hasn’t figured it out yet.

Moses Herzog: My point is that it was a low probability ascribed to recession in 2007Q3, yet we started a recession in 2007Q4. Similarly, right now we have a low (coincident) probability ascribed to recession in 2019Q1. But that doesn’t stop a recession happening in say 2019Q3…

Thanks for the quick reply and the clarification (which was probably already clear to 98% of other readers, but I wasn’t quite sure).

I am all eyes or ears or whatever, Moses, if you can help. I am notoriously somewhat internet incompetent, despite occasionally being able to call big crashes better than almost anybody around. Thanks in advance if you can unleash the deep secret.

You have an extra zero in the address, check the year.

Thanks, Moses, I shall give it another try here. As you have noted, I am senile.

https://economistsview.typepad.com/economistsview/2008/07/gradual-decline.html

Hmmm, still does not look like it is working. Too bad as the commentaty is interesting. Can still be found by googling.

Where is my extra zero, Moses?

@ Barkley Junior

I don’t know if Menzie took the extra time to correct it for you, but the link in this thread works. The one in your prior link didn’t and not only did it have too many zeros, you also apparently typed the wrong year. This link is fine though. If you want to know your error grab someone physically nearby in a lower age bracket who’s not senile and ask them to look at your links in the prior thread. It will jump out at them that you think we are now past the year of our Lord 20,009.

It must be interesting watching you edit other people’s work. Does your publisher have editors for the editors?? If not, you might suggest them to do that.

Actually the link seems to work.

Actually, Mose, I am the editor of editors, notably for the New Palgrave Dictionary, if you know what that is. It involves overseeing lots of other editors and dealing with literally thousands of entries. However, that has to do with knowing more people and just more about everything than anybody else, not about catching how many zeroes are in some url. So, not only ami I half blind as well as senile, but I am a pompous twit. But then, you already fiigured that out.

Moses,

Let me also note that what you are thinking about is a copy editor or proofreader. That is the sort of person who checks on whether or not zeroes are in the right place.

The sort of editor I am is one who decides what gets published and what does not, drawing on advice from referees and editorial board members, although not always agreeing with them. This involves both judging if the content is correct or not as well as the harder part, deciding if it is worthy of being published or not.

After all, writing a paper saying 2+2=4 is correct, but not all that worthy of being published as it is well known, although one of the more amusing things in my late father’s book, Logic for Mathematicians, is that at a certain point he did prove that 2+2=4, although that is not what the theorem specifically said, and most readers would have no idea that this is what it implied if they read the theorem, although it was long a source of humor that my late old man did prove 2+2=4. I have done nothing so worthy or deep my humble junior self.

Yes, the touted effects of corporate tax cuts in the TCJA were pretty outrageous. But economists had already surmised that the great bulk of corporate profits were economic rents (so-called “super normal profits”), so that particular part of the “tax reform” was just a transfer to (mostly wealthy) shareholders. Now, both parties seem to be of the view that the budget does not matter at all, as if “modern monetary theory” were truth, so spending and taxes need not be linked at all, which is very convenient for politicians who want to stay in office. I’m afraid this will end badly, though the reckoning seems far away, when the factors contributing to the global “savings glut” dissipate and the interest on the debt becomes a problem. At that point, inflation will be the only way out. (But the players should know that China, for one, has anticipated this result and years ago moved out of long term U.S. debt.)

don: Sorry, I haven’t been taken over by the MMT-pods. I still think deficits matter (in terms of economics; I think Cheney was right that they don’t seem to matter politically).

While to a degree I can understand your cynicism as related to MMT. I “get it”. But I do think you are a little harsh to them sometimes. I don’t think they are so much “pro-deficit” as they are asking a question “Why do we not care about the deficit when handing out gifts for the wealthy, but when low-income people need a hand, the deficit becomes the bubonic plague??” That in fact is what I am picking up from much of MMT. Somehow, because MMT is such a small group and they may not always articulate the message well, that turns into “MMT are pro-deficit”. In fact I don’t think MMT’s message is that far off from the downturn—“time for fiscal stimulus spending”, upturn—“time to raise government revenues” arguments of Keynesianism, but it somehow ends up lost in translation.

I think your attacks on MMT overall are fair, and that those attacks will motivate MMT folks to strain harder to clarify their message, but I hope you are not completely shutting MMT out as they have some pretty strong logical points sometimes.

Moses Herzog: This is not “matter” in terms of policy. It’s “matter” in theory. MMT’s *model* (as opposed to policy implications) implies that money and bonds are perfect substitutes. I.e., in (M/P)d = kY-hi, h is the interest semi-elasticity of money demand, h is *infinite*. I don’t believe this.

I think reasonable minds can disagree. I will try to do more self-education on the theory and the variables you used in your comment response. I suspect there is some “gray area” here in the arguments (gray area on both sides to be clear). I know you left some MMT links up in a prior post that I haven’t read as much as I need to/should. I only have one MMT book in my personal arsenal which I haven’t read beyond the introduction, and I have requested my public library to pick up one of the better “bibles” on MMT, which I think they will get for me but they haven’t gotten yet.

I think one argument which can be made in MMT’s favor is (and this is an uncomfortable argument for me to make as at rock bottom I don’t believe it myself, as I have never been a big fan of bond financing). But some governments, the obvious example being America, I think probably Japan could fit in as well, have had a hell of a lot of bond offerings and bond auctions over the years. Maybe even the EU in the last 5–7 years could be thrown in as well on having a hell of a lot of bond auctions of large proportions—purchased largely by wealthy people who don’t seem to mind handing over their own savings/cash in exchange for bond securities, with arguably very little of the apocalypse effects many players had predicted. Now that may seem a laughable argument, and I don’t have any math equations to throw at you—still I think even you would admit that’s a fascinating fact that cannot be denied over a period of now decades.

Do you see a time on the near horizon when, say for example, an auction for Japanese bonds is going to fail?? i.e.—NO purchasers for the bonds?? It’s not impossible that could occur–but based on a very long past history it’s hard for me to see that inside the next, say, 5 years.

Your 1st two sentences were spot on. My apologies but as soon as MMT is brought up, I tend to move on.

From the Department of Commerce, GDP change in broad strokes:

https://content.govdelivery.com/accounts/USDOC/bulletins/241f417

Broad strokes? More like Gilligan repeating what the Professor said – but in dumb downed terms!

Today Trump called on the Fed to do more quantitative easing. I am waiting for Republican heads to explode, but am resigned to being disappointed. As long as they get their tax cuts, they will go along with anything their dementia riddled leader says.

If Republicans heads explode – what the Trump twitter would have finally served a useful service!

NYFed Underlying Inflation Gauge (UIG) stands at 2.91% in March. That’s above the current 10-year rate.

Higher short rate actually precedes better growth (not lower): GBP3M

One thing worth noting is that EUR3M, JPY3M are inexorably going down.

Zi Zi: Do you mean GBP3M decline precedes acceleration in *UK* growth? Or *US* growth.

US growth — well poor Britain.

However I think there’s little chance 2019 recession will come, as Trump does only two things —- supply-side economics and firing people.