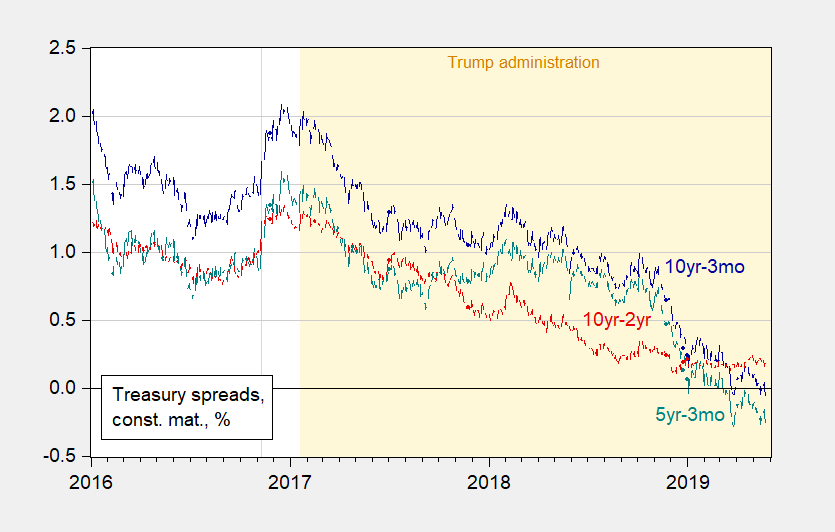

Figure 1: Treasury 10yr-3mo spread (blue), 10yr-2yr (red), 5yr-3mo (teal), in %. Source: Fed via FRED, US Treasury.

Figure 2: Treasury 10yr-3mo spread (blue), 10yr-2yr (red), 5yr-3mo (teal), in %, in 2019. Source: Fed via FRED, US Treasury.

Over the last month, the 10yr-3mo spread has averaged 4 bps — so not quite inversion on a monthly basis.

We are back in 2005 with Greenspan’s bond conundrum:

https://www.frbsf.org/economic-research/publications/economic-letter/2017/november/new-conundrum-in-bond-market/

“When the Federal Reserve raises short-term interest rates, the rates on longer-term Treasuries are generally expected to rise. However, even though the Fed has raised short-term interest rates three times since December 2016 and started reducing its asset holdings, Treasury yields have dropped instead. This decoupling of short-term and long-term rates is reminiscent of the “Greenspan conundrum” of 2004–05.”

Gee the term structure is flat. I never thought the flat structure some 13-14 years ago was that surprising. Michael Bauer patiently explains why a flat term structure today is not that surprising either.

I took the presumption that our good hosts Professor Chinn and Professor Hamilton would whole-heartedly applaud such a web address and such a regular podcast and therefor decided to share it.

https://www.stlouisfed.org/timely-topics/women-in-economics

Of course, it is an egregious sin (EGREGIOUS I SAY!!!!!!!!) they have not invited my favorite female economist from West Bengal way. But….. [ he said seething ] we can bide them some time to correct this sloppy and unprofessional error.

My fearless and completely untechnical prediction is getting more fearless. Fearlessness stops at predicting timing.