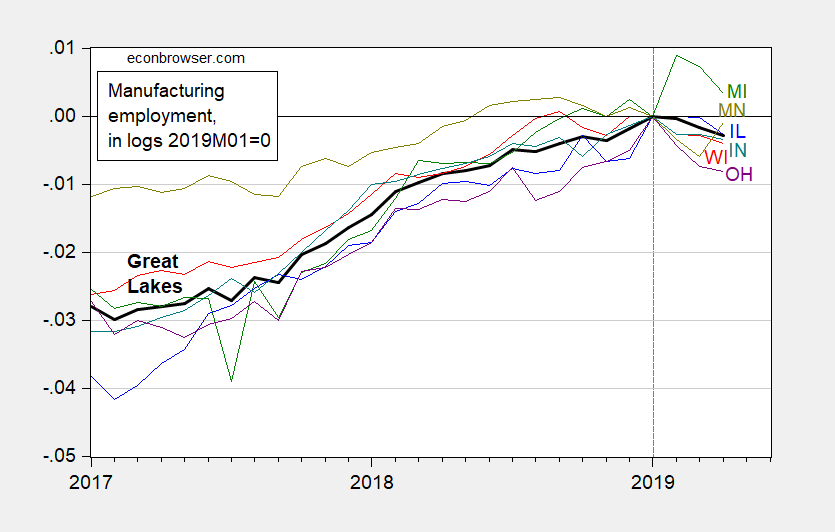

In every single state in the Great Lakes region, save Michigan, manufacturing employment has either peaked or (charitably) gone on a growth hiatus.

Figure 1: Manufacturing employment by state, in logs, 2019M01=0. Source: BLS, and author’s calculations.

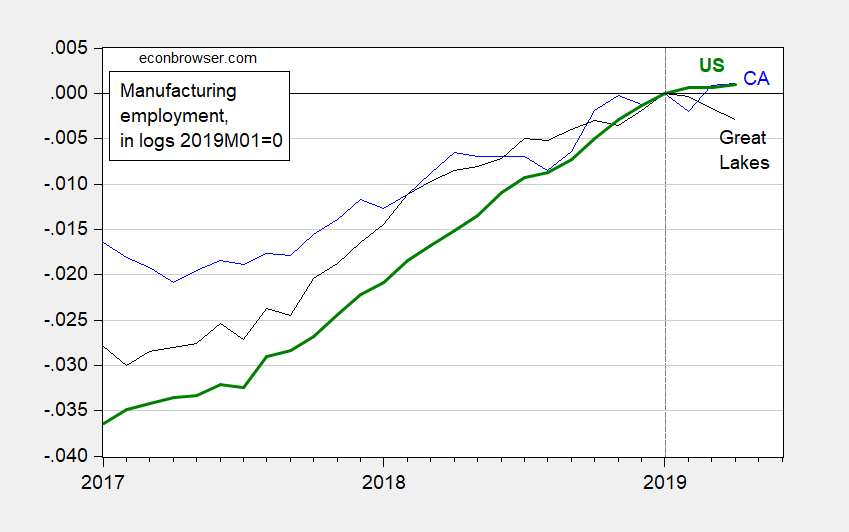

While national manufacturing is still rising (albeit very slowly, essentially flat), it remains less than 0.1% above January levels. And manufacturing employment continues to grow in California (interestingly, a state — California — by the metrics of the Arthur Laffer-Stephen Moore-John Williams – ALEC economic outlook ranking should be doing very badly is still growing).

Figure 2: Manufacturing employment by state, in logs, 2019M01=0. Source: BLS, and author’s calculations.

Dear Folks,

A brief response to PGL and others. Lots of people read more than newspapers. If this administration is favoring Russia, good by good, (and yes, I am not discriminating between production by a firm headquartered here which produces in Germany and a firm which produces here, because they can be moved as foreign direct investment, which is already happening to some extent), it is also favoring other states besides the Midwest. OFII can be disputed about FDI figures, but see

https://siteselection.com/issues/2019/mar/south-carolina-the-souths-magnet-for-foreign-direct-investment.cfm

and in particular:

“In fact, international companies operating in states like Florida, Iowa, Michigan, North Carolina and Ohio have grown their manufacturing workforce by more than 20 percent over that period.”

and

“10 States with the Fastest FDI Employment Growth Rate Over the Past Five Years: Utah (45.7 percent), Florida (43.8 percent), Tennessee (41.3 percent), Oregon (41.0 percent), Michigan (39.7 percent), Kentucky (37.1 percent), Mississippi (36.3 percent), South Dakota (36.0 percent), Missouri (35.0 percent) and Arizona (34.8 percent). The national average is 24.4 percent.

Leading American Manufacturing: International companies were responsible for 62 percent of U.S. manufacturing job growth, contributing 377,200 of the 606,000 net manufacturing job gains made from 2011 to 2016 (latest available data). The 10 states with the fastest FDI manufacturing growth rate include: Rhode Island, South Dakota, Oregon, Michigan, Kentucky, Nebraska, Iowa, Tennessee, Utah and Minnesota.”

Are they analyzing the latest data? No. And you can look at the same figures and see employment growth over 2008-2016 and see Ohio and Michigan, depending on what metric you use, as above. But the primary states where manufacturing growth is taking place, with exceptions, are not in the Midwest.

That is an informative link. Thanks!

How did South Carolina miss that list? “For most of its history, South Carolina has benefitted from a globally-connected economy…Since 2011 foreign-based firms…have invested more than $19 billion in South Carolina, bringing 42,000 new jobs to the state.”

That’s from 6/18 newsletter from the South Carolina Department of Commerce.

Remember Rhett Butler in Gone from the Wind? Quite the trader he was and I think he was South Carolinian.

Perhaps more of those “overpaid empty suit bosses” who do not labor in the factory and provide no value need to be eliminated.

https://www.freep.com/story/money/cars/ford/2019/05/21/ford-job-cuts-analysts/3754205002/

“manufacturing employment continues to grow in California (interestingly, a state — California — by the metrics of the Arthur Laffer-Stephen Moore-John Williams – ALEC economic outlook ranking should be doing very badly is still growing).”

Stephen Moore – the gold bug advocate? Oh I’m sorry – the clown who wants to used a commodity index to guide monetary policy. Maybe he would explain California’s good performance this way. Assume California broke away from TrumpWorld and ran its own monetary policy which led it to devalue with respect to the US$. That’s it – California has gone rogue and thereby flourished by following Moore’s advice on monetary policy. He will explain it during his next appearance on Fox News!

The economic evildoers at the California Chamber of Commerce (leftist to the core!) offer these tidbits: “In 2016, California exports supported 683, 772 jobs in the U.S., 92% of which were supported by MANUFACTURED goods exports. In 2015, there were 70,350 small and medium sized exporters in California which account for 96% of California goods exporters and 43% of known California export value.”

Oh, those socialists! When will they ever learn?

How many of those jobs related to weapons of war? California has always been good at that. Of course they are also good at hi tech, biopharma, making hit movies ….

So Trump beat Clinton in Ohio by more than 8 percentage points in 2016, but in 2019 Ohio is the hardest hit in manufacturing of any Great Lakes state. What does that mean for the 2020 election?

Trump could promise Ohio the moon again, but will they believe him or their lying eyes?

This is a part of how Trump got the electoral college majority in spite of losing the popular vote. The upper midwest and eastern states he won had what amounted to a localized recession in 2016. If that happens again in the same states, there’s not much doubt in my mind they will swing against Trump. If there’s an overall downturn, even if it’s not a full blown technical recession, it could be a complete blow out against Trump. Trump has been spectacularly lucky and gotten away with utter incompetence wrapped in petulance his whole life, so it wouldn’t shock me if things lined up and he squeaked in for a second term. If he does, it will be uglier than his first term, but we will live. I don’t expect it to happen, since I don’t expect boom times to continue without softening for the next 18 months. With more than half the country thinking he’s an idiot when the economy is good, imagine what will happen if the economy turns bad.

It will be a complete blowout which is exactly why the democrats are attempting everything in their power to remove Drumpf from office.

Why would they bother? Pelosi is able to play him like a fiddle. Impeaching him would allow the poor little rich boy to continue to play the victim. Airing out his operations – and remember, his operations are still his operations and he still benefits from the profitability of Trump Organization, and also remember that his tangled finances mean it’s going to be impossible to disentangle Trump from Trump Organization – might let him play the victim, but it would also allow the world to see how he operates, who he owes, whether his net income is anything like what he says, and all kinds of other things. I imagine he’s terrified of being exposed as the failure he truly is. And, by a woman at that. So, there’s lots of reasons to let him stay in office and twist in the wind if you are a Democratic Party operative. If you care about the country and the rule of law, he probably should be impeached. Except that the Trump protection society in the Senate will leave him in place. So once again, why bother?

I found this fascinating. Trump’s most recent financial disclosure:

https://drive.google.com/file/d/1YKGh1wIPkyRswPZeIt1x4SymutIYLR6e/view

While it includes ranges of values and income, it provides more detail than a tax return would show.

it is fascinating that as the midwest struggles, in part due to the tariffs imposed by trump, many of those voters are doubling down on trump in spite of their economic losses. and losses that will continue. its kind of like the corev mentality, where he was sure the soybean farmers would recover by the next harvest…and then the next harvest… and then the next harvest…so he continues to support trump and the “winning” policies, despite being wrong on every turn. if something failed, it must be somebody else’s fault, because trump does not fail. just fascinating the tribalism we still exhibit in a modern democracy.

Don’t you know – every bad event over the past 40 years has to be blamed on Jimmy Carter. Can’t be Reagan’s fault or Bush41’s fault, or Bush43’s fault, or even Trump’s fault. Jimmy Carter! Or was that Bill Clinton and Barack Obama.

Wait – we had a booming economy in the 1990’s – thanks to St. Reagan. And that 2010-2016 recovery. All due to Donald Trump. Just ask Stephen Moore!

Ronald Reagan was a “true American patriot”!!!!! How dare you!!!!!!

https://www.nytimes.com/1991/04/15/world/new-reports-say-1980-reagan-campaign-tried-to-delay-hostage-release.html

Trump balks on infrastructure investment because NANCY is just a mean person!

https://www.motherjones.com/kevin-drum/2019/05/trump-stalks-out-of-infrastructure-meeting-with-democrats

Donald Trump’s trillion-dollar infrastructure bill was obviously DOA from the moment he first announced it. His own party made it clear that they had no intention of spending a bunch of money on infrastructure, and it would have been a debacle if he’d sent an actual plan to Congress. On the other hand, he had promised infrastructure and Democrats were playing along. What to do? Easy! Make up some whiny nonsense about how Democrats are being mean:

President Trump abruptly ended a meeting with Democratic leaders on Wednesday, saying he was unable to work with them on legislation following comments by House Speaker Nancy Pelosi (D-Calif.) that he was “engaged in a coverup.” Trump made an unscheduled appearance in the Rose Garden shortly afterward and in a meandering 10-minute address said he had left the meeting with Pelosi and Senate Minority Leader Charles E. Schumer (D-N.Y.) at which they were supposed to talk about working together on a $2 billion infrastructure plan. “Instead of walking in happily to a meeting, I walk in to look at people who said I was doing a coverup,” Trump said, adding that he can’t work on infrastructure “under these circumstances.”

******

Maybe the White House staff should change the Baby in Chief’s diaper. How weak. How whiny. But he is our President unfortunately.

In describing the mammal co-opting the title of “commander in chief”, one might even use the word “snowflake”. Or is the VSG a strange hybrid of the snowflake, an “orangeflake”???

Baby donnie probably does need a new diaper. He’s the weakest president we have had since I have been paying any attention. Once he’s out of office, he will be remembered in the same way Rutherford B. Hayes isn’t remembered. Does the Navy even name small rowboats after President Hayes? You can be sure there will never be a Trump airport.

@Willie

When I was in grade school, on the playground, peers who acted like donald trump does were referred to as “a chickenshit”. I heard donald trump enjoys being vulgar to his White House staff 24/7, so he might enjoy that nickname.

Willie Hayes wasn’t much of a president, but he did serve with distinction in the Civil War. His bravery caught the attention of Gen. Grant. He retired as a brevet major general. Trump risked STDs instead of Vietnam.

Maybe Hayes wasn’t the best example to use when considering his personal qualities. I’m not sure if there’s anybody who is precedent for Trump. History sure won’t be kind to him.

Teddy Roosevelt used to speak softly but carry a big stick. Trump? He speaks loudly and has a really tiny stick!

Stormy Daniels nickname for Trump is the minute man.

Or was that the mushroom man?!

https://youtu.be/lNy948H2ta4?t=28

Ouch! Pelosi suggests Trump lacks “confidence” to work on an infrastructure deal. Trump indeed is a very weak person!

https://talkingpointsmemo.com/news/pelosi-infrastructure-trump

I looked at a bunch of states from 1990 to date. Manufacturing employment is down in all of the midwest, and in “new auto” industry states including Alabama, Kentucky and South Carolina. California was down. I think the only states that were up over the full time period were Utah and one of the Dakotas. The long run secular trend towards declining employment in manufacturing stands out – productivity rises faster than demand, as in agriculture. The last time I checked manufacturing employment had been falling for a few years in China, too. I assume the same is true of Europe as a whole, and most individual countries, as well as Canada.

Professor Smitka,

I am just an edX MOOC student in introductory economics, but very interested. (I am a long-time agricultural research technician in Georgia.)

In April, I watched the “Integration or Disintegration? The Future of Global Governance and the Global Economy” symposium videos posted by Professor Chinn. I thought that manufacturing employment/productivity/output presentation by Dr. Levy was fascinating.

Last year, I took the MOOC Justice class by Professor Michael Sandel. I watched one of Professor Sandel’s video’s on Youtube where he had one group of Trump voters and one group not-so-much Trump. It never occurred to anyone in either group to look at the observed long-term data on manufacturing productivity/output. I thought the malaise of the Trump supporter group surprised and got the better of the not-so-much Trump group.

Now that I am aware of the long-term manufacturing productivity/employment data, I still do not know how to respond to the malaise of the Trump supporter group. I would guess education/training in other subjects and/or relocation to areas with higher employment demand? Use the long-term observed data at FRED to find areas with increasing/higher demand for employment?

Your post guided me to think about global manufacturing productivity. Thank you very much for the post.

Incidentally, today, I was talking with a post-doc in remote sensing applications in agriculture. They are looking at using drones to locate areas to target insect control. They are also thinking about using drones to deliver insecticides to the target areas. Other applications are soil moisture, etc.

Cheers,

Frank

Frank: Labor productivity has been rising in the entire nonfarm business sector. But real wages have not been rising as quickly. The fact they have not suggests that (in the absence of severe and persistent measurement error) significant monopsony power exists. Antimonopoly measures and pro-labor (maybe even pro-union) policies might then be a way of redressing the imbalance.

Professor Chinn,

Thank you very much for your answer and guidance.

I did some reading on real wages and productivity.

I did find a graph of farm v nonfarm productivity. In the 2006 Economic Report of the President, on page 175, from 1950 to 2006, farm productivity is noticeably higher than nonfarm productivity.

https://www.govinfo.gov/content/pkg/ERP-2006/pdf/ERP-2006.pdf

From my readings, I think the takeaway was real wages have been lagging for decades and it may take decades for real wages to catch up. There appears to be no quick fixes.

Cheers,

Frank

Here’s some more bad news for a Midwest major industry. https://downloads.usda.library.cornell.edu/usda-esmis/files/8336h188j/kp78gr86b/m326mb15n/prog2119.pdf

It’s starting to get late in the planting season. Not too late yet, but late enough for harvest predictions to reach questionable territory.

Corn planted by this time: 49% Average of 2014-18 80%.

Soybeans planted by this time: 19% Average of 2014-18 47%.

Soybeans emerged by this time: 5% Average of 2014-18 17%

Anyone still believing that weather plays no impact on price, or that warming is the major cause of crop harvest reductions is just as dumb as AOC.

Please hope for a warm and extended Fall, but indications are that we could have turned the corner to another long term temperature down turn. LIA, again? Let’s hope not.

WTF? Your statistics show supply is low now. FYI CoRev if this were a weather related inward shift of the supply CURVE, that would increase market prices.

Of course you present no weather information. Could this be a movement ALONG a supply curve? I think so. Repeat after me – low prices have induced farmers to plant less.

You see how easy this gets if you bothered to learn Econ 101. Of course getting the basics right means your usual BS is shown to be what it is – BS.

Hey keep the data coming. It does not mean what you think it means but it does explain why the other preK kids laugh at you all day long!

Pgl, again you embarrass yourself. Clearly you don’t understand the difference between planting and harvest in agriculture. You: “FYI CoRev if this were a weather related inward shift of the supply CURVE, that would increase market prices.” Without HARVEST there is not supply, and the entire process is impacted by weather, as shown here at the planting, but also while growing and at harvest.

Perhaps you don’t understand, being an AOC advocate and with similar understanding of nature, that being late in emerging “Soybeans emerged by this time: 5% Average of 2014-18 17%” is nearly always due to weather and almost never due to planting decisions. Perhaps you also never consider weather outside NYC, and missed the fact of the late Spring snows, the Spring flooding, and heavy rains in those states reported by the USDA. But being someone who also may not have used a garbage disposal and not know that things are grown in the ground, as AOC, it’s possible you just didn’t know these fundamental considerations.

Of course those of us who have read your ignorant comments, did know the its depth.

Repeat after me: In agriculture supply (and delivery) occur after harvest.

“warming is the major cause of crop harvest reductions is just as dumb as AOC.”

LOL! AOC goes understand global warming. CoRev tries to deny it.

Another edition of CoRev opening mouth and inserting foot.

CoRev No question that it’s getting late in the planting season. Fields are wet and soils are cold. And the deadline for insurance is only a week or so away. It’s crunch time.

Anyone still believing that weather plays no impact on price

Once again you’re arguing with a strawman. No one ever said weather doesn’t play a role in prices, but this year’s weather has nothing to do with last year’s prices. The effect of this year’s bad weather will tend to put upward pressure on prices.

or that warming is the major cause of crop harvest reductions

Huh? So a warm Pacific ocean plays no role in how much rainfall the upper Midwest gets in the spring???

we could have turned the corner to another long term temperature down turn.

You’ve been saying this every year for as long as I can remember.

“No one ever said weather doesn’t play a role in prices, but this year’s weather has nothing to do with last year’s prices. The effect of this year’s bad weather will tend to put upward pressure on prices.”

Yep – CoRev not only gets the sign wrong but also the timing.

We have asked him to write down his model but that request went straight over his head!

Why Trump’s new $16B farmer bailout could hurt agriculture

https://www.politico.com/story/2019/05/23/trump-farmer-bailout-trade-usda-1459840

“President Donald Trump’s snap decision to send billions of dollars in new aid to farmers could be bad for the farm economy and the federal budget. Many farmers are still deciding what to plant this spring and could be swayed toward crops that receive higher payouts from the aid package, such as soybeans. That would add to already record supplies and further depress prices that have been falling for five years.”

I guess this White House is confused on farmer incentives because Kudlow has been using the CoRev “model”. But wait a White House photo-opp!

“Farm groups are headed to the White House on Thursday afternoon to join Trump as he announces a $16 billion boost for agriculture. The American Farm Bureau Federation and groups representing soybean, corn, wheat and pork producers are expected to attend, as well as lawmakers including Sen. John Hoeven (R-N.D.), who has worked closely with the administration on the aid package. “We want to make sure that the farmers are being protected as we go through the process of negotiating new trade deals,” White House press secretary Sarah Huckabee Sanders said Wednesday outside the White House.”

OK! Now that the Baby in Chief has shelved infrastructure investment because Pelosi is a meanie – why not have welfare checks for the farmers your trade policy screwed?!

“Some farmers recognize the disparity, and stress that they would prefer to have open access to markets. “We prefer that over a check from the government,” said Mark Watne, president of the North Dakota Farmers Union. “But right now, our own government is making our demand go down. We can’t control that.”

That’s right – these hard working farmers want free trade not government aid.

“Why Trump’s new $16B farmer bailout could hurt agriculture”

who cares, as long at that $16B buys the vote for trump. who knew conservatives were closet socialists!

2slugs, tell pgl: ” Fields are wet and soils are cold. And the deadline for insurance is only a week or so away. It’s crunch time.”

Actually yous claimed: “No one ever said weather doesn’t play a role in prices,… ”

And how can you justify these tow phrases? “…but this year’s weather has nothing to do with last year’s prices. The effect of this year’s bad weather will tend to put upward pressure on prices.

I let the other incidence of this misunderstanding when you made the claim, but you have now doubled down on your original ignorance.

And this comment is also ludicrous: “Huh? So a warm Pacific ocean plays no role in how much rainfall the upper Midwest gets in the spring??? ” it might, but this Spring it has also brought the rain, very cold temperatures, snow and delayed planting season we are now experiencing in those selected states. Are you competing with pgl for who can be most ignorant?

You remind us: “You’ve been saying this every year for as long as I can remember.” And will continue to do so as the evidence increases. These changes are best observed at millennial metrics. After all you (y’all) are concerned over average changes that oscillate within 1-2C degrees over the past 3 centuries plus. All the while the millennial temperatures are slowly falling as we approach the next glaciation, and you deny the existence of the LIA while focusing only on the short term fractional rise and that these falling millennial temperatures are occurring.

CoRev Not being snarky (honest!), but I genuinely do not understand what you’re trying to say here. Prices for both corn and soybeans are depressed. It appears that farmers have decided to slightly reduce soybean acres and slightly increase corn. That decision was mainly attributable to the ongoing Chinese tariffs; however, we’re talking about marginal changes in planned soybean acreage. Farmers are hit with three problems. On the one hand they have the Chinese tariffs, which are pushing soybean prices down. OTOH, they have the bad weather, which exerts upward pressure on soybeans. On Harry Truman’s famous third hand, they have a lot of carryover from last year, which is putting downward pressure on prices. The first and third problems were recognized long ago; it’s the weather problem that was unanticipated in late winter/early spring. I don’t think any of that is controversial.

Your second paragraph confuses local or regional weather with global warming. The fact that it has been cold and wet in the corn and soybean belt is not evidence against global warming. The key is in the name…global warming is global, not regional. A warm Pacific Ocean brings a lot of moisture to the Midwest during the winter and spring, as it did this year. Snow on the ground deep into April kept soil temperatures cold as well.

And no one denies that there was a LIA a few hundred years ago. So what?

The 2slugs says: “Prices for both corn and soybeans are depressed.” Compared to what: historically (year/decade(s), the start of China’s tariffs, a specific/latest weather event, or the latest USDA Report? Time frame and SEASON are always important when comparing agriculture commodity prices. Even you noted the annual fluctuations.

This comment just amazed me: “… it’s the weather problem that was unanticipated in late winter/early spring. I don’t think any of that is controversial.” Weather impact was my point from the very beginning of these soybean discussions. After a year and now a very bad Spring planting season, you (and your cohort with the exception of pgl) recognize that weather can be a problem. Even you recognize: “OTOH, they have the bad weather, which exerts upward pressure on soybeans.” on both the existing and the future supply.

Your 2nd paragraph also misunderstands that crops are impacted by local and regional change,. Global climate is just the accumulation of these LOCAL and REGIONAL climates.

You also need to understand weather better. “A warm Pacific Ocean brings a lot of moisture to the Midwest during the winter and spring, as it did this year. ” It was a large persistent Pacific high pressure area that brought the warmer, near equatorial temperatures, up to near the Arctic Circle and then brought those cold Arctic Circle temperatures and late season snows south. It has moved north and south. Its moves south also caused weather changes along the West coast and into the mountains with record snows. It’s weather not Global Climate Change.

You denied that there was a GLOBAL LIA and limited it to Europe, even though it was obvious even within our US historical records. since evidence has been shown it on EVERY continent.

You’ve been all over the place on the fundamentals both the Ag and warming issues.

CoRev I think you’re confused.

Compared to what: historically (year/decade(s), the start of China’s tariffs, a specific/latest weather event, or the latest USDA Report?

Over the last five years. Even in nominal terms soybeans are at a low point, and corn is also at a low point in real terms.

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

https://www.macrotrends.net/2532/corn-prices-historical-chart-data

You’re just a hobby farmer. You should listen to what real row crop farmers are saying about soybean prices. The tariffs depressed last year’s prices, so they took the advice of some of their brokers and stored crops. Then bad spring weather damaged a lot of those stored crops. Now they can’t plant because the fields are cold and wet. The good news is that this will help support soybean prices. The bad news is that it will only help those farmers who are able to put seed in the ground.

Weather impact was my point from the very beginning of these soybean discussions.

Weather was not a factor causing soybean prices to collapse last summer. In fact, the concern was that soybean yields would be relatively low, which tended to put upward pressure on prices. The big story last year was the tariffs, not weather. This year is not last year. Fields are very wet and the soybean crop looks to be a bust. That will put upward pressure on prices, but even with that upward pressure soybean prices and the good news on NAFTA 1.01, soybean prices have remained relatively low. For example, today’s average cash price in Iowa was up 8 to 9 cents, but was still only $7.49/bushel. It’s still the case that the big elephant in the room remains the tariffs.

Its moves south also caused weather changes along the West coast and into the mountains with record snows. It’s weather not Global Climate Change.

What was the source of the energy needed to move that evaporated water?

You denied that there was a GLOBAL LIA and limited it to Europe

No, I’ve been very skeptical about the medieval warming period being global and as warm as you seem to believe.

2slugs, I’m not at all confused. I asked to what you were comparing, and you answered: “Over the last five years. Even in nominal terms soybeans are at a low point, and corn is also at a low point in real terms.” That means that the tariffs were not the cause for 5 years of diminished prices.

Remember our discussion about insurance? There is an option for NOT PLANTING. Some farmers have been forced to take out that option. A recent WSJ article discussed an upper Midwest soybean (row farmer), and he said that his break even price was $8.80/bu. Today’s spot price was $8.29/bu. If he sold today and collected his subsidy, he would be made good. If he was one who lost his stored beans to flooding his insurance would pay for it. That’s the way row crop farmers must think in today’s farming markets, but this has been so for several decades now.

You asked: “What was the source of the energy needed to move that evaporated water?” Did you NOT read or understand it was a persistent Pacific high pressure system? You need to do a little research to learn how they are formed. They are usually moved by countervailing pressure systems. Highs can block and lows can cause movement. You’re clearly out of depth here.

You are right about my position of your LIA/MWP comments. Regardless, the MWP has also been shown on nearly every continent.

I’m done with taking this off point.

CoRev,

The lack of planting may be partly due to the low prices, but is certainly at least partly due to the weather. As it is, the role of weather can be seen in that last number compared to the first two, the much lower rate of soybeans emerging.

OTOH, global warming is widely seen to be tied to these sorts of bad weather conditions, and, btw, I do not think anybody here ever said weather is unimportant for prices. Indeed, weather reports are the most common mover of prices, but as noted pgl has noted, weather-induced supply shortages should be pushing prices up, which does not seem to be happening particularly.

Barkley now claims: “OTOH, global warming is widely seen to be tied to these sorts of bad weather conditions, and, btw, I do not think anybody here ever said weather is unimportant for prices. Indeed, weather reports are the most common mover of prices,…” Really, then why all the argumentation since last year?

I have admitted from the beginning that the tariffs have lowered prices. Recently I explained its effect was to set a new (lower) plateau price. Even that admission was questioned. Pgl claimed: “…FYI CoRev if this were a weather related inward shift of the supply CURVE, that would increase market prices.” What I see is upward price pressures of 7+% for yesterday’s July 19 to 5/20 prices, $8.215 to $8.80. Yes, pgl is wrong again.

Barkley, 2slugs, baffled, pgl and menzie, this is the origination of my comment re: weather and farming/soybeans:

”

CoRev

June 13, 2018 at 2:30 pm

Menzie, please quit mis-applying Economics issues over agricultural or any other industry. Instead of what would be the profits that might have been have been provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand.

Ag especially is dominated by weather (world-wide) and area planted. Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage. For the Farmer one severe storm, early or late frost, too much rain, too little rain, rain at the wrong time, fire, etc. can wipe out a year’s worth of work. Only after the crop is being harvested or in planning what to plant can the farmer really worry about prices.

There’s far more to discuss on the ag business/trade barriers issue, but economics is only the heart of discussions on blogs like this. You want a proper comparison? Pshaw, only in the blinkered econ environment is it econ-centrist. Before someone makes a snide comment again about this being an econ blog, the subject is actually political.

I think this kind of point is what i was trying to make in my comparison of Micro/Macro econ. But that’s just me another boy raised in farming country with farmers throughout the family.”

Barkley claims another untruth: “OTOH, global warming is widely seen to be tied to these sorts of bad weather conditions, and, btw, I do not think anybody here ever said weather is unimportant for prices.” Climate is tied to all weather conditions! Only the catastrophists focus on BAD weather to the point they exaggerate its impacts. Catastrophists never even acknowledge that there are benefits to some warming, added moisture and added atmospheric CO2. They also fail to acknowledge that there have been reductions in what are considered bad weather or weather effects.

IT IS COLD THAT IS THE CLIMATE PROBLEM. Look at this Spring! Warming is overwhelmingly beneficial.

Repeating using a farmer view: “Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage.” In my area of smaller farms there are many who chose to NOT HARVEST soybeans last Fall because of harvest costs. They, this Spring, just disked (using a disc harrow) them under this Spring and planted some other crop .

If you do not think anybody here ever said weather is unimportant for prices, then your memory is faulty. look through pgl’s comments.

All the terrible weather in “fly over” country this year is not due to climate change.

Rather,it is God punishing them for voting for Trump.

But it will kill the soybean crop so CoRev’s hope for higher prices might pan out. Of course the Midwest farmers will not reap the benefits of higher prices when their crop is destroyed. No – Brazilian farmers will reap the gains.

Make Brazil Great Again!

@spencer

I’m assuming you’re semi-mocking the evangelicals in the south who voted for donald trump in droves (or mocking their behavior rather)?? I’m so sick of some “Christians” saying “”event X or “circumstance X” is God punishing people. I guess they’ve never read about John the Baptist (what a sweet ending there, eh??), the end of the disciples’ lives, and the list goes on and on and on. One would think they’ve never actually read the Bible (another example of people who can probably “read” but in fact are functionally illiterate). It’s like the KKK member who never registers the fact that nearly every major character in the Bible is Jewish, Jesus was Jewish, Mary was Jewish, Joseph was Jewish. All 12 disciples were Jews, but the only one the racists can remember was Jewish was Judas. I guess they think the other 11 originated from the sticks of Alabama.

When the people I grew up with in rural Ky & Tenn said the Jews killed Christ I would ask them isn’t that what God wanted them to do.

Never got a good reply to that.

So these discussions have bounced back and forth between the effects of the tariffs on agriculture and manufacturing. The plight of the poor Iowa farmer has been much discussed and gets a lot of media attention. But it turns out that according to the BEA 2018:Q4 state GDP data, agriculture only accounts for about 3.5% of Iowa’s state GDP, whereas manufacturing accounts for 19.2%.

I knew that number was wider than most people thought but that even surprised me a little I have to say.

Iowa’s public school system and Universities are some of the most high ranking in the nation. That attracts not only jobs, but quality jobs, which is a lesson states such as Oklahoma, Louisiana, Mississippi, Alabama, Kentucky etc can never seem to learn. The governors of those states with crappy public schools run around bragging about a “low unemployment rate”. OK, but how many of those “employed” can pay their rent and car payments?? Of course if we pay them a living wage that means they aren’t going to be getting car loans at 19% interest and a credit card to charge living expenses on at 25% interest that they can never even pay the principal on. And then what would bankers like Jamie Dimon do to convince us that, he’s, like, a “genius” and stuff?? Frightening to imagine. Dimon might actually have to learn to WORK.