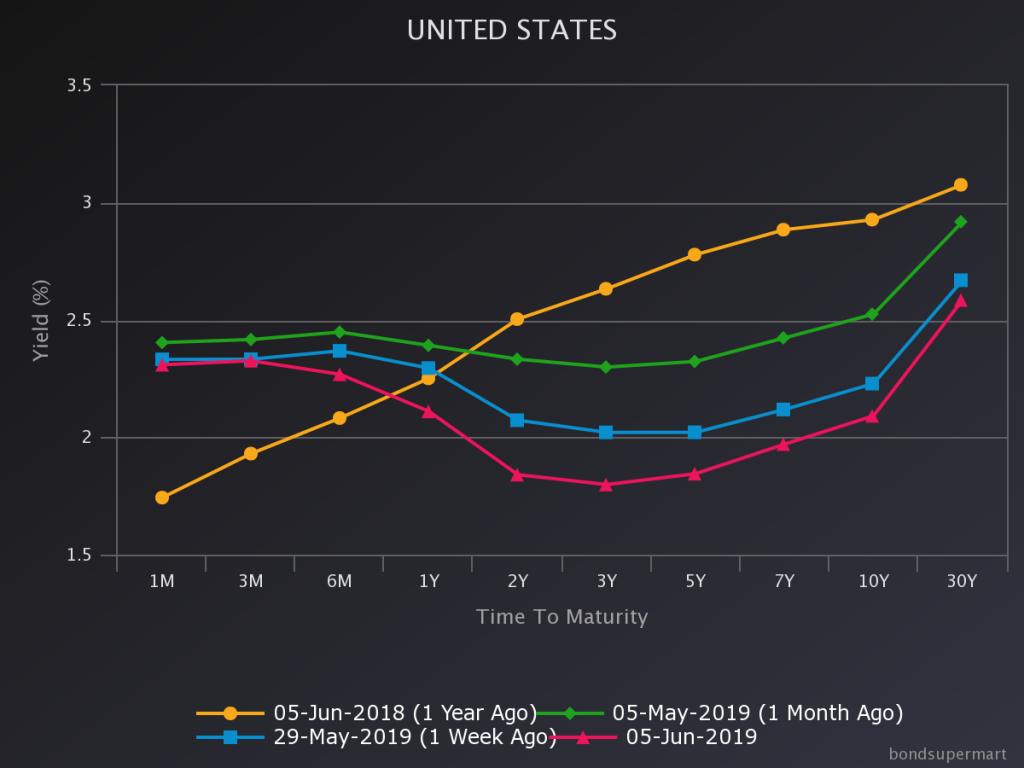

Spreads relative to 3 months continue to decline.

Source: BondSuperMart.com. On the run yields.

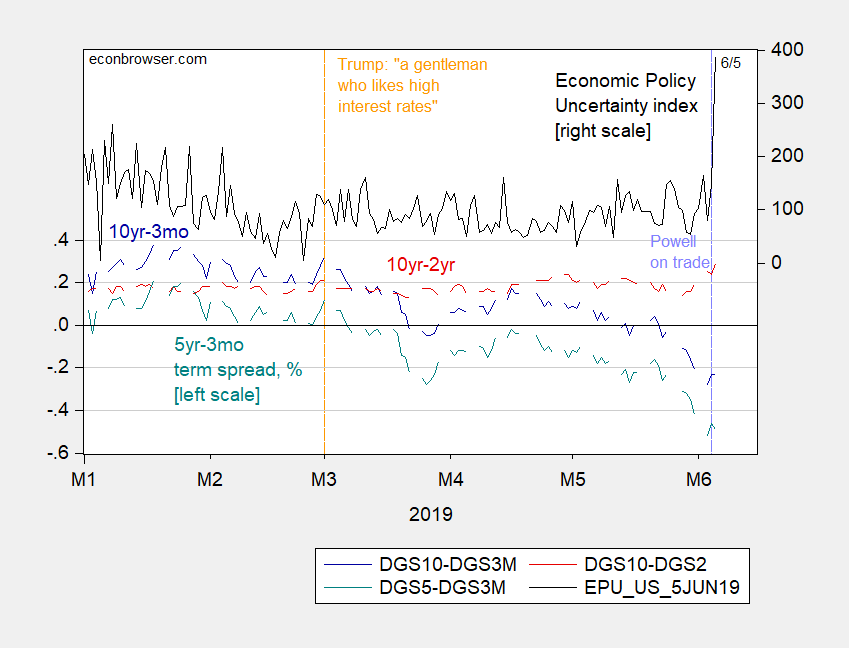

In other words, despite interruptions, key term spreads are declinining even as economic policy uncertainty increases (constant maturity yields):

Figure 1: Treasury 10yr-3mo spread (blue, left scale), 10yr-2yr (red, left scale), 5yr-3mo (teal, left scale), in %; and Economic Policy Uncertainty index (black, right scale). Source: Fed via FRED, US Treasury, and policyuncertainty.com, accessed 6/5/2019.

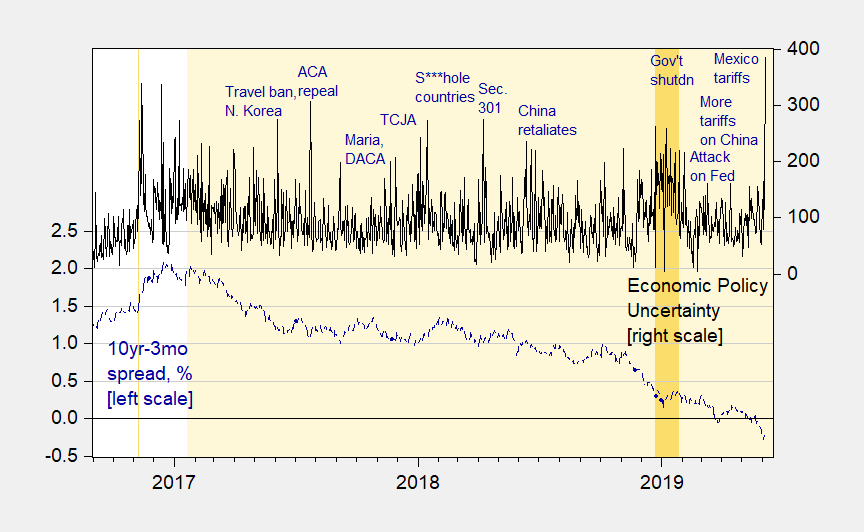

A longer term perspective highlights the inexorable nature of the term spread evolution.

Figure 2: Treasury 10yr-3mo spread (blue, left scale), in %; and Economic Policy Uncertainty index (black, right scale). Source: Fed via FRED, US Treasury, and policyuncertainty.com, accessed 6/5/2019.

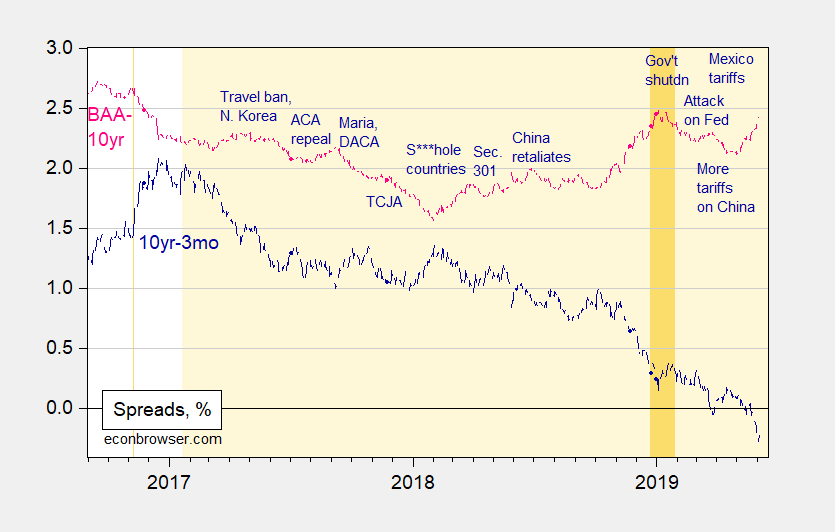

Is uncertainty being manifested in higher risk? One way to assess risk is by looking at credit spreads.

Figure 3: Treasury 10yr-3mo spread (blue), and Moody’s Baa corporate bond yield minus 10 year Treasury yield (pink), in %. Source: Fed via FRED, US Treasury, and Moody’s via FREDb, accessed 6/5/2019.

The Baa-10 year spread is an imperfect measure (see Gilchrist and Zakrajsek for better measures), but it’s easily accessible. As the term spread has declined, the credit spread has increased since the about March 2018, as the Trump administration declared protectionist measures. The trends — down and up — steepened starting in September 2018.

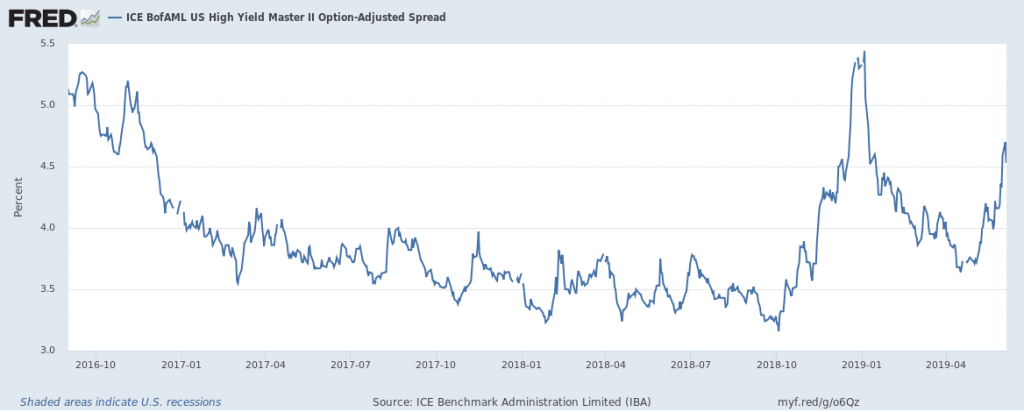

For full measure, here’s a proxy for below-investment-grade bond credit spreads, adjusting for maturities.

Figure 4: ICE BofAML High Yield Master II Option Adjusted Spread, in %. Source: FRED, accessed 6/5/2019.

What to make of all these spreads. I don’t know — but Miller (2019) does suggest something. Unfortunately, he does not provide the recession probability associated with “the best” model at, say, one year horizon.

I was looking for a good excuse to post this, although I have to shamefully confess I haven’t finished reading it yet. The starting pages are quite good. It is a “working” paper and therefor I assume not finalized. She is extremely sharp, so I doubt there are many errors, if any.

https://scholar.harvard.edu/files/CGNT_0.pdf

The much more user friendly version, with easy to read charts is here:

https://blogs.imf.org/2019/05/23/the-impact-of-us-china-trade-tensions/

Does anyone else have any short daydreams about “if I was President of America I would……” or am I the only infantile adult who does this once a month or so?? I sometimes think of who would be on my “CEA” or “NEC”. I have stated before Menzie would be a slam dunk. This lady would be as well if I had to hand her a big fancy title to snag her from the IMF. I don’t know how Treasury Secretary of the U.S. compares to IMF Director of Research status-wise, but I think we would get creative to have the best talent working for America and she is what I think of when I think “best talent”.

“We use data collected at the border and at retailers to characterize the impact of recent changes in US trade policy on importers, consumers, and exporters. We start by studying the tariffs on imports of steel and Chinese goods that were imposed during 2018. We find little difference in the “at-the-dock” ex-tariff price levels and stickiness for otherwise equivalent goods that were affected and not affected. This nearly complete passthrough of tariffs to the total price paid by importers suggests the tariff incidence has fallen largely on the US. We simultaneously estimate exchange rate passthrough and find the response to be far more muted. Next, in-progress analyses of retail prices preliminarily show more heterogeneity, with the higher cost of imports passed through to consumers for some goods, such as washing machines, but absorbed by lower retailer profit margins for others, such as many from China. Finally, in contrast to imports, US exports subjected to retaliatory tariffs exhibited declines in their ex-tariff prices relative to equivalent but non-targeted goods.”

Shorter version – Trump is lying about who is paying these tariffs.

Thanks for noting the David Miller paper. It references Recession Risk and the Excess Bond Premium by Giovanni Favara, Simon Gilchrist, Kurt F. Lewis, and Egon Zakrajšek. They reference this classic:

Bernanke, Ben, Mark Gertler, and Simon Gilchrist. 1999. “The Financial Accelerator in a Quantitative Business Cycle Framework.” In Handbook of Macroeconomics, eds. Michael Woodford and John Taylor, 1341-1393.

Bernanke pioneered this credit spread explanation noting how the spread between the Baa rate and the long-term government bond yield spiked during the Great Depression days. Note it also spiked in late 2008.

Dear Folks,

I’m not denying these recession indicators. But isn’t it reasonable to assume that there will be a big defense spending plan, conveniently announced at the appropriate time before the election, so as to override them?

Julian

Julian Silk: Seems reasonable. But there can be offsetting effects, if the defense spending spike comes at the same time as a supply shock, e.g., Straits of Hormuz blockage.

Dear Menzie and Folks,

I grant Menzie’s point entirely. But I have always wondered whether there was some sort of numerical value to the credit spread difference, in that, say, commercial paper – T Bill rate was somehow numerically related to the length or amplitude of the ensuing recession, or whether it was just a qualitative indicator.

Julian

Defense spending has a lousy multiplier, so it doesn’t stimulate the economy much. Infrastructure isn’t so good anymore because it’s become so capital-intensive. The best economic stimuli are social programs and tax cuts for lower-income people. Don’t expect either of those from this administration.

Fair Economist I haven’t read your link, but I’m skeptical of papers that claim defense spending has a low multiplier. You can make a good case that defense spending isn’t a very good way to increase employment, and you can make a very good case that the multiplier for defense spending is likely to kick in at exactly the wrong time, and you can make a good case that defense spending hurts the economy’s supply side efficiency; but a bump in aggregate demand is pretty much of a bump in aggregate demand. It soaks up at least the same amount of excess saving and probably more because defense spending isn’t as vulnerable to import leakage. I’ve found that a lot of these studies misunderstand how the NIPA data records defense spending. The stimulative effect is when the defense contractor initiates bank loans, orders materials and hires labor; it is not when the final product is produced and the Defense Finance & Accounting System issues a Treasury check to the contractor, which is when it is recorded for NIPA. By that time all of the economic activity has already happened. I did see where your link mentioned “news event” studies and listed a well known study by Ramey. As it happens, I know quite a bit about the actual history of some of those “news event” shocks. For example, Ramey discusses the effect of the increase in Vietnam spending. The public news sources she cites all talked up rumors about a very huge increase in August 1967, so we would have expected a positive shock in GDP from that news event. However, it turns out that internal “close hold’ DoD documents from 1966/1967 reveal that the actual budget submission that was percolating up the chain for congressional approval was fair less than DoD was thinking about 6 months earlier. So it really all depends upon which news source you look at. If you looked at mainstream public news sources (as identified by Ramey), then the expectation in August 1967 was an enormous increase. But if you were a DoD insider or contractor with insider knowledge, then you would have seen the August 1967 DoD news as a big let down. In fact, the budget request increase was so much smaller than originally expected by DoD insiders that DoD had to let a contract with MIT to develop a model to estimate the negative effect on weapon system readiness. There are a lot of those examples, so I’ve never found those stories about weak fiscal multipliers entirely convincing. It’s a lot more complicated than a lot of studies assume…especially Barro’s exceptionally poor analysis.

2slugs,

I do not think defense spending is very good for the longer economy. It does great things locally like almost any pork barrel. I have not seen nor really looked about for estimates of multiplier due to defense spending.

I agree with Eisenhower and Seymour Melman (earlier Frederic Bastiat) that there are often better “investments?

I feel I must comment on the timing of effects from an “increase in defense spending”. If Trump gets away with selling smart munitions etc for the GCC “emergency”, i.e. running out of smart bomb guidance kits to terrorize Yemenis it will be from inventories. The employment impact would be on replenishing stores which will lag several quarters to be seen as activity in GDP. The firms making the inventory will raise cash etc. and employ resources real time.

As to surge in defense spending::

https://en.wikipedia.org/wiki/Military_budget_of_the_United_States

See the charts on “part of GDP” and “real spending”. The effect of sequestration was to slow defense spending growth to less than GDP/…….

Things and operations for defense are far more costly than during the cold war.

https://www.eia.gov/petroleum/supply/weekly/pdf/table1.pdf

Net petroleum imports ticked up a bit on 31 May report week over week but down year over year.

Dear Fair,

It does indeed have a weak multiplier, but but even something with a weak multiplier can have an effect if the initial spending is big enough. To me, come serious indications of a recession, and you will see an announcement of a trillion-dollar increase in defense spending, budget deficits be damned.

J.

P.S. To 2Slugbaits, I hate to agree with Fair Economist on this, and sympathize with what you are writing. But the problem with the multiplier for defense spending is that much of the defense spending is on extremely high-tech stuff, like radar-jamming systems for F-35s or what have you. This conflicts with the demand for the scientists who are developing the electronics in other areas, so there is some interference with what should be a good multiplier otherwise. There is a confidentiality agreement that applies to this, but you may assume that we had to deal with this sort of problem elsewhere.

Julian Silk

Look at the OMB subfunction tables for defense spending. About two-thirds goes to military pay and operations & maintenance. Of course, some spending goes to high tech stuff, but unless there is some way for that higher spending to leak out of the economy, that higher spending has to end up somewhere. An F-35 engineer gets a pay raise as a result of more high tech spending. That engineer then spends that higher income on dinner & a movie (hopefully with his wife), or he buys a gas guzzler truck, or whatever. Now if you showed that high tech engineers have an unusually low MPC and save more of their increased income, then you could make a good case that high tech military procurement spending doesn’t have a strong multiplier. But that’s true of any occupation involving high tech skills be they military or civilian. When you just look at the basic Keynesian aggregate demand fiscal multiplier, there is no special variable for defense spending; it’s just the change in “G”.

I think part of the problem is in how we’re identifying a fiscal multiplier. When we measure it we tend to measure the change in GDP because that’s directly observable. But in the old school Keynesian textbooks that’s not quite how the fiscal multiplier is interpreted. I’m not an economist, but my understanding is that the fiscal multiplier was an aggregate demand concept, so a fiscal multiplier of 1.5 didn’t necessarily mean GDP increased by 1.5 multiplied times the change in government spending; but rather aggregate demand got a bump equal to 1.5 times the change in government spending. So if the aggregate supply curve is steeply vertical, then you would expect to see a higher price level but not much change in output. And here I’m assuming the naïve case in which the Fed doesn’t react to higher fiscal spending. The econometric problem is that we don’t actually observe anything called “aggregate demand” because that’s just a way of conceptualizing macroeconomics. In that sense I think there’s something of a parallel with the simultaneous equations bias in microeconomics if all you observe are changes in equilibrium and you don’t have an IV. An analogy would be to interpret the change in equilibrium sales as being due to a bigger advertising budget and call that an advertising multiplier.

And just to be clear, I’m not advocating military Keynesianism. Military spending is by and large wasteful and much of it hurts productivity, a few spectacular inventions notwithstanding.

I’m not trying to be nasty, but if you want to opine on the fiscal multipliers, why don’t you read the research? It’s so easy these days. Anecdotes mean almost nothing, as you correctly point out, which means if your opinion is based on anecdotes it’s not based on anything. Why would you be confident in it?

Dear Fair,

It does indeed have a weak multiplier, but but even something with a weak multiplier can have an effect if the initial spending is big enough. To me, come serious indications of a recession, and you will see an announcement of a trillion-dollar increase in defense spending, budget deficits be damned.

J.

Having been involved in DOD contracting as a civilian construction contractor, my take is that the announcement would have to happen very soon for the money to be in the system in time to have much of an effect before November 2020. It takes a while to get the projects cranked up, then it takes a while for the money to get paid out. Dumping money into a bunch of equipment runs into capacity problems, ratcheting up profits, perhaps, but not putting a whole lot into the economy in a timely manner.

We can assume that the administration intends to overpay for most everything. Trump has always overpaid for whatever it is he buys. That’s how he loses so much money. Unfortunately, it’s not his money this time, and the chances are that it won’t be timely anyway.

The big egomaniac in the White House seems determined to drive the US economy into recession. Just in time for the 2020 elections.

The US federal reserve must be extremely jealous and feeling very defensive. Historically, it has been the job of the FED to drive the US economy into recession.

When was the last time the President of the USA single-handedly (perhaps with help from the Senate) drove the US economy into recession?

Well, now Powell has come out and said that if Trump’s trade wars push the economy down too much, the Fed will consider lowering interest rates, which the inverted yield curve is already pressuring them to do anyway. That gave the stock market a nice boost, although that may be petering out now, and oil prices have been falling hard.

It seems like an obvious move by the Fed to lower interest rates enough to cancel an inverted curve. Besides it indicating the market thinks current rates are “too high”, it puts a lot of pressure on bank profits. It’s not like they need to rein in catastrophic inflation.

Most concerning is an inversion of the yield curve in an already low interest rate environment.

The term premium is a reflection of bond investors’ uncertainty about future short term rates. If they think short term rates are going up, the term premium and steepness of the yield curve will go up. If they think short term rates are headed down, the term premium and steepness of the yield curve will do down.

But there is an inherent asymmetry in these two risks. Interest rates can’t go below zero, but they can rise without limit. So if you average the expected return of these two risks, there is generally an upward slope to the yield curve.

But what does this asymmetry mean in a low interest rate environment? It means that the downside risk is even less than usual while the upside risk is still unlimited. This should make a yield inversion is even less likely. The fact that we are seeing a yield inversion in a low interest rate environment should be even more concerning than usual.

If the donald trump White House “worries” over undocumented workers is sincere and genuine why aren’t employers who hire illegals ever punished??

https://www.nytimes.com/2019/05/31/us/illegal-immigration-employers-prosecutions.html

That’s a question you’ll never hear Rand Paul, Mitch McConnell. Sensitive Stevie Mnuchin, Wilbur Ross, ICE bureaucrats, Iowa’s Steve King, Phony Fence Rider james Lankford, or Senator Inhofe EVER asking. Because those employers hiring illegals are white men crapping all over working families with no access to legal recompense. They love hurting people who are road fodder. But actually punish those white men who employ what they give lip-service to the white trash JBHs, Ed Hansons, and CoRevs that they detest, and they’re hiding in the Capitol building broom closet with Mitch McConnell.

https://youtu.be/Cms_Q1s5vx4?t=18

2slugbaits: Should anybody be using input-output model multipliers to decide anything? Seriously.

On the other hand, if the USA wishes to return to a state of autarky, then yes, IO multipliers will provide the necessary rhetoric to get you there.

Erik Poole Sorry, I’m not following you. I didn’t comment on IO models. I was simply pointing out that whether you regarded the August 1967 defense budget increase as a larger than expected shock or as a less than expected shock really depends upon your choice of news sources in your news event analysis. If you relied upon mainstream media, then the budget increase was a larger than expected positive shock. If you were a defense contractor with insider information back in February 1967, then the August 1967 spending increase was a lower than expected negative shock. Indeed, in this particular case the then Joint Chiefs of Staff referred to the “insider information” as the worst kept secret in the Building. Defense contractors already knew the magnitude of the increase.

2slugbaits:OK. So where did your “multiplier” come from? Or did you use the term “multiplier” by mistake?

Barkley Rosser: One of problems with modern central banks is the strong tendency to offset what some might see as political mistakes. Example: blowback to US Palestinian Mandate policy in the form of the Sept. 11th attacks and the resulting easy money policy following that. Moral hazard.

Any interest rate cuts in the USA will not materially offset Trump’s rather credible threats to blowup the global economy. There are limits to what monetary policy can accomplish.

Erik,

“US Palestinian Mandate policy”? Sorry, that was not on Osama bin Laden’s list of reasons for the attack. Israel’s invasion of Lebanon was on the list as was unhappiness over the presence of US troops, especially including women, in Saudi Arabia, the land of the Holy Shrines. He did mention broader Israeli policy in a 2002 fatwa after the fact, but that was near the bottom of a list 7 reasons that dragged in Somalia, India, Iraq, and quite a bit more, and even there did not specifically mention the Palestinians. They were way down the list and most certainly not the main reason for the attack. He was from Saudi Arabia and much more upset about the supposed desecrations there done by US troops.

Barkley,

I am familiar with that argument Barkley. Think I read it in an English-language North American newspaper.

From the wiki-page:

In his 1998 fatwa entitled, “Jihad Against Jews and Crusaders”[27] bin Laden identified three grievances against the U.S.:

“ First, for over seven years the United States has been occupying the lands of Islam in the holiest of places, the Arabian Peninsula, plundering its riches, dictating to its rulers, humiliating its people, terrorizing its neighbors, and turning its bases in the Peninsula into a spearhead through which to fight the neighboring Muslim peoples.

If some people have in the past argued about the fact of the occupation, all the people of the Peninsula have now acknowledged it. The best proof of this is the Americans’ continuing aggression against the Iraqi people using the Peninsula as a staging post, even though all its rulers are against their territories being used to that end, but they are helpless.

Second, despite the great devastation inflicted on the Iraqi people by the crusader-Zionist alliance, and despite the huge number of those killed, which has exceeded 1 million… despite all this, the Americans are once against trying to repeat the horrific massacres, as though they are not content with the protracted blockade imposed after the ferocious war or the fragmentation and devastation.

So here they come to annihilate what is left of this people and to humiliate their Muslim neighbors.

Third, if the Americans’ aims behind these wars are religious and economic, the aim is also to serve the Jews’ petty state and divert attention from its occupation of Jerusalem and murder of Muslims there. The best proof of this is their eagerness to destroy Iraq, the strongest neighboring Arab state, and their endeavor to fragment all the states of the region such as Iraq, Saudi Arabia, Egypt, and Sudan into paper statelets and through their disunion and weakness to guarantee Israel’s survival and the continuation of the brutal crusade occupation of the Peninsula. “