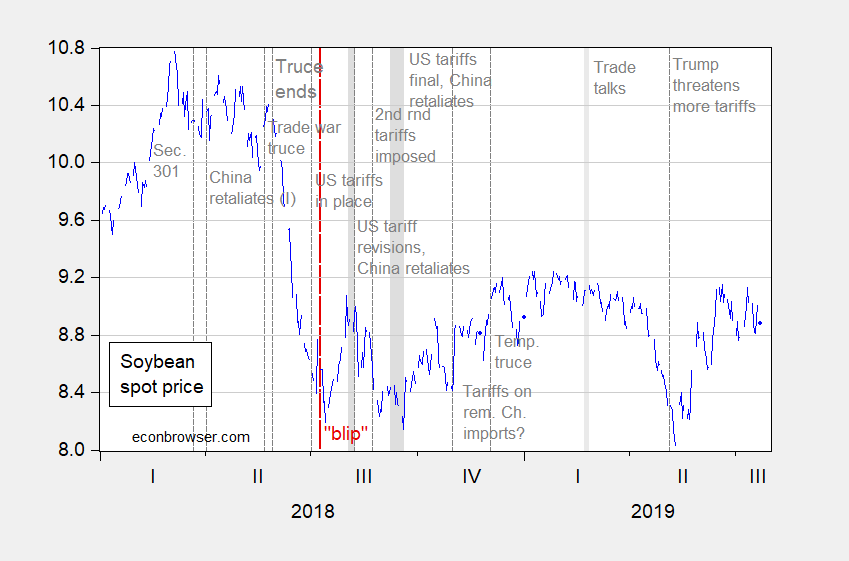

Figure 1: Soybean spot prices. Source: Macrotrends.com, accessed 7/23/2019.

Back on July 9th of last year, an Econbrowser reader wrote:

Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

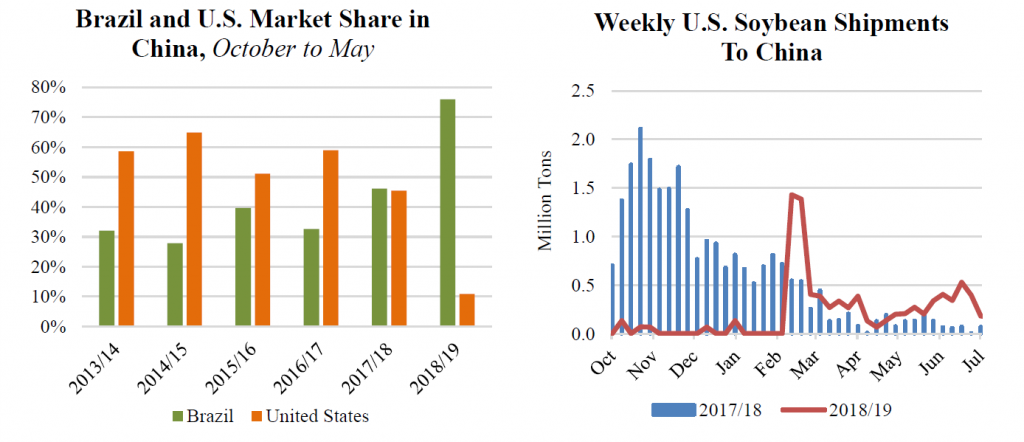

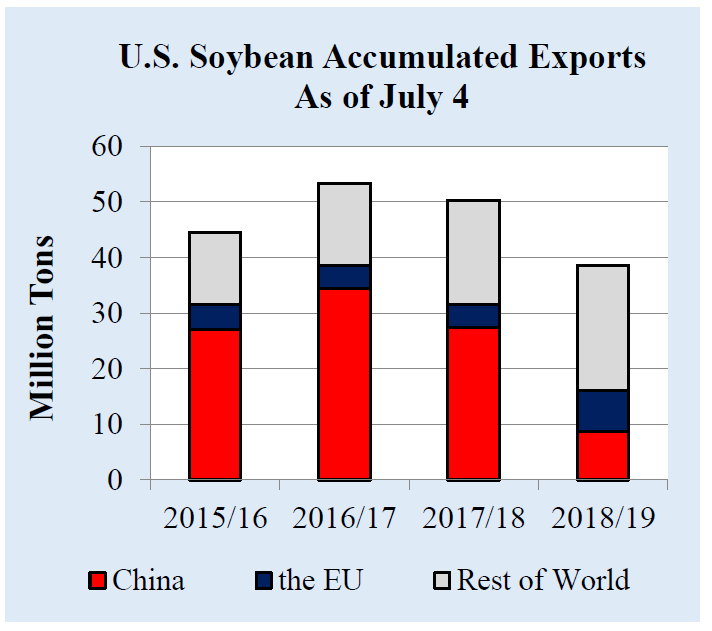

Needless to say, prices are not back to where they were in Sept-Nov 2017. Instead, Brazil has siezed market share and US soybean shipments to China have plummeted. From USDA FAS “Oilseeds”, on July 11th:

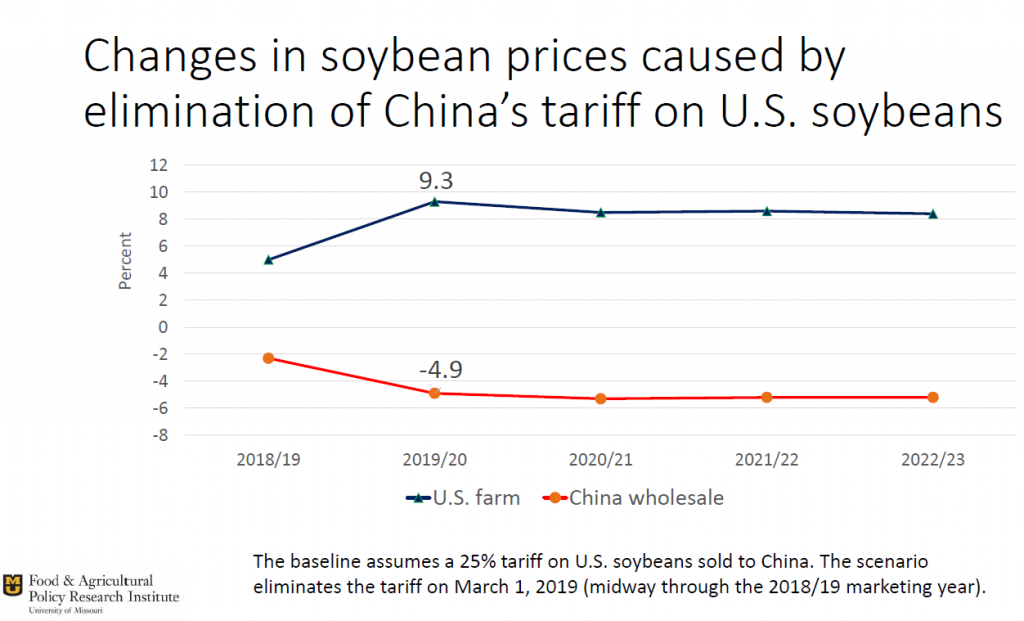

What would happen to prices for US soybeans if the tariffs were removed? A new study out of University of Missouri indicates a big price increase:

Source: Westhoff, et al. (2019).

So, one could appeal to economic modeling to figure out what will happen if we could get rid of the Chinese tariffs. Or one could have faith in the negotiating prowess of Mr. Trump.

Update, 7/25: Socialist publication Bloomberg has an article with this graph:

I guess the administration believes “the blip” will continue…

Trump doesn’t negotiate. He only defaults when he runs out of bluster. That’s been SOP since the early 1980s, and probably longer. He’s too old to learn new tricks, even if he was once capable of it at all. No worries. He will be out in January 2021, whether he accepts it or not. The fluke that was the Trump error will be over soon. That’s another fearless prediction. There’s more where it came from.

Trump is a proponent of brexit and Boris. Will he take credit for the crash in Britain and Europe, or come up with an excuse when things inevitably go south?

Go BoJo!

#ILikeMyBrexitHard

#MakeBritainGreatBritainAgain

Scotland should have divorced themselves from your racist English. Northern Ireland to reunited with the Republic. Rule Britannia – rule your pathetic little nation!

why does it not surprise me that if dick stryker is willing to undermine the usa, he would have no problem undermining the uk. dick stryker likes an old fashioned patriarchal society. ever hear those bojo comments about africa? no wonder dick is such a fan of the man.

https://cdn.cnn.com/cnnnext/dam/assets/160714160747-boris-on-africa-4-exlarge-169.jpg?fbclid=IwAR1vdLYr-TyHF3RhwhWBRjkfOe6AQnySZVcCVIUF7eAOvMs9BdIwjhGSUX4

and

https://cdn.cnn.com/cnnnext/dam/assets/160714160736-boris-on-africa-1-exlarge-169.jpg?fbclid=IwAR38L6MpxX5sa5a2kfgoAveGQD5yOVUHwTgCw7CwttIh8VuXWUimVhK7v00

I hate to say it, Willie, but do not be to sure about Trump being out of office. I do not want his reelection, but I did not want his election in the first place, and like now I always thought he had the chance to win. There have been reports in the last couple of days on how he could lose the popular vote by an even larger margin than he did in 2016, and even lose one of the states he won then, but still squeak through. He is near dead even in Wisconsin rigtht now.

It was a fearless prediction. Right now the economy is good. Trump’s approval numbers are mediocre at best, even though the economy is good. If the economy falls off at all, then his approval will go down again further. It will be close for a lot of reasons, but even without a full blown recession, I don’t expect reelection. You are right, though, anything can happen.

“So, one could appeal to economic modeling to figure out what will happen if we could get rid of the Chinese tariffs.”

We could appeal to economic modeling we know how this so enrages CoRev!

“Or one could have faith in the negotiating prowess of Mr. Trump.”

BAHAHAHAHA. Oh wait – CoRev does have this faith. Which is why we are all laughing. Not with CoRev. We are laughing AT CoRev!

Not to sound like a broken record, but I’m curious the timeline when Brazil could possibly permanently take a dominant share of world soybean markets (“dominance” here meaning a higher world % of the market than USA on a consistent year-to-year basis?? I mean, would there be a “Year X” in the future when at some point it wouldn’t matter if the MAGA tariffs were taken down, America would from then on be 2nd to Brazil?? I think it’s a fair question, and although maybe not a a “slam dunk” theoretically, still, very well within the “realm of possibility”.

Hope all the USA soybean farmers are enjoying this. Oh well, no worries “big government” welfare receiving farmers—your socialist welfare checks from “big government MAGA” USDA will will be arriving any moment now. Go run like the socialist welfare queens you are and see if your USDA socialist welfare deposit has arrived yet. You have direct blessings from CoRev, JBH, Ed Hanson, and “Princeton”Kopits that all of you soybean farmers are only “the most very efficient” of MAGA farmer welfare queens. In fact, “Princeton”Kopits (our resident “arbitrage expert”) and CoRev have both personally volunteered to pour holy water on your heads as you go to withdraw your USDA socialist farmer MAGA money from the bank.

Nice report by the two authors:

Bill George (202) 720-6234 Bill.George@fas.usda.gov

Elisa Loeser (202) 720-9459 Elisa.Loeser@fas.usda.gov

Oh wait Bill and Elisa appear to work in Washington, D.C. It seems that Trump has ordered all Ag Economists to live in Cincinnati. I guess Bill and Elisa will have to find some other line of employment. After all good economic analysis that shows up Donald J. Trump is unAmerican. Yes – fire all those traitors who do actual economic analysis! Make America White Again!

I think they are going to Kansas City, not Cincinnati, pgl.

Maybe but same point. If I had to choose – Cincinnati beats KC!

Close call, pgl.

which is the entire point of the move to begin with. punishment for the educated. lets reeducate the elites by immersing them with the peasants, cultural revolution style with down to the countryside effects.

I can’t say which would be better or worse. I haven’t been to KC. It might be a great city. What will be interesting is the long term unintended consequence of moving government agencies, especially research agencies that require highly educated people, to right wing states. It could make for some interesting cultural shifts in both directions

This video is 22 minutes long. These guys seem to know what they are talking about. [ shrugs ] Maybe they have CoRev on speed-dial.

https://www.youtube.com/watch?v=GewCbYWlnAY&t=1m26s

They start in on their price range forecast at around the 11:08 mark.

https://www.youtube.com/watch?v=GewCbYWlnAY&t=11m08s

And I thought you were previewing “Once Upon a Time in Hollywood”!

I like Tarantino, but you know what, he forgot to send me my invitation AGAIN!!!! Again….. can you believe it??

Maybe Joaquin Phoenix will send me free passes to “Joker”. You never know. Joaquin owes me that much after stealing my hammer, don’t you think?? It’s been over 16 months and he still hasn’t returned my hammer.

Please stop capitizing and boldened completely important words. This just confirms that you are not only stupid but mentally ill, “Moses Herzog.”

No, I shall no longer respond to your inaccurate and completely moronic personal attacks on me, boy, but I shall certainly take you to task for making a fool of yourself as you regularly do for more general posts you make here, boy.

Bolded I think is the word you wanted to use there Phd Junior Barkley. I have high hopes your grammar will improve as you interact more with me.

What, no quoting of polls today where Kamala Harris leads Biden by 1%?? Where Kamala’s 1%= 6 people surveyed by phone?? What a letdown. Keep looking for those political polls with tiny samples and get back to me.

I’m not 100% certain on this, but it appears Tulsi Gabbard got 2% on the CBS New Hampshire poll. I think this will get her into the September TV debate. Although it might only be one item on a longer list of checkmarks to get into the September debate. Either way it helps her. It could put some separation between her and say Kirsten Gillibrand or an Andrew Yang. I like Yang and could conceivably even vote for him, but at this point I don’t think he’s cutting it in the charisma department and he’s using universal income as too much of a crutch. I’m not against universal income, but I don’t like it when it has an infomercial type aftertaste to it, and Yang is giving me that kind of sensation when he discusses it.

Boy,its bright living in the head of a liberal economist. The tunnels of light from the tunnel vision windows are so stark, because of all the sharp corners and walls reflecting in only one direction. Examples of this tunneled view just for soybeans from the above article are many. For instance:

“Production– United States– 126.94– 131.48– 133.85– 124.25– 115.95 (note the change in the last 2 numbers the June and July 2019 estimates for the US 2019/20 crop)” From Table 4 https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf (should look familiar as it’s the Author’s source)

The reasons for this drop is contained at the very beginning of the author’s USDA FAS reference:

“Market Uncertainties of 2018/19 Haunt 2019/20ProspectsThis month, U.S. soybean exports for 2019/20 are lowered from 53.1 million tons to 51.0 million despite near-record supplies.The reduction is driven by a sharp cut to U.S. soybean production (by 8.3 million tons to 104.6 million) due to difficult planting conditions. These factors, paired with large Brazilian supplies and uncertainties over China’s demand caused by the outbreak of African swine fever and the trade tensions, will continue to fuel market uncertainty.”

Note, unlike the author’s emphasis on tariffs, the report lists several other causes: 1) difficult planting conditions, 2) large Brazilian supplies 3) China’s outbreak of African swine fever, and finally 4) the trade tensions.

I doubt if any one here, but me, remembers this comment:

“June 13, 2018 at 2:30 pm

Menzie, please quit mis-applying Economics issues over agricultural or any other industry. Instead of what would be the profits that might have been have been provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand.

Ag especially is dominated by weather (world-wide) and area planted. Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage. ”

As for PRODUCTION/SUPPLY, weather positively affected both the US and Brazil 2018 production with record or near record amounts. US weather has severely affected acreage planted and appears to be negatively affecting production of those planted acres in the major soybean production areas.

As for EXPORT/DEMAND the ASF out break in China has suppressed China’s need for soybeans. These effects are paired with the SUPPLY impacts to eventuate in futures prices, and according to to the Efficient market Theory (EMH), they fully reflect all available information and data.

If you were being objective, shouldn’t your many articles about soybean prices over the past year have included these OTHER MITIGATING IMPACT? Instead your tunnel vision, which appears to be caused by your dislike for President Trump or his trade and other policies, your emphasis as in this article and several others have failed an objectivity test.

Accordingly, this lack of objectivity has lead to many articles skewed by incomplete analyses. Please adhere to the EMH in future articles.

BTW, if you and any others want to get into discussion of the meaning of a price BLIP instead of a singular event. These events have been listed in the comments and several references in this and earlier articles.

CoRev: The USDA FAS report notes uncertainty due to those factors. Do note that adverse weather in the US drove UP global soybean prices relative to what they otherwise would have been — you still do not seem to understand this elementary point, since you repeat this point over and over again. Those weather conditions in market commentary — and in basic economic theory — works against the direction of weakening soybean prices. Hence, you should not be mentioning this issue in your argument. (But for completeness, I will do a post on this subject.)

You are of course addressing however indirectly the point of counterfactual. Well, that is where we need a model; the University of Missouri study indicates that the net effect of the tariffs is negative on US prices. That is the point. That is the point. The net negative effect of the tariffs remains, and will remain until the tariffs are removed. The tariffs are as of 7/24/2019 not removed. Moreover, there is no indication of an incipient resolution to this impasse.

I welcome another forecast from you of when the resolution to this impasse will occur.

“Do note that adverse weather in the US drove UP global soybean prices relative to what they otherwise would have been — you still do not seem to understand this elementary point, since you repeat this point over and over again.”

CoRev is indeed in the habit of repeating misrepresentations like this over and over. It sort of reminds me of the questions this morning to Mueller from the Republican side.

Another fascinating and tunnel vison comment. You conclude: “…the net effect of the tariffs is negative on US prices. That is the point. That is the point. The net negative effect of the tariffs remains, and will remain until the tariffs are removed.”

While emphasizing this, you have consistently ignored this part of the quote you have repeated several times now: “Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end.”

Worse, you also make unsubstantiated claims: ” Do note that adverse weather in the US drove UP global soybean prices relative to what they otherwise would have been —you still do not seem to understand this elementary point, since you repeat this point over and over again. ”

Yet, you ignored the impact of the favorable weather on US record breaking and Brazil’s near record soybean crops, which also should have LOWERED the price of soybeans, but I don’t remember it being recognized, except in passing in well over a year, except by me.

Weather affects the prices of agriculture prices, and is a paramount consideration of farmers’ planting decision making. That has been my position from the beginning, while I accepted the impacts of tariffs on prices. You still do not seem to understand these elementary points, since you ignored them over and over again. You have in turn concentrated, almost solely on the negative impacts of tariffs.

Let me add the beginning and end of the quote you have repeated over and over: “no one has denied the impact of tariffs on FUTURES prices. (The selected part you quoted in this and several other articles) We are on record saying the prices will be back approaching last year’s harvest season prices”. That condition has yet to occur, and prices went back up in the 2018 harvest season. We can disagree whether that rise approached the 2017 harvest season prices.

You have totally ignored my point that you have failed to be objective. My point has been reinforced by your selective quoting, as indicated above, your assumption of my failure to understand the impact UP and DOWN of weather on commodity prices (an objective observer would not has so assumed had they understood the relationship of weather and tariffs in 2018), repeatedly making the same point the net effect of the tariffs is negative on US prices, while ignoring the price impacts of other events, weather and ASF. Why?

“you ignored the impact of the favorable weather on US record breaking and Brazil’s near record soybean crops, which also should have LOWERED the price of soybeans”.

Your dishonesty is beyond the pale here. You repeatedly talked about BAD weather as if it lowered soybean prices. Now that you have finally had it sink into your rather dense and stupid brain that inward shifts of the supply curve raise prices, you have done a 180.

Yea – we had good weather during the 2nd Obama terms which shifted out the supply curve. A point I have made to your fellow Trump sycophat and serial liar Bruce Hall. Yes, soybean prices fell from 2014 to 2016 because of this.

But the time period Menzie has consistently been discussing is what has happened over the past year or so.

But you know – we can expect more of your usual bait and switch and constant lying about what you have said, what others have said, and the basic facts on the ground. It is all you ever do.

Pgl,, show me where I said: ” You repeatedly talked about BAD weather as if it lowered soybean prices.” I have consistently said it effected/lowered farmer’s income.

This is what I consider my seminal comment about weather. Note its date.

“June 13, 2018 at 2:30 pm

Menzie, please quit mis-applying Economics issues over agricultural or any other industry. Instead of what would be the profits that might have been have been provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand.

Ag especially is dominated by weather (world-wide) and area planted. Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage. For the Farmer one severe storm, early or late frost, too much rain, too little rain, rain at the wrong time, fire, etc. can wipe out a year’s worth of work. Only after the crop is being harvested or in planning what to plant can the farmer really worry about prices.”

Find and quote where i said what you claimed. You won’t. It’s too much work and you won’t find it anyway. It’s just another indication of how badly you comprehend what you read.

CoRev: Those remarks are largely irrelevant to an event-study type analysis.

pgl,

You have to realize that CoRev has been misled about weather and soybean prices because he was reading the Steele dossier without realizing that 78% of it has been verified.

CoRev stating that ““no one has denied the impact of tariffs on FUTURES prices” “this will probably be a price blip” “We are on record saying the prices will be back approaching last year’s harvest season prices” is clearly a prediction that the tariffs will have little effect on 2018 harvest-time spot prices. To pretend otherwise with your intellectual garbage about exactly which dataset should be used or that any movement towards 2017 harvest season prices satisfies your “approaching” term, or that weather/ASF can affect prices, or that you really meant the prediction to extend well past 2019 harvest time and indeed indefinitely, or that “blip” means anything other than short-term, small and insignificant is absurd and proves that your entire argument (including your “on record” prediction) is just garbage and hot air.

Oh, and I will once again go “on record” to state that no one in this blog has ever ignored the price impact of weather and ASF. Do you know what an event study is?

Dave: Pretty sure CoRev does *not* understand what an event study is.

Did you notice in CoRev’s initial comment today the following?

“Please adhere to the EMH in future articles.”

First we are talking about blog posts not articles but I bet CoRev has no clue what EMH even stands for. Menzie does – the Efficient Markets Hypothesis. Does CoRev know what this means? Of course not. Menzie certainly does.

But this little lying turd writes a lecture to Menzie to adhere to the EMH? Lord – talk about STOOOOPID!

Here is a link to the paper we have been asking CoRev to read for over a year:

https://www.jstor.org/stable/2325486?seq=1#page_scan_tab_contents

Eugene F. Fama

The Journal of Finance

Vol. 25, No. 2, Papers and Proceedings of the Twenty-Eighth Annual Meeting of the American Finance Association New York, N.Y. December, 28-30, 1969 (May, 1970), pp. 383-417

CoRev tells Menzie to adhere to the EMH but he has never read Fama’s 1970 seminal paper. Which is cool because even if CoRev bothered to read it – he would not understand what it says!

Dave and Menzie, bloviating is just garbage. I do understand what an event study is. I prefer the plain English definition of it in Investopedia. Accordingly, that’s why I am concerned that subsequent event(s) data have not been considered. So saying: “…no one in this blog has ever ignored the price impact of weather and ASF. ” Show us where in this article they have been included/considered in the prices. It is the focus on the singular event over all others that is the objectivity issue.

Menzie, unwittingly even made my point: “Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end.”. Menzie’s agreement: “… net negative effect of the tariffs remains, and will remain until the tariffs are removed.”

Have tariffs been removed? No, then the price blip continues. Have other events also occurred since tariff implementations? Yes, then they too have impacted prices. Where are they considered in this article? I believe they have been implemented in the market due to the Efficient Market Theory (EMT). I previously made a mistake in defining the acronym as EMH. Mea Culpa!

What I find intriguing is the interpretation of “a price blip” for an item with annual production cycles and a universally agreed to conditional, *trade negotiations ending.* How could that be interpreted to a few months of a single year?

CoRev: I see. It is true that some scholars of the Bible have interpreted “days” in the Bible (as in “seven days”) as meaning thousands of years. Are you using a similar logic for “blip”? That seems to be the case.

Menzie asks: “Are you using a similar logic for “blip”? That seems to be the case.” I’m trying to define a blip for a product on an annual production cycle.

I don’t think a few months suffices to define a blip when a year is the minimal cycle time. At least we agreed on the conditional: “Menzie, unwittingly even made my point: “Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end.”. Menzie’s agreement: “… net negative effect of the tariffs remains, and will remain until the tariffs are removed.”

Want to rethink that short blip period in light of the production cycle and conditional? Or are you back on that unconditional train wreck of a PREDICTION you pursued for a year? And you are going to stick to your myopia re: ASF and weather impacting prices.

CoRev: We’re far past a few months. We are now year+ (Trump noted 301 action April 2018). We are now in July 2019. But, perhaps it’s like the French Revolution — still too early to say.

Menzie, says: “We’re far past a few months. We are now year+ (Trump noted 301 action April 2018). We are now in July 2019. But, perhaps it’s like the French Revolution — still too early to say.”

Exactly my point. In your graph you show a presumed start date for the blip ?without an end? So how would you define the end of this conditional price blip? It’s an annual cycle. So a few cycles? A partial cycle? Or the end of the conditional, trade talks ended? You presumably did an event study. Is that not one of the key parameters? Or are you again using a Menzie-unique version?

Moreover how do you apply or factor out the price impacts of the other already identified factors, ASF and weather? Isn’t magnitude of the tariffs price impact another of the key factors of an event study? Or how do you determine the length of the impact? Isn’t length of impact another key factor of an event study? If you say no to any or all of these, what did you study and what were your findings?

Or are you going to come back with another couple sentence nonsense comment and deflection from the question posed to you?

CoRev went from talking about weather that shifted the supply curve inwards to this good weather theme (shifting the supply curve outward). And when confronted with this flip flop, he denies what he wrote earlier. He writes a lot of gibberish so maybe he is so utterly confused that he can’t even remember what he said earlier. But then I suspect you have it right when you said he lies – A LOT!

“I prefer the plain English definition of it in Investopedia.”

actually this is a common theme from corev. in making technical discussions on a blog, when it finally appears he has no understanding of what is being said, his refrain is that he uses the common man’s definition rather than the technically correct definition. so if an expert in a field wants to argue with him, in corevs terms it is necessary that that expert dumb down his argument rather than present a proper argument. in corevs world, if the definition does not help you, then simply change the definition.

dave has hit the nail on the head. corev is simply changing the tact of his argument today. but when this started out, it was very clear that corev meant a short term blip and a return to the previous prices. no he is turning himself in knots with this year long product cycle, etc. garbage. corev you simply need to acknowledge you were wrong, take your beating for continuing to insist you are right when you are not, and keep your trap shut. otherwise i imagine menzie has no other choice but to continue your beatings.

Baffled, I see you are projecting again. I know reading and comprehending is difficult for the ideologues, but why do all of you constantly ignore the CONDITIONAL associated with that estimate? Since that has not been satisfied it must be considered in any discussions. That is unless you are a liberal, where everything is filtered.

I WAS WRONG ABOUT THE DURATION OF THE NEGOTIATIONS! (Capitalized for the comprehension impaired.) The extended negotiations extends the time frame beyond a single GROWING YEAR, which in turn extends the price consideration range. So how do you define and then quantify a blip with this new information?

Or you could just try to estimate the July 15 2019 spot price under my negotiations ended scenario. Alternatively you can guesstimate the change in Menzie’s 872 number. Don’t forget the ASF and weather impacts. Menzie still has not done so.

I’ll wait.

CoRev’s new soybean prices theme song:

https://www.youtube.com/watch?v=_CIE041T954

“He’ll wait tell your price comes down,

he’s coming straight for trump’s heart

No way, CoRev stops it now

As low as you are……

CoRev wrote blather and told trump some words

that meant a lot to him

He hit send, sh*t, trump’s never heard

His dossier says ‘pee’

And while trump leads CoRev can never be free

Such bad trade policy

CoRev’ll wait ’til your price comes down

He’s coming straight for trump’s heart

No way CoRev stops it now,

As low as you are……

Yeah, it’s true folks, nothing to do on a Friday night. : )

I was thinking late last night in my night owl “shift” how fun it would be to try to replicate the Mizzou authors model using “R” if I wasn’t so danged lazy and slow in learning the code. Looking at it, assuming someone provided the data points (I will avoid the term “raw data” here, for fear of demeaning myself by association) I would think the Mizzou model ideal for setting up a model with “R”.

If I was as good at memorizing and studying as I am fantasizing this stuff, I think I should have it mastered by now.

I wager our good friend Frank “Calling all modest southern Georgians!!!! ATTENTION!!! ATTENTION!!!! Hailing all modest southern Georgians!!!!” will have a lot of fun having a stab at this Mizzou model. [ typed the lazy man in extreme jealousy ]

You are still accusing our host of being a liar? Seriously CoRev – just because you lie 24/7 does not give you a right to falsely accuse others of being dishonest.

Pgl, gets it wrong again. I said he wasn’t being objective. I also made a case for him ignoring subsequent events, ASF and weather, in considering price impacts. Please, better comprehend what you read.

You are the only one lying here.

You do amaze.

You remind me a lot of Trump. Lie 24/7 and then accuse others of being the liar. You are a complete waste of time.

Pgl on July24, 1234 I asked you to find and quote where i actually said what you claimed. In that comment I predicted:

“Find and quote where i said what you claimed. You won’t. It’s too much work and you won’t find it anyway. It’s just another indication of how badly you comprehend what you read.”

You haven’t but continue to claim others of lying? Liars calling others liars are really STOOPID.

“CoRev

July 25, 2019 at 6:30 am

Pgl on July24, 1234 I asked you to find and quote where i actually said what you claimed. ”

Sorry CoRev but I do not waste my time cataloguing your serial nonsense and lies. But you know you made that comment MANY times. And several of us reminded you of how you got the economics wrong. Now an adult would admit to the error and learn from it.

But you have proven over and over you are far from adult. Continue your trolling if you wish. But even your own dog has lost interest in your sick behavior.

Pgl, “Find and quote where i said what you claimed. You won’t. It’s too much work and you won’t find it anyway. It’s just another indication of how badly you comprehend what you read.”

Just as predicted. You do not comprehend what you read.

You do amaze, but at least you’re predictably consistent.

Completely separate from the tariff issue, but possibly important for soy bean prices, China is apparently in the early stages of “formalizing” the feeding of pigs.

A large share of China’s flu victims were raised on “informal” pig food – garbage, forage, what have you. Chinese authorities aim to avoid having another big pig kill by moving to formal pig feeding. That means more soy demand. The estimate I’ve seen is a rise from 20 million tons of soy fed to pigs to 65 million. Chinese imports of soy beans ran just shy of 100 million tons prior to tariffs and flu, so the rise in pig feeding could increase imports by 45% or so. Not gonna happen overnight, of course.

This is good news for the pigs and the exporters of Brazilian soybeans. It would be good news for American suppliers of soybeans if the idiot who started this stupid trade war could kiss and make up with China.

When a political goal is wanted, does anyone cares to see things in perspective. If so, just click below and see long term soybean spot price. Year long blip is a misnomer, as is single source soybean price determinants. Soybeans move around historically. And farmers always have it tough.

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

Ed

Ed Hanson: Thank you for your piercing insight.

Yea – farmers do great in 2014. Who was President then?

ed, soybean prices do move around. and many things can cause them to move. the argument at hand is that we have a pretty good idea of what caused the dramatic move down that is under discussion. and we have people on this blog who want to deny that reason. for a “political goal”. in essence, we have a model with evidence of a cause and effect. and certain folks on this blog do not want to acknowledge this outcome, for political reasons. i could just as easily reference this discussion to soybeans or global warming. same argument. and same folks in denial, mostly because they are anti-intellectuals.

“And farmers always have it tough.”

Do they Ed? Even at the current $8.20 price – this chart shows a massive increase from the $3.50 price during the spring of 1972. So by the logic of certain right wingers, soybean prices today are over 2.3 times higher than they were when Nixon ran for reelection.

I wonder if Ed Hanson has the slightest idea what is wrong with this NOMINAL logic. We’ll give you a little hint here Ed – something called inflation adjusted.

Lord you know CoRev is beyond stupid when you have to endure reading this babbling:

“I believe they have been implemented in the market due to the Efficient Market Theory (EMT). I previously made a mistake in defining the acronym as EMH. Mea Culpa!”

Actually most people use the term Efficient Markets Hypothesis. EMT refers to someone who takes care of the injured on the ride to the hospital. But I think we all cracked up when CoRev wrote:

“I prefer the plain English definition of it in Investopedia.”

Well CoRev – here is the Investopedia link:

http://www.investopedia.com/terms/e/efficientmarkethypothesis.asp

“What is the Efficient Market Hypothesis (EMH)?

The Efficient Market Hypothesis, or EMH, is an investment theory whereby share prices reflect all information and consistent alpha generation is impossible. Theoretically, neither technical nor fundamental analysis can produce risk-adjusted excess returns, or alpha, consistently and only inside information can result in outsized risk-adjusted returns. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices. As such, it should be impossible to outperform the overall market through expert stock selection or market timing, and the only way an investor can possibly obtain higher returns is by purchasing riskier investments.”

It continues but I doubt CoRev has any clue what any of these words even mean. But he says this is “plain English”? LOL! BTW – note Investopedia does not call this EMT. Could someone check CoRev’s resume as I doubt he even passed 1st grade reading!

pgl,

Last we heard the only degree he has is in women’s studies, although he later hinted that was “satire,” with the diploma in any case safely in a tube in a drawer maybe with a medallion he received that went to the moon and back. Such a colorful history, our CoRev.

The 2 minute film Investopedia put together on the Efficient Markets Hypothesis is the sort of thing only a 7 year old could appreciate. While it dumb downs the implications of EMH, it likely is WAY over CoRev’s head. Nonetheless, it sticks to holding stocks and does not relate the implications of EMH for things like soybean futures. Of course one would learn a lot by reading that 1970 paper by Fama but CoRev insists he does not need to as CoRev thinks he knows everything!

😉 Whose going on vacation? I just want to know in which head I need to park next.

I bet you are asking this to see whose house will be empty for you to sleep in. Sorry but I do not announce my travel plans to know thieves like you.

You do amaze,CoRev.

@ Menzie

Menzie, I hope you believe me when I say, I’m on your side on all this export commodity stuff. But what exactly was the point/message of your Bloomberg addendum??

“The new payments will be based on the shortfall in exports of each crop compared with the highest year of exports over the past decade, said USDA Chief Economist Robert Johannson. Last year’s payments were based on the shortfall in exports compared to 2017, so THIS TRANCHE may end up being MORE GENEROUS.”

“Overall trade aid is capped at $500,000 per person.”

“With aid flowing to farmers, he has avoided erosion of his political support in rural areas. In June, 54% of rural voters approved of Trump’s job performance versus a national approval rating of 42%, according to a Gallup survey of 701 self-identified rural voters.”

Are we supposed to take “solace” in the fact most of these functionally illiterate farmers will end up STILL voting for the orange-skinned son-of-a-b*tch come late 2020?? With all due respect to you Sir, It’s certainly “the takeaway” I am getting from that individual article.