The Coalition for a Prosperous America publishes another study imbued with “secret sauce” structure…From the “working paper” (more akin to a press release):

Specifically, we introduce the effects of Chinese retaliation with tariffs on US exports to China; we add the effects of the US Department of Agriculture’s (USDA) programs to support farmers and food processors negatively affected by Chinese retaliation; and, we add the impact of the US government spending the revenue generated by the China tariffs. We find that Chinese retaliation reduces the benefit to the US economy by 14 percent, but the net benefit remains large. The USDA programs provide relief to the agricultural industry and restore the net benefit to almost the same level as before the retaliation. Finally, we look at the impact of the government reinvesting the tariff revenue in the US economy by boosting government spending…

I’ve read the “working paper” (and the preceding paper) a couple of times, and am not clear what is going on — the results are based on splicing two models (REMI and BCG data) and running out the results.

Alarm bells went off in my head when I read this:

“Our forecast results differ from many others because ours incorporate more real-world evidence than other forecasts, which tend to rely excessively on unrealistic assumptions based on neoclassical economics. For example, forecasters who have found that tariffs depress US GDP often assume that all or most of the tariff price is passed onto consumers, and that spending on these goods falls substantially as a result of price increases. These assumptions are unwarranted, noting the evidence from the tariffs of 2018-2019, where we have seen minimal price increases from Section 201 and China tariffs.”

This is counter to the most recent research on the subject. From Amiti et al. (2019), an empirical finding:

This paper explores the impacts of the Trump administration’s trade policy on prices and welfare. Over the course of 2018, the U.S. experienced substantial increases in the prices of intermediates and final goods, dramatic changes to its supply-chain network, reductions in availability of imported varieties, and complete passthrough of the tariffs into domestic prices of imported goods. Overall, using standard economic methods, we find that the full incidence of the tariff falls on domestic consumers, with a reduction in U.S. real income of $1.4 billion per month by the end of 2018. We also see similar patterns for foreign countries who have retaliated against the U.S., which indicates that the trade war also reduced real income for other countries.

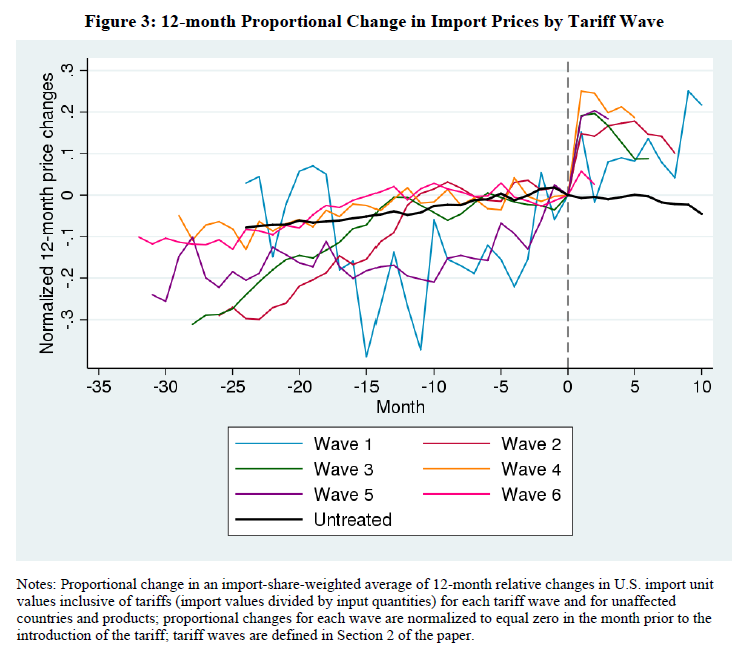

If you are skeptical, a graph of the data on goods subject to the different waves of tariffs is useful. From Amiti et al.

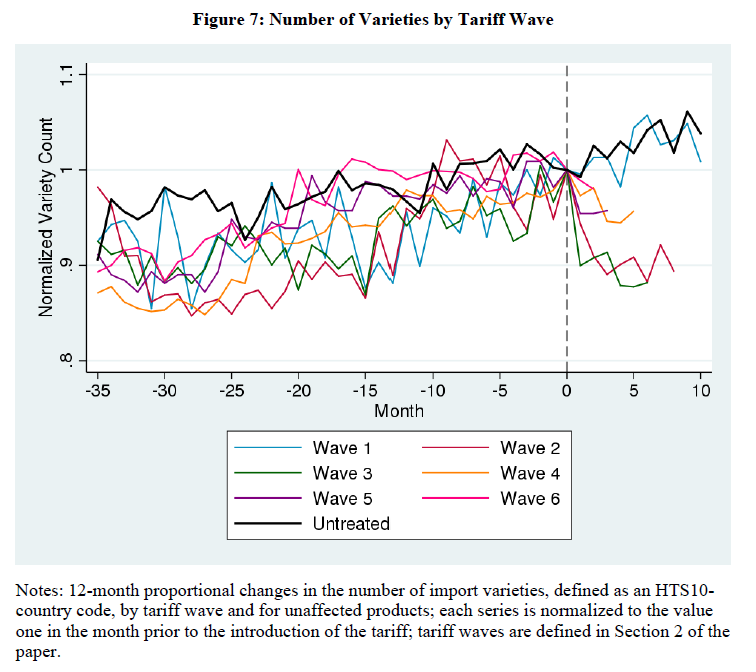

In addition, the variety of goods declined.

If the authors of the CPA study can’t even get the stylized facts right, what hope is there for reasoned analysis?

I will also note that this comment in the CPA working paper (page 5) does not engender confidence:

Our forecast results differ from many others because ours incorporate more real-world evidence than other forecasts, which tend to rely excessively on unrealistic assumptions based on neoclassical economics. For example, forecasters who have found that tariffs depress US GDP often assume that all or most of the tariff price is passed onto consumers…

Well, I hate to tell the authors but that’s not a neoclassical assumption. It might be an assumption in a neoclassical model, but it’s not intrinsically neoclassical. One could just as easily assume in a neoclassical model that the economy is large, so that the terms of trade can be affected by the imposition of a tariff. (Neoclassical means to me “frictionless”, equating marginal conditions either inter- or intra-temporally, with symmetric (full) information).

It seems a lot of the results are driven by (1) government financial support for farmers impacted by Chinese tariffs on US goods, (2) Chinese tariffs on US goods have a relatively small effect, and (3) that the tariff revenue (nearly half a trillion over 5 years!) is spent on infrastructure (which has a high multiplier in most models, presumably also in the REMI model as well). Of course, this works if the US tariffs have a terms of trade effect so that we get Chinese goods (ex-tariffs) more cheaply. As the Amiti et al. paper has documented, that hasn’t happened yet.

On top of the Coalition for a Prosperous America’s crazy currency misalignment paper, it’s clear to me that the group’s studies are mere propaganda.

I checked the resumes of the two authors. Neither have the training nor the experience to model this stuff out. But put that aside for a moment. One of the Usual Suspects in his defense of Judy Shelton noted she was at a seminar where the late great Robert Mundell was also there. I mention this as neither of the authors of the fluff Menzie critiques seem to have a clue what the Mundell-Flemming model might say about a rise in across the board tariffs.

Now we are under floating rates so the Mundell-Flemming model would not this kind of expenditure switching policy designed to increase net export demand would be fully offset by a dollar appreciation. This fluff does not seem to factor that in.

Oh but Judy Shelton would advocate pegging the dollar so this appreciation offset does not occur. Of course that would be a form of currency manipulation. But if the Trump Administration does it – it an’t manipulation I guess!

Oh my. I read the “working paper”…yes, all FIVE pages. Quite a piece of scholarship. What a joke. It’s a free lunch argument. But then again, it was never intended to be a serious analysis. The point of these kinds of papers is to provide a smokescreen for GOP politicians when they are confronted by gullible and clueless voters. The GOP candidate just refers to a study that uses lots of big words and has tables and figures in it. Since most voters are as clueless as CoRev, the con job usually works.

If wishes were horses, this would be analysis.

Most of these papers from industry hacks are free lunch exercises. They always act as if we have a massive output gap, which may have been fine for something done in 2009 but not for 2019. Ever noticed if these papers modeled any form of crowding-out either in the form of higher real interest rates or currency appreciation? Of course not as the authors never took a serious course in macroeconomics.

There do seem to be some hard-to-defend assumptions going into this model.

I have checked on the authors, as did pgl, and there is not much there, especially for Jeff Ferry, who is a CPA but on other identifiable credentials or degrees. About the only thing he seems to have done is be with this new think tank. Byers has more history, having gotten an econ PhD in regional and international econ and econometrics in the 90s from Colorado State. He seems to have no publications and no academic experience, having been in several private sector finance outfits such as Fidelity Investments, as well as three federal financial regulatory bodies, the Comptroller of the Currency, the CTFC, and the SEC, where worked on domestic regulatory issues, not at all related to the things in this model. He has been with this think tank since last September as “Senior Economist.” Not much there, although Byers has more background and cred than Ferry, who has zero.

I think of them as Stink Tanks not Think Tanks.

Just an amusing sidebar:

Even last year’s smaller aid package probably overpaid farmers for their trade-related losses, according to a new analysis from the University of Missouri’s Food and Agricultural Policy Research Institute (FAPRI). The study, as first reported by the The Food and Environment Reporting Network’s Ag Insider, looked specifically at soybeans, because soybeans were hit hardest by the trade dispute, and most of the aid package went to soybean farmers.

According to the new study, Chinese tariffs caused the price of soybeans grown in the U.S. to drop by $.78 per bushel. Last year’s aid package, however, paid farmers more than twice that much — $1.65 per bushel of soybeans that each farmer produced.

Those socialist farmers and their Marxist leader!

Funny about this comment. Catherine Rampell makes the same point in today’s Washington Post noting that President Trump is the true socialist!!! https://www.washingtonpost.com/opinions/trump-is-the-true-socialist/2019/07/25/4f45410c-af1a-11e9-8e77-03b30bc29f64_story.html?utm_term=.abf639e96297 Perhaps Iowa is our real test case as to how central planning can work, the five year plan should be coming out shortly.

‘Maybe Ernst was being painfully un-self-aware here. Or maybe she thinks her voters are. Either way, for decades, “Iowa values” have explicitly included demands for big fat federal government subsidies for corn ethanol — among other payouts and market-distorting government interventions that Republicans might in other contexts smear as “socialist.” Agricultural subsidies have been blessed and perpetuated by politicians from both parties. But lately, a Republican president, with the support of Republican lawmakers, is in the midst of a broader “socialist” endeavor to bail out the farm industry. Nor do Republicans cry “socialism” when the treasury secretary lectures U.S. retailers and manufacturers about how and where they should reallocate their supply chains; nor when the president himself lectures firms about what products to stock; nor when the administration tries to get other countries to engage in more centralized economic planning — by, for example, demanding that European political leaders commit private companies to buy more U.S. crops and liquefied natural gas regardless of price, quality or market needs. You would be hard-pressed to find better recent examples of the U.S. government trying to exert influence, if not outright control, over the means of production, both domestically and abroad. When not disrupting previously functional industries, Republicans have also been busy propping up failing ones. Consider the case of coal. Technological change (i.e., fracking) has made the U.S. coal industry less competitive; at least six major U.S. coal producers have filed for bankruptcy in the past year, with the most recent filing last week. But rather than letting markets run their course, Republicans at both the federal and state levels are concocting complicated handouts. Trump, who rants on Twitter about how Democrats want to turn us into a “Socialist or Communist Country,” has repeatedly attempted Soviet-style bailouts of failing coal plants. On Tuesday, Ohio, a state under unified Republican control, decided to copy him, with a new law that adds taxpayer-funded subsidies for coal-fired and nuclear power plants.’

And our Usual Suspects have applauded all of this. But you see when Trump does it – his minions get advanced notice so they can trade on inside information. So they are allowed to get rich at the expense of us. That ain’t socialism – it is pure corruption and theft!

Trump claims that the Chinese are paying for his tariffs. Well maybe those Chinese living here are paying more for imports like the rest of us!

As far as who pays for the Chinese tariffs on our soybeans – the American taxpayer is paying the bill.

Yes – Trump’s trade policies have screwed the average America. Thank goodness his rich buddies got their tax cut!

I don’t know about you people, but any story that involves a drinking saloon being closed down is extremely sad to me, and might even bring tears……. https://www.youtube.com/watch?v=NER2vwJKc88&t=0m11s

But actually, it’s still worth watching this, Just over 7 minutes:

https://www.youtube.com/watch?v=FxbXhSAia_o

Is this simply typical in Trump’s america nw,

Fake research.

I mean it is easy to spot the problems but It appears nobody cares.

What is going on

As economists know, tariffs impose a deadweight loss on the economy – the loss in consumers’ surplus exceeds the sum of the gain in producer’s surplus plus the gain in tax revenue. But every tax imposes a deadweight loss, so the question is whether the tariff is more efficient or less efficient than the alternative revenue sources. It seems clear that a uniform tariff on all imports would be inferior to the revenue-equivalent uniform tax on all domestic consumption, because the tariff distorts choices between consumption of domestic and foreign goods, as well as the choice between consumption and (untaxed) leisure. But the alternative source of federal tax revenue is not a uniform tax on consumption, but is instead most likely an increase in marginal income tax rates. Because the income tax is graduated, its deadweight loss per dollar of revenue is much greater than the revenue-equivalent increase in a uniform tax on all income (or consumption). The income tax also distorts choices between present and future consumption. So it is something of a horse race as to whether a uniform tariff would improve or reduce economic welfare.

There are several steps in getting from the above argument to a justification for Trump’s tariffs on China; the biggest probably being that tariffs on imports from China are not uniform import tariffs and retaliation from China could increase the deadweight loss of our own tariffs. I am frankly skeptical of the effectiveness of any Chinese retaliation, partly because of the lop-sided nature of the trade (in 2018, U.S. imports from China were $540 billion, whereas U.S. exports to China were $120 billion), and partly because U.S. exports to China are dominated by commodities, which are more able to escape the effects of a single county’s tariffs through arbitrage (shifts in global trade patterns). (I am also skeptical that the tariffs will have dramatic effects on U.S. or global economic growth.) The end result for U.S. economic welfare seems to rest on the labor supply elasticity, estimates of which which I admit I am also skeptical.

Welfare triangles typically are small relative to the tariff revenue, and welfare costs of graduated taxes can be much greater than simple ad valorem taxes, so I would not care to bet a lot of money that the tariffs reduce overall U.S. economic welfare, at least in a static long-run analysis. In any event, the revenue provided by the tariffs should not be given short shrift.

“revenue provided by the tariffs should not be given short shrift”

In the case of soybeans, the revenue is essentially zero in comparison to amount lost. China is not paying those tariffs because they are not buying our soybeans.

In the soybean case, the loss to Chinese consumers is modest but the loss to US suppliers is quite large. Who wins? Oh yea – Brazilian soybean farmers. Make Brazil Great Again!

“In any event, the revenue provided by the tariffs should not be given short shrift.”

First of all the increase in U.S. customs duties (tariffs) so far are reported by the BEA and the increase is not that enormous. Secondly, when economists model the winners and losers, their graphs do show the increase in tariff revenues.

And now a message from our Dear Leader, donald trump:

“Amiti…… [points index finger] You’re fake news!!!!! Redding……. [points index finger] You’re fake news!!!!!! David Weinstein….. [points index finger] You’re fake news!!!!!!! Karen Ni….. Angela Wu…… assorted researchers [points index finger]…..You’re fake news!!!! You should be ashamed of yourselves!!!! I haven’t seen analysis this bad since that liberal Jew David Ricardo. Didn’t Ricardo marry a Quaker??? Are Quakers swarthy looking?!?!? Never mind…… I bet she was. All of you disgust me!!!!!”

[edited MDC]

I found out how to change the text and background environment in “R” today. So like some websites have a “night mode” or a “dark mode” and if the white background wears on your eyes, you can change it to a darker background. You can do that in “R” as well. It’s not going to help me do OLS Regressions or whatever, but it can help typing out code at night and also makes me feel more like I have control over the program instead of the reverse.

Trying to put into perspective the significance of “with a reduction in U.S. real income of $1.4 billion per month by the end of 2018” from Amiti et al. (2019).

1.4 billion seems to be a large number but is it?

Am I reading the right statistics? From FRED the December 2018 Real Personal Income of the US (end of 2018) was 16,483.1 billion of chained 2012 US Dollars

https://fred.stlouisfed.org/series/RPI

If that is the the relevant statistic, a reduction of 1 .4 billion is quite puny.

Kudos that the authors could even measure something that relatively small with confidence.

Ed

So, Ed, you admit that Trump’s policy is damaging the economy, but you argue that it is not by all that much. how much loss would get you to agree that it is unacceptable?

Oh, I know. You are under the delusion that out the other end there will be a pumpkin of a trade deal. So far there has not been one, although CoRev was talking about all this being a “blip” because Trump’s great dealmaking skills would have the Chinese eating out of his hand last year some time. But even if he gets one, well his big NAFTA plus that he cannot get through Congress is barely an improvement over the old NAFTA if it is at all, which is debatable. So, reality is no trade deal for some time to come, and when it comes, ecxpect a big nonthing burger.

But, hey, whatt’s a few billion dollars when it is MAGA time for all the crazies shrieking “Send her back!” when they are not doing “Lock her up!” Red meat for the Trmpshita uber alles!

Trying to put into perspective the significance of “with a reduction in U.S. real income of $1.4 billion per month by the end of 2018” from Amiti et al. (2019).

1.4 billion seems to be a large number but is it?

Am I reading the right statistics? From FRED the December 2018 Real Personal Income of the US (end of 2018) was 16,483.1 billion of chained 2012 US Dollars

https://fred.stlouisfed.org/series/RPI

If that is the the relevant statistic, a reduction of 1 .4 billion is quite puny.

Kudos that the authors could even measure something that relatively small with confidence.

Ed

Ed Hanson: First, you might want to multiply by 12 since the DWL figure is per month, and you cited a AR number for income.

Second, that’s a DWL; there’s a big transfer from consumer to producers of the import competing good. Do you give equal weight to producers as consumers? The tariffs hit consumers and downstream users, and benefited producers like Nucor (and shareholders). That might be what you like, and maybe those undeserving consumers and small firms deserved what they got. But I don’t necessarily have your love of shareholders.

Third, as pointed out in the paper, the adjustment costs of shifting global value chains were large — comparable to the total transfers. Some of those costs are borne by American firms (and hence primarily US shareholders — that might pain you).

You wrote this twice? Now respond to this:

“First, you might want to multiply by 12 since the DWL figure is per month, and you cited a AR number for income. Second, that’s a DWL; there’s a big transfer from consumer to producers of the import competing good. Do you give equal weight to producers as consumers? The tariffs hit consumers and downstream users, and benefited producers like Nucor (and shareholders). ”

OK – the deadweight loss to society is 0.1% of ANNUAL income (per month v. per year – I see you missed that TWICE). Most Harberger’s triangles seem modest relative to aggregate income. But could you please calculate for us how much consumers have lost to the shareholders of big steel and aluminum since you are supposedly interested in relevant comparisons?

Had Ed bothered to read just the first few pages of the actual paper, he might have noticed this:

“We estimate the likely impact on U.S. consumers and find that by the end of 2018, 2 import tariffs were costing U.S. consumers and the firms that import foreign goods an additional $3 billion per month in added tax costs and another $1.4 billion dollars per month in deadweight welfare (efficiency) losses. Tariffs have also changed the pricing behavior of U.S. producers by protecting them from foreign competition and enabling them to raise prices and markups. If we assume that the 2018 tariffs have not affected prices in sectors that do not use or compete with targeted imports, we estimate that the combined effect of input and output tariffs have raised the average price of U.S. manufacturing by one percentage point”.

The ”added tax costs” alone come to $36 billion per year. And consumers also have to endure the higher prices from domestic producers who have been insulated from foreign competition. Now I guess Ed will point out that the price increase consumers have to pay for goods is a “mere” 1%. I wonder if he would also decide to encourage the government to raise taxes by a mere 1% of income.

Ed Hanson If that is the the relevant statistic, a reduction of 1 .4 billion is quite puny.

Keep in mind that this is a flow variable, not a stock variable. That means it’s a deadweight loss that accumulates as long as the tariffs are in place. The cumulative welfare loss will be quite large if these tariffs continue until 20 Jan 2021. And we’re talking about a deadweight loss, so it is a pure loss that does not accrue as a gain to anyone. It’s hard to justify any economic policy that only generates a pure loss with no offsetting benefit. In that regard the question of magnitude is beside the point. You might feel more strongly about losing a lot of income than you would feel about losing only a little income, but most of us would prefer not losing any income.

But someone gained at others expense. Those who get stock trade tips in advance of Trump tweets are making out like bandits on insider trading. The rest of us – especially the average consumer – are getting screwed. Make America Corrupt Again!

Trump doesn’t seem to know what he’s going to tweet before he starts to flap. How could anybody get a tip about what’s coming? He’s a complete bozo, and it’s pretty clear he’s corrupt to the core, but extending to the absurd logical extreme does nobody any good.

Maybe but that means the stock market totally ignores his tweets. If true – that’s a good thing!

https://www.dailymail.co.uk/news/article-7287635/Creator-spoof-Presidential-seal-says-theres-no-chance-accidentally-beamed-stage.html

Dear Menzie,

Sometimes I disagree with you, but not this time. How do these people get paid to write this stuff?

Julian

trolls on this site such as corev, peakloser, rick stryker and bruce must be thrilled that we detain brown skinned american citizens in squalid conditions for nearly a month with no legal access. is this really the america the conservatives are pushing for? appalling.

https://www.cnn.com/2019/07/25/us/us-citizen-detained-texas/index.html

not only have these trolls agreed with policies that inhibit citizens from legally voting, now we move on to the policy of detaining us citizens for weeks because their brown skin makes them look suspect. i hope you are proud of your dear leaders policies corev, peak, bruce and dick. the racism, hatred and bigotry you have all espouseded through the years on this blog is finally a reality. pathetic.

US-born teen detained for weeks by CBP says he was told ‘you have no rights’

And that is just the title. Not letting this kid even see his attorney tells us that the CBP agents knew they were violating the law. Under a real President – these thugs would be fired. Under Trump – the thugs are rewarded.

Talking Points Memo covered this poor lad’s tale too:

https://talkingpointsmemo.com/news/us-born-teen-lost-26-pounds-detained-ice-cbp

The detention led to him losing 26 pounds?! As a soccer player, he was likely fit before the detention so this weight loss had to be bad for his health. Now if CBP detained Donald Trump in this way so he lost 26 pounds, one might say he was a third of the way to a more normal weight.

We don’t have conservatives in this country. We have reactionaries now. They call themselves conservatives, but they are about as far from conservative as you can get.

You are right – conservatives have been pushed aside replaced by a basket of deplorables aka Trump sycophants.

Your Baffingship, as a longtime support of plunder

and subsidizes, you should be praising The El Presidente!

After all, these farmers support your EBT programs and other

food aid handouts.

BEA releases real growth for 2019II. Private consumption up 4.3% as there was a surge in durable goods consumption. Real government purchases up 5%. One might think there was a yuuuge overall growth rate but the reported figure was a mere 2.1%? What gives?

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Oh wait – real fixed investment FELL by bit. And exports fell even more. So much for that investment surge from the Trump tax cut. And his trade policy? Looks like an utter failure!

There were two bright spots in today’s report. Durable goods increased by 12.9 points, mostly due to motor vehicles. That reversed previous sluggish growth in durable goods. The other bright spot was nondefense federal spending, which increased by 15.9 points. The nondefense government spending isn’t sustainable, so this is a one-off deal. The spike in durable goods looks to be one-off given the personal income data. Personal income grew by 0.5 percent, but wages and salaries didn’t see such a big increase. The biggest increase came from interest and dividend income. The rich get richer.

Lots of bad news in the report. Residential construction has seen negative growth in eight of the last nine quarters. Investment in equipment has been anemic over the last two quarters. Exports fell by 5.2 points. Investment in new structures fell 10.6 points. So the economy is definitely getting soft. As CBO predicted, the effects of the Trump tax cut are starting to wear off.

Excellent summary. Take out the increase in durable goods and consumption growth was very modest.

Said it before, and I’ll say it again, 1.5% and below on GDP is the magic number for donald trump on the re-election. If it hits below that is when we get into very gray area. That’s assuming it dips below that a long enough time before Nov. 2020. I’m thinking 2 quarters of pain there in order to effect votes.

As it stands now, if GDP stays above 1.5%, I give the orange creature about a 67% chance of re-election. That’s why these free gifts of rate cuts from Jerome Powell when they aren’t necessary or are arguably undesirable when you are roughly the depth of a sheet of cigarette paper from the ZLB, are pretty major in dictating future events.

When you look at how some recently unemployed factory workers and farmers are still walking around with their red MAGA dunce caps, even below 1.5% is a gray area—but it’s a big line in the sand in my opinion.

Bill McBride has some comments about the numbers. His take is that the Trump tax cut ran up a deficit, and that’s about it. Assuming I can read and didn’t miss something.