Today, we are pleased to present a guest post written by Laurent Ferrara (Banque de France), Céline Poilly (AMSE) and Daniele Siena (Banque de France). The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

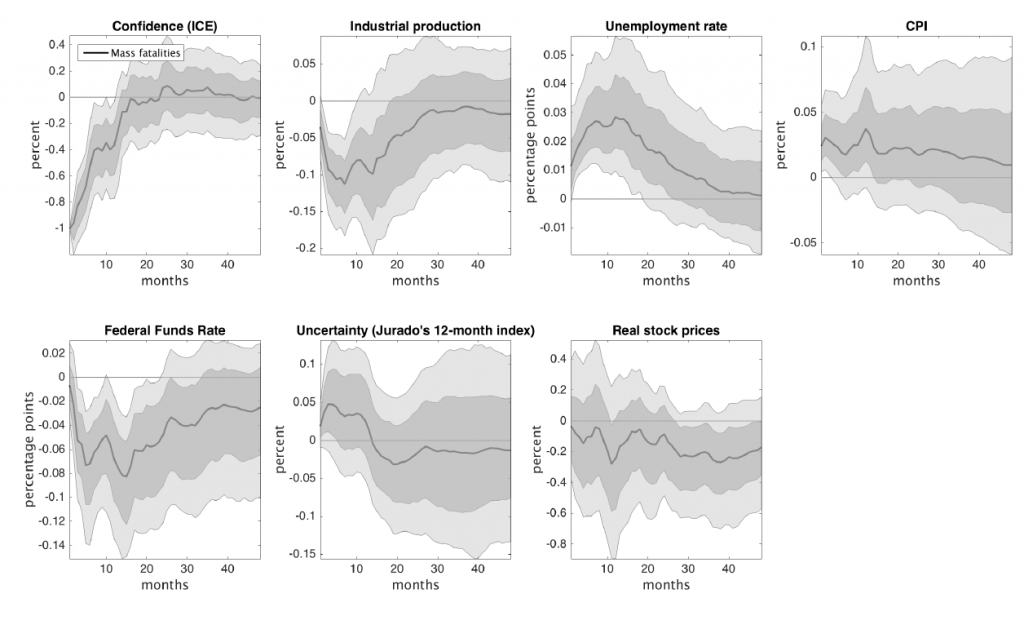

Figure 1: Impulse response functions, using fatalities in shootings (≥ 7) as instrument for consumer confidence. Source: Lagerborg, Pappa and Ravn (2019).

Banque de France and Aix Marseille School of Economics (AMSE) organized their 3rd research workshop on International Macroeconomics on July 5, 2019 in Marseille (France). The goal of the workshop, at its third year, is to create a forum of discussion on the international effects of economic policies across countries starting from both theoretical and empirical contributions. Researchers presented and discussed papers investigating international aspects of monetary, fiscal and other types of economic policies currently implemented or actively discussed in the policy debate.

Ugo Panizza (Graduate Institute of International and Development Studies) presented “Corporate foreign bond issuance and interfirm loans in China”, joint with Yi Huang and Richard Portes on corporate foreign bond issuance and interfirm loans in China. This paper uses firm-level data to document and analyze international bond issuance by Chinese non-financial corporations and the use of the proceeds of issuance. They find that dollar issuance is positively correlated with the differential between domestic and foreign interest rates. This interest rate differential increases the likelihood of dollar bond issuance by risky firms and decreases the likelihood of dollar bond issuance of exporters and profitable firms. Moreover, and most strikingly, risky firms do more inter-firm lending than non-risky firms and this lending rose significantly after the regulatory shock of 2008-09, when the authorities sought to restrict the financial activities of risky firms. Those firms try to boost profitability by engaging in speculative activities that mimic the behavior of financial institutions while escaping prudential regulation that limits risk-taking by financial firms. The discussion was carried out by Evgenia Passari (University Paris Dauphine).

Chiara Scotti (Fed Board) presented “International Capital Flows and Unconventional Monetary Policy”, joint with N. Converse, S. Curcuru and A. Rosenblum. They empirically investigate how unconventional monetary policies carried out by the four main central banks (Fed, Bank of England, ECB and Bank of Japan) affect international capital flows. Identification of shocks is done by looking at intra-day data. Effects on capital flows are estimated using a carefully constructed data set of daily net flows and total assets of 6 mutual fund types. There is no strong consensus in the literature about the effects of unconventional monetary policies as the effects go through three various channels: portfolio rebalancing, signaling effects and confidence effects. Results tend to show empirical evidence of monetary policy relevance for portfolio flows for both equity and debt among advanced economies. What is less standard is that they show that Fed monetary policy shocks do not lead to reallocation towards emerging markets. The paper was discussed by Urszula Szczerbowicz (Banque de France).

Daniele Siena (Banque de France) presented “Questioning the puzzle: fiscal policy, real exchange rate and inflation”, joint with Laurent Ferrara, Luca Metelli and Filippo Natoli. This paper shows that the empirical puzzle that a fiscal boost is deflationary and does not lead to an exchange rate appreciation lies all in the identification of fiscal shocks. The puzzle disappears when narrative shocks (military spending or defense investment) are included in a proxy-SVAR as instruments for current government spending. Additionally, they show that a standard theoretical model is in line to the empirical evidence on a wide set of variables, including consumption and the trade balance. Alexander Kriwoluzky (DIW) led the discussion of the paper.

Morten Ravn (University College London) presented a paper entitled “Sentimental business cycles”, joint with Andresa Lagerborg and Evi Pappa. This paper focuses on the contribution of non-fundamental demand shocks to business cycles and on how to estimate causal effects. The authors estimate the dynamic causal effect of sentiment shocks combining Instrumental Variables (fatalities in mass shooting in the US) and Structural VAR models. They then build a theoretical New Keynesian model with heterogeneous agents and search and matching, consistent with the empirical evidence. Results show that a drop in non-fundamental demand shock leads to negative effect on output but no impact on stock prices. Confidence mainly matters for the labor market. Ethan Ilzetzki (LSE) discussed the paper.

Ivan Jaccard (ECB) presented a joint paper with Frank Smets entitled “Structural Asymmetries and Financial Imbalances in the Eurozone”. The paper starts by showing that net capital inflows are procyclical in the South of the Eurozone and countercyclical in the North. The authors study the dynamics of capital flows between the North and South of Europe in a two-country DSGE model with incomplete international asset markets. They show that the direction of capital flows between the two regions can be explained by propagation of a common shocks in asymmetric ways on debtor and creditor economies. This is consistent with consumption being more volatile in the South than in the North and with higher welfare cost of business cycle fluctuations in the region that experiences procyclical net capital inflows.

Gernot Müller (University of Tübingen) presented “Exchange rate undershooting: theory and evidence”, joint with M. Wolf and T. Hettig, on exchange rate reaction after a monetary policy shock. They run local projections to estimate the effect of US monetary policy shocks on the dollar and find that monetary contractions appreciate the dollar. They establish two results. First, the spot exchange rate undershoots: the appreciation is smaller on impact than in the longer run. Second, forward exchange rates also appreciate on impact, but their response is flat across tenors. Finally, they develop and estimate a New Keynesian model with information frictions. In the model, investors do not observe the natural rate of interest directly. As a result, they learn only over time whether an interest rate surprise represents a monetary contraction. The model accurately predicts the joint dynamics of spot and forward exchange rates following a monetary contraction. The discussion was carried out by Francesco Pappadà (Banque de France)

Nitya Pandalai-Nayar (UT Austin) presented “The Global Business Cycle: Measurement and Transmission”, joint with Zhen Huo and Andrei Levchenko. This paper uses sector-level data for 30 countries and up to 28 years to provide a quantitative account of the sources of international GDP comovement. They propose an accounting framework to decompose comovement into the components due to correlated shocks and to the cross-country transmission of shocks, and apply this decomposition in a multi-country multi-sector DSGE model. They provide an analytical solution to the global influence matrix that characterizes every country’s general equilibrium GDP elasticities with respect to shocks anywhere in the world and then provide novel estimates of country-sector-level technology and non-technology shocks to assess their correlation and quantify their contribution to comovement. TFP shocks are virtually uncorrelated across countries, whereas non-technology shocks are positively correlated. These positively correlated shocks account for two thirds of the observed GDP comovement, with international transmission through trade accounting for the remaining one third. However, trade opening does not necessarily increase GDP correlations relative to autarky, because the contribution of trade openness to comovement depends on whether sectors with more or less correlated shocks grow in influence as countries increase input linkages. Finally, while the dynamic model features rich intertemporal propagation, quantitatively these components contribute little to GDP comovement as impact effects dominate. Julia Schmidt (Banque de France) led the discussion.

This post written by Laurent Ferrara, Céline Poilly and Daniele Siena.

It’s always cool to have access to some papers (even if you do have to do some extra clicks to circumnavigate paywalls). Beggars can’t be choosers, aye??

Some really bad news from http://www.bea.gov – table Table 1.1.6. Real Gross Domestic Product, Chained Dollars

(1) Real exports in 2019QII were lower than they were as of 2018QII by $40 billion per year

(2) Real private investment fell by $50 billion per year in just one quarter although part of that was a decline inventory accumulation

Congress decided to block an $8 billion arms sale to the Saudis for clear reasons but Trump vetoed this ban. I guess selling arms to evil nations abroad is his answer to weakening aggregate demand.

Nothing quite so fun as the U.S. Government co-partnering in the mass slaughtering of Yemeni women and children as we lecture other nations with the naughty finger extended. It’s enough to make Lee Greenwood, religious fundamentalists, and Evangelicals “proud to be an American”.

Dear Folks,

There seems to be a discrepancy in these papers, and maybe it is worth comment. The first discusses holdings of Chinese financial assets (bonds in Chinese firms and interfirm loans in China). But none of the papers seems to discuss Chinese holdings in either European markets or Japan or the U.S. , if this is a correct reading of the Chiara Scotti paper. (It is hard to tell exactly what capital holdings are being modeled there.) Could one of the authors or Menzie or someone else tell me if I am missing something here?

Julian

@ Mr. Silk

It’s probably at least somewhat related to capital controls applied by the Chinese government. Outside of that I would guess the trust factor. But you certainly see more foreign players in Chinese bonds than you did 15 years ago. Menzie or the paper authors can answer it in a much more educated way than me, that’s the best I can do.

Did I miss something?

Is there some reason why we now trust ” firm-level data to document and analyze international bond issuance by Chinese non-financial corporations and the use of the proceeds of issuance” ?

GIGO.

Where did you think they were going to get the information?? I’m honestly curious.

With some blog commenters it’s like listening to Sean Hannity or Rush Limbaugh, they will always tell you how dumb something is, but they never give you the magic solution. It’s absolutely horrid if your a bachelor and you have to pay tax dollars for the public education of other parents’ children isn’t it (and makes ALL of society better in the process) ?? “GIGO” wow that’s impressive. Nothing cliche sounding there. I see a Peter Drucker prize in your future.

They appear to be predicting smooth sailing for the rest of 2019.

https://upfina.com/rate-cut-impact-on-housing-earnings-revisions/

But what does that mean if you feel you have to get it by artificial means, and Jerome Powell cutting rates when he doesn’t really know they need to be cut. Wasting bullets right by the ZLB. It’s not very intelligent of Mr Powell—but sycophants of presidents rarely act in an intelligent manner. Menzie stated before Mr Powell can make more money in the private sector. If all Powell can do is wave pompoms for donald trump, I suggest he leave the Fed now while he still has about 1/4 of his integrity left.

If this was another President, Powell doesn’t make this rate cut—and I have to say it, if Menzie believes otherwise (that Powell would have made this rate cut under a Clinton or under an Obama with the SAME economic conditions) then maybe Menzie should skip a couple years going to jackson Hole. I don’t think hanging out at Fed Res events is necessarily good for free thinking.

My words were probably too harsh in the above comment, which I regret. But some of this stuff makes me extremely angry. I let that anger out in the wrong way, and for that I am sorry.

You know, when I think of all the rate cuts by Greenspan as he was cheered on, and then all the attacks on Obama for cleaning up W. Bush’s mess, and then to watch Powell do “grocery isle clean up” on donald trump’s bad trade policies etc, it just really really really infuriates me. And I let that anger seep out into an unfair and wrong comment towards Menzie, and I’m sorry for that. I guess I will have to do a self-imposed break from blogs (if I can control myself) because I just feel a lot of anger building up to where all this stuff is headed in late 2020 politically, and the anger over events that I can already foresee happening is just going to end up in me saying more things I regret.