Today we are fortunate to present a guest post by Carola Binder at the Department of Economics at Haverford College. Twitter: @cconces

Over the past few decades, central banks around the world have been granted greater independence. Central bank independence (CBI) reforms aim to shield monetary policymakers from political influence and reduce inflationary bias. But as Walsh (2005) notes, “legal measures of Central Bank independence may not reflect the relationship between the Central Bank and the government that actually exists in practice.” Forder (1996) describes how a central bank may be “independent by statute, and it is nevertheless accepted— on all sides— that the government will have its wishes implemented.”

Even without clear acceptance that the central bank will accommodate the government’s wishes, political pressure on the central bank may still affect monetary policy outcomes and credibility. A year ago, for example, Politico noted that “Now that the president has openly criticized the Fed, every action it takes might be viewed through the lens of a reaction to him.”

In a recent paper, I use a narrative approach to study political pressure on 118 central banks around the world. I search country reports from the Economist Intelligence Unit (EIU) and Business Monitor International (BMI) for discussions of political pressure on or government interference with the central bank. The reports are designed to give equal attention to each economy and to report at consistent frequency on monetary policy-related developments, allowing for comparability across many countries and over time. For each central bank in each quarter, I code whether: there is no mention of government pressure on the bank, there is report of pressure but the central bank is resisting it, or the bank is reportedly succumbing to pressure. I also record details about the nature of the pressure (e.g. whether the pressure is to ease or to tighten policy).

I believe that the new dataset, which is publicly available, will be useful for a wide range of applications in monetary policy and politics. In my paper I focus on establishing several key results about the prevalence and persistence of political pressure, and its relationship to legal CBI and to inflation dynamics.

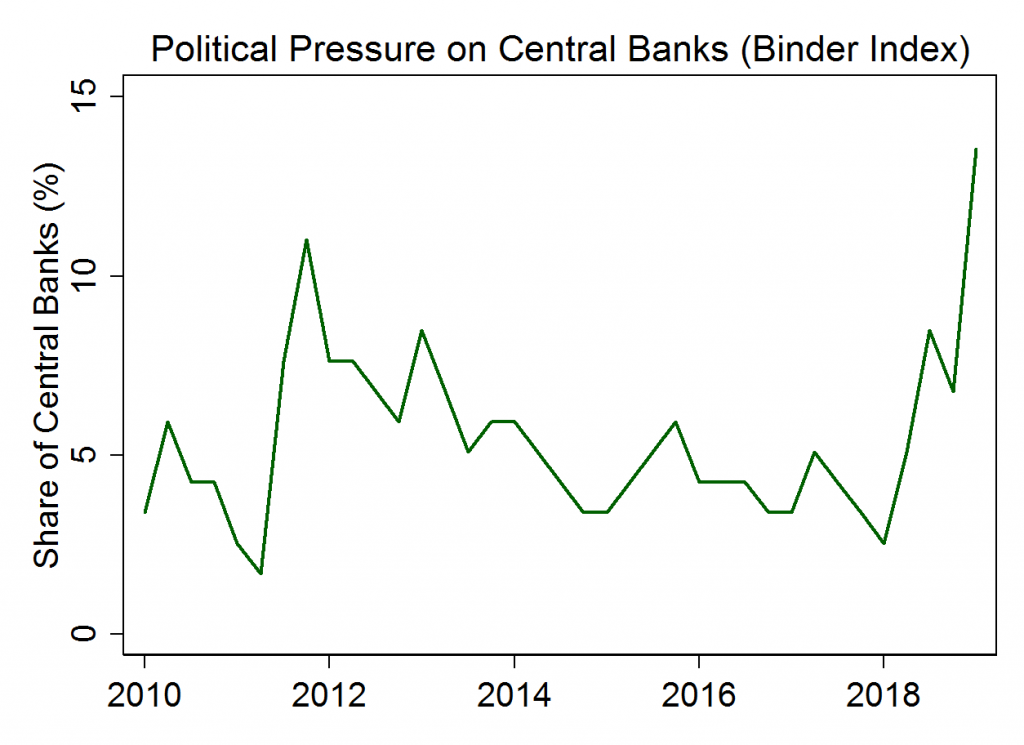

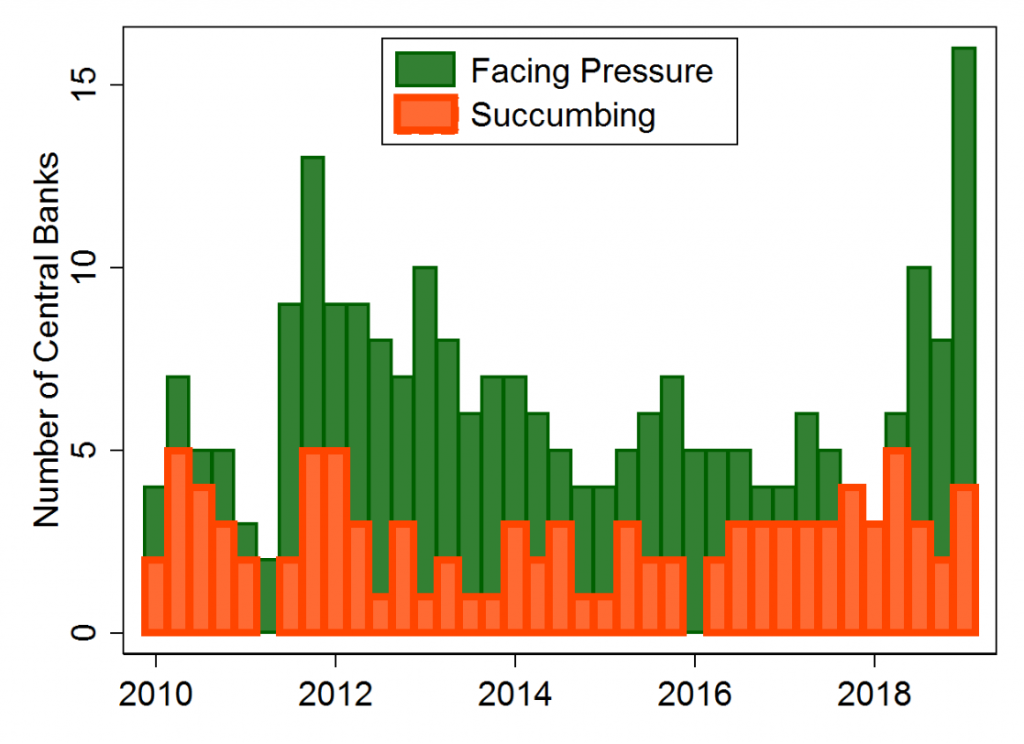

Pressure is widespread, as 39% of the central banks in my sample face at least one report of pressure since 2010. In an average quarter, there are reports of political pressure on over 5% of the central banks. In over 90% of cases, the political pressure is for easier monetary policy. As Figure 1 shows, reports of political pressure were most frequent (14%) in the most recent quarter (2019Q1). Figure 2 shows a breakdown of the number of central banks categorized as resisting or succumbing to pressure over time.

Figure 1: Share of central banks facing reported political pressure over time. Source: Binder (2019).

Figure 2: Number of central banks facing and resisting or succumbing to political pressure over time. Source: Binder (2019).

Overall, the political pressure measures are uncorrelated with legal indices of central bank independence. That is, statutory independence does not seem to protect central banks from government interference. However, in lower-income countries, legal CBI is associated with slightly less frequent political pressure.

Importantly, political pressure rather than legal CBI is associated with higher inflation in cross-sectional and panel analysis. Political pressure is also associated with higher inflation persistence, suggesting lower monetary policy credibility, weaker anchoring of inflation expectations, and higher output costs of disinflation.

Given these results, it is important to understand the political institutions and characteristics that might lead to or reduce political pressure on the central bank. I find that democracies and countries with stronger electoral competition or more checks and balances have less frequent reports of pressure. Executives from left-leaning and especially nationalist parties are more likely to pressure the central bank. In the paper, I also collect new data on International Monetary Fund recommendations to show that global governance institutions may help moderate government pressure on central banks.

Recent commentaries suggest that public support for independent central banks is eroding following the financial crisis and rise of populist movements. While anecdotal evidence abounds, I hope that this data will be useful for researching and monitoring such development.

This post written by Carola Binder.

“public support for independent central banks is eroding following the financial crisis and rise of populist movements.”

It would be tempting to focus on Trump’s attempt to pressure the FED but let’s not forget how the Bernie Bros went after Bernanke, Yellen, etc. Of course they had their little forecast ala Gerald Friedman which they so adored that any reasonable critique from any economist send them over the edge. Hey I consider myself a progressive economist but can we stop assuming that those who provide reasonable economic advise are evil people?

shrug

Well, it’s a well done attempt to quantify empirically the consequences of an inevitability.

Dear Folks,

A useful argument. Please note that while this Administration is eager and pushing for lower rates, it is not the first or even close to it. The Nixon administration aggressively pushed for money supply expansion, even during the wage-and-price control period of 1971-1972. Steven Axilrod, with his “Inside the Fed” (as in https://mitpress.mit.edu/contributors/stephen-h-axilrod – the revised edition), describes a gentlemanly version, and there is more where that came from.

Julian

William Nordhaus’s The Political Business Cycle was published in 1975. Nixon indeed may have been the motivation for this paper. Of course Nixon was corrupt and had to resign to avoid being impeached. Trump is Nixon on steroids.

https://www.jstor.org/stable/2296528?seq=1#page_scan_tab_contents

The Political Business Cycle

William D. Nordhaus

The Review of Economic Studies

Vol. 42, No. 2 (Apr., 1975), pp. 169-190

Right.

This is an interesting summary of Axilrod’s book:

Axilrod’s discussion focuses on how the personalities of the various chairmen affected their capacity for leadership. He describes, for example, Arthur Burns’s response to political pressure from the Nixon White House and Paul Volcker’s radical shift to an anti-inflationary policy at the end of the 1970s—a transition in which Axilrod himself played a crucial role. As for the Greenspan years, Axilrod points to the unintended effects of the Fed’s newfound “garrulousness” (the plethora of announcements and hints about policy intentions)—one of which was the Fed’s loss of credibility in the aftermath of the chairman’s 1996 comment about “irrational exuberance.” And Axilrod incisively outlines the problems—including the subprime mess—inherited from Greenspan by the current chairman, Ben Bernanke. Great leadership in monetary policy, Axilrod says, is determined not by pure economic sophistication but by the ability to push through political and social barriers to achieve a paradigm shift in policy—and by the courage and bureaucratic moxie to pull it off.

“Great leadership in monetary policy, Axilrod says, is determined not by pure economic sophistication but by the ability to push through political and social barriers to achieve a paradigm shift in policy—and by the courage and bureaucratic moxie to pull it off.”

this is why it is so very important to not let trump appoint deputies to the fed. they should be vetted and voted on based upon their expertise, achievements and credibility. hence we should not have an uproar about moore, and then let shelton be approved simply because she is not as bad as moore and we are tired of fighting with trump on all issues. it is not that we are fighting with trump, we are fighting with poor decisions. less poor decisions, but poor nevertheless, should not be given a pass simply because they are less poor than the original. this is trumps MO lately. first provide a ridiculous option, then present a less offensive, but still unacceptable, option in the hopes people tire of fighting. this is how he negotiates.

Rather than the theoretical and grand sounding “independent central bank,” Let’s look at the real world. What has the FED done lately.

1) Consistently failed to reach its target of 2% inflation. Can it be more than a decade?

2) Despite failure above, attempted to increase interest rates generally, beyond its control of short term rates. With what results?

A) severe and persistent interest rate inversion

B) for a considerable length of time a Dollar at high evaluation against other currencies at a time of difficult time of trade exports

C) Created a balance sheet of unprecedented size, which has brought fear to the market of consequences of when the FED gets serious about reducing or not reducing its size.

Other mistakes failures or inconsistencies can be listed, but the point is “independent central bank” is not the same as a mistake free central bank. And if the Bank refuses to correct or even recognize its errors, the people as represented by its political should remain silent for the sake of the grand sounding “Independent?” If so, where is the push for needed change of policy going to come from? Academia with its practically uncountable theories and solutions? Wall Street with its large but very narrow interest. Wait for international speculators to crash the Dollar, a la Great Britain in the last mid-century? And to restate, political pressure which either can be seen as expressing the people’s desires, or as short a term election cycle special interest?

Not as simple an exercise as some may think.

Ed

“B) for a considerable length of time a Dollar at high evaluation against other currencies at a time of difficult time of trade exports”.

I’ll leave it to others to mock the rest of your stupid list but (B) is beyond stupid. “difficult time of trade exports”? WTF? Now exports did fall last quarter in large part because foreign airlines are not buying Boeing 737s. Only an idiot would blame that on the FED but you just did.

Yes we have had large current account deficits for a very long period of time. But everyone with a brain realizes that when national savings is so low that it is far less than our rather weak investment demand, we will have a large current account deficit. The FED is not responsible for low national savings. Trump’s insane fiscal policy may be but not the FED.

Not sure how independent the US federal reserve can be: Art I Section * congress the power to …. “to coin Money, regulate the Value thereof, and of foreign Coin.” Art I Sec 10 denies states’ power to coin money etc.

Insane fiscal policy has to be conspired in with the congress; power of the purse, while the regulation of money is also one of the “powers of congress”.

Sequestration started in 2011, by anti Obama deficit hawks is being softened by the current budget “deal” in to insane fiscal actions.

Trump has partners in fiscal insanity.

Leave it to ilsm to write the most irrelevant gibberish of the day!

Very interesting.

I first became aware of Carola via Noah Smith.

more articles on your blog please!!

Dear Folks,

Let me add something in retrospect that seems obvious. Leave out the U.S. Federal Reserve for the moment, and focus on the European central banks. By having negative interest rates, they are deterring foreign investors from holding money in their currencies. As the foreign investors flee the particular currency (leave out the pound for the moment), the exchange rate of how many dollars are needed to buy one unit of the foreign currency (e.g., the euro) falls – the currency depreciates against the dollar. As it does, or the dollar appreciates, which is the same thing, foreign goods become cheaper relative to American goods to the American consumer. It thus seems to me that these negative interest rates in Europe is an attempt to circumvent the tariffs the U.S. has imposed and threatens against Europe by foreign exchange intervention by the central banks. Something similar may work for the pound under Boris Johnson. If the U.S. interest rates are lowered, but the tariffs are increased, what reason is there to expect that the foreign interest rates will not be lowered even further, nullifying the effect?

Julian

Remember folks, it’s the GOP, otherwise known as the party of “family values”:

https://www.theatlantic.com/ideas/archive/2019/07/ronald-reagans-racist-conversation-richard-nixon/595102/

Well, “it was just late 1971” and Saint Ronnie Reagan calling blacks “monkeys” as the posterboy for all that is Republican, “there’s nothing wrong with that” “hehehehehe” just a few jokes among the special Republican crew there, nothing to be upset over. Apparently African Americans registered as Republicans enjoy being called “monkeys”, just ask J.C. Watts of Oklahoma, Secretary of HUD Ben Carson, Herman Cain, or Thomas Sowell, none of whom can go two breaths without paying homage to Saint Ronnie.

Then we have “Republican light” milquetoast weaklings standing on a Democrat debate stage, telling millions of Democrat voters “we don’t dare go against Republican dogma” because, well, “it just can’t be done” folks. “It can’t be done”.

https://twitter.com/DGoforth918/status/1156387474035367936

“All of this is because donald trump”, and the sad state of America has no connection to illiterate voters who can’t be bothered to read a newspaper on every odd numbered calendar day, because they HAVE to watch Netflix’s 35th “dystopian” series or have to fit time in their schedule for a cerebral game of Minecraft. NO, those things have nothing to do with this. It’s because of Russian bots that Jethro in Yates Center Kansas gets led around by the nose, nothing else. Certainly not the state of Jethro’s local public school system, that’s been starved of funds for decades by Republicans. No worries on that front!!!

There’s no matter in pondering any of the above, because the man who just loves the purple warmongering ogre living in a dark dungeon—Dick Cheney— is going to save us all from this:

https://www.c-span.org/video/?c4810033/cheney

Here’s a first for us.

https://twitter.com/WhiteHouse/status/1157015397696200704

Retweeting Trump’s intellectual garbage again? What’s the matter little Steive Boy? Fox & Friends are not returning your calls?

Let’s see – comparing the murder rate in a city to an entire nation? Talk about apples and oranges. Hey Stevie – we knew you were disgustingly dishonest. But your are this STUPID too?! DAMN!

increased accountability steven? perhaps fewer guns on the streets would reduce that murder rate? think about accountability steven.

Steven’s mentor is John Lott. I’m sure these two can cook the books to argue more guns on the streets somehow lower murder rates.

I am more of a Ronnie Lott fan.

https://smallthoughtsinasportsworld.wordpress.com/tag/ronnie-lott/

The Baltimore Sun reports on the lies at the Trump rally which Princeton Stevie Boy repeats here:

https://www.baltimoresun.com/politics/bs-md-pol-trump-baltimore-murder-20190802-ksybukzpw5h77nrganjpgkshqu-story.html

Gee Stevie – you must have been in Cincinnati with the rest of those Trump racists!

Source article is here. You might try reading it.

https://www.princetonpolicy.com/ppa-blog/2019/7/29/baltimore-border-problems-share-common-cause

The Sun, to whom I spoke this morning, writes:

“The president is accurate that Baltimore’s homicide rate is higher than the countries he listed. That’s according to data published by the United Nations Office on Drugs and Crime last year and U.S. State Department Overseas Security Advisory Council reports published this year. Baltimore’s homicide rate is actually seven times higher than Afghanistan’s…”

You might want to also check Politifact, with whom I corresponded this afternoon.

You spoke with someone at the Baltimore Sun? I bet the person that answered your call told you to please stop harassing them as they are too busy for Trump trolls. But Stevie – try READING your little quote here. Comparing the homicide rate of a CITY to that of an entire COUNTRY. As I said earlier – your comparison is an incredibly dishonest way of doing comparisons. You do know how to read – don’t you? It seems you don’t!

Princeton Stevie must be the dumbest troll ever as he continues to compare a city’s homicide rate to that of an entire nation. PLEASE! A little experiment from my locality. New York City has done an admirable job of keeping its homicide rate at only 12.5 per 100,000, which is darn good for a crowded location. And yes – we have lots of brown and black people. I know Trump and Sycophant Stevie think otherwise but in my view, this diversity makes my city all the better. And yes – we have a Democratic mayor!

Now the State of New York has a lot of rural areas and its homicide rate is only 2.8 per 100,000. And yes our governor is also a Democrat.

Now back to sycophant Steve. Does he compare the CITY of Baltimore’s homicide rate to that of entire nations because he is even dumber than I thought? Or is this self promoting village idiot just desperate to get another invite to Fox & Friends?

Princeton Stevie Boy claimed he was talking to the Baltimore Sun. Well let’s take a look at their recent oped:

https://www.baltimoresun.com/opinion/editorial/bs-ed-0803-trump-cincinnati-20190802-lkjzouxc2zfxtftjao5wsspouy-story.html

‘The pitiful day a U.S. president used a political rally to mock Baltimore’s homicide rate’

That’s the title. Stevie Boy is claiming he was the source for what Trump said here. The editorial does a nice job of noting the events as well as condemning Trump’s tantrum. Permit me to highlight two paragraphs:

“That’s right. If only the Democrats were less sympathetic to immigrants (or at least supported tens of billions of dollars for a new border wall, one presumes) there would be money for urban renewal. That’s some twisted logic coming from the man who thinks Baltimore has wasted or stolen billions already. But then what does that matter? This is someone who argues both sides, none of it sincerely, none of it truthfully. One moment it’s a lack of federal spending, the next moment he says all that is wasted. Or maybe it’s up to Elijah Cummings, one of 435 members of the U.S. House of Representatives, to save Baltimore. What, with a resolution on the House floor? President Trump doesn’t mean a word of it. He’s just lashing out. It’s all a performance. It’s all a show.”

Yep – a dishonest show at that but to the 2nd paragraph:

“This newspaper got some attention six days ago — when Mr. Trump first launched his attacks on Charm City — for describing this president’s shortcomings in unfiltered, unequivocal terms. But that missed an important point that was so vividly on display Thursday: He lacks human empathy. Psychiatry has a name for that condition. It’s called antisocial personality disorder. But taking partisan delight at the suffering of Baltimoreans? That is not the action of a rodent. (As PETA chastised us this week, rats actually care about each other.) Nor can it be explained by mental aberration. This is the behavior of a jerk, a clod, a dolt, a schmuck.”

Trump and sycophant Stevie are indeed a jerk, a clod, a dolt, a schmuck! When Princeton Stevie boy called them – I hope they used this precise language!