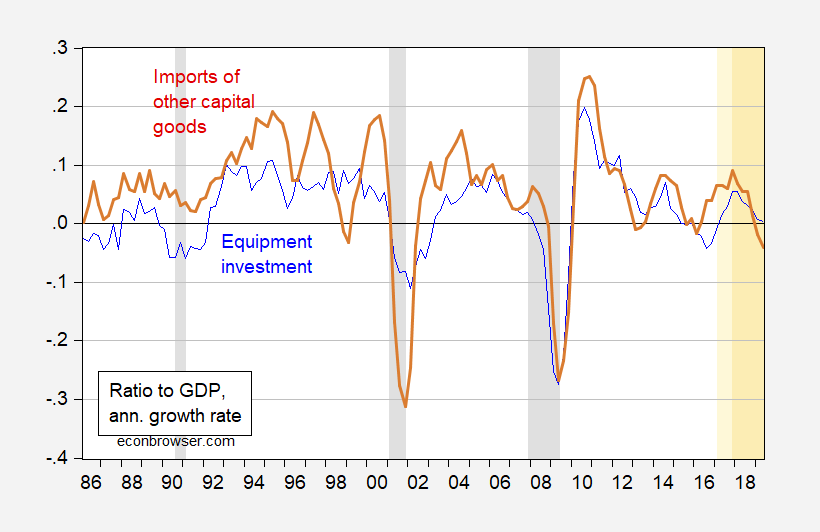

Equipment investment is flat; capital goods imports (aside from aircraft and computers) declining 4% per annum.

Figure 1: Equipment investment (dark blue), and capital goods imports excluding aircraft and computers (red), four quarter change as log ratio to GDP, all in 2012Ch.$. NBER defined recession dates shaded gray. Light orange denotes Trump administration. Orange denotes TCJA in effect. Source: BEA 2019Q2 advance, NBER, and author’s calculations.

Capital goods imports (as a share of GDP) growth is now below zero, while equipment investment growth is at zero. Concurrent negative growth rates signalled the beginning of the 2001 recession, and the worst part of the 2007-09 recession. Of course, concurrent negative growth also signalled the mini- (but not actual) recession of 2016 (2015Q3).

Estimating a probit regression using the investment variable as coincident (not leading) variable, one obtains (1986Q1-2019Q2):

Pr(recession) = –1.32 – 12.21dinvgdp + u

McFadden R2 = 0.30, n = 134. bold denotes significance at 5% msl. I assume that in reality, no recession occurred as of 2019Q2 in defining the recession variable.

The current implied probability of recession as of 2019Q2 is 8%; in 2007Q3 (using latest revised data), the probability was…7%.

“Orange denotes TCJA in effect.”

We were told that TCJA would lead to a yuuuge surge in both series. It seems we were lied to.

Orange to denote TCJA makes me smile.

The model produces 7% odds of recession in Q3 2007 presumably because the subsequent recession was housing and mortgage-credit led, with a big does of financial disintermediation. Capital spending fell as a result, so lagged.

Do we now have reason to believe capital spending might lead? Well, kinda, yeah. Policy uncertainty, tariffs, supply chain disruption, that sort or thing. So 8% in Q2 of this year might actually be reassuring.

Yes, PGL you are right. But even if we had not had the tax cut business investment is weak enough to raise worries about the overall economy.

Cyclically this is the time period when capital spending should be strengthening not weakening.

Historically, large profits and high cash flow burns a hole in executives pockets and they can not wait to spend it. The weak business investment strongly implies that there are other problems in the economy.

Real orders for non-defense capital goods is a component of the leading indicators aind its y/y cH: is now negative.

Negative real non-defense orders has turned negative in every recession and only given one false signal–in 2015-16.

Dear Folks,

Still too early. This is supported by Barry Ritholz, who echoes the argument that the cut is political, in

https://ritholtz.com/2019/07/todays-reckless-irresponsible-politically-motivated-fomc-rate-cut/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+TheBigPicture+%28The+Big+Picture%29

J.

this is why trump wants to load up on his appointees at the fed and in the judiciary. notice how many of his lawsuits are now entering trump appointed courtrooms.

i am more than suspicious that the recent announcement of additional china trade tariffs is explicitly related to the fed dropping rates. i don’t think that trump would have made those tariffs if the fed did not drop rates. now the question is, does collusion exist between the fed and the trump administration in order to coordinate fed policy with trump trade policy? one may argue that this simply makes the trump administrations policy actions more effective, and their is some truth to that. it also completely undermines the political independence of the fed, which in the long term is extremely detrimental to the economic growth and stability of the usa. it would not surprise me at all if it becomes known that powell and trump struck a deal on this one.

I don’t disagree with the Fed for dropping rates a bit. We are going into a downturn. My take is that a rate cut was warranted. What Trump does with tariffs or other erratic, spleen based policy changes is a separate issue. Just as I disagreed completely with the GOP politically motivated insistence on austerity during the recovery from the Great Recession, I’m not willing to resist an appropriate rate cut by the Fed just because it might lessen the coming downturn and benefit Trump as well as the country as a whole. Normally, I don’t want to see anything that improves Trump’s chances of reelection, but if the choice is to harm other Americans, then it’s a bad choice.

P.S. That should be Barry Ritholtz.

J.

My wife had an interesting observation last night. We usually don’t talk about economic issues, because she isn’t the geek I am, and it usually bores her to tears when I go off on some convoluted explanation of what I think is going to happen and why. But, she brought it up while we were carefully not watching anything political that was going on. Her observation was that a recession is about to happen because she’s hearing people talk about buying houses with no money down. Her work takes her into four to five different houses to meet people during the week. During those meetings, she has noticed piles of unopened Amazon boxes. In her mind, that’s evidence of overspending and irresponsible banking. Both are the final hurrah before a crash.

Apparently I’m not the only outhouse economist and used tea leaf reader in the family. And, I appreciate our host professors here for allowing these ramblings to be set next to comments by others who actually know what they are talking about. That said, the fearless prediction just keeps getting more fearless. We are not in the slowdown all the way yet, and won’t be until early next year before it’s apparent to the public. But here comes a bumpy ride.

Professor Chinn,

As we all recall, Harry Truman wanted a “one handed” economist, but if you were asked to address an investment committee, what do you think you could say to the committee “on the other hand” regarding an anticipated recession? Other than some of the consumption data already mentioned by readers, what could be in the data that may hint that we could avoid an incipient recession?

The no-growth steady state ecological economist Herman Daly in fact has only one arm. I have heard him speak three times, and he seems to always start such lectures by announcing that he would have been Truman’s favorite economist because he has only one hand.B

@ Menzie

Menzie, even though I am trying to cut back on my blog comments, I had a question I wondered you would humor me. Even though I am not spending as much time here on the blog, I think you might be mildly proud of me, as I had been studying my “R” program and also some statistics or very basic level econometrics (which was largely motivated by your blog). I noticed McFadden R-squared is only mentioned in the advanced topics portion of Wooldrige’s book. I was trying to figure out how to interpret your McFadden number. Am I right in assuming when you calculated the McFadden number (also called a “pseudo” R-squared, yes??) you wanted a number between 0.2 to 0.4 to indicate strong fit?? Or could it have been a totally different range you were looking for on McFadden, to make sure your model was “appropriate”. I know that in fact your model is appropriate, but was wondering what number you want to get on your McFadden “pseudo” R-squared to feel relatively good about your model. Thanks.

And now the Moron-in-Chief wants to slap another round of tariffs on imports from China. That should help equipment investment!

pgl…..I too am shocked, simply SHOCKED that Team Trump lied about the effects of the TCJA. After all, Trump has always been so honest and above board about his taxes, his intelligence, his ties with Russia, not to mention his fidelity to his menagerie of wives and mistresses. With a record like that, why would anyone doubt his sincerity? Time to go put on that MAGA hat before Fox News comes on.

Trump told us yesterday that Americans will not pay for these new tariffs. Like it is well established that 100% of the incidence of our tariffs are borne by the Chinese suppliers – NOT. Trump also told us about the trillions of customs duties that will be generated by his tariffs. Balancing the budget by robbing the Chinese seems to be the message. Of course none of these claims have an ounce of validity but put on that MAGA hat and it all makes sense!

“Trump also told us about the trillions of customs duties that will be generated by his tariffs. ” Trump told us we would soon have a cure for both cancer and AIDS. This is all just more proof that Trump just says whatever is in his head at a given moment and doesn’t care whether it is grounded in reality or not.

The Trump economy bites coal miners where it counts:

https://www.theguardian.com/business/2019/jul/22/blackjewel-mines-shut-down-layoffs-future

‘Our paychecks bounced’: US workers in limbo as coalmines suddenly close

Blackjewel files for chapter 11 in a move critics say is increasingly used to avoid paying workers what they are owed

Hello Professor Chinn,

Using my R probit regression model I got

intercept = -1.337

coeff = -12.292

And for my 2019q2 prediction, I got 4.752% for implied probability for 2019q2.

Still going over my model. Hope to get closer to your results.

Cheers,

Frank

@ Frank

Whether you do or don’t get the correct answer, I appreciate you putting these numbers up Frank. Still in my early stages, but I do somewhat/partly understand what a probit model is, basically looking for a kind of binary answer—- “yes” there will be recession, “no” there will not be recession. As is the case usually for me, I can grasp some of the conceptual part but not all the math. My guess is you’ve got (basically) the correct math, but your numbers are off because Menzie has added a couple “fine tunings” in. Have you use natural log to smooth out your numbers in there?? And are you certain you used the same number of quarters Menzie did?? n=134.

Menzie also says something about “defining the recession variable” that the latest quarter is not beginning of recession—not sure if that would include adjustment to the math. Please post in this thread when you figure out what is causing your number to be SLIGHTLY off in your probit style equation. Again Frank, correct or incorrect answers, your “R” explorations are like gold for me posted on here.

Hello Moses,

Don’t forget you are talking to a dumb-dumb. My econ experience is at the AP High School level. There are some smart people on this blog and I am not one of them.

After work today, I read Professor Chinn’s problem statement, again.

I think my coefficients are fairly close to Professor Chinn’s.

Reading his variable name “dinvgdp”, it looks like delta-investment-gdp. I’m guessing change in equipment investment as percent of gdp.

I also paid more attention to BEA 2019q2 advance. That is *key*.

I grabbed Line 11 of BEA 2019q2 advance and used that as my test set (1 observation).

My new calculated current implied probability of recession as of 2019Q2 is 7.729%

That 7.729% is close to Professor Chinn”s 8%.

Cheers,

Frank

@ Frank

I’m not buying the “dumb dumb” part of your comment. And if I did buy it (which I never would) I’d have to wonder what that makes me by extension since you managed to figure out 3-4 things I didn’t looking at the same exact post.

I appreciate you sharing how your thought process went to get very similar numbers to Professor Chinn’s. It will help me start to connect these things both econometrics-wise and on the “R”.

It is appreciated, THANKS.

@Frank

I found this link Frank. Often when I am hunting down things “R” related, this UCLA site will pop up. I am guessing the site has lots of gems on it. It discusses probit here and many useful things:

https://stats.idre.ucla.edu/r/dae/probit-regression/

@ Frank

Curious if you ever had problems installing “car” package?? I have tried different mirror sites, of course the main CRAN site. I have downloaded other packages with little problem, but cannot get “car” to install.

I have about 15 other packages I could install but have delayed trying. I will go ahead and install those just to see if it’s a common problem with my set-up, but I don’t think that it is, I think there is some peculiar issue with “car”. I am running 3.3.3 Rstudio for whatever it is worth. I also have XQuartz running.

Moses Herzog I think you meant to say that you’re running “R” version 3.3.0. The “RStudio” versions aren’t that high yet. The CAR package depends on your running “R” version 3.5.0 or higher. See the dependency note at the top of this page.

https://cran.r-project.org/web/packages/car/index.html

The latest “R” version is 3.6.1.

@ 2slugbaits

I appreciate it. I had seen some people say they had similar problems on some problem solving sites. I had tried a couple “solutions” and none seemed to work. I would download the latest version of “R”, happily, and could do it in the next 10 minutes. However I am 98% certain it won’t work with my current hardware set-up, which runs shall we say “a little to the dated side”. What you said obviously makes sense, since most of the people with my same problem were running roughly 3.3—3.5 version of “R”. But your comment is still appreciated as I hadn’t seen the CRAN notation and it’s good to have my suspicions re-affirmed/confirmed.

In the end, it’s “only a data set”. And I should be able to do most of the things Menzie does once I know the code commands better. Still I can’t help but kick my shoes at the dirt on the ground a bit in frustration, as I think the “car” data set would have helped sharpen my skills.

If I am reading this chart:

https://fred.stlouisfed.org/series/NEWORDER

right, then capital goods orders are up. I assume that means since capital goods imported are down, that means US manufacture of capital goods (sold) is up. Not a bad sounding trade off.

Ed

You found one chart where nominal spending is up. Atta boy! Trump will give you a bone. Of course you need to inflation adjust your series.

Ed, you are looking at nominal data and correctly see that it is up.

But the key series is real orders.

New orders for nondefense capital goods in 1982$ (NMONC) is new orders for

nondefense capital goods in current dollars (NMOCN) deflated by PPI for

final demand private capital equipment .

Since BEA turned the leading indicators over to the Conference Board you have to be

careful with this series. In the old days the deflator was extremely volatile because one months

data could be dominated by IT equipment and the next months data by more traditional goods.

One month could actually fall while large aircraft orders, for example, could generate a very large jump.

This is still true, but you do not have direct access to a monthly deflator.

Now the PPI data is smoother and single observation could by quite misleading.

But the real data clearly shows a year over year drop in non-defense capital goods orders.

I’m glad you are letting Ed know he needs to inflation adjust his numbers but c’mon man – do you expect his political masters to allow him to do this right?

I see but it is important to exclude aircraft orders as did Menzie chart. With such exclusion orders are up I believe, both nominal SAAR and real. Does mean more domestic manufacture.. Please link Fred chart if you still disagree. Also since Menzie chart is modified by GDP. it does not directly measure size of orders.

Again, I welcome correction to my interpretation of statistics.

Ed

It is rather customary to express spending as a share of income so your questioning our host doing this shows you still do not get it.

BTW – why are we importing aircraft when Boeing is such a powerhouse? Oh wait – that 737 fiasco!

“since Menzie chart is modified by GDP. it does not directly measure size of orders.”

Huh?

Ed gets really confused when folks talk about relative size!

@ pgi

This explains why Ed keeps running around telling everyone donald trump’s hands are “very big”.

Yeah, this isn’t impressive at all Ed. As I agree with Rothschild legacy owner, Mike Shedlock, the junk bond bubble is basically bursting. Auto and energy are both toast and changes in basic production will sink the US economy. As I have been saying since last year, a recession through this September was very unlikely. Then very likely be the tale end of 2019 even if the official NBER variety call doesn’t happen until 2020 as that I expected as well.

The losses will start in auto and energy as the PGL page from above. These losses will come before the main “sales plunge” in auto sales shows up on bean counters government paper in preparation to phase out balance sheet killing incentives. Then corporate debt will stop rising killing the tech sector this cycle as buybacks are forceably shut down. The economy will see unemployment rise and the asset bubble in this case, corporate junk debt, crash.

People need to understand how this asset bubble effects the economy and why it does. Too many are stuck on the last recession when in fact, is not the asset bubble this time. The US has had a few producer led recessions since 1950.

Shedlock is a nutjob. But then so are you. Sorry dude but your latest rant was a complete mess.