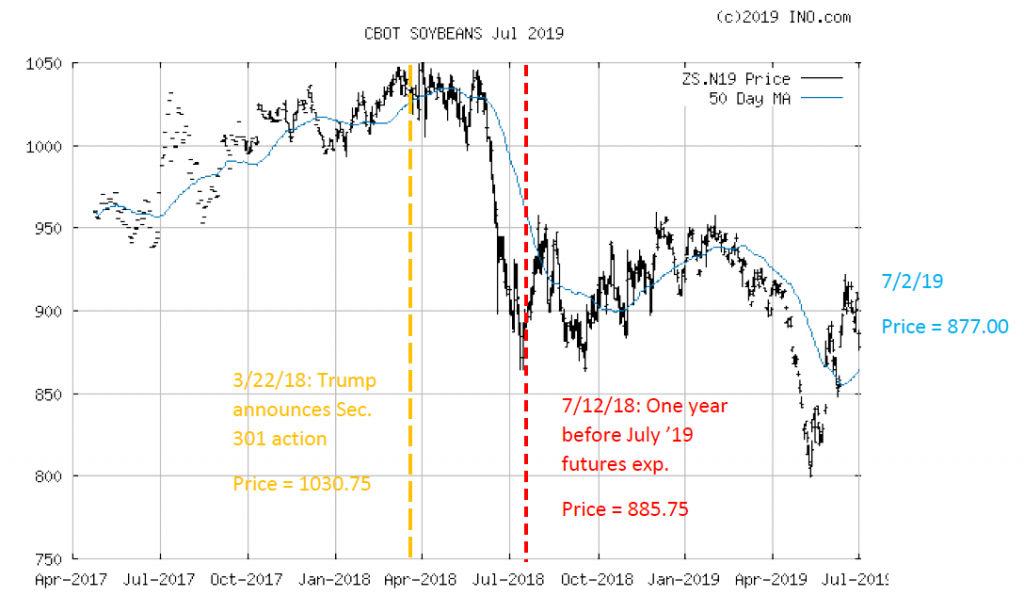

On July 12th, 2018, the closing price for a CBOT soybean futures contract expiring on July 12, 2019, was 885.75. As of 1:40PM Central on July 2nd, the price of the July 2019 contract was 877.00, 0.99% difference. In other words, soybean futures are (still) doing pretty well in terms of forecasting.

Figure 1: Price of contract for soybeans futures expiring July 2019 (black line), fifty data moving average (blue line). Source: ino.com accessed 7/2 1:40PM, and author’s annotations.

In other words, despite the Trump-Xi trade truce, soybean prices remain mired at where they were nearly a year ago (which is why I think Brad Setsers’ “standstill” better describes the outcome).

The usual donald trump marketing scam. Nothing like playing Barbie dolls in front of the crowd is there?? “Today, Mattel’s Barbie goes to an international conference!!!” “Also in todays episode, a French female bureaucrat finally figures out it’s more intelligent to ignore lightweights, than make their entire gender look like a joke. Exciting!!!” :

https://japantoday.com/category/world/unwantedivanka-campaign-pokes-fun-at-trump%27s-daughter

Honest to God, there are women working in porn now setting a better example and doing more tangible and pragmatic actions than ivanka for women’s rights.

http://entertainmentadultunion.com

“Remember, Mattel’s Barbie can do anything she wants girls—no education or scholarship required!!!! You go girl!!!!”

And in other news……..

https://japantoday.com/category/world/hong-kong-protests-may-give-taiwan's-leader-a-boost-vs-china

Gee, you think any lightbulbs are popping on over Taiwanese people’s heads about their right to vote as they watch Hong Kongers’ last spirit of freedom be stomped on by PSB goon boots???

Off-topic

Stash this under “current events”, “Low points for American White House flake” or whatever you like:

https://www.vox.com/2019/6/29/19953294/ocasio-cortez-megan-rapinoe-us-womens-soccer-team-house-representatives

Of course Kamala Harris piggybacks off of someone else’s original idea. But that’s fine, since our politically clueless Barkley Junior has yet to figure out Harris is peeling off more votes from Elizabeth Warren than Bernie. Eventually (after a few months) the grade school math of political polls will hit Barkley “Skewed” Junior in the face, and we’ll have another Barkley Junior rationalization presented to us.

Moses,

What? I don’t think I said Harris was peeling off votes from Bernie nor do I think she is peeling them off from Warren. Is this doing your deranged anti-Warren schtick again? As of right now it is hard to see who is peeling off votes from whom, but both Harris and Warren have been gaining so I doubt either is peeling off the other. Biden has lost a lot, and it is highly likely that a lot of Harris’s gain has been from him, especially among African American women, who were for him 49%, with that taking a big hit. Bernie is not moving, so I do not think anybody is taking anything from him. Buttigieg and O’Rourke are some other that have more noticeable declines, and my guess is that both Harris and Warren have been picking up from them.

As it is, I have no idea what idea it is that you think Harris is “piggybacking” off somebody else.

I would also suggest that you really should not use the word “skewed” ever again in a post here as this reminds everybody of probably your biggest intellectual blunder here, one repeatedly pointed out to you by several people, but that somehow you think makes you look good and me stupid by bringing it up again. Get real, Moses, bringing this up just makes you look stubbornly foolish.

Heck, I though we might be about to have friendly relations, but I guess your anti-Warren frenzy is just too deeply rooted, and all that silly skewed stuff came from you trying to justify the less defensible parts of that frenzy, in short your simply wrong claim that the “average American has more Native American ancestry than Warren.” If you just randomly pick out an American, they are more likely to have zero Native American ancestry than any, and that reflects the hard fact that the distribution of that ancestry across the population is skewed. Got it? Deal with it, and stop making yourself look like a third rate fool.

Oh, got the piggybacking. Harris invited the soccer team to the Senate. Very shameful of her. Simply awful.

As it is, while his polls have stabilized, Bernie’s standing has gradually declined since the beginning of the year, with probably most of those stepping back going over to Warren, who has gradually risen. In contrast, Harris has had a sudden bump due to the debate, with probably most of that coming from Biden who has taken a hit. What will be interesting to see down the road will be Warren and Harris debting. As it is, I think it is between those two and Biden. Bernie will not decline further, and he will make it to the convention with his 15 or so percent. But he no longer has any remotely serious chance of getting the nomination.

Just to fill out the very basic stat stuff here, Mose, although this will bore everybody else to tears, but you seem to need it.

So, for a given distribution, the mode is the value that has the most observations, the median is the value below which half the observations lie and above which half the observations lie, and the mean is the value one gets if one adds up all the values and divides by the number of observations. The mean is often called the “average value,” but that is not the same thing as the “average observation,” which is more like the median, the one for which half the values are above it and half are below it.

Now for some distributions this is not a big deal because all three of these equal each other This happens to be the case for the (Gaussian) normal distribution and also the even distribution, the one that applied for characteristics to the genome in that article you have cited way too many times. However, it is not true for skewed distributions, which is how the characteristics are distributed across the population (and indeed, as has been said way too many times, a genome is not a population), and indeed Native American Indian ancestry has a skewed distribution across both the entire US population as well as the nominally “whilte” population. So the mean does not equal the median does not equal the mode.

Where you got confused in all that was you saw the mean value of percentage Native ancestry and it is indeed higher than the percentage of Native ancestry that Elizabeth Warren has. This is what you ran around yapping about and making ignorant and foolish remarks based on. But as it is, for skewed distributions the mean value exceeds the median value exceeds the mode value. Indeed, the mode and median values are zero, below Warren’s very low percentage, which is why if you were to just randomly select a US citizen, they would be more likely to have less such ancestry than Warren, even though the amount she has is less than the mean or “average” value. That mean gets dragged upwards by the small amount of the population that has a high percentage.

I note another distribution that is skewed, income (also wealth, even more so). So the amount of income more people have than any other amount is less than the amount that the person has who has more than 50% of the population and less than 50% of the population, which in turn is less than the mean (or “average”) level of income, which is much higher as it is dragged upwards by that small amount of very high income/wealthy people.

Do you get this now? if so, please do not use the word “skewed” again anywhere remotely near this issue or in any lame effort to somehow make me look like I do not know what I am talking about regarding this. You make CoRev look good by comparison. After all, he just makes up vaguely plausible looking lies.

BTW, probably the one candidate who might block Harris by going on about what a mean prosecutor she was and did not prosecute Mnuchin would be Warren whom you hate. Bernie and others might also go after her on all that, but it will just end up helping Warren.

Hey – our soccer team is incredible. They can come over to my house any time! Of course AOC is confused here as she is not the Speaker of the House. Now Pelosi should invite our team to DC and tell the Donald F*** YOU!

I expect they will get invited lots of places. I would invite them to Seattle. They probably wouldn’t notice because Meghan Rapinoe already lives here and is a bit better known to the team.

I do not much care about ancestry. That said, I would enjoy the spectacle of Harris evicerating Trump about nearly everything. Including soybean prices. And Buttegig evicerating Pence about religion and being a Midwesterner.

The soccer (football?) team can count on the invitation out here no matter what.

The Guardian has to eat that elitism English girls lost to our arrogant American girls! USA!

https://www.theguardian.com/football/live/2019/jul/02/england-v-usa-womens-world-cup-2019-semi-final-live?fbclid=IwAR3eVKi9kipr2eVYNyyYdMDhH7Nws3FWCXC_YW9jl78EVS_j5MIRlkFx8jk

Of course Trump’s specialty is to create a problem not too long before an international conference so he can undo what he did and return to the status ante quo more or less, but have a big photo op and fake news media released touting his great breakthrough for his followers. This looks pretty much like what went on with this China bit, where negotiations were shut down not too long ago, but now they are back on. We have sort of a similar situation with North Korea as well, great photo op but basically just restarting previously shut down negotiations.

Trump did the world a “favor” but not imposing all those tariffs? Trump did us a “favor” by not starting a war with Iran? And oh yea – he decided to solve the Korea problem by telling Kimmie he can keep his nuclear weapons? What a guy! Oh wait – JBH under another thread claimed all of this backing down from stupid threats makes Trump a saint. Funny thing – in my high school, we saw these clowns as bullies who any girlie man could stand up to!

PGL,

It aint soccer it is football and when your team gets the benefit of highly questionable decisions I would stay silent.

Meanwhile I just have to say it again.

Soy it a gain Sam

Seems like only yesterday……..

https://youtu.be/MplmkXWdSg8?t=134

Good aftertaste though. Like bacon wrapped around mesquite smoked kangaroo meat.

Yea that rewarding of a penalty kick on what was obviously an English flop allowed our goalie to show her stuff! Then again – that penalty kick attempt was really lame! USA! USA!

And BTW – VAR got the earlier call right. She was clearly offside. Have a cup of tea Mr. Magoo.

how about your diving in the match against Spain. disgraceful

@ Not Trampis

USA National Team Women’s soccer—the very first international team to ever “dive”. [Insert laugh track here]

With all due respect Your Matey-ness, Has it ever dawned on you the specific reason why America is the last nation on Earth to care about soccer?? HINT: Only F_____s enjoy watching adult men flop. BTW, these highlights of Australia’s intra-squad exhibition match pretty much outline the problem.

https://youtu.be/5_heIx48eTw?t=18

For the record, USA Men’s National Soccer team is willing to fake lose the next 5 matches with Australia if you will import donald trump and put him in a kangaroo cage for the next 5 years. We’re will to pay shipping costs upfront. This fake losing soccer matches offer only lasts to November of 2020. Act now.

No worries mate, this’ll cheer you up. Barbecue shrimp style:

https://youtu.be/MplmkXWdSg8?t=134

Good times……..

Menzie: “In other words, soybean futures are (still) doing pretty well in terms of forecasting.”

CoRev: “Wow! Picking any number within 24 then touting the correct prediction on a clock as it approaches/passed through that number is an amazement. If you don’t like that analogy try an oscilloscope measuring signals, and pick a number”.

The prediction was for a price on July15. Oh, and 90 days from last July 15. Anyone care to check how many months since the prediction have been at that level?

Why is it we see these prediction confirming articles at market lows?

CoRev: OK. Just skip reading Econbrowser until expiration date, 12th of July. Then I’ll have a big, comprehensive roundup of your inability to understand time series analysis, the the relative performance of futures. I’ll make sure to document each of your comments relevant to this point. You’ve become my poster boy for what not to do in statistical analysis.

Manzie again tries to change the date of the prediction: ” Just skip reading Econbrowser untilexpiration date, 12th of July.” July 12th? Your prediction was for July 15, 2019 not july 12th. Your data was from here:

https://econbrowser.com/wp-content/uploads/2018/07/forecastbasics1.png (Please note both the date and price.)

And your prediction was also made on: “This entry was posted on July 15, 2018 by Menzie Chinn. ”

What is it about being challenged that you can not stand? BTW, how much and when was that ole ASF factored into the prices? In the spirit of Fama, I would consider the recent WSJ and other articles on ASF’s effect in the Asian hog market as critical new information. IIRC, a very recent WSJ article claimed China may be effected in a range from 20-70% of its total hog herd.

Soybeans prices clearly are effected by the ASF epeidemic: “Pressure on commodity prices

In China the outbreak has already hit the wider economy. Consumer price inflation, which had been under control before the disease spread, climbed over 5% last month. This comes at a tricky time for China’s government, which is trying to navigate an awkward trade war with the US and reinvigorate the high pace of economic growth that has defined the country for the last 20 years.

Soybean prices have been hit hardest. The cheap source of protein is the favored feed for fattening pigs and a bellwether for the global agriculture sector. The S&P Global Platts SOYBEX CFR China, which measures the price of the commodity, has dropped 20% to just over $357/mt since the first outbreaks of swine flu were recorded last year. The slump is a record low for the assessment.” https://blogs.platts.com/2019/05/15/african-swine-flu-chinese-commodity/

I have little faith that you have fully accepted this information, because you continue to write articles and comments about Trump and WINNING the trade war, while ignoring ASF’s effects.

Your bias is showing.

CoRev: Are you being deliberately dense here? Do you recall this response from me, if you have any specific questions about the data?

Update, 6/27, 4:40pm Pacific: CoRev has asked for the specific 7/12/2018 contract price for the July 2019 future contract. Spurred by this request, I subscribed to ino.com. (CoRev could’a done this him/herself, since I kept on referring to ino.com, but it is what it is…) The closing price is 885.75. Date is here (xls). (This figure differs slightly — 1.6% — from my eyeball estimate of 900. I will revise text accordingly).

Since there is no trading on 7/15/2018, I’ll use the last recorded close price of 7/13: 874.00 In my book, 877 is pretty darn close to 874. So what exactly is your point?

As for ASF, well I’d say March-May was the time of gradual relevation of information regarding the impact of ASF. While ASF has driven down soybean prices, a poor planting season in the US has driven prices up… To do a decomposition requires time series information, not ad hoc anecdote selection as you prefer.

“Are you being deliberately dense here?”

His standard MO. It is called trolling. But hey – that is what Trump has hired him to do.

Why do I repeat your July 15, 2018 link reference? Because that is your prediction. Date, time and data are all in that simple time capsule.

All references to July 12, 2018 appear as obfuscation or smoke screening that single July 15, 2018 article. When you say: “Since there is no trading on 7/15/2018, I’ll use the last recorded close price of 7/13: 874.00 In my book, 877 is pretty darn close to 874. So what exactly is your point?” Where did you get this? https://econbrowser.com/wp-content/uploads/2018/07/forecastbasics1.png Do you now get my point? Consistency and objectivity are important when predicting prices that change constantly.

BTW, thank you for finally admitting that the tariff is not the only factor affecting soybean prices. Fama would be proud that you eventually answered after several requests.

CoRev: I used 7/12 in more recent posts because that’s the contract expiration data and so one year earlier (which conforms to the Chinn-Coibion finding) is 7/12/2018. But for you, you will see near month contract price for 7/15/2018 from a July 2019 contract is 774, even closer to what is given now, so making my case stronger. Do you not understand?

“Manzie again tries to change the date of the prediction”.

Manzie – who is that? Oh right – Menzie who you insist is being dishonest. No he is not. But you are. Please stop as this has gone beyond repugnant.

You know – most people who find themselves in a deep hole simply stop digging. But not you. Can you please do more to embarrass your poor mom? Lord!

CoRev: Are you being deliberately dense here? Do you recall this response from me, if you have any specific questions about the data?

Since there is no trading on 7/15/2018, I’ll use the last recorded close price of 7/13: 874.00 In my book, 877 is pretty darn close to 874. So what exactly is your point?

I nominate you for the most obtuse person in the blogosphere, eclipsing Don Luskin.

“I nominate you for the most obtuse person in the blogosphere, eclipsing Don Luskin.”

I would have called CoRev the new Stupidest Man Alive except Brad DeLong might sue me for trademark infringement! BTW – Luskin’s old blog was entitled “poorandstupid” which some noted stood for the fact that anyone who trusted Luskin on investment advice was Poor because Luskin is stupid!

Dear Folks,

I don’t want to get involved in the Democratic debates or that over using the word “skewed” properly. But I do have a question. How do soybeans stack up against other futures as a possible store of wealth? Yes, we are all hearing “recession, recession, recession”, but if there is inflation, does this add anything to soybean prices historically, as a spillover from precious metals purchases, or is it really a completely separable commodity? Menzie, can you or anyone else answer this? Thanks.

Julian

Soybean prices:

9/30/13 – $12.83/bushel

10/1/15 – $8.77/bushel

10/2/17 – $9.57/bushel

7/2/19 – $8.76/bushel

https://markets.businessinsider.com/commodities/soybeans-price

You love to do this. As if history started in 2013. No Bruce – soybean prices rose a lot from 2010 to 2014. And then they fell a bit. We have been through this data MANY times. Which means when you cherry pick and lie like this – EVERY ONE knows what you are doing.

Like the old adage. Every one is laughing … AT you not WITH you.

pgl, did I cherry pick? I don’t think so. I think you cherry pick when you used a brief period of increased prices after 2013. Look at the link; look at the history. Soybean prices during the peak economic period before the “great recession” were in the $8-9 range. Then they went up and then they went down and then they went up and then they went down.

And it was all Trump’s fault!

You’re pathetic.

“I think you cherry pick when you used a brief period of increased prices after 2013.”

Seriously Bruce? I never had done anything of the sort. Way to win a “debate” by flat out lying what I have said. I’m pathetic? Rolling on the floor laughing (at you of course).

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

“Soybean Prices – 45 Year Historical Chart

Interactive chart of historical daily soybean prices back to 1971. The price shown is in U.S. Dollars per bushel. The current price of soybeans as of July 02, 2019 is $8.7975 per bushel.”

Here you go Brucie boy – cherry pick dates to your heart’s content. Of course be warned the rest of us can access this chart too. So when you lie from Trump, we know exactly how you pulled off your cherry picking. Bruce Hall – most inept Trump troll ever!

Gee I just looked at Brucie’s little link. While it only goes back to 2007 (not 1971) it still CLEARLY shows the soybean price boom during Obama’s first term. And yet Bruce did not note this? Yes – he is indeed a Trump troll and a particularly inept one at that!

Come on Bruce – are you incapable of checking your own links? Or are you just incapable of being even remotely honest?

pgl thanks for the link. I can clearly see an aberration in prices for a few years and then a return to normal. What do you see?

How about this? https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Oilseeds%20and%20Products%20Annual_Brasilia_Brazil_4-2-2019.pdf

Do you see that as U.S. prices were falling in 2015-18 that Brazilian production was climbing rapidly? That couldn’t have had any impact on prices, eh?

No, it was all Trump’s fault. Pathetic.

“Do you see that as U.S. prices were falling in 2015-18 that Brazilian production was climbing rapidly?”

Oh wow – you finally noted that a rise in global supply might lower prices. Well done as you and CoRev have so far blamed the recent fall in prices on an inward supply curve. Then again – knowledge of economics is not a requirement for being one of Trump’s trolls!

“Brazil accounts for more than one third of soybean production”.

Historically American farmers produced a lot more soybeans that Brazilian farmers. But this trade war could change all of that as China is buying more Brazilian beans and less American beans. This has been the point that the Trump trolls keep dodging. Make Brazil Great Again!

Menzie, again, I’m mot a statistician. I’m not trying to validate the methodology you used, but the actual PREDICTION. That is where the value lies in your model. It was off at the 6 months mark. We’ll soon see the 12 month data.

As for your blip comment, I have already admitted I was wrong on the tariff negotiations time frame. I doubt admitting it again will make any difference?

Bruce, pgl still hasn’t learned the difference between futures and spot prices let alone the impact of anything other than tariffs. His claim that the price rise was under Obama, implying some causality, is just another of his many ludicrosities.

He does amaze.

CoRev: I am amazed how you can write these words, given you confused spot, forwards, specific forward contracts expiring on different dates, front month futures as proxies for spot, and over a number of posts. If you *really* want me to dig up all the examples (on which you were called upon, at each juncture), I will be happy to aggregate and compile into one single post for all to see – as a pedagogical post on how to misunderstand derivatives (and plain english). Please write yea or nay.

Menzie, what I see is you are getting more desperate as we approach July 15! Remember this number $8.72/bushel.

“Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans. Hence, my best guess of soybean prices one year from today is 872. …”

As I have done for months now, I plan on using this link for spot prices. https://markets.businessinsider.com/commodities/soybeans-price

When asked to provide an alternative source you have ignored the request.

I have also used this definition for Spot Price:

Spot price definition

The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future.”

Coupled with the extended explanation:

“How are commodity spot prices different than futures prices?

A commodity’s spot price is the price at which the commodity could be traded at any given time in the marketplace. In contrast, a commodity’s futures price is the price of the commodity in relation to its current spot price, time until delivery, risk-free interest rate and storage costs at a future date.”

Your given time is July 15, 2019. Your given price is $8.72/bushel. I’ve repeated these definitions and data points for months now.

If you disagree this is your last time to make a case.

CoRev: OK, I’ll use 872 for front-month futures on 7/15 (which is standard proxy for spot — did you know that by the way?). What is your forecast – shall we use October 2017 price, which was what you said (last harvest season in your 2018 comment?). I’m pretty sure in the absence of some super-big event I’m gonna win (or to be precise, futures are gonna win).

“Bruce, pgl still hasn’t learned the difference between futures and spot prices let alone the impact of anything other than tariffs.”

Actually I do know what spot prices are as opposed to future prices. I also get that an inward shift of the supply curve does NOT explain falling prices. Do you? Of course not.

Of course if one reads your incessant babbling, one’s head might just explode. Keep up the comic relief for us!

Wow – “As I have done for months now, I plan on using this link for spot prices.”

Ah yes – a source that dates back to 2007. Of course that Macrotrends link I have noted many times provides the same spot data back to 1971. Come CoRev – do learn to graduate from the sand box someday!

Menzie, 😉

Happy 4th!

Menzie now admits: “CoRev: OK, I’ll use 872 for front-month futures on 7/15…” Well, yeah. It is your PREDICTION that we have discussed for these many months. Anything else just look like you can not live by your prediction.

Do you still believe the spot price will be $8.72 on 7/15?

Buried in your prediction article was this:

“Even so, futures at the 6 and 12 month horizons predict correctly the sign of change in actual spot prices more than would happen by random chance (63%), and significantly so. ”

The price at the 6 month mark, 12/15/20128 was $9.01. Not $8.72. The price on 7/13/2018, the last trading day before 7/15, was $8.14.

CoRev: Yes, that’s a market timing result, which does not deny the superiority at the 12 month horizon for RMSE results. I stressed one year because of the results in Table II, which compared out-of-sample results, futures against random walk. The Theil U-statistic was lowest in this 12 month case.

Bruce, this comment from your Brazil reference is more than just interesting but explains some of the US soybean prices:

“Post contacts report that as of the last two months, demand for May-July soybean contracts –traditionally the strongest export months for the Brazilian soybeans -has been anemic. According to interlocutors, the lack of sales is driven by the reluctance of the Chinese and other buyers to make any moves ahead of the expected final resolution to the ongoing U.S.-China trade talks. According to Post conversations, Brazilian producers would, in fact, be keen to sell right now, with the Real losing some ground to the U.S. dollar in recent weeks. (See policy section for more details). However, traders in Brazil simply cannot find interested buyers to conclude any contracts right now. ”

Remember the impact of those “ole Trump tariffs” are never ending according to the many articles here? What has occurred to diminish China’s demand? Just for pgl and his like here, ASF has happened. Supply and demand still are the underpinnings of prices.

Who’da guessed? Certainly not pgl!

Gee the trade war is even affecting the decisions of Brazilian farmers! They may not speak English but it seems they get this stuff a lot better than you do!

“I have also used this definition for Spot Price:

Spot price definition

The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future.”

Your earlier rant. Oh gee – after a year of incessant stupidity you finally was able to cut and paste a basic definition. Next you will graduate to reading The Cat in the Hat. Or maybe taking off your shoes so as to add 2 plus 2. Being able to cut and paste a basic definition that even two year olds have known for a while does not excuse your persistent confusion, stupidity, and down right lies.

Come on CoRev – we’d ask you to grow up but your own mother gave up on that years ago.

Here’s another gem from Bruce’s Brazil link re: the Brazil price premium disappearance:

“By late February, U.S. soybeans FOB Gulf prices were up over $355/ ton, whereas FOB Paranagua prices dropped to around $344/ ton.”

CoRev: You do know the spread re-appeared after February…

Menzie, a reduced spread. Bruce’s reference shows it there at least through the end of March, 2019. We both agreed that it was probably due to Chinese Government direction, and I added the reason was to keep pressure on US trade negotiations. Moreover, Bruce’s reference also provided this explanation for a Brazil/US price differential:

“Although the difficult economic and political environment dampened domestic commodity demand, Brazilian farmers realized significant gains with deprecation of the the Brazilian Real (Real). Since soybeans are priced in U.S. dollars in the international market, the weaker exchange rate increased domestic soybean prices (more Reals per U.S. dollars). The weaker Real also made Brazilian soybean exports more competitive on the world market. Soybean export receipts were up 29 and 33 percent in 2017 and in 2018 respectively as a result of higher domestic prices. Although commensurate with an increase in volume, the revenue increase is less impressive.”

So what was the cause of the spread? From January thru ~mid-May the Real’s value was declining against the $. Chinese Govt policy?

Ah yes – Brucie Boy has taught you how to cherry pick data too. Trump is so proud of his little team here. Oh yea – our host knows the spread has reappeared. Oh my – Trump needs to fire the two of you for being so inept!

Page 9 of that link Bruce Hall provided and CoRev has touted as proof that the Trump trade wars have not done what our host has been saying:

‘Domestic commodity prices are also under pressure from the pending trade talks between the United States and China. In April 2018, China imposed a 25 percent duty on U.S. soybeans, spurring its buyers to source a greater volume of soybeans from Brazil. This underpinned the price premiums commanded by Brazilian soybeans in the second half of 2018. (See GAIN BR1816 for expanded coverage). However, the FOB soybean prices at Paranagua port dropped sharply in February and March 2019, triggering corresponding adjustment in farm gate prices for producers in Mata Grosso and Parana. Graph five shows that farm gate prices for the two states are down sharply from last season’s peaks, currently hovering around R$ 63 per sack in Mato Grosso and R$ 69 per sack in Parana.’

The first two sentences is exactly what our host has been saying. Why did Bruce Hall and CoRev not note this? Yes there was a drop in Brazilian prices in early 2019 but as the data shows the price premiums commanded by Brazilian soybeans have returned. Something our host has noted several times.

Yep – Bruce Hall and CoRev cherry pick data and just ignore basic reality. Trump’s perfect trolls!

Pgl, another Fama denier. When do YOU think the tariff impacts were impounded in US soybean prices? The trade talks have not ended, but at every announcement the information is temporarily impounded before they return to the new post-tariff plateau average. In your ignorance you still can not accept Fama works for soybeans.

After the many times I provided this definition, you finally acknowledge it? For several months you never realized you were the one wrong about the the definition of spot prices. You probably still don’t.

How did you miss this in your quote?

“However, the FOB soybean prices at Paranagua port dropped sharply in February and March 2019, triggering corresponding adjustment in farm gate prices for producers in Mata Grosso and Parana. Graph five shows that farm gate prices for the two states are down sharply from last season’s peaks, currently hovering around R$ 63 per sack in Mato Grosso and R$ 69 per sack in Parana.”

I remember our discussion over the disappearing Brazil premium was at this same time. You were claiming it existed without any evidence.

You do amaze.

CoRev: I seem to recall that the drop in soybean prices was “a blip” until the negotiations are over. At this pace, the negotiations are gonna be over a long time from now…

A lot of things seem to be converging at once. I’m just a humble investor seeking to preserve capital in retirement so I don’t have to be a greeter at a Big Box store. I just too a look at Gold futures. May 1 price: 1284; Today’s price: 1423 and if I have done the math correctly that’s a 10% rise over the past two months. this coupled with the bond rate inversion is somewhat troubling and several manufacturing statistics seem to be leveling off. S&P 500 PEs are too high for my comfort zone but I’m not sure that I can reliably say that we will see a major correction this year (more worried about 2020). Now that President Trump has announced his Fed appointees, what will Fed Chair Powell do? Maybe Dr. Nelson can persuade the Fed to move back to the Gold standard.

Alan Goldhammer: Gold futures *do not* work as an unbiased predictor. See Chinn-Coibion (2014), Table 1.

Menzie – thank you for the reference, it was quite informative. I don’t take any particular statistic in isolation and whether it is framing lumber, gold, or soybeans, one has to carefully aggregate across a number of categories to get a feeling for where things are headed.

Diversify as best you can and take your lumps. That is the magic investment. Consider who this advice came from and knock yourself out.